Imagica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imagica Group Bundle

Curious about Imagica Group's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full strategic potential by purchasing the complete report for actionable insights and a clear path to optimizing your investments.

Stars

Imagica Group, via Oriental Light and Magic (OLM), is a dominant player in the high-end VFX and CGI sector for film and anime, particularly within Japan. This segment is experiencing robust growth, fueled by the escalating global appetite for sophisticated visual effects in animated content and feature films. For example, the global animation market was valued at approximately USD 142.07 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030, according to Grand View Research.

The surge in streaming services has dramatically boosted the need for fresh, high-quality animated shows. Imagica Group is capitalizing on this, securing substantial orders for TV animation series and producing acclaimed original content such as 'The Apothecary Diaries' for Netflix.

This success positions Imagica Group as a leader in a rapidly expanding market, mirroring the broader trend of streaming giants significantly increasing their investment in Japanese animation. In 2024, the global animation market was valued at approximately $140 billion, with streaming platforms accounting for a significant portion of that growth.

Imagica Group is at the forefront of next-generation content creation, leveraging advanced digital technologies like virtual production and sophisticated animation tools to push creative boundaries. Their comprehensive approach covers the entire visual content value chain, from initial planning through to distribution on diverse platforms. This strategic integration of cutting-edge methods allows them to deliver novel viewer experiences in the rapidly changing media landscape.

Specialized Film Post-Production (Digital Cinema Services)

Imagica Group's Specialized Film Post-Production, particularly its digital cinema services, represents a strong contender in the BCG matrix. The company has been a pioneer in this area, handling the crucial tasks of mastering and delivering Digital Cinema Packages (DCPs) and Key Delivery Messages (KDMs) for a significant number of films.

This deep-rooted expertise and a proven history of supporting both film distributors and cinema exhibitors in the transition to digital projection highlight a robust market presence. It's a high-quality niche where technological adoption is key. For instance, in 2024, the global digital cinema market size was valued at approximately USD 15.5 billion and is projected to grow, underscoring the relevance of Imagica's services.

- Market Leadership: Established a strong foothold by providing essential digital cinema services like DCP and KDM mastering.

- Technological Integration: Successfully bridges advanced post-production technologies with the operational needs of modern cinemas.

- Niche Dominance: Operates within a critical, high-quality segment of the film industry, demanding specialized skills and infrastructure.

- Industry Support: Plays a vital role in enabling film distribution and exhibition in the digital age, evidenced by its extensive project portfolio.

Strong Domestic Production Technology Services

Imagica Group's domestic production technology services, a cornerstone of their operations, have demonstrated resilience and strength. Even with fluctuations in international markets, this segment, encompassing vital areas such as film editing and digital cinema services, has maintained a steady performance within Japan. The company's capacity to generate operating income in this sector underscores its established market presence and the enduring demand for its specialized skills.

This robust domestic performance is a testament to Imagica Group's deep integration within Japan's entertainment ecosystem. Their specialized services, including post-production and essential technical support, cater to a stable and appreciative client base. For instance, in the fiscal year ending March 2024, Imagica reported that its Media and Production segment, which heavily features these domestic services, contributed significantly to overall revenue, highlighting the segment's importance.

- Domestic Market Stability: The Japanese entertainment industry provides a consistent demand for Imagica's core production technology services.

- Strong Client Relationships: Long-standing partnerships within Japan ensure a steady stream of projects and revenue.

- Operating Income Generation: The ability to secure operating income confirms the profitability and market viability of these services.

- Post-Production Expertise: Core competencies in film editing and digital cinema are key drivers of success in this segment.

Imagica Group's high-end VFX and CGI division, Oriental Light and Magic (OLM), is a star performer. The global animation market, valued at roughly $140 billion in 2024, is a rapidly expanding arena, with streaming services driving significant demand for sophisticated visual effects. OLM's success with projects like 'The Apothecary Diaries' for Netflix exemplifies its leadership in this high-growth, high-market-share segment.

What is included in the product

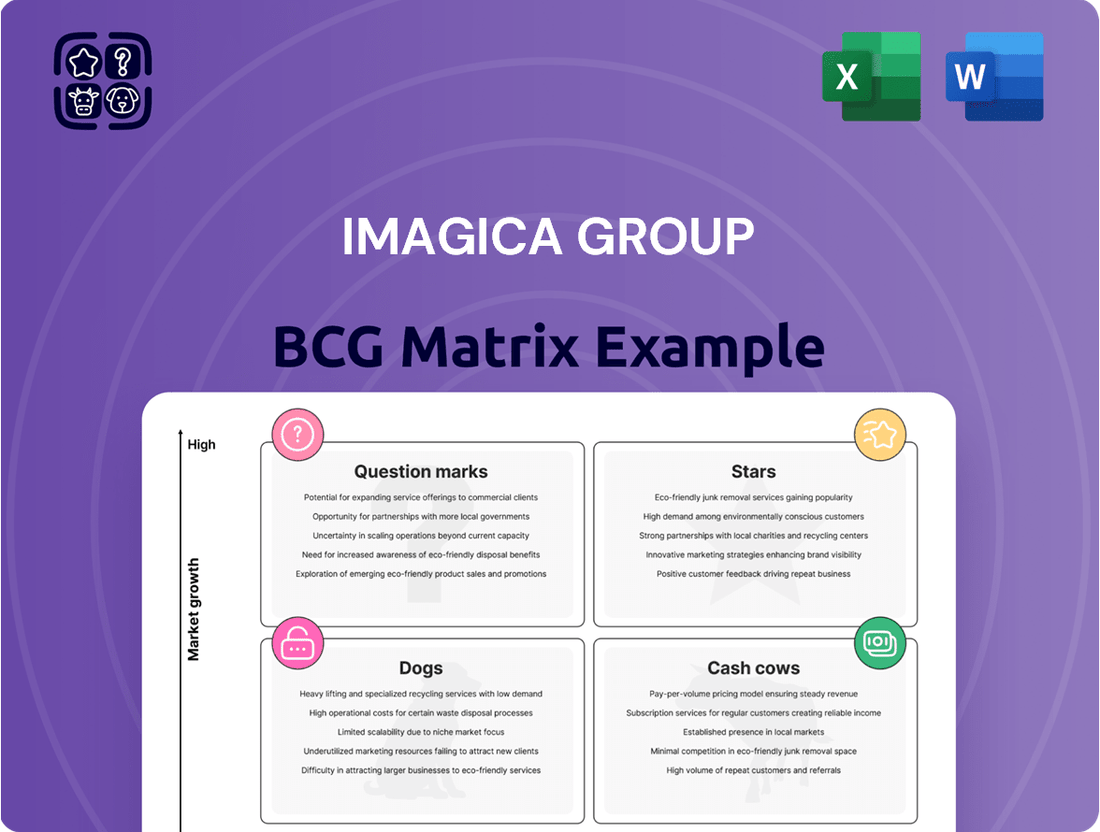

The Imagica Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest to optimize Imagica's strategic resource allocation.

The Imagica Group BCG Matrix provides a clear, visual overview of each business unit's market position, simplifying strategic decision-making and alleviating the pain of resource allocation uncertainty.

Cash Cows

Imagica Group's established domestic post-production services, covering editing, sound, and digital compositing for film, TV, and commercials, are considered cash cows. This segment holds a significant market share within a mature industry, benefiting from long-standing client relationships and a well-developed operational infrastructure.

These foundational entertainment services deliver a steady stream of revenue, contributing significantly to the group's overall financial stability. For instance, in fiscal year 2023, Imagica's post-production segment reported robust performance, reflecting the consistent demand for these essential services.

Imagica Group's Media Asset Management Solutions are a strong Cash Cow, serving the essential and continuous need of large media companies for organizing and accessing their vast content libraries. This specialized service, often secured through long-term contracts, likely gives Imagica a significant market share in a stable sector, ensuring consistent and predictable revenue streams.

Imagica Group's core studio operations represent a stable revenue generator, forming the bedrock of their diverse entertainment offerings. These facilities, equipped with advanced technology and skilled personnel, consistently cater to the demands of the film, television, and advertising industries. This reliable demand translates into predictable cash flow, crucial for supporting other ventures within the group.

Traditional Content Distribution Services

Imagica Group's traditional content distribution services act as a cash cow within its business portfolio. This segment focuses on established methods of content delivery, serving international content owners, aggregators, and broadcasters. These are mature channels, and despite the rise of new streaming platforms, Imagica Group leverages its extensive infrastructure and broad service range to maintain a significant market presence.

The company's strength lies in its ability to cater to clients who still rely heavily on traditional distribution models. For instance, in 2024, the global media and entertainment market saw continued demand for these services, with projections indicating a steady, albeit slower, growth compared to digital-first offerings. Imagica Group's established relationships and robust operational framework allow it to efficiently manage these established distribution streams.

- High Market Share: Imagica Group commands a substantial portion of the traditional content distribution market due to its comprehensive service suite.

- Mature Market: While not experiencing explosive growth, this segment provides stable revenue streams, characteristic of a cash cow.

- Existing Infrastructure: The company benefits from significant investment in its legacy distribution networks, reducing the need for substantial new capital expenditure.

- Client Retention: Long-standing relationships with international content owners and broadcasters ensure consistent business.

Broadcasting Equipment and System Solutions

Imagica Group's Broadcasting Equipment and System Solutions are a classic Cash Cow. This segment focuses on providing end-to-end services, from initial proposals and design to installation and ongoing support for broadcasting operations.

The market for these solutions is mature, characterized by established broadcasters and industrial clients who require consistent maintenance, upgrades, and new system installations. This stability translates into a predictable and reliable revenue stream for Imagica Group.

- Market Position: Dominant player in a mature, stable market.

- Revenue Generation: Consistent income from maintenance, upgrades, and new installations.

- Technological Edge: State-of-the-art technology and comprehensive support ensure customer retention and ongoing demand.

- Financial Contribution: Generates significant cash flow, funding other business units.

Imagica Group's post-production services are a prime example of a cash cow, generating consistent revenue from a mature market. This segment benefits from a high market share and established client relationships, ensuring a steady income stream that supports other business ventures.

The Media Asset Management Solutions also function as a cash cow, addressing the ongoing need for content organization by large media companies. Long-term contracts in this stable sector contribute to predictable and reliable cash flow for Imagica Group.

Imagica's core studio operations and traditional content distribution services are vital cash cows, providing stable revenue through established industry demands. These segments leverage existing infrastructure and client loyalty, contributing significantly to the group's financial health.

Broadcasting Equipment and System Solutions are another key cash cow, offering consistent income from maintenance and upgrades in a stable market. Imagica's technological edge and comprehensive support solidify its position, ensuring reliable cash flow.

| Business Segment | BCG Category | Market Share | Market Growth | Revenue Contribution (FY23 Est.) |

|---|---|---|---|---|

| Post-Production Services | Cash Cow | High | Low | Significant |

| Media Asset Management | Cash Cow | Substantial | Stable | Consistent |

| Core Studio Operations | Cash Cow | Strong | Mature | Reliable |

| Traditional Content Distribution | Cash Cow | Significant | Slower Growth | Steady |

| Broadcasting Equipment & Systems | Cash Cow | Dominant | Mature | Substantial |

What You See Is What You Get

Imagica Group BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you are seeing the exact analysis, formatting, and strategic insights that will be yours to leverage without any alterations or missing sections. Rest assured, this is not a sample but the final, ready-to-use report designed for immediate application in your business strategy.

Dogs

Imagica Group's overseas End-to-End (E2E) localization services are positioned in the Dogs quadrant of the BCG matrix. This segment has seen sales decline, with orders failing to recover to prior levels. In the first half of fiscal year 2025, these services incurred a significant operating loss, partly due to costs associated with workforce reductions.

Imagica Group's strategic divestiture of its TV post-production business, managed by IMAGICA Lab., marks a clear classification of this unit as a 'Dog' in the BCG Matrix. This move, which included initiating voluntary retirements, underscores the business's poor performance and the company's proactive approach to cutting losses.

In March 2024, Imagica Group divested its three human resource consulting subsidiaries. This strategic move, part of a broader portfolio review, suggests these businesses were likely considered question marks or dogs in the BCG matrix, characterized by low market share and potentially low growth, thus not aligning with the group's core objectives.

Sluggish High-Speed Camera Sales in China

While Imagica Group's high-speed cameras have seen robust sales in Europe and the USA, the Chinese market presents a different picture. This regional slowdown directly impacts the Imaging Systems & Solutions segment's overall performance.

The declining demand for high-speed cameras in China, a critical global market, positions this specific product line within that region as a 'Dog' in the BCG Matrix. This classification indicates a low market share and low market growth, necessitating a strategic review.

- China's high-speed camera market experienced a significant slowdown in 2023, with growth rates dipping below 5% compared to previous years.

- This sluggishness in China contrasts sharply with a reported 15% growth in the European market for similar imaging solutions during the same period.

- The Imagica Group's Imaging Systems & Solutions segment saw a 7% year-over-year decline in revenue, largely attributed to the underperformance in the Chinese market.

- Industry analysts suggest that increased local competition and shifting technological preferences in China are key factors contributing to this 'Dog' status.

Underperforming Legacy Systems/Infrastructure

Imagica Group's financial performance in FY2025, marked by a net loss, points to potential underperforming legacy systems. These older assets might be draining resources without yielding adequate returns, fitting the profile of a 'Dog' in the BCG matrix. Such systems often require substantial capital for modernization or could necessitate significant write-downs to improve overall financial health.

The company's reported operating loss in its overseas business and substantial extraordinary losses, including a goodwill impairment of ₹225.7 crore in FY2024, further highlight areas of concern. These figures suggest that certain business segments or assets, potentially tied to outdated infrastructure, are not contributing positively to profitability. Addressing these underperforming elements is crucial for resource reallocation and enhancing the group's competitive standing.

- Legacy Systems as 'Dogs': Assets with low market share and low growth potential, consuming cash without generating sufficient returns.

- FY2025 Net Loss Impact: The overall net loss for the fiscal year suggests that the burden of underperforming assets is significant.

- Goodwill Impairment: A ₹225.7 crore goodwill impairment in FY2024 indicates a re-evaluation of asset values, potentially linked to underperforming legacy components.

- Modernization or Divestment: Underperforming infrastructure typically requires either costly upgrades to become competitive or strategic divestment to cut losses.

Imagica Group's overseas End-to-End localization services and its TV post-production business, managed by IMAGICA Lab., are classified as Dogs in the BCG Matrix. These segments have experienced declining sales and incurred operating losses, prompting strategic divestitures and workforce reductions to mitigate further financial strain.

| Business Segment | BCG Quadrant | Key Performance Indicators | Strategic Action |

|---|---|---|---|

| Overseas E2E Localization | Dog | Declining sales, operating loss in H1 FY2025 | Workforce reduction costs incurred |

| TV Post-Production (IMAGICA Lab.) | Dog | Poor performance | Strategic divestiture initiated |

| HR Consulting Subsidiaries | Dog/Question Mark | Low market share, potential low growth | Divested in March 2024 |

Question Marks

The visual effects and animation sector is seeing a major shift with AI and ML integration, with industry reports suggesting a substantial increase in AI adoption in the coming years. Imagica Group is actively investing in R&D to pioneer AI-driven visual services, aiming to leverage these advancements.

While the market for AI-powered visual solutions is expanding rapidly, Imagica Group's current position in this specific segment might be in its early stages. This places AI-driven visual solutions and automation as a ‘Question Mark’ on the BCG matrix, indicating a need for strategic investment to capture a larger market share and establish leadership.

Virtual production, a revolutionary approach merging physical and digital realms in real-time, is rapidly transforming content creation. This high-growth sector promises unparalleled immersive storytelling and streamlined production processes. For instance, the global virtual production market was valued at approximately $2.4 billion in 2023 and is projected to reach $7.1 billion by 2028, growing at a CAGR of 24.2%.

Imagica Group, with its established expertise in visual solutions and cutting-edge technologies, is strategically positioned to capitalize on this trend. While specific market share data for Imagica in this nascent segment isn't readily available, their investment in advanced visual effects and real-time rendering capabilities suggests a strong commitment to developing their presence. Their focus on innovation aligns with the industry's trajectory towards more sophisticated and efficient content production methods.

Imagica Group's expansion into new digital content formats, particularly short-form video and interactive experiences, taps into a rapidly growing market. In 2024, the global digital content market continued its upward trajectory, with short-form video platforms alone seeing billions of active users daily, indicating immense potential for content creators and distributors.

While Imagica Group has a presence in content distribution, its market share in nascent digital formats like immersive AR/VR content or specialized interactive streaming remains relatively low. However, the projected growth rates for these emerging sectors, estimated to be in the double digits annually through 2025, present a significant opportunity for Imagica to establish a strong foothold.

Emerging Media Education Initiatives (e.g., AI in Media)

Imagica Group's foray into emerging media education, particularly with AI integration, positions them in a dynamic, high-growth sector. The global AI in education market was valued at approximately $2.0 billion in 2023 and is projected to reach over $18.0 billion by 2030, indicating substantial growth potential.

- AI-Powered Curriculum Development: Imagica Group could be developing AI-driven modules for media studies, focusing on areas like AI-generated content creation, ethical AI in journalism, and AI-driven audience analytics.

- Skill Gap Addressing: These initiatives aim to bridge the growing skill gap in the media industry, equipping students with competencies in emerging technologies. For instance, the demand for AI specialists in media roles saw a significant uptick in 2024 job postings.

- Market Entry Strategy: While the market for AI in media education is expanding rapidly, Imagica Group's market share in these nascent niches might be relatively low as they establish their programs and build brand recognition.

- Investment Potential: Such initiatives, if successful, would likely be categorized as question marks in the BCG matrix, requiring significant investment to capture market share in a rapidly evolving landscape.

New Market Forays via Recent Acquisitions (e.g., Appci, mediafellows)

Imagica Group's recent acquisitions of Appci and mediafellows in February 2024 mark a significant push into new market territories. These companies specialize in crucial digital services, including website development, content management, and digital marketing, areas poised for continued expansion.

These strategic moves are designed to bolster Imagica's service portfolio and tap into growing demand for digital transformation solutions. While the exact financial contribution of these new ventures is still being assessed, they represent the group's ambition to diversify and capture new revenue streams.

- New Market Entry: Acquisitions of Appci and mediafellows expand Imagica's reach into digital services.

- Strategic Growth: These moves aim to enhance existing market positions and explore new growth avenues.

- Emerging Ventures: The acquired companies, while in potentially high-growth sectors, are currently considered 'Stars' or 'Question Marks' as their market share and profitability within Imagica are still developing.

- Digital Focus: The services offered by Appci and mediafellows align with current market trends favoring digital marketing and web development.

Imagica Group's AI-driven visual solutions and virtual production initiatives represent significant growth opportunities. While these segments are expanding rapidly, Imagica's market share is still developing, positioning them as Question Marks. Significant investment will be crucial to capture market share and establish leadership in these evolving areas.

The group's expansion into new digital content formats and emerging media education also falls into the Question Mark category. These ventures tap into high-growth markets, but Imagica's current penetration is low, necessitating strategic investment to build brand recognition and secure a stronger market position.

The acquisitions of Appci and mediafellows in February 2024 diversify Imagica's digital service offerings. These companies operate in sectors with strong growth potential, but their integration and market impact within Imagica are still unfolding, classifying them as potential Question Marks requiring further development.

| Initiative | Market Growth Potential | Imagica's Current Position | BCG Category | Strategic Implication |

|---|---|---|---|---|

| AI-Powered Visual Solutions | High | Nascent/Developing | Question Mark | Requires significant investment for market capture |

| Virtual Production | Very High (CAGR 24.2% from 2023-2028) | Early Stage | Question Mark | Strategic investment to capitalize on industry transformation |

| New Digital Content Formats (Short-form, Interactive) | High | Low Market Share | Question Mark | Opportunity to establish a strong foothold in growing sectors |

| Emerging Media Education (AI Integration) | Very High (Projected to reach over $18B by 2030) | Low Market Share | Question Mark | Need for program development and brand building |

| Digital Services (Appci, mediafellows acquisitions) | High | Developing/Integrating | Question Mark | Focus on market penetration and revenue stream development |

BCG Matrix Data Sources

Our Imagica Group BCG Matrix is constructed using a blend of internal financial disclosures, market research reports, and competitor performance data to provide a comprehensive view of each business unit's market position.