Grupo Inbursa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Inbursa Bundle

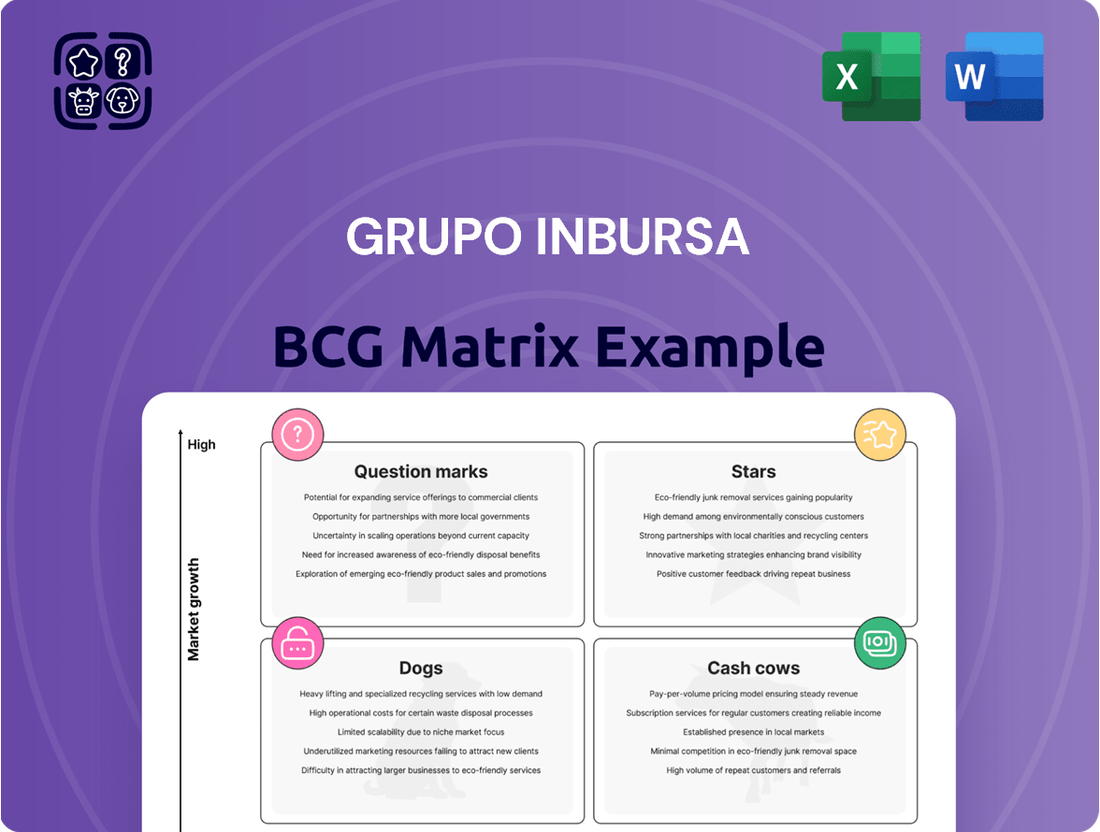

Unlock the strategic positioning of Grupo Inbursa's diverse portfolio with our comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders, which are generating consistent cash flow, and which require careful consideration for the future.

This preview offers a glimpse into the powerful insights available. Purchase the full BCG Matrix report to gain a detailed quadrant-by-quadrant breakdown, data-backed recommendations, and a clear roadmap for optimizing Grupo Inbursa's product strategy and resource allocation.

Stars

Grupo Financiero Inbursa's retail loan portfolio has experienced remarkable expansion, growing by 27.1% between March 2024 and March 2025. This impressive surge is a testament to the company's strategic focus on key consumer credit segments.

The primary drivers behind this growth are significant increases in auto loans, payroll loans (including a notable contribution from Brazil), and credit card balances. This indicates Inbursa is effectively capturing market share in a dynamic and expanding consumer credit landscape.

The wholesale loan portfolio of Grupo Financiero Inbursa demonstrated robust expansion, increasing by 13.7% between March 2024 and March 2025. This significant growth underscores Inbursa's solid standing in the commercial banking sector and the sustained demand for its corporate lending solutions. Such performance solidifies its position as a star performer within the company's financial offerings.

Grupo Inbursa is demonstrating exceptional strength in digital transaction adoption, with a remarkable 94.5% of its transactions occurring through digital channels as of December 2024. This overwhelmingly digital engagement underscores a significant competitive advantage.

This high adoption rate positions Grupo Inbursa favorably within the expanding digital banking landscape. It not only attracts new clientele but also solidifies its market leadership by catering to evolving customer preferences for convenience and accessibility.

Acquisition of Cetelem Mexico

Grupo Inbursa's strategic acquisition of 80% of Cetelem Mexico in March 2024 marked a pivotal moment in its business expansion. This move significantly bolstered Inbursa's presence in the consumer and commercial auto financing sectors. The impact was immediate and substantial, contributing to a remarkable 36.4% surge in the total loan portfolio throughout 2024.

This acquisition firmly establishes Inbursa as a dominant player in the auto financing market, a segment recognized for its robust growth potential. The integration of Cetelem Mexico's operations is expected to yield further synergistic benefits and solidify Inbursa's competitive edge.

- Acquisition of Cetelem Mexico: Inbursa acquired 80% in March 2024.

- Impact on Loan Portfolio: Drove 36.4% growth in the total loan portfolio in 2024.

- Market Positioning: Strengthened Inbursa's leadership in the high-growth auto financing segment.

Robust Capitalization Ratio

Grupo Inbursa's capitalization is exceptionally strong, a key factor in its strategic positioning. As of May 2025, the company reported a fully loaded CET1 ratio of 22.51%. This figure significantly surpasses the minimum regulatory requirements, underscoring Inbursa's robust financial health.

This high level of capitalization provides Inbursa with substantial capacity for further loan expansion and a strong buffer against potential economic downturns. It empowers the company to actively pursue emerging market opportunities and allocate capital towards high-growth sectors, reinforcing its competitive edge.

- Robust Capitalization: Inbursa's fully loaded CET1 ratio stood at 22.51% in May 2025, well above regulatory minimums.

- Financial Strength: This ratio indicates a strong financial foundation and resilience.

- Growth Capacity: The high capitalization supports aggressive pursuit of market opportunities and investment in growth areas.

Grupo Inbursa's auto financing segment, significantly bolstered by the March 2024 acquisition of 80% of Cetelem Mexico, has emerged as a star performer. This strategic move drove a remarkable 36.4% surge in the total loan portfolio during 2024, cementing Inbursa's leadership in this high-growth area.

The retail loan portfolio's 27.1% growth between March 2024 and March 2025, fueled by auto loans, payroll loans, and credit cards, further highlights Inbursa's strong market position. Coupled with a robust wholesale loan expansion of 13.7% in the same period, these segments demonstrate consistent high performance and market demand, characteristic of star business units.

| Business Unit | Growth (Mar'24-Mar'25) | Key Drivers | Market Position |

|---|---|---|---|

| Retail Loans | 27.1% | Auto Loans, Payroll Loans, Credit Cards | Strong Expansion |

| Wholesale Loans | 13.7% | Corporate Lending Solutions | Robust Standing |

| Auto Financing (incl. Cetelem Mexico) | 36.4% (2024 Total Portfolio Impact) | Acquisition of Cetelem Mexico | Dominant Player, High Growth Potential |

What is included in the product

Highlights which Grupo Inbursa units to invest in, hold, or divest based on market share and growth.

Grupo Inbursa's BCG Matrix offers a clear, visual roadmap, relieving the pain of strategic uncertainty by highlighting growth opportunities and resource allocation.

Cash Cows

Grupo Inbursa's commercial banking services are a bedrock of its operations, forming a significant chunk of its overall loan book. This segment is characterized by its maturity and stability, acting as a reliable generator of consistent cash flow.

While the growth rate might not match more dynamic sectors, the established client base and deep relationships within the commercial space ensure a steady income stream. For instance, as of the first quarter of 2024, Inbursa reported a robust loan portfolio, with commercial lending playing a crucial role in its overall financial performance, contributing significantly to its net interest income.

Fondo Inbursa, a cornerstone of Grupo Inbursa's investment services, has demonstrated exceptional financial performance, achieving the highest profitability in USD for an impressive 44-year period, from March 1981 to March 2025. This sustained success, coupled with consistent growth in assets under management, firmly establishes it as a Cash Cow within the group's portfolio.

The segment's maturity and strong market position suggest it generates substantial, reliable revenue with minimal need for further capital infusion for growth or marketing. This allows Grupo Inbursa to leverage the cash flows generated by Fondo Inbursa to support other business units or strategic initiatives.

Grupo Inbursa's traditional insurance offerings, including life and property & casualty (P&C), are likely its cash cows. Despite Mexico's relatively low insurance penetration, these established products benefit from Inbursa's strong market presence. They consistently generate stable premium income, bolstering the group's profitability even in a market experiencing more moderate growth.

Established Retail Deposit Base

Grupo Financiero Inbursa's established retail deposit base acts as a significant cash cow. By the end of March 2025, these deposits saw a robust increase of 23.1%, totaling $392,283 million pesos. This substantial and expanding base offers a dependable and cost-effective funding stream for the institution's lending operations.

This stability translates directly into improved financial margins and consistent cash flow for Grupo Inbursa. The low cost of these retail deposits allows the company to lend at more competitive rates, further solidifying its market position.

- Retail Deposit Growth: 23.1% increase by March 2025.

- Total Retail Deposits: $392,283 million pesos as of March 2025.

- Funding Advantage: Provides a stable and low-cost source for lending.

- Financial Impact: Contributes to healthy margins and strong cash flow.

Synergies from Slim Family Conglomerate

As a core part of the expansive Slim family conglomerate, Grupo Inbursa enjoys significant advantages. This integration fosters powerful synergies, creating a stable and loyal client base that consistently fuels its operations.

This established network acts as a powerful engine, generating a reliable stream of business and substantially lowering the costs associated with acquiring new customers. In essence, it functions as a dependable cash generator for the group.

For instance, in 2024, Grupo Inbursa reported a net profit of approximately MXN 20.5 billion, a testament to the consistent revenue streams derived from its integrated business model and extensive customer reach.

- Synergistic Client Base: Grupo Inbursa leverages the vast customer network of the broader Slim conglomerate, ensuring a continuous influx of business.

- Reduced Acquisition Costs: The inherent trust and brand recognition within the conglomerate significantly lower the expense of attracting new clients.

- Stable Revenue Generation: This integrated approach provides a predictable and consistent revenue stream, reinforcing its position as a cash cow.

- Financial Performance (2024): The company's net profit of around MXN 20.5 billion highlights the effectiveness of these synergistic advantages.

Grupo Inbursa's established commercial banking services are a prime example of a cash cow. These operations benefit from a mature market position and deep client relationships, ensuring a steady and predictable revenue stream. The consistent contribution to net interest income, as seen in the first quarter of 2024, underscores their role as reliable cash generators.

Fondo Inbursa's remarkable 44-year track record of profitability, culminating in March 2025, solidifies its status as a cash cow. Its sustained success and growing assets under management generate substantial, reliable income with minimal need for reinvestment, allowing capital to be redirected to other areas of the business.

The traditional insurance offerings, including life and property & casualty, are also strong cash cows for Grupo Inbursa. Despite market penetration challenges, these products consistently deliver stable premium income, bolstering overall profitability through their dependable revenue generation.

Grupo Financiero Inbursa's retail deposit base, which saw a 23.1% increase to $392,283 million pesos by March 2025, acts as a significant cash cow. This stable, low-cost funding source enhances financial margins and provides consistent cash flow for lending activities.

The synergies derived from being part of the Slim conglomerate create a powerful cash cow. This integrated approach fosters a stable, loyal customer base, significantly reducing acquisition costs and ensuring a predictable stream of business, as evidenced by the 2024 net profit of MXN 20.5 billion.

Delivered as Shown

Grupo Inbursa BCG Matrix

The Grupo Inbursa BCG Matrix preview you see is the identical, fully finalized document you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive report has been meticulously crafted to provide strategic insights into Grupo Inbursa's business units, mirroring the professional quality and analytical depth of the final deliverable. You can confidently expect the same polished formatting and actionable data, ready for immediate integration into your strategic planning or presentations. This preview guarantees that the purchased file is not a sample or a demo, but the complete, analysis-ready BCG Matrix for Grupo Inbursa.

Dogs

Grupo Inbursa's legacy financial products, particularly those that haven't embraced digital transformation, are likely positioned as Dogs in their BCG Matrix. Think of traditional, branch-heavy banking services that are seeing declining customer engagement as digital alternatives become the norm. For instance, Inbursa's older fixed-term deposit accounts with limited online functionality might be experiencing reduced uptake compared to more agile, digitally-native competitors.

Low-Growth Niche Investment Funds, within Grupo Inbursa's portfolio, would represent areas where specific investment products or strategies are not capturing significant market share and are experiencing minimal growth. These funds operate in specialized segments that may have limited appeal or have been outpaced by broader market trends. For instance, a hypothetical niche fund focusing on a particular legacy technology sector might see its assets under management (AUM) stagnate or decline if that technology is no longer in high demand.

In 2024, the investment landscape continues to evolve, with investors increasingly favoring growth-oriented sectors and innovative strategies. Funds that fail to adapt or offer compelling returns in these dynamic environments are likely to fall into the low-growth category. If Grupo Inbursa had a fund dedicated to, say, a declining physical media market, its AUM would likely reflect this stagnation, potentially showing a low single-digit percentage growth or even a contraction in AUM over the past year.

Certain less competitive insurance lines, where Grupo Inbursa might have a minimal market share and face significant competition, could be categorized as Dogs. These niche segments, while part of the broader growing insurance market, may demand substantial resources for relatively low returns. For instance, Inbursa's participation in highly specialized liability insurance for emerging technologies or niche agricultural risks might fall into this quadrant if their market penetration is limited and competitive pressures are high.

Physical Branch Network in Declining Areas

Physical branches situated in areas experiencing economic downturns or population decline, particularly where digital banking is prevalent, could be classified as Dogs within Grupo Inbursa's BCG Matrix. These locations often present a challenge due to high operational expenses coupled with decreasing foot traffic and a diminished market share in their immediate surroundings.

For instance, a report from the Bank for International Settlements (BIS) in 2024 highlighted that while digital transactions surged, physical branch usage in certain declining urban sectors saw a drop of over 15% compared to pre-pandemic levels. This indicates a potential for these Inbursa branches to become cost centers with limited growth prospects.

- High Operational Costs: Maintaining physical infrastructure in low-traffic areas leads to disproportionately high per-transaction costs.

- Low Market Share: Declining demographics and increased digital competition shrink the potential customer base for these branches.

- Diminishing Returns: Investments in revitalizing these branches may yield minimal returns given the unfavorable market conditions.

- Strategic Re-evaluation: Such units often require a strategic decision regarding closure, downsizing, or repurposing to mitigate losses.

Outdated Internal Systems/Technology

Grupo Inbursa's legacy internal systems and technologies represent a significant Dogs category. These outdated assets, while essential for day-to-day operations, are costly to maintain and struggle to keep pace with modern business demands. For instance, in 2024, the company's IT spending on maintaining legacy infrastructure could represent a substantial portion of its operational budget, diverting funds that could otherwise be invested in growth initiatives or innovative solutions.

These systems often exhibit inefficiencies, leading to slower processing times and increased potential for errors, which directly impact customer service and operational agility. The lack of integration with newer platforms further exacerbates these issues, creating data silos and hindering comprehensive analysis.

The cost of maintaining these systems can be substantial. For example, a significant percentage of IT budgets in large financial institutions are often allocated to simply keeping older systems running, rather than developing new capabilities. This can translate to millions of dollars annually for a company like Inbursa, impacting its profitability and competitive edge.

- High Maintenance Costs: Legacy systems often require specialized, costly support and are prone to unexpected breakdowns.

- Operational Inefficiencies: Outdated technology can lead to slower transaction processing and increased manual workarounds.

- Limited Scalability: These systems may not be able to handle increased transaction volumes or adapt to new market demands.

- Security Vulnerabilities: Older systems are often more susceptible to cyber threats, posing a significant risk.

Grupo Inbursa's legacy financial products, particularly those that haven't embraced digital transformation, are likely positioned as Dogs in their BCG Matrix. These are offerings like traditional, branch-heavy banking services that are seeing declining customer engagement as digital alternatives become the norm. For instance, Inbursa's older fixed-term deposit accounts with limited online functionality might be experiencing reduced uptake compared to more agile, digitally-native competitors.

Low-Growth Niche Investment Funds, within Grupo Inbursa's portfolio, would represent areas where specific investment products or strategies are not capturing significant market share and are experiencing minimal growth. These funds operate in specialized segments that may have limited appeal or have been outpaced by broader market trends. For example, a hypothetical niche fund focusing on a particular legacy technology sector might see its assets under management (AUM) stagnate or decline if that technology is no longer in high demand.

Certain less competitive insurance lines, where Grupo Inbursa might have a minimal market share and face significant competition, could be categorized as Dogs. These niche segments, while part of the broader growing insurance market, may demand substantial resources for relatively low returns. For instance, Inbursa's participation in highly specialized liability insurance for emerging technologies or niche agricultural risks might fall into this quadrant if their market penetration is limited and competitive pressures are high.

Question Marks

Grupo Inbursa's new digital financial products, like their mobile banking app offering streamlined account management and investment options tailored for millennials and Gen Z, would likely be classified as Stars or Question Marks in the BCG Matrix. These initiatives tap into the rapidly expanding digital banking sector, a high-growth market, but as new entrants, they would initially possess a low market share.

Significant investment is necessary to build brand awareness, acquire customers, and refine the user experience to compete effectively in this dynamic digital space. For instance, by the end of 2023, digital banking adoption in Mexico saw a notable surge, with over 60% of the banked population utilizing mobile banking services, indicating a strong market opportunity for Inbursa's digital offerings.

Grupo Inbursa's Q1 2025 report highlights its expansion into Brazil with payroll loans, classifying this venture as a Question Mark. This move targets a high-growth market, but Inbursa's current market share there is minimal.

Success in Brazil's payroll loan sector will demand significant capital outlay and well-executed strategies to gain traction. The company's ability to navigate local regulations and competitive pressures will be critical for this initiative to transition from a Question Mark to a Star.

Grupo Inbursa's exploration into specialized fintech partnerships, particularly in areas like blockchain and AI-driven advisory, positions it to potentially tap into high-growth, albeit nascent, markets. While specific recent partnerships for 2024 are not publicly detailed, Inbursa's strategic focus on digital transformation suggests such collaborations are likely being pursued.

These ventures, while promising for future expansion, would represent a minimal market share for Inbursa initially, reflecting the early stages of adoption for these innovative solutions within the broader financial services landscape. For instance, the global fintech market was projected to reach over $300 billion by 2024, indicating substantial growth potential but also intense competition for established players entering the space.

Emerging Green Finance Initiatives

Grupo Inbursa's emerging green finance initiatives, such as sustainable investment products, would likely be categorized as Question Marks in a BCG matrix. This reflects their position in a rapidly expanding market driven by increasing ESG (Environmental, Social, and Governance) focus within the financial sector.

While the overall green finance market is experiencing significant growth, Inbursa's market share in these nascent areas is probably low due to their early stage of development. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management in 2024, a substantial increase from previous years, highlighting the market's potential but also its competitive landscape.

- Market Growth: The global sustainable investment market is expanding rapidly, with assets projected to continue their upward trajectory.

- Inbursa's Position: Inbursa's green finance products are new entrants, suggesting a limited current market share within this burgeoning sector.

- Strategic Focus: These initiatives require significant investment to gain traction and potentially become future Stars for the company.

- Competitive Landscape: The increasing global adoption of ESG principles means Inbursa faces competition from established players and new entrants alike in the green finance space.

Development of Advanced Wealth Management Tools

Grupo Inbursa's venture into advanced, technology-driven wealth management tools for high-net-worth individuals presents a classic Question Mark scenario. While the market for sophisticated wealth solutions is experiencing robust growth, estimated to expand significantly in the coming years, Inbursa faces the challenge of substantial investment requirements to carve out a meaningful market presence.

This segment demands cutting-edge platforms and personalized services, areas where specialized fintech firms and established global players already hold considerable sway. For Inbursa to succeed, it must not only match but exceed the technological sophistication and service offerings of these competitors.

- High Growth Potential: The global wealth management market is projected to see continued strong growth, with particular acceleration in digital offerings.

- Significant Investment Needed: Developing and maintaining advanced technological infrastructure, data analytics capabilities, and cybersecurity measures requires substantial capital outlay.

- Intense Competition: Inbursa will compete against established banks with existing wealth divisions and agile fintech startups specializing in digital wealth solutions.

- Market Share Challenge: Gaining significant market share will necessitate a compelling value proposition that differentiates Inbursa from its rivals in attracting and retaining high-net-worth clients.

Grupo Inbursa's new digital financial products, like their mobile banking app, and their expansion into Brazil with payroll loans are prime examples of Question Marks. These ventures are in high-growth markets but currently hold a low market share for Inbursa.

Similarly, their exploration into specialized fintech partnerships, particularly in blockchain and AI, and their emerging green finance initiatives also fall into the Question Mark category. These areas offer significant future potential but require substantial investment to gain traction and compete.

The company's foray into advanced, technology-driven wealth management tools for high-net-worth individuals also represents a Question Mark. While the market is growing, Inbursa faces intense competition and the need for significant capital to establish a strong presence.

These initiatives, while promising, demand strategic execution and considerable financial resources to transition from Question Marks to Stars, reflecting the dynamic and competitive nature of the financial services landscape in 2024 and beyond.

| Initiative | Market Growth | Inbursa Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Digital Banking Products | High (e.g., >60% mobile banking adoption in Mexico by end of 2023) | Low (new entrants) | High (brand awareness, customer acquisition) | Question Mark |

| Brazil Payroll Loans | High (emerging market) | Minimal | Significant (capital outlay, local strategy) | Question Mark |

| Fintech Partnerships (Blockchain/AI) | High (nascent but growing, global fintech market projected >$300B by 2024) | Minimal (early stage) | High (R&D, integration) | Question Mark |

| Green Finance Initiatives | High (global sustainable investment market ~$35.3T in 2024) | Low (early stage) | High (product development, market penetration) | Question Mark |

| Advanced Wealth Management | High (robust growth in sophisticated solutions) | Low (new entrant challenge) | Substantial (technology, talent) | Question Mark |

BCG Matrix Data Sources

Our Grupo Inbursa BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.