Immunocore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Immunocore Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Immunocore's trajectory. Our comprehensive PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and refine your strategic approach. Download the full version to gain a decisive advantage.

Political factors

Government healthcare spending and reimbursement policies are critical for Immunocore, especially concerning its innovative ImmTAC therapies. These policies directly shape market access and revenue potential for high-cost treatments.

For instance, the Inflation Reduction Act in the US, enacted in 2022, introduced drug pricing negotiation provisions that could impact the profitability of oncology drugs. This regulatory environment affects investment decisions and the financial outlook for companies like Immunocore.

Immunocore's lead product, KIMMTRAK, used for uveal melanoma, faces varying reimbursement landscapes globally. These differences in policy significantly influence its worldwide accessibility and overall commercial success, with pricing and reimbursement decisions being key determinants.

The stringency and efficiency of regulatory bodies like the FDA and EMA are paramount for Immunocore's pipeline progression. Changes in regulatory leadership or policy, such as those observed with the FDA in 2024-2025, can create substantial uncertainty, alter drug review timelines, and influence investor sentiment within the biotech industry.

Immunocore's ImmTAC candidates, targeting oncology, infectious diseases, and autoimmune conditions, depend on predictable and transparent regulatory pathways to advance from clinical trials to market approval. For instance, the FDA's Prescription Drug User Fee Act (PDUFA) target action dates are critical milestones that directly impact development timelines and financial projections.

Global political stability and international trade relations are crucial for Immunocore, influencing its supply chain, manufacturing, and market expansion. For instance, the BIOSECURE Act, proposed in 2024, highlights the potential impact of protectionist policies on the biopharma sector by aiming to restrict collaborations with specific Chinese biotech companies, which could disrupt supply chains and market access for companies like Immunocore.

Trade disputes or shifts in geopolitical alliances can directly affect Immunocore's ability to source essential materials and distribute its innovative therapies, such as KIMMTRAK. The company's global commercialization strategy and pipeline development are intrinsically linked to the predictability and stability of international trade frameworks, making geopolitical shifts a significant consideration for its long-term growth and operational efficiency.

Healthcare Reform Initiatives

Broader healthcare reform initiatives, such as those seen in the United States and Europe in 2024 and projected into 2025, significantly impact biopharmaceutical companies like Immunocore. Reforms aiming to expand patient access and control healthcare spending present a dual-edged sword. For instance, the Inflation Reduction Act in the US, with its provisions for Medicare drug price negotiation, could exert downward pressure on pricing for certain high-cost therapies, a factor Immunocore must monitor closely for its products like KIMMTRAK.

Conversely, policy shifts towards value-based care models and a focus on addressing significant unmet medical needs can create substantial opportunities for innovative treatments. Many governments are prioritizing rare diseases and oncology, areas where Immunocore has a strong presence. For example, the European Medicines Agency's (EMA) ongoing review of market access pathways in 2024 and 2025 continues to emphasize the clinical utility and cost-effectiveness of novel therapies, potentially benefiting Immunocore's pipeline if clinical data demonstrates clear advantages.

Immunocore's strategic alignment with these evolving healthcare priorities is crucial for sustained growth. This involves not only demonstrating the clinical efficacy of its therapies but also actively engaging with policymakers to shape reimbursement landscapes. The company's success in navigating these reforms will hinge on its ability to articulate the long-term value proposition of its treatments, considering factors such as patient outcomes, reduced hospitalizations, and overall healthcare system savings, which are key considerations in value-based assessments throughout 2024-2025.

- Healthcare Spending Trends: Global healthcare spending was projected to reach over $11 trillion in 2024, with continued growth anticipated into 2025, driven partly by demand for innovative medicines.

- Value-Based Reimbursement: A growing number of countries are implementing or expanding value-based reimbursement schemes, with over 30% of new drug approvals in major European markets in 2024 being subject to some form of outcomes-based agreement.

- Oncology Market Focus: The oncology market, a key area for Immunocore, is expected to continue its strong growth trajectory, with advancements in immunotherapy and personalized medicine being major drivers, projected to reach over $300 billion by 2025.

Intellectual Property Protection Policies

Government policies on intellectual property (IP) protection, particularly patent laws and data exclusivity, are absolutely crucial for Immunocore's operations. These frameworks are the bedrock upon which the company builds its innovative ImmTAC platform and develops its pipeline of therapeutic assets. A strong IP environment directly encourages the significant investment required for biopharmaceutical research and development.

The strength and scope of patent protection directly influence Immunocore's ability to maintain its competitive edge and ensure the long-term success of its novel therapies. For instance, the company's reliance on its proprietary ImmTAC technology means that any weakening of patent rights could significantly diminish its market exclusivity.

Potential shifts in IP legislation, especially concerning biologics, biosimilars, or the emerging area of AI-generated inventions, present a key area of consideration. Such changes could affect the enforceability of existing patents or the ability to secure new ones, thereby impacting Immunocore's future revenue streams and market position.

- Global IP Landscape: As of early 2024, the global average patent term for pharmaceuticals remains 20 years from filing, but effective market exclusivity can be shorter due to regulatory review periods.

- Data Exclusivity: In the US, biologics typically receive 12 years of data exclusivity, a critical period for recouping R&D costs for companies like Immunocore.

- Biosimilar Competition: The increasing prevalence of biosimilar approvals, particularly in Europe, highlights the importance of robust patent strategies to defend market share.

- AI and IP: Discussions are ongoing globally regarding the patentability of AI-generated inventions, a factor that could influence future drug discovery and development IP.

Government policies on drug pricing and reimbursement significantly impact Immunocore's revenue potential, especially for its high-cost ImmTAC therapies. The Inflation Reduction Act in the US, for instance, introduced drug price negotiation provisions that could affect oncology drug profitability, a key market for Immunocore.

Regulatory approval pathways, such as those managed by the FDA and EMA, are critical for Immunocore's pipeline progression. Changes in regulatory leadership or policy during 2024-2025 can alter drug review timelines and influence investor sentiment in the biotech sector.

Geopolitical stability and international trade relations affect Immunocore's supply chain and market access. Protectionist policies, like the proposed BIOSECURE Act in 2024, could disrupt collaborations and market entry for biopharmaceutical companies.

| Factor | 2024-2025 Outlook | Impact on Immunocore |

| Healthcare Spending | Projected to exceed $11 trillion globally in 2024, with continued growth into 2025. | Drives demand for innovative medicines, potentially benefiting Immunocore's therapies. |

| Value-Based Reimbursement | Over 30% of new drug approvals in major European markets in 2024 subject to outcomes-based agreements. | Requires Immunocore to demonstrate clear clinical utility and cost-effectiveness for market access. |

| Regulatory Policy Changes | Ongoing shifts in FDA/EMA review processes and potential new legislation. | Can affect drug approval timelines, market access, and R&D investment decisions. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Immunocore, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying critical threats and opportunities within Immunocore's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Immunocore's strategy.

Economic factors

Global economic growth significantly impacts healthcare spending, which in turn affects Immunocore's market. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023. This generally translates to more robust healthcare budgets, potentially increasing patient access to specialized therapies like KIMMTRAK.

However, economic uncertainties can temper this. If global economic growth falters, leading to recessions, healthcare systems might face budget constraints. This could mean slower adoption rates for high-cost treatments or increased pressure on pricing, directly influencing Immunocore's revenue streams and market penetration strategies.

Immunocore's financial performance is significantly tied to the drug pricing and reimbursement environment. The company's innovative immunotherapies, like KIMMTRAK, carry substantial development costs, making favorable reimbursement crucial for market access and profitability. For instance, the Centers for Medicare & Medicaid Services (CMS) announced a 3.2% increase in the Medicare Physician Fee Schedule for 2024, impacting reimbursement rates for many treatments, though specific impacts on advanced therapies are still being assessed.

Government policies, such as the Inflation Reduction Act (IRA) of 2022, introduce new dynamics. The IRA allows Medicare to negotiate prices for certain high-cost drugs, potentially affecting future revenue streams for companies like Immunocore. While KIMMTRAK is not yet subject to these negotiations, upcoming drug launches will need to navigate this evolving landscape, where price ceilings could influence commercial strategies and profitability projections.

The biotechnology sector saw significant venture capital funding in 2023, reaching approximately $30 billion globally, a slight decrease from 2022 but still indicating a strong appetite for innovation. This capital availability is vital for Immunocore's substantial R&D investments, particularly for progressing its ImmTAC candidates through the rigorous and expensive clinical trial phases across oncology, infectious diseases, and autoimmune conditions.

As of early 2025, the investment landscape remains dynamic. While public markets have shown signs of recovery, the cost of capital for early-stage biotechnology companies can still be a hurdle. For Immunocore, a sustained flow of investment is essential to fuel the development of its next-generation therapies, with specific funding rounds in late 2024 and early 2025 being critical for advancing its most promising candidates.

Competition and Market Dynamics

The competitive landscape for Immunocore, particularly in the T cell receptor (TCR) bispecific immunotherapy market and the broader oncology and rare disease segments, directly influences its market share and pricing power. The oncology immunotherapy market is highly dynamic, with numerous companies vying for patient populations. For instance, by early 2024, the global cancer immunotherapy market was valued at approximately $130 billion and is projected to grow significantly, underscoring the intense competition Immunocore faces.

New therapeutic entrants for indications like uveal melanoma, where Immunocore's Kimmtrak is approved, or the potential development of biosimilars for existing treatments, can further intensify this competition. This necessitates continuous innovation. Immunocore's strategy relies on differentiating its ImmTAC molecules through unique mechanisms of action and clinical data to maintain its competitive edge and secure favorable reimbursement.

- Market Share Pressure: Intense competition from established and emerging biotech firms in oncology and rare diseases can dilute Immunocore's market share for its approved therapies.

- Pricing Power Constraints: The presence of multiple treatment options, including potential biosimilars or alternative modalities, can limit Immunocore's ability to command premium pricing for its ImmTAC therapies.

- Innovation Imperative: To sustain its competitive advantage, Immunocore must demonstrate the superiority of its ImmTAC platform through ongoing clinical trials and the development of next-generation molecules.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant consideration for Immunocore, given its international commercial activities, notably with KIMMTRAK sales across the US, Europe, and other global markets. A strengthening US dollar, for instance, can diminish the reported value of revenue generated in foreign currencies when translated back into the company's primary reporting currency. This dynamic directly affects the company's top-line results and overall profitability.

For example, if Immunocore reports in USD and a substantial portion of its sales occur in Euros, a stronger dollar means fewer dollars are received for the same Euro amount. This can create a drag on reported revenue growth. Conversely, a weaker dollar could boost reported international sales values. Effective management of these currency exposures is therefore crucial for maintaining financial stability and predictable earnings.

In 2024, the US Dollar Index (DXY) has shown volatility, reflecting global economic shifts and monetary policy divergence. While specific 2025 data is still emerging, historical trends suggest that significant swings in major currency pairs like EUR/USD and GBP/USD can materially impact companies with broad international sales footprints like Immunocore. For instance, a 5% appreciation of the USD against the Euro could translate to a notable reduction in reported European sales revenue.

- Global Sales Impact: Immunocore's international sales, particularly in regions like Europe, are directly exposed to currency translation risks.

- USD Strength Effect: A stronger US dollar can reduce the reported value of non-USD revenues, impacting financial statements.

- Financial Stability: Proactive currency risk management is essential for Immunocore's financial health and predictable performance.

- Market Volatility: Ongoing fluctuations in major currency pairs, such as EUR/USD, necessitate continuous monitoring and hedging strategies.

Global economic growth influences healthcare spending, directly impacting Immunocore's market access and revenue potential. The IMF's 2024 global growth projection of 3.2% suggests a supportive environment for healthcare budgets, potentially aiding patient access to therapies like KIMMTRAK. However, economic downturns could lead to budget constraints, affecting adoption rates and pricing for advanced treatments.

The biotechnology sector's investment climate is crucial for Immunocore's R&D. While venture capital funding in 2023 was around $30 billion globally, early 2025 indicates a dynamic landscape where capital cost remains a factor for early-stage companies. Sustained investment is vital for Immunocore to advance its ImmTAC candidates through costly clinical trials.

Currency exchange rates significantly affect Immunocore's international revenue. A strengthening US dollar, for example, can reduce the reported value of sales made in other currencies, impacting overall financial performance. The volatility of the DXY in 2024 highlights the need for robust currency risk management strategies.

Preview Before You Purchase

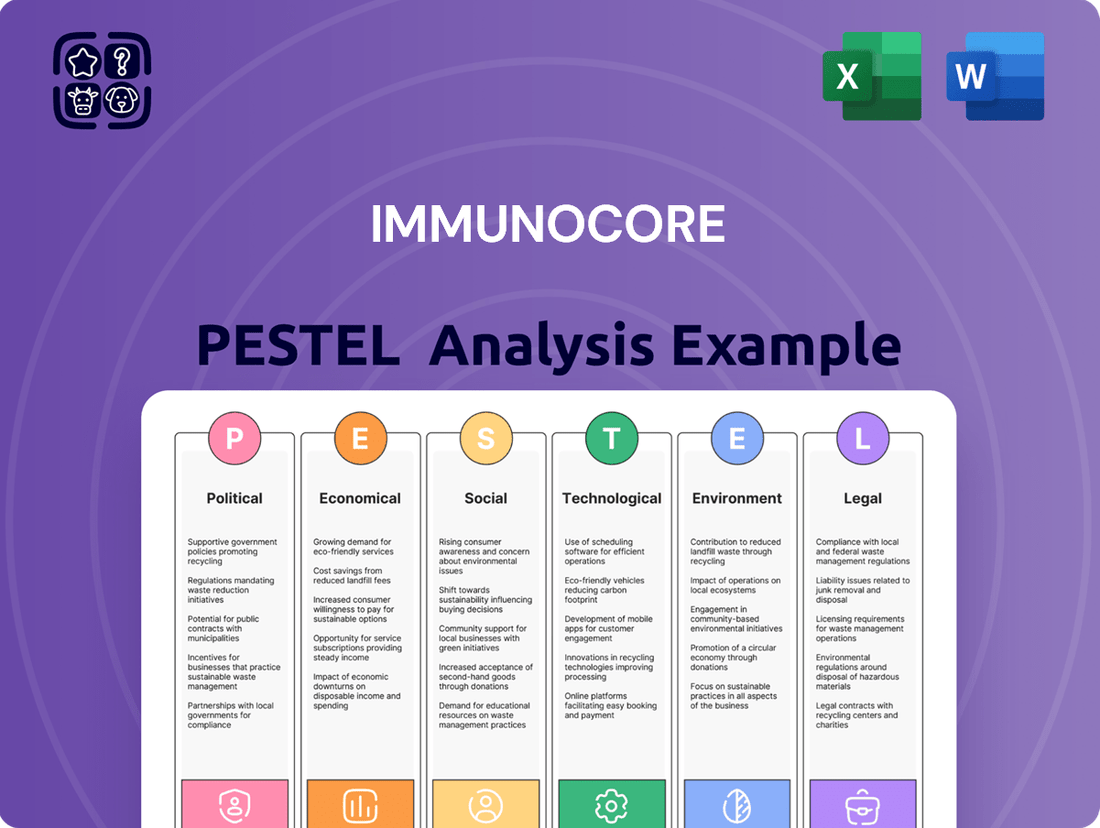

Immunocore PESTLE Analysis

The preview shown here is the exact Immunocore PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Immunocore.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

Patient awareness and acceptance of novel therapies, particularly T cell receptor bispecific immunotherapies like ImmTAC molecules, are paramount for driving patient uptake. Educational initiatives highlighting uveal melanoma and the advantages of targeted treatments directly influence patient demand.

Conversely, potential patient hesitancy stemming from concerns over side effects, treatment complexity, or a general lack of understanding can significantly impede adoption. To counter this, robust patient engagement and comprehensive support programs are essential for fostering trust and facilitating acceptance of these advanced therapeutic approaches.

The prevalence and incidence of diseases Immunocore targets are crucial for its market potential. For instance, uveal melanoma, a primary focus, has an incidence rate of approximately 5-10 cases per million people annually in Western countries. An uptick in these rates or better diagnostics means a larger patient pool for their therapies.

Similarly, the market for treatments targeting other solid tumors is vast, with many cancers showing increasing incidence globally. Improved early detection methods for these conditions directly translate to a wider addressable market for Immunocore's innovative approaches.

For infectious diseases like HIV and hepatitis B, the global burden remains significant, with millions living with these conditions. Any rise in incidence or improved identification of infected individuals expands the potential patient base for Immunocore's therapeutic candidates in these areas.

Societal attitudes towards healthcare access significantly influence the market for advanced therapies like those developed by Immunocore. In 2024, persistent socioeconomic disparities mean that access to cutting-edge treatments often correlates with income and insurance status, potentially limiting the patient pool for Immunocore's therapies.

Geographic limitations also play a crucial role; for instance, in the United States, rural populations often face greater challenges in accessing specialized medical centers where complex treatments are administered. This uneven distribution of healthcare resources can affect patient identification and treatment initiation for Immunocore's products.

Furthermore, a growing societal emphasis on health equity and inclusive healthcare is driving policy changes. By 2025, we anticipate increased regulatory and public pressure on biotechnology firms to ensure their innovative treatments are accessible to diverse patient populations, including those historically underserved in clinical trials and treatment pathways.

Patient Advocacy and Support Groups

Patient advocacy groups play a crucial role in influencing public perception and driving research funding for rare diseases. Their efforts directly impact the environment in which companies like Immunocore operate, potentially accelerating the adoption of new therapies.

For instance, strong advocacy for uveal melanoma, the focus of Immunocore's Kimmtrak, can lead to increased awareness and demand. This heightened awareness can translate into more favorable reimbursement discussions with payers and a larger pool of eligible patients for ongoing and future clinical trials. In 2024, patient advocacy organizations continued to be instrumental in raising awareness for rare cancers, with many reporting increased engagement and successful fundraising campaigns for research initiatives.

- Patient advocacy groups are vital in shaping public discourse around rare diseases.

- Support for therapies like Kimmtrak can influence reimbursement decisions.

- Advocacy efforts can significantly boost clinical trial recruitment numbers.

- In 2024, patient advocacy saw a notable rise in digital engagement and grassroots organizing.

Ethical Considerations in Biotechnology

Societal attitudes towards advanced biotechnologies like gene editing and novel immunotherapies are evolving, impacting public perception and regulatory oversight. For Immunocore, whose ImmTAC molecules harness the immune system, ethical debates around long-term safety and fair access are crucial. For instance, public trust in gene therapy, a related field, saw a notable shift following advancements in CRISPR technology, with surveys in late 2023 indicating a growing, albeit cautious, optimism for therapeutic applications, balanced by concerns about unintended consequences.

These considerations directly influence the regulatory pathways and market acceptance of Immunocore's innovative treatments. As of early 2024, discussions around equitable distribution of advanced therapies, particularly in the context of high treatment costs, are intensifying. Companies like Immunocore must proactively address these ethical dimensions through transparent communication and robust adherence to evolving ethical frameworks to maintain public confidence and navigate potential regulatory hurdles.

Key ethical considerations for Immunocore include:

- Long-term patient outcomes and safety monitoring for novel immunotherapies.

- Ensuring equitable access to potentially life-saving treatments, addressing affordability and availability.

- Transparency in clinical trial data and communication regarding treatment risks and benefits.

- Navigating public perception and potential concerns related to immune system manipulation.

Societal attitudes towards advanced biotechnologies, including novel immunotherapies like Immunocore's ImmTAC molecules, are a significant factor. Public perception, shaped by media and scientific discourse, influences regulatory approval and patient acceptance. For instance, public trust in gene therapy, a related field, saw a notable shift following advancements in CRISPR technology, with surveys in late 2023 indicating growing, albeit cautious, optimism for therapeutic applications, balanced by concerns about unintended consequences.

Ethical considerations surrounding long-term safety, equitable access, and the manipulation of the immune system are paramount. As of early 2024, discussions around the affordability and distribution of advanced therapies are intensifying, requiring companies like Immunocore to engage in transparent communication and adhere to evolving ethical frameworks to maintain public confidence and navigate potential regulatory hurdles.

Patient advocacy groups play a vital role in shaping public discourse and driving research funding for rare diseases, directly impacting the environment for companies like Immunocore. In 2024, patient advocacy saw a notable rise in digital engagement and grassroots organizing, with organizations instrumental in raising awareness for rare cancers and supporting research initiatives.

The prevalence and incidence of diseases Immunocore targets, such as uveal melanoma (approx. 5-10 cases per million annually in Western countries), directly influence its market potential. Improved early detection and a growing societal emphasis on health equity are expanding the addressable market, though socioeconomic disparities and geographic limitations in healthcare access remain challenges that need to be addressed by 2025.

Technological factors

Continued advancements in T cell receptor (TCR) engineering are fundamental to Immunocore's competitive edge. The company's ImmTAC (Immune mobilising Monoclonal T cell Receptor against p53) technology relies on sophisticated TCR design to target intracellular cancer antigens. This technological foundation directly influences the potency, specificity, and safety profile of their drug candidates.

Innovations in designing more potent, specific, and safer ImmTAC molecules are crucial for the effectiveness and expansion of Immunocore's pipeline. For instance, by refining TCR binding affinity and half-life, they can enhance anti-tumor activity while minimizing off-target effects. This focus on engineering precision is key to overcoming challenges in delivering targeted therapies.

Research and development in TCR engineering are vital for broadening the application of Immunocore's platform beyond its current indications. As of early 2024, the company continues to invest heavily in exploring new TCR targets and optimizing delivery mechanisms. This ongoing innovation is essential for unlocking the full potential of their technology in diverse cancer types.

The development of diagnostic technologies is crucial for Immunocore's KIMMTRAK, which targets the HLA-A*02:01 biomarker. By 2024, the precision diagnostics market is projected to reach over $70 billion globally, highlighting the increasing importance of accurate patient identification for targeted therapies.

Advancements in companion diagnostics, often integrated with treatment regimens, directly enhance the effectiveness and patient selection for therapies like KIMMTRAK. This synergy supports a personalized medicine approach, ensuring that patients most likely to benefit receive the treatment, thereby optimizing outcomes and resource allocation.

Technological advancements in biopharmaceutical manufacturing are crucial for Immunocore to efficiently scale production of its ImmTAC molecules. Innovations like continuous manufacturing offer the potential to streamline processes, leading to reduced costs and improved product consistency. For instance, the biopharmaceutical industry saw significant investment in advanced manufacturing technologies throughout 2024, with a focus on improving yield and reducing batch variability, directly benefiting companies like Immunocore.

Furthermore, advancements in bioprocessing, such as novel cell culture techniques and downstream purification methods, are key to enhancing the quality and safety of complex biologics. These improvements can lead to higher purity and potency of ImmTACs. By 2025, we anticipate further integration of automation and artificial intelligence in bioprocessing, aiming to optimize workflows and minimize human error, thereby supporting Immunocore's commitment to high-quality therapeutics.

Artificial Intelligence and Data Analytics in Drug Discovery

The increasing integration of artificial intelligence (AI) and advanced data analytics into drug discovery and development processes presents substantial opportunities for Immunocore. AI can significantly accelerate target identification, optimize molecule design, and enhance clinical trial efficiency, potentially reducing R&D timelines and costs for new ImmTAC candidates.

For instance, in 2024, companies are increasingly leveraging AI platforms to analyze vast biological datasets, leading to faster identification of novel therapeutic targets. This technological shift can directly benefit Immunocore's pipeline by streamlining the preclinical stages of its ImmTAC development.

- AI-driven target identification: Expedites the discovery of novel disease targets.

- Optimized molecule design: Enhances the efficacy and safety profiles of ImmTAC candidates.

- Clinical trial acceleration: Improves patient stratification and data analysis for faster trial completion.

- Reduced R&D costs: Streamlines processes, leading to more efficient resource allocation.

Gene Editing and Synthetic Biology Applications

Advancements in gene editing technologies like CRISPR-Cas9 are revolutionizing therapeutic development, potentially leading to more precise and effective cellular therapies. These breakthroughs could impact Immunocore by opening doors for next-generation TCR therapies with enhanced specificity and durability. The synthetic biology sector, meanwhile, is creating novel drug delivery mechanisms and bio-manufacturing processes that might offer future platform integration opportunities.

The broad technological trend of increasing sophistication in cellular engineering, driven by gene editing, presents a landscape where Immunocore's ImmTAC technology could be further refined or complemented. For instance, by 2024, the global gene editing market was valued at approximately $5.2 billion and is projected to grow significantly, indicating substantial investment and innovation in this space. Synthetic biology, with its focus on designing and constructing new biological parts, devices, and systems, could also offer avenues for developing more advanced cancer treatments or improving manufacturing efficiency for Immunocore's therapies.

While Immunocore's primary focus remains on its ImmTAC platform, the rapid evolution of gene editing and synthetic biology presents potential strategic considerations. These fields could influence the competitive landscape by introducing alternative therapeutic modalities or enabling collaborations that enhance existing capabilities. For example, the ability to engineer immune cells with greater precision, a hallmark of gene editing, could inspire future platform enhancements or synergistic partnerships for Immunocore.

Continued advancements in TCR engineering are central to Immunocore's strategy, with ongoing R&D in 2024 focusing on enhancing ImmTAC molecule potency and specificity. Innovations in AI-driven drug discovery are also accelerating target identification and optimizing molecule design for new ImmTAC candidates.

The precision diagnostics market, vital for identifying biomarkers like HLA-A*02:01 for KIMMTRAK, was projected to exceed $70 billion globally by 2024. Furthermore, advancements in biopharmaceutical manufacturing, including AI integration in bioprocessing, are crucial for scaling production efficiently and ensuring product quality.

The gene editing market, valued at approximately $5.2 billion in 2024, presents opportunities for refining TCR therapies, while synthetic biology offers potential for novel drug delivery and manufacturing improvements.

| Technological Factor | Description | Impact on Immunocore | 2024/2025 Data Point |

|---|---|---|---|

| TCR Engineering | Advancements in designing potent, specific, and safer TCRs. | Enhances ImmTAC efficacy and broadens pipeline applications. | Continued R&D investment in TCR optimization. |

| AI in Drug Discovery | Utilizing AI for target identification and molecule design. | Accelerates R&D timelines and reduces costs for new ImmTACs. | Increasing use of AI platforms for biological data analysis. |

| Precision Diagnostics | Development of companion diagnostics for biomarker identification. | Improves patient selection for therapies like KIMMTRAK. | Precision diagnostics market >$70 billion globally by 2024. |

| Biopharmaceutical Manufacturing | Innovations in bioprocessing and advanced manufacturing. | Enables efficient scaling of ImmTAC production and improves quality. | Focus on AI integration in bioprocessing for optimization. |

| Gene Editing & Synthetic Biology | Developments in CRISPR-Cas9 and bio-manufacturing. | Potential for next-generation TCR therapies and platform enhancements. | Gene editing market ~$5.2 billion in 2024. |

Legal factors

Immunocore's core strength lies in its proprietary Immuno-Oncology T-cell Receptor (ImmTAC) platform, which is heavily reliant on robust intellectual property (IP) protection, primarily through patents. These patents are crucial for safeguarding its innovative therapeutic approach and specific drug candidates, such as KIMMTRAK (tebentafusp-tebn). The strength and breadth of these IP rights directly influence Immunocore's ability to maintain market exclusivity and fend off competition.

The evolving legal framework governing biologics, biosimilars, and novel therapeutic modalities presents both opportunities and challenges. Potential patent disputes, particularly concerning the patentability of complex biological entities and the scope of existing patents, can significantly impact Immunocore's competitive standing and future revenue streams. For instance, the ongoing developments in biosimilar regulations globally require constant vigilance to protect its market position.

Proactive monitoring and rigorous defense of its intellectual property portfolio are continuous and critical legal imperatives for Immunocore. This includes actively pursuing new patent filings, challenging potential infringements, and staying abreast of legislative changes that could affect patent validity or enforceability. In 2023, Immunocore reported significant investment in R&D, underscoring the importance of IP as a key asset in its strategy.

Immunocore navigates a complex web of global regulations, demanding strict compliance with bodies like the FDA and EMA for its innovative therapies. Failure to adhere can result in severe penalties, product withdrawals, or significant approval delays, impacting market entry and revenue streams.

The company must remain acutely aware of evolving regulatory landscapes, including potential leadership changes within agencies or new guidance documents, necessitating ongoing legal oversight and adaptation to maintain operational integrity and market access.

Legislation concerning drug pricing and reimbursement is a critical factor for Immunocore. In the United States, the Inflation Reduction Act (IRA) of 2022, for instance, allows Medicare to negotiate prices for certain high-cost drugs, directly impacting potential revenue streams for companies like Immunocore. This legislation, which began its implementation phase in 2023 with initial negotiations for a select number of drugs, represents a significant shift in the market access landscape.

Navigating these evolving pricing regulations requires robust legal and strategic planning. Immunocore must carefully consider how these laws, which are being phased in over several years, will affect its commercialization strategies for its therapies. For example, the IRA’s provisions for drug price negotiation are set to expand to more drugs over time, necessitating ongoing adaptation.

Furthermore, Immunocore's global operations mean it must comply with a complex web of national and regional pricing and reimbursement policies. These can vary significantly, with some countries employing strict price controls or value-based assessment frameworks that influence market access and profitability. Staying abreast of these diverse legal requirements is paramount for successful international market penetration.

Clinical Trial Regulations and Data Privacy

Immunocore's clinical trials operate under stringent regulatory frameworks, focusing on patient safety, data accuracy, and ethical research practices. These regulations are crucial for maintaining the integrity of scientific findings and public trust. For instance, the U.S. Food and Drug Administration (FDA) mandates rigorous oversight of clinical trials, with significant penalties for non-compliance.

Navigating the complex landscape of global data privacy laws, such as the General Data Protection Regulation (GDPR) in Europe, is critical. These laws dictate how patient data collected during clinical investigations can be handled, stored, and used, impacting everything from consent forms to data anonymization processes. In 2023, fines for GDPR violations exceeded €1.5 billion globally, highlighting the financial and reputational risks of non-compliance.

- Regulatory Oversight: Clinical trials are governed by bodies like the FDA and the European Medicines Agency (EMA), ensuring patient safety and data integrity.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is essential for handling sensitive patient information, with significant penalties for breaches.

- Evolving Legal Scrutiny: Legal requirements concerning trial design, patient representation, and transparent reporting can influence development timelines and increase operational costs.

Product Liability and Litigation Risks

As a commercial-stage biotechnology firm, Immunocore navigates significant product liability and litigation risks. These concerns stem from the safety and efficacy of its existing therapies, such as KIMMTRAK, and any new treatments it brings to market. For instance, in 2023, the pharmaceutical industry saw a notable increase in product liability claims, with defense costs often running into millions, impacting companies' financial stability.

To counter these legal exposures and safeguard its reputation, Immunocore must maintain stringent quality control measures throughout its development and manufacturing processes. Robust post-market surveillance and comprehensive pharmacovigilance systems are crucial for identifying and addressing any potential adverse events promptly.

The company's ability to manage these legal challenges is directly tied to its operational diligence. Failure to adhere to regulatory standards or effectively manage product-related issues could lead to costly lawsuits, regulatory sanctions, and a significant blow to investor confidence.

Immunocore's legal framework is heavily influenced by intellectual property protection, particularly patents safeguarding its Immuno-Oncology T-cell Receptor (ImmTAC) platform and therapies like KIMMTRAK. The company must actively defend its IP against potential disputes and biosimilar challenges to maintain market exclusivity. In 2023, Immunocore continued to invest heavily in research and development, underscoring the strategic importance of its robust patent portfolio.

Environmental factors

The biopharmaceutical industry, including companies like Immunocore, faces significant challenges in managing waste generated during manufacturing. The production of advanced therapies, such as Immunocore's ImmTAC molecules, often relies heavily on single-use systems, leading to substantial plastic waste. For instance, the global biopharmaceutical single-use technology market was valued at approximately USD 13.6 billion in 2023 and is projected to grow substantially, indicating an increasing volume of plastic waste.

Addressing this environmental impact is becoming critical. Immunocore, like its peers, must adopt robust waste management strategies and investigate novel approaches to reduce its ecological footprint. This includes exploring circular economy principles and advanced recycling technologies for biopharmaceutical plastics, especially as regulatory bodies and investors increasingly scrutinize environmental, social, and governance (ESG) performance. Companies are under pressure to demonstrate commitment to sustainability, with many aiming for zero waste to landfill by 2030.

Biopharmaceutical manufacturing, by its nature, demands significant energy, directly impacting a company's carbon footprint. For Immunocore, this means a substantial contribution to greenhouse gas emissions from its production processes.

The biopharma industry, including Immunocore, is under growing scrutiny to curb its environmental impact. This pressure stems from both regulatory bodies and increasing investor demand for sustainable practices.

To address this, Immunocore is likely exploring strategies such as integrating renewable energy sources into its operations and refining manufacturing workflows for greater energy efficiency. The adoption of greener technologies is key to meeting sustainability targets and complying with evolving environmental standards.

Pharmaceutical manufacturing, including Immunocore's operations, typically demands substantial water volumes for processes like cleaning, cooling, and synthesis. In 2024, the global pharmaceutical industry's water footprint is a growing concern, with many facilities striving to reduce consumption. For instance, some leading biopharmaceutical companies have set targets to decrease water intensity by 15-20% by 2025 compared to 2020 baselines.

Wastewater discharge from pharmaceutical plants can contain active pharmaceutical ingredients (APIs) and other chemical residues, posing potential risks to aquatic ecosystems if not adequately treated. Immunocore's commitment to efficient water management and advanced wastewater treatment technologies is crucial for environmental stewardship. By adopting green chemistry principles, such as using less hazardous solvents and optimizing reaction pathways, the company can further minimize its water-related environmental impact.

Supply Chain Environmental Impact

The environmental impact of Immunocore's operations is not confined to its own facilities but stretches across its entire supply chain. This includes the environmental consequences stemming from the acquisition of raw materials and the transportation of finished goods. For instance, the pharmaceutical industry's reliance on specialized chemicals and energy-intensive manufacturing processes can contribute to greenhouse gas emissions and waste generation throughout the value chain.

Effectively managing and reducing the environmental footprint of suppliers and logistics providers is becoming a critical component of Immunocore's sustainability efforts. This is crucial for accurate sustainability reporting and fulfilling corporate social responsibility commitments. Companies like Immunocore are increasingly scrutinized for their Scope 3 emissions, which encompass indirect emissions from their value chain. For example, in 2024, many large pharmaceutical companies reported significant portions of their total carbon footprint originating from their supply chains, often exceeding 70% of their total emissions.

- Supply Chain Emissions: Pharmaceutical supply chains often involve complex global networks, leading to substantial transportation-related emissions.

- Resource Intensity: The sourcing of specialized raw materials and manufacturing processes can be resource-intensive, impacting water usage and waste generation.

- Supplier Engagement: Proactive engagement with suppliers to adopt greener practices is vital for Immunocore to mitigate its overall environmental impact.

- Regulatory Scrutiny: Increasing environmental regulations globally are placing greater emphasis on companies to demonstrate control and improvement within their extended supply chains.

Regulatory Pressure for Sustainable Practices

Global regulatory bodies are increasingly focusing on the environmental footprint of the pharmaceutical sector. For instance, the World Health Organization (WHO) and the European Medicines Agency (EMA) are actively developing and refining guidelines that address the environmental impact across the entire lifecycle of medicines, from manufacturing and packaging to end-of-life disposal. This push towards sustainability means companies like Immunocore need to be highly attuned to these evolving standards.

These regulatory shifts are not merely suggestions; they are becoming mandates that will influence operational procedures and strategic planning. Companies are expected to demonstrate a commitment to reducing waste, minimizing carbon emissions, and ensuring responsible sourcing of materials. Failure to adapt could lead to compliance issues, fines, and damage to corporate reputation, impacting investor confidence and market access. For example, by 2024, many European countries have already implemented stricter waste management protocols for medical supplies, impacting packaging choices.

Immunocore should therefore proactively embed environmental sustainability into its core business strategy. This involves not only meeting current regulations but also anticipating future requirements and identifying opportunities for innovation in eco-friendly practices. Such a proactive approach can translate into operational efficiencies, cost savings, and a stronger brand image in an increasingly environmentally conscious market. By 2025, it's projected that over 60% of major pharmaceutical companies will have publicly stated net-zero emission targets, a trend Immunocore will need to align with.

- Growing WHO and EMA Guidelines: Stricter environmental impact assessments for drug production are becoming standard, affecting packaging and disposal protocols.

- Focus on Lifecycle Impact: Regulations now scrutinize the entire supply chain, from raw material sourcing to product end-of-life.

- Proactive Strategy is Key: Immunocore must integrate environmental considerations to ensure compliance, maintain reputation, and potentially gain a competitive edge.

- Market Trends: By 2025, a significant majority of large pharmaceutical firms are expected to commit to net-zero emissions, signaling a broad industry shift.

Environmental factors significantly shape Immunocore's operational landscape. The biopharmaceutical industry's reliance on single-use technologies, projected to grow substantially from its USD 13.6 billion valuation in 2023, generates considerable plastic waste, necessitating robust waste management strategies. Furthermore, energy-intensive manufacturing processes contribute to a significant carbon footprint, driving the need for renewable energy integration and efficiency improvements, especially as over 60% of major pharmaceutical companies are expected to have net-zero emission targets by 2025.

Water consumption and wastewater discharge are also critical environmental concerns. The industry's water footprint is under increasing scrutiny, with many companies aiming for 15-20% water intensity reduction by 2025. Effective wastewater treatment is paramount to prevent the release of active pharmaceutical ingredients into ecosystems. Finally, the entire supply chain, from raw material sourcing to transportation, contributes to emissions, with Scope 3 emissions often exceeding 70% of a company's total carbon footprint in 2024, highlighting the importance of supplier engagement and sustainable logistics.

| Environmental Factor | Industry Trend/Data (2023-2025) | Implication for Immunocore |

|---|---|---|

| Waste Generation (Single-Use Tech) | Global market valued at USD 13.6 billion in 2023, with projected growth. | Requires advanced waste management and circular economy principles. |

| Energy Consumption & Carbon Footprint | Growing pressure for net-zero targets; over 60% of major pharma firms expected to have them by 2025. | Need for renewable energy adoption and process efficiency to reduce emissions. |

| Water Usage & Wastewater | Aim for 15-20% water intensity reduction by 2025; scrutiny on API discharge. | Focus on water conservation and advanced wastewater treatment technologies. |

| Supply Chain Emissions (Scope 3) | Often >70% of total emissions in 2024; increasing regulatory focus. | Mandatory engagement with suppliers for sustainable practices and emissions reduction. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Immunocore is built on a robust foundation of data from leading scientific journals, regulatory bodies like the FDA and EMA, and reputable financial market intelligence firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the biopharmaceutical sector.