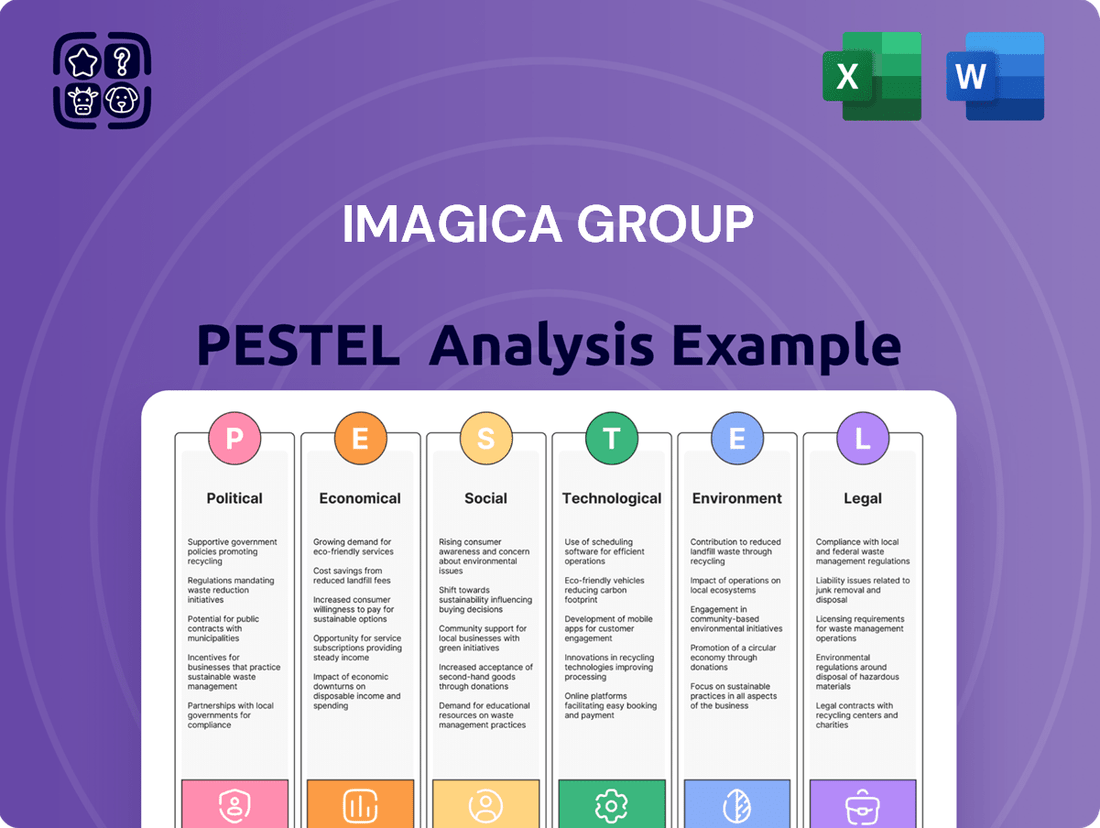

Imagica Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Navigate the dynamic landscape affecting Imagica Group with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks are shaping its future. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a critical understanding of the external forces impacting Imagica Group's operations and strategic direction. This expertly crafted PESTLE analysis provides deep insights into the factors that matter most for informed decision-making. Download the full version to unlock a strategic advantage.

Political factors

Governments worldwide are increasingly recognizing the economic and cultural significance of creative industries, leading to targeted support. For instance, the Indian government’s National Film Heritage Mission, launched in 2017 with a significant allocation, aims to preserve cinematic heritage, indirectly benefiting companies like Imagica by fostering a richer content ecosystem and potential for archival content utilization.

These support mechanisms, such as tax credits for film production or grants for digital innovation, directly reduce operational costs and encourage investment in new ventures. In 2023, several countries introduced or enhanced these incentives; for example, the UK's creative industries tax reliefs are estimated to have supported over £5.1 billion in production spending in 2022, a figure that continues to influence investment decisions across the sector.

Regulatory bodies worldwide, including those in India where Imagica World Entertainment operates, set strict guidelines for content. These can range from censorship rules and broadcasting standards to age ratings, directly influencing the creative output of entertainment companies. For instance, in 2024, India's Ministry of Information and Broadcasting continued to enforce regulations on digital content, impacting how companies like Imagica can present their films and shows.

Such policies can significantly restrict creative freedom, forcing Imagica Group to adapt its content for different markets or face potential legal repercussions. This necessitates careful planning in production pipelines and distribution strategies, ensuring compliance to maintain market access and avoid penalties. For example, a film deemed unsuitable for a particular age group in one region might require significant edits or a complete re-release strategy.

International trade relations significantly shape the landscape for companies like Imagica Group. Favorable bilateral and multilateral trade agreements can streamline the cross-border movement of media content, services, and intellectual property, directly benefiting Imagica's post-production and VFX operations by opening new global markets. For instance, the EU's Digital Single Market strategy aims to reduce barriers to digital services, potentially benefiting Imagica's service exports to European clients.

Conversely, protectionist policies or strained international relations can erect significant hurdles. These could manifest as increased tariffs on imported equipment necessary for Imagica's studios or restrictions on talent mobility, impacting the ability to source specialized skills globally. The ongoing trade discussions between major economies in 2024-2025 will be crucial in determining the extent of these potential impacts.

Intellectual Property Rights Enforcement

The strength and enforcement of intellectual property (IP) laws are paramount for Imagica Group, a business heavily reliant on its creative content. Strong IP protection is essential to prevent piracy and unauthorized use of its original content, visual effects, and proprietary technologies. This ensures Imagica receives fair compensation and can reinvest in developing new creative assets.

Weak IP enforcement can significantly impact Imagica's revenue streams and devalue its creative investments. For instance, the global market for counterfeit goods, which often infringes on IP, was estimated to be worth over $500 billion in recent years, highlighting the pervasive nature of IP theft. In India, where Imagica operates, the government has been working to strengthen IP enforcement mechanisms, with initiatives aimed at combating online piracy and improving the registration and protection of intellectual property.

- IP Protection: Robust enforcement safeguards Imagica's original content, visual effects, and proprietary technologies from piracy.

- Revenue Assurance: Effective IP laws ensure fair compensation for creative output, encouraging continued investment in new assets.

- Global Context: The global counterfeit goods market exceeding $500 billion underscores the importance of strong IP enforcement worldwide.

- Indian Initiatives: India's ongoing efforts to bolster IP enforcement, particularly against online piracy, are crucial for companies like Imagica.

Broadcasting and Telecommunications Policy Shifts

Shifts in broadcasting and telecommunications policy directly influence how Imagica Group delivers and monetizes its content. Regulations impacting internet service providers and streaming platforms, for instance, can alter bandwidth availability and digital distribution costs. In 2024, the Indian government continued to focus on digital infrastructure development, with initiatives aimed at expanding broadband access, which could positively impact Imagica's reach.

These policy changes can significantly affect Imagica's business model. For example, new rules on content licensing or data localization could necessitate operational adjustments. The Telecom Regulatory Authority of India (TRAI) has been actively involved in discussions around net neutrality and platform regulation, which are critical considerations for a digital media company like Imagica.

- Broadcasting Policy: Evolving regulations on content moderation and advertising standards in broadcasting.

- Telecommunications Infrastructure: Government investments in 5G rollout and fiber optic networks can enhance Imagica's streaming capabilities.

- Digital Distribution: Policy frameworks governing over-the-top (OTT) services and data privacy impact Imagica's direct-to-consumer strategies.

- Content Licensing: Changes in rules for acquiring and distributing content across various platforms.

Government support for creative industries, such as tax incentives and grants, directly benefits companies like Imagica by reducing costs and encouraging investment. For instance, the UK's creative industries tax reliefs supported over £5.1 billion in production spending in 2022. India's National Film Heritage Mission also fosters a richer content ecosystem.

Regulatory frameworks, including content censorship and broadcasting standards, directly influence Imagica's creative output and distribution strategies. India's Ministry of Information and Broadcasting continued enforcing digital content regulations in 2024, requiring careful adaptation for market compliance.

International trade policies and intellectual property (IP) enforcement significantly impact Imagica's global market access and revenue. Strong IP protection is crucial, especially as the global counterfeit goods market exceeds $500 billion, with India actively strengthening its IP enforcement mechanisms.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Imagica Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the Imagica Group's operating landscape.

A concise PESTLE analysis for Imagica Group that highlights key external factors, serving as a quick reference to alleviate concerns about market volatility and regulatory changes.

Economic factors

Japan's economic growth is a crucial driver for Imagica Group. In 2024, Japan's GDP growth is projected to be around 0.7%, a moderate but positive trend. This economic stability directly impacts consumer spending on entertainment, influencing demand for Imagica's services.

International markets also play a significant role. For instance, the US economy, a major market for media and entertainment, is expected to grow by approximately 1.9% in 2024. Stronger global economic conditions translate to increased production budgets for Imagica's clients, boosting revenue for its post-production and content creation divisions.

Conversely, economic slowdowns pose a risk. A significant downturn in major markets could lead to reduced advertising spend and lower investment in new film and television projects, directly impacting Imagica Group's top line. For example, a projected 0.5% contraction in a key European market in late 2024 could signal such a risk.

The advertising market is a crucial revenue stream for media companies, directly impacting their ability to fund content production. Digital advertising, especially programmatic buying, is reshaping client investment, favoring online platforms over traditional broadcast. This shift means more demand for high-quality visual content and post-production services, areas where Imagica Group operates.

In 2024, global advertising spending is projected to reach $700 billion, with digital advertising accounting for over 60% of this total. This robust growth in the ad market, driven by increased digital consumption, translates into greater opportunities for content creators and service providers like Imagica Group.

Imagica Group, with its Japanese base and international reach, faces significant exposure to currency exchange rate fluctuations, especially concerning the Japanese Yen (JPY). For instance, in early 2024, the Yen experienced periods of weakness against major currencies like the US Dollar, which could have positively impacted Imagica's foreign revenue when converted back to Yen.

A strengthening Yen, however, could make Imagica's services pricier for its overseas clientele, potentially dampening demand and impacting its competitive edge in the global market. Conversely, a weaker Yen can enhance the affordability of international acquisitions and boost the value of revenue earned from foreign operations.

Effective management of foreign exchange risk is therefore paramount for Imagica Group. For example, companies often employ hedging strategies, such as forward contracts, to lock in exchange rates and mitigate the impact of adverse currency movements on their financial performance.

Inflation and Operational Costs

Rising inflation presents a significant challenge for Imagica Group, directly impacting its operational costs. For instance, the cost of skilled labor, essential for creative industries, saw an upward trend. In India, average wages for creative professionals experienced an estimated increase of 7-10% in 2024. Energy expenses, crucial for powering studios and data centers, also climbed; India's wholesale price index for fuel and power was up by approximately 4.5% year-on-year as of early 2025.

These escalating costs can squeeze Imagica Group's profit margins if they cannot be effectively passed on to clients or offset by internal efficiencies. Strategic pricing adjustments become paramount in this environment. Furthermore, the company must focus on operational efficiency improvements, such as optimizing energy consumption and streamlining workflows, to maintain profitability amidst a competitive landscape.

- Increased Labor Costs: Skilled professionals in media and entertainment can see wage increases of 7-10% in 2024.

- Higher Energy Expenses: The wholesale price index for fuel and power in India rose approximately 4.5% year-on-year in early 2025.

- Equipment Procurement: The cost of acquiring new technology and equipment for production is also subject to inflationary pressures.

- Impact on Margins: Unmanaged cost increases can directly reduce profit margins, necessitating careful financial management.

Investment in Digital Infrastructure

Investment in digital infrastructure, like widespread high-speed internet and robust cloud computing, is a critical driver for companies in the visual solutions and media sectors. For Imagica Group, this means faster data handling, smoother remote teamwork, and the ability to leverage cutting-edge technologies, all of which directly enhance their service delivery and foster innovation.

Globally, digital infrastructure spending is on an upward trajectory. For instance, the global cloud computing market was valued at approximately $610 billion in 2023 and is projected to reach $1.3 trillion by 2028, indicating substantial private and public sector commitment. This growth directly supports Imagica Group's need for efficient data transfer and advanced technological adoption.

- Increased Bandwidth: Essential for high-definition media asset management and real-time collaboration.

- Cloud Adoption: Facilitates scalable storage, processing, and delivery of visual content.

- 5G Rollout: Promises lower latency and higher speeds, enabling new applications in media production and distribution.

- Government Initiatives: Many nations are investing heavily in broadband expansion to boost digital economies, creating a more favorable operating environment.

Economic growth directly fuels consumer spending on entertainment, a key factor for Imagica Group. Japan's GDP growth, projected around 0.7% in 2024, supports domestic demand, while global economic health, like the US's estimated 1.9% growth in 2024, impacts international client budgets for content production.

Fluctuations in currency exchange rates, particularly the Japanese Yen, significantly affect Imagica Group's international revenue and acquisition costs. For example, a weaker Yen in early 2024 could have boosted repatriated foreign earnings, while a stronger Yen might increase the cost of services for overseas clients.

Rising inflation, with estimated wage increases of 7-10% for Indian creative professionals in 2024 and a 4.5% rise in India's fuel and power wholesale price index by early 2025, directly increases Imagica Group's operational costs, potentially squeezing profit margins if not managed through pricing or efficiency gains.

Investment in digital infrastructure, such as the projected growth of the global cloud computing market from $610 billion in 2023 to $1.3 trillion by 2028, is crucial for Imagica Group's data handling, remote collaboration, and adoption of advanced technologies, enhancing service delivery and innovation.

| Economic Factor | 2024/2025 Data Point | Impact on Imagica Group |

| Japan GDP Growth | ~0.7% (2024 Projection) | Supports domestic consumer spending on entertainment. |

| US GDP Growth | ~1.9% (2024 Projection) | Influences international client budgets for content production. |

| Indian Creative Wages | 7-10% Increase (2024 Estimate) | Increases operational costs for skilled labor. |

| Global Cloud Market | $610B (2023) to $1.3T (2028 Projection) | Enables efficient data handling and technological adoption. |

What You See Is What You Get

Imagica Group PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis of the Imagica Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. You'll gain insights into market dynamics and strategic considerations.

Sociological factors

Consumers are increasingly shifting from traditional television to streaming services and short-form digital content, with platforms like YouTube and TikTok seeing massive engagement. For instance, global mobile video consumption is projected to reach over 100 billion hours per month by 2025, highlighting a significant move towards on-demand and mobile-first experiences.

This evolution in media habits directly affects Imagica Group's business by requiring a pivot in content creation and distribution strategies. The demand for content optimized for diverse digital platforms and varying screen sizes necessitates agile post-production and media asset management solutions, driving the need for efficient digital workflows to keep pace.

There's a surging global appetite for content that reflects diverse cultural backgrounds, with anime and Japanese dramas leading the charge. This presents a prime opportunity for Imagica Group, a Japan-based entity, to capitalize on its proficiency in local content production and visual effects. By focusing on authentic storytelling and cultural nuances, Imagica can cater to both its domestic and expanding international fan base.

The media and entertainment sector, particularly in specialized fields like visual effects (VFX) and computer-generated imagery (CGI), relies heavily on a workforce possessing advanced technical and creative proficiencies. Imagica Group's success is thus directly tied to the availability of such talent.

Globally, the demand for skilled professionals in VFX and animation has been steadily increasing. For instance, the global VFX market was valued at approximately $14.2 billion in 2023 and is projected to reach $26.7 billion by 2030, indicating a strong need for qualified individuals. However, emerging technologies such as artificial intelligence (AI) in content creation and virtual production present potential skills gaps. A 2024 report by the World Economic Forum highlighted that 40% of workers will require retraining in the next five years due to technological advancements, a trend that will undoubtedly affect specialized industries like media production.

This dynamic necessitates that Imagica Group proactively invests in talent development and educational initiatives. Such strategies are crucial for bridging any existing or future skills gaps, ensuring the company can effectively scale its operations and drive innovation in a rapidly evolving technological landscape.

Influence of Social Media on Content Trends

Social media platforms are undeniably shaping content trends, with platforms like TikTok and Instagram driving the demand for short-form, visually engaging content. Imagica Group must recognize this shift; for instance, TikTok's global user base surpassed 1.5 billion in 2024, highlighting its influence on audience preferences. This necessitates adapting content strategies to incorporate interactive elements and real-time engagement to capture attention in a crowded digital landscape.

The viral nature of social media marketing presents both opportunities and challenges for Imagica Group. Content that resonates can achieve rapid, widespread distribution, but failing to align with current online cultural moments can lead to invisibility. Understanding audience sentiment and emerging content formats is crucial for effective campaign planning and execution in 2024-2025.

Imagica Group can leverage social media for direct audience interaction, fostering community and gathering valuable feedback. This approach is supported by data showing that brands actively engaging on social media see higher customer loyalty. Key considerations include:

- Adaptation to short-form video formats: Catering to platforms like Reels and TikTok.

- Emphasis on interactive content: Utilizing polls, Q&As, and live sessions.

- Real-time trend monitoring: Quickly identifying and capitalizing on viral content opportunities.

- Data-driven content optimization: Using analytics to refine visual styles and narrative approaches.

Work-Life Balance and Employee Expectations

Societal shifts are increasingly prioritizing work-life balance, a trend that significantly impacts industries like entertainment and media where Imagica Group operates. Employees, especially those in creative roles, now expect more flexibility and a healthier integration of personal and professional lives. This evolving expectation directly affects Imagica's ability to attract and retain skilled talent in a competitive landscape.

To address this, Imagica Group needs to implement strategies that foster a supportive work environment. Offering flexible work arrangements, such as hybrid models or adjusted hours, alongside robust benefits packages and a positive company culture, are crucial. For instance, a 2024 survey indicated that 70% of job seekers consider work-life balance a top priority when evaluating potential employers.

Failure to adapt to these changing employee expectations can lead to higher turnover rates and decreased operational efficiency. A disengaged workforce, struggling with burnout, will inevitably impact the quality of creative output and overall staff morale. Imagica's proactive response to these sociological factors is therefore essential for its long-term success and sustainability.

Consumers are increasingly seeking content that reflects diverse cultural backgrounds, with a notable rise in the popularity of international genres like anime, which presents an opportunity for Imagica Group to leverage its expertise in local content production.

The media landscape is rapidly evolving with a significant shift towards digital and short-form content, as evidenced by the projected 100 billion+ monthly hours of global mobile video consumption by 2025, requiring Imagica to adapt its content creation and distribution strategies.

Societal expectations around work-life balance are impacting talent acquisition and retention, with a 2024 survey showing 70% of job seekers prioritizing this factor, necessitating flexible work arrangements and supportive company cultures from employers like Imagica.

The demand for skilled professionals in VFX and animation remains high, with the global VFX market projected to reach $26.7 billion by 2030, yet emerging technologies like AI in content creation necessitate proactive talent development and retraining initiatives for companies such as Imagica.

Technological factors

Artificial Intelligence and Machine Learning are rapidly evolving, offering Imagica Group opportunities to automate post-production, enhance visual effects, and even assist in content creation. For instance, AI-powered tools can streamline tasks like rotoscoping and color grading, potentially cutting production time significantly.

The company's investment in R&D for AI is crucial for staying competitive. This includes exploring AI for efficient media asset management and sophisticated content indexing, which can lead to cost savings and unlock new creative avenues. For example, the global AI market in media and entertainment was projected to reach $11.8 billion by 2024, indicating substantial growth and adoption.

The widespread adoption of cloud computing is revolutionizing post-production by enabling seamless remote collaboration on massive media files. This shift allows geographically dispersed teams to work together efficiently, boosting project turnaround times and fostering innovation. For Imagica Group, this means enhanced operational flexibility and a reduced reliance on physical infrastructure.

By embracing cloud-based workflows, Imagica Group can tap into a global talent pool, improving the quality and diversity of its creative output. This infrastructure also facilitates easier international partnerships, expanding market reach and operational efficiency. The global cloud computing market itself is projected to reach over $1 trillion by 2025, indicating the significant scale of this technological trend.

Virtual production, blending physical sets with real-time CGI, is transforming how content is made. This technology, along with sophisticated real-time rendering, allows for faster iteration and more visually impressive results.

Imagica Group, leveraging its existing VFX and CGI strengths, is well-positioned to integrate these advancements. This adoption can lead to more efficient production workflows, significantly cutting down post-production time and costs, a crucial factor in today's competitive market.

The market for virtual production services is experiencing rapid growth; for instance, the global virtual production market was valued at approximately $2.5 billion in 2023 and is projected to reach over $7.5 billion by 2028, indicating a substantial opportunity for companies like Imagica.

Cybersecurity Threats and Data Protection

Imagica Group, as a holder of significant media assets and sensitive customer information, is increasingly exposed to cybersecurity threats. These risks encompass data breaches, ransomware attacks, and the potential theft of intellectual property, all of which could severely damage its reputation and operational continuity.

To counter these escalating dangers, Imagica must maintain stringent cybersecurity measures and robust data protection protocols. This commitment is vital for preserving client confidence, adhering to evolving data privacy regulations, and securing its unique proprietary content. Continuous investment in advanced security infrastructure and comprehensive employee training programs are therefore non-negotiable necessities.

- Data Breach Impact: A significant data breach could lead to substantial financial penalties and loss of customer trust, impacting future revenue streams.

- Ransomware Costs: The average cost of a ransomware attack for businesses in 2024 is projected to exceed $1.5 million, a figure Imagica must actively mitigate.

- Intellectual Property Value: Protecting high-value digital assets, including film rights and creative content, is crucial for maintaining Imagica's competitive edge and market valuation.

- Regulatory Compliance: Adherence to data protection laws like GDPR and CCPA requires ongoing vigilance and investment in security frameworks.

Evolution of Immersive Technologies (VR/AR/Metaverse)

The rapid advancement of virtual reality (VR), augmented reality (AR), and the metaverse opens significant new frontiers for content creation and audience engagement. Imagica Group is well-positioned to capitalize on these trends by developing immersive experiences, interactive digital content, and virtual spaces, thereby diversifying its portfolio beyond conventional media. This strategic pivot can introduce novel revenue streams and attract a new demographic of users.

The global metaverse market is projected to reach substantial figures, indicating strong future growth potential. For instance, some reports suggest the metaverse could contribute trillions to the global economy by 2030. Imagica’s expertise in entertainment production can be leveraged to create compelling VR/AR content for gaming, education, and virtual events, tapping into this expanding market.

- Market Growth: The AR and VR market size was valued at approximately USD 28.9 billion in 2023 and is expected to grow significantly, with projections reaching over USD 200 billion by 2028.

- Content Demand: There's a growing consumer appetite for interactive and immersive entertainment, with VR gaming revenue alone expected to see a compound annual growth rate (CAGR) of over 15% in the coming years.

- Investment: Major tech companies are investing heavily in metaverse development, with billions allocated to R&D and platform creation, signaling a long-term commitment to these immersive technologies.

Emerging technologies like AI and machine learning offer Imagica Group significant opportunities to enhance its production processes, from automating post-production tasks to improving content creation. For instance, the global AI in media and entertainment market was projected to reach $11.8 billion by 2024, highlighting the potential for efficiency gains.

Cloud computing is fundamentally changing post-production by enabling seamless remote collaboration, which boosts project turnaround times and allows access to a global talent pool. The global cloud computing market is expected to exceed $1 trillion by 2025, underscoring its critical role in operational flexibility.

Virtual production, which merges physical sets with real-time CGI, is transforming content creation, allowing for faster iterations and more visually impactful results. The virtual production market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially.

The increasing sophistication of cybersecurity threats necessitates robust data protection measures for Imagica Group, especially concerning intellectual property and customer data. The average cost of a ransomware attack for businesses in 2024 is anticipated to surpass $1.5 million, emphasizing the need for strong defenses.

| Technology Area | Opportunity/Risk | Market Data/Projection |

| AI & Machine Learning | Production Automation, Content Creation | AI in Media & Entertainment Market: $11.8B (2024 Projection) |

| Cloud Computing | Remote Collaboration, Operational Flexibility | Global Cloud Computing Market: >$1T (2025 Projection) |

| Virtual Production | Efficient Workflows, Visual Enhancement | Virtual Production Market: ~$2.5B (2023 Value), >$7.5B (2028 Projection) |

| Cybersecurity | Data Breach Risk, IP Theft | Ransomware Attack Cost: >$1.5M (2024 Average Projection) |

Legal factors

Imagica Group's reliance on original content, including visual effects and CGI, makes robust copyright and intellectual property (IP) laws absolutely critical. These laws protect the company's creative output, ensuring its unique visual elements and digital assets are legally secured against unauthorized duplication or use. For instance, in 2024, the global market for digital content creation and licensing is projected to see continued growth, underscoring the value of strong IP protection.

Adherence to IP regulations is paramount for Imagica Group's licensing deals and for preventing costly infringements. Protecting its creative assets across various jurisdictions is essential for maintaining revenue streams and brand integrity. A 2023 report indicated that IP-related disputes can result in millions of dollars in damages and significant reputational harm, a risk Imagica must actively mitigate.

Imagica Group's operations necessitate strict adherence to data privacy laws. For instance, Japan's Act on the Protection of Personal Information (APPI) governs how personal data is collected, used, and stored, impacting Imagica's client and employee data management. Non-compliance can lead to significant penalties, reinforcing the importance of robust data governance practices.

Imagica Group must navigate Japan's stringent labor laws, which dictate working hours, minimum wages, and workplace safety standards. For instance, Japan's Industrial Safety and Health Act mandates specific safety protocols, and the Labor Standards Act sets limits on overtime, with penalties for violations. Compliance ensures fair treatment for all employees, from administrative staff to highly skilled creative professionals, fostering a positive work environment and mitigating legal risks.

Content Licensing and Distribution Agreements

The legal framework governing content licensing and distribution agreements is fundamental to Imagica Group's revenue streams. Navigating these complex contracts, which detail rights, territorial limitations, royalty payments, and digital distribution channels, is essential for market expansion and effective monetization of their intellectual property.

For instance, the global digital content market was valued at approximately $3.1 trillion in 2023 and is projected to grow significantly. Imagica Group's success hinges on its ability to secure favorable licensing terms within this dynamic landscape.

- Regulatory Compliance: Adherence to intellectual property laws, copyright regulations, and data privacy standards is paramount for all distribution agreements.

- Contractual Clarity: Well-defined clauses regarding usage rights, territory, duration, and revenue sharing prevent disputes and ensure predictable income.

- Digital Distribution Challenges: Evolving digital rights management (DRM) technologies and platform-specific terms require constant legal review and adaptation.

- Cross-Border Agreements: International licensing necessitates understanding and complying with diverse legal systems and intellectual property treaties.

Antitrust and Competition Laws

Imagica Group operates within a media and entertainment sector closely monitored by antitrust and competition laws. These regulations aim to prevent market monopolization and foster fair competition, impacting how Imagica can grow through mergers, acquisitions, or strategic alliances. For instance, the Competition Commission of India (CCI) actively scrutinizes deals within the entertainment sector to ensure they don't stifle competition. Failure to comply can lead to significant penalties and limitations on future business ventures, as seen in past CCI investigations into other media entities.

Ensuring adherence to these legal frameworks is crucial for Imagica's sustained market presence and expansion. The company must navigate regulations that govern pricing, content distribution, and potential collaborations to avoid legal repercussions. In 2024, the CCI continued its focus on digital markets, which could indirectly influence Imagica's digital content strategies and partnerships. This proactive legal compliance safeguards against potential fines and operational disruptions.

- Regulatory Oversight: Antitrust laws prevent market dominance and promote a competitive landscape for companies like Imagica.

- Compliance Necessity: Mergers, acquisitions, and partnerships require careful review to ensure adherence to competition regulations.

- Market Expansion Impact: Non-compliance can result in fines, legal challenges, and restrictions on growing market share.

- Industry Scrutiny: The media and entertainment industry, including digital platforms, faces ongoing scrutiny from competition authorities globally.

Imagica Group's operations are significantly shaped by intellectual property (IP) and copyright laws, which are vital for protecting its original content, including visual effects and CGI. These legal protections are essential for securing unique digital assets and preventing unauthorized use, especially as the global digital content market continues its growth trajectory, projected to reach trillions by 2025.

Navigating complex licensing agreements and cross-border distribution necessitates a thorough understanding of international IP treaties and digital rights management. For instance, the value of IP in the entertainment sector is immense, with disputes often costing millions, highlighting the need for robust legal strategies to safeguard revenue streams and brand integrity.

| Legal Factor | Impact on Imagica Group | Data/Trend (2024-2025) |

|---|---|---|

| Intellectual Property & Copyright | Protects original content, visual effects, and CGI; crucial for licensing revenue. | Global digital content market expected to exceed $3.5 trillion by 2025, emphasizing IP value. |

| Data Privacy Laws | Governs collection, use, and storage of client and employee data. | Increased regulatory focus on data protection globally, with significant penalties for non-compliance. |

| Labor Laws | Dictates working hours, wages, and safety standards for employees. | Continued emphasis on fair labor practices and workplace safety across all operational regions. |

| Antitrust & Competition Laws | Regulates mergers, acquisitions, and strategic alliances to ensure fair market practices. | Growing scrutiny of digital platforms and content distribution deals by competition authorities. |

Environmental factors

The film and television industry is increasingly prioritizing environmental sustainability, pushing production companies towards greener methods. Imagica Group, a significant player, can lead by adopting eco-friendly workflows, including waste reduction and energy optimization in its studios. This commitment to responsible production, such as using recycled materials or implementing energy-efficient lighting, can attract clients who value environmental consciousness.

Visual effects and post-production, particularly high-resolution rendering and extensive data storage, demand substantial energy. Imagica Group's data centers, render farms, and studios are significant power consumers, directly impacting operational costs.

In 2024, the global data center energy consumption was estimated to be around 1.5% of total global electricity usage, a figure projected to rise. For Imagica Group, optimizing hardware efficiency, integrating renewable energy sources like solar or wind power for their facilities, and streamlining workflows are vital for both cost reduction and showcasing environmental stewardship.

Imagica Group's studios and production sites generate diverse waste streams, including construction debris, props, and e-waste. Effective waste management is crucial for environmental stewardship and regulatory adherence. For instance, in 2023, the Indian waste management sector saw significant growth, with the government aiming to process over 60% of municipal solid waste by 2025, highlighting a growing emphasis on recycling and responsible disposal.

Pressure for Corporate Social Responsibility (CSR)

Stakeholders, from investors to employees and clients, are increasingly focused on a company's environmental and social governance (ESG) performance. For Imagica Group, this translates into a significant push to showcase robust corporate social responsibility. This includes being transparent about its environmental footprint, ensuring ethical labor practices, and actively engaging with the community. These efforts directly impact its reputation, attractiveness to investors, and relationships with clients.

The demand for demonstrated CSR is growing, with global ESG investments expected to surpass $33.9 trillion by 2026, according to Bloomberg Intelligence. Imagica Group's ability to meet these expectations can become a key differentiator. A strong CSR profile isn't just about compliance; it's a strategic advantage that can enhance brand loyalty and attract top talent.

- Growing ESG Investment: Global ESG investments are projected to reach $33.9 trillion by 2026, highlighting investor demand for responsible corporate behavior.

- Stakeholder Scrutiny: Investors, employees, and clients are actively evaluating companies' environmental and social impact.

- Reputational Impact: Transparent reporting on environmental impact, ethical labor, and community engagement directly influences Imagica Group's public image.

- Competitive Edge: A strong CSR strategy can differentiate Imagica Group in the market, attracting both capital and customers.

Climate Change Impact on Infrastructure

While not as immediately apparent as other PESTLE factors, climate change poses a subtle yet significant long-term threat to Imagica Group's physical assets and operational flow. Extreme weather events, like increased flooding or unseasonal heatwaves, could disrupt supply chains or impact employee accessibility to facilities, necessitating robust contingency planning. For instance, the Indian Meteorological Department has projected an increase in the frequency and intensity of extreme rainfall events in certain regions of India, a key operating area for Imagica. This macro-level risk demands strategic foresight in infrastructure resilience and business continuity measures.

Imagica's infrastructure, including theme parks and entertainment venues, could face direct physical damage from escalating climate-related disasters. The company must consider investments in climate-resilient design and operational adjustments to safeguard against potential disruptions. For example, a 2024 report by the World Meteorological Organization highlighted a global trend of rising insurance costs for climate-vulnerable infrastructure, a factor that could influence Imagica’s operational expenses and capital allocation strategies.

- Increased Frequency of Extreme Weather: Projections indicate a rise in events like heavy rainfall and heatwaves impacting India.

- Infrastructure Vulnerability: Theme parks and operational sites may require upgrades for resilience against climate impacts.

- Supply Chain Disruption: Climate events can affect the transport of goods and services essential for Imagica's operations.

- Employee Commuting Challenges: Adverse weather can hinder staff access to workplaces, impacting service delivery.

The increasing focus on environmental sustainability within the film and television sector pressures Imagica Group to adopt greener production methods. Optimizing energy consumption in data centers and studios is crucial, as global data center energy use was around 1.5% of total global electricity in 2024, a figure expected to climb. Effective waste management is also vital, with India aiming to process over 60% of municipal solid waste by 2025, reflecting a broader trend towards recycling and responsible disposal.

Growing investor demand for strong ESG performance, with global ESG investments projected to exceed $33.9 trillion by 2026, makes corporate social responsibility a strategic advantage for Imagica Group. Addressing climate change risks, such as potential disruptions from extreme weather events, is also essential, with India experiencing an increase in extreme rainfall frequency. This necessitates investments in climate-resilient infrastructure to mitigate operational impacts and rising insurance costs, as noted in a 2024 World Meteorological Organization report.

| Environmental Factor | Description | Relevant Data/Trend |

| Sustainability in Production | Industry shift towards eco-friendly workflows. | Growing demand for responsible production practices. |

| Energy Consumption | High energy demand from studios and data centers. | Global data center energy consumption ~1.5% of global electricity in 2024, projected to rise. |

| Waste Management | Generation of diverse waste streams from operations. | India's goal to process >60% of municipal solid waste by 2025. |

| ESG Performance | Stakeholder focus on environmental and social governance. | Global ESG investments to surpass $33.9 trillion by 2026. |

| Climate Change Impact | Risks from extreme weather events to assets and operations. | Projected increase in extreme rainfall frequency in India. Rising insurance costs for climate-vulnerable infrastructure globally. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Imagica Group is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the entertainment and media landscape.