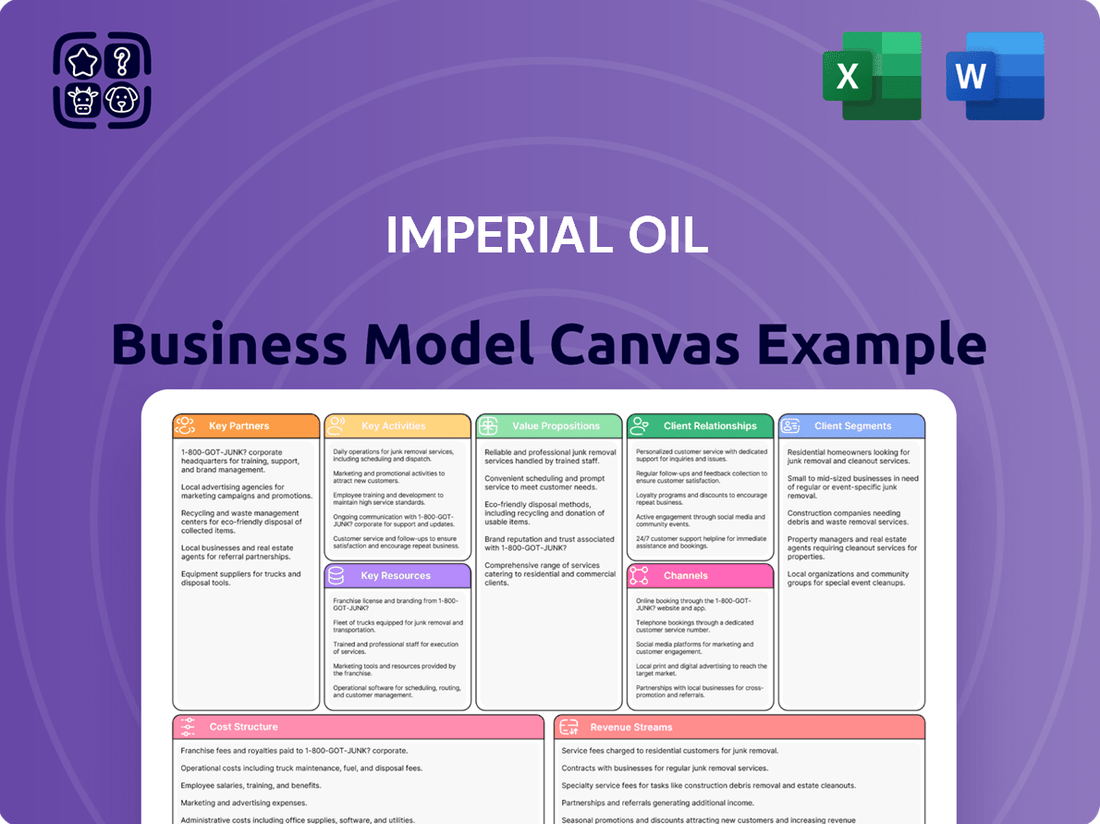

Imperial Oil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imperial Oil Bundle

Imperial Oil's Business Model Canvas offers a comprehensive look at how this energy giant operates, from its upstream exploration and production to its downstream refining and marketing. Understand their key customer segments, value propositions, and revenue streams.

Dive deeper into the strategic blueprint that powers Imperial Oil's success. This detailed canvas breaks down their cost structure, key resources, and crucial partnerships, offering actionable insights for your own business strategy.

Unlock the full potential of strategic analysis by downloading Imperial Oil's complete Business Model Canvas. Gain a clear, actionable understanding of their competitive advantages and market positioning, perfect for investors and business planners.

Partnerships

Imperial Oil's strategic alliance with its majority owner, ExxonMobil, is a cornerstone of its business model. ExxonMobil holds a substantial 69.6% ownership stake, fostering a deep, collaborative relationship that grants Imperial access to global expertise and vast resources. This partnership is crucial for technology transfer and the adoption of shared best practices across their operations.

This significant ownership by ExxonMobil allows for potential integration of supply chains and sharing of operational efficiencies, which can translate into cost savings and improved performance. For instance, in 2024, Imperial Oil reported capital expenditures of approximately $2.4 billion, a significant portion of which likely benefits from ExxonMobil’s global procurement and technological insights.

Imperial Oil actively engages in key joint ventures, a prime example being its 25% stake in Syncrude, a major player in oil sands production. This partnership is vital for distributing the substantial capital required for large-scale projects.

These collaborations are instrumental in mitigating the significant operational risks associated with complex upstream activities. By sharing these burdens, Imperial Oil can pursue more ambitious ventures.

In 2023, Syncrude's production reached approximately 270,000 barrels per day, underscoring the scale and importance of these joint ventures for Imperial Oil's overall upstream output and resource development.

Imperial Oil actively partners with technology and innovation providers to pioneer advanced energy recovery methods. These collaborations are crucial for developing and implementing techniques like solvent-assisted steam-assisted gravity drainage (SA-SAGD), which significantly boost efficiency and minimize environmental footprints.

In 2024, Imperial Oil continued its focus on innovation, with significant investments in research and development aimed at enhancing resource recovery and sustainability. These partnerships allow for the integration of cutting-edge solutions, reinforcing the company's dedication to technological advancement in the energy sector.

Suppliers and Contractors

Imperial Oil relies on a broad spectrum of suppliers and contractors to keep its operations running smoothly and to manage its significant capital projects. These partnerships are critical for securing everything from specialized drilling equipment to the skilled workforce needed for complex refining upgrades and new exploration ventures.

In 2024, Imperial Oil continued to leverage this extensive network. For instance, the company's commitment to major projects, such as the Cold Lake redevelopment, necessitates robust relationships with numerous service providers for specialized equipment, engineering expertise, and construction labor. These collaborations are fundamental to maintaining efficiency and safety across its upstream, downstream, and chemical segments.

- Supplier Network: A diverse base of suppliers provides essential materials, chemicals, and specialized equipment for exploration, production, and refining processes.

- Contractor Services: Contractors are vital for maintenance, turnaround activities, and the execution of large-scale capital projects, ensuring specialized skills and labor are available.

- Value Chain Integration: Partnerships with suppliers and contractors are integral to the seamless functioning of Imperial Oil's entire value chain, from resource extraction to product delivery.

- Project Execution: The successful and timely completion of major capital investments, like those in the oil sands and downstream facilities, is heavily dependent on the reliability and capability of its contractor base.

Government and Regulatory Bodies

Imperial Oil engages with various levels of government and regulatory bodies to secure permits for operations and ensure adherence to stringent environmental and safety regulations. These collaborations are essential for the successful execution of major initiatives, such as the development of renewable diesel facilities, underscoring the critical role of these partnerships in navigating the energy sector's complex regulatory framework.

In 2024, Imperial Oil's commitment to regulatory compliance and government relations is evident in its ongoing projects. For instance, the company's Strathcona Renewable Diesel project, which commenced operations in 2023, required extensive engagement with provincial and federal environmental agencies for approvals and ongoing monitoring. This project aims to produce 1.7 billion liters of renewable diesel annually, contributing to Canada's climate goals.

- Permitting and Approvals: Securing necessary permits from federal, provincial, and municipal authorities for exploration, production, refining, and new infrastructure projects.

- Regulatory Compliance: Adhering to all applicable laws and regulations concerning environmental protection, worker safety, emissions standards, and product quality.

- Policy Engagement: Participating in consultations and dialogues with government bodies to inform energy policy development and advocate for a stable operating environment.

- Strategic Project Advancement: Collaborating with government agencies to facilitate the development and implementation of key strategic projects, including those focused on lower-emission fuels and energy transition initiatives.

Imperial Oil's key partnerships are vital for its operational success and strategic growth. The significant ownership by ExxonMobil, around 69.6%, provides access to global resources and technological advancements, crucial for efficiency and innovation. Joint ventures, like the stake in Syncrude, enable the sharing of substantial capital requirements and operational risks in large-scale projects, such as oil sands production where Syncrude produced about 270,000 barrels per day in 2023.

Collaboration with technology providers is essential for developing advanced recovery methods, like SA-SAGD, to boost efficiency and reduce environmental impact. Furthermore, a robust network of suppliers and contractors is indispensable for acquiring materials, specialized equipment, and skilled labor for both ongoing operations and major capital projects, including the Cold Lake redevelopment in 2024.

Engagement with government and regulatory bodies is critical for securing permits and ensuring compliance with environmental and safety standards, facilitating projects like the Strathcona Renewable Diesel facility, which started operations in 2023 and produces 1.7 billion liters of renewable diesel annually.

What is included in the product

This Business Model Canvas for Imperial Oil outlines its integrated energy operations, focusing on upstream exploration and production, downstream refining and marketing, and chemical manufacturing. It details key partners, activities, and resources, emphasizing a commitment to innovation and sustainability across its value chain.

Imperial Oil's Business Model Canvas provides a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

This structured approach helps Imperial Oil quickly identify and address potential operational inefficiencies, acting as a pain point reliever by offering a digestible overview of their entire business.

Activities

Imperial Oil's core business revolves around the exploration and production of oil and gas resources. This includes a significant focus on bitumen and synthetic crude oil from Canada's oil sands, with major operations at Kearl and Cold Lake.

In 2024, Imperial Oil's upstream segment demonstrated robust performance. The company reported an average upstream production of approximately 420,000 gross barrels of oil equivalent per day, with oil sands operations contributing a substantial portion of this output.

These upstream activities are critical, providing the essential feedstock for Imperial Oil's downstream refining and marketing segments, thereby underpinning its integrated business strategy and ensuring a consistent supply chain.

Imperial Oil's core operation involves refining crude oil into a broad spectrum of valuable petroleum products. This includes essential fuels like gasoline and diesel, as well as specialized products such as jet fuel and asphalt. These transformations occur at significant facilities, including the Strathcona, Nanticoke, and Sarnia refineries.

This downstream processing is crucial for converting raw crude into market-ready goods that meet the demands of various sectors. In 2024, Imperial Oil continued to be a major supplier of these refined products, contributing significantly to Canada's energy landscape.

Imperial Oil's marketing and distribution of fuels and lubricants is anchored by its extensive coast-to-coast network of Esso branded service stations across Canada. This robust infrastructure ensures broad accessibility for retail consumers. In 2024, Imperial Oil continued to leverage this network, alongside dedicated commercial sales channels, to reach a diverse customer base, from individual drivers to large industrial clients.

The company's strategy focuses on making its petroleum products readily available throughout Canada, catering to both everyday needs and specialized commercial requirements. This widespread presence is a critical component of their business model, facilitating consistent revenue generation and brand loyalty.

Production and Marketing of Petrochemicals

Imperial Oil's key activities include the production and marketing of petrochemicals, transforming hydrocarbon by-products into valuable chemical commodities for industrial clients. This segment is crucial to their diversified business model, adding significant value by leveraging their upstream resources.

In 2024, Imperial Oil's petrochemical operations are a vital part of its integrated value chain. The company actively markets a range of petrochemicals, including polyethylene and ethylene, which are fundamental building blocks for numerous industries, from packaging to automotive manufacturing.

- Production: Manufacturing of key petrochemicals like polyethylene and ethylene.

- Marketing: Selling these products to a broad base of industrial customers.

- Value Addition: Processing by-products from oil and gas operations into higher-value chemical products.

- Market Reach: Serving diverse sectors that rely on petrochemicals as essential raw materials.

Development of Lower-Emission Fuels and Technologies

Imperial Oil is actively engaged in developing lower-emission fuels, notably through the construction of Canada's largest renewable diesel facility at its Strathcona refinery. This strategic move, with a significant capital investment, underscores the company's commitment to aligning with global energy transition trends and diversifying its future revenue sources. The facility is designed to produce approximately 1 billion liters of renewable diesel annually, utilizing feedstock like canola oil and animal fats.

This development is a crucial element of Imperial Oil's strategy to adapt to a changing energy landscape and meet growing demand for lower-carbon intensity fuels. By investing in these advanced technologies, the company aims to reduce its own operational emissions and provide sustainable fuel options to the market.

- Investment in Renewable Diesel: Construction of Canada's largest renewable diesel facility at Strathcona refinery.

- Production Capacity: Expected to produce approximately 1 billion liters of renewable diesel annually.

- Feedstock Utilization: Employs feedstocks such as canola oil and animal fats.

- Strategic Alignment: Supports energy transition goals and diversifies revenue streams.

Imperial Oil's key activities encompass the entire energy value chain, from extracting raw resources to delivering refined products and chemicals. This integrated approach allows for significant operational synergies and market responsiveness.

Core activities include upstream oil and gas production, with a strong emphasis on oil sands operations. Downstream, the company refines crude oil into fuels and other petroleum products, supported by a vast marketing and distribution network. Additionally, petrochemical production represents a vital segment, transforming by-products into valuable industrial chemicals.

The company is also actively investing in lower-emission fuels, notably renewable diesel, demonstrating a strategic pivot towards sustainability and future energy demands. These diverse activities collectively form the backbone of Imperial Oil's business model, ensuring a consistent supply of energy and chemical products across Canada.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Upstream Production | Exploration and production of crude oil and natural gas, particularly oil sands. | Average upstream production of ~420,000 gross boe/d. |

| Downstream Refining | Processing crude oil into gasoline, diesel, jet fuel, asphalt, etc. | Operates refineries in Strathcona, Nanticoke, and Sarnia. |

| Marketing & Distribution | Sales of refined products through Esso stations and commercial channels. | Extensive coast-to-coast network of branded retail outlets. |

| Petrochemicals | Production and marketing of chemicals like polyethylene and ethylene. | Supplies essential raw materials to various industries. |

| Renewable Fuels | Development and production of lower-emission fuels. | Constructing Canada's largest renewable diesel facility at Strathcona. |

Preview Before You Purchase

Business Model Canvas

The Imperial Oil Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use analysis of Imperial Oil's business strategy. You'll gain immediate access to this same comprehensive document, allowing you to leverage its insights without any surprises.

Resources

Imperial Oil's extensive hydrocarbon reserves, particularly its substantial holdings in the Alberta oil sands, form the bedrock of its upstream operations. Key assets like the Kearl oil sands project and its Cold Lake operations, alongside a significant 25% stake in the Syncrude Canada oil sands facility, represent vast quantities of oil and gas. These reserves are the primary physical resources that fuel its production capabilities and are central to its business model.

Imperial Oil's advanced refining and petrochemical infrastructure is a cornerstone of its operations. The company boasts a network of sophisticated facilities across Canada, including its Strathcona refinery, which recently integrated a new renewable diesel unit. This robust infrastructure is essential for transforming crude oil into a wide array of valuable products, from fuels to petrochemical feedstocks.

In 2024, Imperial Oil continued to invest in modernizing its refining assets. For instance, the company's Sarnia refinery is undergoing significant upgrades to enhance its processing capabilities and product slate. These investments are crucial for maintaining competitiveness and adapting to evolving market demands for cleaner fuels and specialized chemical products.

Imperial Oil's nationwide distribution and marketing network is a cornerstone of its business model. This extensive infrastructure, encompassing pipelines, rail, and marine transport, ensures efficient delivery of its products throughout Canada.

The company's presence is further amplified by its vast network of Esso-branded service stations, which serve as crucial touchpoints for consumers. In 2024, Imperial Oil operated approximately 1,900 Esso and Mobil retail service stations across Canada, highlighting its extensive market penetration and accessibility.

Proprietary Technology and Intellectual Property

Imperial Oil leverages proprietary technology, including its advanced solvent-assisted SAGD (SA-SAGD) process, to significantly improve oil sands recovery efficiency. This innovation is crucial for maintaining a competitive edge in a demanding market.

The company's commitment to technological development is also evident in its adoption of autonomous haul systems, which are designed to boost operational efficiency and reduce costs. These systems are integral to Imperial Oil's strategy for sustainable and cost-effective resource extraction.

These technological advancements are not just about efficiency; they play a vital role in lowering the company's environmental footprint. For instance, SA-SAGD technology can reduce steam-to-oil ratios, leading to lower greenhouse gas emissions per barrel produced.

- Solvent-Assisted SAGD (SA-SAGD): Reduces steam usage by up to 25% compared to conventional SAGD, leading to lower operating costs and emissions.

- Autonomous Haul Systems: Aim to improve mine productivity and safety, contributing to a more streamlined and cost-effective operation.

- Digitalization and Data Analytics: Used across operations to optimize performance, predict maintenance needs, and enhance decision-making.

- Intellectual Property: Patents and trade secrets related to these technologies provide a significant barrier to entry for competitors.

Skilled Workforce and Operational Expertise

Imperial Oil's business model heavily relies on a highly experienced and skilled workforce. This human capital is essential for navigating the complexities of integrated oil and gas operations, ensuring safety and efficiency from exploration to production and refining.

Deep operational expertise is not just about technical know-how; it encompasses the ability to manage intricate processes, maintain high safety standards, and optimize performance across the entire value chain. This expertise is a cornerstone for reliable and profitable operations.

In 2024, Imperial Oil continued to invest in its people, recognizing that skilled employees are key to overcoming industry challenges and driving innovation. The company's commitment to training and development ensures its workforce remains at the forefront of industry best practices.

- Skilled Workforce: Imperial Oil employs thousands of individuals with specialized skills in engineering, geology, operations, and safety management.

- Operational Expertise: The company boasts decades of experience in managing large-scale, complex projects, including upstream extraction, midstream transportation, and downstream refining.

- Safety and Efficiency: This expertise directly translates into a strong safety record and operational efficiency, crucial for maintaining profitability in the volatile energy sector.

- Talent Development: Imperial Oil actively engages in talent development programs to maintain and enhance the skills of its workforce, ensuring continuity and future capability.

Imperial Oil's key resources are its vast hydrocarbon reserves, particularly in the Alberta oil sands, and its advanced refining and petrochemical infrastructure. The company also leverages proprietary technologies like SA-SAGD and autonomous haul systems to enhance efficiency and reduce environmental impact. Its extensive distribution network, including approximately 1,900 Esso and Mobil retail stations in 2024, and a highly skilled workforce are also critical assets.

Value Propositions

Imperial Oil delivers a steady flow of critical energy products, including crude oil, natural gas, gasoline, and diesel, thanks to its end-to-end integrated operations. This integrated model, from upstream extraction to downstream refining and marketing, provides a robust and reliable energy supply for Canada.

In 2024, Imperial Oil's upstream segment produced an average of 421,000 barrels of oil equivalent per day, underscoring its capacity to meet demand. This consistent production is vital for ensuring energy security for Canadian households and businesses.

Imperial Oil offers a broad spectrum of high-quality petroleum products and petrochemicals, all sold under the well-regarded Esso brand. This extensive product line meets the diverse demands of industrial, commercial, and individual consumers across Canada.

In 2024, Imperial Oil continued to be a key supplier of fuels like gasoline and diesel, alongside lubricants and asphalt. Their petrochemical offerings are also vital for manufacturing sectors. For instance, in the first quarter of 2024, Imperial Oil reported total petroleum product sales volumes of 414,000 barrels per day, underscoring the significant demand for their diverse range.

Imperial Oil is making significant strides in lower-emission energy solutions, notably through its substantial investments in renewable diesel. For instance, the company is progressing with its renewable diesel project in Strathcona, Alberta, which is expected to produce about 1 billion liters annually. This initiative directly caters to the increasing market demand for more sustainable fuel alternatives.

Beyond renewable fuels, Imperial Oil is actively exploring and implementing carbon capture, utilization, and storage (CCUS) technologies. These efforts are crucial for reducing the carbon intensity of its operations and supporting Canada's broader energy transition goals. The company's commitment is reflected in its ongoing evaluation of CCUS opportunities across its value chain.

Operational Excellence and Cost Efficiency

Imperial Oil drives operational excellence by integrating advanced technologies, such as autonomous haul systems, across its operations. This commitment to continuous optimization and disciplined capital allocation is central to achieving cost-effective production.

The company's focus on efficiency directly translates into competitive pricing for its products and contributes to robust financial performance. For instance, in 2023, Imperial Oil reported a strong operational performance, with its upstream segment delivering significant production volumes.

- Technological Integration: Implementing autonomous haul systems to enhance efficiency and safety in mining operations.

- Cost Management: Disciplined capital allocation strategies aimed at optimizing production costs.

- Competitive Pricing: Leveraging operational efficiencies to offer competitive market pricing for refined products.

- Financial Performance: Driving strong financial results through a consistent focus on operational excellence.

Consistent Shareholder Returns

Imperial Oil consistently rewards its shareholders by returning surplus cash. This is primarily achieved through regular dividend payments and strategic share buybacks, which directly enhance shareholder value and appeal to those prioritizing stable income and long-term capital appreciation.

For 2024, Imperial Oil's commitment to shareholder returns is evident. The company declared a first-quarter dividend of $0.41 per share and continued its share repurchase program, demonstrating ongoing financial discipline. This approach is designed to provide predictable returns, making Imperial Oil an attractive option for investors seeking stability in their portfolios.

- Consistent Dividend Payouts: Imperial Oil has a history of maintaining and increasing its dividend payments, providing a reliable income stream for investors.

- Share Repurchase Programs: The company actively buys back its own shares, which reduces the number of outstanding shares and can increase earnings per share.

- Financial Strength: These return strategies are underpinned by Imperial Oil's strong financial performance and cash flow generation capabilities.

- Investor Confidence: The focus on shareholder returns signals financial health and management's confidence in the company's future prospects.

Imperial Oil's value proposition centers on providing reliable, high-quality energy products through its integrated operations, meeting diverse consumer and industrial needs. The company also emphasizes its commitment to lower-emission solutions, particularly renewable diesel, and leverages technological advancements for operational efficiency and cost management. This focus on operational excellence, coupled with consistent shareholder returns via dividends and buybacks, positions Imperial Oil as a stable investment.

Customer Relationships

For individual consumers buying fuels and lubricants, Imperial Oil mainly engages in transactional relationships. This happens through its vast network of Esso-branded service stations, where the emphasis is on making things easy, using a trusted brand, and ensuring quick service when you buy.

In 2024, Imperial Oil continued to leverage its widespread Esso and Mobil retail network to serve millions of customers daily. This direct interaction at the pump is a cornerstone of their customer relationship strategy for the retail segment, prioritizing ease of transaction and brand familiarity.

Imperial Oil prioritizes strong connections with its major commercial and industrial customers, serving sectors like transportation, manufacturing, and agriculture. This commitment is evident through dedicated account managers who provide personalized service and technical assistance to ensure client needs are met effectively.

These relationships are solidified by tailored supply agreements, designed to align with the unique operational requirements of each large business. For instance, in 2024, Imperial Oil continued to emphasize these partnerships as a core element of its customer strategy, aiming to secure long-term supply contracts and foster loyalty within key industrial segments.

Imperial Oil prioritizes transparent investor relations, actively engaging with shareholders and the financial community through detailed quarterly earnings reports and investor presentations. This commitment to open communication, exemplified by their consistent delivery of financial data, helps foster trust and confidence among stakeholders.

Brand Loyalty and Marketing Initiatives

Imperial Oil cultivates brand loyalty for its Esso brand by consistently delivering high-quality fuels and convenience store offerings. This commitment is reinforced through targeted marketing campaigns that highlight product benefits and value, aiming to resonate with consumer needs and preferences.

Loyalty programs play a crucial role in encouraging repeat business and fostering a connection with customers. For instance, Esso’s Speedpass+ program offers convenient payment options and rewards, driving engagement and repeat visits to their retail locations.

Imperial Oil's marketing initiatives, including sponsorships and community engagement, further strengthen brand presence. In 2024, the company continued its focus on digital marketing and customer experience enhancements to solidify its market position.

- Consistent Product Quality: Esso fuels are recognized for their reliability, a key driver of repeat customer visits.

- Targeted Marketing Campaigns: Initiatives focus on value, convenience, and brand benefits to attract and retain customers.

- Loyalty Programs: Programs like Speedpass+ incentivize repeat purchases and build customer relationships.

- Digital Engagement: Imperial Oil leverages digital platforms to enhance customer interaction and loyalty in 2024.

Community Engagement and Corporate Social Responsibility

Imperial Oil actively engages its operating communities through robust corporate social responsibility programs. These initiatives are designed to foster trust and secure a positive social license to operate, which is crucial for long-term business sustainability. In 2024, the company continued its focus on local partnerships and environmental stewardship, recognizing their importance in maintaining strong community relationships.

The company's commitment extends to tangible contributions to community development, supporting local economies and social well-being. This approach helps to build a foundation of mutual respect and shared value. For example, in 2024, Imperial Oil supported various local projects aimed at enhancing education and infrastructure in the regions where it has a significant presence.

- Community Investment: In 2024, Imperial Oil continued to invest in community programs focused on education, environmental conservation, and local economic development, reinforcing its commitment to social well-being.

- Environmental Stewardship: The company's environmental initiatives in 2024 emphasized responsible resource management and minimizing operational impact, aligning with community expectations for ecological preservation.

- Local Partnerships: Imperial Oil fostered collaborations with local organizations and Indigenous communities in 2024, aiming to create shared value and address community needs through joint efforts.

- Social License: Maintaining a positive social license to operate remained a key priority in 2024, achieved through transparent communication and consistent demonstration of corporate responsibility.

Imperial Oil maintains diverse customer relationships, from transactional interactions at Esso stations to deeply integrated partnerships with large industrial clients. These relationships are built on consistent quality, tailored services, and loyalty programs like Speedpass+ to foster repeat business and brand affinity.

In 2024, Imperial Oil's focus on digital engagement and targeted marketing further solidified its connection with consumers. Simultaneously, the company strengthened ties with commercial clients through customized supply agreements, ensuring alignment with their specific operational needs and promoting long-term loyalty.

The company also prioritizes transparent investor relations, providing detailed financial data to build trust. Furthermore, Imperial Oil actively engages with operating communities through corporate social responsibility programs, fostering positive relationships and a social license to operate.

These efforts are supported by investments in community development, environmental stewardship, and local partnerships, demonstrating a commitment to shared value and mutual respect.

Channels

Imperial Oil's Esso-branded retail service stations form a crucial customer-facing segment, directly selling gasoline, diesel, and convenience items to individual consumers across Canada. This extensive network acts as the primary channel for reaching the end-user market.

As of the end of 2023, Imperial Oil operated approximately 1,800 Esso and Mobil retail service stations nationwide. These stations not only facilitate fuel sales but also offer a range of convenience store products, contributing to diversified revenue streams.

In 2024, the company continues to invest in modernizing these locations, enhancing the customer experience and potentially integrating new services to adapt to evolving consumer preferences and the energy transition. This focus aims to maintain market share and brand loyalty in a competitive landscape.

Imperial Oil leverages a dedicated direct sales force and robust commercial channels to deliver fuels, lubricants, and petrochemicals directly to major industrial, commercial, and wholesale clients. This approach is crucial for managing large-volume transactions and offering tailored supply agreements.

In 2024, Imperial Oil's commitment to these direct channels underscores its strategy to secure consistent demand from key business sectors. For instance, their operations in the oil sands, a significant part of their business, rely heavily on efficient logistics and direct supply chains to industrial partners.

Imperial Oil boasts an extensive pipeline and transportation network, a cornerstone of its business model. This integrated infrastructure is crucial for moving crude oil from its production sites, particularly in Western Canada, to its refineries and then distributing refined products across the country. In 2024, the company continued to rely heavily on these assets to ensure efficient and cost-effective operations.

This network includes significant pipeline mileage, alongside rail and marine capabilities, allowing for flexible and reliable movement of vast quantities of product. Such robust logistics are vital for maintaining market access and managing supply chain risks. The company's 2024 performance underscored the importance of this extensive operational backbone.

Wholesale and Distributor Partnerships

Imperial Oil leverages wholesale and distributor partnerships to amplify its market presence, reaching segments beyond its direct operations. These collaborations are crucial for expanding access to its diverse product portfolio, from fuels to lubricants, in various regions and specialized markets.

These strategic alliances allow Imperial Oil to tap into established networks, providing efficient distribution and customer service. For instance, in 2024, the company continued to work with a broad network of independent businesses to ensure its products are readily available across Canada.

- Market Penetration: Partnerships enable access to underserved or geographically challenging markets, increasing overall sales volume.

- Cost Efficiency: Utilizing existing distribution infrastructure reduces Imperial Oil's capital expenditure and operational overhead.

- Product Reach: Wholesalers and distributors ensure a wider availability of Imperial Oil's refined products and petrochemicals to end-users.

Digital Platforms and Online Presence

Imperial Oil leverages its corporate website and various digital channels to connect with stakeholders. These platforms are crucial for investor relations, providing access to financial reports and company updates. In 2024, the company continued to emphasize transparent communication through these digital avenues.

Beyond investor outreach, Imperial Oil's online presence serves as a primary source for news dissemination and general corporate information. While not a direct sales channel for all its offerings, it functions as a vital hub for engagement and information sharing with the public and business partners.

- Corporate Website: A central hub for investor relations, news, and corporate information.

- Digital Engagement: Facilitates communication with shareholders, media, and the public.

- Information Dissemination: Key channel for sharing company performance and strategic updates.

- Not a Direct Sales Channel: Primarily informational and engagement focused, not for direct product sales.

Imperial Oil's retail network, comprising approximately 1,800 Esso and Mobil service stations as of late 2023, serves as a direct channel for consumer sales of fuel and convenience items. These branded locations are central to customer engagement and brand visibility across Canada.

In 2024, the company continues to invest in modernizing these retail sites, aiming to enhance customer experience and adapt to evolving market demands, including the energy transition. This strategic focus supports brand loyalty and market share maintenance.

Beyond retail, Imperial Oil utilizes a direct sales force and robust commercial channels to supply fuels, lubricants, and petrochemicals to industrial and wholesale clients. This is critical for large-volume transactions and tailored supply agreements, securing consistent demand from key business sectors.

Imperial Oil's extensive pipeline and transportation infrastructure, including rail and marine capabilities, forms a vital channel for moving crude oil and distributing refined products. This integrated network is essential for cost-effective operations and market access, as underscored by its performance in 2024.

Wholesale and distributor partnerships extend Imperial Oil's market reach, providing access to diverse regions and specialized markets. These collaborations, active throughout 2024, leverage established networks for efficient product distribution and customer service.

Customer Segments

Individual consumers and motorists are a core customer segment for Imperial Oil, primarily purchasing gasoline and diesel fuel at Esso-branded service stations. They seek dependable fuel quality and the convenience offered by a widespread network of retail locations, often prioritizing brand familiarity and trust. In 2024, the demand for personal transportation fuels remained a significant driver of revenue for the company.

Imperial Oil serves a vast array of Commercial and Industrial Businesses, including those in transportation, manufacturing, agriculture, and construction. These sectors rely heavily on consistent, high-quality fuel and lubricant supplies to maintain their operational efficiency. For instance, in 2024, the Canadian transportation sector, a key customer base, continued to see demand for diesel and gasoline, with fuel prices fluctuating based on global supply dynamics.

These businesses prioritize dependable supply chains and competitive pricing for their bulk fuel and specialized petroleum product needs. They are also looking for customized solutions that can optimize their energy consumption and reduce operational costs. In 2023, industrial lubricant sales in Canada showed steady demand, reflecting the ongoing activity in manufacturing and heavy industry, a trend expected to continue into 2024.

Imperial Oil's petrochemical products are crucial for customers in the chemical and manufacturing sectors, acting as fundamental building blocks for diverse industrial processes. These buyers, including plastics manufacturers and specialty chemical producers, rely on precise product specifications and dependable delivery to maintain their own production schedules and product quality.

In 2024, the global petrochemical market continued to show robust demand, with key segments like polyethylene and polypropylene experiencing steady growth, directly impacting Imperial Oil's customer base. For instance, the automotive sector's increasing use of lightweight plastics, a direct application of petrochemicals, underscores the critical nature of this customer segment.

Wholesale Distributors and Resellers

Wholesale distributors and resellers are crucial partners for Imperial Oil, buying petroleum products in large quantities for onward sale. These businesses, ranging from independent fuel retailers to larger logistics firms, are key to extending Imperial Oil's reach into diverse geographic and market segments. In 2024, Imperial Oil continued to rely on these channels to efficiently move its refined products across Canada.

These intermediaries play a vital role in the supply chain, managing local logistics and customer relationships. Their ability to purchase in bulk allows Imperial Oil to optimize production and distribution. For instance, a significant portion of Imperial Oil's gasoline and diesel sales in Western Canada in 2024 were facilitated through these wholesale channels.

- Market Reach Extension: These partners enable Imperial Oil to access customers that might be difficult to reach directly.

- Bulk Purchasing Power: They buy significant volumes, supporting Imperial Oil's operational efficiency.

- Intermediary Role: They manage the final leg of distribution and often provide localized customer service.

- 2024 Significance: Wholesale channels remained a cornerstone for product placement and sales volume in the Canadian market.

Shareholders and Investors

Shareholders and investors form a crucial segment for Imperial Oil, encompassing both individual retail investors and large institutional entities like pension funds and asset managers. These stakeholders are primarily motivated by the prospect of financial returns, specifically through dividend payouts and capital appreciation of their shares.

Imperial Oil's strategy to attract and retain this segment centers on demonstrating robust financial performance and maintaining a high degree of transparency in its reporting. For instance, in 2023, Imperial Oil reported a net income of $5.1 billion and paid out $2.3 billion in dividends, reflecting a commitment to shareholder returns.

- Financial Returns: Seeking dividends and stock price growth.

- Engagement Strategy: Strong financial performance and transparent reporting.

- 2023 Performance: $5.1 billion net income and $2.3 billion in dividends paid.

- Investor Confidence: Aiming to build and maintain trust through consistent results.

Government entities and regulatory bodies represent a distinct customer segment for Imperial Oil, particularly concerning environmental compliance, permitting, and the responsible operation of its facilities. These stakeholders are focused on adherence to regulations, public safety, and the economic contributions of the energy sector.

Imperial Oil engages with these bodies to ensure operational continuity and to align with national and provincial energy policies. For example, in 2024, the company continued to invest in emissions reduction technologies, a key area of focus for government oversight.

Academic and research institutions also engage with Imperial Oil, seeking data and collaborations for studies on energy, environment, and economics. These partnerships contribute to industry knowledge and innovation, with research funding often being a component of engagement.

Cost Structure

Imperial Oil's cost structure heavily relies on substantial capital and exploration expenditures. These costs are essential for discovering new oil and gas reserves and for building and enhancing production facilities, particularly for their significant oil sands operations like Kearl and Cold Lake.

For 2025, Imperial Oil anticipates capital and exploration expenditures to range between $1.9 billion and $2.1 billion. This significant investment underscores the capital-intensive nature of the energy sector and Imperial Oil's commitment to future production capacity.

Imperial Oil's production and manufacturing costs encompass the direct expenses of extracting crude oil and natural gas, and then refining these into a range of petroleum and petrochemical products. These costs are fundamental to their operations.

Key elements within this cost structure include the significant expenditure on energy required for extraction and refining processes, as well as the wages and benefits for their workforce. Additionally, regular maintenance of complex machinery and the purchase of necessary raw materials are substantial cost drivers.

For 2024, Imperial Oil reported substantial capital expenditures, with a significant portion allocated to upstream projects aimed at enhancing production efficiency and maintaining existing assets. For instance, their upstream capital intensity remains a critical factor, reflecting the ongoing investment needed to sustain and grow their oil and gas output.

Imperial Oil's distribution and marketing expenses are substantial, covering the intricate logistics of moving refined products across Canada. This includes significant costs associated with pipeline operations, railcar fleets, and trucking services to ensure timely delivery to a vast network of Esso service stations and commercial customers.

Operating its extensive retail network, comprising thousands of Esso branded service stations, also incurs considerable costs. These expenses are essential for maintaining brand presence and accessibility to end-consumers nationwide.

Marketing and advertising campaigns are critical for promoting Imperial Oil's brand and product offerings, such as Esso Synergy gasoline. In 2024, the company continued to invest in these areas to maintain market share and attract customers in a competitive landscape.

Depreciation, Depletion, and Amortization

Imperial Oil, as a capital-intensive player in the energy sector, faces significant costs related to Depreciation, Depletion, and Amortization (DD&A). This category represents the gradual reduction in the value of its physical assets and natural resources as they are used or consumed. In 2024, DD&A is a crucial component of their cost structure, reflecting the ongoing investment in and extraction from their oil and gas reserves.

This significant expense highlights the wear and tear on their extensive infrastructure, including refineries, pipelines, and exploration equipment. The depletion aspect specifically accounts for the extraction of oil and gas, directly tying costs to the consumption of their primary resource base.

- Depreciation of fixed assets like refineries and pipelines.

- Depletion of oil and gas reserves as they are extracted.

- Amortization of intangible assets related to exploration and development.

- These costs are fundamental to understanding the profitability of operations.

Environmental Investments and Compliance Costs

Imperial Oil dedicates substantial resources to environmental protection and meeting stringent regulations. This includes ongoing investments in technologies and projects designed to lower their environmental footprint, a growing priority for long-term viability.

These expenditures cover a range of activities, from managing operational impacts to actively pursuing emission reduction strategies. For instance, the company's commitment to sustainability is evident in its development of a renewable diesel facility and its engagement in carbon capture initiatives.

- Environmental Stewardship: Costs associated with maintaining environmental standards and remediation efforts.

- Regulatory Compliance: Expenses incurred to meet government environmental regulations and reporting requirements.

- Emission Reduction Investments: Capital allocated to projects like renewable diesel production and carbon capture technologies to decrease greenhouse gas emissions.

Imperial Oil's cost structure is dominated by capital and exploration expenditures, essential for its extensive oil sands operations. These investments, projected between $1.9 billion and $2.1 billion for 2025, highlight the sector's capital intensity. Production and manufacturing costs, including energy, labor, and maintenance for complex machinery, are also significant drivers.

Depreciation, Depletion, and Amortization (DD&A) represent a substantial cost, reflecting the wear on infrastructure and the extraction of resources. Environmental compliance and emission reduction initiatives, such as renewable diesel projects, also contribute to the overall cost base.

| Cost Category | Key Components | 2024/2025 Relevance |

|---|---|---|

| Capital & Exploration Expenditures | Oil sands development, facility upgrades, exploration | $1.9B - $2.1B projected for 2025 |

| Production & Manufacturing Costs | Energy, labor, raw materials, maintenance | Direct costs of extraction and refining |

| Depreciation, Depletion & Amortization (DD&A) | Asset wear, resource extraction, intangible assets | Significant cost reflecting asset usage |

| Distribution & Marketing | Pipelines, rail, trucking, retail network operations | Logistics for product delivery and brand presence |

| Environmental & Regulatory | Compliance, emission reduction technology | Investments in sustainability and regulatory adherence |

Revenue Streams

Imperial Oil generates revenue primarily through the sale of crude oil, bitumen, and natural gas. These sales stem directly from the company's upstream operations, encompassing its wholly-owned production facilities such as Kearl and Cold Lake, alongside its stake in joint ventures like Syncrude.

In 2024, Imperial Oil's upstream segment was a significant contributor to its financial performance, reflecting ongoing production and market demand for its hydrocarbon products. The company's ability to extract and market these resources efficiently underpins this core revenue stream.

Imperial Oil's primary revenue engine is the sale of refined petroleum products, a diverse portfolio encompassing gasoline, diesel, jet fuel, heating oil, and lubricants, predominantly marketed under the recognizable Esso brand. These essential fuels reach consumers and businesses through a multi-channel approach, including a vast network of retail service stations, direct commercial contracts with industrial clients, and broader wholesale distribution agreements.

In 2024, Imperial Oil reported significant performance in its downstream segment, driven by these refined product sales. For instance, the company's refined products segment generated approximately $37.5 billion in revenue for the full year 2023, a figure expected to see continued strength and potentially growth in 2024, reflecting robust demand for transportation fuels and industrial lubricants.

Imperial Oil generates significant revenue through the sale of petrochemical products, catering to a broad base of industrial clients. These sales leverage by-products from their refining operations, adding a valuable dimension to their profitability.

In 2024, Imperial Oil's petrochemical segment demonstrated robust performance. The company reported that its petrochemicals business contributed substantially to its downstream earnings, highlighting the strategic importance of this revenue stream.

Sales of Lower-Emission Fuels (e.g., Renewable Diesel)

Imperial Oil is set to generate revenue from the sale of lower-emission fuels, specifically renewable diesel, with its new facility slated to begin operations in mid-2025. This move taps into the increasing market preference for sustainable energy solutions, establishing a significant new revenue stream. This aligns with global trends toward decarbonization in the transportation sector.

The company's investment in renewable diesel production is a strategic response to evolving energy demands and regulatory landscapes. By offering these lower-emission alternatives, Imperial Oil aims to capture market share and diversify its product portfolio. The projected demand for renewable fuels is expected to grow substantially in the coming years, driven by environmental mandates and consumer awareness.

- New Revenue Stream: Sales of renewable diesel commencing mid-2025.

- Market Alignment: Addresses growing demand for sustainable energy.

- Strategic Focus: Diversification into lower-emission fuel markets.

- Future Growth: Positioned to benefit from increasing renewable fuel adoption.

Investment and Other Income

Imperial Oil's Investment and Other Income stream encompasses earnings beyond its primary oil and gas operations. This includes interest generated from the company's cash reserves and short-term investments, as well as any miscellaneous non-operational revenue. For instance, in 2023, Imperial Oil reported $352 million in "other income and other expense, net," which would include such items. While not as substantial as its upstream and downstream segment revenues, this income source provides a supplementary boost to the company's overall financial health.

This segment is crucial for understanding the full financial picture of Imperial Oil. It highlights how the company manages its surplus capital and generates returns from financial assets. These earnings, though often fluctuating based on market interest rates and investment performance, contribute to a more robust and diversified revenue base.

- Interest Income: Earnings from cash balances and short-term investments.

- Other Non-Operational Earnings: Miscellaneous income not directly tied to core business activities.

- Contribution to Financial Performance: Supplements core revenues, enhancing overall profitability.

- 2023 Data: Reported $352 million in other income and other expense, net.

Imperial Oil's revenue streams are diverse, spanning the extraction and sale of crude oil and natural gas, the production and distribution of refined petroleum products like gasoline and diesel, and the marketing of petrochemicals. The company also anticipates a new revenue stream from renewable diesel sales starting mid-2025.

| Revenue Stream | Description | 2023 Data/Key Points | 2024 Outlook/Notes |

| Upstream (Crude Oil & Natural Gas) | Sales from wholly-owned facilities and joint ventures. | Significant contributor to financial performance. | Continued production and market demand expected. |

| Downstream (Refined Products) | Sales of gasoline, diesel, jet fuel, lubricants under the Esso brand. | Generated approximately $37.5 billion in revenue in 2023. | Robust demand anticipated for transportation fuels. |

| Petrochemicals | Sales of petrochemical products to industrial clients. | Contributed substantially to downstream earnings. | Leverages refining by-products for added profitability. |

| Renewable Diesel | Sales of lower-emission fuels. | New facility to begin operations mid-2025. | Addresses growing demand for sustainable energy solutions. |

| Investment and Other Income | Interest from cash reserves and miscellaneous non-operational revenue. | Reported $352 million in other income and other expense, net in 2023. | Supplements core revenues and enhances overall profitability. |

Business Model Canvas Data Sources

The Imperial Oil Business Model Canvas is built upon a foundation of comprehensive financial disclosures, detailed market research reports, and internal operational data. These sources ensure each component, from value propositions to cost structures, is grounded in verifiable information.