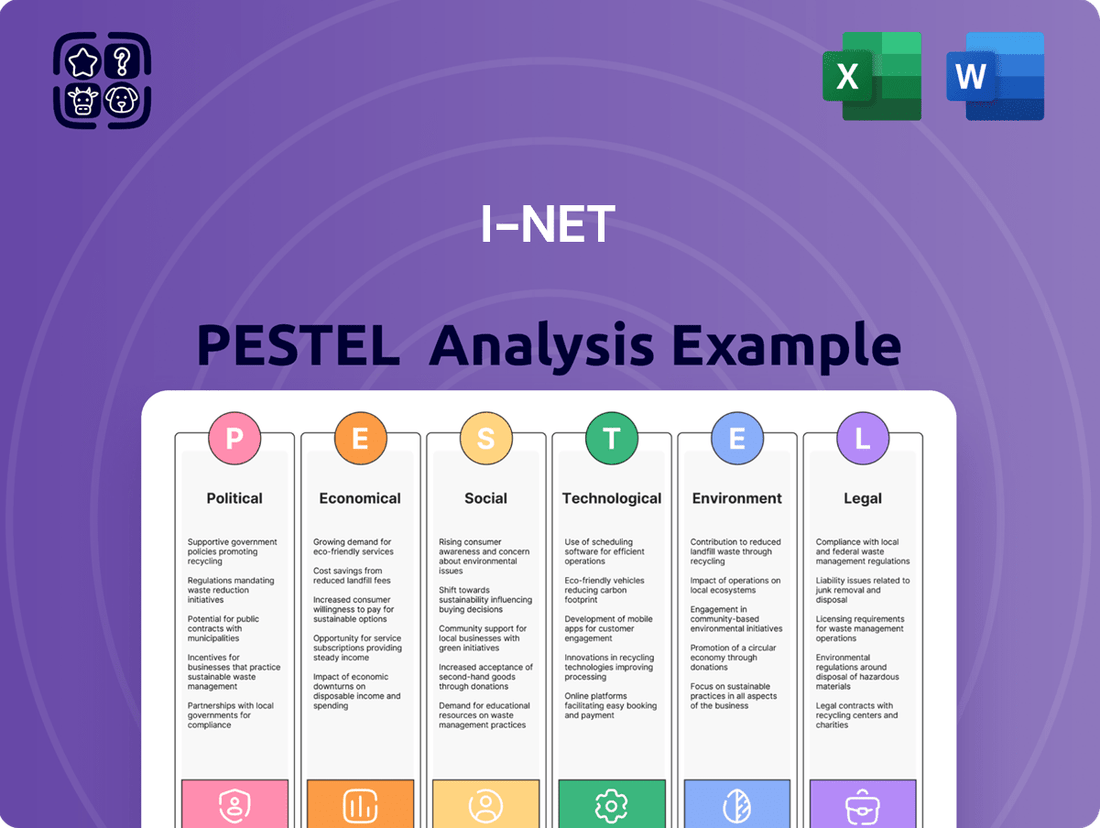

I-Net PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

I-Net Bundle

Unlock the forces shaping I-Net's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain a critical advantage by leveraging these expert insights to refine your own market approach. Download the full analysis now for actionable intelligence that drives informed decisions.

Political factors

Japan's government is heavily invested in digital transformation (DX), spearheaded by the 'Society 5.0' vision and the creation of the Digital Agency. This strategic push aims to build a super-smart society by embedding cutting-edge digital technologies across all industries, thereby boosting efficiency and enhancing daily life.

The Digital Agency plays a crucial role by consolidating digital policy formulation and execution, ensuring a more cohesive and effective approach to driving national DX efforts. This centralized body is key to accelerating the adoption of new technologies and streamlining government services.

By 2025, Japan aims to have 80% of government services available online, a significant leap from 2022's 40%, reflecting the tangible progress of these initiatives. The government has allocated ¥1.3 trillion (approximately $8.7 billion USD) in its fiscal year 2024 budget to further these digital ambitions, demonstrating a strong financial commitment to the transformation.

Japan is actively fortifying its cybersecurity posture, with a significant development being the submission of the 'Active Cyber Defense' bill in February 2025. This legislation is designed to bolster the nation's ability to respond effectively to cyber threats.

Further underscoring this commitment, the Japanese government is crafting a new cybersecurity strategy specifically to safeguard critical digital infrastructure from emerging threats, including those posed by the quantum era and escalating geopolitical tensions. This proactive approach aims to ensure resilience in an increasingly complex digital landscape.

Key components of this enhanced strategy involve deepening public-private partnerships and, crucially, empowering authorities with the ability to monitor communications data even during peacetime. This measure is intended to provide the necessary tools to neutralize foreign servers implicated in cyberattacks, thereby strengthening national security.

Political factors impacting the telecommunications sector are evolving, with Japan's Ministry of Internal Affairs and Communications (MIC) spearheading significant regulatory changes. Amendments to the Telecommunications Business Act (TBA), effective January 2024, now mandate the renewal of telecom business registrations for mergers involving designated telecom facilities, adding a layer of oversight to industry consolidation.

Further underscoring this regulatory push, guidelines for Mobile Virtual Network Operators (MVNOs) were revised in March 2024. These revisions specifically target the review of cost allocation for mobile interconnection charges, aiming to foster a more transparent and competitive pricing environment for smaller players in the market.

Data Privacy Legislation and Enforcement

Japan's Act on the Protection of Personal Information (APPI) is set for a triennial review, with significant amendments anticipated in 2025. These proposed changes could ease data breach reporting obligations for certified organizations, potentially extending the permissible reporting timelines. This signals a move towards balancing regulatory burden with operational efficiency.

Further discussions are exploring the permissible use of personal data for generative AI training, even without explicit user consent. This initiative aims to foster technological innovation in AI, while grappling with the complex ethical and legal considerations of data privacy. The outcome of these discussions will be critical for the future development of AI in Japan.

Key aspects of the proposed APPI amendments include:

- Relaxed reporting for data breaches: Certified organizations may face less stringent timeframes for reporting incidents.

- AI data usage: Consideration is being given to using personal data for generative AI education without explicit consent.

- Balancing innovation and privacy: The amendments seek to strike a balance between promoting technological advancement and safeguarding individual data rights.

Government Procurement and Industry Support

The Japanese government is actively promoting digital transformation and bolstering its cybersecurity sector through targeted policy initiatives and financial aid. For instance, the government allocated ¥1.2 trillion (approximately $8 billion USD) in its 2024 budget towards digital infrastructure and cybersecurity enhancements, aiming to foster innovation and secure critical national assets.

New regulations slated for implementation in 2026 will mandate rigorous inspections of private companies' cybersecurity protocols. Failure to meet these standards could jeopardize eligibility for crucial state subsidies, a significant incentive for businesses operating in technology-dependent sectors. This policy aims to create a more resilient digital ecosystem and elevate Japan's standing in advanced fields like AI and semiconductors.

Key aspects of this government support include:

- Subsidies for Cybersecurity Upgrades: Financial assistance is available for businesses investing in advanced cybersecurity solutions and training.

- Incentives for Digital Transformation: Grants and tax breaks are offered to companies adopting new digital technologies and processes.

- Regulatory Compliance Framework: A clear set of cybersecurity standards will be enforced, with penalties for non-compliance affecting access to government support.

- Focus on Strategic Industries: Special emphasis is placed on strengthening cybersecurity within sectors deemed critical for national competitiveness, such as AI, semiconductors, and advanced manufacturing.

Japan's government is driving digital transformation with a ¥1.3 trillion budget for fiscal year 2024, aiming for 80% of government services online by 2025. This push includes strengthening cybersecurity, with the Active Cyber Defense bill submitted in February 2025 and a new strategy to protect critical infrastructure. Amendments to the Telecommunications Business Act in January 2024 and revised MVNO guidelines in March 2024 are also shaping the telecom landscape.

| Initiative | Target Year | Budget/Allocation | Key Metric |

|---|---|---|---|

| Digital Transformation (DX) | Ongoing | ¥1.3 trillion (FY2024) | 80% of government services online by 2025 |

| Cybersecurity Enhancement | Ongoing | ¥1.2 trillion (FY2024) | New strategy for critical infrastructure protection |

| Telecommunications Act Amendments | January 2024 | N/A | Mandatory registration renewal for mergers |

| MVNO Guidelines Revision | March 2024 | N/A | Review of mobile interconnection charges |

What is included in the product

The I-Net PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the I-Net's operating landscape.

The I-Net PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics and potential disruptions.

Economic factors

Corporate IT spending in Japan is a significant driver of digital transformation, with the market expected to hit USD 304.8 billion by 2033, expanding at a robust 20.3% compound annual growth rate from 2025. This surge is fueled by businesses integrating advanced technologies like AI, IoT, and cloud computing to enhance operational efficiency and address persistent labor shortages.

The impending '2025 Digital Cliff' underscores the critical need for Japanese companies to accelerate their digital adoption. Failing to do so risks substantial economic repercussions, making strategic IT investments crucial for sustained competitiveness and productivity in the coming years.

The Japanese cloud computing market is set for substantial expansion, projected to grow by USD 20.47 billion between 2024 and 2029, reflecting a compound annual growth rate of 14.8%. Some projections even suggest a more robust 22.1% CAGR from 2025 to 2030.

This growth is fueled by key factors such as the significant cost savings businesses realize by migrating to cloud services. Furthermore, the increasing adoption of hybrid cloud models, which combine public and private cloud environments, is a major contributor. The integration of advanced technologies like edge computing and sophisticated data analytics also plays a crucial role in driving market expansion.

While large enterprises dominated revenue share in 2024, the small and medium-sized enterprise (SME) segment is demonstrating rapid advancement and is expected to become an increasingly important driver of market growth in the coming years.

Japan's economic growth is projected to be modest, around 0.3-0.4% for the 2024/25 fiscal year. However, the outlook for 2025 is more optimistic, with an anticipated real growth rate of 1.1-1.2%.

Japanese corporations are on track to achieve record profits for the fifth year running. The technology and artificial intelligence sectors, in particular, are demonstrating enhanced profitability, contributing to this trend.

Despite headwinds such as inflation and global trade uncertainties, a robust labor market is expected to bolster wage increases and consumer spending, providing a supportive environment for business profits.

Investment in AI and Semiconductor Industries

Japan's commitment to bolstering its AI and semiconductor sectors is substantial, with a USD 65 billion plan unveiled in November 2024, targeting significant advancements by 2030. This strategic initiative includes crucial subsidies and financial incentives designed to fortify supply chains, foster innovation, and stimulate economic expansion.

Further underscoring this trend, Microsoft announced a considerable $2.9 billion investment to expand its cloud infrastructure within Japan by 2025. This move is specifically geared towards enhancing AI capabilities and providing access to cutting-edge computing resources.

- Japan's 2030 AI/Semiconductor Plan: USD 65 billion investment announced November 2024.

- Key Objectives: Strengthening supply chains, supporting innovation, boosting economic growth.

- Microsoft's Cloud Expansion: $2.9 billion investment by 2025 in Japan.

- Purpose of Cloud Investment: To improve AI performance and offer advanced computing resources.

Impact of Labor Shortages

Japan's aging population and declining birthrate are creating a significant labor shortage, with projections indicating a potential deficit of 11 million workers by 2040. This demographic shift is a powerful catalyst for digital transformation, pushing companies to adopt automation and AI to compensate for the shrinking workforce and maintain operational efficiency.

The impact of these labor constraints is particularly evident in sectors like manufacturing and logistics, where businesses are investing heavily in robotics and smart factory solutions. For instance, in 2023, Japan's industrial robot shipments reached a record high, underscoring the trend towards automation-driven productivity.

This persistent labor challenge directly fuels the demand for IT services and solutions capable of enhancing productivity and addressing workforce limitations. Companies are seeking advanced software, cloud computing, and data analytics to optimize operations and bridge the gap created by fewer available workers. The need for skilled IT professionals to implement and manage these technologies is also growing.

- Japan's projected worker deficit: 11 million by 2040.

- Industrial robot shipments: Reached record highs in 2023.

- Key drivers for IT demand: Automation, AI, cloud computing, and data analytics.

- Sectoral impact: Manufacturing and logistics are leading automation adoption.

Japan's economic outlook for the 2024/25 fiscal year anticipates modest growth, around 0.3-0.4%, with a more optimistic projection of 1.1-1.2% real growth for 2025. Despite global trade uncertainties, a strong labor market is expected to support wage increases and consumer spending, bolstering corporate profits, which are on track for a fifth consecutive year of record highs, particularly in technology and AI sectors.

The nation's strategic focus on AI and semiconductors is backed by a USD 65 billion plan announced in November 2024, aiming for significant advancements by 2030 through subsidies and incentives to strengthen supply chains and foster innovation. Complementing this, Microsoft's $2.9 billion investment by 2025 to expand its cloud infrastructure in Japan will enhance AI capabilities and access to advanced computing resources.

Japan's demographic challenges, including an aging population and declining birthrate, are projected to create an 11 million worker deficit by 2040, driving substantial demand for IT solutions like automation and AI to maintain productivity. This is evident in sectors like manufacturing and logistics, which saw record industrial robot shipments in 2023, highlighting a clear trend towards automation-driven operational efficiency.

| Economic Indicator | 2024/25 Fiscal Year Projection | 2025 Projection | Key Drivers |

|---|---|---|---|

| Real GDP Growth | 0.3-0.4% | 1.1-1.2% | Strong labor market, consumer spending, tech sector growth |

| Corporate Profits | Record Highs (5th Consecutive Year) | Continued Strength | AI and semiconductor sector profitability |

| IT Spending | USD 304.8 billion by 2033 (20.3% CAGR from 2025) | N/A | Digital transformation, AI, IoT, cloud adoption, labor shortage mitigation |

| Cloud Market Growth | USD 20.47 billion (2024-2029, 14.8% CAGR) | 22.1% CAGR (2025-2030) | Cost savings, hybrid cloud adoption, edge computing, data analytics |

Same Document Delivered

I-Net PESTLE Analysis

The preview you see here is the exact I-Net PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to use, offering a comprehensive look at the external factors influencing the internet industry. You'll gain immediate access to this detailed analysis upon completing your transaction.

Sociological factors

Japan's commitment to enhancing digital literacy is a significant sociological driver. The government is actively working to boost digital skills, especially among older populations and those in less connected regions, as part of its broader digital transformation strategy. This effort is designed to ensure more equitable participation in the digital economy.

Key programs like the Skills for Innovation (SFI) initiative are central to this push, aiming to integrate digital literacy across Japan's educational frameworks by 2025. This proactive approach seeks to close the digital divide and foster inclusive societal development.

The widespread adoption of remote and hybrid work, accelerated by the COVID-19 pandemic, has fundamentally reshaped workplace dynamics in Japan. This shift has significantly boosted demand for cloud storage and other digital solutions as businesses adapt to new operational models.

As of early 2024, a notable percentage of Japanese companies are implementing hybrid work, leading to an increased market need for virtual cooperation platforms and digital services. This trend directly fuels the expansion of the cloud solutions market, with companies investing in infrastructure to support distributed workforces.

The ongoing evolution towards flexible work arrangements underscores the critical requirement for robust network infrastructure and secure digital platforms. This demand is particularly evident in the growth of cybersecurity solutions and high-speed internet services, essential for seamless remote collaboration.

Japan's rapidly aging population, with over 29% of its citizens aged 65 or older as of 2023, is creating significant labor shortages. This demographic shift is a powerful catalyst for digital transformation, pushing businesses to adopt technology for automation and efficiency to offset a declining workforce.

The government's 'Society 5.0' initiative directly addresses these societal needs by promoting the integration of advanced technologies, like AI and robotics, into public services and various industries. This focus aims to enhance productivity and maintain living standards despite demographic pressures.

Growing Demand for Digital Services

The increasing digitization of businesses and the widespread adoption of mobile devices are fueling a growing demand for personal storage systems that offer seamless data accessibility across multiple devices. This trend is directly benefiting internet service providers by creating a need for robust cloud storage solutions and enhanced connectivity.

Furthermore, the societal shift towards a cashless economy presents a significant opportunity. Governments are actively promoting digital payments, with targets like doubling cashless payment usage to 40% by 2025. Internet service providers are well-positioned to capitalize on this by offering secure, user-friendly digital platforms for financial transactions.

- Digitalization Drive: Businesses are increasingly moving online, necessitating greater data storage and accessibility.

- Mobile Ubiquity: The proliferation of smartphones and tablets means users expect to access their data anywhere, anytime.

- Cashless Transition: Government initiatives are pushing for higher adoption of digital payments, creating demand for secure online transaction infrastructure.

- Service Provider Opportunity: Internet providers can leverage these trends by offering integrated cloud storage and secure digital payment gateways.

Societal Acceptance of AI

Societal acceptance of AI, particularly generative AI, is a key factor influencing its integration into various sectors. In Japan, awareness of generative AI among the general population reached a notable 72.4% by February 2025, with adoption climbing to 42.5%.

Japanese enterprises, often perceived as traditionally cautious, are demonstrating a significant shift towards embracing AI technologies. Over 80% of major corporations in Japan are either currently implementing or actively considering the adoption of generative AI solutions.

This trend indicates a growing comfort level with AI, though it's characterized by a measured approach. The observed growth in adoption reflects a clear preference among Japanese businesses for conducting thorough evaluations and comprehensive risk assessments prior to committing to full-scale AI implementation.

Key data points illustrating this societal shift include:

- 72.4%: Awareness of generative AI among Japanese respondents as of February 2025.

- 42.5%: Adoption rate of generative AI in Japan as of February 2025.

- Over 80%: Major Japanese corporations implementing or considering generative AI.

- Measured Growth: Reflects a preference for thorough evaluation and risk assessment before widespread adoption.

Japan's aging demographic, with over 29% of its population aged 65+ in 2023, is driving automation adoption to combat labor shortages. The Society 5.0 initiative champions AI and robotics integration, aiming to boost productivity and maintain living standards.

The increasing digital literacy, with government programs targeting skills enhancement by 2025, alongside a 72.4% awareness of generative AI by February 2025, indicates a society ready for technological integration. This readiness is further supported by over 80% of major corporations exploring AI, demonstrating a clear societal and business shift towards digital solutions.

The move towards a cashless society, targeting 40% cashless payment usage by 2025, coupled with the widespread adoption of mobile devices, fuels demand for secure digital transaction platforms and accessible cloud storage. Internet service providers are positioned to benefit from these trends by offering integrated services.

| Sociological Factor | Description | Impact on Internet Services | Relevant Data (2023-2025) |

|---|---|---|---|

| Aging Population | Over 29% of Japan's population is 65+ (2023), creating labor shortages. | Drives demand for automation, AI, and remote work solutions. | Society 5.0 initiative promotes tech integration. |

| Digital Literacy & AI Adoption | Growing digital skills and AI awareness. | Increases demand for cloud services, data storage, and digital platforms. | 72.4% AI awareness (Feb 2025), 42.5% AI adoption (Feb 2025), 80%+ corporations exploring AI. |

| Cashless Economy & Mobile Use | Shift towards digital payments and ubiquitous mobile devices. | Necessitates secure online transaction infrastructure and seamless data access. | Target of 40% cashless payment usage by 2025. |

Technological factors

The Japanese cloud computing market is booming, fueled by innovations like hybrid cloud and the rise of edge computing. Infrastructure as a Service (IaaS) is leading the charge, expected to be the most profitable segment with the highest growth rate.

Companies in Japan are increasingly adopting cloud services to reduce operational costs and efficiently handle vast amounts of data. This trend is further accelerated by advancements in cloud solutions, making them more flexible and powerful for businesses.

Japan's 5G network expansion is remarkably advanced, achieving 98.1% nationwide coverage by March 2024, surpassing its 2025 target of 97%. This robust infrastructure is a key enabler of digital transformation, powering high-speed connectivity essential for innovations in smart manufacturing, remote healthcare, and connected vehicles.

The widespread availability of 5G is fostering the growth of advanced cloud services and artificial intelligence applications. This technological leap provides a critical foundation for businesses to develop and deploy next-generation solutions, driving efficiency and creating new market opportunities.

The increasing integration of Artificial Intelligence (AI) and Generative AI is a significant technological driver. Japan's AI market, valued at around $6.6 billion in 2024, is expected to surge to $35.2 billion by 2033, reflecting a robust 20.4% compound annual growth rate.

This technological shift is evident in corporate adoption, with over 80% of major Japanese companies either deploying or exploring generative AI solutions. The Japanese government is actively fostering this growth through strategic initiatives and substantial financial backing, aiming to bolster national competitiveness in the AI landscape.

Evolving Cybersecurity Threat Landscape

Japan's cybersecurity environment is increasingly complex, with a notable rise in cyber espionage and ransomware incidents. Industries like manufacturing and technology are particularly vulnerable, facing sophisticated attacks that disrupt operations and compromise sensitive data. For instance, reports from 2023 indicated a significant uptick in ransomware targeting Japanese businesses, with some sectors experiencing double-digit percentage increases in attacks compared to the previous year.

The exposure of Operational Technology (OT) and Industrial Control Systems (ICS) devices presents a growing challenge, amplifying the potential impact of cyber threats on critical infrastructure. This trend underscores a critical need for enhanced cyber resilience measures across all industrial sectors. The number of connected OT/ICS devices in Japan has been steadily growing, creating a larger attack surface that requires specialized security protocols.

This dynamic threat landscape directly fuels the demand for cutting-edge cybersecurity solutions and services. As organizations strive to protect their digital assets and operational continuity, investment in advanced threat detection, prevention, and response capabilities is becoming paramount. The global cybersecurity market, which Japan is a significant part of, is projected to continue its robust growth through 2025, driven by these evolving threats.

- Increased Ransomware Attacks: Japanese businesses saw a notable surge in ransomware incidents in 2023, impacting sectors like manufacturing and IT.

- OT/ICS Vulnerabilities: A growing number of exposed Operational Technology and Industrial Control Systems devices heighten the risk to critical infrastructure.

- Market Demand: The evolving threat landscape is driving substantial demand for advanced cybersecurity solutions and services in Japan and globally.

Development of Network-Related Hardware and Software

IIJ's strategic focus on network hardware and software development aligns perfectly with the accelerating pace of technological advancement. The global 5G market alone was projected to reach $710.2 billion by 2028, indicating a massive demand for the underlying infrastructure that companies like IIJ help build.

The increasing integration of AI, machine learning, and edge computing directly fuels the need for sophisticated, high-performance storage and resilient network capabilities. These emerging technologies are driving demand for specialized hardware and software solutions that can process data closer to its source, a trend IIJ is well-positioned to capitalize on.

- 5G Network Expansion: Continued rollout of 5G is a primary driver for network infrastructure upgrades.

- AI and Machine Learning Adoption: These technologies require robust data processing and low-latency network solutions.

- Edge Computing Growth: Decentralized computing necessitates advanced hardware and software at the network edge.

- Cloud Service Demands: Growing reliance on cloud services amplifies the need for scalable and efficient network components.

Technological advancements in Japan are rapidly reshaping the business landscape, with cloud computing and 5G expansion at the forefront. The nation's commitment to advanced infrastructure, evidenced by its early achievement of 98.1% 5G coverage by March 2024, provides a fertile ground for innovation.

The integration of Artificial Intelligence (AI) is a significant trend, with Japan's AI market projected to grow from approximately $6.6 billion in 2024 to $35.2 billion by 2033, a compound annual growth rate of 20.4%. This surge is driven by widespread corporate adoption, with over 80% of major Japanese companies exploring generative AI.

| Technology Area | 2024 Value (USD Billion) | Projected 2033 Value (USD Billion) | CAGR (%) |

|---|---|---|---|

| Artificial Intelligence | 6.6 | 35.2 | 20.4 |

| 5G Coverage (Target) | 97% (2025) | 98.1% (Achieved March 2024) | N/A |

Legal factors

Japan's Act on the Protection of Personal Information (APPI), the cornerstone of data privacy, is slated for its triennial review, with significant amendments anticipated for 2025 and implementation targeted for 2027. These updates aim to streamline data handling while bolstering individual rights.

A notable proposed change involves easing data breach reporting obligations for organizations that achieve specific certifications, granting them a more extended period to notify authorities and affected individuals. This aims to balance timely disclosure with the practicalities of incident response.

Furthermore, discussions are actively exploring the expansion of individual rights, particularly concerning the suspension of personal data usage. This includes sensitive information categories like biometric data and data pertaining to children, reflecting a growing global emphasis on granular control over personal information.

The Telecommunications Business Act (TBA) remains the foundational legislation for Japan's telecom sector. Recent amendments, effective January 2024, mandate the renewal of telecom business registrations for specific mergers involving designated telecom facilities, impacting corporate restructuring.

Further regulatory shifts occurred in March 2024 with the Ministry of Internal Affairs and Communications (MIC) revising guidelines for Mobile Virtual Network Operators (MVNOs). These revisions specifically call for a thorough review of mobile interconnection charges, potentially altering cost structures for MVNOs and impacting their competitive pricing strategies.

Japan's commitment to cybersecurity is evident with new legislation. The 'Active Cyber Defense' bill, submitted to the Diet in February 2025, is designed to bolster public-private collaboration and could mandate cyber-attack reporting for critical infrastructure entities.

Further strengthening its security posture, Japan enacted the Act on the Protection and Use of Critical Economic Security Information in 2024. This legislation imposes specific constraints on how crucial economic security data can be managed, reflecting a proactive approach to national security in the digital age.

Data Breach Notification Requirements

Data breach notification requirements are a critical legal factor for businesses. Under Japan's Act on the Protection of Personal Information (APPI), any actual or suspected leakage, loss, or damage to personal information necessitates reporting, even if the data hasn't yet been fully integrated into a system. This broad scope underscores the importance of robust data security measures.

Proposed amendments are looking to refine these reporting timelines for certified organizations. The goal is to allow a more manageable period, potentially 30 or 60 days, for reporting incidents. This adjustment aims to balance the need for timely disclosure with the practicalities of investigating and understanding a breach.

Furthermore, other legislation, like the Telecommunications Business Act, also mandates reporting specific types of information leakages to relevant authorities, such as the Ministry of Internal Affairs and Communications (MIC). These overlapping regulations highlight a complex legal landscape that businesses must navigate to ensure compliance.

Key aspects of these legal factors include:

- Mandatory Reporting: The APPI requires reporting of any personal information leakage, loss, or damage, regardless of its stage.

- Evolving Timelines: Proposed amendments may offer certified organizations a grace period of 30 or 60 days for breach notifications.

- Sector-Specific Rules: The Telecommunications Business Act imposes separate reporting obligations for certain information leakages.

- Compliance Burden: Businesses must stay abreast of these varied and evolving legal requirements to avoid penalties.

Regulations on Digital Platforms and Competition

Japan's commitment to fostering competition in the digital sphere is evident with recent legislative actions. In June 2024, the Japanese Diet passed a significant law targeting major tech companies like Google and Apple. This legislation mandates that these platforms must permit third-party app stores and payment systems on their mobile operating systems, a move designed to curb monopolistic practices.

This new regulation, set to take effect by December 2025, is poised to inject more dynamism into the market. It includes provisions for penalties to ensure compliance, signaling a strong governmental stance on fair competition. The Information Distribution Platform Act, also enacted in 2024, further strengthens the legal framework by addressing issues related to rights infringement occurring through specified telecommunications services.

- Digital Platform Regulation: Japan's new law, effective December 2025, requires Google and Apple to allow alternative app stores and payment options.

- Competition Enhancement: The legislation aims to prevent monopolization and stimulate competition within mobile ecosystems.

- Penalties for Non-Compliance: The law includes penalties for companies that fail to adhere to the new mandates.

- Information Distribution Platform Act: Enacted in 2024, this act tackles rights infringement issues on specified telecommunications platforms.

Japan's legal landscape continues to evolve, particularly concerning data privacy and digital markets. The Act on the Protection of Personal Information (APPI) is undergoing review, with proposed amendments expected to ease data breach reporting for certified organizations. This move, anticipated for implementation in 2027, aims to balance regulatory oversight with practical business needs.

The Telecommunications Business Act (TBA) also saw updates in early 2024, affecting corporate restructuring through new registration requirements for certain mergers. Furthermore, revised guidelines for Mobile Virtual Network Operators (MVNOs) in March 2024 call for a review of interconnection charges, potentially impacting pricing strategies.

Cybersecurity remains a priority, with a proposed 'Active Cyber Defense' bill submitted in February 2025 that could mandate reporting of cyber-attacks for critical infrastructure. The 2024 Act on the Protection and Use of Critical Economic Security Information further reinforces national security measures by regulating the management of vital economic data.

Japan's commitment to fair competition in digital markets is highlighted by a law passed in June 2024, effective December 2025, which mandates major tech platforms like Google and Apple to allow third-party app stores and payment systems. This legislation, coupled with the 2024 Information Distribution Platform Act addressing rights infringements, aims to curb monopolistic practices and foster a more open digital ecosystem.

Environmental factors

IIJ's cloud computing services rely heavily on data centers and network infrastructure, making their energy consumption a key environmental factor. The escalating demand for cloud solutions and big data analytics directly amplifies the energy footprint of these operations. For instance, global data center energy consumption was projected to reach 1.8% of total electricity demand in 2023, highlighting the scale of this issue.

The increasing reliance on digital services means that the environmental impact of large-scale IT infrastructure, including data centers, faces growing scrutiny from regulators and the public. Companies like IIJ are therefore under pressure to adopt more energy-efficient technologies and renewable energy sources to mitigate their carbon emissions.

Japan's ambitious goal of achieving carbon neutrality by 2050 significantly impacts the IT sector, including companies like IIJ. This national commitment translates into a push for sustainability across all industries, requiring IT firms to re-evaluate their energy consumption and operational footprints.

The government's drive towards carbon neutrality is expected to spur investment in energy-efficient data centers and cloud infrastructure. For IIJ, this presents both a challenge to adapt existing systems and a clear opportunity to innovate and offer greener IT solutions, potentially attracting environmentally conscious clients and benefiting from government incentives for sustainable technology adoption.

Reports from the Ministry of Economy, Trade and Industry (METI) in 2023 highlighted the importance of digital transformation for achieving decarbonization, with specific initiatives aimed at promoting green IT. These efforts are likely to include setting targets for reducing IT-related carbon emissions and offering financial support for companies investing in eco-friendly technologies, creating a favorable environment for IIJ's sustainability initiatives.

The push for Green IT is gaining serious momentum, with companies actively seeking solutions to shrink their carbon footprint. This isn't just about feeling good; regulations are tightening, and clients are increasingly prioritizing suppliers with strong environmental credentials. For instance, a 2024 survey by Deloitte found that 65% of consumers consider a company's environmental impact when making purchasing decisions.

This translates into a growing demand for cloud services that utilize renewable energy sources or employ highly efficient cooling technologies. Businesses are realizing that adopting greener IT practices can lead to cost savings through reduced energy consumption. In 2025, the global Green IT market is projected to reach $78.4 billion, up from $48.1 billion in 2020, highlighting a significant growth opportunity.

Companies like IIJ can capitalize on this by developing and promoting their environmentally conscious IT offerings. By highlighting energy efficiency, the use of renewable power, and sustainable hardware lifecycle management in their services, they can attract clients who are committed to sustainability and looking to align their own operations with these values.

Sustainability Reporting and Transparency

Companies are facing growing pressure to be open about their environmental performance, with detailed sustainability reports becoming the norm. For a company like IIJ, this means clearly outlining its energy consumption, carbon footprint from network operations and hardware production, and how it handles waste. This transparency is crucial for building trust with investors and securing business with environmentally conscious corporate clients.

The demand for robust Environmental, Social, and Governance (ESG) reporting is significantly impacting business operations. By 2024, over 90% of S&P 500 companies were expected to issue sustainability reports, with a growing emphasis on quantifiable environmental metrics. IIJ's commitment to detailed reporting on its energy efficiency initiatives, such as optimizing data center power usage, and its progress in reducing e-waste from hardware lifecycle management, directly addresses these stakeholder expectations.

- Energy Efficiency: IIJ's efforts to reduce energy consumption in its data centers, a key environmental impact area for network providers.

- Carbon Emissions: Transparency regarding Scope 1, 2, and 3 emissions associated with its operations and supply chain.

- Waste Management: Reporting on recycling rates and responsible disposal of electronic waste generated from hardware development and maintenance.

- Stakeholder Confidence: Demonstrating a commitment to sustainability enhances IIJ's reputation and appeal to investors and corporate clients prioritizing ESG factors.

Resource Management and E-waste

IIJ's operations, involving network hardware and software, highlight the importance of resource management and e-waste. Sustainable sourcing and manufacturing are key, especially as global e-waste generation continues to rise. In 2023, the UN reported over 62 million tonnes of e-waste were produced, a figure projected to reach 82 million tonnes by 2030.

Responsible e-waste management is crucial for companies like IIJ. This involves designing products for durability and recyclability, and establishing robust take-back programs. For instance, the European Union's Ecodesign directive aims to improve the environmental performance of products throughout their lifecycle, influencing how hardware is developed and managed.

IIJ's approach to resource management should encompass the entire lifecycle of its network equipment and servers. This includes efficient energy use in data centers and responsible end-of-life processing for decommissioned hardware. The company's commitment to sustainability in these areas can mitigate environmental impact and align with growing regulatory and consumer expectations.

- Global E-waste Growth: Over 62 million tonnes of e-waste generated in 2023, projected to reach 82 million tonnes by 2030.

- Circular Economy Focus: Emphasis on product design for longevity, repairability, and recyclability to reduce waste.

- Regulatory Landscape: Adherence to environmental regulations like the EU's Ecodesign directive influences product lifecycle management.

- Data Center Efficiency: Implementing energy-efficient practices in data centers and managing server lifecycles are critical environmental considerations.

Environmental factors significantly influence IIJ's operations, particularly concerning energy consumption and carbon emissions from its data centers and network infrastructure. The increasing demand for cloud services amplifies this impact, with global data center energy consumption reaching 1.8% of total electricity demand in 2023.

Japan's commitment to carbon neutrality by 2050 mandates that IT firms like IIJ adopt energy-efficient technologies and renewable energy sources. This national goal is expected to drive investment in greener IT solutions, creating opportunities for companies that prioritize sustainability.

The growing emphasis on Green IT and ESG reporting means companies must be transparent about their environmental performance. By 2024, over 90% of S&P 500 companies were expected to issue sustainability reports, highlighting the importance of quantifiable environmental metrics for stakeholder confidence.

Resource management and e-waste are also critical environmental considerations, especially with global e-waste generation projected to reach 82 million tonnes by 2030. IIJ must focus on product durability, recyclability, and responsible end-of-life processing for its hardware to align with circular economy principles and regulatory expectations.

| Environmental Factor | 2023 Data/Projection | Impact on IIJ | Opportunity/Mitigation |

|---|---|---|---|

| Data Center Energy Consumption | 1.8% of global electricity demand (2023) | High energy footprint for cloud services | Invest in energy-efficient cooling and renewable energy sources |

| E-waste Generation | 62 million tonnes (2023), projected 82 million tonnes by 2030 | Lifecycle management of hardware | Design for durability/recyclability, implement take-back programs |

| Carbon Neutrality Goals (Japan) | Carbon neutral by 2050 | Regulatory pressure for reduced emissions | Develop and promote greener IT solutions, leverage government incentives |

| ESG Reporting Demand | >90% of S&P 500 issuing reports (2024) | Need for transparency in environmental performance | Detailed reporting on energy efficiency and waste management |

PESTLE Analysis Data Sources

Our PESTLE Analysis for i-Net is meticulously constructed using data from reputable sources such as the International Telecommunication Union (ITU), national regulatory bodies, and leading market research firms specializing in the technology sector. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the internet industry.