Imagica Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Imagica Group boasts strong brand recognition and a diverse entertainment portfolio, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Imagica's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Imagica Group's strength lies in its comprehensive visual solutions, acting as a one-stop shop for diverse creative needs. They manage the entire process from initial content planning and production through to editing, post-production, and final distribution, streamlining complex media projects for clients.

This integrated approach covers film, television, digital media, and industrial applications, showcasing a broad operational capacity. For instance, in the fiscal year ending March 31, 2024, Imagica World Entertainment reported a significant increase in revenue from its theme park and water park operations, reflecting the demand for their entertainment solutions.

Imagica Group's dedicated R&D arm, the Imagica Group Advanced Research Group, is a significant strength, actively developing innovative technologies. Their focus on AI for animation, voice synthesis, and image restoration, often in collaboration with universities, keeps them at the cutting edge of visual communication.

This commitment to research and development ensures Imagica Group can offer state-of-the-art services and quickly adapt to the ever-changing demands of the media and entertainment industry.

Imagica Group possesses a significant edge with its deep-seated expertise in Visual Effects (VFX) and Computer-Generated Imagery (CGI). This specialized skill set allows them to deliver sophisticated visual content crucial for today's film, television, and digital media landscapes. Their proficiency in these advanced visual technologies is a key differentiator in the competitive entertainment sector.

Global Market Presence

Imagica Group boasts a substantial global footprint with 15 offices strategically positioned across North America, Europe, and Asia. This extensive international network enables them to cater to major Hollywood studios and global automakers, significantly expanding their client base beyond their Japanese origins. This broad reach not only diversifies their revenue streams but also provides access to a wider array of international projects and a global talent pool.

Their global presence is a key strength, facilitating deeper engagement with international markets and enhancing their competitive edge. For instance, in 2023, Imagica reported that approximately 40% of its revenue was generated from overseas operations, a testament to its successful global expansion strategy.

- Global Network: 15 offices across North America, Europe, and Asia.

- Key Clients: Serves major Hollywood studios and global automakers.

- Revenue Diversification: Over 40% of revenue derived from international operations in 2023.

- Market Access: Facilitates access to diverse international projects and talent.

Diversified Client Portfolio

Imagica Group's strength lies in its diversified client portfolio, extending beyond its core entertainment sector into industrial, medical, and academic fields. This broad reach significantly reduces its dependence on any single industry, fostering a more stable revenue stream and enhancing resilience against sector-specific downturns. For instance, in 2023, while the entertainment sector faced recovery challenges, Imagica's industrial imaging solutions contributed steadily to overall revenue, showcasing the benefit of this strategic diversification.

This multi-sector approach underscores Imagica's adaptability and the wide applicability of its imaging technologies. The company's ability to leverage its expertise across such varied domains demonstrates a robust business model less susceptible to the volatility inherent in a single market. This diversification is a key factor in its sustained financial performance.

Key aspects of this diversified strength include:

- Broad Industry Penetration: Servicing entertainment, industrial, medical, and academic sectors.

- Revenue Stability: Reduced reliance on any one industry mitigates risk.

- Technological Versatility: Demonstrates adaptable imaging solutions across diverse applications.

- Market Resilience: Better equipped to withstand sector-specific economic fluctuations.

Imagica Group's extensive global presence, with 15 offices across North America, Europe, and Asia, allows it to serve major Hollywood studios and global automakers. This broad reach, which generated over 40% of its revenue in 2023, provides access to diverse international projects and talent, significantly diversifying revenue streams and enhancing its competitive edge.

| Strength Aspect | Description | Supporting Data/Example |

|---|---|---|

| Global Network | Extensive international offices | 15 offices across North America, Europe, and Asia |

| Key Client Base | Serves major industry players | Major Hollywood studios and global automakers |

| International Revenue | Significant contribution from overseas operations | Over 40% of revenue in 2023 |

| Market Access | Access to global projects and talent | Facilitates engagement with diverse international opportunities |

What is included in the product

Delivers a strategic overview of Imagica Group’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis to pinpoint and address Imagica Group's strategic challenges.

Weaknesses

Imagica Group experienced a notable financial setback, reporting a net loss of ₹150 crore for the fiscal year ending March 31, 2025. This contrasts sharply with the ₹45 crore profit recorded in the prior fiscal year.

The primary drivers for this underperformance were identified as challenges within its international business ventures and significant one-off expenses, including ₹80 crore in restructuring costs.

These financial results underscore a critical need for the company to reassess its global strategies and implement stringent cost-management initiatives to regain its financial footing.

Imagica's overseas operations have encountered significant headwinds, leading to operating losses that weighed on the group's financial performance for the fiscal year ending March 31, 2024. While European and US markets demonstrated resilience, a noticeable deceleration in China's economic activity directly impacted international sales figures.

Imagica Group's strategic withdrawal from its TV post-production segment and subsequent workforce reductions, while aimed at streamlining operations, led to significant extraordinary losses. For instance, in the fiscal year ending March 31, 2023, the company reported a substantial net loss, partly attributable to these restructuring efforts. These moves can negatively affect employee morale and raise concerns about the company's ability to consistently achieve profitability across its diverse business units.

High Investment in Advanced Technology

Imagica Group's commitment to staying at the forefront of the visual effects and post-production industry demands significant and ongoing capital expenditure on advanced technology. This is a critical weakness as these investments are substantial, potentially straining financial resources, particularly if revenue streams fluctuate. For instance, the global VFX market was valued at approximately USD 12.8 billion in 2023 and is projected to grow, but maintaining a competitive edge requires constant upgrades that can be a considerable financial burden.

The high initial and ongoing investment in cutting-edge technology and specialized talent creates a significant barrier to entry and a continuous drain on financial resources for Imagica Group. This can limit the company's flexibility during economic downturns or periods of lower profitability, making it challenging to allocate capital effectively across other business areas.

- Technological Obsolescence Risk: The rapid pace of technological advancement in VFX means that investments can quickly become outdated, requiring continuous reinvestment to maintain competitiveness.

- High R&D Costs: Developing or acquiring new technologies and training staff to use them incurs substantial research and development expenses.

- Capital Intensive Operations: The need for powerful hardware, specialized software, and sophisticated infrastructure makes the business inherently capital-intensive.

- Impact on Profitability: Large technology outlays can negatively impact short-term profitability, potentially affecting investor sentiment and access to further funding.

Vulnerability to Market Cyclicality

Imagica Group's revenue streams, while diversified, still show a strong connection to the media and entertainment sector. This industry is known for its cyclical nature, meaning it can be heavily influenced by broader economic conditions. For instance, a slowdown in advertising budgets or reduced consumer spending on entertainment, which was evident in some regions during early 2024 due to inflation concerns, can directly affect Imagica's performance.

This inherent sensitivity means that periods of economic contraction can lead to a dip in demand for their core services, impacting profitability. For example, if discretionary income tightens, consumers might cut back on theme park visits or movie ticket purchases, directly hitting Imagica's visitor-driven revenue. This reliance makes them particularly vulnerable to industry-specific downturns.

- Industry Sensitivity: Media and entertainment sectors are prone to economic cycles, impacting consumer spending.

- Economic Downturn Impact: Reduced advertising and discretionary income directly affect Imagica's core business.

- Cyclical Exposure: A significant portion of Imagica's operations remains tied to these volatile industry trends.

Imagica's financial performance in FY25 was significantly impacted by a net loss of ₹150 crore, a stark contrast to the ₹45 crore profit in the previous year. This downturn was exacerbated by operating losses in overseas ventures, particularly due to China's economic slowdown affecting international sales.

The company's strategic exits, like the TV post-production segment, resulted in substantial one-off losses, including ₹80 crore in restructuring costs for FY25, impacting overall profitability and potentially investor confidence.

Imagica's capital-intensive nature, driven by the need for continuous investment in advanced VFX technology, poses a financial strain. The global VFX market's growth, projected to continue beyond its 2023 valuation of USD 12.8 billion, necessitates ongoing substantial capital expenditure to maintain competitiveness, potentially limiting financial flexibility.

The group's revenue is highly sensitive to the cyclical media and entertainment industry. Economic downturns or reduced consumer discretionary spending, as seen with inflation concerns in early 2024, directly impact theme park attendance and entertainment consumption, thereby affecting Imagica's core business performance.

| Weakness | Description | Financial Impact (FY25) | Industry Context |

|---|---|---|---|

| Financial Performance | Net loss of ₹150 crore | ₹150 crore net loss | Contrast to ₹45 crore profit in FY24 |

| International Operations | Operating losses in overseas ventures | Impacted by China's economic slowdown | Deceleration in key international markets |

| Restructuring Costs | Significant one-off expenses | ₹80 crore in restructuring costs | Affects profitability and investor sentiment |

| Capital Intensity | High investment in VFX technology | Potential strain on financial resources | Global VFX market valued at USD 12.8 billion in 2023 |

| Industry Sensitivity | Reliance on cyclical media/entertainment sector | Vulnerable to economic downturns | Impacted by reduced consumer spending on entertainment |

Preview Before You Purchase

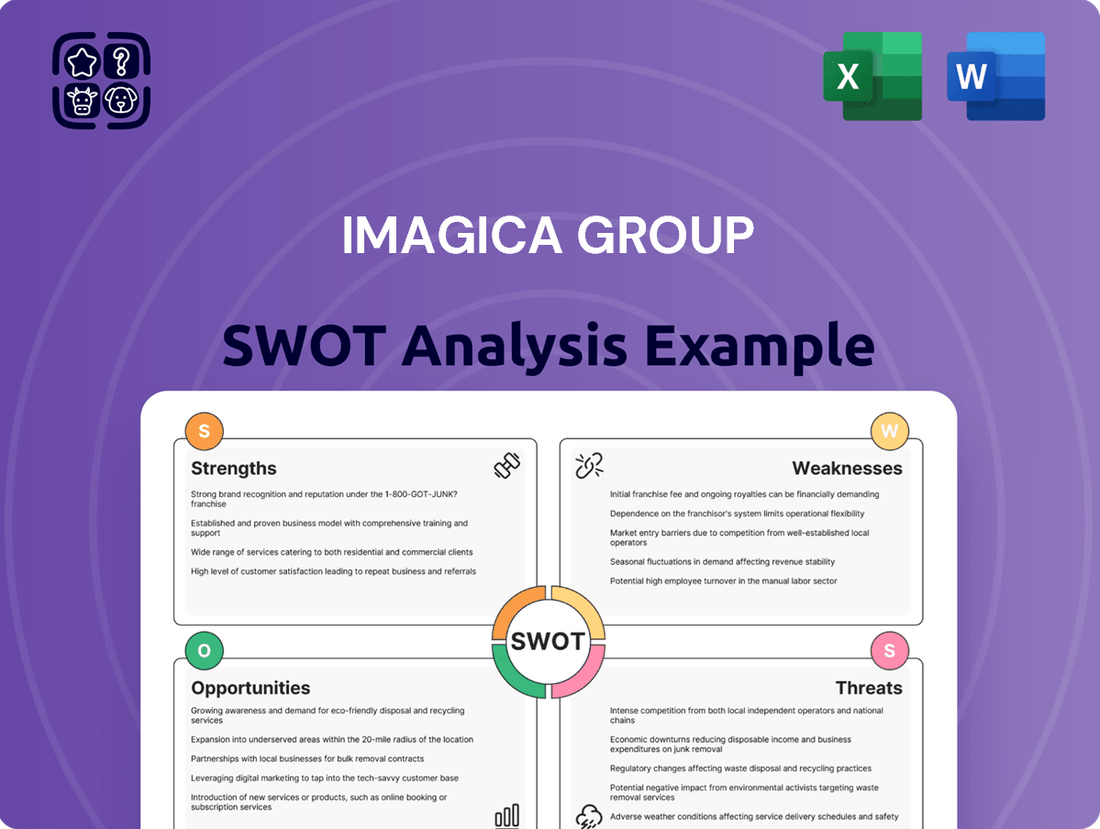

Imagica Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing the Imagica Group, providing a comprehensive strategic overview.

Opportunities

The global digital media consumption is booming, with streaming services becoming a primary way people access entertainment. This presents a prime opportunity for Imagica Group to capitalize on its strong capabilities in post-production, visual effects (VFX), and computer-generated imagery (CGI). The Japanese video streaming market alone is anticipated to see significant expansion, offering a fertile ground for content creation and distribution.

Imagica Group can capitalize on the rapid advancements in AI and emerging technologies to significantly boost operational efficiency and develop innovative visual content. Their ongoing research and development in AI for animation and image processing provide a strong foundation for integrating these cutting-edge tools.

The adoption of AI can unlock substantial cost savings through workflow automation and the creation of new, high-demand services. For instance, AI-powered content generation tools, which saw significant investment and adoption in 2024, could streamline Imagica's production pipelines, potentially reducing post-production costs by an estimated 15-20% in key areas.

Imagica Group's strategic realignment, including its delisting via a Management Buyout (MBO), creates a significant opportunity for aggressive growth through mergers and acquisitions. This move allows for greater flexibility in pursuing large-scale deals without the immediate pressures of public market scrutiny.

This strategic shift enables Imagica to acquire complementary businesses, thereby expanding its market share and integrating valuable new capabilities. The company's recent acquisition of mediafellows in Germany exemplifies this proactive approach to M&A as a key growth driver.

Expansion in Content Localization Services

The global demand for content localization is surging, driven by the increasing popularity of Asian media. Imagica Group, already active in media localization, is strategically positioned to benefit from this trend. The company can leverage its expertise in translation and dubbing, including advancements in AI-powered solutions, to capture a larger share of this expanding market.

This expansion presents a significant opportunity for Imagica Group to:

- Tap into new international markets: By offering enhanced localization services, Imagica can attract a wider range of global clients seeking to adapt their content for diverse audiences.

- Diversify revenue streams: Expanding into specialized localization services, such as AI-driven dubbing and subtitling, can create new and recurring revenue opportunities beyond traditional media production.

- Enhance competitive advantage: Investing in cutting-edge localization technology can differentiate Imagica Group from competitors and solidify its position as a leader in the media services sector.

Growth in Gaming and Interactive Media

The gaming and interactive media sector is experiencing significant growth, creating a robust demand for advanced 3D CGI production and visual effects. Imagica Group is well-positioned to capitalize on this trend, leveraging its expertise in CGI and visual solutions to capture a larger share of this expanding market.

Domestic sales in game 3DCG production have already shown positive performance, indicating a strong foundation for further expansion. For instance, the global games market was projected to reach $200 billion in 2024, with mobile gaming alone accounting for a substantial portion of this revenue. Imagica Group's ability to deliver high-quality visual content aligns perfectly with the industry's needs.

- Expanding Market: The global gaming market continues its upward trajectory, presenting significant opportunities for CGI and VFX services.

- Leveraging Expertise: Imagica Group's established capabilities in 3D CGI production are a direct asset for securing projects in this lucrative industry.

- Domestic Success: Recent strong sales in game 3DCG production highlight the company's existing traction and potential for further growth.

- Industry Demand: The increasing sophistication of game development fuels a consistent need for high-quality visual assets, a core offering of Imagica Group.

The burgeoning global digital media landscape, particularly the expansion of streaming services, offers Imagica Group a significant avenue to leverage its post-production, VFX, and CGI strengths. The Japanese video streaming market, for example, is projected for substantial growth, creating fertile ground for content creation and distribution.

Advancements in AI and emerging technologies present a key opportunity for Imagica to enhance operational efficiency and innovate visual content, building on its existing R&D in AI for animation and image processing. The integration of AI, which saw increased investment and adoption in 2024, could lead to substantial cost savings, potentially reducing post-production costs by 15-20% in certain areas through workflow automation.

Imagica's delisting via MBO provides the flexibility for aggressive growth through mergers and acquisitions, allowing it to acquire complementary businesses and expand market share. The acquisition of German media company mediafellows exemplifies this strategy.

The escalating global demand for content localization, fueled by the popularity of Asian media, positions Imagica to benefit by expanding its translation and dubbing services, including AI-driven solutions. This allows Imagica to tap into new international markets, diversify revenue streams, and enhance its competitive edge.

The robust growth in the gaming and interactive media sector creates a strong demand for advanced 3D CGI and visual effects, areas where Imagica has established expertise. The global games market was estimated to reach $200 billion in 2024, with mobile gaming a significant contributor, highlighting the market's potential for Imagica's high-quality visual content.

| Opportunity Area | Market Trend | Imagica's Advantage | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Digital Media Consumption | Growth in streaming services | Post-production, VFX, CGI expertise | Japanese video streaming market expansion |

| Technological Advancements | AI integration in creative workflows | R&D in AI for animation/image processing | AI adoption potentially reducing costs by 15-20% |

| Mergers & Acquisitions | Strategic flexibility post-MBO | Acquisition of complementary businesses | Acquisition of mediafellows |

| Content Localization | Increasing demand for localized content | Translation, dubbing, AI-powered solutions | Growing market for Asian media localization |

| Gaming & Interactive Media | Demand for 3D CGI and VFX | Established CGI and visual solutions expertise | Global games market projected at $200 billion (2024) |

Threats

Imagica Group faces significant challenges in the fiercely competitive media and entertainment sector, both within Japan and on the global stage. Major international and domestic companies in film, television, and streaming, alongside niche post-production specialists, are constantly vying for audience attention and client contracts.

This crowded market can lead to downward pressure on pricing and necessitates continuous investment in cutting-edge technology and creative talent to maintain a competitive edge. For instance, the global media and entertainment market was valued at approximately $2.5 trillion in 2023 and is projected to grow, but this growth is accompanied by intense rivalry among established giants and emerging digital platforms.

The media and entertainment landscape is constantly evolving, with new software, platforms, and AI tools emerging at an unprecedented pace. Imagica Group must stay ahead of these rapid technological shifts to remain competitive.

Failure to invest in and adapt to these innovations, such as advancements in virtual reality or personalized content delivery, could render existing offerings obsolete. For instance, the global AI in media market was projected to reach $3.8 billion in 2024, highlighting the significant investment required to leverage these technologies.

Keeping pace demands substantial and continuous financial commitment to research, development, and implementation of cutting-edge technologies. This ongoing expenditure is crucial for maintaining a competitive edge in a dynamic industry.

Broader economic downturns, like the potential slowdown anticipated in late 2024 or early 2025, can significantly impact the entertainment industry. This often translates to reduced production budgets for films and television shows, and a general decrease in advertising spend. For Imagica Group, which provides services to this sector, this means a direct vulnerability to economic contractions. We could see fewer projects commissioned and a lower overall demand for their offerings, directly affecting revenue streams.

Talent Shortages and Retention

Imagica Group faces a significant threat from talent shortages and retention challenges, particularly in specialized areas like visual effects, CGI, and advanced media production. The demand for these niche skills often outstrips supply.

Attracting and keeping top-tier talent in these competitive fields is an ongoing struggle. For instance, the global demand for skilled VFX artists is projected to grow, with reports indicating a shortage in many key markets as of early 2024.

This scarcity can lead to increased operational costs due to higher salary demands and recruitment expenses. Furthermore, a lack of readily available skilled professionals can directly impede Imagica's ability to deliver projects on time and to the high standards expected in the entertainment industry.

- High demand for specialized skills: Visual effects and CGI require expertise not easily found.

- Retention difficulties: Keeping highly skilled employees is a constant challenge in this sector.

- Cost implications: Talent shortages can drive up labor costs, impacting profitability.

- Project delivery impact: A lack of skilled personnel can delay or compromise project execution.

Data Security and Intellectual Property Risks

Imagica Group's handling of sensitive media content and vast client data makes it a prime target for cyber threats, including data breaches and intellectual property theft. A significant security lapse could result in substantial financial penalties, severe reputational damage, and a critical erosion of client confidence. For instance, the global average cost of a data breach reached $4.35 million in 2023, a figure that underscores the potential financial fallout.

The potential for intellectual property theft is also a major concern, particularly given the creative nature of Imagica's business. Protecting proprietary content and client information requires continuous investment in advanced security protocols and employee training. In 2024, cybersecurity spending by businesses worldwide is projected to exceed $200 billion, highlighting the industry's recognition of these pervasive risks.

- Cybersecurity threats pose a significant risk to Imagica's sensitive media and client data.

- Data breaches can lead to severe financial penalties, with global average costs reaching millions of dollars.

- Intellectual property theft is a critical concern for creative industries like Imagica's.

- Robust security measures and ongoing investment are essential to mitigate these threats.

Imagica Group operates in a highly competitive landscape, facing pressure from both international and domestic players in film, television, and streaming. This rivalry, coupled with the rapid evolution of media technologies like AI and VR, necessitates continuous and substantial investment to stay relevant. For example, the global AI in media market was projected to reach $3.8 billion in 2024, indicating the significant financial commitment required to leverage these advancements.

Economic downturns, anticipated for late 2024 and early 2025, pose a direct threat by reducing production budgets and advertising spend, impacting Imagica's service demand. Furthermore, a persistent challenge lies in securing and retaining specialized talent, such as VFX artists, where demand often outstrips supply, driving up labor costs and potentially hindering project delivery timelines. The global demand for skilled VFX artists was reported to be growing in early 2024, with shortages noted in many markets.

Cybersecurity risks are paramount, with sensitive media content and client data making Imagica a target for breaches and intellectual property theft. The global average cost of a data breach reached $4.35 million in 2023, highlighting the severe financial and reputational consequences of a security lapse. Businesses worldwide were projected to spend over $200 billion on cybersecurity in 2024, underscoring the critical need for robust protective measures.

SWOT Analysis Data Sources

This Imagica Group SWOT analysis is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.