Imperial Oil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imperial Oil Bundle

Imperial Oil's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of Stars, Cash Cows, Dogs, and Question Marks. This snapshot offers a glimpse into their market share and growth potential, but to truly harness this information for your own strategic advantage, you need the full picture.

Dive deeper into Imperial Oil's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Imperial Oil's Strathcona Renewable Diesel Facility, slated for operation by mid-2025, is a prime example of a 'Star' in the BCG matrix. Its anticipated annual production of over one billion liters of renewable diesel directly addresses Canada's increasing need for lower-carbon fuel alternatives.

This strategic investment benefits from integration with existing refinery infrastructure, which is expected to optimize capital expenditure. Consequently, Imperial Oil is well-positioned to capture a significant share of the burgeoning Canadian low-carbon fuel market, solidifying its 'Star' status through strong growth potential and market leadership.

The Kearl Oil Sands Operation is a significant asset for Imperial Oil, consistently driving growth. Imperial is focused on enhancing bitumen recovery and optimizing the mine's progression, ensuring its long-term viability.

In 2024, Kearl reached a milestone with record full-year production. This achievement, coupled with maintaining low unit cash costs, highlights the operation's efficiency and its strong position within the oil sands market, reflecting a high market share.

The Grand Rapids Solvent-Assisted SAGD Project in Cold Lake is a prime example of Imperial Oil's Stars in the BCG Matrix. This initiative has significantly surpassed initial production forecasts since its commencement, showcasing its high-growth potential.

This project is not only boosting output but also actively reducing greenhouse gas emissions intensity, a crucial factor in sustainable resource development. Imperial Oil's investment in this innovative technology solidifies its leadership in the evolving oil sands sector.

Esso and Mobil Branded Retail Network

Imperial Oil's extensive network of Esso and Mobil branded retail stations across Canada is a significant asset, holding a substantial share of the fuel marketing sector. This established presence provides a stable revenue stream and a strong platform for customer engagement.

The company's approach to this segment emphasizes capital efficiency and strategic partnerships, aiming to grow market share without excessive investment. This strategy is particularly relevant in the mature Canadian fuel market, which, while stable, offers limited organic growth opportunities.

- Market Share: In 2024, Imperial Oil's retail fuel market share in Canada remained robust, benefiting from the strong brand recognition of Esso and Mobil.

- Capital Efficiency: The company continues to focus on optimizing its retail operations, with capital expenditures in the downstream segment aimed at enhancing existing sites and select new builds.

- Partnerships: Strategic alliances with convenience store operators and other retail partners are crucial for maximizing the profitability and reach of the fuel stations.

- Future Outlook: While the fuel market is mature, Imperial Oil's commitment to efficient operations and brand strength positions its retail network as a steady performer within its portfolio.

Enhanced Bitumen Recovery Technology (EBRT) Pilot

The Enhanced Bitumen Recovery Technology (EBRT) pilot project at Aspen is positioned as a 'Star' within Imperial Oil's BCG Matrix. This initiative holds significant promise for reducing greenhouse gas emissions intensity in oil sands extraction, a critical environmental consideration for the sector.

The technology is designed not only for environmental benefits but also to achieve reductions in both capital and operating expenses. This dual advantage makes it a strong candidate for future investment and expansion.

With a projected start-up in 2027, the EBRT pilot is expected to be a pivotal development for the sustainability and long-term economic feasibility of oil sands operations.

- Projected 2027 Start-up: Indicates a near-term operational impact.

- Dual Benefit: Aims to lower GHG emissions intensity and reduce costs.

- Strategic Importance: Positions oil sands for long-term viability and sustainability.

Imperial Oil's Strathcona Renewable Diesel Facility, set to begin operations by mid-2025, is a clear 'Star' due to its significant contribution to Canada's low-carbon fuel needs. This facility is projected to produce over one billion liters of renewable diesel annually, addressing a key market demand.

The Kearl Oil Sands Operation is another 'Star,' demonstrating strong growth and efficiency. In 2024, Kearl achieved record full-year production while maintaining low unit cash costs, underscoring its high market share and operational excellence.

The Grand Rapids Solvent-Assisted SAGD Project is also a 'Star,' exceeding initial production forecasts and actively reducing greenhouse gas emissions intensity. This project highlights Imperial Oil's leadership in innovative and sustainable oil sands development.

The Enhanced Bitumen Recovery Technology (EBRT) pilot at Aspen, with a projected 2027 start-up, is positioned as a 'Star.' It aims to lower GHG emissions intensity and reduce costs, crucial for the long-term viability of oil sands operations.

| Asset | BCG Category | Key Growth Driver | 2024 Performance Highlight |

|---|---|---|---|

| Strathcona Renewable Diesel | Star | Canada's demand for low-carbon fuels | Slated for mid-2025 operation, over 1 billion liters/year projected |

| Kearl Oil Sands | Star | Bitumen recovery and cost efficiency | Record full-year production, low unit cash costs |

| Grand Rapids SAGD | Star | Exceeding production forecasts, GHG reduction | Significant output boost and emissions intensity reduction |

| Aspen EBRT Pilot | Star | GHG reduction and cost savings | Projected 2027 start-up, dual environmental and economic benefits |

What is included in the product

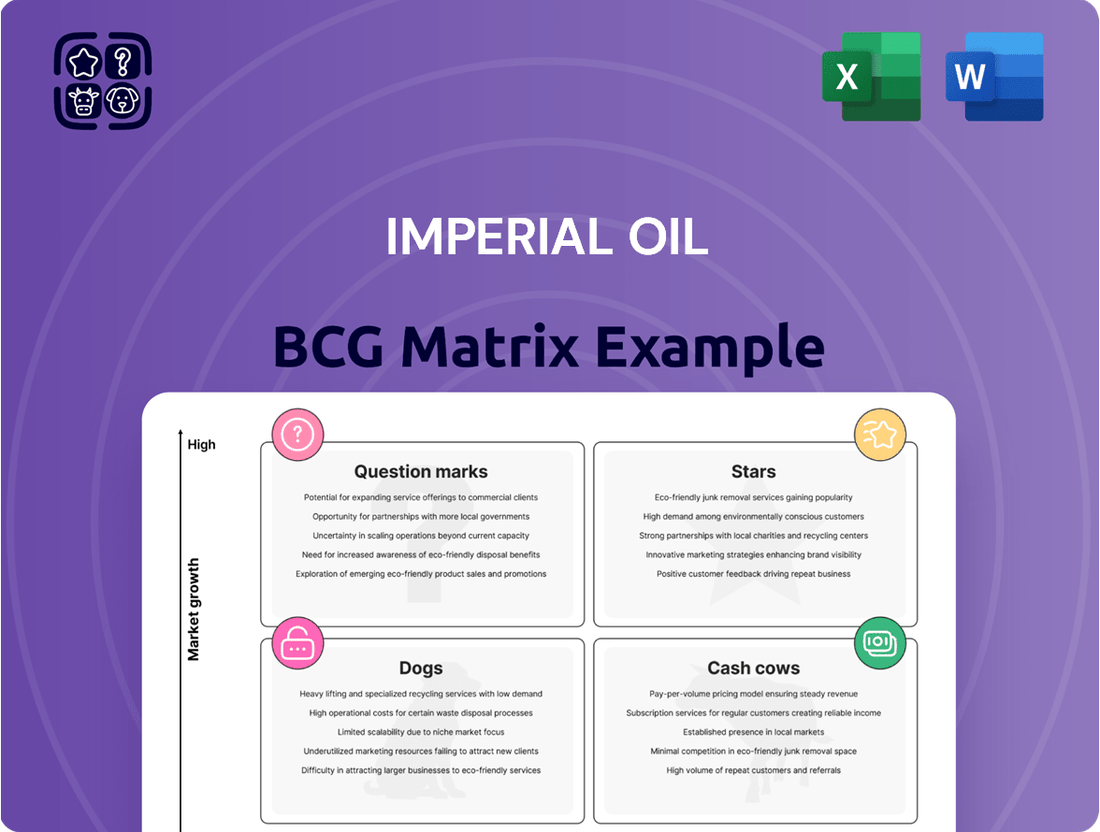

Imperial Oil's BCG Matrix analyzes its business units, guiding investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear, one-page Imperial Oil BCG Matrix provides a visual roadmap, alleviating the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

Imperial Oil's Cold Lake oil sands operation, when viewed as a mature production asset excluding new growth initiatives, clearly fits the description of a Cash Cow within the BCG matrix. Its established, long-life reserves and relatively low production decline rate mean it reliably churns out substantial cash flow for the company.

The strategic emphasis for Cold Lake is on optimizing existing operations to extract maximum value, rather than pursuing significant expansion. This involves a strong focus on operational efficiency and cost management to maintain its strong cash-generating capabilities.

In 2024, Imperial Oil reported that its Cold Lake operations contributed significantly to its overall production volumes. For instance, through the first nine months of 2024, Imperial Oil's upstream segment, which includes Cold Lake, averaged production of approximately 413,000 barrels of oil equivalent per day.

Imperial Oil's downstream refining operations are a clear Cash Cow. In 2024, these segments demonstrated impressive performance, with high capacity utilization and strong refining margins contributing significantly to the company's bottom line. This consistent generation of net income is a hallmark of a successful Cash Cow.

The company's strategic advantage lies in its ability to effectively manage refining margins, even amidst market volatility. Coupled with a robust coast-to-coast logistics network, this operational efficiency ensures a stable and predictable cash flow, reinforcing the Cash Cow status of its downstream segment.

Imperial Oil's petrochemical production stands as a cornerstone of its operations, consistently generating stable revenue. This segment is deeply integrated with the company's refining and upstream activities, creating a robust business model.

Despite a dip in net income for the chemical segment in Q1 2025, its long-standing market presence and strategic integration with other business units solidify its classification as a Cash Cow. This indicates a mature business with strong cash-generating capabilities.

Conventional Crude Oil and Natural Gas Production

Imperial Oil's conventional crude oil and natural gas production, while perhaps not experiencing the explosive growth of its oil sands ventures, serves as a vital cash cow. These mature assets consistently generate reliable production volumes and a predictable stream of cash flow, underpinning the company's financial stability.

This segment of Imperial Oil's operations is characterized by its established infrastructure and long-standing production history. Although the growth potential might be more subdued, the dependable output ensures a steady contribution to the company's bottom line, acting as a financial bedrock.

- Steady Cash Flow: Conventional assets provide consistent revenue, supporting dividends and reinvestment.

- Mature Production Base: These fields have established production profiles, offering a predictable output.

- Financial Resilience: The reliable cash generation from these assets enhances Imperial Oil's overall financial strength.

- Contribution to Portfolio: They balance higher-growth, higher-risk segments with stability.

Existing Logistics and Distribution Network

Imperial Oil's extensive logistics and distribution network, encompassing pipelines, terminals, and transportation assets across Canada, functions as a significant Cash Cow within its business portfolio. This established infrastructure provides a crucial competitive edge by ensuring the efficient movement of products to key markets, thereby maximizing refinery flexibility and driving consistent revenue streams.

In 2023, Imperial Oil reported significant capital expenditures dedicated to maintaining and enhancing its logistics and supply chain operations. For instance, the company continued investments in its extensive pipeline network, which is vital for transporting crude oil and refined products. This robust network facilitates access to high-demand regions, contributing directly to the stability and profitability of the business.

- Extensive Network: Operates a vast system of pipelines, terminals, and distribution centers across Canada.

- Revenue Generation: Efficiently moves products, maximizing refinery output and ensuring consistent cash flow.

- Competitive Advantage: Enables cost-effective delivery to high-value markets, strengthening market position.

- Refinery Flexibility: Supports optimal refinery operations by ensuring reliable supply and product offtake.

Imperial Oil's refining segment consistently delivers strong financial results, making it a prime example of a Cash Cow. In the first half of 2024, Imperial Oil's downstream segment reported an operating income of $2.1 billion, showcasing its robust cash-generating capability.

This segment benefits from high utilization rates and favorable refining margins, which have been a consistent feature of its performance. For example, during the second quarter of 2024, refining throughput averaged 390,000 barrels per day, demonstrating operational strength.

The company's strategic focus on operational efficiency and its integrated logistics network further solidify this segment's Cash Cow status. This ensures a steady and predictable contribution to Imperial Oil's overall profitability.

| Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Refining | Cash Cow | High utilization, strong margins, stable cash flow | Operating Income: $2.1 billion (H1 2024) |

| Cold Lake Oil Sands | Cash Cow | Mature, long-life reserves, low decline rate | Upstream Production Avg: 413,000 boe/d (first 9 months 2024) |

| Petrochemicals | Cash Cow | Stable revenue, strategic integration | Consistent market presence |

Full Transparency, Always

Imperial Oil BCG Matrix

The Imperial Oil BCG Matrix preview you are viewing is the exact, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no demo content—just the comprehensive strategic analysis ready for immediate application. You can confidently assess the quality and detail, knowing the final product will be identical and professionally formatted for your business planning needs. This preview ensures transparency and guarantees you're investing in a polished, actionable report.

Dogs

Imperial Oil's older, less efficient conventional crude oil and natural gas assets, especially those with dwindling output and escalating operating expenses, can be categorized as Dogs within the BCG Matrix. These assets often struggle to achieve profitability, potentially breaking even or even draining cash reserves, which makes them prime candidates for divestment or a significant reduction in capital allocation. For instance, in 2024, while Imperial Oil reported robust overall financial performance, specific legacy conventional fields might be showing signs of economic strain due to lower production volumes and the associated higher per-barrel operating costs compared to newer, more efficient operations.

Imperial Oil's non-core or underperforming exploration ventures are those projects that haven't delivered substantial discoveries or proven to be economically sound. These ventures, often in regions with limited growth prospects, represent a low market share and drain resources without generating significant profits. For example, in 2023, Imperial Oil reported exploration expenses of $428 million, a portion of which would be allocated to these less successful endeavors.

Outdated or high-cost production technologies represent a significant challenge, potentially categorizing them as Dogs in the BCG matrix. These are methods that have become uncompetitive due to escalating operational expenses, a larger environmental footprint, or less efficient resource recovery when contrasted with more modern techniques. While Imperial Oil is known for its commitment to innovation, the possibility of legacy technologies persisting in certain areas cannot be entirely dismissed.

Segments with Persistent Negative Margins or Low Demand

Imperial Oil might classify certain underperforming product lines or regional markets as Dogs within its BCG Matrix. These are areas that consistently struggle with profitability or face declining demand, with little indication of future improvement. For instance, a specific niche petrochemical product that has seen its market shrink due to technological obsolescence or shifting consumer preferences could fall into this category.

Identifying these segments is crucial for effective resource allocation. In 2023, Imperial Oil reported that its Chemical segment, while contributing to overall revenue, faced margin pressures due to global supply dynamics. While not explicitly a Dog, segments within this or other business units that exhibit sustained negative performance metrics, such as consistently negative operating margins or declining sales volumes year-over-year, would warrant closer examination for potential divestment or restructuring.

- Underperforming Specialty Chemicals: Certain niche chemical products facing intense competition or reduced industrial demand.

- Declining Regional Fuel Markets: Specific geographic areas where Imperial Oil's fuel sales volumes have seen a persistent, significant drop.

- Legacy Product Lines: Older product offerings that have been superseded by newer, more efficient alternatives and lack a viable market.

Assets Requiring Significant Decommissioning Costs with Limited Future Value

Assets nearing the end of their operational life that require substantial decommissioning and reclamation costs with little to no future revenue potential could be viewed as Dogs in the BCG Matrix. Imperial Oil, like all energy companies, faces these long-term liabilities.

These assets, often older wells or facilities, represent a drain on resources. The costs associated with safely shutting down, removing, and restoring the environment can be significant, especially when there's no ongoing income stream to offset them. For instance, in 2024, the energy sector continues to grapple with the financial implications of aging infrastructure, with estimates for decommissioning costs varying widely based on asset type and location.

- Aging Infrastructure: Assets reaching end-of-life, demanding extensive decommissioning expenses.

- Limited Revenue: Little to no future income generation from these assets.

- Financial Liability: Significant costs for safe shutdown and environmental reclamation.

- Strategic Challenge: Balancing these liabilities with ongoing operational needs.

Imperial Oil's "Dogs" represent business segments or assets with low market share and low growth prospects. These are typically older, less efficient operations or product lines that struggle to generate significant profits, often requiring more capital than they return. Identifying and managing these "Dogs" is crucial for optimizing resource allocation and focusing investment on more promising areas.

In 2024, Imperial Oil's focus on efficiency and modernization means that truly underperforming legacy assets, such as certain older conventional oil fields with high operating costs, would likely fall into this category. These assets may have limited potential for growth and could be candidates for divestment or reduced capital expenditure.

For example, while Imperial Oil reported strong overall performance in 2023, with total revenues of $40.7 billion, specific segments experiencing declining demand or facing intense competition without a clear path to market share growth would be classified as Dogs. These could include niche chemical products or specific regional fuel markets where sales volumes are consistently decreasing.

| Potential "Dog" Segments | Characteristics | 2023 Data Insight (Illustrative) |

|---|---|---|

| Legacy Conventional Oil & Gas Assets | Low production, high operating costs, limited growth potential. | While overall upstream production was robust, specific older fields may show declining profitability metrics. |

| Underperforming Niche Chemicals | Facing intense competition, declining industrial demand, or technological obsolescence. | The Chemical segment reported margin pressures; specific niche products within this could be Dogs. |

| Declining Regional Fuel Markets | Persistent, significant drop in fuel sales volumes in specific geographic areas. | Overall fuel sales performance is key, but localized market shrinkage would flag potential Dogs. |

Question Marks

The Leming redevelopment project at Cold Lake, employing steam-assisted gravity drainage, is slated for a late 2025 startup, with significant production contributions expected in 2026 and onward. This project, targeting a peak output of approximately 9,000 barrels per day, currently falls into the Question Mark category of the BCG Matrix. Its future market share and profitability are still in the formative stages, requiring careful observation and strategic decision-making as it ramps up operations.

Imperial Oil's participation in carbon capture and storage (CCS) ventures, particularly through the Pathways Alliance and its application in producing low-carbon hydrogen, positions these initiatives as potential stars within its business portfolio. These areas are characterized by substantial growth prospects, driven by global decarbonization efforts, though their long-term market dominance and financial returns remain subject to considerable uncertainty and necessitate significant capital outlay.

Imperial Oil is actively pursuing digital transformation, focusing on machine learning and AI to enhance operational efficiency. These initiatives are crucial for optimizing exploration and production processes, aiming to reduce downtime and improve resource extraction. For example, in 2024, the company continued to invest in advanced analytics for reservoir management, expecting to see gradual improvements in production yields.

Development of Low-Carbon Hydrogen Value Chain

Imperial Oil's development of a low-carbon hydrogen value chain, particularly in conjunction with its Strathcona renewable diesel facility, fits squarely into the Question Mark category of the BCG Matrix. This sector is characterized by significant growth potential as the world transitions to cleaner energy sources. For instance, Canada's hydrogen strategy aims for 30% of its hydrogen produced to be low-carbon by 2030, indicating a robust market expansion.

While the market itself is expanding rapidly, Imperial Oil's position within this emerging value chain is still being defined. The company's market share in low-carbon hydrogen production and its associated profitability are not yet solidified, reflecting the inherent uncertainties of a nascent industry.

- High Growth Potential: The global hydrogen market is projected to reach $183 billion by 2025, with low-carbon hydrogen being a key driver.

- Uncertain Market Share: Imperial Oil's specific share of this growing low-carbon hydrogen market is still developing.

- Nascent Profitability: The financial returns and long-term profitability of low-carbon hydrogen ventures are yet to be fully proven.

- Strategic Importance: This initiative aligns with broader energy transition goals, making it strategically vital despite current uncertainties.

Exploration of New Energy Transition Opportunities

Imperial Oil is actively exploring new energy transition opportunities beyond its established renewable diesel and carbon capture and storage (CCS) projects. These ventures target high-growth, yet speculative, markets. For instance, in 2024, Imperial Oil reported continued investment in its Strathcona Renewable Diesel facility, which is expected to produce 1.1 billion liters annually, demonstrating a tangible step in low-carbon solutions.

The company's broader assessment includes investigating emerging technologies and business models within the energy transition. While these initiatives hold significant potential, their commercial viability and impact on market share remain uncertain, necessitating considerable capital outlay and ongoing research and development.

- Diversification into new low-carbon ventures.

- Focus on high-growth, evolving market segments.

- Requirement for substantial investment and risk assessment.

- Uncertainty regarding commercial viability and market share impact.

Imperial Oil's low-carbon hydrogen initiatives, including its involvement with the Strathcona renewable diesel facility, are classified as Question Marks. These ventures are in a high-growth market, with Canada aiming for 30% low-carbon hydrogen production by 2030. However, Imperial Oil's specific market share and profitability in this developing sector are still uncertain, requiring significant investment and strategic positioning.

| Initiative | BCG Category | Growth Potential | Market Share | Profitability | Key Data Point |

|---|---|---|---|---|---|

| Low-Carbon Hydrogen | Question Mark | High | Uncertain | Nascent | Canada's 2030 low-carbon hydrogen target |

| Leming Redevelopment | Question Mark | Moderate (project specific) | Developing | Uncertain | Targeting 9,000 bpd peak production |

BCG Matrix Data Sources

Our Imperial Oil BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research, and industry growth forecasts for strategic clarity.