I-Net Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

I-Net Bundle

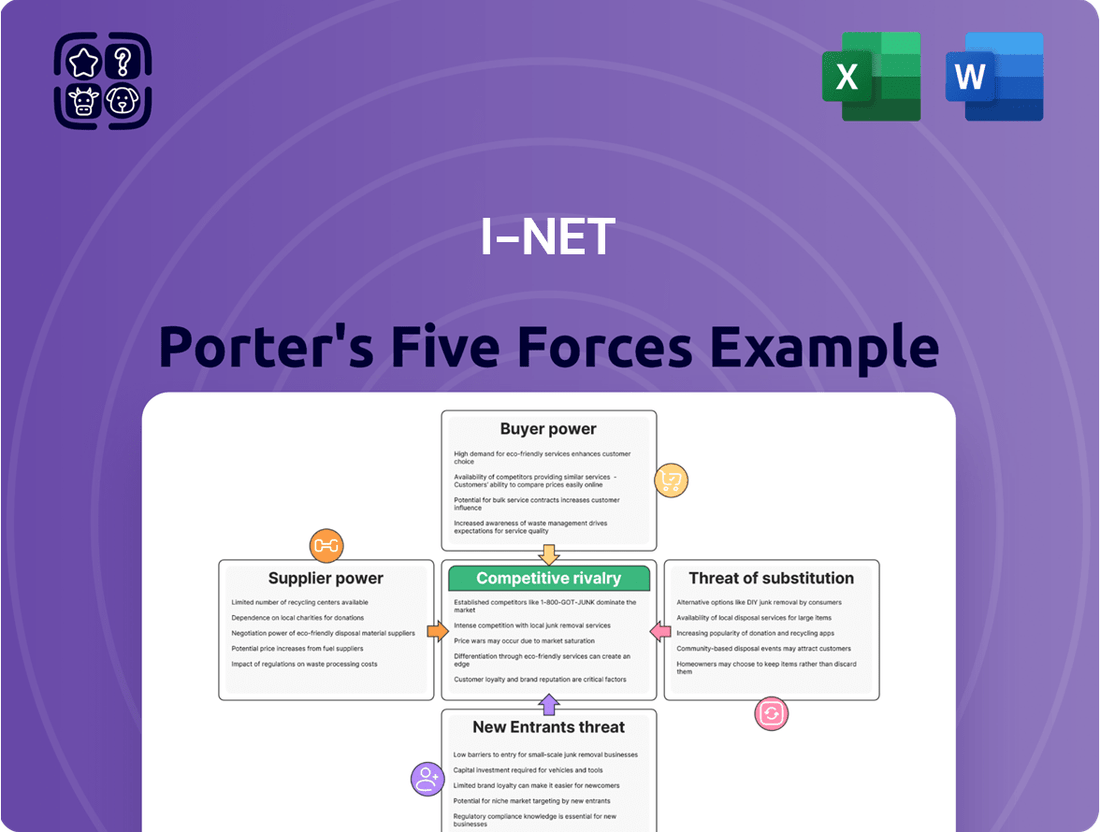

The I-Net Porter's Five Forces Analysis reveals the intense competition and significant threats I-Net faces in its market. Understanding buyer power and the threat of substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping I-Net’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IIJ's reliance on a concentrated group of key technology providers for essential network infrastructure, hardware, and software significantly influences supplier bargaining power. For instance, in the realm of advanced networking equipment crucial for high-speed internet and cloud services, a limited number of dominant suppliers can dictate terms. This concentration means IIJ might face higher costs or less favorable contract conditions if these specialized component providers hold substantial market sway.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for a company like IIJ, which operates within the Information Network (I-Net) industry. If there are many readily available alternative suppliers for essential components like network hardware, data center infrastructure, or specialized software, the power of any single supplier diminishes. For instance, in 2024, the semiconductor industry, a key supplier for network equipment, saw continued diversification of manufacturing hubs, potentially offering IIJ more options and reducing reliance on any one source.

Conversely, if IIJ relies on highly specialized or proprietary technologies for its network services, the switching costs to alternative vendors can be substantial. This could involve significant investment in new infrastructure, retraining staff, or potential service disruptions. In cases where such specialized inputs are critical and few suppliers exist, those suppliers gain considerable leverage, able to command higher prices or dictate terms.

High switching costs significantly bolster the bargaining power of IIJ's suppliers. Imagine the expense and sheer effort needed to shift from one cloud platform to another or to reconfigure complex network infrastructure; these hurdles give current vendors more leverage. IIJ's deep integration of specific technologies into its service offerings means that any change in suppliers could be a remarkably complex and costly undertaking, thereby increasing the bargaining power of its established vendors.

Importance of IIJ to the Supplier

The significance of IIJ as a customer heavily influences a supplier's willingness to negotiate. If IIJ constitutes a substantial percentage of a supplier's revenue, the supplier will likely offer more favorable terms to secure continued business, thereby reducing their bargaining power. For instance, if IIJ accounts for over 10% of a specific component supplier's sales, that supplier's leverage diminishes considerably.

Conversely, if IIJ is a minor client for a large, diversified supplier, the supplier retains greater bargaining power. This is particularly true if IIJ's procurement volume is small relative to the supplier's total output and the broader market. In 2024, many IT infrastructure suppliers experienced robust demand, potentially increasing their pricing power against smaller clients.

- IIJ's Revenue Share: A higher revenue share for IIJ with a supplier increases IIJ's bargaining power.

- Supplier Diversification: Suppliers with many clients have more power over individual, smaller customers like IIJ.

- Market Conditions (2024): Strong market demand in 2024 generally favored suppliers, potentially increasing their leverage.

- Procurement Scale: The sheer volume of IIJ's purchases relative to the supplier's capacity is a key determinant.

Threat of Forward Integration by Suppliers

Should a key supplier decide to enter the Internet service provision or cloud computing market themselves, it could pose a significant threat to IIJ, increasing the supplier's bargaining power. While less common for hardware manufacturers, software or platform providers could potentially expand their offerings to directly compete with IIJ's services, especially in cloud solutions.

Japan's cloud computing market is experiencing significant growth, with a projected CAGR of 14.8% between 2024 and 2029. This expansion might encourage some suppliers to consider forward integration, directly offering services that IIJ currently provides.

- Supplier Forward Integration: Suppliers moving into IIJ's core business areas.

- Market Growth Incentive: The expanding Japanese cloud market (14.8% CAGR 2024-2029) incentivizes this.

- Competitive Threat: Software and platform providers are more likely to integrate forward.

The bargaining power of suppliers is a critical factor in the Information Network (I-Net) industry, influencing costs and operational flexibility. For companies like IIJ, this power is shaped by supplier concentration, the availability of substitutes, switching costs, and the relative importance of the buyer to the supplier. In 2024, the tech landscape saw continued consolidation in some hardware sectors, while also offering more diversification in software and cloud services, creating a dynamic environment for supplier negotiations.

| Factor | Impact on IIJ's Supplier Bargaining Power | 2024 Context/Example |

| Supplier Concentration | High concentration of key tech providers increases supplier leverage. | Limited suppliers for advanced networking equipment can dictate terms. |

| Availability of Substitutes | Many substitute inputs reduce supplier power. | Diversification in semiconductor manufacturing in 2024 offered more sourcing options. |

| Switching Costs | High switching costs for specialized inputs empower suppliers. | Integrating proprietary software or hardware creates significant barriers to changing vendors. |

| IIJ's Customer Importance | IIJ being a significant customer reduces supplier power. | If IIJ represents a large portion of a supplier's revenue, terms are likely more favorable. |

| Supplier Forward Integration | Suppliers entering IIJ's market increases their leverage. | Growth in Japan's cloud market (14.8% CAGR 2024-2029) might incentivize this. |

What is included in the product

Analyzes the competitive intensity within I-Net's industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, providing a clear roadmap to competitive advantage.

Customers Bargaining Power

IIJ's corporate client base, while a strength, also presents a potential area for customer bargaining power. A significant portion of IIJ's revenue, for instance, could be tied to a handful of major corporations. In 2023, for example, while specific client revenue breakdowns aren't publicly detailed, the trend in the IT services sector shows that a few key accounts often drive a substantial percentage of revenue for providers like IIJ.

The bargaining power of customers in the Japanese internet service provider (ISP) market is significantly influenced by the availability of alternative providers. With dominant players like NTT, KDDI, and SoftBank in the fixed broadband sector, corporate customers often have multiple options to choose from, thereby strengthening their negotiating position.

The competitive landscape in Japan's telecommunications sector is further intensified by the presence of numerous global and local competitors offering various cloud computing solutions and systems integration services. This abundance of choice directly translates to increased customer bargaining power, as they can readily switch providers if terms are unfavorable.

For corporate clients, switching Internet service providers or cloud solutions can involve significant technical and operational challenges. These include complex data migration, extensive system reconfiguration, and the risk of potential downtime, all of which contribute to substantial switching costs.

These elevated switching costs directly reduce customer bargaining power. The effort and expense associated with changing providers can easily outweigh the perceived benefits of a cheaper alternative, making customers hesitant to switch.

However, the landscape is evolving. The increasing availability of advanced integration software is designed to streamline these transitions. This development has the potential to lower these barriers over time, thereby gradually reducing the switching costs for customers.

Price Sensitivity of Customers

The price sensitivity of corporate clients significantly influences their bargaining power. In markets where numerous providers offer similar services, clients are naturally more inclined to seek the lowest price, compelling companies like IIJ to maintain competitive pricing structures. For instance, in 2024, the average annual IT spending per employee for small to medium-sized businesses (SMBs) in the enterprise software sector was estimated to be around $3,500, highlighting a key area where price comparisons are crucial.

However, the perceived value of a service can mitigate this price sensitivity. For mission-critical offerings, such as high-speed internet connectivity or robust cloud solutions essential for business operations, factors like reliability, uptime guarantees, and enhanced security often take precedence over minor price differences. This means that while cost is a consideration, it may not be the sole determinant for clients if a provider can demonstrate superior performance and dependability.

- Price Sensitivity Impact: Corporate clients' sensitivity to price changes directly correlates with their ability to negotiate better terms.

- Competitive Market Dynamics: In highly competitive telecom and cloud service markets, IIJ faces pressure to offer competitive pricing to retain and attract clients.

- Value Proposition: For essential services, reliability and security can reduce price sensitivity, as clients prioritize uninterrupted operations and data protection.

- 2024 Data Point: The average annual IT spending per employee for SMBs in enterprise software was approximately $3,500 in 2024, indicating a focus on cost-effectiveness in IT investments.

Customer's Ability to Self-Provide

Large corporate clients, particularly those with substantial IT budgets, can leverage their resources to build in-house capabilities, such as developing their own network infrastructure or private cloud solutions. This self-sufficiency directly diminishes their need for external providers like IIJ, significantly boosting their negotiation leverage.

For instance, a major financial institution might invest millions in creating a proprietary data center, complete with redundant power, cooling, and high-speed connectivity, thereby bypassing the need for a managed network service. This capability acts as a potent threat, allowing them to demand more favorable terms or pricing from IIJ.

- Significant upfront investment by clients in self-provisioning IT infrastructure.

- Reduced reliance on external providers like IIJ for core IT and network services.

- Enhanced bargaining power for large clients in negotiations due to credible threat of insourcing.

- Example: Financial institutions building private data centers to control costs and security.

The bargaining power of customers is a key factor influencing profitability within the internet service provider (ISP) and IT solutions market. When customers have many choices or can easily switch, they can demand lower prices or better terms. This is particularly true for large corporate clients who often have significant IT budgets and can explore alternative solutions, including building their own infrastructure.

In 2024, the competitive landscape in Japan's telecommunications sector, with major players like NTT, KDDI, and SoftBank, means corporate clients have multiple providers for fixed broadband and cloud services. This abundance of choice directly increases customer bargaining power, as they can readily switch if terms are unfavorable. For example, the threat of a large enterprise moving to a competitor offering a 5% price reduction can force existing providers to match or lose business.

| Factor | Impact on Customer Bargaining Power | Example/Data Point |

|---|---|---|

| Availability of Alternatives | High | Dominant players like NTT, KDDI, SoftBank in Japan's fixed broadband market provide numerous options. |

| Switching Costs | Moderate to High (but decreasing) | Complex data migration and system reconfiguration create initial barriers, but integration software is reducing these. |

| Price Sensitivity | High | In 2024, SMB IT spending averaged $3,500 per employee, indicating a strong focus on cost-effectiveness. |

| Client's Ability to Self-Provision | High for large clients | Major financial institutions investing in private data centers bypass external providers. |

Same Document Delivered

I-Net Porter's Five Forces Analysis

This preview showcases the complete I-Net Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently acquire this in-depth strategic tool, ready for immediate application to your business planning.

Rivalry Among Competitors

The Japanese internet service provider and IT solutions market is a crowded space. It's characterized by established telecom giants like NTT, KDDI, and SoftBank, who dominate broadband and mobile. This maturity means intense competition for market share.

Beyond these large players, IIJ also contends with a broad array of IT service providers. This includes global consulting firms such as Accenture, Deloitte Consulting, and IBM Consulting, alongside specialized IT solution vendors. The sheer diversity of these competitors amplifies the rivalry.

For instance, in 2023, the Japanese IT services market was valued at approximately $150 billion, with significant portions attributed to cloud services and system integration, areas where IIJ and its diverse competitors actively vie for business.

The growth rate of Japan's internet services, cloud computing, and systems integration markets directly impacts how intensely companies compete. For instance, the Japanese cloud computing market is anticipated to expand at a robust 14.8% compound annual growth rate (CAGR) between 2024 and 2029.

Similarly, the systems integration market in Japan is forecast to achieve an 8.95% CAGR from 2025 through 2033. While such rapid expansion can initially temper fierce price wars by offering ample room for all participants, it also acts as a magnet, drawing in new competitors and thus potentially escalating rivalry in the longer term.

IIJ's ability to differentiate its extensive portfolio of network services, cloud solutions, and systems integration is a key factor in managing competitive rivalry. By focusing on robust, high-value offerings tailored for corporate clients, IIJ aims to stand out.

However, this differentiation strategy faces pressure. If competitors, such as NTT Communications or KDDI, offer comparable end-to-end solutions, rivalry escalates, driven by feature sets, service reliability, and the quality of customer support. For instance, in 2023, the Japanese IT services market saw significant competition, with major players investing heavily in cloud and network infrastructure to capture market share.

Switching Costs for Customers

High switching costs for corporate clients can significantly reduce competitive rivalry by making it more difficult for rivals to attract existing customers. For instance, if a company like IIJ offers a suite of deeply integrated services, moving to a competitor might involve substantial costs and disruptions for that client.

However, the landscape is evolving. The ongoing digital transformation across industries, coupled with the increasing availability of versatile integration software, is gradually lowering these barriers. This trend makes it more feasible for customers to switch providers, which in turn can intensify competitive pressures.

Consider the financial implications: the cost of migrating data, retraining staff, and reconfiguring systems can deter a customer from switching. Yet, as cloud-native solutions and open APIs become more prevalent, these migration hurdles are shrinking.

- Customer Retention: High switching costs typically lead to higher customer retention rates, as the effort and expense involved in changing providers act as a deterrent.

- Competitive Threat: Conversely, if switching costs are low, new entrants or existing rivals can more easily attract customers away from established players, increasing the intensity of competition.

- IIJ's Position: IIJ's integrated service model aims to create stickiness, but the broader market trend towards interoperability and modular solutions could erode this advantage over time.

Exit Barriers

High exit barriers in the internet service provider (ISP) sector, like substantial fixed assets in network infrastructure and data centers, can trap companies in a market even when profitability declines. IIJ, for instance, has made significant investments in its backbone network and data centers, creating these barriers. This situation often forces companies to stay and compete fiercely on price to retain market share, rather than cutting their losses and exiting, thereby intensifying overall rivalry.

- IIJ's Capital Expenditures: In fiscal year 2024, IIJ reported capital expenditures of ¥49.2 billion, primarily directed towards network infrastructure and data center development, underscoring the high fixed asset base.

- Long-Term Contracts: Many ISP contracts, especially for enterprise clients, have multi-year terms, making it costly and complex for companies to terminate their operations prematurely.

- Intensified Price Competition: The inability to easily exit leads to a scenario where companies may engage in aggressive pricing strategies to attract and retain customers, even if margins are thin, as seen in the competitive Japanese ISP market.

The competitive rivalry within the Japanese internet service and IT solutions market is fierce, driven by a mix of established telecom giants and a broad spectrum of IT service providers. This intense competition is further fueled by the rapid growth in cloud computing and systems integration, areas where companies like IIJ actively compete for market share.

While IIJ strives to differentiate through its integrated service offerings, the increasing trend towards interoperability and modular solutions may reduce customer switching costs over time, potentially intensifying rivalry. Furthermore, significant investments in network infrastructure and data centers create high exit barriers, compelling companies to compete aggressively on price even when profitability is challenged.

| Key Competitor Type | Examples | Market Share Impact |

| Telecom Giants | NTT, KDDI, SoftBank | Dominant in broadband and mobile, driving intense competition for overall connectivity. |

| Global IT Consultancies | Accenture, Deloitte Consulting, IBM Consulting | Compete on large-scale system integration and digital transformation projects. |

| Specialized IT Vendors | Various niche providers | Offer specific solutions in cloud, security, and managed services, fragmenting the market. |

SSubstitutes Threaten

The threat of substitutes for high-speed internet access is growing, particularly with the rise of 5G Fixed Wireless Access (FWA). While fiber-optic broadband (FTTH) remains the dominant technology in Japan, mobile operators are actively deploying 5G FWA, presenting a viable alternative for many users.

In 2024, the expansion of 5G networks is making FWA increasingly competitive. Although 5G FWA may not yet offer the same level of consistent performance and stability as dedicated fiber for critical corporate applications, its flexibility and potentially lower deployment costs make it an attractive substitute, especially for businesses with less demanding connectivity requirements.

Corporate clients can opt for in-house IT solutions, building and managing their own private clouds and network infrastructure, as a direct substitute for services like those offered by IIJ. This approach is especially viable for large enterprises possessing substantial IT budgets and in-house technical expertise, allowing them greater control over their data and operations.

The choice between in-house solutions and external providers like IIJ often comes down to a strategic assessment of cost-effectiveness, the desire for complete control, and the need for scalability versus the convenience and specialized knowledge that external IT service providers bring to the table.

Clients can easily switch to alternative cloud models, posing a threat to IIJ's cloud services. For instance, opting for fully public cloud solutions from major providers like AWS, Azure, or Google Cloud presents a readily available substitute. This is particularly relevant as the Japan cloud computing market shows robust growth, with public cloud services capturing a substantial market share, indicating a strong client inclination towards external cloud offerings.

Use of Standardized Software and SaaS Alternatives

The increasing availability and adoption of standardized Software-as-a-Service (SaaS) applications pose a significant threat to traditional, custom-built IT solutions. Businesses are finding it more efficient and cost-effective to leverage off-the-shelf SaaS products that offer integrated functionalities, bypassing the complexities and costs associated with extensive system integration projects.

This trend is particularly evident in markets like Japan, where the SaaS sector is experiencing robust growth. In 2024, SaaS represented a substantial 46.80% of the Japanese cloud computing market, underscoring a clear shift towards cloud-based, readily available software solutions. This growing reliance on SaaS can diminish the demand for bespoke system integration services as companies opt for quicker, more standardized deployments.

Key factors contributing to this threat include:

- Cost-Effectiveness: SaaS solutions often have lower upfront costs and predictable subscription fees compared to custom development.

- Speed of Deployment: Businesses can implement SaaS applications much faster than integrating complex, bespoke systems.

- Integrated Functionality: Many SaaS offerings bundle essential features, reducing the need for piecing together various custom components.

- Scalability and Updates: SaaS providers typically handle scalability and updates, freeing businesses from these IT burdens.

Managed Services from Non-Traditional Providers

The threat of substitutes for traditional IT service providers like IIJ is growing as clients increasingly unbundle services. Instead of a single, comprehensive managed IT solution, businesses are opting for specialized services from niche providers. This allows them to tailor their IT infrastructure to specific needs, potentially at a lower cost or with higher expertise in a particular area.

For instance, companies might seek dedicated cybersecurity solutions from a firm focused solely on that domain, or specialized network management from another. This fragmentation of services directly substitutes the bundled offerings often provided by established players. IIJ Global's own offering of Secure Access Service Edge (SASE) demonstrates an awareness of this trend, catering to the demand for specialized managed security solutions.

- Niche Providers: Companies can now source specialized IT functions like cybersecurity, cloud management, or data analytics from providers excelling in those specific areas, bypassing comprehensive IT service packages.

- Cost Efficiency: Unbundling allows businesses to pay only for the services they need, potentially leading to significant cost savings compared to all-inclusive managed service contracts.

- Technological Advancements: Rapid advancements in specific IT fields create opportunities for specialized firms to offer cutting-edge solutions that larger, more generalized providers might struggle to match quickly.

- IIJ's Response: IIJ Global's investment in SASE solutions indicates a recognition of the market shift towards specialized, secure network access management, a direct response to the substitute threat.

The threat of substitutes for traditional internet services is evolving, with 5G Fixed Wireless Access (FWA) emerging as a significant alternative. While fiber remains strong, mobile operators' 5G FWA deployments in 2024 are making it increasingly competitive, especially for users with less critical connectivity needs due to its flexibility and potentially lower costs.

Businesses are also exploring in-house IT solutions as a substitute for external providers like IIJ, particularly large enterprises with substantial IT budgets and expertise. This allows for greater control over data and operations, though it requires significant investment and technical capability.

The growing adoption of Software-as-a-Service (SaaS) applications presents a clear substitute for custom-built IT solutions. In Japan, SaaS captured a notable 46.80% of the cloud computing market in 2024, highlighting a market shift towards readily available, cost-effective, and rapidly deployable software.

Companies are increasingly unbundling IT services, opting for specialized solutions from niche providers instead of comprehensive managed IT packages. This trend allows for tailored IT infrastructure, potentially at lower costs and with higher expertise in specific areas like cybersecurity or network management.

| Substitute Category | Key Characteristics | Impact on Traditional Providers | 2024 Data/Trend |

|---|---|---|---|

| 5G Fixed Wireless Access (FWA) | Flexibility, potentially lower cost, improving performance | Direct competitor to wired broadband, especially for less demanding users | Increasingly competitive due to 5G network expansion |

| In-house IT Solutions | Full control, customization, higher upfront investment | Threat to managed service providers for large enterprises | Viable for companies with significant IT budgets and expertise |

| Standardized SaaS Applications | Cost-effectiveness, speed of deployment, integrated functionality | Reduces demand for custom development and system integration | 46.80% of Japan's cloud market in 2024 |

| Niche Specialized IT Providers | Focused expertise, cost efficiency through unbundling | Challenges bundled service offerings from established players | Growing trend as businesses seek tailored solutions |

Entrants Threaten

Entering the Internet service provider and cloud computing market, especially for business clients, demands significant capital for network infrastructure, data centers, and cutting-edge technology. IIJ, for instance, manages one of Japan's most extensive Internet backbone networks, highlighting the scale of investment needed.

These considerable initial expenditures serve as a major deterrent for potential new competitors looking to enter the space. The Japanese cloud computing market is projected to reach USD 31.44 billion by 2025, underscoring the substantial financial commitment required to establish a foothold.

The telecommunications and Internet service sector in Japan is heavily regulated, demanding numerous licenses for operation. For instance, obtaining a Type I telecommunications business license from the Ministry of Internal Affairs and Communications (MIC) is a prerequisite for providing network services. This intricate web of regulations, including data privacy laws and spectrum allocation rules, presents a substantial barrier to entry.

New companies, particularly those from overseas, face a steep learning curve in understanding and complying with these complex Japanese legal frameworks. The cost and time associated with securing the necessary permits and ensuring ongoing compliance can deter potential entrants, thereby reinforcing the position of established players. In 2023, the MIC continued to refine regulations, emphasizing cybersecurity and consumer protection, further increasing the compliance burden.

For new companies wanting to enter the Japanese internet service provider market, securing access to crucial distribution channels is a major hurdle. Building a robust sales force capable of reaching corporate clients requires significant effort and investment.

Established players like Internet Initiative Japan (IIJ) already possess a strong foundation, boasting a loyal customer base and deep-rooted relationships with businesses. This existing network provides IIJ with a considerable competitive edge.

To compete, newcomers must be prepared to pour substantial resources into sales, marketing initiatives, and strategic partnerships to even begin gaining a foothold in the market.

Brand Loyalty and Switching Costs for Customers

Existing corporate clients often demonstrate strong loyalty to established IT providers. This loyalty stems from the reliability and trust cultivated over years of service, often involving critical infrastructure. For instance, in 2024, the average enterprise IT infrastructure migration project can cost upwards of $1 million, factoring in data transfer, system integration, and employee retraining, making switching a significant financial undertaking.

The substantial switching costs associated with changing critical IT infrastructure create a formidable barrier for new entrants. These costs extend beyond mere financial outlay to include potential disruptions, loss of productivity, and the need for extensive employee re-training. Consequently, new providers must offer demonstrably superior value or significantly lower pricing to entice customers away from their current, trusted vendors.

- High Switching Costs: Migrating critical IT infrastructure can cost millions, deterring many clients from switching.

- Established Trust: Long-term relationships build reliability and trust, which new entrants find difficult to replicate quickly.

- Value Proposition: New entrants need a compelling offer, either through superior technology or aggressive pricing, to overcome existing loyalties.

Technological Expertise and Talent Acquisition

The creation and delivery of high-speed internet, reliable cloud services, and intricate system integrations demand a highly specialized technological workforce. New entrants face significant hurdles in attracting and keeping this talent in Japan's competitive tech landscape, particularly if they lack brand recognition or appealing compensation. For instance, in 2024, Japan's Ministry of Internal Affairs and Communications reported a persistent shortage of IT professionals, with demand significantly outstripping supply across key sectors.

Japan's ongoing digital transformation, with a strong push towards advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT), intensifies the need for these skilled professionals. This heightened demand, coupled with the specialized nature of the required expertise, creates a substantial barrier for new companies aiming to enter the market. The cost and effort associated with building a competent technical team can be prohibitive, especially when competing against established players with existing talent pools and robust employer branding.

- Specialized Skills Gap: High demand for AI, IoT, cybersecurity, and cloud computing expertise in Japan.

- Talent Acquisition Costs: Competitive salaries and benefits are necessary to attract top-tier tech talent.

- Retention Challenges: Established companies often offer better career progression and stability, making it hard for new entrants to retain staff.

- Impact of Digital Transformation: Government initiatives and private sector investment in digital technologies further escalate the need for skilled workers, increasing competition.

The threat of new entrants in Japan's ISP and cloud computing market is significantly mitigated by the immense capital required for infrastructure, data centers, and advanced technology. For example, IIJ's extensive network underscores the substantial investment needed. This high barrier to entry, coupled with the projected growth of the Japanese cloud computing market to USD 31.44 billion by 2025, emphasizes the financial commitment required for new players.

Porter's Five Forces Analysis Data Sources

Our I-Net Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research, company filings, and industry expert interviews, to provide a comprehensive understanding of the competitive landscape.