I-Net Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

I-Net Bundle

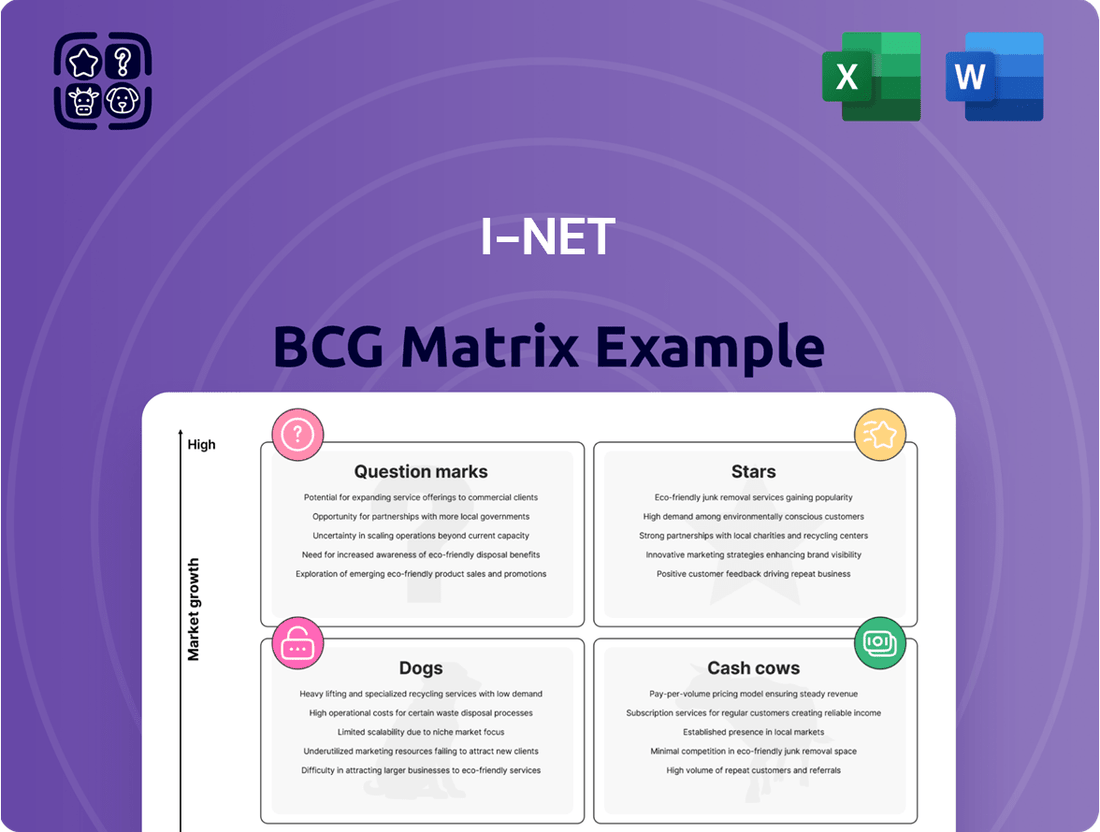

Unlock the strategic secrets of the I-Net BCG Matrix and understand your product portfolio's true potential. See where your offerings fit as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for a comprehensive analysis and actionable insights to drive your business forward.

Stars

IIJ's cloud computing solutions are a strong Star, thriving in Japan's booming cloud market. This sector is expected to grow at a compound annual growth rate (CAGR) between 14.8% and 22.6% up to 2029-2030, fueled by digital transformation and the nation's sovereign AI push.

IIJ provides a full suite of cloud offerings, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). These services are essential for businesses moving their operations from traditional on-premise setups to the cloud.

The company's unique 'Service Integration' approach, which blends network services with systems integration, positions it favorably in this high-growth area. This strategy helps IIJ secure large-scale projects and solidify its Star status.

Systems Integration (SI) for Digital Transformation is a prime Star for IIJ, driven by Japan's aggressive push for DX. This focus fuels demand for system upgrades and modern infrastructure.

IIJ has capitalized on this trend, securing over 15 major, multi-year SI projects in FY2024, with a combined value of approximately JPY45.0 billion. This demonstrates strong market traction and IIJ's capability in supporting large-scale digital initiatives.

The SI segment experienced remarkable revenue growth of 37.8% year-over-year in FY2024. This impressive expansion highlights both the rapid growth of the digital transformation market and IIJ's significant success in capturing a substantial share.

Cybersecurity services are a key growth area for I-Net, fitting the Star quadrant due to escalating cyber threats and the demand for advanced protection. IIJ Global Solutions, a subsidiary, received the Japan Rising Star of the Year Award 2025, underscoring its rapid expansion in customer acquisition and its focus on cutting-edge solutions like Sophos' Taegis ManagedXDR. This award validates I-Net's strong performance and expertise in a sector where businesses are heavily investing in security.

High-Speed Corporate Internet Access (as part of integrated offerings)

High-speed corporate Internet access, when integrated into broader service offerings, particularly for 'Service Integration' projects, positions IIJ's offering as a Star within the I-Net BCG Matrix. This is driven by sustained strong demand from Japanese businesses actively migrating to Internet-based network infrastructures.

IIJ's strategy leverages its established leadership in Internet services to foster growth. By bundling connectivity with higher-value services such as cloud computing and systems integration, IIJ ensures its core Internet access remains a vital component within its expanding portfolio.

- Market Demand: Japanese enterprises show robust demand for migrating to Internet-based network systems.

- Integration Advantage: Bundling high-speed Internet with cloud and systems integration drives growth.

- IIJ's Position: IIJ's leading role as an Internet service provider is key to this Star positioning.

- Relevance: This integrated model keeps core connectivity highly relevant in a rapidly evolving market.

Network Cloud Solutions

IIJ's Network Cloud Solutions are positioned as Stars within the I-Net BCG Matrix. These offerings virtualize network functions and provide unified, cloud-based management, enabling secure, high-speed access independent of specific carriers. This innovation directly supports customer workstyle transformation and aligns with the growing demand for flexible, efficient network infrastructures.

The emphasis on virtualized and cloud-native networking is a strategic move, capitalizing on the widespread adoption of cloud technologies and digital integration. As of early 2024, the global network virtualization market was projected to reach over $80 billion by 2027, indicating a substantial growth trajectory. IIJ's solutions are well-placed to capture a significant portion of this expanding market as businesses increasingly prioritize agility and cost-effectiveness in their network operations.

- Virtualization of Network Functions: IIJ's solutions abstract hardware, allowing for dynamic allocation and management of network resources.

- Cloud-Based Unified Management: Centralized control and monitoring of network services through a cloud platform, simplifying operations.

- Carrier-Agnostic Access: Provides secure and high-speed connectivity without being tied to a single telecommunications provider.

- Support for Workstyle Innovation: Enables flexible work arrangements and improves operational efficiency for clients.

Stars represent high-growth, high-market-share business units. For IIJ, its cloud computing solutions are a prime example, benefiting from Japan's robust digital transformation and sovereign AI initiatives, with projected CAGR between 14.8% and 22.6% up to 2029-2030. Similarly, Systems Integration (SI) for Digital Transformation is a strong Star, evidenced by IIJ securing over 15 major SI projects in FY2024, totaling approximately JPY45.0 billion, and achieving 37.8% year-over-year revenue growth in this segment during the same fiscal year. Cybersecurity services, bolstered by IIJ Global Solutions receiving the Japan Rising Star of the Year Award 2025, also firmly belong in the Star quadrant due to escalating cyber threats and the demand for advanced protection.

| Business Unit | Market Growth | Market Share | IIJ's Position | Key Drivers |

| Cloud Computing | High | High | Star | Digital Transformation, Sovereign AI |

| Systems Integration (DX) | High | High | Star | DX push, large-scale project wins (15+ in FY24) |

| Cybersecurity Services | High | High | Star | Rising cyber threats, award recognition (Japan Rising Star 2025) |

What is included in the product

Detailed breakdown of products within the I-Net BCG Matrix quadrants.

Strategic guidance on investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

A clear I-Net BCG Matrix visualizes your portfolio, easing the pain of strategic allocation.

Cash Cows

IIJ's established corporate Internet connectivity services are a prime example of a Cash Cow within the I-Net BCG Matrix. As a pioneer in Japan since 1992, IIJ commands a substantial market share among corporate clients, ensuring a steady stream of recurring revenue.

Despite the mature market for basic connectivity, IIJ's strong position generates predictable and robust cash flow. This stability is vital, allowing the company to reinvest in and support its higher-growth business areas.

IIJ's traditional managed network services are a solid Cash Cow, providing consistent, high-margin revenue from established corporate clients. These services, often secured by long-term contracts, require minimal new investment, allowing IIJ to generate substantial cash flow with relative ease. For instance, in fiscal year 2023, IIJ reported a significant portion of its revenue from its Network segment, which encompasses these services, demonstrating their enduring profitability.

IIJ's data center colocation services, exemplified by their Shiroi Data Center, are a prime example of a Cash Cow within the I-Net BCG Matrix. These operations are designed to house and manage customer equipment, generating steady, recurring revenue from service fees and space rentals. The demand for reliable data center space continues to rise, ensuring a consistent income stream.

The inherent capital intensity of building and maintaining data centers means substantial initial investment. However, once operational, these facilities typically require less ongoing investment for growth compared to more dynamic business segments. This leads to predictable and stable cash flow generation, a hallmark of a Cash Cow. For instance, the global data center colocation market was valued at approximately $55 billion in 2023 and is projected to grow steadily, indicating sustained demand for these services.

ATM Operation Business

IIJ's ATM operation business, while a specialized area, functions as a Cash Cow within the I-Net BCG Matrix. This segment brought in JPY2,948 million in revenue for the fiscal year 2024, marking a modest 1.2% increase from the previous year. The low growth suggests a mature market, yet its steady revenue and likely strong position in its niche contribute significantly to the company's cash flow with limited investment requirements.

The characteristics of this ATM operation business align with a Cash Cow:

- Mature Market: Experiencing low growth, indicating market saturation.

- Consistent Revenue: Generated JPY2,948 million in FY2024, a 1.2% year-over-year increase.

- Strong Market Share: Presumed high penetration in its specialized niche.

- Positive Cash Flow: Contributes significantly to overall company cash generation with minimal investment needs.

Legacy Systems Operation and Maintenance

Ongoing operation and maintenance for legacy systems are a prime example of a Cash Cow within the I-Net BCG Matrix, particularly for companies like IIJ. These services are often bundled into larger systems integration contracts, providing a steady stream of revenue. Clients depend on these services to keep their existing IT infrastructures running smoothly, making them essential for business continuity.

The stability of these recurring revenues is a key characteristic of a Cash Cow. While the growth potential might be limited compared to newer, more innovative offerings, the consistent cash flow generated is invaluable. This is because the maintenance services are critical for clients, ensuring low promotional costs and a predictable income for the provider.

- Stable Recurring Revenue: IIJ's operation and maintenance services generate consistent income from clients with established IT systems.

- Low Promotional Costs: The essential nature of these services means less need for aggressive marketing to secure business.

- Predictable Cash Flow: Contractual obligations ensure a reliable cash inflow, supporting overall financial health.

- Foundation for Growth: Cash generated from these services can be reinvested in higher-growth areas of the business.

Cash Cows are mature, low-growth businesses that generate more cash than they consume, providing a stable income stream for the company. These segments typically have a high market share and require minimal investment to maintain their position, making them the financial backbone of an organization. The predictable cash flow from Cash Cows is crucial for funding other business units, such as Stars or Question Marks, and for returning value to shareholders.

IIJ's established corporate Internet connectivity services and data center colocation are prime examples of Cash Cows. These segments benefit from a strong market presence and recurring revenue models. For instance, in fiscal year 2023, IIJ's Network segment, which heavily features these services, demonstrated consistent profitability, underscoring their Cash Cow status.

The ATM operation business, despite its low growth rate, also functions as a Cash Cow, contributing JPY2,948 million in revenue in fiscal year 2024. This stability, coupled with the essential nature of ongoing operation and maintenance services for legacy systems, highlights the reliable cash-generating capabilities of these mature business areas within IIJ's portfolio.

| Business Segment | BCG Matrix Category | FY2024 Revenue (JPY million) | Growth Rate (YoY) | Key Characteristics |

|---|---|---|---|---|

| Corporate Internet Connectivity | Cash Cow | (Significant portion of Network Segment revenue) | Low (Mature Market) | High Market Share, Recurring Revenue, Stable Cash Flow |

| Data Center Colocation | Cash Cow | (Steady income stream) | Moderate (Global market projected steady growth) | Capital Intensive but Stable Operations, Recurring Fees |

| ATM Operation Business | Cash Cow | 2,948 | 1.2% | Niche Market, Consistent Revenue, Minimal Investment |

| Operation & Maintenance Services | Cash Cow | (Bundled into contracts) | Low (Essential for existing systems) | Stable Recurring Revenue, Low Promotional Costs |

Delivered as Shown

I-Net BCG Matrix

The I-Net BCG Matrix preview you are currently viewing is the exact, fully completed document you will receive upon purchase. This means you're seeing the finalized strategic analysis, ready for immediate application without any watermarks or placeholder content. Once acquired, this comprehensive report is yours to edit, present, and integrate into your business planning processes directly.

Dogs

Sales of generic or older network hardware and software, where IIJ might not have a strong competitive position or significant market share, are likely in the Dogs category of the I-Net BCG Matrix. These products often exist in slow-growing markets with fierce competition, leading to slim profit margins and dim future outlooks.

For instance, the global market for traditional network switches, a segment where IIJ might have older product lines, saw a modest growth of around 3% in 2023, according to IDC. This indicates a mature market with limited upside potential for undifferentiated offerings.

These types of products can tie up valuable capital and resources without delivering substantial returns, making them prime candidates for divestment or a strategic reduction in focus to optimize IIJ's portfolio.

Basic dial-up access services, once the gateway to the internet, now represent a declining market. For a company like IIJ, which pioneered internet services, these offerings would fall into the Dogs category of the BCG Matrix. This is because the market is experiencing virtually no growth, with high-speed broadband dominating consumer and business connectivity.

In 2024, the penetration of dial-up internet is extremely low, with most developed nations having broadband adoption rates exceeding 90%. Consequently, IIJ's market share in this segment is likely negligible, contributing little to revenue or strategic advantage. These services are likely cash consumers or at best, barely break even, making significant investment for turnaround uneconomical.

Non-strategic, low-volume bespoke software development projects, often characterized by their lack of integration into broader service offerings or limited scalability, can be categorized as Dogs within the I-Net BCG Matrix. These are typically one-off engagements with minimal potential for future revenue or market expansion, consuming valuable engineering talent without yielding significant returns. For instance, in 2024, a hypothetical I-Net might find that 5% of its development capacity was dedicated to such projects, generating less than 1% of its overall revenue.

Highly Commoditized Basic IT Support for Small Businesses

Highly commoditized basic IT support for small businesses, even if offered by a company like IIJ that primarily serves larger corporations, would typically be placed in the Dog quadrant of the I-Net BCG Matrix. This is because the market for such services is highly competitive, with numerous providers and little room for differentiation, leading to intense price wars. For instance, in 2024, the global IT support services market, while growing, saw significant pressure on margins for basic, undifferentiated offerings, with many small businesses prioritizing cost over advanced features.

This segment is characterized by low barriers to entry, meaning new competitors can easily emerge, further fragmenting the market and driving down prices. Consequently, achieving a significant market share or substantial profitability in this area is exceptionally challenging for any provider, including IIJ. Data from late 2023 and early 2024 indicated that small businesses often sought the most budget-friendly IT solutions, impacting the revenue potential for basic support services.

- Market Saturation: The basic IT support sector for small businesses is crowded with providers, making it difficult to stand out.

- Price Sensitivity: Small businesses in this segment are highly focused on cost, limiting pricing power.

- Low Profitability: Fierce competition and commoditization lead to thin profit margins.

- Resource Reallocation: Companies like IIJ might find it more strategic to invest in higher-margin corporate services rather than basic small business IT support.

Maintenance of Severely Outdated On-Premise Systems without DX Link

Maintaining severely outdated on-premise IT systems for clients, especially without a clear digital transformation (DX) or cloud migration strategy, positions these engagements as potential Dogs in the I-Net BCG Matrix. This is particularly relevant in markets like Japan, which is facing a significant '2025 Cliff' due to the reliance on legacy systems.

These legacy systems often lead to escalating maintenance costs, consuming resources that could be allocated to more innovative initiatives. Furthermore, they act as a significant bottleneck, hindering the adoption of new technologies and impeding a client's ability to adapt to evolving market demands.

If IIJ's role is confined to simply maintaining these aging systems without actively guiding clients toward modernization, these partnerships are likely to exhibit low growth. The increasing burden of upkeep will further erode profitability, making them a drain on resources and a strategic liability.

- Escalating Costs: In 2024, the average cost of maintaining legacy IT systems globally continued to rise, with some reports indicating increases of 10-15% year-over-year due to specialized skills and parts becoming scarcer.

- Hindered Innovation: Companies burdened by legacy systems often spend up to 80% of their IT budget on maintenance, leaving little for new development or digital transformation efforts.

- Japan's 2025 Cliff: This refers to the potential economic impact in Japan as many companies are still reliant on systems developed before 2000, facing significant risks and costs if not updated by 2025.

- Low Growth Potential: Engagements focused solely on maintaining outdated systems offer minimal opportunity for revenue growth or value creation, classifying them as Dogs in a portfolio analysis.

In the I-Net BCG Matrix, "Dogs" represent products or services with low market share in low-growth industries. These offerings typically consume more resources than they generate, offering little potential for future growth or profitability.

For instance, a company might offer legacy software maintenance for a declining platform, where demand is minimal and competition is fierce, leading to low margins. In 2024, such services might represent a small fraction of a company's revenue, perhaps less than 2%, while still requiring dedicated support staff.

These segments are often candidates for divestment or a strategic decision to minimize investment, freeing up capital for more promising areas of the business.

| Category | Market Growth | Market Share | Profitability | Strategic Focus |

| Dogs | Low | Low | Low | Divest/Minimize |

Question Marks

The IIJ Sensing Data Management Service, launched in July 2025, is positioned as a Question Mark in the I-Net BCG Matrix. Its focus on high-growth sectors such as food industry temperature control and construction safety control, powered by IoT and sensing data, aligns with a dynamic market landscape.

Despite the considerable growth potential within the sensing data and IoT market, IIJ's recent entry into this space means it currently possesses a relatively small market share. This necessitates substantial investment to cultivate market presence and secure a leading position.

IIJ's ventures into labor-saving rice farming, employing agricultural robots, wireless tech, and AI, fit squarely into the Question Mark category of the I-Net BCG Matrix. This is a burgeoning, high-potential area within the expansive IoT and AI sectors.

As a nascent undertaking, IIJ's penetration in this specialized agricultural technology domain is presently minimal. Significant capital infusion is required to validate its effectiveness and achieve scalability, a crucial step before it can ascend to Star status.

New IoT-oriented mobile communication solutions, such as low-power wide-area networks (LPWAN) like LoRaWAN and NB-IoT, are emerging as critical enablers for early-stage IoT adoption across diverse sectors. These technologies offer extended range and reduced power consumption, making them ideal for applications like smart agriculture and industrial asset tracking.

For IIJ, these specialized IoT mobile solutions represent a significant opportunity within a high-growth market. While IIJ has a broad mobile portfolio, its penetration in these niche IoT segments is currently low, highlighting the need for strategic investment in marketing and product development to capture market share.

Emerging AI-Agent Based Solutions (in early development/deployment)

Emerging AI-agent based solutions from IIJ, currently in early development or deployment, represent a significant push into intelligent automation, aligning with Japan's broader AI strategy. These nascent offerings are positioned within a high-growth technological landscape but are expected to have minimal initial market penetration. Significant investment in research and development, coupled with aggressive market penetration strategies, will be crucial for IIJ to elevate these solutions from "question marks" to market leaders.

These AI-agent solutions are designed to automate complex tasks and provide intelligent assistance across various business functions. For instance, IIJ is exploring AI-powered customer service agents capable of handling intricate queries, and predictive maintenance agents for industrial equipment. The global market for AI in business process automation was projected to reach over $25 billion in 2024, highlighting the substantial growth potential for such innovations.

- High Growth Potential: Tapping into the burgeoning AI and intelligent automation market, which saw global AI spending reach an estimated $200 billion in 2024.

- Low Initial Market Share: These solutions are in their infancy, meaning IIJ will face intense competition and the challenge of building brand recognition and customer trust from the ground up.

- Significant R&D Investment: Continued investment is necessary to refine AI algorithms, ensure data security, and develop user-friendly interfaces, reflecting the industry trend where leading AI companies invest heavily in ongoing research.

- Market Penetration Strategy: IIJ must develop robust go-to-market strategies, including partnerships and targeted marketing, to capture market share in a rapidly evolving sector.

Overseas Business Expansion in New Regions

IIJ's approach to global business development, leveraging local subsidiaries, strategically places its new regional ventures into the Question Mark quadrant of the BCG Matrix. This is because while these international markets present considerable growth potential, IIJ typically enters them with a relatively small market share.

These new overseas ventures necessitate significant capital investment and focused strategic planning to navigate initial market entry challenges, such as establishing brand recognition and distribution networks. For instance, in 2024, IIJ continued its expansion efforts, with new ventures in emerging markets like Vietnam and Indonesia requiring substantial upfront investment to compete with established players.

- Substantial Investment: IIJ's overseas expansion requires significant capital for market research, establishing local operations, and marketing.

- Low Initial Market Share: In new regions, IIJ starts with a small footprint, characteristic of a Question Mark in the BCG matrix.

- High Growth Potential: These new markets offer substantial opportunities for future revenue and market share growth.

- Strategic Focus Needed: Success hinges on targeted strategies to overcome entry barriers and build a strong competitive position.

IIJ's new ventures in AI-agent based solutions are positioned as Question Marks due to their high growth potential within the booming AI market, which saw global AI spending exceed $200 billion in 2024. However, these offerings currently have minimal market penetration, necessitating substantial investment in R&D and market strategies to compete effectively.

The company's expansion into new overseas markets, such as Vietnam and Indonesia in 2024, also falls into the Question Mark category. These regions offer significant growth prospects, but IIJ's initial market share is low, requiring considerable capital and strategic planning to establish a strong foothold against established competitors.

IIJ's sensing data management services, focusing on sectors like food safety and construction, represent another Question Mark. The IoT and sensing data market is expanding rapidly, but IIJ's recent entry means it must invest heavily to build its presence and capture a meaningful share of this dynamic, high-potential sector.

Similarly, IIJ's foray into agricultural technology, utilizing robots and AI for rice farming, is a Question Mark. This niche is part of the high-growth IoT and AI landscape, but IIJ's current market penetration is minimal, demanding significant capital for validation and scalability to move beyond its early stages.

| IIJ Venture Area | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| AI-Agent Solutions | Question Mark | High (Global AI spending > $200B in 2024) | Low | High |

| Overseas Expansion (e.g., Vietnam, Indonesia) | Question Mark | High (Emerging Markets) | Low | High |

| Sensing Data Management | Question Mark | High (IoT & Sensing Data Market) | Low | High |

| Agricultural Robotics/AI | Question Mark | High (IoT & AI Sectors) | Low | High |

BCG Matrix Data Sources

Our I-Net BCG Matrix is constructed using a blend of internal sales data, customer feedback, and competitive market analysis to provide a comprehensive view of product performance and market potential.