Grupo Inbursa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Inbursa Bundle

Grupo Inbursa operates within a dynamic Mexican market, where political stability, economic fluctuations, and evolving social trends significantly influence its financial services. Understanding these external forces is crucial for strategic planning and identifying both opportunities and potential threats.

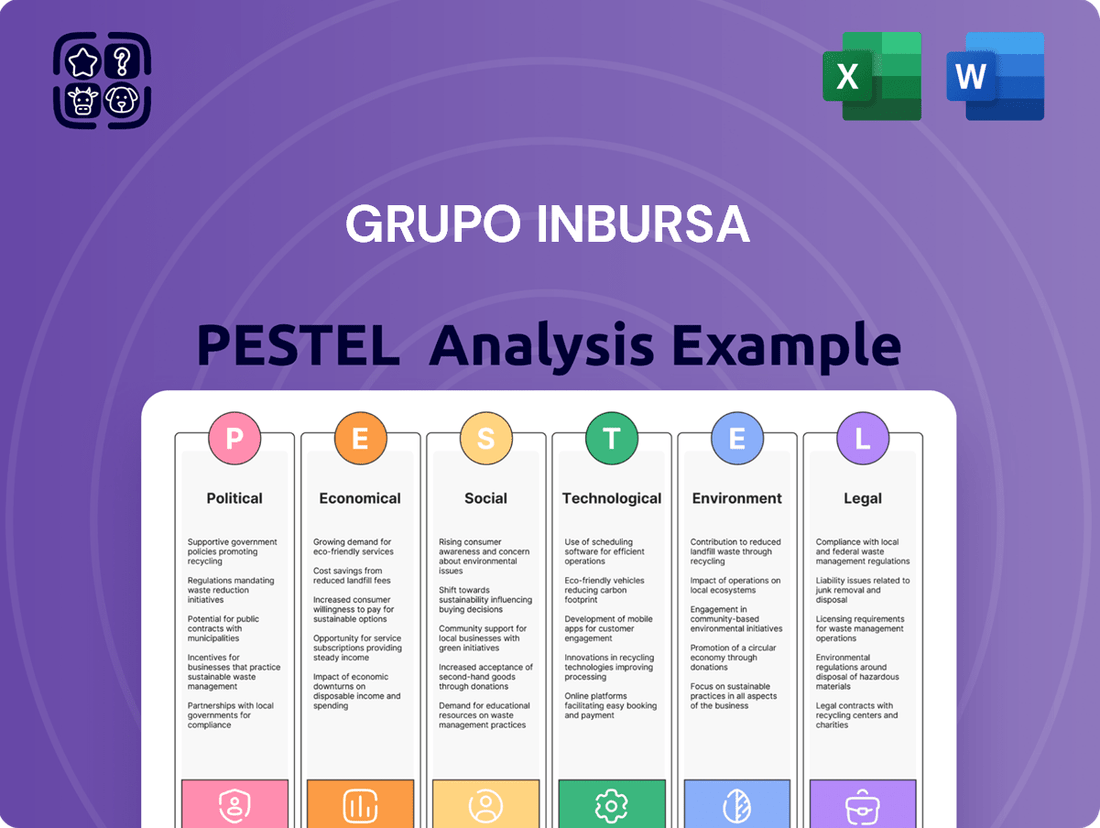

Gain a competitive edge by delving into the comprehensive PESTLE analysis of Grupo Inbursa. This detailed report unpacks the political, economic, social, technological, legal, and environmental factors shaping the company's future. Equip yourself with actionable intelligence to make informed decisions and strengthen your market strategy. Download the full version now for immediate access to these vital insights.

Political factors

Mexico's political stability and policy direction significantly influence its financial sector, and by extension, Grupo Inbursa. Shifts in government outlook, such as Moody's downgrade of Mexico's government outlook to negative in November 2024, directly impact investor confidence and the cost of capital for financial institutions.

These concerns, stemming from issues like judicial weakening and rising debt levels, create an environment of uncertainty that can affect Inbursa's operational costs and investment strategies. The group's substantial presence in the Mexican market makes it particularly susceptible to these macroeconomic political shifts.

Mexico's financial sector operates under a stringent regulatory landscape, largely mirroring international benchmarks like Basel III. This framework dictates capital adequacy, risk management, and operational standards for entities such as Grupo Inbursa.

Recent legislative efforts in Mexico, focusing on lowering entry barriers and fostering greater competition, directly influence Inbursa's strategic planning and market positioning. For instance, reforms aimed at digital banking and fintech integration are reshaping the competitive dynamics within the industry.

Adherence to evolving regulations, including stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, remains paramount. In 2023, Mexican financial institutions collectively reported billions in suspicious transaction alerts, highlighting the critical nature of robust compliance systems.

Mexico's trade relationship with the United States remains a cornerstone of its economic stability, directly impacting sectors like manufacturing and agriculture which are key to financial services. In 2024, continued discussions around trade agreements and potential adjustments to existing ones, such as the USMCA, create an environment of cautious optimism for businesses and investors. Any shifts in these dynamics can influence capital flows and lending activities within Mexico's financial system.

Broader geopolitical tensions globally can also create ripple effects. For instance, supply chain disruptions stemming from international conflicts could indirectly affect the Mexican economy by altering commodity prices or impacting foreign direct investment. Grupo Inbursa, like other financial institutions, must monitor these external factors as they can introduce volatility into the market, potentially influencing consumer and business confidence, and thus, demand for financial products.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Efforts

Mexico's commitment to combating money laundering and terrorist financing is robust, with a legal framework that adheres to international benchmarks established by the Financial Action Task Force (FATF). This regulatory environment directly impacts financial institutions like Grupo Inbursa, necessitating sophisticated compliance measures.

Grupo Inbursa must maintain rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) programs. These programs are critical for preventing illicit financial activities and ensuring the integrity of the financial system. For instance, in 2023, Mexican authorities reported a significant increase in suspicious transaction reports filed by financial entities, underscoring the active enforcement of these regulations.

- Know Your Customer (KYC) Protocols: Strict customer due diligence is mandatory to identify and verify the identity of clients, especially those conducting high-value transactions or operating in high-risk sectors.

- Transaction Monitoring: Continuous surveillance of financial transactions is required to detect unusual patterns or activities that may indicate money laundering or terrorist financing.

- Suspicious Activity Reporting: Financial institutions are obligated to report any suspicious transactions or activities to the relevant authorities, such as the Financial Intelligence Unit (FIU).

- Compliance Training: Regular training for employees on AML/CTF regulations and best practices is essential to ensure effective implementation and awareness across the organization.

Financial Inclusion Initiatives

The Mexican government is actively pushing for greater financial inclusion, aiming to bring more of its citizens into the formal financial system. This involves regulatory shifts and the promotion of digital platforms for accessing financial services. For instance, by the end of 2023, Mexico's central bank reported that over 70% of the adult population had some form of bank account, a significant increase driven by these efforts.

Grupo Inbursa must align its strategies with these national objectives to tap into previously unbanked or underbanked segments of the population. Initiatives often focus on simplifying account opening procedures and expanding access to digital payment solutions. By doing so, Inbursa can not only support government goals but also unlock substantial new market opportunities.

- Digital Onboarding: Streamlining account opening via mobile apps and online channels to reach remote or less digitally savvy populations.

- Product Innovation: Developing financial products tailored to the needs of low-income individuals and small businesses, such as micro-insurance or accessible credit lines.

- Partnerships: Collaborating with fintech companies and government agencies to broaden distribution networks and enhance financial literacy programs.

Political stability and government policy significantly shape Mexico's financial landscape, directly impacting Grupo Inbursa. For example, Moody's November 2024 outlook downgrade to negative for Mexico's government highlights investor concerns about judicial weakening and rising debt, creating an environment of uncertainty that can affect Inbursa's operational costs and strategic investments.

Mexico's regulatory framework, aligned with international standards like Basel III, dictates capital adequacy and risk management for financial institutions such as Inbursa. Reforms aimed at lowering entry barriers and promoting fintech integration are actively reshaping the competitive dynamics of the sector, influencing Inbursa's market positioning and strategic planning.

The government's push for financial inclusion, aiming to bring more citizens into the formal financial system, is a key political driver. By the end of 2023, over 70% of Mexican adults had bank accounts, a testament to these efforts, presenting opportunities for Inbursa to expand its reach through digital solutions and tailored products.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Grupo Inbursa, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within Grupo Inbursa's operating landscape.

Grupo Inbursa's PESTLE analysis acts as a pain point reliver by providing a clear, summarized version of complex external factors, enabling faster decision-making and reducing uncertainty during strategic planning.

Economic factors

Mexico's economic growth trajectory is a key determinant for Grupo Inbursa's performance. While projections for 2025 suggest a GDP expansion between 2% and 3%, a more cautious view from Moody's, citing the 1.5% GDP growth in the third quarter of 2024, indicates potential headwinds. This slower growth environment could temper demand for financial products and services, impacting Inbursa's loan portfolios and overall profitability.

Banco de México's monetary policy, particularly its stance on interest rates, directly influences Grupo Inbursa's operating environment. In late 2024 and projected into 2025, inflation has remained a key concern, prompting the central bank to maintain a relatively restrictive interest rate policy. For instance, the benchmark interest rate was hovering around 11.25% in early 2024, a level that impacts borrowing costs across the economy.

Higher interest rates can initially benefit banks like Inbursa by widening net interest margins, as the cost of deposits often lags behind the repricing of loans. However, sustained high rates can suppress demand for credit from businesses and individuals, potentially slowing loan growth. Furthermore, it increases the risk of non-performing loans as borrowers face higher repayment burdens, impacting asset quality metrics for Grupo Inbursa.

Consumer spending is a cornerstone of economic health, directly influencing sectors like retail banking. In 2024, Mexico experienced robust consumer lending growth, a positive sign for institutions like Grupo Inbursa.

However, forecasts for 2025 suggest a potential moderation in this loan portfolio expansion. This projected slowdown could present a challenge for Inbursa's retail banking operations, necessitating strategic adjustments to maintain growth momentum.

Foreign Investment and Nearshoring

Mexico's economy is experiencing a significant boost from nearshoring, attracting substantial foreign direct investment (FDI). This trend is directly benefiting sectors that Grupo Inbursa serves, such as financial services. The influx of capital is expected to stimulate economic activity, creating new avenues for commercial banking and investment opportunities.

In 2023, Mexico saw a remarkable surge in FDI, reaching approximately $36 billion, a significant portion of which is attributed to nearshoring initiatives. This increased investment is fostering growth across various industries, directly translating into a higher demand for sophisticated financial products and services. Grupo Inbursa is well-positioned to capitalize on this economic expansion.

- Nearshoring FDI: Mexico's FDI in 2023 reached around $36 billion, with nearshoring as a key driver.

- Economic Stimulation: Increased foreign investment is expected to expand Mexico's GDP, creating a more robust economic environment.

- Financial Services Demand: The growth in industrial and manufacturing sectors due to nearshoring will likely increase demand for corporate banking, trade finance, and investment management services.

Fiscal Policy and Government Debt

Mexico's fiscal position and debt levels are critical considerations for Grupo Inbursa. A widening fiscal deficit and rising government debt, as noted by rating agencies, can impact investor confidence and limit the government's ability to stimulate the economy. This is particularly relevant given that Mexico's public debt-to-GDP ratio stood at approximately 50.6% at the end of 2023, a figure that requires careful monitoring.

The government's capacity to offer economic support is directly tied to its fiscal health. Increased borrowing costs due to higher debt levels could strain public finances, potentially affecting sectors reliant on government spending or subsidies. For instance, if interest payments on debt consume a larger portion of the budget, funds available for infrastructure or social programs might be reduced.

Moody's has previously flagged concerns regarding Mexico's fiscal trajectory, suggesting that sustained deficits could constrain future economic support. This sentiment underscores the importance of fiscal discipline for maintaining a stable financial system and fostering a predictable environment for businesses like Grupo Inbursa.

- Government Debt-to-GDP Ratio: Mexico's public debt-to-GDP was around 50.6% by the close of 2023.

- Fiscal Deficit Concerns: Rating agencies, including Moody's, have expressed concerns about Mexico's widening fiscal deficit.

- Impact on Economic Support: Higher debt levels can reduce the government's capacity to provide economic stimulus or support critical sectors.

- Investor Confidence: Fiscal stability is a key driver of investor confidence in the Mexican economy.

Mexico's economic growth is projected to be between 2% and 3% for 2025, following a 1.5% GDP expansion in Q3 2024, according to Moody's. This growth pace influences demand for financial services. Banco de México's monetary policy, with a benchmark interest rate around 11.25% in early 2024, impacts borrowing costs and loan growth, potentially affecting Inbursa's net interest margins and asset quality.

Nearshoring is significantly boosting Mexico's economy, evidenced by approximately $36 billion in FDI in 2023, creating opportunities for financial services. However, a potential moderation in consumer lending growth in 2025 may require strategic adjustments for Grupo Inbursa.

Mexico's fiscal health, with a public debt-to-GDP ratio of about 50.6% at the end of 2023, and concerns over a widening fiscal deficit, could affect investor confidence and the government's ability to provide economic support.

| Economic Indicator | 2023 Data | 2024 Projection | 2025 Projection | Impact on Inbursa |

|---|---|---|---|---|

| GDP Growth | (Specific 2023 data not provided in source) | (Specific 2024 data not provided in source) | 2%-3% | Influences demand for financial products. |

| Interest Rate (Benchmark) | (Specific 2023 data not provided in source) | ~11.25% (early 2024) | (Likely to remain influenced by inflation) | Affects net interest margins and loan demand. |

| Foreign Direct Investment (FDI) | ~$36 Billion | (Expected to remain strong due to nearshoring) | (Expected to remain strong due to nearshoring) | Drives demand for corporate and investment banking. |

| Public Debt-to-GDP Ratio | ~50.6% | (Monitoring required) | (Monitoring required) | Impacts investor confidence and fiscal support capacity. |

Preview Before You Purchase

Grupo Inbursa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Inbursa provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Grupo Inbursa's strategic landscape.

Sociological factors

Mexico's population is notably young, with a median age of around 29 years as of 2024, meaning a significant portion of the population is entering their prime working and earning years. This demographic trend fuels demand for a wide array of financial products and services, from savings accounts and credit to investment vehicles.

The country is also experiencing a steady increase in urbanization, with over 80% of the population now residing in urban areas. This concentration of people in cities creates hubs for economic activity and makes it easier for financial institutions like Inbursa to reach customers through physical branches and digital channels, supporting its strategy of offering accessible financial solutions.

This youthful, urbanizing population is highly digitally connected, with smartphone penetration rates exceeding 70% in major urban centers. This presents a substantial opportunity for Inbursa to expand its digital banking and mobile-first offerings, catering to a generation that expects seamless, on-the-go financial management and is receptive to innovative fintech solutions.

Despite advancements, a notable percentage of Mexican adults, estimated at around 30% in recent surveys, remain outside the formal banking system. This unbanked population represents a significant untapped market for financial services, requiring tailored strategies to onboard them.

Grupo Inbursa, like other financial institutions, sees a clear imperative to boost financial literacy across Mexico. By offering educational resources and simpler, more accessible financial products, the company can attract and retain a broader customer base, driving growth in an area with substantial potential.

Consumer behavior is rapidly shifting towards digital channels, with a significant portion of the Mexican population now utilizing mobile devices for financial transactions. In 2024, it's estimated that over 75% of internet users in Mexico engage in online banking, a trend that directly impacts how financial institutions like Grupo Inbursa must operate.

This digital adoption necessitates Inbursa's strategic focus on enhancing its mobile banking applications and online investment platforms. By offering seamless digital payment solutions and user-friendly online investment tools, Inbursa can better serve a market that increasingly prefers convenience and accessibility, mirroring global trends where digital financial services are becoming the norm.

Trust in Financial Institutions

Trust in financial institutions in Mexico is a nuanced sociological factor. Historically, events like the 1994-95 economic crisis and perceptions of high banking fees have contributed to a degree of skepticism among certain demographics. Grupo Inbursa, like all financial entities, must actively work to cultivate and sustain this trust.

Maintaining trust involves a multi-faceted approach for Inbursa. This includes ensuring absolute transparency in all dealings, providing consistently superior customer service, and investing in robust, secure digital platforms that users can rely on. Building a reputation for reliability is paramount in the financial sector.

- 2023 Consumer Confidence: Mexico's consumer confidence index showed fluctuations, with trust in financial services being a key component influencing overall sentiment.

- Digital Adoption: As of late 2024, a significant portion of the Mexican population is increasingly comfortable with digital banking, yet security concerns remain a factor in trust.

- Regulatory Oversight: Strong regulatory frameworks, like those overseen by the Comisión Nacional Bancaria y de Valores (CNBV), play a crucial role in bolstering public confidence in financial institutions.

Social Trends and Lifestyle Changes

Evolving social trends are significantly shaping consumer demand for financial services. For instance, the increasing awareness and concern over healthcare costs in Mexico are driving a greater demand for specialized insurance products, particularly health and private medical insurance. Grupo Inbursa needs to ensure its product development directly addresses these shifting consumer priorities.

The burgeoning growth of e-commerce also presents a clear signal for financial institutions. As more transactions move online, there's a parallel rise in demand for digital financial services, including online banking, mobile payments, and digital investment platforms. Inbursa's strategy must incorporate robust digital offerings to capture this expanding market segment.

- Rising Healthcare Costs: Mexico's healthcare expenditure as a percentage of GDP saw an increase, highlighting the growing need for private medical insurance.

- Digital Adoption: E-commerce sales in Mexico have experienced substantial year-over-year growth, indicating a strong consumer shift towards online channels for purchases and services.

- Demand for Specialization: Consumer surveys indicate a growing preference for tailored insurance policies that cover specific risks, moving beyond traditional general coverage.

Mexico's youthful demographic, with a median age around 29 in 2024, fuels demand for financial products as a large segment enters prime earning years. Urbanization, with over 80% of the population in cities by 2024, concentrates economic activity, aiding Inbursa's reach through physical and digital channels.

High digital connectivity among the urban youth, with smartphone penetration over 70% in major centers by late 2024, offers Inbursa a strong opportunity for mobile-first financial services. Despite this, roughly 30% of Mexican adults remained unbanked in recent surveys, presenting a significant market for tailored financial inclusion strategies.

Financial literacy remains a key area for improvement, with Inbursa needing to offer educational resources to capture a broader customer base. Consumer behavior is increasingly digital, with over 75% of internet users in Mexico engaging in online banking as of 2024, necessitating Inbursa's focus on robust digital platforms.

Trust in financial institutions is influenced by past economic events and fees, requiring Inbursa to prioritize transparency and superior customer service. Evolving social trends, such as rising healthcare costs, are driving demand for specialized insurance products, a need Inbursa must address through product development.

| Sociological Factor | Description | Implication for Grupo Inbursa | Relevant Data (2024/2025) |

|---|---|---|---|

| Demographics | Young, growing population | Increased demand for savings, credit, and investment products | Median age: ~29 years (2024) |

| Urbanization | High concentration in urban areas | Easier customer access via physical and digital channels | Urban population: >80% (2024) |

| Digital Adoption | High smartphone penetration and online banking usage | Opportunity for digital-first offerings and mobile banking enhancement | Smartphone penetration in urban centers: >70% (late 2024); Online banking users: >75% of internet users (2024) |

| Financial Inclusion | Significant unbanked population | Untapped market requiring tailored onboarding strategies | Unbanked adults: ~30% (recent surveys) |

| Consumer Behavior Trends | Shift towards digital and specialized products (e.g., health insurance) | Need for robust digital platforms and tailored insurance offerings | E-commerce growth substantial; Healthcare expenditure increasing |

Technological factors

Mexico's fintech sector is booming, with the number of registered fintech companies increasing by approximately 30% in 2023 alone, according to the Mexican Fintech Association. This rapid expansion means traditional financial institutions like Grupo Inbursa face escalating competition from agile, tech-driven startups.

This intense competition necessitates a proactive approach to technological adoption. Inbursa must continuously innovate its digital offerings, from mobile banking platforms to payment solutions, to retain and attract customers in this evolving landscape.

The influx of fintech innovation also pressures Inbursa to explore partnerships or acquisitions to leverage cutting-edge technologies and maintain a competitive edge, ensuring its services remain relevant and appealing to a digitally-native consumer base.

Grupo Inbursa's strategic positioning is heavily influenced by the accelerating digital transformation within Mexico's financial landscape. The increasing adoption of digital banking, mobile payment solutions like Mercado Pago and SPEI transfers, and sophisticated online investment platforms by consumers necessitates a strong digital backbone. In 2024, digital banking transactions in Mexico are projected to see continued growth, with mobile banking usage expected to reach over 70% of the banked population.

To capitalize on these trends and maintain a competitive edge, Inbursa's ongoing investment in robust digital infrastructure is paramount. This includes enhancing cloud capabilities, cybersecurity measures, and user-friendly mobile applications to support seamless digital customer experiences and streamline internal operations. By prioritizing these technological advancements, Inbursa can improve operational efficiency and better serve its expanding digital customer base.

The financial sector in Mexico is grappling with a significant rise in cybercrime, with ransomware, phishing, and extortion attacks becoming increasingly sophisticated. For Grupo Inbursa, safeguarding sensitive customer data and the integrity of digital transactions is not just a technical challenge but a fundamental requirement for maintaining trust. This directly impacts their ability to comply with Mexico's evolving data protection regulations, such as the Federal Law on the Protection of Personal Data Held by Private Parties.

Artificial Intelligence (AI) and Automation

The financial sector's embrace of Artificial Intelligence (AI) and automation is accelerating, with institutions like Grupo Inbursa poised to benefit significantly. AI is no longer a niche technology; it's becoming a core component for both fintech startups and established players, driving advancements in personalized financial advice, robust fraud detection, and highly efficient operational workflows. By integrating AI, Inbursa can expect to see a marked improvement in customer engagement through tailored recommendations and a more streamlined user journey. Furthermore, AI's analytical capabilities can optimize internal processes, reduce operational costs, and significantly bolster risk management strategies.

The impact of AI on financial services is already quantifiable. For instance, in 2024, the global AI in finance market was valued at approximately $26.5 billion, with projections indicating substantial growth. This technology allows for sophisticated data analysis, leading to better predictive modeling for credit risk and investment opportunities. Inbursa can harness these capabilities to gain a competitive edge.

Key areas where AI and automation can empower Grupo Inbursa include:

- Enhanced Customer Personalization: AI-driven platforms can analyze customer data to offer highly tailored financial products, investment advice, and banking services, improving satisfaction and loyalty.

- Streamlined Operations and Cost Reduction: Automation of routine tasks, such as data entry, customer service inquiries, and transaction processing, can lead to significant efficiency gains and lower operational expenses.

- Advanced Fraud Detection and Prevention: AI algorithms can identify and flag suspicious activities in real-time with greater accuracy than traditional methods, protecting both the institution and its clients.

- Improved Risk Management: AI's ability to process vast datasets allows for more sophisticated credit scoring, market risk assessment, and regulatory compliance monitoring, mitigating potential financial losses.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are increasingly influencing the financial sector in Latin America. These innovations are paving the way for new operational efficiencies and product offerings for companies like Grupo Inbursa. The tokenization of assets, for example, is a growing trend that could unlock liquidity and create novel investment opportunities.

The adoption of blockchain in fintech is accelerating, with projections indicating significant growth. For Inbursa, this presents a strategic avenue to enhance services such as cross-border payments, potentially reducing transaction times and costs. Furthermore, the inherent security features of DLT can bolster the integrity of financial transactions and data management.

- Growth in Latin American Blockchain Adoption: Reports suggest a substantial year-over-year increase in blockchain investments across Latin America, with fintech being a primary driver.

- Tokenization Market Potential: The global market for tokenized assets is anticipated to reach trillions of dollars by the end of the decade, indicating a significant future opportunity.

- Cross-Border Payment Improvements: Blockchain solutions have demonstrated the ability to cut cross-border transaction fees by up to 50% and settlement times from days to minutes in pilot programs.

Grupo Inbursa must prioritize advanced cybersecurity measures to combat the escalating threat of cybercrime in Mexico's financial sector. The increasing sophistication of attacks necessitates robust defenses to protect sensitive customer data and ensure transaction integrity, aligning with data protection regulations.

The integration of Artificial Intelligence (AI) and automation is crucial for Inbursa to enhance customer personalization, streamline operations, and improve fraud detection. With the global AI in finance market valued at approximately $26.5 billion in 2024, leveraging AI offers a significant competitive advantage.

Blockchain and Distributed Ledger Technology (DLT) present opportunities for Inbursa to improve cross-border payments and explore asset tokenization. Blockchain's ability to reduce transaction fees by up to 50% and settlement times to minutes in trials highlights its transformative potential.

| Technology | Impact on Inbursa | Relevant Data/Trend (2024/2025) |

|---|---|---|

| Cybersecurity | Protecting customer data and transaction integrity against rising cyber threats. | Mexico's financial sector faces increasing cybercrime; robust defenses are critical. |

| AI & Automation | Enhancing personalization, operational efficiency, and fraud detection. | Global AI in Finance market ~$26.5 billion (2024); AI drives personalized advice and risk management. |

| Blockchain & DLT | Improving cross-border payments, asset tokenization, and transaction security. | Blockchain can reduce cross-border fees by up to 50% and settlement times significantly. |

Legal factors

Grupo Inbursa navigates a stringent legal landscape in Mexico, primarily dictated by the Banking Law and directives from the National Banking and Securities Commission (CNBV) and Banco de México. These regulations are critical, setting standards for everything from initial licensing to ongoing capital adequacy and liquidity management. For instance, as of early 2024, the CNBV mandates specific capital ratios designed to ensure the stability of financial institutions, with major banks like Inbursa needing to maintain robust buffers against potential economic shocks.

Grupo Inbursa, like all financial institutions in Mexico, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws, which are increasingly aligned with global best practices, mandate comprehensive customer verification, ongoing transaction monitoring, and the prompt reporting of any suspicious activities to regulatory bodies. Failure to comply can result in substantial fines and reputational damage, making adherence a cornerstone of Inbursa's operational strategy.

Data privacy and consumer protection laws are paramount for Grupo Inbursa, a financial institution managing vast amounts of sensitive customer data. Regulations like Mexico's Federal Law on the Protection of Personal Data Held by Private Parties (LFPDPPP) mandate strict controls over data collection, processing, and storage. Failure to comply can result in significant fines and reputational damage, impacting customer trust and market position.

Inbursa's commitment to these regulations is crucial for safeguarding customer interests and fostering confidence in its services. For instance, as of early 2024, the Mexican government continues to emphasize data security, with ongoing discussions around enhancing penalties for data breaches. This proactive approach ensures Inbursa operates ethically and legally, building a strong foundation for sustained growth in the competitive financial landscape.

Competition Law and Market Concentration

Mexico's competition law, enforced by the Federal Economic Competition Commission (COFECE), aims to prevent monopolistic practices and promote a fair playing field, even within the financial sector. While specific structural separation mandates for financial groups like Grupo Inbursa are not a primary focus, the overarching goal is to ensure that no single entity unduly dominates the market. This means Inbursa must navigate a regulatory landscape that scrutinizes market concentration and potential anti-competitive behaviors.

The Mexican banking sector, including insurance and financial services offered by groups like Inbursa, exhibits a degree of market concentration. For instance, as of the first quarter of 2024, the top five banking institutions held a significant share of total banking assets. This concentration necessitates that Inbursa's strategic expansions or acquisitions are carefully evaluated against competition law to avoid creating or reinforcing a dominant market position that could stifle competition.

Grupo Inbursa's strategic planning must therefore incorporate an understanding of competition law implications, particularly concerning market share and potential impacts on consumer choice and pricing. Key considerations include:

- Market Share Analysis: Regularly assessing Inbursa's market share across various financial services segments in Mexico relative to competitors.

- Merger and Acquisition Scrutiny: Anticipating potential regulatory review of any future M&A activities by COFECE to ensure they do not lead to undue market concentration.

- Competitive Practices: Ensuring all business practices, including pricing and product offerings, adhere to regulations designed to prevent anti-competitive collusion or abuse of dominant positions.

Taxation Policies

Changes in Mexico's general tax rules and federal tax code directly impact financial institutions like Grupo Inbursa, affecting profitability and operational costs. For instance, the 2024 tax reform proposals in Mexico, while not yet fully enacted, signal potential adjustments to corporate income tax rates and specific deductions that could alter net earnings. Inbursa must remain vigilant about these modifications to ensure full compliance and to strategically optimize its financial planning.

Staying informed about tax law changes is crucial for maintaining a competitive edge.

- Corporate Income Tax (ISR): Monitoring any shifts in the general ISR rate for financial institutions.

- Withholding Taxes: Understanding changes to withholding tax regulations on financial transactions and investments.

- Tax Incentives: Evaluating the impact of any new or revoked tax incentives relevant to the financial sector.

- Reporting Requirements: Adapting to updated tax reporting obligations and compliance procedures.

Grupo Inbursa must adhere to Mexico's financial regulations, including capital adequacy ratios set by the CNBV, which are crucial for stability. As of early 2024, these requirements ensure institutions like Inbursa maintain sufficient reserves against economic downturns.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws is non-negotiable, with strict enforcement and penalties for non-adherence. Data privacy laws, such as Mexico's LFPDPPP, also mandate robust data protection measures, with potential fines for breaches impacting customer trust.

Mexico's competition law, overseen by COFECE, prevents market dominance, requiring Inbursa to monitor its market share, especially in light of the sector's concentration. For example, as of Q1 2024, the top five banks held a substantial portion of total banking assets, making M&A activities subject to close regulatory scrutiny.

Tax laws, including corporate income tax and withholding regulations, significantly influence Inbursa's profitability. Potential adjustments to these laws, as seen in 2024 reform proposals, necessitate ongoing strategic financial planning and compliance monitoring.

Environmental factors

Mexico's financial sector is experiencing a significant surge in demand for ESG integration, with a notable increase in sustainable investment funds. By 2024, assets under management in ESG-focused funds in Mexico were projected to reach over $10 billion USD, highlighting a clear market trend.

Grupo Inbursa has a prime opportunity to bolster its standing and appeal to a growing cohort of ethically-minded investors by showcasing robust ESG principles. Demonstrating tangible commitments, such as reducing its operational carbon footprint by 15% by 2027, would significantly enhance its reputation.

Grupo Inbursa, like all financial institutions, faces growing pressure to evaluate and mitigate climate change risks. This includes physical risks, like extreme weather events impacting collateral or infrastructure, and transition risks, stemming from the shift to a low-carbon economy which could affect asset values. For instance, the increasing frequency of severe weather events in Mexico, such as hurricanes and droughts, poses a direct threat to physical assets and insurance portfolios.

Conversely, these climate challenges also unlock significant opportunities for Inbursa. The burgeoning field of sustainable finance and green investments offers avenues for growth. As of early 2024, global investment in clean energy reached record highs, indicating a strong market demand for financial products supporting environmental initiatives, a trend Inbursa can capitalize on.

Mexico is making significant strides in sustainable finance, evidenced by its active issuance of green bonds and the ongoing development of a national sustainable taxonomy. This creates a fertile ground for financial institutions like Inbursa to engage with environmentally conscious projects.

Inbursa can leverage these governmental pushes by actively financing initiatives that directly align with the United Nations Sustainable Development Goals (SDGs) and broader environmental objectives. For instance, by providing capital for renewable energy projects or sustainable infrastructure, Inbursa not only supports environmental targets but also taps into a growing market segment.

The Mexican government's commitment to sustainable finance is substantial. In 2023, Mexico's green bond market saw continued activity, with issuers raising capital for projects focused on climate change mitigation and adaptation. This trend is expected to accelerate in 2024 and 2025 as the sustainable taxonomy becomes more established, offering clear guidelines for what qualifies as green investment.

Environmental Regulations and Compliance

Grupo Inbursa must navigate a complex web of environmental regulations that directly impact its lending and investment activities. For instance, Mexico's commitment to increasing renewable energy generation, aiming for 35% of electricity from clean sources by 2024, influences which energy projects are favored for financing. Similarly, evolving waste management laws and emissions standards can affect the viability of investments in certain industrial sectors.

These regulatory shifts necessitate a proactive approach to compliance and risk management within Inbursa's portfolio. By aligning its financial products and services with environmental mandates, the company can mitigate risks and capitalize on emerging green finance opportunities. This includes scrutinizing the environmental impact of financed projects to ensure adherence to national and international standards.

- Renewable Energy Targets: Mexico's National Energy Policy aims to boost clean energy, impacting Inbursa's project finance decisions in the energy sector.

- Waste Management Laws: Stricter regulations on industrial waste disposal and recycling can influence lending to manufacturing and resource-intensive industries.

- Emissions Standards: Compliance with air and water quality regulations affects the operational costs and investment attractiveness of various businesses Inbursa supports.

Corporate Social Responsibility and Sustainability Reporting

Grupo Inbursa, like many financial institutions, faces increasing pressure to showcase its commitment to environmental sustainability. This involves not only implementing eco-friendly practices but also transparently reporting on these efforts through corporate social responsibility (CSR) initiatives. By clearly communicating its environmental stewardship, Inbursa can bolster its public image and align with growing stakeholder expectations for responsible business conduct.

In 2023, the global financial sector saw a significant uptick in sustainable finance, with assets under management in ESG (Environmental, Social, and Governance) funds reaching over $3.7 trillion according to Morningstar. Inbursa's proactive communication of its environmental initiatives, such as reduced paper consumption or investments in green technologies, can attract environmentally conscious investors and customers. For instance, detailing energy efficiency improvements in its corporate offices or its carbon footprint reduction targets can provide tangible evidence of its commitment.

To effectively demonstrate its environmental responsibility, Inbursa could consider:

- Publishing an annual sustainability report: This report should detail environmental performance metrics, such as carbon emissions, waste management, and water usage, alongside specific goals for improvement.

- Highlighting green financial products: Promoting investment funds or loans that support renewable energy projects or sustainable businesses can attract a growing segment of the market.

- Engaging in community environmental projects: Participating in or sponsoring local conservation efforts or reforestation drives can enhance brand reputation and demonstrate tangible environmental commitment.

- Setting science-based emissions reduction targets: Aligning with global climate goals, such as those outlined by the Science Based Targets initiative, would provide a credible framework for its environmental strategy.

Mexico's push for cleaner energy, targeting 35% renewable electricity by 2024, directly shapes Inbursa's project financing in the energy sector.

Stricter waste management and emissions standards influence lending to industries, requiring Inbursa to assess environmental compliance and operational risks in its portfolio.

The growing demand for ESG integration in Mexico's financial sector, with sustainable funds projected to exceed $10 billion USD in assets by 2024, presents a significant opportunity for Inbursa to attract ethically-minded investors by demonstrating clear environmental commitments.

| Environmental Factor | Impact on Grupo Inbursa | Data/Trend (2023-2025) |

|---|---|---|

| Renewable Energy Push | Influences project finance decisions, favoring green energy projects. | Mexico's goal: 35% renewable electricity by 2024. Global clean energy investment reached record highs in early 2024. |

| Climate Change Risks | Requires mitigation of physical (extreme weather) and transition (low-carbon economy) risks in portfolios. | Increasing frequency of hurricanes and droughts in Mexico impacts insurance and collateral. |

| Sustainable Finance Growth | Opportunity to attract ESG-focused investors and develop green financial products. | Global ESG fund AUM exceeded $3.7 trillion in 2023. Mexican sustainable funds projected over $10 billion USD by 2024. |

| Environmental Regulations | Necessitates compliance and risk management for lending and investment activities. | Mexico's green bond market saw continued activity in 2023, expected to accelerate in 2024-2025 with taxonomy development. |

PESTLE Analysis Data Sources

Our Grupo Inbursa PESTLE Analysis is built on a robust foundation of data from official Mexican government agencies, reputable financial institutions, and leading economic research firms. We leverage insights from regulatory bodies, market trend reports, and technological advancements to ensure a comprehensive understanding of the external environment.