Imagica Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Imagica Group navigates a competitive landscape shaped by moderate buyer power and the constant threat of substitutes, particularly in the entertainment sector. Understanding the intensity of rivalry among existing players is crucial for pinpointing their strategic positioning.

The complete report reveals the real forces shaping Imagica Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Imagica Group's reliance on specialized talent, like VFX artists and CGI specialists, means these professionals can demand higher compensation due to their unique, in-demand skills. This concentration of expertise in the creative sector grants significant bargaining power to these individuals and the agencies that employ them.

Furthermore, access to cutting-edge technology, particularly advanced AI tools for content creation and editing, is controlled by a limited number of specialized providers. These technology suppliers, offering essential hardware and software, wield considerable leverage over companies like Imagica.

The visual effects market, a key area for Imagica, is seeing substantial growth, partly due to AI integration in rendering processes. This AI adoption necessitates significant investments in storage capacity and complex system integration, further bolstering the negotiating position of technology providers who offer these critical solutions.

Proprietary software and high-end hardware vendors wield significant influence over companies like Imagica Group. This power stems from the specialized nature of their offerings in visual effects, animation, and media asset management, coupled with substantial switching costs. Transitioning to different providers often involves considerable expense, workflow disruption, and the need for staff retraining, effectively locking in clients.

For instance, the reliance on specific software suites for complex animation pipelines means that changing vendors can halt production. The global AI in media and entertainment market, expected to reach over $30 billion by 2027, underscores the increasing dependence on advanced technological solutions, often from a limited number of key suppliers.

In content production, holders of valuable intellectual property (IP) and original content rights, like popular anime franchises or film concepts, wield significant bargaining power. Imagica Group, as a content producer, often needs to license these assets. The cost and terms of these licenses directly impact profitability and competitive positioning.

The escalating value of intellectual property assets within television and film production studios underscores this supplier power. For instance, major studios in 2024 continued to command premium rates for their established IP, reflecting strong demand and limited availability of comparable content. This trend directly influences Imagica's cost of goods sold for content acquisition.

Infrastructure and Studio Space Providers

The bargaining power of infrastructure and studio space providers for Imagica Group is significant, particularly in a market like Japan. Access to high-specification soundstages and specialized facilities can be a major leverage point for landlords. This is especially true as the demand for quality production spaces continues to rise, driven by both domestic and international productions.

While investments in virtual production studios are increasing, the overall availability of suitable studio space can remain constrained. Local productions often receive priority, potentially leading to higher rental costs or limited access for companies like Imagica Group. This dynamic can directly impact Imagica's operational costs and production scheduling flexibility.

- Limited Availability: The scarcity of high-spec studio space in competitive markets grants providers considerable leverage.

- Prioritization of Local Productions: This practice can reduce availability and increase costs for international or non-local entities.

- Technological Investments: While virtual production is growing, traditional high-spec facilities remain in demand, maintaining supplier power.

Specialized Education and Training Institutions

Specialized education and training institutions that provide media education and specialized programs in areas like visual effects (VFX) and computer-generated imagery (CGI) possess a notable bargaining power. These institutions are vital for supplying Imagica Group with a workforce equipped with the essential skills for modern media production, including post-production and advanced visual solutions.

The rapid technological advancements, especially the increasing integration of Artificial Intelligence (AI) in media creation, are amplifying the demand for professionals adept at using these new tools. For instance, the global AI in media market was projected to reach approximately $2.7 billion in 2024 and is expected to grow significantly, underscoring the critical role of these educational providers in talent development.

- Talent Pipeline: Educational institutions act as a primary source for skilled talent, giving them leverage in curriculum development and placement services.

- Niche Expertise: The specialized nature of VFX, CGI, and AI-driven media production means fewer institutions offer this training, concentrating supply.

- Industry Relevance: As technology shifts, institutions that adapt their curricula to include AI and new software become indispensable for companies like Imagica.

- Demand for Skills: The growing complexity of visual effects and the adoption of AI in content creation directly translate to higher demand for graduates from these specialized programs.

Imagica Group faces significant supplier power from entities controlling specialized talent and proprietary technology. The demand for VFX artists and CGI specialists, coupled with the limited availability of advanced AI tools, allows these suppliers to command higher prices and dictate terms. This is further exacerbated by high switching costs associated with specialized software and hardware, effectively locking in clients and strengthening the suppliers' negotiating position.

Holders of valuable intellectual property (IP) also exert considerable influence, as licensing these assets is crucial for content production. The increasing value of established IP in 2024 means studios can charge premium rates, directly impacting Imagica's production costs. Similarly, providers of high-specification studio spaces, particularly in competitive markets, leverage limited availability and prioritization of local productions to increase rental costs.

| Supplier Category | Key Leverage Points | Impact on Imagica Group |

|---|---|---|

| Specialized Talent (VFX, CGI) | Unique, in-demand skills; concentration of expertise | Higher labor costs; potential talent acquisition challenges |

| Technology Providers (AI, Software, Hardware) | Control of cutting-edge tools; high switching costs | Increased technology acquisition costs; dependence on specific vendors |

| Intellectual Property (IP) Holders | Ownership of valuable content rights | Higher licensing fees; impact on content acquisition budget |

| Studio Space Providers | Limited availability of high-spec facilities; prioritization of local productions | Increased rental costs; potential production scheduling constraints |

What is included in the product

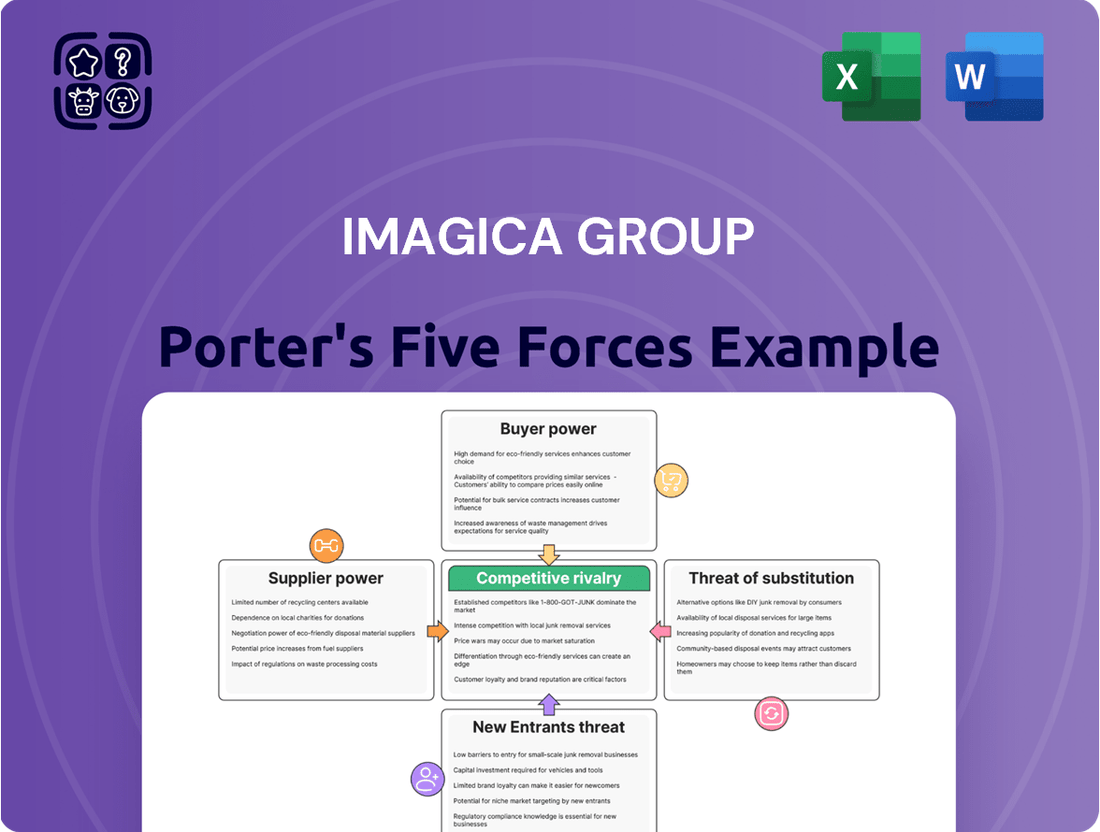

This analysis of Imagica Group's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Major entertainment studios and broadcasters act as significant customers for Imagica Group's post-production and visual effects services. These large entities, often commissioning substantial projects, wield considerable bargaining power. Their ability to select from various service providers means they can negotiate favorable terms, impacting Imagica's pricing and profit margins.

The bargaining power of customers is amplified by the sheer number of streaming platforms and digital media companies seeking content. These entities, including major players in the burgeoning Japanese OTT market projected to hit USD 8.4 billion by 2025, have a wide array of choices for animation, VFX, and personalized content. This creates a strong negotiating position for them.

Customers in this sector are highly discerning, prioritizing both high-quality output and cost-effectiveness. They demand efficient solutions and competitive pricing, putting pressure on suppliers like Imagica Group to deliver superior services without inflated costs. Their ability to switch providers easily if demands aren't met further strengthens their leverage.

Large advertising agencies and major corporate clients hold significant bargaining power over VFX and CGI service providers like those within Imagica Group. They can dictate specific creative visions, impose stringent deadlines, and negotiate aggressively on pricing. This power is amplified by the growing digital advertising landscape, where clients demand efficient and secure management of a vast array of media assets.

Individual Content Creators and Smaller Studios

Individual content creators and smaller studios, while lacking the sheer volume of larger clients, wield increasing bargaining power. The widespread availability of advanced, often AI-driven, production tools democratizes content creation, offering them a broader selection of service providers. This can translate into a greater sensitivity to pricing and a demand for adaptable, scalable solutions.

This dynamic pressures companies like Imagica Group to consider more accessible service tiers and flexible pricing strategies. For instance, the global creator economy, valued at over $250 billion in 2023, highlights the growing influence of these smaller entities. Their collective demand for cost-effective and adaptable solutions means Imagica Group must remain competitive in its service offerings.

- Democratization of Tools: Access to AI video editing and content creation platforms expands creator options.

- Price Sensitivity: Individual creators and small studios often prioritize cost-effectiveness.

- Demand for Flexibility: Scalable and adaptable service models are increasingly sought after.

- Market Influence: The substantial growth of the creator economy amplifies the collective bargaining power of smaller players.

Media Education Students and Institutions

In media education, students and institutions hold significant bargaining power. The proliferation of diverse digital learning platforms, many now featuring advanced AI capabilities, provides students with numerous alternatives. For instance, by 2024, the global e-learning market was projected to reach over $400 billion, highlighting the intense competition and the need for institutions like those within Imagica Group to offer compelling value propositions.

This power is amplified by the increasing demand for specialized skills and demonstrable career outcomes. Students are discerning, evaluating not just the curriculum but also the integration of cutting-edge technology and the tangible return on investment in terms of job placement and salary potential. A 2023 survey indicated that over 70% of students consider career services and alumni networks a key factor in their educational choices.

- Student Choice: A vast array of online and blended learning options, including AI-driven personalized learning paths, gives students leverage.

- Cost Sensitivity: Tuition fees and the overall cost of education are critical considerations, pushing institutions to offer competitive pricing and value.

- Career Focus: The demonstrable employability and earning potential post-graduation are paramount, influencing student enrollment decisions.

- Technological Integration: The adoption of innovative teaching tools and platforms, including AI, directly impacts an institution's attractiveness.

Customers, particularly large entertainment studios and broadcasters, possess substantial bargaining power due to their significant order volumes and the availability of alternative service providers for post-production and visual effects. This leverage allows them to negotiate favorable pricing and terms, directly influencing Imagica Group's profitability. The increasing demand from streaming platforms, a market projected to grow substantially, further empowers these clients.

The collective influence of individual content creators and smaller studios is also growing, driven by the democratization of production tools and the expansion of the creator economy, valued at over $250 billion in 2023. These smaller entities prioritize cost-effectiveness and demand flexible, scalable solutions, compelling companies like Imagica Group to adapt their service offerings and pricing strategies to remain competitive.

In the educational sector, students and institutions are discerning customers, evaluating not only curriculum but also technological integration and career outcomes. With the global e-learning market exceeding $400 billion by 2024, students have numerous choices, making institutions like those within Imagica Group focus on delivering strong value propositions and demonstrable ROI.

| Customer Segment | Bargaining Power Factors | Impact on Imagica Group |

|---|---|---|

| Major Studios/Broadcasters | High volume orders, numerous alternatives | Negotiate lower prices, tighter margins |

| Streaming Platforms | Growing market, diverse content needs | Demand competitive pricing and specialized services |

| Individual Creators/Small Studios | Democratized tools, creator economy growth | Push for flexible pricing, scalable solutions |

| Educational Institutions/Students | E-learning market expansion, career focus | Require strong value, technological integration, and demonstrable outcomes |

What You See Is What You Get

Imagica Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis of the Imagica Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted report you will receive immediately after completing your purchase, offering no surprises or placeholder content. You can confidently expect to download this comprehensive analysis, ready for immediate use and application to your business strategy.

Rivalry Among Competitors

The media and entertainment sector in Japan, especially in the realms of post-production and visual effects (VFX), is a crowded space. A multitude of domestic and international companies vie for market share, creating a highly competitive environment.

This intense rivalry is fueled by the market's growth potential. The Japanese animation, VFX, and post-production market is projected to reach USD 8.62 billion by 2025. Such promising growth naturally draws in new competitors, further intensifying the existing competition.

The entertainment industry, including Imagica Group's sector, is experiencing intense rivalry fueled by rapid technological advancements. The integration of Artificial Intelligence (AI) across content creation, post-production, and visual effects is a significant factor. Companies are heavily investing in AI-powered tools to boost efficiency and cut costs, making innovation crucial for market leadership.

For instance, the global AI in media and entertainment market was valued at approximately $3.5 billion in 2023 and is projected to reach over $15 billion by 2028, indicating a compound annual growth rate of around 34%. This surge in AI adoption means businesses like Imagica Group must continuously upgrade their technological capabilities to remain competitive.

Imagica Group contends with both domestic Japanese animation studios, many with decades of experience, and increasingly, international entertainment powerhouses. The global success of Japanese films, such as the critically acclaimed 'Godzilla Minus One' which grossed over $100 million worldwide by early 2024, underscores the high quality of Japanese productions and signals a growing appetite for them internationally. This success can, in turn, intensify competition by drawing more global players into the Japanese market or by raising the bar for local studios aiming for international distribution.

Service Diversification and Specialization

Imagica Group faces intense competitive rivalry stemming from both specialized niche players and broad-spectrum service providers. Competitors might distinguish themselves by focusing on particular areas, such as advanced visual effects for blockbuster films or unique animation styles for children's content, or by offering a comprehensive suite of integrated services that mirror Imagica’s own model.

Imagica's extensive service portfolio, encompassing post-production, media asset management, content production, VFX, CGI, studio operations, and media education, positions it against a diverse array of rivals in each segment. For instance, in the VFX segment, Imagica competes with studios known for their specialized CGI capabilities, while in content production, it faces competition from companies with established relationships in broadcast and digital media.

- Niche Specialization: Competitors focusing on specific VFX techniques or animation styles can offer highly specialized expertise, potentially attracting clients seeking those particular skills.

- Integrated Service Providers: Companies offering a broad range of visual solutions, similar to Imagica, create direct competition across multiple service lines.

- Imagica's Broad Offering: Imagica’s comprehensive visual solutions, including post-production, media asset management, content production, VFX, CGI, studio operations, and media education, mean it competes across multiple segments, each with its own competitive dynamics.

Pricing Pressures and Cost Efficiency

The entertainment and media industry, where Imagica Group operates, is characterized by intense competition, often translating into significant pricing pressures. To thrive, companies must constantly seek ways to reduce costs. Those that can leverage technology, such as AI for more efficient post-production processes, or streamline their operational workflows, gain a crucial edge.

Imagica Group's financial performance highlights this challenge. For instance, the company has reported net losses in certain periods, and has undertaken workforce reductions in some of its business segments. These actions underscore the critical need for stringent cost management to maintain competitiveness in a market where price sensitivity can heavily influence consumer choices and profitability.

- Pricing Pressures: Intense rivalry necessitates competitive pricing strategies.

- Cost Efficiency Advantage: Technological adoption, like AI in post-production, drives cost savings.

- Operational Optimization: Streamlining workflows is key to reducing overhead.

- Imagica's Financial Context: Reported net losses and workforce adjustments signal the importance of cost control.

Imagica Group faces a highly competitive landscape in Japan's media and entertainment sector, particularly in post-production and VFX. This rivalry is intensified by the market's growth, projected to reach USD 8.62 billion by 2025, attracting both domestic and international players. The rapid integration of AI in content creation, with the global AI in media market valued at $3.5 billion in 2023 and expected to exceed $15 billion by 2028, further escalates competition as companies invest heavily in technological advancements to boost efficiency and reduce costs.

Competitors range from specialized niche studios to broad-spectrum service providers, each vying for market share across Imagica's diverse offerings, including post-production, VFX, CGI, and content production. The success of Japanese films like 'Godzilla Minus One,' grossing over $100 million globally by early 2024, highlights the quality of local productions and can attract more international competition. This intense rivalry often leads to significant pricing pressures, making cost efficiency and operational optimization, particularly through technology adoption, critical for maintaining profitability, especially given Imagica's past financial challenges such as reported net losses and workforce adjustments.

| Competitive Factor | Description | Impact on Imagica Group |

| Market Growth | Japan's post-production and VFX market projected to reach USD 8.62 billion by 2025. | Attracts new entrants, increasing overall competition. |

| Technological Advancements (AI) | Global AI in media market: $3.5 billion (2023) to >$15 billion (2028). | Requires continuous investment in AI to maintain efficiency and competitiveness. |

| Competitor Landscape | Niche specialists and integrated service providers. | Imagica must differentiate services across its broad portfolio (post-production, VFX, CGI, etc.). |

| Pricing Pressures | Intense rivalry leads to aggressive pricing strategies. | Necessitates strong cost management and operational efficiency. |

SSubstitutes Threaten

Large entertainment conglomerates and major broadcasters might choose to bolster their internal post-production, visual effects, and media asset management departments. This strategic shift would diminish their need for external services, directly impacting companies like Imagica Group.

With the increasing affordability and accessibility of advanced technology, particularly with AI advancements, some clients may find it more economical to manage specific production elements in-house. This is especially true for more standardized tasks that can be efficiently handled through automation.

The rise of generative AI and automated content creation tools presents a significant threat of substitution for Imagica Group. These tools can now produce articles, images, and even videos with remarkable speed and quality, potentially reducing the demand for traditional content creation services. For instance, by mid-2024, AI-powered content generation platforms are estimated to have captured a notable portion of the digital content market, impacting agencies that rely on human-driven creativity for routine tasks.

The growing accessibility of off-the-shelf software and cloud-based platforms for tasks like video editing and graphic design presents a significant threat of substitutes for Imagica Group. These readily available tools, often with lower upfront costs and flexible subscription models, can fulfill the needs of smaller clients or those with simpler projects, bypassing the need for Imagica's more integrated services.

For example, the media asset management sector is increasingly shifting towards cloud solutions, driven by their scalability and cost advantages. In 2024, the global cloud-based digital asset management market was valued at approximately $4.5 billion and is projected to grow substantially, indicating a strong preference for these more accessible alternatives.

Alternative Entertainment and Media Forms

Consumers are increasingly flocking to digital platforms, with the global gaming market alone projected to reach over $200 billion in 2024. This presents a significant threat to traditional entertainment forms that Imagica Group might produce. The rise of user-generated content and short-form video platforms means consumers have readily available, often free, alternatives to professionally produced films and television.

This substitution effect directly impacts demand for services reliant on high-end visual effects and post-production. For instance, the continued growth of esports and interactive streaming services diverts significant entertainment spending and attention away from cinema and traditional broadcast media. By 2024, mobile gaming is expected to account for a substantial portion of this burgeoning market.

- Digital Entertainment Dominance: The global gaming market is set to surpass $200 billion in 2024, indicating a massive shift in consumer entertainment spending.

- User-Generated Content: Platforms like TikTok and YouTube offer a vast, often free, alternative to professionally produced media, impacting demand for traditional content.

- Interactive Media Growth: The increasing popularity of esports and interactive streaming services further fragments the entertainment landscape, drawing audiences away from cinema and television.

Outsourcing to Lower-Cost Regions or Freelancers

The threat of substitutes for Imagica Group's services, particularly in post-production and visual effects (VFX), is significant. Clients can opt to outsource these tasks to regions with substantially lower labor costs, especially for projects that are not highly complex or are driven by volume. For instance, countries in Eastern Europe and Southeast Asia have seen a rise in VFX outsourcing, offering competitive pricing that can undercut established players.

Furthermore, the increasing accessibility of advanced technology has democratized the industry. This allows a wider array of individual artists and smaller studios to offer specialized services. These smaller entities can often provide more agile and cost-effective solutions compared to larger, more established companies like Imagica Group. In 2024, the global VFX market was valued at approximately $15.8 billion, with a growing segment driven by these more flexible, smaller-scale providers.

- Cost Advantage: Outsourcing to lower-cost regions offers significant savings on labor, a major component of post-production and VFX.

- Technological Accessibility: Advanced software and hardware are now more accessible, enabling smaller studios and freelancers to compete on technical capability.

- Specialization: Niche studios and individual artists can offer highly specialized skills that might be more cost-efficient than a full-service provider for specific tasks.

- Market Dynamics: The rise of independent filmmakers and streaming services demanding content at various budget levels further fuels the demand for flexible and affordable outsourcing options.

The threat of substitutes for Imagica Group is multifaceted, stemming from both technological advancements and evolving consumer behavior. Generative AI and automated content creation tools are rapidly improving, offering a faster and potentially cheaper alternative for certain content needs. Furthermore, the increasing accessibility of advanced software and cloud platforms allows smaller players and even in-house teams to handle tasks previously exclusive to specialized companies like Imagica.

The entertainment landscape itself is a significant source of substitution. The burgeoning gaming market, projected to exceed $200 billion in 2024, alongside the dominance of user-generated content on platforms like TikTok and YouTube, diverts consumer attention and spending away from traditional media. This shift means less demand for services focused on high-end visual effects and post-production for films and television.

Clients also have the option to outsource post-production and VFX to regions with lower labor costs, particularly for less complex projects. The global VFX market, valued around $15.8 billion in 2024, sees a growing segment driven by these more agile, cost-effective providers, posing a direct challenge to established firms.

| Substitute Category | Description | 2024 Market Relevance |

|---|---|---|

| AI Content Generation | Automated creation of articles, images, videos. | Capturing a notable portion of the digital content market. |

| Cloud-Based DAM | Scalable and cost-effective media asset management. | Global market valued at approx. $4.5 billion, with strong growth. |

| Gaming & Interactive Media | Digital entertainment alternatives. | Global gaming market projected over $200 billion. Esports and streaming fragment attention. |

| User-Generated Content | Free, readily available content on platforms like TikTok/YouTube. | Significant diversion of consumer attention from professional media. |

| Low-Cost Outsourcing | VFX and post-production services from regions with lower labor costs. | Competitive pricing impacting established players in the $15.8 billion VFX market. |

Entrants Threaten

The visual solutions, post-production, and VFX sector, particularly at the caliber Imagica Group operates, demands immense capital. New players must invest heavily in advanced technology, software, and specialized studios, creating a significant financial hurdle.

For instance, a single high-end render farm can cost hundreds of thousands of dollars, and acquiring licenses for industry-standard VFX software like Autodesk Maya or Foundry Nuke can run into tens of thousands per seat annually. Imagica's extensive infrastructure, including sound stages and motion capture facilities, represents a multi-million dollar investment, making it difficult for smaller entities to compete on scale and capability.

The entertainment industry, particularly in areas like visual effects (VFX) and computer-generated imagery (CGI), demands highly specialized talent. Professionals with deep expertise in complex workflows and cutting-edge technology are scarce, forming a significant barrier to entry for new companies. Building a team that possesses this level of skill and experience is not only difficult but also incredibly time-consuming, often requiring years of dedicated training and project development.

Imagica Group's deep-rooted brand reputation in Japan's media and entertainment sector, cultivated over years of operation, presents a significant barrier. This established trust is further solidified by enduring relationships with key industry clients, making it difficult for newcomers to replicate the same level of credibility and access. For instance, Imagica Group's extensive work with major broadcasters and production houses, built over decades, provides a consistent revenue stream and a strong competitive advantage.

Intellectual Property and Proprietary Technologies

Imagica Group's threat of new entrants is significantly shaped by intellectual property and proprietary technologies. Established players often possess unique workflows, specialized techniques, and proprietary software that are challenging for newcomers to replicate. For instance, in the animation and VFX sector, the development and refinement of in-house rendering engines or motion capture systems represent substantial barriers.

While AI tools are democratizing some aspects of content creation, the true differentiator lies in the expertise needed to integrate and optimize these technologies for complex productions. This human capital, honed through years of experience, is not easily replicated. For example, a studio that has invested heavily in developing proprietary AI algorithms for realistic character rendering or complex simulation physics will have a distinct advantage.

- Proprietary Software: Companies like Imagica may have developed custom software for animation, editing, or special effects that offer unique capabilities and efficiencies, making it hard for new entrants to match.

- Specialized Techniques: Years of operational experience lead to the development of unique production methodologies and quality control processes that are difficult to reverse-engineer.

- AI Integration Expertise: While AI tools are available, the skill in effectively integrating, fine-tuning, and optimizing them for high-end, complex productions remains a key proprietary advantage.

- Talent and Know-how: The accumulated knowledge and skill of a workforce in leveraging existing technologies and intellectual property are significant, albeit intangible, barriers to entry.

Regulatory and Licensing Requirements

The threat of new entrants for Imagica Group, particularly within its media production and entertainment segments, is somewhat mitigated by regulatory and licensing requirements. While not as heavily regulated as, say, financial services, new players must still navigate compliance related to content ownership, intellectual property rights, and data privacy, especially with increasing digital content distribution. For instance, in 2024, the Indian government continued to emphasize data localization and compliance with IT rules for digital platforms, adding a layer of complexity for new entrants in the digital media space.

These requirements can translate into significant upfront costs and time investment for new companies seeking to establish themselves. Understanding and adhering to these regulations, such as those governing broadcasting licenses or digital content distribution agreements, can be a considerable barrier. For example, obtaining necessary clearances for film distribution or theme park operations involves multiple governmental approvals, which can deter smaller, less capitalized competitors.

The landscape of media and entertainment is also subject to evolving legal frameworks. New entrants must stay abreast of changes in copyright law, digital rights management, and consumer protection regulations.

- Content Licensing: Securing rights for music, imagery, and scripts can be complex and costly.

- Data Protection: Compliance with data privacy laws like India's Digital Personal Data Protection Act, 2023, impacts how user data is collected and managed.

- Broadcasting Regulations: For television or radio content, specific licenses and content guidelines must be followed.

- Intellectual Property: Protecting original content and respecting existing IP is crucial and legally mandated.

The threat of new entrants for Imagica Group is generally moderate due to substantial capital requirements and the need for specialized talent in its core businesses like visual effects and theme parks. However, advancements in technology and evolving content creation methods are continually reshaping this dynamic.

In 2024, the cost of acquiring and maintaining cutting-edge VFX software and hardware continues to be a significant barrier, with licenses for advanced rendering software alone costing upwards of $20,000 per seat annually. Furthermore, building specialized infrastructure like motion capture studios represents an investment in the millions of dollars, which deters many smaller players.

The scarcity of highly skilled professionals in areas such as AI-driven animation and complex CGI rendering also limits the pool of potential new entrants. Companies like Imagica benefit from established relationships and decades of experience, creating a strong moat against newcomers who struggle to build comparable expertise and client trust.

| Barrier | Estimated Cost/Impact | Relevance to Imagica |

| Capital Investment (VFX Tech) | $100,000s - $Millions | High; essential for quality |

| Specialized Talent Acquisition | High Salary + Training Costs | Critical; difficult to replicate |

| Brand Reputation & Client Relationships | Years to Build | Significant; established trust |

| Proprietary Technology/IP | Development Costs | Key differentiator |

Porter's Five Forces Analysis Data Sources

Our Imagica Group Porter's Five Forces analysis is built upon a foundation of verified data, including the company's annual reports, industry-specific market research from firms like IBISWorld, and relevant regulatory filings.