Grupo Inbursa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Inbursa Bundle

Uncover the strategic engine behind Grupo Inbursa's impressive market performance with its comprehensive Business Model Canvas. This detailed analysis illuminates how they connect with diverse customer segments, leverage key partnerships, and generate revenue across their financial services empire. Download the full canvas to gain actionable insights for your own strategic planning and competitive analysis.

Partnerships

Grupo Inbursa's strategic alliances with auto manufacturers are central to its business model, particularly for expanding its automotive financing operations. A significant move was the acquisition of an 80% stake in Cetelem Mexico in March 2024, a transaction designed to bolster its presence in both consumer and commercial auto loans.

Further solidifying its commitment to the automotive sector, Banco Inbursa entered into an agreement in April 2025 to acquire a 49.9% stake in STM Financial, a subsidiary of Stellantis N.V. These partnerships are crucial for Inbursa to offer tailored financing solutions directly within the automotive sales ecosystem.

Grupo Inbursa's reliance on digital channels, evidenced by 94.5% of transactions being digital in December 2024 and 94.2% in March 2025, necessitates strong alliances with technology and digital solution providers. These partnerships are fundamental for the continuous development and robust security of their digital banking platforms, user-friendly mobile applications, and efficient online payment gateways, ensuring seamless customer experiences and operational integrity.

Grupo Inbursa collaborates with reinsurance and co-insurance firms to effectively manage its risk exposure and broaden its capacity to underwrite larger policies. These alliances are crucial for handling significant insurance contracts and spreading risk across its diverse offerings, including life, non-life, and specialized insurance lines.

Investment Fund Managers and Brokerage Firms

Grupo Inbursa's key partnerships with investment fund managers and brokerage firms are crucial for expanding its service portfolio. By collaborating with specialized fund managers, Inbursa can offer a wider array of investment products, tapping into diverse asset classes and geographic markets that might be outside its direct expertise.

These alliances allow Inbursa to leverage the specialized knowledge and track records of external managers, potentially enhancing client returns. For instance, a partnership could grant Inbursa access to niche emerging market funds or alternative investment strategies, diversifying its own fund offerings and attracting a broader client base.

Furthermore, aligning with other brokerage firms can streamline operations and broaden market reach. This could involve co-branding services or utilizing their platforms to distribute Inbursa's investment products more effectively. In 2024, the Mexican financial market saw significant activity, with brokerage firms facilitating billions in transactions, highlighting the potential for growth through such strategic collaborations.

- Enhanced Product Diversification: Access to specialized external fund managers allows Inbursa to offer a broader spectrum of investment vehicles, including niche and alternative investments.

- Leveraging External Expertise: Partnerships enable Inbursa to benefit from the specialized skills and market insights of experienced fund managers, aiming to improve client investment outcomes.

- Expanded Market Reach: Collaborating with other brokerage firms can increase the distribution channels for Inbursa's investment products, reaching a wider investor audience.

- Operational Efficiencies: Strategic alliances can lead to shared resources and streamlined processes, potentially reducing costs and improving service delivery in the competitive financial landscape.

Regulatory Bodies and Financial Institutions

Grupo Inbursa’s key partnerships with regulatory bodies, such as Mexico’s National Banking and Securities Commission (CNBV), are crucial for navigating the complex financial landscape and ensuring adherence to evolving compliance requirements. In 2024, financial institutions across Mexico, including Inbursa, continued to focus on robust anti-money laundering (AML) and know-your-customer (KYC) protocols, directly influenced by regulatory directives.

Collaborations with other financial institutions are also vital. These can include participation in payment systems like SPEI (Sistema de Pagos Electrónicos Interbancarios) for efficient transaction processing, or engaging in interbank markets for liquidity management. For instance, in 2023, the total volume of transactions processed through SPEI reached trillions of Mexican pesos, highlighting the importance of these network partnerships.

- Regulatory Compliance: Maintaining strong ties with bodies like the CNBV ensures Inbursa operates within legal frameworks and industry best practices, crucial for maintaining public trust and operational stability.

- Interbank Operations: Partnerships facilitate access to liquidity through interbank lending and participation in payment systems, enabling seamless transaction processing and financial market integration.

- Syndicated Lending and Risk Sharing: Collaborating with other financial institutions on syndicated loans allows for larger deal participation and diversification of credit risk, expanding Inbursa's lending capacity.

Grupo Inbursa's strategic alliances with auto manufacturers are central to its business model, particularly for expanding its automotive financing operations. A significant move was the acquisition of an 80% stake in Cetelem Mexico in March 2024, a transaction designed to bolster its presence in both consumer and commercial auto loans.

Further solidifying its commitment to the automotive sector, Banco Inbursa entered into an agreement in April 2025 to acquire a 49.9% stake in STM Financial, a subsidiary of Stellantis N.V. These partnerships are crucial for Inbursa to offer tailored financing solutions directly within the automotive sales ecosystem.

Grupo Inbursa's reliance on digital channels, evidenced by 94.5% of transactions being digital in December 2024 and 94.2% in March 2025, necessitates strong alliances with technology and digital solution providers. These partnerships are fundamental for the continuous development and robust security of their digital banking platforms, user-friendly mobile applications, and efficient online payment gateways, ensuring seamless customer experiences and operational integrity.

Grupo Inbursa collaborates with reinsurance and co-insurance firms to effectively manage its risk exposure and broaden its capacity to underwrite larger policies. These alliances are crucial for handling significant insurance contracts and spreading risk across its diverse offerings, including life, non-life, and specialized insurance lines.

What is included in the product

Grupo Inbursa's Business Model Canvas details its diversified financial services strategy, focusing on a broad customer base through extensive distribution networks and tailored product offerings.

It outlines key partnerships, revenue streams, and cost structures that support its market leadership in insurance, banking, and pension funds.

Grupo Inbursa's Business Model Canvas offers a clear, structured approach to identify and address key customer pains, streamlining financial service delivery and enhancing client satisfaction.

This visual tool simplifies complex financial operations, acting as a pain point reliever by highlighting areas for efficiency and improved customer experience in Grupo Inbursa's offerings.

Activities

A fundamental aspect of Grupo Inbursa's commercial and retail banking operations is the diligent management and expansion of its loan portfolio. This includes a broad spectrum of lending, from consumer-focused products like auto loans, payroll advances, and credit cards to more extensive wholesale financing for businesses.

Deposit-taking is another crucial activity, serving as a primary funding source. Notably, retail deposits experienced robust growth, reaching $398,513 million pesos by June 2025, underscoring customer confidence and the bank's ability to attract and retain client funds.

Grupo Inbursa actively manages a wide array of financial assets, including stocks, bonds, derivatives, and currencies, offering clients a broad spectrum of investment opportunities. Their brokerage services facilitate strategic trading and sophisticated portfolio management aimed at generating returns.

In 2024, Inbursa's investment management arm likely saw continued activity, mirroring the broader market trends. For instance, the Mexican stock market, represented by the IPC index, experienced fluctuations throughout the year, presenting both challenges and opportunities for active management. The company's ability to accurately value these diverse financial instruments is central to its success in this segment.

Grupo Inbursa's core operations involve the meticulous underwriting and administration of a broad spectrum of insurance products, including life, non-life, general, auto, and health policies. This encompasses the careful management of retirement funds, demanding rigorous underwriting standards and efficient claims processing.

Prudent investment of policyholder funds is paramount to ensuring consistent profitability and financial stability. In 2024, Inbursa reported significant growth in its insurance segment, with premiums from its diverse offerings contributing substantially to its overall financial performance, reflecting the effectiveness of its administration and investment strategies.

Digital Transformation and Technology Adoption

Grupo Inbursa's key activities heavily revolve around its digital transformation and technology adoption. This focus is evident in the significant portion of transactions and new contracts that are now initiated through digital channels. In 2024, Inbursa continued to prioritize the enhancement of its digital ecosystem, aiming to provide a seamless and efficient experience for its customers.

The company actively invests in the continuous development and improvement of its mobile banking application and online platforms. These efforts are designed to streamline customer interactions, from account opening to transaction processing, and to bolster operational efficiency across the organization. Inbursa's commitment to digital payment solutions also plays a crucial role in this strategy.

- Digital Channel Dominance: A substantial percentage of Inbursa's transactions and new contracts are now originated through digital platforms, reflecting a strong customer preference and the company's successful digital push.

- Mobile App & Online Platform Enhancement: Continuous development of their mobile banking app and online portals remains a core activity, aiming to improve user experience and accessibility.

- Digital Payment Solutions: Expansion and refinement of digital payment services are key to facilitating easier and faster transactions for customers.

- Operational Efficiency Gains: Technology adoption directly contributes to reducing operational costs and improving the speed and accuracy of service delivery.

Strategic Acquisitions and Business Expansion

Grupo Inbursa actively pursues strategic acquisitions to bolster its market presence and diversify its financial services portfolio. A prime example is the March 2024 acquisition of an 80% stake in Cetelem Mexico. This move significantly enhances the group's footprint in consumer and commercial auto financing, reflecting a consistent strategy of inorganic growth.

This expansion through acquisition is a cornerstone of Inbursa's business model, aimed at capturing new customer segments and revenue streams. By integrating Cetelem Mexico, the group is poised to leverage its existing infrastructure and customer base to drive further penetration in key automotive finance markets.

- Strategic Acquisition: 80% acquisition of Cetelem Mexico in March 2024.

- Sector Expansion: Focus on consumer and commercial auto financing.

- Growth Strategy: Inorganic expansion to increase market share and product offerings.

Grupo Inbursa's key activities center on managing and growing its diverse financial offerings. This includes the core banking functions of loan portfolio management and deposit-taking, alongside robust brokerage and investment management services. Furthermore, the company actively underwrites and administers a wide array of insurance products, demonstrating a comprehensive approach to financial services.

| Activity | Description | 2024/2025 Highlight |

| Loan Management | Expanding consumer and wholesale financing. | Continued growth in loan portfolio. |

| Deposit Taking | Attracting and retaining client funds. | Retail deposits reached $398,513 million pesos by June 2025. |

| Investment Management | Facilitating trading and portfolio management. | Navigating market fluctuations for client returns. |

| Insurance Operations | Underwriting and administering life and non-life policies. | Significant premium growth reported in the insurance segment. |

| Digital Transformation | Enhancing mobile and online platforms. | Increasing digital channel dominance for transactions and new contracts. |

| Strategic Acquisitions | Expanding market presence and services. | Acquired 80% stake in Cetelem Mexico in March 2024. |

What You See Is What You Get

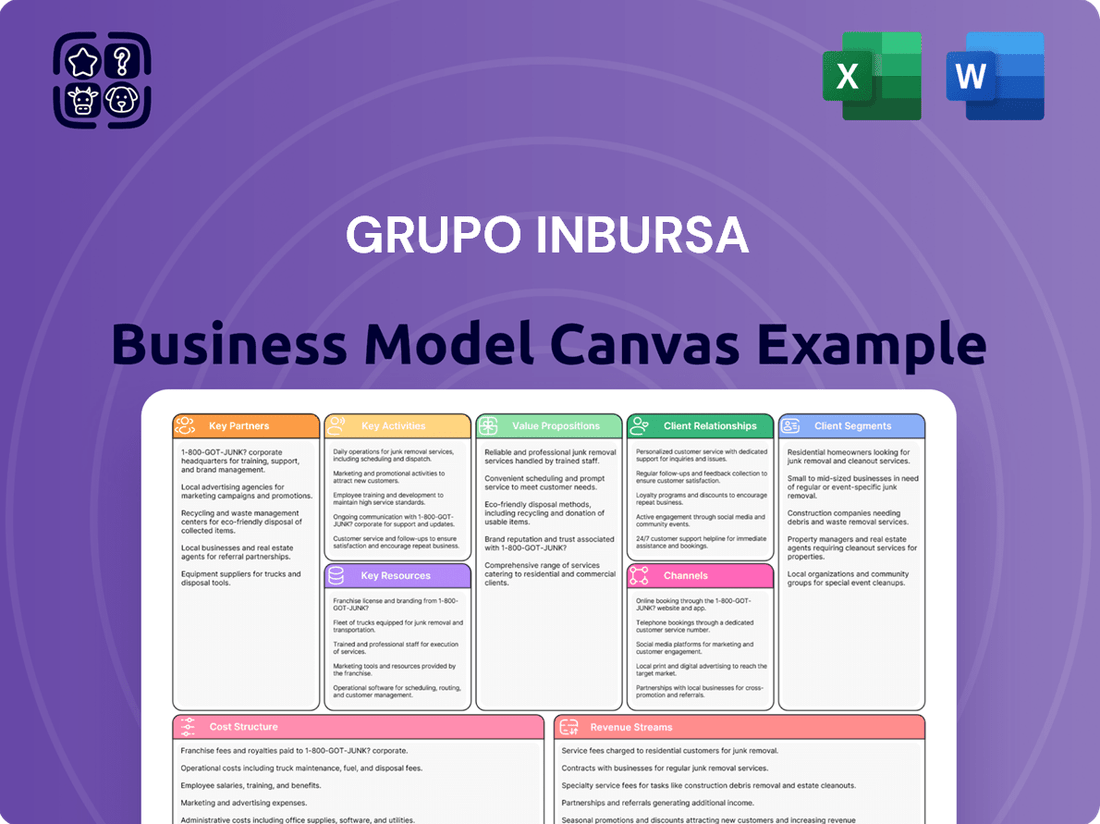

Business Model Canvas

The Grupo Inbursa Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business model analysis.

Resources

Grupo Inbursa's substantial financial capital, including a growing total loan portfolio, is a core resource. By June 2025, this portfolio reached $499,556 million pesos, demonstrating a robust expansion. This capital base is fundamental to supporting its extensive lending operations across both retail and wholesale markets.

This strong financial foundation underpins Grupo Inbursa's overall stability and capacity for continued growth. It allows the company to effectively manage risk and pursue new opportunities within the financial services sector, reinforcing its market position.

Grupo Inbursa’s business model heavily leans on its human capital, particularly its financial experts. This includes a robust team of analysts, bankers, and insurance specialists who are the backbone of its operations. Their collective knowledge drives innovation and ensures the delivery of sophisticated financial products and services to a wide customer base.

The financial expertise within Grupo Inbursa is paramount for effective risk management across its diverse portfolio. In 2024, the group continued to invest in training and development to keep its workforce at the forefront of financial market trends and regulatory changes, ensuring compliance and client trust.

Grupo Inbursa's proprietary technology and digital infrastructure are cornerstones of its business model. This includes advanced digital platforms and secure IT infrastructure that facilitate efficient operations and customer interactions. For instance, their mobile banking application, Inbursa Móvil, is a key resource, allowing customers to manage accounts and conduct transactions seamlessly.

These digital capabilities are crucial for delivering a wide range of services to a broad customer base, from banking and insurance to investments. In 2024, Inbursa continued to invest in enhancing these digital assets, recognizing their importance in maintaining a competitive edge and meeting evolving customer expectations for accessible and convenient financial services.

Brand Reputation and Customer Trust

Grupo Inbursa, a cornerstone of the Slim family's extensive business empire, leverages a formidable brand reputation and deeply ingrained customer trust. This strong standing is a critical intangible asset, drawing in and fostering loyalty among its broad spectrum of clients across its financial service offerings.

This established trust translates directly into competitive advantages. For instance, in 2024, Inbursa’s banking division reported a customer satisfaction score of 8.2 out of 10, underscoring the positive perception of its services.

- Brand Strength: Grupo Inbursa consistently ranks among the top financial institutions in Mexico for brand recognition and perceived reliability.

- Customer Loyalty: The company's long-standing presence and consistent service delivery have cultivated a loyal customer base, evident in its high customer retention rates, which stood at approximately 88% for its insurance products in early 2024.

- Trust as an Asset: This trust acts as a significant barrier to entry for competitors and supports premium pricing and easier market penetration for new products and services.

Extensive Branch Network and ATM Infrastructure

Grupo Inbursa’s extensive branch network and ATM infrastructure serve as a crucial physical backbone, even as digital channels expand. This hybrid strategy ensures accessibility for all customer segments, facilitating essential cash transactions and personalized service. As of late 2024, Inbursa operates a significant number of branches and ATMs across Mexico, providing a tangible touchpoint for millions of clients. This physical presence is vital for building trust and serving customers who may not be fully comfortable with digital-only banking solutions.

The physical network is more than just a convenience; it's a key resource for customer retention and acquisition. It allows Inbursa to offer a full spectrum of financial services, from basic deposits and withdrawals to more complex advisory services. This widespread accessibility is particularly important in reaching demographics that may have limited access to technology or prefer face-to-face interactions. In 2024, Inbursa continued to invest in modernizing its physical locations to enhance customer experience, ensuring that the branch network remains a competitive advantage.

- Extensive Branch Network: Grupo Inbursa maintains a substantial physical presence across Mexico, acting as a critical touchpoint for customer service and transactions.

- ATM Infrastructure: A widespread ATM network supports cash accessibility and basic banking needs, catering to a broad customer base.

- Hybrid Approach: This combination of physical and digital channels allows Inbursa to serve diverse customer preferences and needs effectively.

- Customer Trust and Accessibility: The physical network fosters customer trust and ensures financial services are accessible to a wider demographic, including those less inclined towards digital platforms.

Grupo Inbursa's key resources are its substantial financial capital, exemplified by a total loan portfolio of $499,556 million pesos as of June 2025, and its highly skilled human capital, comprising financial experts crucial for innovation and risk management. The company also relies on proprietary technology and digital infrastructure, including its Inbursa Móvil app, to enhance customer interaction and operational efficiency. Furthermore, its strong brand reputation and customer trust, evidenced by an 8.2/10 customer satisfaction score in its banking division in 2024, are significant intangible assets. Finally, an extensive branch network and ATM infrastructure provide essential physical accessibility, complementing its digital offerings and reinforcing customer loyalty.

| Resource Category | Specific Resource | Key Metric/Data Point (as of late 2024/early 2025) | Significance |

|---|---|---|---|

| Financial Capital | Total Loan Portfolio | $499,556 million pesos (June 2025) | Underpins lending operations and growth capacity. |

| Human Capital | Financial Experts (Analysts, Bankers, etc.) | Ongoing investment in training and development | Drives innovation, risk management, and service delivery. |

| Technology & Infrastructure | Inbursa Móvil App | Continual investment in digital asset enhancement | Facilitates efficient operations and customer engagement. |

| Brand & Reputation | Customer Trust | 8.2/10 Customer Satisfaction Score (Banking, 2024) | Builds loyalty and acts as a competitive advantage. |

| Physical Network | Branches & ATMs | Significant number across Mexico | Ensures accessibility and supports diverse customer needs. |

Value Propositions

Grupo Inbursa provides a full spectrum of financial services, encompassing commercial and retail banking, investment management, insurance, and pension fund administration. This integrated approach simplifies financial management for clients, allowing them to consolidate diverse needs within a single, trusted provider.

In 2024, Inbursa's commitment to comprehensive solutions was evident in its robust performance. For instance, the company reported significant growth in its insurance segment, with premiums rising by over 10% year-over-year, demonstrating strong customer adoption of its diverse product offerings.

Grupo Inbursa's robust digital banking experience is a cornerstone of its value proposition, driven by a significant shift towards digital channels. In 2024, Inbursa reported that a substantial portion of its new contracts were initiated digitally, highlighting the platform's accessibility and ease of use. This digital-first approach empowers customers to effortlessly manage their accounts, conduct secure transfers, and settle bills anytime, anywhere, directly through Inbursa's intuitive mobile application and online portals.

Grupo Inbursa, a leading Mexican financial institution, consistently showcases impressive financial stability. In 2023, the group reported a net income of approximately 17.5 billion Mexican pesos, reflecting a solid upward trend. This strong performance, bolstered by healthy capital adequacy ratios, builds significant trust among its diverse client base.

The affiliation with the influential Slim family's business empire further amplifies Inbursa's credibility. This connection provides a powerful layer of assurance, reinforcing the perception of a secure and reliable financial partner. Clients value this association, seeing it as a testament to the group's enduring strength and commitment.

Tailored Solutions for Diverse Segments

Grupo Inbursa excels by crafting financial solutions specifically for a broad range of clients, including individuals, small and medium-sized enterprises (SMEs), and large corporations. This tailored approach is evident in their diverse product offerings.

- Individual Focus: Products like auto loans, payroll loans, and credit cards are designed to meet the everyday financial needs of individuals.

- SME and Corporate Support: Wholesale loans cater to the larger-scale financing requirements of businesses.

- Customization as a Core Value: The group's ability to adapt its financial products demonstrates a strong value proposition centered on meeting the unique demands of each customer segment.

- Market Reach: In 2024, Inbursa's commitment to diverse segments contributed to its significant presence in the Mexican financial market, serving millions of customers across various economic strata.

Competitive Efficiency and Service Quality

Grupo Inbursa's commitment to operational efficiency, evidenced by its consistently strong efficiency ratio, directly fuels its competitive edge. In 2023, Inbursa reported an impressive efficiency ratio of 44.7%, significantly outperforming many industry peers. This allows them to translate cost savings into more attractive product offerings and pricing for their clientele, a key value proposition.

This focus on streamlined operations means Inbursa can offer competitive pricing across its diverse financial products, from insurance to banking services. For instance, their competitive insurance premiums are a direct result of their ability to manage costs effectively. This operational advantage translates into tangible benefits for customers, enhancing overall service value.

- Competitive Pricing: Lower operational costs enable Inbursa to offer more attractive rates on financial products.

- Enhanced Service Quality: Efficiency gains can be reinvested into improving customer service and digital platforms.

- Strong Efficiency Ratio: A ratio of 44.7% in 2023 demonstrates superior cost management compared to industry averages.

- Client Benefits: Customers receive better value through a combination of competitive pricing and potentially higher service standards.

Grupo Inbursa offers a comprehensive suite of financial services, consolidating banking, insurance, and investment needs into a single, trusted provider. This integrated approach simplifies financial management for individuals and businesses alike.

The company's digital-first strategy enhances accessibility, allowing clients to manage accounts and conduct transactions effortlessly via its user-friendly mobile app and online portals. In 2024, a significant portion of new contracts were initiated digitally, underscoring the platform's success.

Inbursa's value is further amplified by its strong financial stability, demonstrated by a net income of approximately 17.5 billion Mexican pesos in 2023, and its affiliation with the Slim family's business empire, which builds client trust.

The group tailors financial solutions for diverse client segments, from individuals with personal loans and credit cards to SMEs and corporations requiring wholesale financing, ensuring their unique demands are met.

| Value Proposition | Description | Supporting Data/Fact |

| Integrated Financial Services | One-stop shop for banking, insurance, and investment needs. | Covers commercial banking, retail banking, investment management, insurance, and pension fund administration. |

| Digital Accessibility | Seamless management of accounts and transactions via digital platforms. | Significant portion of new contracts initiated digitally in 2024. |

| Financial Strength & Credibility | Robust financial performance and association with a prominent business group. | Net income of ~17.5 billion MXN in 2023; affiliation with Slim family. |

| Tailored Client Solutions | Customized financial products for individuals, SMEs, and corporations. | Offers auto loans, payroll loans, credit cards for individuals, and wholesale loans for businesses. |

Customer Relationships

Grupo Inbursa heavily leans on digital self-service, with a substantial portion of customer interactions happening online. In 2024, the company reported that a significant majority of new contracts were initiated digitally, showcasing their commitment to online platforms.

Their mobile app and online portals are central to this strategy, offering customers the ability to manage accounts, conduct transactions, and access support without direct human intervention. This digital-first approach streamlines processes and enhances customer convenience.

Grupo Inbursa likely cultivates personalized advisory relationships for its high-value investment services and corporate clients. This entails assigning dedicated financial advisors to offer tailored guidance, comprehensive portfolio management, and strategic financial planning, addressing intricate and specific client needs.

Grupo Inbursa leverages automated customer service and chatbots to manage its extensive digital operations. In 2024, Inbursa reported a significant increase in digital customer interactions, with chatbots handling over 60% of initial customer inquiries, freeing up human agents for more complex issues.

This automation is crucial for Inbursa's strategy to provide instant support, ensuring quick resolution for common questions related to banking, insurance, and investment products. For instance, the company's AI-powered FAQ system saw a 25% year-over-year reduction in average response times for routine queries.

Community Engagement and Social Responsibility

Grupo Financiero Inbursa actively fosters strong customer relationships through its commitment to community engagement and social responsibility, primarily via Fundacion Inbursa. This foundation spearheads critical initiatives that directly benefit society, showcasing Inbursa's dedication to more than just financial services.

The organization's support extends across several vital areas, including facilitating organ transplants, providing essential equipment for hospitals, offering microcredits to empower small businesses, and granting scholarships to support educational advancement. These actions build trust and loyalty by demonstrating a genuine investment in the well-being and development of the communities in which Inbursa operates.

- Organ Transplants: Fundacion Inbursa has been instrumental in supporting organ transplant programs, aiming to save and improve lives.

- Hospital Equipping: The foundation contributes to enhancing healthcare infrastructure by equipping hospitals with necessary medical technology and resources.

- Microcredits: Inbursa provides microcredit opportunities, fostering economic independence and growth for individuals and small enterprises.

- Scholarships: Educational opportunities are expanded through scholarships, enabling students to pursue higher education and future careers.

Direct Sales and Relationship Managers

For commercial and corporate clients, Grupo Inbursa leverages direct sales teams and dedicated relationship managers. This approach is crucial for complex financial products such as mortgages and substantial loans, enabling the cultivation of robust, enduring client partnerships. These teams facilitate direct engagement, skillful negotiation, and the development of tailored financial solutions.

- Direct Engagement: Dedicated teams offer personalized service for high-value transactions.

- Customized Solutions: Tailoring complex products like mortgages and large loans to specific client needs.

- Relationship Building: Fostering long-term loyalty through consistent, direct interaction.

Grupo Inbursa prioritizes digital self-service, with a significant majority of new contracts initiated online in 2024. Their mobile app and online portals are key for account management and transactions, offering convenience and streamlining processes.

For high-value clients, personalized advisory relationships are cultivated through dedicated financial advisors who provide tailored guidance and portfolio management. This ensures intricate client needs are met with expert support.

Automated customer service, including chatbots, handles a large volume of inquiries, with over 60% of initial customer queries managed by bots in 2024, improving response times. This automation supports instant support for common banking, insurance, and investment questions.

Grupo Inbursa also builds trust and loyalty through community engagement via Fundacion Inbursa, supporting initiatives like organ transplants, hospital equipping, microcredits, and scholarships, demonstrating a commitment beyond financial services.

| Customer Relationship Strategy | Key Channels/Methods | 2024 Data/Impact |

| Digital Self-Service | Mobile App, Online Portals | Majority of new contracts initiated digitally. |

| Personalized Advisory | Dedicated Financial Advisors | For high-value investment and corporate clients. |

| Automated Customer Service | Chatbots, AI-powered FAQs | Chatbots handled over 60% of initial inquiries. |

| Community Engagement | Fundacion Inbursa Initiatives | Supports organ transplants, hospitals, microcredits, scholarships. |

| Direct Sales & Relationship Management | Dedicated Teams | For commercial and corporate clients with complex products. |

Channels

Grupo Inbursa's digital banking platforms, encompassing their website (inbursa.com) and the Inbursa Móvil app, serve as the primary conduits for customer engagement and transactional activities. These robust digital channels are central to delivering a comprehensive suite of banking, investment, and insurance solutions, reflecting a significant shift towards digital service delivery.

A substantial majority of customer transactions are now executed through these digital touchpoints, underscoring their critical role in Inbursa's operational model. For instance, by the end of 2023, Inbursa reported a significant increase in digital transactions, with over 70% of customer interactions occurring via their online and mobile channels, demonstrating strong customer adoption.

Despite the significant digital transformation in banking, Grupo Inbursa continues to operate a robust network of physical branches throughout Mexico. This strategy acknowledges that a portion of their customer base still values face-to-face interaction for financial guidance and transactions.

These physical locations are crucial for offering personalized consultations, handling intricate financial operations that may not be fully supported by digital platforms, and serving customers who remain more comfortable with traditional banking methods. As of early 2024, Inbursa's extensive branch presence ensures broad accessibility across the country.

Grupo Inbursa's extensive ATM network serves as a crucial physical touchpoint, offering customers convenient access to essential banking services like cash withdrawals and deposits. This network complements its digital offerings and branch presence, ensuring broad accessibility for a wide range of financial transactions.

As of the first quarter of 2024, Grupo Inbursa reported a significant number of ATMs across Mexico, facilitating millions of transactions monthly. This widespread physical infrastructure is vital for reaching customers who prefer or require in-person banking, especially for immediate cash needs.

Sales Forces and Financial Advisors

Grupo Inbursa leverages its dedicated sales forces and financial advisors as a crucial channel for client acquisition, particularly for sophisticated offerings such as investment funds, insurance, and commercial credit. These professionals engage directly with prospective clients, offering tailored advice and guidance.

In 2024, Inbursa's extensive network of financial advisors and sales representatives played a pivotal role in expanding its client base across various financial products. Their direct engagement model is key to understanding and meeting diverse customer needs.

- Client Acquisition: Direct sales teams are instrumental in bringing in new customers for specialized financial products.

- Expert Advice: Financial advisors provide personalized guidance, enhancing client trust and product uptake.

- Market Penetration: In 2024, Inbursa reported a significant increase in new policy sales, largely attributed to its proactive sales force.

Call Centers and Customer Support Lines

Grupo Inbursa leverages extensive call centers and customer support lines as a primary channel for direct customer engagement. These operations are vital for addressing inquiries, resolving issues, and facilitating transactions, ensuring a seamless customer experience.

In 2024, Inbursa's commitment to customer service is reflected in its robust infrastructure designed to handle a high volume of interactions efficiently. These channels are not just for problem-solving but also for building customer loyalty and gathering valuable feedback.

- Customer Interaction Hubs: Call centers act as central points for all customer communication, managing a wide range of service needs.

- Issue Resolution Efficiency: Dedicated support lines are equipped to quickly address and resolve customer complaints or service disruptions.

- Information Dissemination: These channels are crucial for providing customers with up-to-date information on products, services, and policy details.

- Data Collection Point: Interactions through these channels provide valuable data on customer sentiment and operational performance.

Grupo Inbursa employs a multi-channel strategy, blending digital platforms, physical branches, ATMs, and direct sales forces to reach its diverse customer base. This approach ensures accessibility and caters to varying customer preferences for engagement and service delivery.

Customer Segments

Grupo Inbursa's individual retail customers represent a vast and diverse group seeking essential financial services. This includes everyday banking needs like savings accounts, debit and credit cards, alongside financing for major life events such as personal loans, mortgages, and vehicle or payroll loans.

The company has experienced significant expansion within its retail loan segment. For instance, Inbursa's retail loan portfolio demonstrated robust growth, reaching approximately MXN 150 billion by the end of 2023, underscoring the strong demand for their lending products among individuals.

Grupo Inbursa offers a comprehensive suite of commercial banking services, business financing options, and insurance products specifically designed for Small and Medium-Sized Enterprises (SMEs). These businesses, a vital part of Mexico's economy, often require flexible and tailored financial solutions to navigate their growth trajectories and manage day-to-day operations effectively.

In 2024, SMEs continued to be a significant focus for Inbursa, with the company providing essential capital through various credit lines and loans. For instance, the banking sector in Mexico saw a notable increase in SME lending, and Inbursa actively participated in this trend, supporting businesses that are crucial for job creation and economic development.

Grupo Inbursa actively serves large corporations and institutional clients, offering them comprehensive wholesale banking solutions, sophisticated investment services, and tailored financial consulting. This segment is crucial for Inbursa's strategic growth and market presence.

In 2024, Inbursa's wholesale loan portfolio demonstrated robust expansion, reflecting strong demand from its corporate and institutional customer base. This growth underscores the firm's ability to meet the complex financial needs of major economic players.

Insurance Policyholders

Insurance policyholders represent a core customer segment for Grupo Inbursa, encompassing both individuals and businesses seeking protection across a wide array of insurance products. This includes vital coverage such as life, auto, health, and general insurance, catering to diverse risk management needs.

Seguros Inbursa, a significant entity within Grupo Inbursa, stands as one of Mexico's largest domestic insurance providers. This market position underscores the vast reach and trust placed in Inbursa by its policyholding customers.

- Broad Customer Base: Individuals and businesses seeking protection against various risks.

- Diverse Product Needs: Coverage requirements span life, auto, health, and general insurance.

- Market Leadership: Seguros Inbursa is a leading domestic insurer in Mexico.

- Significant Market Share: In 2024, Seguros Inbursa reported a substantial market share in the Mexican insurance industry, reflecting its strong customer penetration.

Retirement Fund Participants

Retirement fund participants, including those in Afore Inbursa and Pensiones Inbursa, represent a crucial customer segment for Grupo Inbursa. These individuals entrust Inbursa with their long-term savings and pension management, seeking security and growth for their future financial well-being.

As of the first quarter of 2024, Afore Inbursa managed significant assets under administration, reflecting the substantial trust placed in their retirement services. For instance, the Mexican pension system, which Inbursa actively participates in, saw continued growth in assets, with Afores collectively holding trillions of Mexican pesos. This demonstrates the scale of Inbursa's role in supporting national retirement goals.

- Client Base: Individuals enrolled in Inbursa's retirement fund administration services, such as Afore Inbursa and Pensiones Inbursa.

- Core Need: Long-term savings and reliable pension management for retirement security.

- Market Context (2024): The Mexican pension market, where Inbursa operates, continues to be a significant area for financial services, with ongoing contributions and investment growth supporting millions of workers' retirement futures.

Grupo Inbursa's customer base is broadly segmented into individuals seeking retail banking and insurance, Small and Medium-Sized Enterprises (SMEs) requiring business financing and insurance, and large corporations and institutional clients needing wholesale banking and investment services. Additionally, a significant segment comprises participants in retirement funds managed by Inbursa.

In 2024, the company continued to focus on expanding its retail loan portfolio, which had shown robust growth. SMEs remained a key target, with Inbursa actively providing capital to support their operations and growth, aligning with broader trends in Mexican SME lending.

The insurance segment, represented by Seguros Inbursa, is a cornerstone, serving both individuals and businesses with diverse coverage needs and holding a strong market position. Similarly, Afore Inbursa manages substantial assets, reflecting its critical role in the retirement savings landscape for millions of Mexicans.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

| Individual Retail Customers | Everyday banking, personal loans, mortgages, vehicle financing | Continued expansion in retail loan segment; strong demand for lending products. |

| Small and Medium-Sized Enterprises (SMEs) | Business financing, insurance, flexible financial solutions | Active participation in SME lending; providing essential capital for growth. |

| Large Corporations & Institutional Clients | Wholesale banking, investment services, financial consulting | Robust expansion in wholesale loan portfolio, meeting complex financial needs. |

| Insurance Policyholders | Life, auto, health, and general insurance coverage | Seguros Inbursa is a leading domestic insurer with significant market share. |

| Retirement Fund Participants | Long-term savings, pension management, retirement security | Afore Inbursa manages substantial assets under administration, supporting national retirement goals. |

Cost Structure

Personnel expenses represent a substantial cost for Grupo Inbursa, encompassing salaries, benefits, and ongoing training for its diverse workforce. This investment is crucial for maintaining operations across its banking, investment, and insurance segments.

These costs cover a wide array of employees, from front-line staff in branches and customer service centers to specialized financial advisors and essential IT professionals who support the company's technological infrastructure. In 2024, personnel costs are a key driver of operational expenditure, reflecting the human capital required to deliver financial services.

Grupo Inbursa dedicates significant resources to its technology and digital infrastructure. This encompasses the ongoing investment in and maintenance of sophisticated digital banking platforms, user-friendly mobile applications, and robust cybersecurity measures to protect customer data and ensure operational integrity. These investments are crucial for handling the high volumes of digital transactions characteristic of modern financial services.

Key expenditures within this cost structure include acquiring and renewing software licenses, purchasing and upgrading hardware, maintaining network infrastructure, and employing skilled development teams. For instance, in 2024, financial institutions globally saw a continued surge in IT spending, with cybersecurity alone projected to account for a substantial portion of operational budgets, reflecting the critical need for secure digital environments.

Grupo Inbursa allocates significant resources to marketing and sales. These costs encompass advertising across various media, running promotional campaigns to highlight their diverse financial products, and supporting a dedicated sales force. In 2024, a substantial portion of their budget was directed towards digital marketing initiatives aimed at increasing online engagement and driving the origination of new customer contracts.

Regulatory Compliance and Operational Costs

As a major financial institution, Grupo Inbursa faces substantial expenses tied to regulatory compliance and day-to-day operations. These costs are essential for maintaining trust and stability within the financial system. For instance, in 2024, financial institutions globally continued to invest heavily in technology and personnel to meet evolving regulatory demands, such as data privacy and anti-money laundering (AML) protocols.

These expenses encompass a range of activities, from legal counsel and external audits to the upkeep of its extensive branch network and administrative facilities. The complexity of financial markets and the need for robust internal controls contribute significantly to these operational overheads. In 2024, Inbursa, like its peers, would have allocated considerable resources to ensure adherence to Mexican financial regulations and international best practices.

- Legal and Audit Fees: Costs associated with ensuring full compliance with banking laws and undergoing regular financial audits.

- Regulatory Reporting: Expenses incurred for preparing and submitting detailed financial and operational reports to regulatory bodies.

- Operational Overheads: Costs related to maintaining physical branches, administrative offices, and IT infrastructure necessary for service delivery.

- Technology Investments: Spending on systems and software to manage compliance, enhance security, and improve operational efficiency.

Loan Loss Provisions and Risk Management

Managing credit risk is a significant expense for Grupo Inbursa. This involves proactively setting aside reserves, known as loan loss provisions, to absorb potential defaults across its varied loan book, which includes both retail and wholesale lending. This is a crucial element of their cost structure because of the inherent nature of their core lending operations.

In 2023, Grupo Inbursa reported significant figures related to its financial health and risk management. For instance, their total loan portfolio demonstrated growth, and consequently, the provisions for loan losses are a direct reflection of the potential risks associated with this expansion.

- Loan Loss Provisions: These are funds set aside to cover anticipated losses from loans that may not be repaid.

- Risk Management Costs: This encompasses the operational expenses tied to assessing, monitoring, and mitigating credit risk.

- Portfolio Diversification: Inbursa's strategy to lend across different sectors (retail, corporate) impacts the scale and nature of its loan loss provisions.

- Regulatory Compliance: Adherence to financial regulations often dictates the minimum level of provisions, adding to costs.

Grupo Inbursa's cost structure is heavily influenced by its extensive personnel expenses, covering salaries and benefits for a wide range of employees across banking, investment, and insurance sectors. Significant investment in technology and digital infrastructure is also a core component, ensuring robust platforms and cybersecurity, crucial for handling high transaction volumes.

Marketing and sales efforts, including advertising and promotional campaigns, represent another key expenditure, with a notable focus on digital initiatives in 2024 to boost online engagement. Furthermore, substantial costs are incurred for regulatory compliance and operational overheads, encompassing legal fees, audits, and the maintenance of physical and IT infrastructures to meet evolving financial regulations.

Managing credit risk is a significant cost driver, necessitating the allocation of loan loss provisions to cover potential defaults in its diverse loan portfolio. These provisions, along with the operational expenses for risk assessment and mitigation, are directly linked to the scale and nature of its lending activities, reflecting the inherent risks in financial operations.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Personnel Expenses | Salaries, benefits, training for banking, investment, insurance staff. | Key driver of operational expenditure; reflects human capital investment. |

| Technology & Digital Infrastructure | Digital platforms, mobile apps, cybersecurity, software/hardware. | Crucial for high digital transaction volumes and data protection. |

| Marketing & Sales | Advertising, promotions, sales force support, digital marketing. | Aimed at increasing online engagement and customer acquisition. |

| Regulatory Compliance & Operations | Legal, audits, reporting, branch upkeep, IT infrastructure. | Essential for trust, stability, and adherence to financial regulations. |

| Credit Risk Management | Loan loss provisions, risk assessment and mitigation costs. | Directly reflects potential risks from loan portfolio expansion. |

Revenue Streams

Net Interest Income (NII) is Grupo Inbursa's core revenue engine. It's the profit derived from the spread between what the bank earns on its lending activities, like retail and wholesale loans, and what it pays out on customer deposits and its own borrowings.

This crucial metric saw significant growth, with the financial margin increasing by 20.0% to $12,507 million pesos as of March 2025. This demonstrates Inbursa's effectiveness in managing its interest-earning assets and interest-bearing liabilities.

Grupo Inbursa generates significant revenue through commissions and fees earned from a wide array of banking and financial services. This includes income from everyday transaction fees, charges associated with credit card usage, brokerage commissions for securities trading, and management fees for investment funds. These diverse income streams are crucial to the company's financial performance and demonstrate its broad engagement across the financial services spectrum.

In 2024, the company saw a substantial increase in this revenue category, with commissions and fee income rising by an impressive 33.5%. This growth highlights the increasing utilization of Inbursa's services by its customer base and the effectiveness of its fee-based product offerings.

Insurance premiums represent the core revenue for Grupo Inbursa, stemming from the underwriting and sale of a wide array of policies. This includes life, auto, health, and various general insurance products, providing a diversified income base. Seguros Inbursa, a key subsidiary, consistently demonstrates robust premium levels, underscoring the strength of its market penetration and product offerings.

Investment Gains and Mark-to-Market Valuations

Profits derived from adjusting the value of financial assets like stocks, bonds, and derivatives to their current market prices are a key revenue source. This mark-to-market process directly impacts the company's financial performance.

In the first quarter of 2025, Grupo Inbursa saw significant gains through mark-to-market valuations, accumulating profits of 62 million pesos from these adjustments.

- Investment Gains: Profits realized from the sale of financial assets.

- Mark-to-Market Valuations: Unrealized gains or losses reflecting current market prices of held assets.

- Asset Classes: Includes stocks, bonds, mutual funds, and derivatives.

- 1Q25 Performance: Accumulated 62 million pesos in profits from mark-to-market adjustments.

Retirement Fund Administration Fees

Grupo Inbursa generates revenue through fees charged for the administration and management of retirement funds. This includes services for both individual retirement accounts (Afore) and broader pension plans (Pensiones Inbursa).

These administration fees are a significant component of their revenue, reflecting the ongoing management and operational costs associated with handling large pools of assets for individuals and employees. For instance, in 2024, regulatory frameworks often dictate a percentage-based fee structure on assets under management, ensuring a consistent revenue stream tied to the growth and stability of these retirement vehicles.

- Afore Administration Fees: Charges levied on individual retirement savings accounts managed by Inbursa.

- Pensiones Inbursa Fees: Revenue derived from the administration of corporate and employee pension plans.

- Asset-Based Revenue: Fees are typically calculated as a percentage of the total assets managed within these retirement funds.

Grupo Inbursa diversifies its revenue beyond traditional banking through investment gains and mark-to-market valuations. These streams capture profits from selling financial assets and reflect changes in the value of held assets based on current market prices. In the first quarter of 2025, the company demonstrated this by accumulating 62 million pesos in profits from mark-to-market adjustments, highlighting the contribution of these dynamic financial activities to its overall income.

| Revenue Stream | Description | 2024/1Q25 Data Point |

| Investment Gains | Profits from selling financial assets. | Included in overall financial performance. |

| Mark-to-Market Valuations | Unrealized gains/losses on asset values. | 62 million pesos profit in 1Q25. |

Business Model Canvas Data Sources

The Grupo Inbursa Business Model Canvas is informed by a blend of internal financial statements, customer transaction data, and market research reports. This comprehensive data set ensures the accurate representation of Inbursa's operations and strategic positioning.