Imperial Oil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imperial Oil Bundle

Imperial Oil operates within a dynamic landscape shaped by political stability, economic fluctuations, and evolving social attitudes towards energy. Understanding these external forces is crucial for strategic planning and mitigating risks. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights for your business. Download the full version now to gain a competitive edge.

Political factors

Government policies, particularly Canada's commitment to energy transition and carbon pricing, directly shape Imperial Oil's operational expenses and strategic investment choices. For instance, the federal carbon tax, which is set to increase, adds to the cost of production for fossil fuels.

Evolving federal and provincial environmental regulations, such as stricter emissions standards for the oil and gas sector and new rules for resource development, can significantly alter the economic viability of Imperial Oil's projects. In 2024, discussions around methane emission regulations continue to impact operational compliance costs.

The overall political stability and the predictability of the regulatory landscape for oil and gas are crucial for attracting investment. A stable environment encourages both domestic and international capital, which is vital for Imperial Oil's future expansion and asset development plans.

Imperial Oil's operations in Canada are significantly influenced by the federal government's ongoing commitment to reconciliation with Indigenous peoples. This translates into mandatory, often intricate, consultation processes for new projects and existing operations. For instance, the Trans Mountain Pipeline expansion, a project with significant implications for the energy sector, has faced extensive engagement requirements with numerous First Nations and Métis communities across its route, highlighting the political necessity of these consultations.

Navigating these relationships effectively is paramount. Imperial Oil's ability to forge successful partnerships and establish mutually beneficial agreements with Indigenous communities directly impacts its social license to operate. Failure to do so can lead to substantial project delays, legal challenges, and reputational damage, as seen in various resource development disputes across Canada in recent years.

The evolving political and legal landscape concerning Indigenous land rights and resource stewardship introduces considerable uncertainty for major energy undertakings. Imperial Oil must remain attuned to court decisions and policy shifts that could affect project approvals, operational permits, and revenue sharing, particularly as Indigenous groups increasingly assert their rights in resource development discussions.

Global trade policies and geopolitical events, including international sanctions and trade disputes, significantly influence the demand and pricing of crude oil and refined products, directly impacting Imperial Oil's access to export markets. For instance, ongoing geopolitical tensions in major oil-producing regions can lead to supply disruptions and price volatility, affecting Imperial Oil's profitability.

Canada's trade relations with key energy-consuming nations are crucial for market access and competitive positioning for Canadian oil and gas exports. In 2024, Canada's energy exports are projected to remain robust, but trade agreements and potential tariffs could alter market dynamics.

As a major integrated player, Imperial Oil is inherently susceptible to shifts in global energy trade dynamics. For example, changes in trade agreements, such as potential adjustments to agreements with the United States, could impact the flow of Canadian crude oil and refined products.

Energy Security Policies

Government policies focused on bolstering energy security, both within Canada and globally, directly influence Imperial Oil's strategic landscape. Initiatives promoting increased domestic oil and gas production, such as those potentially seen in response to geopolitical instability in 2024-2025, offer a supportive environment for the company's upstream operations.

Conversely, accelerating mandates for renewable energy adoption and carbon emission reductions, which are likely to intensify through 2025, pose significant long-term challenges. These policies could necessitate substantial capital reallocation and strategic pivots away from traditional fossil fuel assets, impacting Imperial Oil's business model.

- Domestic Production Support: Policies encouraging Canadian energy self-sufficiency can boost demand for Imperial Oil's products and exploration activities.

- Energy Transition Pressure: Government targets for emissions reductions and renewable energy integration, like those expected to be reinforced by 2025, create headwinds for fossil fuel-dependent businesses.

- International Supply Diversification: Global efforts to secure diverse energy sources may create opportunities for Canadian exports, benefiting companies like Imperial Oil.

Fiscal Policies and Taxation

Changes in federal and provincial fiscal policies, such as corporate tax rates and royalty structures, directly impact Imperial Oil's profitability. For instance, the Canadian federal corporate income tax rate was 15% in 2024, with provincial rates varying. Government incentives, like those for carbon capture, utilization, and storage (CCUS), can significantly sway investment decisions, potentially lowering operational costs or encouraging new projects.

The overall fiscal regime in Canada is a crucial determinant of the energy sector's competitiveness. Imperial Oil's financial performance is closely tied to these government policies, influencing capital allocation and strategic planning. For example, changes in resource royalties or specific industry levies can alter the economic viability of exploration and production activities.

- Federal Corporate Tax Rate: 15% (2024)

- Provincial Tax Rates: Vary significantly, impacting overall tax burden.

- Government Incentives: Crucial for CCUS and emissions reduction investments.

- Royalty Structures: Directly affect upstream profitability and investment decisions.

Government policies, including carbon pricing and emissions regulations, directly influence Imperial Oil's operational costs and investment strategies. For example, Canada's federal carbon tax, which is set to increase, adds to the cost of producing fossil fuels.

The political stability and regulatory predictability for the oil and gas sector are vital for attracting investment. A stable environment, such as that seen with ongoing support for domestic energy production through 2024-2025, encourages capital inflow for Imperial Oil's expansion plans.

Reconciliation efforts with Indigenous peoples necessitate extensive consultation for new projects, impacting timelines and operational approvals. The Trans Mountain Pipeline expansion, for instance, required significant engagement with numerous First Nations communities, underscoring the political importance of these relationships for projects like those Imperial Oil undertakes.

Global trade policies and geopolitical events can affect crude oil demand and pricing, influencing Imperial Oil's market access. Canada's energy exports remain robust in 2024, but trade agreements and international stability are key factors for market dynamics.

What is included in the product

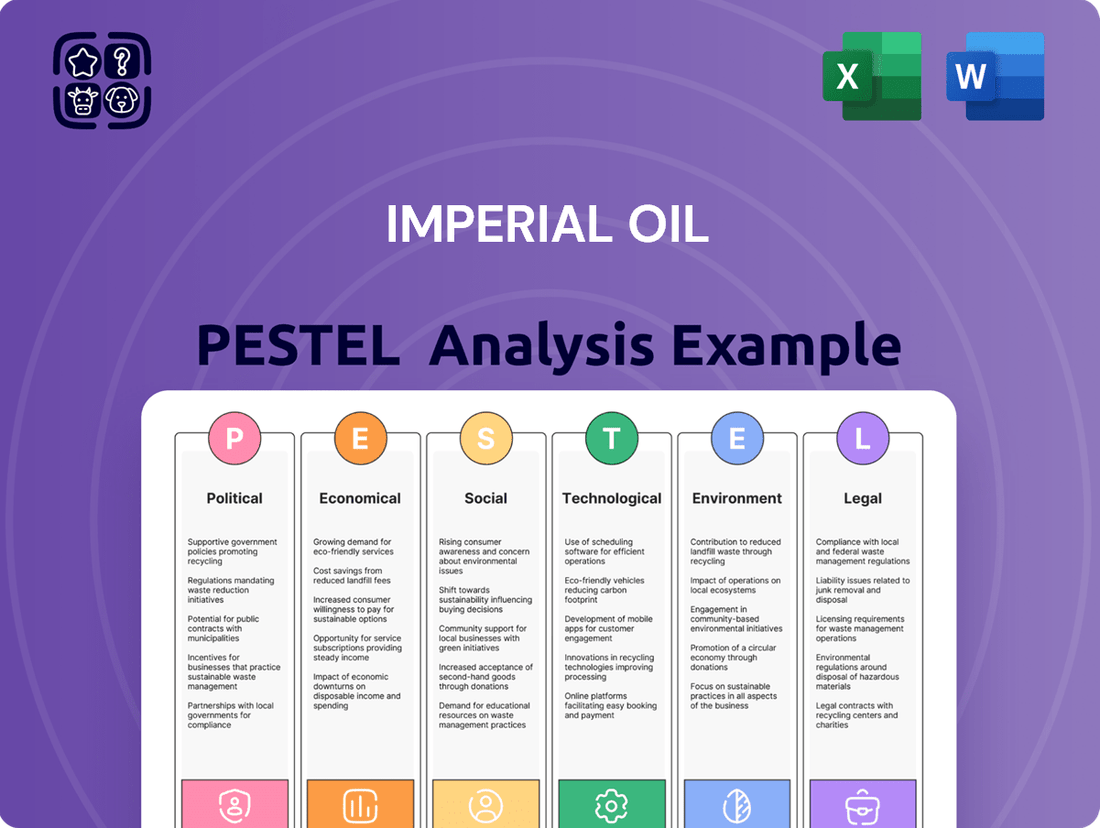

This Imperial Oil PESTLE analysis meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential implications for Imperial Oil's future success.

A clear, actionable summary of Imperial Oil's PESTLE analysis, presented in a digestible format, empowers decision-makers to proactively address external challenges and capitalize on emerging opportunities.

Economic factors

Global oil and gas prices are the main economic engine for Imperial Oil, directly influencing its earnings, profit margins, and investment choices. The company's upstream exploration and production activities are particularly vulnerable to price swings, even with its refining and petrochemical operations offering some buffer.

For instance, West Texas Intermediate (WTI) crude oil prices averaged around $77.50 per barrel in early 2024, a significant factor for Imperial Oil's upstream segment. Conversely, sustained periods of lower prices, such as those seen in late 2023, can prompt reductions in capital spending and production levels, impacting future growth prospects.

Canada's economic performance directly shapes the demand for Imperial Oil's products. In 2024, the Canadian economy is projected to grow at a moderate pace, with forecasts from the Bank of Canada suggesting a GDP growth of around 1.5% to 2.5% for the year. This growth is crucial for Imperial Oil's downstream operations, impacting sales of gasoline and diesel fuel.

A robust economy typically means more people driving and more goods being transported, which directly boosts demand for refined petroleum products. For example, during periods of strong economic expansion, like the post-pandemic recovery in 2022 which saw Canada's GDP grow by 3.7%, Imperial Oil experienced increased sales volumes. Conversely, economic slowdowns, such as the anticipated cooling in 2025, could lead to reduced consumer spending and industrial activity, potentially dampening demand for the company's fuels and petrochemicals.

Rising inflation, which saw Canada's Consumer Price Index (CPI) reach 2.9% year-over-year in April 2024, directly impacts Imperial Oil by increasing operational expenses. This includes higher costs for labor, raw materials, and essential equipment, potentially squeezing the company's profit margins.

Furthermore, the Bank of Canada's policy rate, which stood at 5.00% as of June 2024, influences borrowing costs. Elevated interest rates can make it more expensive for Imperial Oil to finance its capital-intensive projects, potentially leading to delays or a reduction in planned investments.

The company's overall financial health and investment strategies are therefore closely tied to the prevailing macroeconomic trends of inflation and interest rate fluctuations.

Exchange Rates

As a Canadian company deeply involved in global commodity markets, Imperial Oil's financial performance is closely tied to the exchange rate between the Canadian dollar (CAD) and the US dollar (USD). Fluctuations here can significantly impact its bottom line.

A weaker Canadian dollar generally benefits Imperial Oil. For instance, if the CAD depreciates against the USD, the Canadian dollar value of its oil sales, which are often priced in USD, increases. This can lead to higher reported revenues in Canada. Conversely, a stronger CAD can have the opposite effect, reducing the domestic currency value of USD-denominated earnings.

However, the situation isn't entirely one-sided. While a weaker CAD boosts revenue from US dollar sales, it also makes imported goods and services, such as specialized equipment or technology, more expensive in Canadian dollar terms. This can increase operating costs.

The volatility of exchange rates introduces a layer of financial risk that Imperial Oil must manage. For example, in early 2024, the CAD/USD exchange rate hovered around 1.35, meaning for every US dollar earned, Imperial Oil received approximately 1.35 Canadian dollars. Any significant shift in this rate, up or down, directly alters the company's financial reporting and profitability.

- Impact on Revenue: A weaker CAD against the USD typically boosts Imperial Oil's reported revenues when oil is sold in USD.

- Impact on Costs: Conversely, a weaker CAD can increase the cost of imported machinery and services needed for operations.

- Exchange Rate Volatility: Fluctuations in the CAD/USD rate create financial uncertainty and risk for the company.

- 2024 Context: Throughout much of 2024, the CAD/USD exchange rate has remained a key factor, with rates often trading in the 1.34-1.37 range, influencing the translation of USD earnings.

Capital Investment and Access to Capital

Imperial Oil's capacity for major capital projects, like expanding oil sands operations or modernizing refineries, is directly tied to its access to ample funding and the prevailing cost of that capital. For instance, in 2023, Imperial Oil reported capital and strategic investments totaling $3.1 billion, underscoring the scale of its financial needs.

Investor sentiment, increasingly shaped by environmental, social, and governance (ESG) factors and discussions around the energy transition, significantly impacts the availability and pricing of financing for companies in the oil and gas sector. This sentiment can influence borrowing costs and the willingness of financial institutions to provide loans or underwrite equity offerings.

Imperial Oil's strategic approach to allocating its capital is paramount for ensuring sustained long-term value creation. This involves judicious decisions on where to invest, whether in exploration, production, refining, or new energy ventures, balancing immediate returns with future growth prospects.

- Capital Expenditure: Imperial Oil's 2023 capital expenditures reached $3.1 billion, demonstrating substantial investment requirements.

- Financing Costs: The cost of capital for energy companies is sensitive to global economic conditions and investor perceptions of the industry's long-term viability.

- Investor Sentiment Impact: Negative investor sentiment due to ESG concerns can lead to higher borrowing costs and reduced access to capital markets.

- Strategic Allocation: Effective capital allocation is critical for maintaining competitiveness and achieving growth objectives in a dynamic energy landscape.

Economic factors significantly shape Imperial Oil's operations and profitability. Global oil and gas prices, such as West Texas Intermediate (WTI) which averaged around $77.50 per barrel in early 2024, are primary drivers of its upstream segment earnings. Canada's economic growth, projected at 1.5% to 2.5% for 2024 by the Bank of Canada, directly influences demand for refined products. Inflation, with Canada's CPI at 2.9% year-over-year in April 2024, increases operational costs, while interest rates, with the Bank of Canada's policy rate at 5.00% in June 2024, affect borrowing costs for capital projects.

The exchange rate between the Canadian and US dollars also plays a crucial role. A weaker CAD, often trading around 1.35 CAD to 1 USD in early 2024, can boost revenue from USD-denominated oil sales but also increases the cost of imported equipment. Imperial Oil's substantial capital expenditures, like the $3.1 billion invested in 2023, are sensitive to financing costs and investor sentiment, which is increasingly influenced by ESG considerations.

| Economic Factor | 2024/2025 Data Point | Impact on Imperial Oil |

|---|---|---|

| WTI Crude Oil Price | Avg. ~$77.50/barrel (Early 2024) | Boosts upstream segment revenue and profitability. |

| Canadian GDP Growth | Projected 1.5%-2.5% (2024) | Drives demand for refined products in downstream operations. |

| Canadian CPI (Inflation) | 2.9% YoY (April 2024) | Increases operational expenses for labor, materials, and equipment. |

| Bank of Canada Policy Rate | 5.00% (June 2024) | Affects borrowing costs for capital-intensive projects. |

| CAD/USD Exchange Rate | Approx. 1.35 (Early 2024) | Influences USD-denominated revenue translation and import costs. |

| Capital Expenditures | $3.1 billion (2023) | Highlights significant funding needs and sensitivity to capital costs. |

Same Document Delivered

Imperial Oil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Imperial Oil PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Public perception of the oil and gas industry, including Imperial Oil, is increasingly influenced by climate change concerns. Surveys in late 2024 and early 2025 indicate a growing segment of the Canadian population views fossil fuels as a primary driver of environmental degradation, impacting consumer choices and investment trends.

Heightened public awareness translates into tangible pressure. Expect continued activism and advocacy groups to scrutinize Imperial Oil's environmental footprint, potentially influencing regulatory decisions and investor sentiment throughout 2025.

For Imperial Oil, a strong social license to operate hinges on transparently communicating sustainability efforts and demonstrating genuine commitment to environmental stewardship. This includes investments in lower-emission technologies and clear reporting on emissions reduction targets.

The energy sector, including Imperial Oil, faces an aging workforce, with many experienced professionals nearing retirement. This trend, coupled with a high demand for specialized skills in areas like digital technology and advanced engineering, creates a significant talent gap. For instance, reports in late 2024 and early 2025 highlight a growing shortage of petroleum engineers and geoscientists, impacting operational efficiency and innovation.

Demographic shifts are also reshaping the talent pool. Younger generations often prioritize work-life balance, environmental sustainability, and opportunities for continuous learning, factors Imperial Oil must consider when developing recruitment and retention strategies. Companies like Imperial Oil are increasingly focusing on creating inclusive and dynamic workplace cultures, alongside robust training and development programs, to attract and keep the next generation of energy professionals.

Stakeholders, from investors to local communities, are pushing Imperial Oil to go beyond minimum legal requirements in its corporate social responsibility efforts. This means actively engaging with communities, building strong relationships with Indigenous groups, ensuring fair labor practices, and being open about environmental and social impacts. For instance, in 2023, Imperial Oil reported $18 million in community investments, highlighting a growing focus on these areas.

Meeting these elevated expectations is crucial for maintaining a positive public image and keeping stakeholders invested. A failure to do so can lead to reputational damage and a loss of support, impacting everything from access to capital to operational permits. The company's 2024 sustainability report detailed a 15% increase in employee volunteer hours, reflecting a commitment to community engagement.

Health and Safety Standards

Societal expectations for stringent health and safety standards in the oil and gas sector are exceptionally high, given the industry's inherent risks. Imperial Oil, like its peers, faces intense scrutiny regarding its operational safety. For instance, in 2024, the Canadian Association of Petroleum Producers reported a continued focus on reducing lost-time injury frequency rates across the industry.

Imperial Oil must consistently invest in and uphold robust safety protocols, comprehensive training programs, and effective emergency preparedness. This commitment is crucial not only for protecting its workforce and surrounding communities but also for maintaining its social license to operate. A significant safety lapse could lead to severe reputational damage, substantial legal liabilities, and a significant erosion of public trust.

- Employee Safety Investment: Imperial Oil's commitment to safety is reflected in its ongoing investments in advanced safety equipment and training, aiming to meet or exceed industry benchmarks.

- Regulatory Compliance: Adherence to evolving health and safety regulations, such as those mandated by provincial energy regulators, is a non-negotiable aspect of operations.

- Community Impact: The company's safety performance directly influences community perception and its ability to operate without disruption, underscoring the importance of preventing incidents.

- Industry Benchmarking: Imperial Oil actively monitors and strives to improve its safety metrics against industry best practices and competitor performance.

Consumer Preferences and Lifestyle Changes

Consumer preferences are increasingly leaning towards sustainability, impacting demand for traditional fuels. For instance, a significant portion of Canadians are considering or actively purchasing electric vehicles (EVs), with surveys in late 2023 and early 2024 indicating a growing interest, potentially reducing gasoline demand. This shift, coupled with lifestyle changes like the prevalence of remote work, which reduces daily commuting, directly influences fuel consumption patterns. Imperial Oil must proactively adapt its product portfolio and strategic direction to align with these evolving consumer desires and societal trends to maintain its market position.

Key shifts influencing Imperial Oil include:

- Growing EV Adoption: Increased consumer interest and government incentives for electric vehicles directly challenge the long-term demand for gasoline and diesel.

- Remote Work Impact: The sustained trend of remote and hybrid work models has demonstrably reduced overall vehicle miles traveled, affecting fuel sales.

- Sustainability Demand: A rising consumer consciousness for environmentally friendly products and services pressures companies to offer greener alternatives.

- Energy Transition Focus: Public and investor focus on the energy transition necessitates a strategic pivot towards lower-carbon solutions for continued relevance.

Public perception of the oil and gas industry, including Imperial Oil, is increasingly influenced by climate change concerns. Surveys in late 2024 and early 2025 indicate a growing segment of the Canadian population views fossil fuels as a primary driver of environmental degradation, impacting consumer choices and investment trends.

Heightened public awareness translates into tangible pressure. Expect continued activism and advocacy groups to scrutinize Imperial Oil's environmental footprint, potentially influencing regulatory decisions and investor sentiment throughout 2025.

For Imperial Oil, a strong social license to operate hinges on transparently communicating sustainability efforts and demonstrating genuine commitment to environmental stewardship. This includes investments in lower-emission technologies and clear reporting on emissions reduction targets.

The energy sector, including Imperial Oil, faces an aging workforce, with many experienced professionals nearing retirement. This trend, coupled with a high demand for specialized skills in areas like digital technology and advanced engineering, creates a significant talent gap. For instance, reports in late 2024 and early 2025 highlight a growing shortage of petroleum engineers and geoscientists, impacting operational efficiency and innovation.

Demographic shifts are also reshaping the talent pool. Younger generations often prioritize work-life balance, environmental sustainability, and opportunities for continuous learning, factors Imperial Oil must consider when developing recruitment and retention strategies. Companies like Imperial Oil are increasingly focusing on creating inclusive and dynamic workplace cultures, alongside robust training and development programs, to attract and keep the next generation of energy professionals.

Stakeholders, from investors to local communities, are pushing Imperial Oil to go beyond minimum legal requirements in its corporate social responsibility efforts. This means actively engaging with communities, building strong relationships with Indigenous groups, ensuring fair labor practices, and being open about environmental and social impacts. For instance, in 2023, Imperial Oil reported $18 million in community investments, highlighting a growing focus on these areas.

Meeting these elevated expectations is crucial for maintaining a positive public image and keeping stakeholders invested. A failure to do so can lead to reputational damage and a loss of support, impacting everything from access to capital to operational permits. The company's 2024 sustainability report detailed a 15% increase in employee volunteer hours, reflecting a commitment to community engagement.

Societal expectations for stringent health and safety standards in the oil and gas sector are exceptionally high, given the industry's inherent risks. Imperial Oil, like its peers, faces intense scrutiny regarding its operational safety. For instance, in 2024, the Canadian Association of Petroleum Producers reported a continued focus on reducing lost-time injury frequency rates across the industry.

Imperial Oil must consistently invest in and uphold robust safety protocols, comprehensive training programs, and effective emergency preparedness. This commitment is crucial not only for protecting its workforce and surrounding communities but also for maintaining its social license to operate. A significant safety lapse could lead to severe reputational damage, substantial legal liabilities, and a significant erosion of public trust.

- Employee Safety Investment: Imperial Oil's commitment to safety is reflected in its ongoing investments in advanced safety equipment and training, aiming to meet or exceed industry benchmarks.

- Regulatory Compliance: Adherence to evolving health and safety regulations, such as those mandated by provincial energy regulators, is a non-negotiable aspect of operations.

- Community Impact: The company's safety performance directly influences community perception and its ability to operate without disruption, underscoring the importance of preventing incidents.

- Industry Benchmarking: Imperial Oil actively monitors and strives to improve its safety metrics against industry best practices and competitor performance.

Consumer preferences are increasingly leaning towards sustainability, impacting demand for traditional fuels. For instance, a significant portion of Canadians are considering or actively purchasing electric vehicles (EVs), with surveys in late 2023 and early 2024 indicating a growing interest, potentially reducing gasoline demand. This shift, coupled with lifestyle changes like the prevalence of remote work, which reduces daily commuting, directly influences fuel consumption patterns. Imperial Oil must proactively adapt its product portfolio and strategic direction to align with these evolving consumer desires and societal trends to maintain its market position.

Key shifts influencing Imperial Oil include:

- Growing EV Adoption: Increased consumer interest and government incentives for electric vehicles directly challenge the long-term demand for gasoline and diesel.

- Remote Work Impact: The sustained trend of remote and hybrid work models has demonstrably reduced overall vehicle miles traveled, affecting fuel sales.

- Sustainability Demand: A rising consumer consciousness for environmentally friendly products and services pressures companies to offer greener alternatives.

- Energy Transition Focus: Public and investor focus on the energy transition necessitates a strategic pivot towards lower-carbon solutions for continued relevance.

| Sociological Factor | Trend/Observation (2024-2025) | Impact on Imperial Oil |

|---|---|---|

| Climate Change Awareness | Growing public concern over fossil fuels' environmental impact. | Increased scrutiny on emissions, pressure for sustainable practices. |

| Talent Shortage | Aging workforce, demand for specialized skills (digital, engineering). | Challenges in recruitment and retention, potential operational impact. |

| Corporate Social Responsibility (CSR) Expectations | Stakeholders demand proactive community engagement and ethical practices. | Need for transparent reporting, strong community relations, and Indigenous partnerships. |

| Health & Safety Standards | High societal expectations for operational safety in the industry. | Mandatory investment in safety protocols, training, and emergency preparedness. |

| Consumer Preferences | Shift towards sustainability and EVs, impact of remote work on fuel demand. | Need to adapt product portfolio and strategy to evolving consumer desires. |

Technological factors

Imperial Oil's upstream operations are significantly impacted by technological advancements. New seismic imaging techniques and directional drilling methods are enhancing efficiency and reducing environmental impact. For instance, in 2024, the company continued to invest in digital oilfield technologies, aiming to improve operational performance across its key assets in Western Canada.

Innovations in data analytics and artificial intelligence are enabling more precise reservoir modeling. This optimization can lead to increased recovery rates from existing oil fields, a critical factor for resource maximization. Imperial Oil's focus on these digital tools is a strategic move to maintain cost competitiveness in a dynamic market.

Technological advancements are significantly reshaping refining and petrochemical operations. For Imperial Oil, innovations in areas like advanced catalysis and digital process optimization offer substantial improvements in product yield and energy efficiency. For instance, new catalytic converters introduced in 2023 have shown up to a 5% increase in gasoline yield and a 3% reduction in energy consumption at pilot plants.

These process enhancements directly impact profitability by lowering operational costs and increasing the output of higher-value petrochemicals. Imperial Oil's investment in upgrading its Sarnia refinery, for example, includes implementing advanced process control systems expected to boost efficiency by 7% by the end of 2024, directly contributing to a more competitive market position.

Furthermore, the drive towards lower emissions is being met with new technologies. Innovations in carbon capture and utilization (CCU) and more efficient combustion techniques are becoming critical. By 2025, it's projected that refineries adopting these technologies could see a 10-15% reduction in their greenhouse gas emissions intensity, a key factor for environmental performance and regulatory compliance.

Carbon Capture, Utilization, and Storage (CCUS) technologies are increasingly crucial for the oil and gas sector to manage greenhouse gas emissions. Imperial Oil's commitment to CCUS at its operations, such as the proposed Pathways Alliance project, demonstrates a strategic move to lower its carbon intensity and meet Canada's climate targets.

The economic feasibility and widespread adoption of CCUS are key technological hurdles for Imperial Oil's sustainability. For instance, the Pathways Alliance aims to capture 15 million tonnes of CO2 annually by 2030, requiring significant technological advancement and investment to achieve this scale and cost-effectiveness.

Digitalization and Automation

Imperial Oil is increasingly leveraging digital technologies like the Internet of Things (IoT) and advanced analytics to boost efficiency and safety. For instance, predictive maintenance, powered by digital insights, helps anticipate equipment failures in refineries and upstream operations, minimizing costly downtime. This focus on digitalization is crucial for maintaining a competitive edge in the evolving energy sector, with companies investing heavily to integrate these advancements.

Automation is a key driver for optimizing resource allocation and reducing operational risks. In 2024, the energy industry saw continued investment in automated drilling systems and smart logistics, aiming to enhance precision and lower the potential for human error. This trend is expected to accelerate, with a significant portion of capital expenditures in the upstream sector directed towards technological upgrades that enable greater automation.

- Enhanced Efficiency: Digitalization and IoT adoption in 2024 allowed for real-time monitoring and control of operations, leading to an estimated 5-10% improvement in asset utilization for leading energy firms.

- Reduced Downtime: Predictive maintenance strategies, implemented through digital platforms, are projected to reduce unplanned downtime by up to 20% in the coming years.

- Optimized Resource Allocation: Automation in logistics and production processes helps minimize waste and ensures resources are deployed more effectively, contributing to cost savings.

- Improved Safety: By automating hazardous tasks and providing better data for decision-making, digital technologies significantly enhance workplace safety in complex energy operations.

Renewable Energy and Low-Carbon Solutions

Imperial Oil, while rooted in oil and gas, is increasingly impacted by the global shift towards renewable energy and low-carbon solutions. The company must actively monitor technological advancements in areas like biofuels and hydrogen production, as these could disrupt traditional energy markets. For instance, the International Energy Agency (IEA) reported in 2024 that global investment in clean energy technologies reached a record $2 trillion in 2023, signaling a significant market shift that Imperial Oil needs to address.

Technological progress in renewable energy presents a dual challenge and opportunity for Imperial Oil. Embracing these innovations could lead to diversification and new revenue streams, such as investments in sustainable aviation fuel (SAF) or blue hydrogen production, which leverages existing natural gas infrastructure. By 2025, the demand for hydrogen is projected to grow significantly, creating potential avenues for companies like Imperial Oil to adapt their operations.

Imperial Oil's strategic response to these technological factors will be crucial for its long-term viability. Evaluating potential integration of renewable energy technologies into its existing portfolio, or exploring new ventures in low-carbon solutions, will be key. The company's ability to innovate and adapt to these evolving technological landscapes will determine its competitive position in the energy sector of the coming years.

- Technological Advancements: Monitoring breakthroughs in biofuels, hydrogen, and carbon capture utilization and storage (CCUS) is essential.

- Market Diversification: Exploring opportunities in alternative energy sources to mitigate reliance on fossil fuels.

- Investment Trends: Observing the surge in global clean energy investments, which reached $2 trillion in 2023 according to the IEA.

- Future Demand: Anticipating the growing demand for low-carbon solutions, such as hydrogen, which is expected to see substantial growth by 2025.

Technological advancements continue to reshape Imperial Oil's operations, from enhancing upstream efficiency with AI-driven reservoir modeling to improving downstream product yields through advanced catalysis. The company's strategic investments in digital oilfield technologies and process automation, as seen in its 2024 initiatives, aim to boost operational performance and cost competitiveness. Furthermore, the growing importance of Carbon Capture, Utilization, and Storage (CCUS) technologies, with projects like the Pathways Alliance targeting significant CO2 reductions by 2030, highlights the sector's technological evolution towards sustainability.

| Technology Area | Impact on Imperial Oil | Key Data/Trends (2024-2025) |

|---|---|---|

| Digital Oilfield & AI | Enhanced reservoir modeling, increased recovery rates, improved operational efficiency. | Continued investment in digital technologies for upstream assets in Western Canada. |

| Advanced Catalysis | Improved product yield and energy efficiency in refining. | New catalysts showing up to 5% gasoline yield increase and 3% energy reduction (pilot plants, 2023). |

| CCUS | Greenhouse gas emission reduction, meeting climate targets. | Pathways Alliance aims to capture 15 million tonnes CO2 annually by 2030; significant technological and investment hurdles remain. |

| Renewable Energy Tech | Potential for diversification, new revenue streams (biofuels, hydrogen). | Global clean energy investment reached $2 trillion in 2023; hydrogen demand projected to grow significantly by 2025. |

Legal factors

Imperial Oil navigates a complex web of environmental laws, from federal mandates on emissions to provincial rules for water use and land reclamation. Failure to comply can result in significant fines and legal battles, impacting operations and public trust.

The company's commitment to environmental stewardship is crucial, especially as standards for greenhouse gas emissions and biodiversity protection continue to tighten. For instance, in 2024, Canada's strengthened carbon pricing system continues to influence operational costs and investment decisions for energy companies like Imperial Oil.

Imperial Oil operates under stringent occupational health and safety legislation, which mandates specific standards for workplace safety and employee well-being. These regulations, enforced by bodies like Health Canada and provincial ministries, directly impact operational procedures and risk management strategies across all Imperial Oil facilities, from exploration sites to refineries.

Failure to comply with these health and safety laws can result in significant legal repercussions for Imperial Oil, including substantial fines and potential operational disruptions. For instance, in 2023, the Canadian Centre for Occupational Health and Safety reported over $1 billion in workplace-related costs due to injuries and illnesses, highlighting the financial risks of non-compliance.

Proactive and continuous improvement in safety protocols is not just a best practice but a legal requirement for Imperial Oil. This includes investing in advanced safety training, implementing robust hazard identification systems, and ensuring all equipment meets or exceeds regulatory safety standards to prevent accidents and protect its workforce.

As a major integrated energy company in Canada, Imperial Oil operates under strict competition laws and anti-trust regulations aimed at fostering a fair marketplace and preventing monopolistic practices. These regulations directly influence Imperial Oil's strategies concerning product pricing, marketing efforts, and any potential mergers or acquisitions it might consider within the Canadian energy sector.

The company must diligently ensure its operations and business conduct remain compliant with anti-trust legislation. Non-compliance can result in substantial financial penalties, potentially reaching millions of dollars, and could necessitate significant operational adjustments or divestitures, as seen in past regulatory actions against large corporations in various industries.

Indigenous Rights and Land Claims

Canadian law acknowledges Indigenous rights, impacting Imperial Oil's operations on traditional lands. These rights include those related to land and resource access, directly influencing project development. For instance, in 2023, ongoing land claim negotiations in Alberta continued to shape resource development agreements.

Imperial Oil faces a legal duty to consult and accommodate Indigenous communities. Non-compliance can lead to significant project delays, court injunctions, and substantial financial penalties. Recent court decisions in 2024 have reinforced the importance of meaningful consultation, setting precedents for future project approvals.

- Legal Obligation: The Canadian Constitution Act, 1982, Section 35, recognizes and affirms existing Aboriginal and treaty rights, necessitating consultation.

- Potential Impact: Delays and legal challenges can add millions of dollars to project costs, as seen in past resource projects facing protracted consultation processes.

- Operational Continuity: Proactive engagement and respect for these legal frameworks are vital for Imperial Oil to maintain smooth operations and secure project approvals.

International and Domestic Trade Laws

Imperial Oil's extensive operations in crude oil and refined product trading necessitate strict adherence to a web of international trade laws. This includes navigating complex customs regulations and export/import controls governing cross-border transactions. For instance, in 2024, global oil trade volumes remained robust, underscoring the importance of compliance with agreements like those managed by the World Trade Organization.

Domestically, Imperial Oil's product distribution across Canada is significantly shaped by interprovincial trade laws and regulations. These rules impact how refined products move between provinces, influencing logistics and market access. Ensuring compliance with these varied provincial frameworks is crucial for maintaining efficient supply chains and reaching Canadian consumers.

- International Trade Agreements: Compliance with global trade accords ensures continued market access for crude oil and refined products.

- Customs Regulations: Navigating import and export duties and procedures is vital for cost-effective international trade.

- Export/Import Controls: Adherence to government-imposed restrictions on the movement of oil and gas products is mandatory.

- Interprovincial Trade Laws: Understanding and following regulations for product movement within Canada ensures smooth domestic distribution.

Imperial Oil operates under a comprehensive legal framework that governs environmental protection, worker safety, and fair market competition. The company must adhere to evolving regulations concerning greenhouse gas emissions, with Canada's carbon pricing system continuing to impact operational costs in 2024. Furthermore, stringent occupational health and safety laws necessitate robust safety protocols to prevent workplace incidents and associated financial liabilities, which in 2023 exceeded $1 billion in Canadian workplace-related costs.

The company's business practices are also subject to competition laws, ensuring fair market conduct and preventing anti-competitive behavior, with potential penalties for non-compliance including substantial fines. Additionally, Imperial Oil must navigate the legal landscape surrounding Indigenous rights, including consultation and accommodation obligations, as reinforced by recent court decisions in 2024 that emphasize meaningful engagement. Compliance with international and interprovincial trade laws is also critical for managing cross-border transactions and domestic product distribution.

Environmental factors

Imperial Oil is under increasing pressure to cut greenhouse gas emissions from its operations and products due to the global push for climate change mitigation. This involves managing direct emissions from upstream and downstream activities, as well as the lifecycle emissions of its products. For instance, in 2023, Imperial Oil reported its Scope 1 and 2 greenhouse gas emissions intensity was 45 kg CO2e/boe, a slight increase from 44 kg CO2e/boe in 2022, highlighting the ongoing challenge.

The company faces scrutiny from investors, regulators, and the public concerning its climate change strategy and contribution. As of early 2024, the Canadian government's carbon pricing mechanisms continue to impact the oil and gas sector, with further escalations planned. Imperial Oil's response includes investments in lower-emission technologies and exploring carbon capture, utilization, and storage (CCUS) opportunities, such as its proposed project at the Cold Lake facility, aiming to reduce emissions by approximately 1 million tonnes per year.

Imperial Oil's extensive operations, especially in oil sands extraction and refining, consume significant amounts of water. This makes effective water management a paramount environmental consideration for the company. For instance, in 2023, Imperial Oil reported using approximately 220 million cubic meters of water across its Canadian operations, with a substantial portion attributed to its oil sands facilities.

The increasing reality of water scarcity in certain regions, coupled with tightening regulations on water usage, demands that Imperial Oil prioritize efficient water recycling, conservation, and responsible wastewater treatment. Failure to do so could impact operational continuity and the company's environmental standing.

Adopting robust water stewardship practices is not just about compliance; it's essential for ensuring the long-term viability of its operations and maintaining a positive environmental reputation in the face of growing public and regulatory scrutiny.

Imperial Oil's exploration, production, and infrastructure projects can significantly affect local ecosystems and biodiversity. The company is expected to actively minimize habitat disruption and protect wildlife, particularly in ecologically sensitive regions. For instance, in 2023, Imperial Oil reported investing $100 million in environmental initiatives, with a portion allocated to biodiversity conservation and land reclamation efforts across its Canadian operations.

Waste Management and Pollution Prevention

Imperial Oil faces significant environmental pressures regarding waste management and pollution prevention. The company must develop robust strategies to handle industrial waste, hazardous materials, and by-products from its refining and exploration activities. For instance, in 2023, Canadian oil and gas companies collectively managed millions of tonnes of waste, with a focus on reducing landfill disposal and increasing recycling or reuse.

Preventing pollution across air, water, and soil remains a paramount concern. Accidental spills or uncontrolled emissions can lead to substantial environmental damage and regulatory penalties. Imperial Oil's commitment to best practices in spill prevention and emission control is crucial for maintaining its operational license and public trust.

Adherence to stringent environmental regulations and a proactive approach to continuous improvement in pollution prevention are vital. This includes investing in advanced technologies for emission scrubbing and wastewater treatment. For example, the Canadian government's strengthened environmental protection measures, including updated air quality standards, are driving innovation in the sector.

- Waste Generation: Managing diverse waste streams from operations, including by-products and process residues.

- Pollution Prevention: Implementing measures to avoid spills and control emissions into air, water, and soil.

- Regulatory Compliance: Meeting evolving environmental standards and reporting requirements.

- Corporate Responsibility: Demonstrating commitment to environmental stewardship through best practices and continuous improvement.

Energy Transition and Renewable Energy Growth

The global movement toward a lower-carbon economy is accelerating, with renewable energy sources experiencing substantial growth. This environmental shift directly influences the long-term demand for fossil fuels, impacting companies like Imperial Oil. For instance, by the end of 2023, global renewable energy capacity additions reached a record high, exceeding 510 gigawatts, a significant increase from previous years.

This transition affects investment flows, potentially diverting capital away from traditional energy sectors and towards cleaner alternatives. Imperial Oil must consider how this evolving energy landscape shapes its business model and explore avenues in low-carbon solutions to ensure its continued relevance and competitiveness in the coming years.

- Renewable Capacity Growth: Global renewable energy capacity additions reached over 510 GW in 2023, a record high.

- Investment Shifts: Growing investor preference for ESG (Environmental, Social, and Governance) compliant assets is influencing capital allocation in the energy sector.

- Demand Evolution: The increasing adoption of electric vehicles and energy efficiency measures are projected to moderate the growth in demand for traditional fuels.

Imperial Oil faces increasing pressure to reduce greenhouse gas emissions, with its 2023 Scope 1 and 2 emissions intensity at 45 kg CO2e/boe. The company is investing in lower-emission technologies like carbon capture, as seen with its proposed Cold Lake project aiming for a 1 million tonne annual reduction. Water management is also critical, with 2023 operations using approximately 220 million cubic meters of water, necessitating efficient recycling and conservation efforts amid growing scarcity concerns.

PESTLE Analysis Data Sources

Our Imperial Oil PESTLE Analysis is informed by a comprehensive review of data from government agencies, industry associations, and reputable financial news outlets. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, reliable information.