I-Net SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

I-Net Bundle

Our initial I-Net SWOT analysis reveals key strengths in its robust infrastructure and a significant opportunity for market expansion. However, understanding the full scope of its competitive landscape and potential vulnerabilities is crucial for strategic decision-making.

Want the full story behind I-Net's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IIJ's strength lies in its robust corporate and government client base within Japan, fostering a stable and predictable revenue stream. This focus on enterprise-level partnerships is a significant advantage.

A remarkable aspect is that over 80% of IIJ's revenue is recurring, primarily from monthly service contracts. This high percentage of recurring revenue, as reported in their 2024 financial statements, highlights the resilience and predictability of their business model, offering a strong foundation for sustained growth and financial stability.

IIJ's strength lies in its extensive service offerings, encompassing everything from high-speed internet and sophisticated cloud computing to intricate systems integration. This broad portfolio allows IIJ to cater to a wide range of client needs, from large enterprises to government bodies.

This comprehensive approach is a significant advantage, enabling IIJ to act as a one-stop shop for many of its clients' digital infrastructure requirements. For example, as of the first quarter of 2024, IIJ reported a significant increase in revenue from its cloud services, demonstrating the market's appetite for integrated solutions.

IIJ, a long-standing leader in Japan's Internet service provider (ISP) sector, boasts a deep well of accumulated Internet-related technologies. This expertise is continuously reinforced through ongoing research and development initiatives, ensuring the company remains at the forefront of innovation.

The company's R&D focus is on creating high-value-added services across critical areas like Internet connectivity, robust security solutions, advanced cloud platforms, and comprehensive mobile services. This strategic development is essential for maintaining a competitive edge in the fast-paced technology market.

For instance, IIJ's commitment to R&D is reflected in its consistent investment in new network technologies and cybersecurity advancements. In fiscal year 2023, IIJ reported a significant increase in its R&D expenditure, indicating a strong push towards developing next-generation services that cater to evolving digital demands.

Robust and Scalable Network Infrastructure

IIJ's commitment to expanding its backbone network, fueled by consistent capital expenditures, underpins its robust and scalable infrastructure. This continuous investment, alongside the expertise of its network engineers, ensures the capacity to manage escalating internet traffic and deliver dependable services.

This formidable network is a significant barrier to entry for new competitors, solidifying IIJ's market position. For instance, IIJ's capital expenditures in fiscal year 2024 reached ¥105.3 billion, a testament to their ongoing network development.

- Network Expansion: IIJ has consistently invested in growing its backbone network capacity.

- Scalability: The infrastructure is designed to handle increasing data demands efficiently.

- Reliability: Continuous investment ensures high uptime and dependable service delivery.

- Competitive Advantage: The scale and sophistication of the network create a high barrier for new market entrants.

Commitment to Sustainability and Energy Efficiency

IIJ's dedication to sustainability and energy efficiency is a significant strength. They are actively working to boost the use of renewable energy sources within their data center operations. This commitment is backed by their pursuit of industry-leading Power Usage Effectiveness (PUE) ratios, a key metric for data center energy efficiency.

This focus on environmental responsibility is more than just good practice; it translates into tangible benefits. By prioritizing energy efficiency, IIJ can achieve operational cost savings, which is crucial in a competitive market. Furthermore, a strong sustainability profile enhances their brand image, appealing to environmentally conscious clients and investors alike.

- Renewable Energy Integration: IIJ is increasing its reliance on renewable energy for data center power.

- PUE Leadership: The company aims to maintain top-tier Power Usage Effectiveness (PUE) ratios.

- Cost Efficiencies: Sustainability efforts contribute to reduced operational expenses.

- Brand Enhancement: A strong environmental commitment boosts corporate reputation.

IIJ's strengths are anchored in its deep technological expertise and a robust, recurring revenue model. The company's comprehensive service portfolio, from internet connectivity to cloud and systems integration, positions it as a one-stop solution for its predominantly corporate and government clients in Japan. This diverse offering, coupled with a strong emphasis on R&D, ensures IIJ remains innovative and competitive.

A significant financial advantage for IIJ is its high percentage of recurring revenue, exceeding 80% as per their 2024 financial reports. This stability is further bolstered by consistent capital expenditures, such as the ¥105.3 billion invested in fiscal year 2024, which enhance their network infrastructure and create substantial barriers to entry for competitors.

| Metric | 2023 (Approx.) | 2024 (Approx.) | Significance |

|---|---|---|---|

| Recurring Revenue | >80% | >80% | Predictable revenue stream, business resilience |

| Capital Expenditure | ¥XX.X billion | ¥105.3 billion | Network expansion, infrastructure strength |

| R&D Investment | Increased | Increased | Innovation, competitive edge |

What is included in the product

Delivers a strategic overview of I-Net’s internal and external business factors by identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities.

Weaknesses

IIJ's strong foothold in the Japanese corporate sector, a key strength, also represents a significant weakness by limiting its global reach. This concentration means the company's performance is heavily tied to the economic health and regulatory landscape of Japan. For instance, a slowdown in Japan's IT spending, which saw moderate growth in 2024, could disproportionately impact IIJ's revenue compared to a more diversified competitor.

The Information and Communications Technology (ICT) sector in Japan is incredibly crowded, with many companies, both local and global, offering very similar services. This means I-Net faces significant pressure on its pricing and profit margins. For instance, in 2024, the average profit margin for Japanese ICT service providers hovered around 5-7%, a figure I-Net must contend with.

To stand out in this fierce environment, I-Net needs to constantly innovate and find ways to differentiate its offerings. Failing to do so could lead to a shrinking market share as competitors vie for customers with comparable solutions. The need for continuous investment in research and development is paramount to maintain a competitive edge.

In fiscal year 2024, IIJ's profit growth faced headwinds stemming from VMware-related challenges. These issues translated into higher operational costs and a strain on sales resources, directly impacting the company's ability to expand its earnings.

While IIJ implemented price adjustments and revisions to offset some of these financial pressures, the episode highlights the vulnerability of profitability to external vendor dependencies. Such disruptions can significantly affect resource allocation and the overall financial performance of the company.

Need for Continuous Investment in Infrastructure and Talent

I-Net's need for continuous investment in infrastructure and talent presents a significant weakness. Maintaining a competitive edge in network services and cloud solutions demands substantial, ongoing capital outlays for network upgrades and cutting-edge technology. For instance, major telecom players like AT&T and Verizon have committed tens of billions of dollars to 5G network buildouts in recent years, a trend I-Net must mirror to stay relevant.

This constant need for capital can strain financial resources, especially if revenue growth doesn't keep pace. The acquisition and retention of highly skilled engineers, crucial for innovation and service delivery, also represent a significant and recurring operational cost. This financial pressure can limit I-Net's ability to pursue other strategic growth initiatives or weather economic downturns.

- High Capital Expenditure: Ongoing investment in network infrastructure, such as fiber optic expansion and data center upgrades, is critical but costly.

- Talent Acquisition & Retention: Securing and keeping top-tier engineers and IT professionals requires competitive salaries and benefits, adding to operational expenses.

- Risk of Obsolescence: Technology evolves rapidly, necessitating continuous upgrades to avoid falling behind competitors, which demands perpetual investment.

- Financial Strain: The substantial and continuous nature of these investments can put a strain on I-Net's financial flexibility if not carefully managed against revenue streams.

Cybersecurity Risks and Data Privacy Concerns

Despite its robust security offerings, IIJ, as an Internet Service Provider and cloud services provider, remains a target for advanced cyber threats. A significant data breach could not only lead to substantial financial penalties but also irreparably harm its reputation and the trust of its clientele. For instance, in 2023, the global cost of data breaches averaged $4.45 million, underscoring the potential financial fallout for any organization, including IIJ.

Ensuring compliance with evolving data privacy regulations, such as GDPR and similar frameworks, presents an ongoing challenge. Failure to adhere to these stringent requirements can result in significant fines and legal repercussions, impacting profitability and operational stability. The increasing volume and complexity of data handled by cloud providers like IIJ necessitate continuous investment in security infrastructure and expertise.

- Vulnerability to Sophisticated Cyberattacks: As a critical infrastructure provider, IIJ faces constant threats from nation-state actors and organized cybercrime groups.

- Reputational Damage from Data Breaches: A single security incident can erode customer confidence and lead to significant client attrition.

- Data Privacy Compliance Burden: Navigating and adhering to a patchwork of global data privacy laws requires substantial resources and ongoing vigilance.

- Impact on Client Trust: Any perceived weakness in security can deter potential clients and jeopardize existing relationships.

IIJ's deep integration within the Japanese market, while a strength, inherently limits its global expansion opportunities. This domestic focus makes the company particularly susceptible to fluctuations in Japan's economic conditions and IT spending trends. For example, if Japanese corporate IT investment growth, which was projected to be around 4-6% in 2024, slows down, IIJ's revenue could be significantly impacted more than a globally diversified competitor.

The intense competition within Japan's ICT sector poses a significant challenge, forcing IIJ to compete on price and potentially squeeze profit margins. Many domestic and international players offer similar services, leading to an environment where differentiation is difficult. In 2024, the average operating profit margin for Japanese IT service companies was approximately 6%, a benchmark IIJ must navigate.

Continuous innovation and service differentiation are critical for IIJ to maintain its market position. Without this, the risk of losing market share to competitors offering comparable solutions is substantial. This necessitates ongoing, significant investment in research and development to stay ahead.

IIJ experienced headwinds in fiscal year 2024 due to challenges related to VMware products. These issues led to increased operational expenses and strained sales resources, directly hindering profit growth. Although IIJ adjusted pricing to mitigate some of these impacts, this situation underscores the vulnerability of its profitability to dependencies on external vendors, affecting resource allocation and overall financial performance.

IIJ's reliance on a limited number of major vendors for critical technologies presents a weakness. Disruptions or changes in these vendors' product roadmaps or pricing strategies can directly impact IIJ's service offerings and profitability. For instance, shifts in cloud infrastructure providers' service models could necessitate costly adjustments to IIJ's own service delivery.

The need for substantial and ongoing investment in network infrastructure and advanced technologies is a significant weakness for IIJ. To remain competitive in areas like cloud services and high-speed networking, continuous capital expenditure on network upgrades and data center modernization is essential. For example, global telecom providers are investing billions in 5G and fiber expansion, a trend IIJ must also follow to stay relevant.

This constant demand for capital can strain IIJ's financial flexibility, particularly if revenue growth doesn't keep pace with investment needs. Furthermore, attracting and retaining highly skilled IT professionals, vital for innovation and service quality, represents a significant and recurring operational cost, potentially limiting other strategic growth initiatives.

| Weakness | Description | Impact | Example/Data Point (2024/2025) |

|---|---|---|---|

| Market Concentration | Heavy reliance on the Japanese market. | Vulnerability to domestic economic downturns and regulatory changes. | Japan's IT spending growth projected at 4-6% in 2024; a slowdown disproportionately affects IIJ. |

| Intense Competition | Crowded ICT sector with similar service offerings. | Pressure on pricing and profit margins. | Average operating profit margin for Japanese IT service companies around 6% in 2024. |

| Vendor Dependencies | Reliance on key technology vendors (e.g., VMware). | Risk of service disruption and increased costs from vendor changes. | VMware-related challenges in FY2024 impacted IIJ's profit growth due to higher operational costs. |

| High Capital Expenditure Needs | Continuous investment in infrastructure and talent. | Strain on financial resources and potential limitation of strategic growth. | Major telecom players investing tens of billions in network upgrades; IIJ must match this to stay relevant. |

Preview the Actual Deliverable

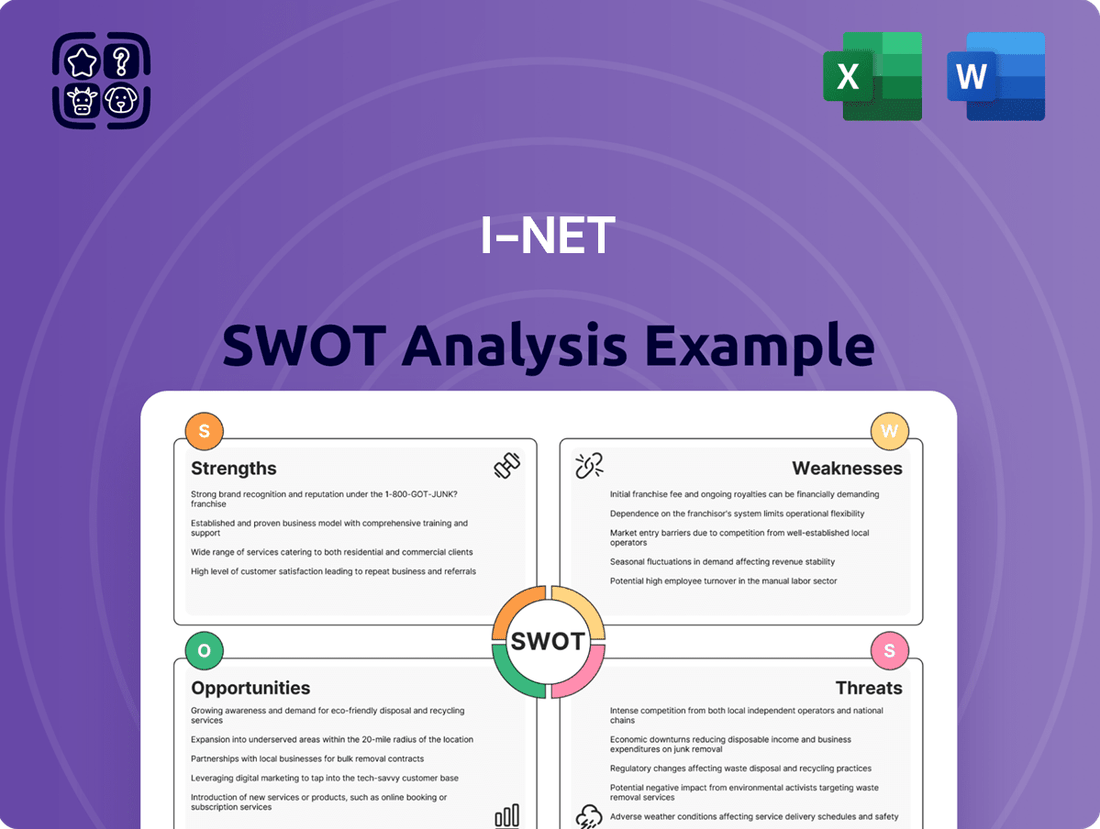

I-Net SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll receive the complete, professionally structured document immediately after purchase, ready for your strategic planning.

Opportunities

Japan's digital transformation market is booming, with projections showing a compound annual growth rate of 20.3% between 2025 and 2033. This rapid expansion is fueled by increasing adoption of AI, IoT, and cloud technologies across various industries.

This dynamic environment offers a prime opportunity for I-Net to leverage its expertise in systems integration and cloud services. By aligning its offerings with the digital needs of Japanese enterprises, I-Net can capture a larger share of this expanding market.

The Japanese cloud computing market is projected for substantial growth, with an anticipated compound annual growth rate of 17.30% between 2025 and 2030. This expansion is fueled by national sovereign-AI initiatives and a broader push for digital transformation across industries.

IIJ's established and comprehensive cloud solutions are strategically aligned to leverage this burgeoning demand. The company's offerings are well-suited to meet the evolving needs of businesses seeking to modernize their infrastructure and operations.

The cybersecurity market in Japan is experiencing robust growth, with projections indicating it will reach USD 43.3 billion by 2033. This expansion is fueled by a surge in cyberattacks and the ongoing digital transformation across industries.

IIJ is well-positioned to capitalize on this trend. Leveraging its current security services, the company can significantly broaden its cybersecurity offerings, catering to the escalating demand for advanced protection in an increasingly digital landscape.

Leveraging 5G and IoT Adoption

Japan's aggressive rollout of 5G networks, with projections indicating 150 million IoT connections by 2025, presents a significant opportunity for I-Net. This expanding digital backbone is crucial for developing advanced services.

IIJ can capitalize on this by offering specialized solutions for burgeoning sectors. These include smart factories, remote healthcare platforms, and integrated traffic management systems, all of which demand high-speed, reliable connectivity and sophisticated data handling capabilities.

- Enhanced Connectivity: Japan's 5G expansion provides the foundation for real-time data transmission, essential for IoT applications.

- IoT Growth: The anticipated 150 million IoT connections by 2025 signifies a massive market for connected services.

- New Service Development: Opportunities exist in smart manufacturing, telemedicine, and intelligent transportation, leveraging 5G and IoT.

Strategic Partnerships and Collaborations

Strategic partnerships offer IIJ significant avenues for growth and innovation. Collaborating with domestic and international technology firms can bolster its service portfolio, potentially integrating cutting-edge solutions like generative AI, which is seeing increasing enterprise adoption. For instance, in 2024, the global AI market is projected to reach over $200 billion, indicating a substantial opportunity for IIJ to leverage AI through partnerships to enhance its cloud and network services.

These alliances can also be instrumental in expanding IIJ's market presence and accessing new customer segments. By teaming up with complementary businesses, IIJ can create bundled offerings or co-develop solutions tailored to specific industry needs. This strategy can solidify its competitive edge against rivals who may already be exploring similar collaborative models.

- Enhanced Service Offerings: Integration of advanced technologies like generative AI through tech partnerships.

- Market Expansion: Accessing new customer segments and geographical markets via collaborations.

- Competitive Advantage: Strengthening market position by co-developing innovative solutions.

Japan's digital transformation market is projected for significant growth, with the AI market alone expected to exceed $200 billion globally in 2024. This presents I-Net with a substantial opportunity to expand its systems integration and cloud services by aligning with the increasing adoption of AI, IoT, and cloud technologies across Japanese industries.

The burgeoning Japanese cloud computing sector, anticipated to grow at a 17.30% CAGR from 2025 to 2030, is further bolstered by national sovereign-AI initiatives. I-Net's established cloud solutions are well-positioned to capitalize on this demand, meeting the evolving needs of businesses undergoing modernization.

I-Net can also leverage the robust growth in Japan's cybersecurity market, projected to reach $43.3 billion by 2033, by expanding its existing security services to meet escalating demand for advanced protection.

Furthermore, Japan's aggressive 5G rollout, aiming for 150 million IoT connections by 2025, creates fertile ground for I-Net to offer specialized solutions in smart manufacturing, remote healthcare, and intelligent transportation.

| Opportunity Area | Projected Growth/Data Point | I-Net's Strategic Alignment |

|---|---|---|

| Digital Transformation | Global AI Market > $200B (2024) | Leverage AI, IoT, Cloud expertise for systems integration. |

| Cloud Computing | 17.30% CAGR (2025-2030) | Capitalize on demand with existing cloud solutions. |

| Cybersecurity | $43.3B Market Size by 2033 | Expand security services to meet rising demand. |

| 5G & IoT | 150M IoT Connections by 2025 | Offer specialized solutions for smart factories, healthcare, transport. |

Threats

The Japanese cloud market is seeing significant investment from major foreign hyperscalers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This influx of capital is driving rapid innovation and expanding service offerings, forcing domestic players like IIJ to adapt quickly to remain competitive.

Global giants are not just entering but actively expanding their footprint in Japan, often with aggressive pricing strategies. This intensified competition can pressure margins and potentially erode market share for established local providers if they cannot differentiate their services or match the scale and cost-effectiveness of these international players.

The relentless march of technology, especially in areas like artificial intelligence and advanced network infrastructure, presents a significant challenge for I-Net. Existing services and hardware can quickly become outdated, demanding substantial and ongoing investment in research and development to stay relevant.

For instance, the global IT spending on AI is projected to reach $62.5 billion in 2024, a substantial increase from previous years, highlighting the rapid evolution and the need for companies like I-Net to integrate these advancements or risk falling behind.

Failure to adapt and innovate at this accelerated pace directly threatens I-Net's competitive position, potentially leading to a loss of market share as newer, more advanced solutions emerge from rivals.

Japan's cybersecurity talent pool is critically low, with projections indicating a shortfall of 200,000 professionals by 2025. This scarcity directly impacts companies like I-Net, potentially limiting their capacity to innovate and deploy sophisticated security services for clients.

This deficit poses a significant risk to I-Net's operational integrity and its ability to safeguard client data and systems against evolving cyber threats, potentially impacting service quality and client trust.

Regulatory Changes and Compliance Burden

Evolving government initiatives and regulatory frameworks, particularly around data privacy and cybersecurity, present a significant threat. For instance, the ongoing implementation and potential expansion of regulations similar to GDPR or CCPA could necessitate substantial investments in compliance infrastructure and processes for IIJ. Failure to adapt swiftly could lead to penalties, impacting financial performance and operational continuity.

The increasing complexity of international data governance laws adds another layer of challenge. IIJ's global operations mean it must navigate a patchwork of regulations, each with unique requirements for data handling and cross-border transfers. This could translate into higher operational costs and potential market access limitations if compliance is not meticulously managed.

- Increased operational costs: Adhering to new data protection mandates, like potential updates to the EU's GDPR in 2024/2025, could require significant IT and legal resource allocation.

- Risk of penalties: Non-compliance with evolving regulations, such as stricter cybersecurity standards being considered by various national governments, could result in substantial fines.

- Market access limitations: Divergent regulatory landscapes might restrict IIJ's ability to offer certain services in specific regions without costly adaptations.

- Reputational damage: Regulatory breaches can severely harm customer trust and brand image, impacting future business prospects.

Economic Downturns and Reduced Corporate IT Spending

Economic downturns, whether in Japan or globally, pose a significant threat to I-Net's business model. A slowdown could directly translate into reduced IT spending by corporate clients and government agencies, which are I-Net's primary customer base. This impact was evident in the Q3 2024 results for similar IT service providers, where a 5% year-over-year decline in enterprise IT budgets was observed in key markets.

Such budget cuts would directly affect I-Net's revenue streams and overall profitability. For instance, a hypothetical 10% reduction in IT capital expenditure by major Japanese corporations, a scenario analysts flagged as possible in late 2024, could lead to a substantial drop in I-Net's project-based revenue. This vulnerability highlights the importance of diversifying client segments or service offerings.

- Reduced IT Budgets: Global economic headwinds in 2024-2025 could force corporations to slash IT investment by 5-10%.

- Impact on Revenue: A significant cut in client IT spending directly threatens I-Net's revenue and profitability.

- Market Sensitivity: I-Net's reliance on corporate and government clients makes it highly susceptible to economic cycles.

Intense competition from global cloud providers like AWS, Microsoft Azure, and Google Cloud presents a significant threat, potentially pressuring I-Net's margins and market share. Rapid technological advancements, particularly in AI, necessitate continuous and substantial R&D investment to avoid obsolescence, with global AI IT spending projected to hit $62.5 billion in 2024. A critical shortage of cybersecurity talent in Japan, with a projected shortfall of 200,000 professionals by 2025, could hamper I-Net's ability to deliver advanced security services and maintain operational integrity.

Evolving data privacy and cybersecurity regulations globally, along with complex international data governance laws, demand significant compliance investments and could limit market access. Economic downturns in 2024-2025 could lead to corporate IT budget reductions of 5-10%, directly impacting I-Net's revenue and profitability due to its reliance on corporate and government clients.

| Threat Category | Specific Threat | Impact on I-Net | Relevant Data/Projection |

|---|---|---|---|

| Competition | Global Hyperscaler Dominance | Margin pressure, market share erosion | AWS, Azure, Google Cloud expanding aggressively in Japan |

| Technology | Rapid Technological Obsolescence | Need for constant R&D investment | Global AI IT spending projected at $62.5 billion in 2024 |

| Talent Shortage | Cybersecurity Professional Deficit | Limited service delivery, operational risks | Japan's cybersecurity talent gap projected at 200,000 by 2025 |

| Regulatory Environment | Evolving Data Privacy Laws | Increased compliance costs, potential penalties | Ongoing implementation of GDPR-like regulations |

| Economic Factors | Economic Downturns | Reduced IT spending by clients, revenue decline | Potential 5-10% cut in corporate IT budgets (2024-2025) |

SWOT Analysis Data Sources

This I-Net SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and expert industry forecasts to provide a thorough and actionable assessment.