IHS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHS Bundle

Unlock the critical external factors shaping IHS's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full analysis now and make informed decisions.

Political factors

IHS Towers' significant presence in emerging markets like Nigeria makes it acutely sensitive to government stability and policy shifts. Political unrest or changes in regulatory environments can directly affect its operational licenses and the overall investment climate, impacting its business model.

The company's 2024 annual report underscores this vulnerability, specifically citing economic and political uncertainties in key markets, with Nigeria, its largest market, being a primary area of concern. This highlights the direct correlation between political factors and IHS Towers' financial performance and strategic planning.

The telecommunications sector operates under a stringent regulatory framework, directly impacting IHS Towers' operations through rules on spectrum allocation, tower sharing agreements, and foreign investment limits. A supportive regulatory landscape that promotes infrastructure sharing and capital investment is crucial for IHS's growth trajectory.

Conversely, restrictive policies or abrupt regulatory shifts can impede expansion plans and inflate operational expenses. IHS Towers' 2024 sustainability report highlights its dedication to engaging with governmental bodies and regulatory agencies, underscoring the importance of this relationship for its business model.

Governments in emerging markets are increasingly prioritizing digital inclusion and broadband penetration, recognizing their crucial role in fostering economic growth and social development. This aligns directly with IHS Towers' mission to expand mobile connectivity. Such government focus can translate into valuable support, including incentives and strategic partnerships for infrastructure development, accelerating market penetration and network expansion.

IHS Towers actively engages in digital inclusion efforts, exemplified by its participation in Nigeria's 3 Million Technical Talent (3MTT) program, which has already trained over 100,000 students in essential digital skills. Furthermore, a significant collaboration with UNICEF and the ITU's Giga initiative aims to connect schools to the internet, underscoring the company's commitment to bridging the digital divide and creating a more connected future.

Geopolitical Risks and Sanctions

IHS Towers operates across numerous international markets, many of which are emerging economies. This global footprint inherently exposes the company to geopolitical risks. These can range from escalating trade tensions between major economic blocs to the imposition of international sanctions or localized regional conflicts. Such events can significantly disrupt global supply chains, which are critical for infrastructure deployment, and can also lead to currency instability in affected regions, impacting IHS Towers' financial performance.

The ability of mobile network operators (MNOs), IHS Towers' primary customers, to invest in expanding their networks is directly tied to the political and economic stability of the countries they operate in. Geopolitical instability can deter MNO investment, thereby slowing down the demand for new tower infrastructure and impacting IHS Towers' revenue growth prospects. The company itself acknowledges this in its annual reports, highlighting compliance with laws, regulations, and sanctions as a key risk factor it actively manages.

- Global Exposure: IHS Towers' operations span over 10 countries as of late 2023, increasing its vulnerability to diverse geopolitical events.

- Supply Chain Impact: Trade disputes or sanctions can affect the cost and availability of essential equipment like base station components, impacting project timelines and costs.

- Customer Investment Sensitivity: MNO capital expenditure plans are highly sensitive to political stability; for instance, a conflict in a key market could halt network upgrades.

- Regulatory Compliance: Navigating varying international sanctions regimes requires robust compliance frameworks, adding operational complexity and potential cost.

Infrastructure as Critical National Information Infrastructure

Governments increasingly recognize telecommunication towers as critical national information infrastructure, a designation that elevates their strategic importance. This recognition, exemplified by Nigeria's approach, can translate into more robust security protocols and protective measures for tower assets. For instance, IHS Nigeria's partnership with the Nigerian Security and Civil Defence Corps (NSCDC) in 2023 highlights direct collaboration to ensure the physical security of vital telecom infrastructure, a trend likely to continue as digital reliance grows.

These designations often come with increased government oversight and potential for preferential treatment or regulatory support. The strategic importance means that disruptions to these networks are viewed as national security threats, prompting proactive measures. IHS Towers, as a major operator, benefits from this as it can lead to a more stable operating environment and potentially reduced risks of vandalism or unauthorized access, which are significant concerns in the sector.

This governmental focus can also facilitate infrastructure development and expansion. By securing critical infrastructure status, companies like IHS may find it easier to obtain permits, access government funding initiatives, or engage in public-private partnerships aimed at improving national connectivity. The ongoing expansion of 5G networks globally, with an estimated 1.5 billion new 5G connections expected by the end of 2024, further underscores the need for secure and reliable tower infrastructure, reinforcing these political factors.

- Critical Infrastructure Designation: Telecommunication towers are increasingly classified as critical national information infrastructure by governments worldwide.

- Enhanced Security: This status leads to improved security measures and protection for tower assets, often involving government agencies.

- Partnerships for Protection: IHS Nigeria's collaboration with the NSCDC demonstrates a practical application of this protective framework.

- Strategic Importance: The designation reflects the vital role of telecom infrastructure in national security and economic stability, especially with the ongoing 5G rollout.

Government stability and policy consistency are paramount for IHS Towers, particularly in its key emerging markets. Political shifts can directly impact regulatory frameworks, foreign investment rules, and the overall business environment, influencing operational continuity and expansion plans. The company's 2024 financial disclosures noted that political uncertainties in Nigeria, its largest market, represent a significant risk factor.

Governments are increasingly prioritizing digital inclusion and the expansion of broadband services, aligning with IHS Towers' core business. This focus can lead to supportive policies, incentives, and partnerships that facilitate infrastructure development and market penetration. For example, the Nigerian government's 3 Million Technical Talent (3MTT) program, in which IHS participates, aims to boost digital skills, reflecting this broader governmental objective.

IHS Towers' global footprint exposes it to geopolitical risks, including trade disputes and regional conflicts, which can disrupt supply chains for essential equipment and affect customer investment capacity. The company actively manages compliance with international sanctions and diverse regulatory landscapes as a key operational challenge.

Telecommunication towers are increasingly recognized as critical national infrastructure, leading to enhanced security measures and potential government support. This strategic designation, as seen in Nigeria's approach to protecting telecom assets, reinforces the importance of reliable connectivity and can foster a more stable operating environment for IHS Towers, especially with the ongoing global expansion of 5G networks.

| Political Factor | Impact on IHS Towers | 2024/2025 Relevance |

|---|---|---|

| Government Stability & Policy | Affects regulatory environment, investment climate, and operational licenses. | Nigeria's political landscape remains a key consideration for IHS Towers' growth and risk assessment. |

| Digital Inclusion Initiatives | Can drive demand for infrastructure and create opportunities for partnerships. | Governmental push for broadband penetration supports IHS Towers' mission and potential for new deployments. |

| Geopolitical Risks | Disrupts supply chains and impacts customer (MNO) investment decisions. | Global trade tensions and regional instability continue to pose risks to equipment sourcing and market demand. |

| Critical Infrastructure Status | Enhances security and can lead to preferential regulatory treatment or support. | Growing recognition of telecom infrastructure's importance provides a more secure operational framework for tower assets. |

What is included in the product

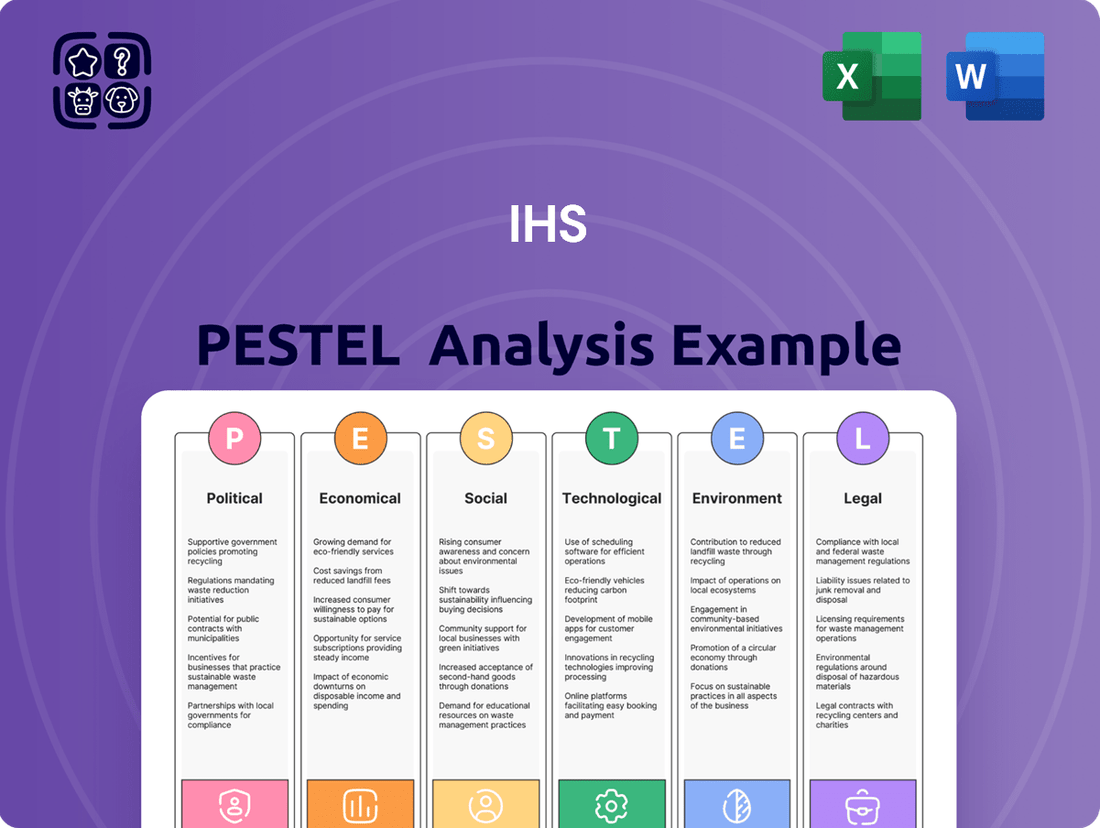

The IHS PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the IHS.

This comprehensive review is designed to equip stakeholders with actionable insights for strategic decision-making and risk mitigation.

Provides a clear, actionable framework for understanding external influences, simplifying complex market dynamics for strategic decision-making.

Economic factors

Currency fluctuations, particularly the devaluation of the Nigerian Naira, present a significant challenge for IHS Towers. As Nigeria represents their largest market, a weaker Naira directly translates to lower reported U.S. dollar revenues. This foreign exchange exposure can create substantial headwinds, impacting the company's overall profitability through unrealized foreign exchange losses.

The impact of the Nigerian Naira's devaluation was clearly visible in IHS Towers' Q1 2024 financial results. While the trend showed some stabilization by Q4 2024, the volatility underscores the ongoing risk associated with currency movements in key operating regions. For instance, the Naira experienced significant depreciation against the US Dollar throughout much of 2024, directly affecting IHS Towers' reported revenue figures.

Economic growth in emerging markets is a huge factor for companies like IHS Towers. When these economies are doing well, people generally have more money to spend. This means more people can afford mobile phones and data plans, which directly boosts the demand for the cell towers IHS builds and manages. For instance, in 2024, many African economies are projected to see solid GDP growth, with some countries like Rwanda and Cote d'Ivoire expected to grow by over 6%.

As emerging economies expand, their GDP per capita tends to rise. This increase in individual wealth means consumers have more disposable income, leading to higher spending on telecommunications services. IHS Towers' strategic presence in Africa and Latin America, regions with significant growth potential, allows them to tap into this expanding consumer base. In 2025, Sub-Saharan Africa's GDP is anticipated to expand by approximately 3.7%, according to IMF projections, signaling continued opportunities for increased mobile service adoption.

Inflationary pressures, especially concerning fuel and energy, directly impact IHS Towers' operational expenditures. Powering towers, a significant cost driver, is particularly sensitive in areas with inconsistent grid electricity. For instance, in 2024, IHS Towers continued to focus on managing these rising energy costs.

To counter these effects, IHS Towers has proactively implemented strategies such as incorporating power indexation into their service agreements. Furthermore, substantial investments in hybrid power systems and solar energy solutions are underway to create more resilient and cost-effective power solutions for their tower infrastructure, aiming to stabilize operational expenses against volatile energy markets.

Access to Capital and Investment Climate

IHS Towers' growth hinges on securing capital and navigating a positive investment environment. This means readily available debt and equity, alongside investor confidence in the stability and economic outlook of its operational regions. For instance, in 2023, IHS Towers secured a $200 million revolving credit facility, demonstrating ongoing access to financing.

The company's strategic priorities include enhancing capital deployment efficiency and fortifying its financial structure. This focus is crucial as global interest rates and inflation can impact borrowing costs and investor appetite. The overall investment climate, influenced by regulatory stability and economic growth forecasts, directly affects IHS Towers' capacity for network expansion and infrastructure upgrades.

- Access to Capital: IHS Towers' ability to fund new tower builds and acquisitions is directly tied to its access to diverse financing sources, including bank loans and capital markets.

- Investment Climate: Favorable regulatory frameworks, political stability, and predictable economic policies in its operating countries are critical for attracting and retaining investor confidence.

- Capital Allocation: The company's strategic review aims to optimize the deployment of capital, ensuring investments yield the highest returns and support long-term network expansion.

- Balance Sheet Strength: Strengthening its balance sheet through prudent financial management enhances creditworthiness and provides a more robust foundation for future capital raising.

Mobile Network Operator (MNO) Performance and Consolidation

The financial health of Mobile Network Operators (MNOs) is a critical economic factor for IHS Towers. In 2024, IHS Towers' top three MNO customers represented a significant 98.5% of its consolidated revenue. This heavy reliance means any financial strain or strategic shifts within these key clients, such as market consolidation, directly impacts IHS's revenue streams and lease agreement fulfillment capabilities.

Market consolidation among MNOs can lead to fewer, larger players, potentially altering negotiation power for tower leases. This could result in pressure on pricing or changes in demand for tower infrastructure. For instance, if two major MNOs merge, they might consolidate their tower portfolios, potentially reducing the need for external tower space from providers like IHS.

- Customer Concentration: 98.5% of IHS Towers' 2024 consolidated revenue came from its top three MNO customers.

- Economic Sensitivity: IHS's performance is directly tied to the financial stability and strategic decisions of these major MNOs.

- Consolidation Impact: MNO mergers could lead to renegotiated tower lease terms or reduced demand for new sites.

The economic landscape for IHS Towers is heavily influenced by currency valuations and the financial health of its clients. The devaluation of the Nigerian Naira, a key market for IHS, directly impacts reported U.S. dollar revenues, as seen in Q1 2024 results. Furthermore, the company's reliance on a few major Mobile Network Operators (MNOs), who accounted for 98.5% of its consolidated revenue in 2024, makes it vulnerable to any financial strains or consolidation within these partnerships.

Economic growth in emerging markets is a significant driver for IHS Towers, as increased GDP per capita fuels demand for telecommunications services. Projections for solid GDP growth in many African economies in 2024, with some exceeding 6%, alongside an anticipated 3.7% expansion in Sub-Saharan Africa's GDP for 2025, signal continued opportunities for mobile service adoption. However, inflationary pressures, particularly on fuel and energy costs, directly affect operational expenditures, necessitating strategies like power indexation in contracts and investments in hybrid and solar power solutions.

Access to capital and a favorable investment climate are crucial for IHS Towers' expansion. The company's ability to secure financing, demonstrated by a $200 million revolving credit facility in 2023, is vital for new tower builds and acquisitions. Investor confidence, bolstered by regulatory stability and positive economic outlooks in operating regions, directly influences the company's capacity for network growth and infrastructure upgrades.

Full Version Awaits

IHS PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This IHS PESTLE Analysis provides a comprehensive overview of the external factors impacting the industry. The content and structure shown in the preview is the same document you’ll download after payment.

Sociological factors

The surge in mobile phone ownership and the widespread embrace of digital services, particularly in developing economies, are directly fueling the growth of companies like IHS Towers. As more individuals gain access to mobile technology and the internet, the need for reliable and far-reaching telecommunications infrastructure intensifies. This trend is a cornerstone for IHS's business model.

By 2030, mobile subscriber penetration across Africa is projected to hit 50%, a significant increase that will undoubtedly spur greater demand for network expansion and upgrades. This growing user base translates into a direct need for more cell towers and related infrastructure, which IHS Towers is strategically positioned to provide.

Rapid urbanization is a major driver for increased demand for mobile network capacity, particularly in densely populated city centers. Simultaneously, there's a strong push to connect rural and underserved populations, requiring significant infrastructure investment to overcome the digital divide.

IHS Towers actively addresses these dual trends by strategically deploying small cells in urban areas to boost capacity and expanding its network reach into rural communities. This approach ensures they cater to the growing needs of city dwellers while also bringing essential connectivity to previously unconnected regions.

A prime example of this commitment is IHS Towers' success in bringing mobile network coverage to over 580 rural communities in Nigeria. This initiative directly tackles the rural connectivity challenge, demonstrating a tangible impact on bridging the digital gap.

Emerging markets are characterized by a youthful demographic, with a significant portion of the population under 25. This digitally native generation is driving demand for mobile data and digital services, creating a fertile ground for growth. For instance, in many African markets where IHS Towers operates, the median age hovers around 18-20 years, showcasing this youth bulge.

IHS Towers actively fosters digital literacy through its commitment to developing digital skills. Initiatives such as STEM training programs and the establishment of ICT centers are crucial. These efforts directly contribute to equipping the young, growing population with the necessary competencies for an increasingly digital economy, ensuring a pipeline of digitally savvy users and employees.

Socioeconomic Development and Digital Inclusion

Mobile connectivity is a powerful engine for socioeconomic progress, unlocking opportunities in education, healthcare, jobs, and financial services. IHS Towers' network infrastructure is key to bridging the digital divide, fostering community growth and making a tangible societal difference, a central theme in their sustainability efforts.

The company's commitment to this is evident in its 2024 financial allocations. Specifically, 55% of IHS Towers' sustainability spending was directed towards programs focused on education and economic development.

- Digital Inclusion: IHS Towers' infrastructure enables greater access to essential services through mobile technology.

- Socioeconomic Impact: This connectivity supports advancements in education, healthcare, and employment opportunities.

- Sustainability Focus: In 2024, a significant 55% of sustainability expenditure was allocated to education and economic growth.

Health and Safety Standards

Ensuring the well-being of employees and the communities surrounding tower sites is a key sociological factor. IHS Towers prioritizes this by implementing robust health and safety standards, which in turn fosters trust and mitigates operational risks.

The company's commitment is evident in its introduction of Life Saving Rules and HSE Principles. This focus has yielded positive results, with IHS Towers reporting a reduction in recordable work-related injuries during 2024.

- Employee Safety: IHS Towers' Life Saving Rules are designed to prevent fatalities and serious injuries.

- Community Impact: Strong safety protocols protect not only workers but also the general public near tower operations.

- Risk Mitigation: Adherence to HSE Principles helps avoid accidents, which can lead to costly disruptions and reputational damage.

- Performance Improvement: A reported decrease in recordable work-related injuries in 2024 demonstrates the effectiveness of their safety initiatives.

Sociological factors significantly influence IHS Towers' operational landscape and growth trajectory. The increasing digital literacy and adoption of mobile services, particularly among the youth in emerging markets, directly correlates with the demand for robust telecommunications infrastructure. This demographic trend is a powerful catalyst for IHS Towers' expansion.

The company's focus on bridging the digital divide, by connecting underserved rural populations, demonstrates a commitment to societal progress. This not only expands their market reach but also enhances their social license to operate. For instance, IHS Towers' initiatives in Nigeria have brought connectivity to hundreds of rural communities, fostering socioeconomic development.

Prioritizing employee and community safety is paramount. IHS Towers' implementation of stringent health, safety, and environment (HSE) principles, including Life Saving Rules, directly contributes to operational stability and fosters trust. This proactive approach resulted in a reduction of recordable work-related injuries in 2024, underscoring the effectiveness of their safety programs.

| Sociological Factor | Impact on IHS Towers | Supporting Data/Initiatives (2024/2025) |

|---|---|---|

| Youth Demographic & Digital Adoption | Drives demand for mobile data and services, necessitating infrastructure expansion. | Median age in many African markets is around 18-20 years, with increasing mobile penetration. |

| Bridging the Digital Divide | Expands market reach and enhances social responsibility by connecting underserved areas. | Over 580 rural communities in Nigeria connected by IHS Towers. |

| Employee & Community Well-being | Ensures operational stability, mitigates risks, and builds trust. | Reduction in recordable work-related injuries in 2024 due to HSE principles and Life Saving Rules. |

| Socioeconomic Impact | Contributes to advancements in education, healthcare, and employment, aligning with sustainability goals. | 55% of sustainability spending in 2024 directed towards education and economic development. |

Technological factors

The ongoing global rollout of 5G technology represents a significant technological catalyst for IHS Towers. This advancement necessitates a denser network infrastructure, including more towers and small cells, to effectively utilize the higher frequency bands characteristic of 5G. This directly translates to increased demand for new site construction and co-location opportunities for IHS Towers.

IHS Towers is strategically positioned to capitalize on the escalating need for robust communication infrastructure as 5G deployment continues across its key operational regions. For instance, in 2024, significant 5G spectrum auctions and initial network buildouts are expected to accelerate demand for tower space in markets like South Africa and Nigeria, where IHS has a substantial presence.

The ongoing expansion of fiber optic infrastructure is a critical technological factor for IHS Towers, directly impacting its ability to support advanced mobile services. This expansion is essential for the smooth operation and future rollout of 4G and 5G networks, which require significantly higher bandwidth and lower latency to meet escalating data consumption by users.

IHS Towers is actively engaged in deploying fiber-to-the-tower (FTTT) solutions to bolster its transmission capacity and overall network performance. This strategic investment ensures that its tower infrastructure can handle the increased data traffic generated by modern mobile technologies. For example, IHS Nigeria's deployment of 10,000km of fiber optic cables is a concrete step towards enabling new generation technologies like 5G, enhancing connectivity across its network.

The increasing demand for ubiquitous connectivity is driving the adoption of Distributed Antenna Systems (DAS) and small cells. These technologies are crucial for bolstering network performance in densely populated urban environments and large indoor venues, areas where traditional macro towers struggle to provide adequate coverage and capacity.

IHS Towers is actively expanding its infrastructure portfolio by offering these advanced solutions, demonstrating a commitment to addressing the dynamic requirements of its clientele. Their connected DAS offerings are specifically designed for large buildings, ensuring seamless and robust wireless communication within these complex structures.

The market for DAS and small cells is experiencing significant growth. For instance, the global DAS market was valued at approximately $7.5 billion in 2023 and is projected to reach over $15 billion by 2029, with a compound annual growth rate of around 12%. This growth underscores the critical role these technologies play in the modern telecommunications landscape.

Energy Solutions and Hybrid Power Systems

Technological advancements in energy solutions, especially hybrid power systems and solar, are pivotal for lowering operational expenses and environmental footprints, particularly in regions with inconsistent grid electricity. IHS Towers' commitment to this is evident in their substantial investment in 'Project Green,' designed to lessen reliance on diesel generators.

This strategic shift not only addresses cost efficiencies but also aligns with growing sustainability mandates. For instance, by integrating solar and battery storage, IHS Towers aims to achieve significant reductions in diesel consumption, which directly translates to lower fuel costs and reduced carbon emissions. In 2023, IHS Towers reported a notable decrease in diesel usage across its African operations, attributing a portion of this success to the rollout of hybrid power solutions.

- Project Green Focus: IHS Towers is actively deploying hybrid power systems, combining solar, batteries, and existing diesel generators, to improve energy efficiency and reduce operational costs.

- Diesel Dependency Reduction: The company's strategy aims to significantly cut down on diesel fuel consumption, a major expense and environmental concern for telecom tower operations.

- Sustainability Goals: These technological investments support broader environmental, social, and governance (ESG) objectives by lowering the carbon intensity of operations.

- Market Impact: In markets with unreliable grid infrastructure, these advanced energy solutions enhance site uptime and reliability, crucial for telecom service providers.

Network Virtualization and Edge Computing

The shift towards network virtualization and edge computing presents a fascinating technological evolution that could indirectly shape the demand for tower infrastructure. While companies like IHS Towers may not directly own the active network equipment involved, these advancements could necessitate new types of hosting capabilities at tower sites.

Specifically, the increasing reliance on edge computing, which brings data processing closer to the source of data generation, might lead to a future where tower companies are called upon to host more sophisticated equipment, including small-scale data centers, directly at their tower locations. This could represent a diversification opportunity for tower providers as networks become more distributed and require localized processing power.

For instance, the 5G rollout, a key driver for edge computing, is seeing significant investment. In 2024, global 5G infrastructure spending was projected to reach over $150 billion, with a substantial portion dedicated to densifying networks and enabling edge capabilities. This trend underscores the potential for tower companies to adapt their infrastructure to accommodate these evolving technological demands. IHS Towers has already been signaling its intent to diversify, as evidenced by its strategic partnerships and investments in new service areas beyond traditional tower leasing.

- Network Virtualization: Enables more flexible and efficient network management, potentially reducing the need for some physical network components but increasing the demand for robust connectivity at distributed points.

- Edge Computing: Drives the need for localized compute and storage, creating opportunities for tower sites to host small data centers or specialized equipment to reduce latency.

- 5G Rollout: A primary catalyst for edge computing, requiring denser network infrastructure and potentially more diverse hosting solutions at tower locations.

- IHS Towers Diversification: Proactive strategy to adapt to technological shifts by exploring new service offerings that leverage existing tower infrastructure for future network demands.

The continuous evolution of mobile network technology, particularly the widespread adoption of 5G, directly fuels demand for more tower infrastructure. This includes the need for denser networks and the integration of small cells to support higher frequencies and increased data traffic. IHS Towers is well-positioned to benefit from this trend, with significant 5G spectrum auctions and network buildouts expected in key markets like South Africa and Nigeria throughout 2024.

Advancements in fiber optic networks are crucial for supporting the high bandwidth and low latency required by 4G and 5G services. IHS Towers' investment in fiber-to-the-tower (FTTT) solutions, such as the 10,000km of fiber deployed in Nigeria, enhances its network capacity and readiness for next-generation technologies.

The growth in Distributed Antenna Systems (DAS) and small cells, driven by the demand for ubiquitous connectivity in urban areas and venues, presents another opportunity. The global DAS market, valued at approximately $7.5 billion in 2023, is projected to exceed $15 billion by 2029, highlighting the increasing importance of these solutions.

Technological improvements in energy solutions, especially hybrid and solar power systems, are vital for reducing operational costs and environmental impact. IHS Towers' Project Green initiative, aimed at decreasing reliance on diesel generators, saw a notable reduction in diesel usage across its African operations in 2023, demonstrating a commitment to sustainability and efficiency.

| Technology | Impact on IHS Towers | Market Data/Example |

|---|---|---|

| 5G Deployment | Increased demand for new sites and co-location. | Accelerated demand in South Africa and Nigeria in 2024. |

| Fiber Optic Expansion | Enhanced transmission capacity for advanced services. | 10,000km of fiber deployed in IHS Nigeria. |

| DAS & Small Cells | Addresses urban coverage and capacity needs. | Global DAS market projected to reach over $15 billion by 2029. |

| Hybrid/Solar Power | Reduced operational costs and environmental footprint. | Notable decrease in diesel usage in IHS Towers' African operations in 2023. |

Legal factors

IHS Towers navigates a complex web of telecommunications regulations across its eight operating markets, including licensing, spectrum allocation, and infrastructure sharing. Failure to comply with these rules, as noted in their 2023 annual report, poses a significant risk, potentially leading to fines, loss of operating licenses, or service interruptions.

The construction and operation of telecommunications towers are heavily regulated by local land use and zoning ordinances. These laws mandate obtaining specific permits, conducting thorough environmental impact assessments, and adhering to aesthetic guidelines designed to integrate infrastructure with the surrounding landscape. For instance, in 2024, the average time to secure a zoning permit for a new tower in the US was approximately 6-9 months, with some jurisdictions extending this to over a year, directly influencing project timelines and escalating deployment costs for companies like American Tower Corporation.

Long-term master lease agreements (MLAs) with mobile network operators are fundamental to IHS Towers' revenue generation. The legal strength and specific terms within these contracts, such as rent escalators, power indexation, and renewal provisions, directly impact the company's financial health. For instance, IHS Towers reported in its 2023 annual report that these MLAs underpin a substantial portion of its recurring income.

IHS Towers has demonstrated significant commercial success through the renewal and extension of crucial MLAs. These agreements with major players like MTN Nigeria and Airtel Nigeria cover a substantial percentage of the company's revenue streams, reinforcing its stable financial outlook. The company's ability to secure these long-term commitments highlights the critical legal framework supporting its business model.

Competition Law and Antitrust Regulations

IHS Towers, as a significant independent tower operator, must navigate a complex web of competition and antitrust laws across its operational regions. These regulations are designed to prevent monopolies, ensure fair market practices, and scrutinize any proposed mergers or acquisitions to maintain a healthy competitive landscape. In 2024, the Latin American telecom tower sector remains robustly competitive, featuring a mix of established global entities and agile local providers, all vying for market share and new infrastructure development contracts.

The enforcement of these laws can directly impact IHS Towers' strategic growth initiatives, particularly concerning potential consolidation or expansion through acquisitions. For instance, regulatory bodies in key markets like Brazil and Mexico actively monitor tower ownership concentration to safeguard consumer interests and promote innovation. The ongoing liberalization of telecommunications markets in many Latin American countries further intensifies the need for strict adherence to these legal frameworks.

- Market Concentration: Antitrust authorities review tower ownership levels to prevent excessive market dominance by any single operator.

- Fair Competition: Regulations ensure that all players, including IHS Towers, compete on a level playing field, prohibiting anti-competitive practices.

- Mergers & Acquisitions: Significant M&A activities by IHS Towers would be subject to approval by competition authorities in relevant jurisdictions, assessing potential impacts on market competition.

- Regulatory Scrutiny: The Latin American telecom tower market, valued in the billions of dollars, faces increasing regulatory oversight in 2024-2025 to ensure fair play and prevent undue market power.

Data Privacy and Security Laws

While IHS Towers is primarily an infrastructure provider, its operations indirectly facilitate services that process significant user data. Staying compliant with evolving data privacy and security regulations, such as GDPR and similar frameworks globally, is increasingly crucial for the entire telecommunications sector. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and has seen ongoing enforcement actions, sets a high bar for data protection.

IHS Towers' commitment to ethical operations and robust governance, as highlighted in their sustainability reporting, is essential for navigating this complex legal landscape. The company must ensure its infrastructure supports clients in meeting their data protection obligations. The global data privacy market was valued at approximately USD 2.1 billion in 2023 and is projected to grow significantly, underscoring the importance of these legal factors.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is paramount for clients utilizing IHS Towers' infrastructure.

- Security Standards: Ensuring the physical and digital security of tower sites is critical to prevent data breaches for tenants.

- Evolving Regulations: Staying abreast of new and updated data protection laws across different operating regions is an ongoing challenge.

- Ethical Governance: Demonstrating a strong commitment to ethics and governance builds trust with clients and regulators.

IHS Towers operates within a framework of telecommunications laws, including licensing and spectrum allocation, with non-compliance risking fines and operational disruptions. Local zoning and environmental regulations for tower construction, requiring permits and impact assessments, significantly affect deployment timelines and costs, as seen with average US permit times of 6-9 months in 2024.

Master Lease Agreements (MLAs) are legally binding contracts critical to IHS Towers' revenue, with terms like rent escalators and renewal clauses directly influencing financial performance. The company's success in renewing these agreements with major operators underscores the stability provided by this legal foundation.

Antitrust and competition laws are vital as IHS Towers navigates market concentration and potential mergers, especially in competitive regions like Latin America where regulatory bodies monitor ownership levels to ensure fair practices and consumer interests. The Latin American telecom tower market, a multi-billion dollar industry, is experiencing increased regulatory scrutiny in 2024-2025.

Data privacy regulations, such as GDPR, are increasingly relevant as tower operations indirectly support data processing. Ensuring infrastructure supports client data protection obligations is crucial, with the global data privacy market valued at approximately USD 2.1 billion in 2023, highlighting the growing importance of this legal aspect.

Environmental factors

Tower sites, particularly those relying on diesel generators due to inconsistent grid access, are significant contributors to energy consumption and, consequently, carbon emissions. This reliance presents an environmental challenge for companies like IHS Towers.

IHS Towers is proactively addressing its environmental impact by integrating renewable energy sources into its operations. The company has set ambitious goals for reducing its Scope 1 and Scope 2 emissions intensity.

Demonstrating progress, IHS Towers achieved an approximately 11% reduction in its Scope 1 and Scope 2 kilowatt-hour emissions intensity in 2024 compared to the previous year. This builds on a larger trend, with a 20% reduction achieved since 2021.

Climate change is increasingly manifesting as more frequent and severe extreme weather events, such as intense storms and widespread flooding. These events pose a significant threat to critical infrastructure, including telecommunications towers, potentially causing damage and operational disruptions. For instance, in late 2023, Nigeria experienced devastating floods impacting numerous communities, a trend expected to persist and potentially worsen due to ongoing climate shifts.

To mitigate these risks, a focus on resilient infrastructure design and robust, proactive maintenance strategies is crucial. Companies must invest in hardening their assets against the elements and develop contingency plans for rapid response and recovery. This proactive approach is essential for ensuring business continuity and minimizing losses in the face of escalating climate-related challenges.

Highlighting this imperative, IHS Nigeria, a major tower company, partnered with UNICEF in late 2023 to provide emergency relief to communities devastated by floods. This collaboration underscores the direct engagement of companies like IHS with the tangible impacts of climate change and their role in addressing its consequences, demonstrating a commitment beyond core business operations.

Telecommunications infrastructure development, upkeep, and eventual retirement create significant waste streams, notably e-waste from frequent equipment refreshes. For instance, in 2024, the global volume of e-waste was projected to reach 61.3 million metric tons, a substantial increase from previous years, highlighting the growing challenge.

Adopting robust waste management protocols is crucial for telecommunications firms to meet environmental regulations and bolster their sustainability credentials. Companies are increasingly investing in circular economy models, with some reporting that over 70% of their decommissioned equipment is now reused or recycled as of their latest 2025 sustainability reports.

Resource Scarcity (e.g., Water)

Water scarcity is a growing environmental consideration for businesses, impacting operations in specific regions. While tower infrastructure itself might not demand vast amounts of water, adopting sustainable water management is crucial for overall environmental responsibility. For instance, IHS Towers' partnership with WaterAid in Rwanda saw the creation of rainwater harvesting systems at schools, directly benefiting communities by ensuring access to clean water.

This initiative highlights a proactive approach to environmental stewardship. By investing in such projects, companies can mitigate risks associated with water stress and contribute positively to local ecosystems and populations. Such actions are increasingly important as global water resources face mounting pressure from climate change and increased demand.

- Water Stress Impact: Regions facing water scarcity can pose operational challenges and reputational risks.

- Sustainable Practices: Implementing water conservation and alternative sourcing methods are key for long-term viability.

- Community Engagement: Projects like rainwater harvesting demonstrate corporate commitment to social and environmental well-being.

- IHS Towers Initiative: The Rwanda project provided clean water access to communities through sustainable infrastructure.

Biodiversity and Land Impact

The placement and construction of new telecommunication towers can significantly affect local ecosystems and how land is utilized. This necessitates careful planning and environmental stewardship to mitigate any adverse ecological consequences.

IHS Towers recognizes the importance of responsible land management. They have actively engaged in environmental restoration projects, demonstrating a commitment to minimizing their footprint. For instance, in 2023, the company participated in planting 7,800 seedlings in Brazil's Amazon region, directly contributing to the restoration of degraded areas.

- Biodiversity Impact: Tower construction can disrupt habitats and affect local wildlife populations.

- Land Use: Siting decisions must consider existing land use patterns and potential conflicts.

- Reforestation Efforts: IHS Towers' initiative in Brazil highlights a proactive approach to ecological restoration, planting 7,800 seedlings in 2023.

Environmental factors significantly influence telecommunications infrastructure, particularly concerning energy consumption and emissions. IHS Towers is actively working to reduce its carbon footprint by integrating renewable energy solutions, achieving an 11% reduction in Scope 1 and 2 emissions intensity in 2024.

Extreme weather events, exacerbated by climate change, pose a direct threat to tower infrastructure, necessitating resilient design and proactive maintenance. IHS Nigeria's collaboration with UNICEF in late 2023 to aid flood-affected communities exemplifies the tangible impact of these environmental shifts.

The growing volume of e-waste, projected to reach 61.3 million metric tons globally in 2024, presents a challenge for equipment management, with companies increasingly adopting circular economy principles, with over 70% of decommissioned equipment being reused or recycled by 2025.

Water scarcity and responsible land use are also critical environmental considerations. IHS Towers' reforestation efforts, including planting 7,800 seedlings in Brazil in 2023, and community water projects demonstrate a commitment to environmental stewardship.

| Environmental Factor | Impact on Infrastructure | Mitigation/Action by IHS Towers | Relevant Data/Initiative |

|---|---|---|---|

| Energy Consumption & Emissions | High reliance on diesel generators leads to carbon emissions. | Integration of renewable energy sources. | 11% reduction in Scope 1 & 2 emissions intensity (2024). |

| Climate Change & Extreme Weather | Risk of damage and operational disruption from events like floods. | Resilient infrastructure design and proactive maintenance. | Partnership with UNICEF for flood relief (late 2023). |

| Waste Management (E-waste) | Significant waste streams from equipment refreshes. | Adoption of circular economy models. | Over 70% of decommissioned equipment reused/recycled (2025 reports). |

| Water Scarcity & Land Use | Operational challenges and ecosystem impact. | Sustainable water management and land restoration. | Planted 7,800 seedlings in Brazil (2023); rainwater harvesting projects. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in reliable and current information.