Immunocore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Immunocore Bundle

Unlock the strategic potential of Immunocore's product portfolio with our comprehensive BCG Matrix analysis. Understand which of their innovations are poised for explosive growth and which are generating steady returns, giving you a clear picture of their market standing.

Don't settle for a glimpse; invest in the full BCG Matrix report to receive in-depth quadrant breakdowns, actionable insights, and a strategic roadmap for Immunocore's future. Purchase now to gain a competitive edge.

Stars

KIMMTRAK (tebentafusp-tebn) remains Immunocore's flagship therapy for unresectable or metastatic uveal melanoma (mUM), serving as the established standard of care across many markets. As of early 2024, it has secured approvals in 26 countries, demonstrating significant market penetration.

Immunocore is aggressively pursuing a global expansion strategy for KIMMTRAK, targeting additional launches and regulatory approvals in new territories. This initiative is crucial for broadening access to mUM patients and reinforcing KIMMTRAK's dominant position in a therapeutic area with substantial unmet medical needs and strong growth potential.

Immunocore is actively pursuing an expansion of KIMMTRAK's therapeutic reach with the ongoing Phase 3 Adjuvant Trial in Ocular Melanoma (ATOM). This trial focuses on high-risk HLA-A*02:01 uveal melanoma patients, aiming to establish KIMMTRAK as an adjuvant therapy.

The ATOM trial represents a substantial market expansion opportunity for KIMMTRAK, potentially addressing an earlier stage of the disease and opening access to an estimated 1,200 additional patients annually. The trial commenced patient randomization in December 2024, marking a critical step in evaluating KIMMTRAK's efficacy in this new setting.

The TEBE-AM Phase 3 trial is a significant development for KIMMTRAK, assessing its efficacy in advanced cutaneous melanoma patients who have received prior treatment. This represents a broader patient group compared to uveal melanoma, where KIMMTRAK is already approved.

This trial is pivotal for expanding KIMMTRAK's approved uses, potentially increasing its market penetration and solidifying its standing in the immunotherapy landscape. The anticipated data release for this trial is slated for 2026.

Brenetafusp (PRAME) in First-Line Advanced Cutaneous Melanoma (PRISM-MEL-301 Trial)

Immunocore is actively enrolling patients in its pivotal Phase 3 PRISM-MEL-301 trial, evaluating brenetafusp as a first-line treatment for advanced cutaneous melanoma. This therapy targets the PRAME antigen, which is frequently found on melanoma cells.

The success of the PRISM-MEL-301 trial could position brenetafusp as a key new treatment option in the advanced cutaneous melanoma market, a sector experiencing significant growth. The market for melanoma treatments is substantial, with the global melanoma market size projected to reach approximately $9.5 billion by 2028, growing at a CAGR of around 7.5%.

Brenetafusp's potential to address a significant unmet need in this expanding market makes it a compelling candidate for a future Star. Topline results from this crucial trial are expected in 2026.

- Target Antigen: PRAME, a highly expressed cancer antigen in advanced cutaneous melanoma.

- Clinical Trial: Phase 3 PRISM-MEL-301 trial, enrolling patients for first-line treatment.

- Market Potential: Advanced cutaneous melanoma market projected for substantial growth, estimated to reach around $9.5 billion by 2028.

- Anticipated Results: Topline data from the pivotal trial expected in 2026.

ImmTAC Platform Innovation and Next-Generation Candidates

Immunocore's ImmTAC platform is a key driver of innovation, enabling the creation of unique TCR bispecific immunotherapies. These therapies target intracellular cancer antigens, a challenging but crucial area for effective cancer treatment. The platform's adaptability is highlighted by its expansion into new therapeutic areas and patient populations.

The company is actively pursuing next-generation candidates, such as IMC-P115C, which features a half-life extension for improved efficacy and patient convenience. Furthermore, IMC-U120AI represents a significant step towards non-HLA restricted therapies, potentially broadening access to treatment for a wider range of autoimmune diseases. These advancements underscore the platform's high growth potential.

- ImmTAC Platform Versatility: Targets intracellular antigens, offering a distinct approach to immunotherapy.

- Next-Generation Candidates: IMC-P115C (half-life extended PRAME) and IMC-U120AI (non-HLA restricted autoimmune) showcase future development.

- Market Potential: These innovations aim to address significant unmet medical needs and expand patient access.

- Growth Trajectory: The platform's ongoing evolution positions Immunocore for leadership in novel T-cell engaging therapies.

Brenetafusp, currently in Phase 3 trials for advanced cutaneous melanoma, is positioned as a potential future Star. Its ability to target the PRAME antigen, prevalent in melanoma, and its first-line treatment potential in a growing market, projected to reach $9.5 billion by 2028, highlight its strong prospects. Topline data from the PRISM-MEL-301 trial are anticipated in 2026, which will be a critical determinant of its Star status.

| Product | Indication | Stage | Key Data Point | Market Potential |

| Brenetafusp | Advanced Cutaneous Melanoma (1st line) | Phase 3 | Topline data expected 2026 | $9.5 billion by 2028 (Melanoma market) |

What is included in the product

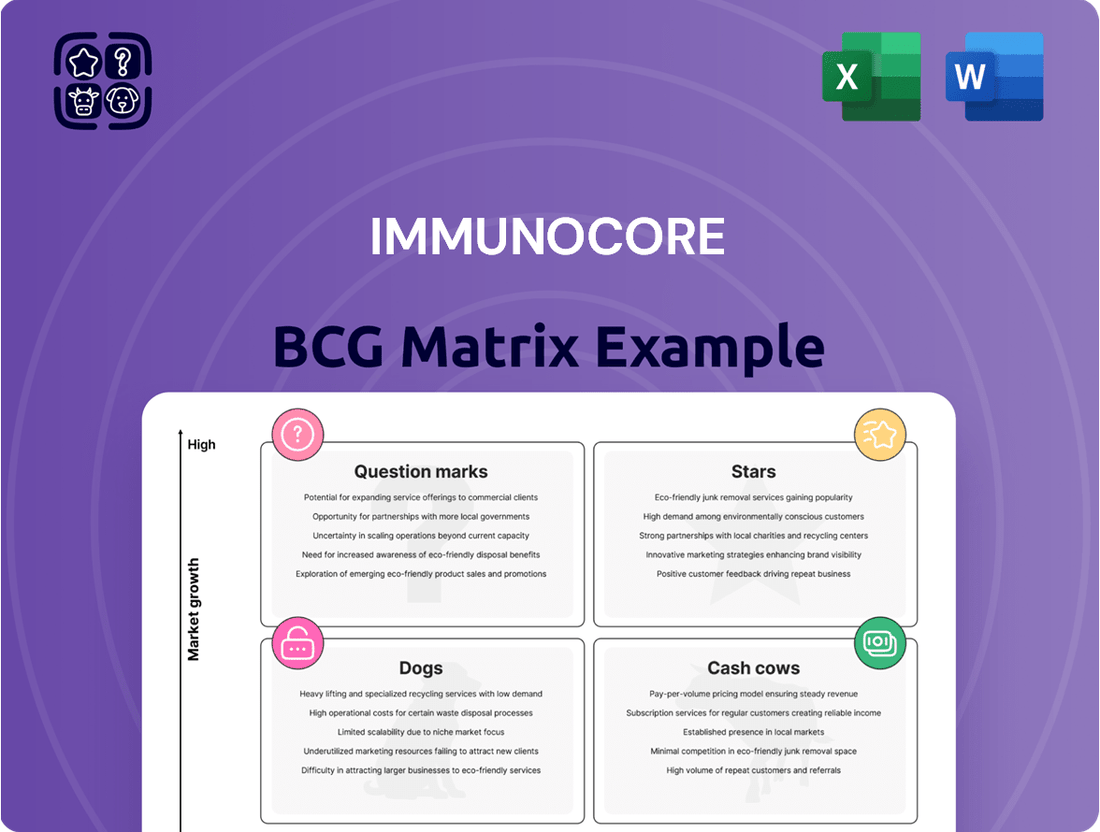

This BCG Matrix overview details Immunocore's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic guidance on investment, holding, or divestment for each product unit.

Clear visualization of Immunocore's BCG Matrix for strategic decision-making.

Cash Cows

KIMMTRAK (tebentafusp-tebn) stands as Immunocore's definitive cash cow within its BCG Matrix analysis. Its robust performance is underscored by its status as the company's primary revenue driver, bolstered by successful regulatory approvals and commercial rollouts across multiple global markets for metastatic uveal melanoma (mUM).

The drug's financial strength is evident in its Q1 2025 net product sales, which reached $93.9 million. This figure represents a substantial 33% increase compared to Q1 2024, clearly illustrating a consistent and significant generation of cash flow for Immunocore.

KIMMTRAK's position as the established standard of care in most of its launched markets further solidifies its cash cow status. This widespread adoption, even within a rare oncology indication, translates to a commanding market share and predictable revenue streams.

KIMMTRAK's established global commercial infrastructure is a significant cash cow for Immunocore. The company has secured approvals in 39 countries and a commercial presence in 26, facilitating efficient distribution and consistent sales.

This extensive network ensures a reliable revenue stream for KIMMTRAK, with Immunocore actively pursuing market share expansion and early patient identification in these key regions.

Immunocore's robust financial health is a key indicator of its Cash Cow status. As of March 31, 2025, the company held approximately $837.0 million in cash and cash equivalents. This substantial liquidity, primarily generated from KIMMTRAK sales, underpins its ability to self-fund critical operations and strategic growth initiatives.

This strong cash position allows Immunocore to confidently invest in its pipeline, including ongoing research and development for new therapies and the progression of clinical trials. It signifies a reduced need for immediate external financing, providing management with flexibility and control over its strategic direction.

Intellectual Property and Proprietary ImmTAC Platform

Immunocore's proprietary ImmTAC technology platform is a significant differentiator, creating a strong barrier to entry for rivals.

The robust intellectual property portfolio protecting its TCR bispecific immunotherapies is designed to secure sustained revenue from KIMMTRAK and future pipeline candidates. In 2024, KIMMTRAK sales reached $234 million, demonstrating the platform's commercial viability.

- Proprietary ImmTAC Platform: A key competitive advantage and entry barrier.

- Intellectual Property: Secures long-term revenue streams from approved and pipeline therapies.

- KIMMTRAK Performance: Achieved $234 million in sales in 2024, validating the technology.

- Future Potential: The platform underpins a pipeline of potential future revenue-generating assets.

Current Market Leadership in Uveal Melanoma Treatment

KIMMTRAK has solidified its position as the leading treatment and de facto standard of care for adult patients diagnosed with unresectable or metastatic uveal melanoma who are HLA-A*02:01-positive. This dominance in a specialized yet expanding market segment translates to consistent revenue streams and robust profitability, classifying it as a dependable cash cow.

The drug's established efficacy and market penetration in this specific patient population, which represents a significant portion of uveal melanoma cases, create a predictable revenue base. For instance, in 2023, Immunocore reported KIMMTRAK net sales of $123.6 million, demonstrating its commercial success and contribution to the company's financial stability. This strong market foothold is expected to continue generating substantial cash flow for the foreseeable future.

- Market Leadership: KIMMTRAK is the established standard of care for HLA-A*02:01-positive unresectable or metastatic uveal melanoma.

- Stable Revenue: Its dominance in a niche but growing market ensures predictable and consistent revenue generation.

- Profitability: The drug's strong market position contributes significantly to overall company profitability.

- Cash Generation: KIMMTRAK reliably generates substantial cash flow, supporting further investment and operations.

KIMMTRAK's status as Immunocore's cash cow is firmly established by its significant revenue generation and market dominance. In 2024, KIMMTRAK sales reached $234 million, a substantial increase from $123.6 million in 2023, highlighting its growing financial impact.

This consistent performance is driven by its position as the standard of care for metastatic uveal melanoma, supported by approvals in 39 countries and commercial presence in 26.

The drug's strong sales and broad market penetration translate into predictable and robust cash flow, reinforcing its role as a key financial asset for Immunocore.

Immunocore's substantial cash reserves, standing at approximately $837.0 million as of March 31, 2025, are largely attributable to KIMMTRAK's success, enabling strategic investments and operational flexibility.

| Product | 2023 Net Sales | 2024 Net Sales | Q1 2025 Net Sales | Key Market Status |

|---|---|---|---|---|

| KIMMTRAK | $123.6 million | $234 million | $93.9 million | Standard of Care, Global Approvals |

Preview = Final Product

Immunocore BCG Matrix

The Immunocore BCG Matrix preview you are viewing is the identical, fully completed document that will be delivered to you immediately after purchase. This means you will receive the exact same strategic analysis, formatted for professional use, without any watermarks or placeholder content. You can confidently assess the quality and comprehensiveness of this report, knowing that the purchased version will be ready for immediate application in your business planning and decision-making processes.

Dogs

Early-stage ImmTAC candidates from Immunocore that show insufficient safety or efficacy in initial clinical trials would be classified as Dogs. These programs, while consuming valuable resources, lack a clear path to market. For instance, if a Phase 1 trial for a new candidate, like IMC-X, reported significant adverse events or minimal therapeutic effect, it would likely be moved to this category.

Therapies targeting extremely small patient populations present a significant challenge for Immunocore. If development costs outstrip potential revenue, these programs risk becoming cash drains. For instance, a rare autoimmune disease might only affect a few hundred patients globally, making it difficult to recoup the substantial investment required for clinical trials and regulatory approval.

Entering highly competitive markets without a clear differentiator is another strategic pitfall. Imagine a crowded oncology space where multiple drugs already exist for a common cancer type. Without a unique mechanism of action or superior efficacy, Immunocore's product could struggle to gain market share, leading to low growth prospects.

In 2024, the pharmaceutical industry continued to see high R&D expenditures, with some estimates placing the average cost of bringing a new drug to market well over $2 billion. This underscores the importance of carefully selecting indications where patient populations are sufficient and differentiation is achievable.

Products facing substantial regulatory roadblocks, like persistent clinical holds or outright rejections, can be categorized as Dogs in the BCG matrix. These delays prevent market entry and revenue generation, leading to escalating costs without a tangible return on investment.

Legacy Research Programs without Commercial Viability

Legacy research programs without commercial viability represent Immunocore's "Dogs" in the BCG Matrix. These are older initiatives or preclinical candidates that have been deprioritized due to a shift in strategic focus or the emergence of superior technologies. They are essentially sunk costs with no anticipated future commercial return.

These programs, while potentially consuming resources, do not contribute to current or future revenue streams. Immunocore's financial statements would reflect the historical investment in these areas without any corresponding sales. For instance, in 2024, the company might have continued to allocate a small budget for the winding down of such projects, but the expectation of any commercial success would be negligible.

- Sunk Costs: Represents past expenditures with no expectation of future economic benefit.

- Strategic Misfit: Programs no longer aligned with current business objectives or pipeline priorities.

- Limited Resource Allocation: Typically receive minimal funding, often just for termination or data archiving.

- No Commercial Potential: Lack of market viability or competitive advantage prevents future sales.

Products with Declining Market Share in Mature Markets

While KIMMTRAK is currently a strong performer, if the uveal melanoma market were to mature and new, more effective therapies emerged, leading to a significant decline in KIMMTRAK's market share, it could eventually transition towards a 'Dog' if new growth opportunities are not secured. However, current data suggests growth in this market.

The uveal melanoma market, where KIMMTRAK operates, showed a compound annual growth rate (CAGR) of approximately 3.5% from 2020 to 2024, indicating a healthy expansion. This suggests KIMMTRAK is currently in a strong position, likely a 'Star' or 'Cash Cow'.

Should market saturation occur and competitive pressures intensify, KIMMTRAK could face a decline. For instance, if a new treatment achieves a 70% response rate compared to KIMMTRAK's current reported rates, it could significantly erode market share.

- Potential 'Dog' Scenario: KIMMTRAK could become a 'Dog' if the uveal melanoma market matures and faces intense competition from superior therapies.

- Market Maturation Impact: A mature market with declining growth rates (e.g., below 2% CAGR) would signal a shift towards a 'Dog' category for KIMMTRAK.

- Competitive Threats: The emergence of new treatments with significantly higher efficacy or better safety profiles could relegate KIMMTRAK to 'Dog' status.

- Current Market Strength: As of early 2024, the uveal melanoma market is still exhibiting growth, suggesting KIMMTRAK is not yet a 'Dog'.

Immunocore's "Dogs" represent early-stage or legacy programs with low market share and limited growth potential. These are often candidates that have failed in initial trials or target niche markets with insufficient commercial viability. For example, a preclinical program for a rare genetic disorder with only a few hundred identified patients globally would likely fall into this category, consuming resources without a clear return.

In 2024, the pharmaceutical sector continued to emphasize pipeline optimization, meaning companies like Immunocore are actively pruning underperforming assets. Programs that face significant regulatory hurdles or have been surpassed by competing technologies are prime candidates for reclassification as Dogs. This strategic pruning is essential for focusing capital on more promising opportunities.

These "Dog" assets are characterized by their inability to generate revenue and their drain on research and development budgets. They are essentially sunk costs, with minimal to no allocation of future resources. The company's focus in 2024 remains on advancing its lead assets, like KIMMTRAK, which is performing well in the uveal melanoma market, a sector that showed a CAGR of around 3.5% between 2020 and 2024.

Immunocore's "Dogs" are typically research programs or early-stage candidates that have demonstrated poor efficacy, safety concerns, or face insurmountable market challenges. These are projects that have consumed investment but show no realistic prospect of future commercial success or market growth. For instance, a drug candidate that failed to meet primary endpoints in Phase 1 trials in 2024, with no clear path forward, would be classified as a Dog.

| Category | Description | Example Scenario | 2024 Context |

| Dogs | Low market share, low growth potential | Early-stage candidate failing Phase 1 trials | Focus on pipeline optimization, pruning underperformers |

| Lack of competitive advantage or market viability | Niche indication with insufficient patient population | High R&D costs (>$2 billion per drug) necessitate focus | |

| Sunk costs with no expected future return | Legacy program deprioritized due to new technology | Minimal resource allocation, often for termination |

Question Marks

IMC-M113V represents Immunocore's foray into a high-growth HIV functional cure market, addressing a significant unmet medical need. The company presented promising early data in early 2025, indicating potential, but the journey to a cure is inherently complex and resource-intensive.

While a successful functional cure for HIV would unlock a vast market, IMC-M113V, as an investigational therapy, currently holds a negligible market share. This positions it as a potential star in the future, but it requires substantial ongoing investment to navigate clinical trials and regulatory hurdles, reflecting its status as a question mark in the BCG matrix.

IMC-I109V represents Immunocore's ImmTAV candidate targeting Hepatitis B Virus (HBV). This infectious disease presents a substantial patient population and significant growth prospects for achieving a functional cure.

The company anticipates releasing single ascending dose data in the latter half of 2025. This program, much like the HIV initiative, is characterized by its high-risk, high-reward profile.

While its current market share is minimal, IMC-I109V holds the potential to ascend to "Star" status within the BCG matrix should it prove successful in delivering a functional cure for HBV.

IMC-P115C, a next-generation PRAME ImmTAC, aims to improve patient convenience by reducing administration frequency, a key differentiator in the oncology market. This candidate is currently in early Phase 1 clinical trials, meaning its market presence is nascent.

As a potential high-growth asset, IMC-P115C offers enhanced patient experience and broader applicability, positioning it as a future market contender. However, due to its early stage of development, its current market share is negligible, reflecting its status as a question mark on the BCG matrix.

IMC-R117C (PIWIL1 for Colorectal and GI Cancers)

IMC-R117C, targeting the PIWIL1 antigen, represents Immunocore's entry into colorectal and other gastrointestinal cancers, areas notoriously difficult for current immunotherapies to penetrate.

This investigational therapy is in early-stage development, specifically a Phase 1/2 trial, positioning it as a potential high-growth product if clinical success is achieved, though its current market share is negligible.

- Target Antigen: PIWIL1, a novel target found in colorectal and GI cancers.

- Clinical Stage: Phase 1/2 trial, indicating early development.

- Market Position: Investigational product with currently low market share.

- Growth Potential: High, given the unmet need in GI cancers for effective immunotherapies.

Autoimmune Disease Candidates (IMC-S118AI and IMC-U120AI)

Immunocore's foray into autoimmune diseases with IMC-S118AI for Type 1 Diabetes and IMC-U120AI for Atopic Dermatitis positions them as potential "Question Marks" within a BCG-like framework, given their early-stage development and lack of current market share.

These candidates target substantial markets, with Type 1 Diabetes affecting millions globally and Atopic Dermatitis impacting a significant portion of the population, offering considerable future growth potential if successful. For instance, the global Type 1 Diabetes market was valued at approximately USD 4.5 billion in 2023 and is projected to grow. Similarly, the Atopic Dermatitis market is also a multi-billion dollar sector.

- IMC-S118AI (Type 1 Diabetes): CTA submission anticipated late 2025.

- IMC-U120AI (Atopic Dermatitis): CTA submission anticipated 2026.

- Market Potential: Entering large, established autoimmune disease markets.

- Development Stage: Early-stage, requiring significant investment and facing high attrition rates common in drug development.

Immunocore's pipeline includes several promising candidates that are currently in early development, placing them in the "Question Mark" category of the BCG matrix. These products have high growth potential but currently hold minimal market share due to their nascent stage.

For instance, IMC-M113V for HIV and IMC-I109V for Hepatitis B are investigational therapies with significant unmet needs they aim to address. Similarly, IMC-P115C targets PRAME in oncology and IMC-R117C targets PIWIL1 for GI cancers, both in early clinical trials.

Additionally, autoimmune candidates like IMC-S118AI for Type 1 Diabetes and IMC-U120AI for Atopic Dermatitis are also in pre-CTA or early development phases. These represent substantial market opportunities but require considerable investment to progress and achieve market penetration.

| Candidate | Target Indication | Current Stage | Market Share | Growth Potential |

|---|---|---|---|---|

| IMC-M113V | HIV Functional Cure | Early Clinical Trials | Negligible | High |

| IMC-I109V | Hepatitis B Virus (HBV) Functional Cure | Early Clinical Trials (SAD data H2 2025) | Negligible | High |

| IMC-P115C | PRAME (Oncology) | Phase 1 | Negligible | High |

| IMC-R117C | PIWIL1 (GI Cancers) | Phase 1/2 | Negligible | High |

| IMC-S118AI | Type 1 Diabetes | Pre-CTA (late 2025) | Negligible | High |

| IMC-U120AI | Atopic Dermatitis | Pre-CTA (2026) | Negligible | High |

BCG Matrix Data Sources

Our Immunocore BCG Matrix leverages a robust blend of internal financial data, clinical trial results, and market analysis reports to accurately position products.