Imperial Oil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imperial Oil Bundle

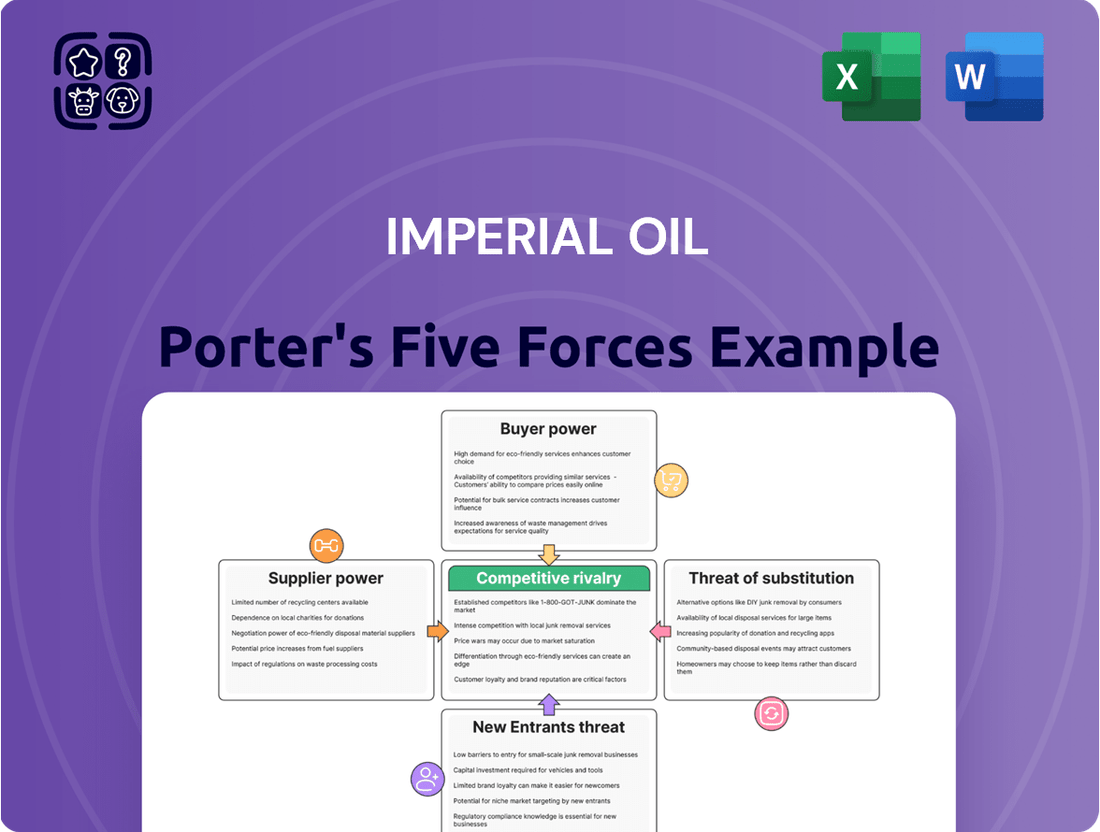

Imperial Oil operates within a dynamic energy sector, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

The complete report reveals the real forces shaping Imperial Oil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, particularly for specialized equipment and advanced technology, often features a concentrated supplier base. This means a limited number of companies provide critical components, giving them significant pricing power. For a major player like Imperial Oil, the cost and complexity of switching to alternative suppliers can be substantial, reinforcing the suppliers' leverage.

Imperial Oil, despite its integrated nature, may still need to purchase crude oil from external sources for its refining activities. The power of these suppliers is substantial, driven by global market conditions, geopolitical events, and the specific characteristics of the crude oil itself. For instance, in 2024, global crude oil benchmarks like West Texas Intermediate (WTI) and Brent crude experienced significant price volatility, directly affecting Imperial Oil's procurement costs for its downstream operations.

Suppliers offering advanced drilling technologies, seismic services, and specialized engineering and maintenance are a significant factor in Imperial Oil's operational landscape. Their proprietary nature and the deep expertise required mean these providers often wield considerable bargaining power. For instance, the development of sophisticated hydraulic fracturing equipment or advanced reservoir simulation software represents a substantial investment, limiting the number of capable suppliers and thus enhancing their leverage over companies like Imperial Oil.

Labor Unions and Skilled Workforce

The bargaining power of labor unions and the availability of a skilled workforce significantly impact Imperial Oil. In 2024, the Canadian oil and gas sector continued to face challenges in securing specialized talent, particularly in areas like reservoir engineering and advanced drilling operations. This scarcity empowers unions representing these skilled workers, allowing them to negotiate for improved wages and benefits, directly affecting Imperial Oil's labor costs.

- Skilled Workforce Availability: Shortages in specialized oil and gas roles in 2024 gave skilled workers more leverage.

- Union Negotiation Power: Unions can push for higher compensation and better working conditions, increasing operational expenses for Imperial Oil.

- Impact on Costs: Increased labor costs due to strong union bargaining can affect Imperial Oil's profitability and competitiveness.

- Talent Scarcity: Persistent skill gaps in the industry amplify the bargaining power of the available skilled labor force.

Regulatory and Environmental Compliance Service Providers

The bargaining power of suppliers in the regulatory and environmental compliance sector is significant for Imperial Oil. As environmental regulations tighten and the push for decarbonization intensifies, companies like Imperial Oil increasingly rely on specialized service providers for compliance and sustainability initiatives.

Imperial Oil's strategic focus on reducing emissions, exemplified by its investments in renewable diesel production, directly increases its dependence on suppliers offering advanced environmental technologies and services. For instance, the company has committed substantial capital to projects aimed at lowering its environmental footprint, which necessitates sourcing expertise and equipment from these specialized providers.

- Increased Demand for Decarbonization Solutions: Suppliers of carbon capture, utilization, and storage (CCUS) technologies and renewable energy solutions are experiencing heightened demand, bolstering their pricing power.

- Regulatory Mandates Drive Reliance: Stricter environmental regulations, such as those pertaining to greenhouse gas emissions, compel companies like Imperial Oil to engage specialized compliance service providers, reducing their ability to negotiate unfavorable terms.

- Investment in Sustainability: Imperial Oil's significant investments in renewable diesel facilities, projected to contribute to lower-carbon fuel production, underscore its reliance on suppliers for critical components and expertise in these emerging fields.

Suppliers of specialized equipment, technology, and critical raw materials, such as crude oil, hold significant bargaining power over Imperial Oil. This leverage is amplified by the concentrated nature of some supplier markets and global commodity price fluctuations, as seen with oil benchmarks in 2024. Furthermore, the increasing demand for decarbonization solutions and compliance services strengthens the position of providers in these niche areas, impacting Imperial Oil's operational costs and strategic investments.

| Supplier Category | Key Factors Influencing Power | Impact on Imperial Oil | 2024 Relevance |

|---|---|---|---|

| Specialized Equipment & Technology | Proprietary nature, high R&D costs, limited providers | Higher procurement costs, potential delays | Continued reliance on advanced drilling and extraction tech |

| Crude Oil Suppliers | Global supply/demand, geopolitical events, oil quality | Volatility in feedstock costs for refining | WTI and Brent price fluctuations directly impacted costs |

| Skilled Labor & Unions | Scarcity of specialized talent, collective bargaining | Increased labor expenses, potential operational disruptions | Talent shortages in engineering and operations |

| Environmental Compliance & Decarbonization | Stringent regulations, demand for green tech | Increased reliance on service providers, investment in new tech | Growing market for CCUS and renewable energy solutions |

What is included in the product

This analysis dissects Imperial Oil's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the oil and gas industry.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis for Imperial Oil, offering a clear visual of market pressures.

Customers Bargaining Power

Imperial Oil's Esso branded retail fuels are primarily sold to individual consumers, creating a highly fragmented customer base. This fragmentation means that no single customer holds significant sway over pricing or terms.

While individual buyers have minimal bargaining power, their collective purchasing decisions and sensitivity to fuel prices can impact Imperial Oil's market share and overall pricing strategies. For instance, in 2024, gasoline prices in Canada saw fluctuations, with average prices in major cities like Toronto and Vancouver often exceeding $1.70 per litre, making consumers more price-conscious.

To counter this, Imperial Oil focuses on differentiating its offering beyond just price. Factors like brand recognition, the convenience of its extensive network of Esso service stations, and the appeal of its loyalty programs, such as Esso Extra, play a crucial role in retaining customers and mitigating the impact of a fragmented market.

Large industrial and commercial customers, like airlines and manufacturing plants, are significant buyers of Imperial Oil's petroleum products and petrochemicals. Their substantial order volumes give them considerable leverage, allowing them to demand competitive pricing and superior service. For instance, a major airline could negotiate favorable terms due to its consistent, large fuel purchases.

This bargaining power means these customers can easily switch to alternative suppliers if Imperial Oil's offerings aren't sufficiently attractive. To counter this, Imperial Oil often employs long-term contracts and develops customized solutions, ensuring customer loyalty and predictable demand, thereby managing the inherent power these large clients wield.

Many of Imperial Oil's core products, such as gasoline, diesel fuel, and fundamental petrochemicals, are classified as commodities. This inherent nature means there's very little to distinguish one supplier's product from another's, making customers highly attuned to price differences.

When products are essentially the same across various providers, customers have the freedom to choose the cheapest option. This ease of switching significantly reduces Imperial Oil's leverage to charge higher prices unless they've cultivated exceptional brand loyalty or offer truly unique services that competitors cannot easily replicate.

For instance, in 2023, the global gasoline market saw significant price volatility, with average retail prices in Canada fluctuating considerably, highlighting the price-sensitive nature of this commodity for consumers. This environment directly impacts Imperial Oil's pricing power.

Impact of Regulatory Environment on Demand

Government policies, including carbon taxes and clean energy mandates, directly shape customer preferences and demand for petroleum products. As Canada progresses towards its net-zero emissions targets, there's a discernible shift in consumer behavior, favoring lower-carbon alternatives over traditional fossil fuels.

This regulatory push can significantly impact Imperial Oil's sales volumes for conventional products. For instance, in 2024, Canada's federal carbon pricing system continued to influence energy costs, potentially dampening demand for gasoline and diesel. Imperial Oil's strategic response involves adapting its product portfolio and investing in lower-emission solutions to meet evolving market expectations.

- Government policies like carbon pricing directly affect the cost of traditional fuels.

- Net-zero emission targets encourage a move towards cleaner energy alternatives.

- This shift can reduce demand for petroleum products, impacting sales volumes.

- Imperial Oil must adapt its offerings to align with regulatory changes and customer preferences.

Availability of Alternative Fuels and Technologies

The growing availability of alternative fuels and energy-efficient technologies significantly bolsters customer bargaining power. As more options emerge, such as electric vehicles and advanced biofuels, consumers gain leverage to demand better pricing and performance from traditional fuel providers like Imperial Oil.

Imperial Oil's strategic investment in renewable diesel production, with a significant capital expenditure of approximately $720 million announced in 2022 for its Strathcona refinery, directly addresses this shifting market dynamic. This move aims to capture a share of the growing demand for lower-carbon fuels and retain customer loyalty in an increasingly competitive energy landscape.

- Increased Customer Options: The rise of electric vehicles and alternative fuel sources provides consumers with choices beyond conventional gasoline and diesel.

- Pressure on Pricing: Greater availability of substitutes can force traditional energy companies to compete more aggressively on price.

- Imperial Oil's Renewable Diesel Investment: The company's commitment to renewable diesel production signals an adaptation to customer preferences for more sustainable energy solutions.

Imperial Oil faces moderate customer bargaining power, largely driven by the commodity nature of its core products and increasing consumer price sensitivity. While individual retail customers have minimal power, their collective actions and sensitivity to price fluctuations, like the average gasoline price in Toronto exceeding $1.70 per litre in 2024, can influence market dynamics. Large industrial clients, however, wield significant leverage due to their substantial order volumes, enabling them to negotiate favorable terms and easily switch suppliers if pricing or service is not competitive.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Imperial Oil's Mitigation Strategies |

|---|---|---|---|

| Individual Consumers (Retail Fuels) | Low to Moderate | Price sensitivity, brand loyalty, convenience, loyalty programs | Brand differentiation, extensive retail network, loyalty programs (e.g., Esso Extra) |

| Industrial/Commercial Clients (Bulk Fuels, Petrochemicals) | High | Large order volumes, commodity nature of products, availability of substitutes | Long-term contracts, customized solutions, competitive pricing |

| Overall Market Sensitivity | Moderate | Commodity pricing, government policies (e.g., carbon taxes), availability of alternatives | Product portfolio adaptation, investment in lower-emission solutions, focus on value-added services |

Full Version Awaits

Imperial Oil Porter's Five Forces Analysis

This preview showcases the complete Imperial Oil Porter's Five Forces Analysis, detailing the competitive landscape for the company. You'll receive this exact, professionally formatted document immediately after purchase, providing a thorough examination of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. No placeholders or samples; what you see is precisely what you get, ready for immediate use.

Rivalry Among Competitors

The Canadian oil and gas sector is dominated by a handful of major integrated companies, with Imperial Oil, Suncor Energy, and Cenovus Energy being prominent examples. This limited number of significant players creates a highly concentrated market structure.

This concentration fuels intense competition among these giants. They battle for market share across all stages of the oil and gas value chain, from upstream exploration and production to downstream refining and retail marketing.

For instance, in 2023, Suncor Energy reported adjusted funds from operations of CAD 14.4 billion, while Cenovus Energy posted CAD 7.7 billion, highlighting their substantial operational scale and capacity for aggressive competition against Imperial Oil.

Imperial Oil benefits from its integrated business model, which spans upstream (exploration and production), downstream (refining and marketing), and chemical operations. This integration helps buffer the company against the volatility of commodity prices by allowing different segments to offset each other's performance. For instance, strong refining margins can compensate for lower crude oil prices.

However, this integrated approach is not unique in the Canadian oil and gas sector. Competitors like Suncor Energy and Cenovus Energy also operate with similar integrated business models. This means that while integration offers a degree of resilience, it also fuels intense rivalry. Companies are constantly vying for market share and striving for greater operational efficiency across all their business units to maintain a competitive edge.

In 2024, the Canadian energy landscape continues to be shaped by these integrated players. For example, Imperial Oil reported strong downstream performance in the first quarter of 2024, with its refining segment contributing significantly to overall profitability, demonstrating the practical benefit of its integrated strategy amidst fluctuating upstream commodity prices.

The oil and gas industry is inherently capital-intensive, demanding enormous upfront investments for exploration, drilling, production facilities, and transportation infrastructure. For instance, a single offshore oil platform can cost billions of dollars to construct and deploy. This substantial financial barrier to entry means that only well-capitalized companies can compete, and those already in the market are heavily invested in maintaining and expanding their operations.

This high fixed cost structure compels existing players to pursue maximum production and throughput to spread these costs over a larger volume, thereby achieving economies of scale. In 2024, major integrated oil companies like ExxonMobil and Shell continued to invest tens of billions of dollars in capital expenditures, underscoring this reality. This drive for volume often translates into aggressive competition for market share and resource access.

Government Policies and Regulations

Government policies and regulations significantly shape the competitive landscape for Imperial Oil. In 2024, the Canadian energy sector continues to navigate evolving environmental standards, carbon pricing mechanisms, and government incentives for renewable energy projects. These regulatory shifts can create both opportunities and challenges, potentially intensifying rivalry as companies adapt their strategies to comply with new mandates or capitalize on government support.

For instance, federal and provincial governments often introduce policies that directly impact the cost of operations and investment decisions. Changes in carbon pricing, as seen with Canada's federal carbon tax, can alter the economics of fossil fuel production. In 2023, the federal carbon tax applied to emissions from large industrial facilities, including oil and gas operations, with rates expected to continue their upward trajectory. This creates a dynamic where companies that can more efficiently reduce their emissions or invest in lower-carbon technologies may gain a competitive edge.

- Environmental Regulations: Stricter emissions standards and water usage regulations can increase operational costs and require significant capital investment in new technologies.

- Carbon Pricing: The implementation and potential increases in carbon taxes or cap-and-trade systems directly affect the profitability of hydrocarbon production, incentivizing a shift towards cleaner operations.

- Investment Incentives: Government programs supporting clean energy development or carbon capture utilization and storage (CCUS) can create new competitive arenas for companies seeking to diversify or reduce their environmental footprint.

- Resource Development Policies: Provincial regulations concerning oil and gas exploration, production, and royalty structures directly influence the economic viability of projects for companies like Imperial Oil.

Access to Markets and Infrastructure

Competitive rivalry is significantly influenced by access to markets and crucial infrastructure like pipeline capacity. The expansion of the Trans Mountain Pipeline, for instance, has been a game-changer, boosting Canadian oil export capabilities. This increased capacity intensifies competition as producers vie for access to these newly opened markets, aiming to secure more favorable pricing for their crude oil.

- Trans Mountain Pipeline Expansion: This project is designed to increase oil export capacity from 300,000 barrels per day to 890,000 barrels per day.

- Market Access Impact: Enhanced export capacity allows Canadian producers to reach a wider range of international buyers, potentially leading to improved price realization compared to being solely reliant on domestic markets.

- Producer Competition: With greater export opportunities, the competition among Canadian oil producers to secure transportation and reach these global markets becomes more pronounced.

The Canadian oil and gas sector is characterized by a high degree of competitive rivalry among a few dominant integrated players. These companies, including Imperial Oil, Suncor Energy, and Cenovus Energy, compete fiercely across the entire value chain, from exploration to retail. Their integrated business models, while offering some resilience, also mean they are constantly vying for market share and operational efficiency. For example, in the first quarter of 2024, Imperial Oil's strong downstream performance highlighted the benefits of integration, a strategy also pursued by its major competitors.

The intense rivalry is further fueled by the industry's capital-intensive nature, requiring massive investments that create high barriers to entry. This compels existing firms to maximize production and achieve economies of scale, leading to aggressive competition for resources and market access. Government policies, such as carbon pricing and environmental regulations, also play a significant role, creating a dynamic environment where companies that adapt efficiently can gain an edge.

The expansion of key infrastructure like the Trans Mountain Pipeline intensifies this rivalry by opening up new export markets. Producers now compete more intensely to secure capacity and reach global buyers, aiming for better pricing. This increased market access means that competition is not just about production efficiency but also about strategic positioning in international trade.

| Company | 2023 Revenue (CAD Billions) | 2023 Net Income (CAD Billions) | Q1 2024 Production (kbpd) |

|---|---|---|---|

| Imperial Oil | 49.2 | 5.1 | 419 |

| Suncor Energy | 55.9 | 5.7 | 840 |

| Cenovus Energy | 63.1 | 4.5 | 790 |

SSubstitutes Threaten

The accelerating shift towards electric vehicles (EVs) presents a significant long-term threat to Imperial Oil's core business. As EV adoption gains momentum, driven by government incentives and improving infrastructure, demand for gasoline and diesel is expected to wane.

In 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years, indicating a growing consumer preference for alternatives to internal combustion engine vehicles. This trend directly impacts Imperial Oil's downstream segment, which relies heavily on the sale of refined petroleum products.

The expansion of charging networks and advancements in battery technology further solidify the viability of EVs, making them increasingly attractive substitutes for traditional fuel-powered transportation. This sustained substitution could lead to reduced volumes and potentially lower margins for Imperial Oil's fuel products over the coming decades.

Significant investments and technological advancements in renewable energy sources like solar, wind, and hydropower are accelerating the shift away from fossil fuels for electricity generation. For instance, Canada's federal government committed to a net-zero electricity grid by 2050, a goal that necessitates a substantial increase in renewable capacity.

While Imperial Oil's core business is in petroleum products, this broader energy transition poses a systemic threat to the long-term dominance of oil and gas. The increasing cost-competitiveness of renewables, coupled with supportive government policies, makes them a viable and growing substitute for energy needs previously met by fossil fuels.

The rise of biofuels like ethanol and biodiesel poses a significant threat to Imperial Oil's traditional gasoline and diesel sales. These alternatives offer a pathway to reduce reliance on fossil fuels, driven by both environmental concerns and government mandates. For instance, Canada's Clean Fuel Regulations aim to reduce the carbon intensity of transportation fuels, encouraging the adoption of renewable options.

Imperial Oil is proactively addressing this threat by investing in renewable diesel production, as seen with its Strathcona refinery project. This strategic move allows the company to not only mitigate the substitution risk but also to capture market share in the expanding renewable fuels sector. By 2030, the global biofuels market is projected to reach substantial figures, highlighting the growing importance of this segment.

Improvements in Energy Efficiency

Improvements in energy efficiency present a significant threat of substitutes for Imperial Oil. As industries and consumers adopt more efficient technologies, the overall demand for energy, including petroleum products, naturally declines. For instance, advancements in vehicle fuel economy directly reduce the need for gasoline and diesel, core products for Imperial Oil.

The drive for greater energy efficiency is a continuous trend, impacting demand across multiple fronts. By 2024, the automotive sector has seen substantial gains in average fuel economy, with new passenger vehicles in the US achieving an estimated 28.0 miles per gallon (MPG) in 2023, a notable increase from previous years. This ongoing improvement means less fuel is consumed per mile driven, directly impacting the volume of sales for refined products.

- Reduced Consumption: Enhanced efficiency in industrial machinery and building insulation lowers the overall energy footprint, lessening reliance on fossil fuels.

- Technological Advancements: Innovations in areas like LED lighting and smart home technology contribute to decreased electricity demand, indirectly affecting the need for energy derived from oil and gas.

- Transportation Sector Impact: The growing adoption of electric vehicles (EVs) and more fuel-efficient internal combustion engines directly substitutes demand for traditional gasoline and diesel. By the end of 2023, global EV sales surpassed 13 million units, a testament to this shift.

Hydrogen as an Emerging Energy Carrier

While still in its nascent stages for broad market penetration, hydrogen is rapidly evolving as a promising clean energy alternative. Its potential applications span transportation, heavy industry, and electricity generation, directly challenging traditional energy sources.

As hydrogen production costs decline and fueling infrastructure expands, it poses a growing threat as a substitute for some of Imperial Oil's core hydrocarbon products. Industrial sectors, in particular, are exploring hydrogen for processes like steelmaking and ammonia production, where it can directly replace natural gas or other fossil fuels.

- Emerging Applications: Hydrogen is being developed for fuel cell electric vehicles (FCEVs), industrial heat, and grid-scale energy storage.

- Cost Reduction Trends: The cost of green hydrogen production is projected to fall significantly in the coming years, making it more competitive. For instance, BloombergNEF reported in early 2024 that electrolyzer costs had fallen by over 50% in the past decade.

- Infrastructure Development: Significant investment is flowing into hydrogen refueling stations and production facilities globally, supported by government initiatives and private sector partnerships.

- Industrial Substitution Potential: Sectors like cement and chemicals are actively investigating hydrogen as a decarbonization pathway, representing a direct substitute for current energy inputs.

The threat of substitutes for Imperial Oil is multifaceted, encompassing electric vehicles, biofuels, energy efficiency, and emerging technologies like hydrogen. These alternatives directly challenge the demand for Imperial Oil's core petroleum products across transportation and industrial sectors.

The accelerating adoption of electric vehicles, with global sales projected to surpass 15 million units in 2024, directly erodes demand for gasoline and diesel. Simultaneously, government regulations like Canada's Clean Fuel Regulations are promoting biofuels, such as renewable diesel, which Imperial Oil is investing in to counter this substitution.

Improvements in energy efficiency, evident in the automotive sector's increasing average fuel economy, further reduce overall energy consumption. Emerging technologies like hydrogen, with falling production costs and expanding infrastructure, also present a growing substitute, particularly for industrial applications.

| Substitute Category | Key Trend/Driver | Impact on Imperial Oil | Relevant 2024 Data/Projections |

|---|---|---|---|

| Electric Vehicles (EVs) | Growing consumer adoption, government incentives, improved infrastructure | Reduced demand for gasoline and diesel | Global EV sales projected to exceed 15 million units |

| Biofuels | Environmental concerns, government mandates (e.g., Clean Fuel Regulations) | Competition for traditional diesel and gasoline markets | Global biofuels market projected for substantial growth by 2030 |

| Energy Efficiency | Technological advancements in vehicles, industry, and buildings | Lower overall energy consumption, reduced fuel demand | New passenger vehicles in US achieving ~28.0 MPG (2023 average) |

| Hydrogen | Declining production costs, expanding infrastructure, industrial decarbonization efforts | Potential substitute for fossil fuels in transportation and industry | Electrolyzer costs fallen over 50% in the past decade (early 2024 report) |

Entrants Threaten

The oil and gas sector, including companies like Imperial Oil, demands massive upfront investments. Developing new oil fields, building refineries, and establishing distribution networks can easily cost billions of dollars, creating a significant hurdle for potential new competitors.

For instance, major oil sands projects in Canada, Imperial Oil's primary operational area, often require capital expenditures exceeding CAD $10 billion for development. This immense financial commitment acts as a powerful deterrent, effectively limiting the number of new entrants capable of competing at scale.

New entrants in the Canadian oil and gas sector encounter significant challenges due to extensive regulatory hurdles and environmental regulations. Navigating complex environmental assessments, obtaining necessary permits, and ensuring compliance with evolving climate change policies, including net-zero targets, represent substantial barriers. For instance, in 2023, the Canadian government continued to emphasize its commitment to emissions reductions, with ongoing discussions and implementation of policies that directly impact operational requirements and capital expenditures for any new player looking to enter the market.

Imperial Oil, a titan in the Canadian energy sector, along with its integrated peers, possesses a formidable advantage due to decades of operational experience and deeply entrenched supply chains. This history translates into significant economies of scale, making it incredibly difficult for new companies to enter the market and compete on cost. For instance, Imperial Oil's extensive network of refineries, pipelines, and retail outlets, built over many years, represents a massive capital investment that new entrants would need to replicate, a daunting financial undertaking.

Access to Resources and Distribution Networks

New companies looking to enter the oil and gas sector face substantial hurdles in securing essential resources and distribution channels. Gaining access to commercially viable crude oil and natural gas reserves, along with securing crucial pipeline capacity, refining facilities, and extensive retail distribution networks, represents a significant barrier for any new entrant.

Imperial Oil's advantage lies in its deeply integrated asset base. For instance, as of the first quarter of 2024, Imperial Oil reported gross oil and gas production of approximately 412,000 gross oil-equivalent barrels per day. This level of established production is difficult for newcomers to replicate quickly.

- Capital Intensity: The sheer cost of acquiring exploration rights, drilling, and building infrastructure is prohibitive for most new players.

- Established Infrastructure: Existing companies like Imperial Oil already possess vast networks of pipelines, refineries, and retail outlets, creating a significant cost and time disadvantage for new entrants.

- Regulatory Hurdles: Navigating complex environmental and operational regulations requires significant expertise and financial backing, which startups often lack.

- Supply Chain Control: Access to and control over critical supply chain elements, from extraction to sale, is a major deterrent for new market participants.

Technological Complexity and Expertise

The petroleum industry, including operations like those of Imperial Oil, demands highly sophisticated technologies for everything from finding oil reserves to processing it into usable products. This technological intensity creates a significant hurdle for any newcomers. For instance, advanced seismic imaging and drilling techniques, particularly for challenging environments like oil sands, require immense capital investment and specialized knowledge that are not readily available.

Acquiring or developing the necessary technological capabilities and the skilled workforce to operate them presents a formidable barrier to entry. Companies need expertise in areas such as reservoir engineering, advanced chemical processes for refining, and complex logistical management. Without this deep technical know-how, new entrants would struggle to compete effectively or even begin operations.

- High Capital Expenditure: Developing proprietary extraction technologies for oil sands, for example, can cost billions of dollars, a prohibitive sum for most new firms.

- Specialized Expertise Required: The industry needs geoscientists, chemical engineers, and process control specialists, a talent pool that is both scarce and expensive.

- Intellectual Property: Existing players often hold patents on key technologies, further restricting access for potential entrants.

The threat of new entrants for Imperial Oil is generally low due to extremely high capital requirements and established infrastructure. New companies face prohibitive costs for exploration, extraction, and refining, often running into billions of dollars. For example, developing a new oil sands project in Canada can easily exceed CAD $10 billion.

Furthermore, existing players like Imperial Oil benefit from decades of operational experience, extensive supply chain control, and deep regulatory expertise, making it difficult for newcomers to match their economies of scale and efficiency. As of Q1 2024, Imperial Oil’s gross oil-equivalent production was around 412,000 barrels per day, showcasing the scale that new entrants would need to overcome.

Regulatory and environmental compliance adds another significant layer of difficulty, requiring substantial investment in expertise and technology to meet standards, such as those related to net-zero targets increasingly emphasized by governments in 2023 and continuing into 2024.

| Barrier to Entry | Description | Example for Imperial Oil |

|---|---|---|

| Capital Intensity | Immense upfront investment for exploration, drilling, and infrastructure. | Developing new oil sands projects can cost over CAD $10 billion. |

| Established Infrastructure | Existing, extensive networks of pipelines, refineries, and retail outlets. | Imperial Oil's integrated network built over decades. |

| Regulatory Hurdles | Complex environmental and operational compliance, including climate policies. | Navigating evolving net-zero regulations and permit processes. |

| Technological Sophistication | Need for advanced extraction and processing technologies and skilled workforce. | Expertise in seismic imaging and specialized refining processes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Imperial Oil is built upon a foundation of robust data, including their annual reports, investor presentations, and filings with securities regulators. We also incorporate industry-specific data from reputable sources like the Canadian Association of Petroleum Producers and market intelligence reports.