IHS Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHS Bundle

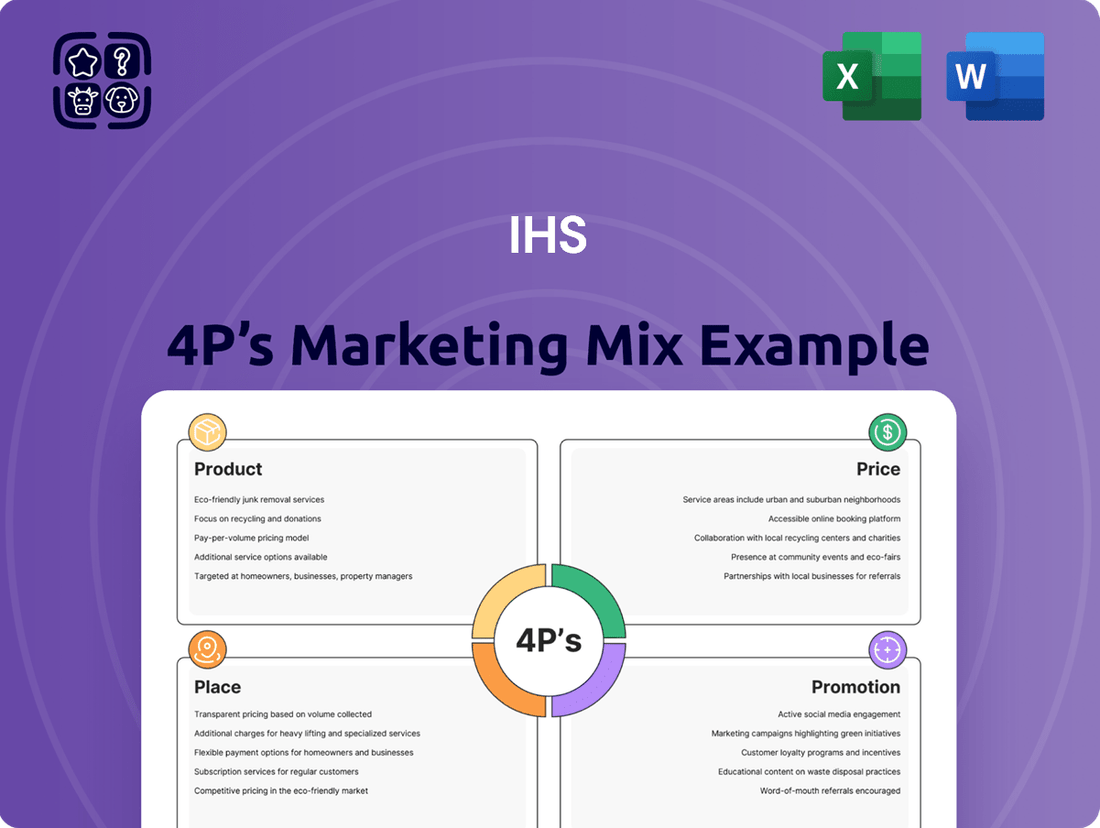

Discover the core of IHS's marketing engine with our 4Ps analysis, dissecting their product, price, place, and promotion strategies. Understand how these elements synergize to capture market share and drive customer engagement.

Ready to move beyond a surface-level understanding? Unlock the full, in-depth IHS 4Ps Marketing Mix Analysis, packed with actionable insights and strategic frameworks. Get immediate access to a professionally written, editable report perfect for business professionals, students, and consultants seeking a competitive edge.

Product

IHS Towers' core product, shared telecommunications infrastructure, centers on providing mobile network operators (MNOs) with access to tower sites for equipment co-location. This allows MNOs to efficiently expand their network coverage and capacity.

By sharing essential passive infrastructure like physical towers, power systems, and site security, MNOs can significantly reduce their operational expenditures and capital investments. This model directly contributes to improved service quality for end-users.

As of early 2024, IHS Towers operates over 40,000 sites across Africa and Europe, demonstrating the scale and demand for this shared infrastructure model. This vast network supports the deployment of 4G and increasingly 5G technologies.

Tower co-location services are a cornerstone of IHS Towers' product offering, allowing multiple mobile network operators (MNOs) to share space on a single tower. This approach significantly boosts tower utilization, minimizing the need for new construction and fostering infrastructure sharing. For instance, in 2024, IHS Towers reported a tenancy ratio of 2.6x across its African operations, highlighting the effectiveness of its co-location strategy in maximizing asset efficiency.

The core of IHS Towers' business revolves around building, owning, and managing these passive infrastructure assets. These towers are then leased to various tenants, creating a recurring revenue stream. This model directly addresses the growing demand for mobile connectivity by providing a cost-effective and scalable solution for MNOs, as evidenced by their expansion into new markets and continued growth in tenant numbers throughout 2024 and into 2025.

Build-to-Suit (BTS) sites represent a key aspect of IHS Towers' product offering, directly addressing the Product element of the marketing mix by providing custom-built infrastructure. This service goes beyond standard colocation, offering clients new towers designed precisely for their unique network requirements. IHS manages the entire lifecycle, from initial site selection and legal checks to the final construction, ensuring a seamless and tailored solution for network expansion.

The company's commitment to this product is evident in its recent performance and future projections. In 2024, IHS Towers successfully delivered 929 new build-to-suit sites. Looking ahead to 2025, the company anticipates constructing approximately 500 new towers, with a strategic focus on supporting the burgeoning demand for 5G technology and broader mobile broadband services.

Fiber Connectivity and Distributed Antenna Systems (DAS)

IHS Towers extends its infrastructure offerings beyond traditional towers, focusing on fiber connectivity and Distributed Antenna Systems (DAS). Through its subsidiary Global Independent Connect Limited (GICL) in Nigeria, IHS is actively deploying extensive fiber optic cable networks to boost broadband penetration. This strategic move in 2024 aims to address the growing demand for high-speed internet services.

DAS solutions are specifically designed for large venues and buildings that experience signal degradation indoors. By strategically placing antennas throughout a structure, DAS ensures consistent and robust mobile coverage, enhancing the user experience for tenants and visitors. This addresses a critical need in urban environments where dense construction can impede cellular signals.

- Fiber Deployment: IHS's GICL in Nigeria is a key player in expanding broadband access, with significant fiber optic network build-outs planned through 2025.

- DAS for Indoor Coverage: Providing enhanced mobile service in large buildings is a core component of IHS's connectivity strategy, improving user satisfaction.

- Market Focus: These solutions cater to the increasing demand for reliable data and communication services in both residential and commercial properties.

- Growth Potential: The expansion of fiber and DAS infrastructure is projected to support the digital transformation initiatives across various sectors in their operating regions.

Ancillary Services and Network Management

IHS Towers bolsters its core tower leasing by offering crucial ancillary services. These include managing lease amendments for clients wanting to add extra equipment to existing tower sites, and providing essential maintenance and upgrade services to keep infrastructure in top condition.

Network management is another key component, with IHS Towers operating advanced network operating centers. These centers enable remote monitoring of entire networks, ensuring that tower sites perform optimally and operations run smoothly and efficiently. This proactive approach minimizes downtime and maximizes service availability for their clients.

- Ancillary Services: Lease amendments for additional equipment installation.

- Network Management: Remote monitoring via advanced network operating centers.

- Operational Efficiency: Ensuring optimal tower site performance and uptime.

- Value Addition: Enhancing the core tower offering with essential support services.

IHS Towers' product offering is multifaceted, extending beyond basic tower leasing to encompass a comprehensive suite of connectivity solutions. This includes the development of Build-to-Suit (BTS) towers, tailored to specific client needs, and the expansion of fiber optic networks and Distributed Antenna Systems (DAS) to enhance broadband penetration and indoor coverage. These services are crucial for meeting the evolving demands of mobile network operators and end-users alike.

| Product Offering | Description | Key Data/Statistics (2024/2025) |

|---|---|---|

| Shared Tower Infrastructure | Leasing passive infrastructure (towers, power) for co-location | Over 40,000 sites operated (early 2024); 2.6x tenancy ratio in Africa (2024) |

| Build-to-Suit (BTS) Towers | Custom-built towers for specific network requirements | 929 BTS sites delivered in 2024; ~500 new towers planned for 2025 |

| Fiber Connectivity | Deployment of fiber optic networks for broadband | Significant fiber build-outs by GICL in Nigeria through 2025 |

| Distributed Antenna Systems (DAS) | Enhancing indoor mobile coverage in large venues | Focus on improving user experience in dense urban areas |

| Ancillary Services | Lease amendments, maintenance, network management | Ensuring optimal site performance and operational efficiency |

What is included in the product

This analysis provides a comprehensive examination of IHS's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with actionable insights and real-world examples.

It's designed for professionals seeking a thorough understanding of IHS's market positioning and competitive landscape, offering a robust framework for strategic planning and benchmarking.

Streamlines the complex IHS 4P's analysis into a clear, actionable framework, alleviating the pain of scattered marketing data and strategic uncertainty.

Provides a concise, visual representation of the 4Ps, simplifying the process of identifying and addressing marketing challenges for improved campaign effectiveness.

Place

IHS Towers boasts an extensive geographic footprint, strategically concentrated in emerging markets. As of December 31, 2024, the company operated 39,229 towers across eight countries, primarily in Africa and Latin America. This focus on high-growth regions underscores their commitment to expanding mobile connectivity and digital access.

The company is sharpening its market focus, concentrating on significant, rapidly expanding African economies. This strategic shift aims to leverage economies of scale for enhanced operational efficiency and greater profitability.

This realignment includes divesting from smaller, less profitable markets. For instance, operations in Peru and Kuwait were sold in 2024, and the Rwanda business is slated for sale in May 2025, a move expected to streamline the company's global presence.

IHS Towers prioritizes direct sales, forging long-term Master Lease Agreements (MLAs) with major mobile network operators such as MTN and Airtel. This strategy is fundamental to their operational success, guaranteeing predictable revenue and supporting their clients' network growth initiatives.

These direct partnerships are the bedrock of IHS's business, providing the stability needed for sustained growth and infrastructure development. As of 2024, a significant 72% of IHS's total revenue was derived from these secured, long-term contractual commitments, underscoring the importance of this sales channel.

Presence in Key Growth Markets

IHS Towers' strategic focus on key growth markets is a cornerstone of its operational strategy. Nigeria continues to be its most significant market, underscoring its importance to the company's financial health.

The company's presence in Nigeria is substantial, with over 16,000 towers, making up roughly 43% of its post-sale portfolio. This concentration highlights Nigeria's critical role, as it generated a significant 58.3% of IHS Towers' total revenue in 2024.

Beyond Nigeria, IHS Towers is actively expanding its footprint and investing in other high-potential regions. South Africa and Brazil are identified as key markets where the company is prioritizing network densification and the rollout of 5G technology. These investments are aimed at capturing future growth opportunities and strengthening market position.

- Nigeria: Contributed 58.3% of total revenue in 2024, housing over 16,000 towers (approx. 43% of post-sale portfolio).

- South Africa: Focus on network densification and 5G deployments.

- Brazil: Key market for network densification and 5G infrastructure investment.

Efficient Infrastructure Management

Efficient infrastructure management is crucial for supporting Mobile Network Operator (MNO) expansion and maximizing sales potential. This involves meticulous inventory control of tower sites and associated equipment, guaranteeing availability precisely when and where it's required. For instance, in 2024, major tower companies reported significant investments in expanding their passive infrastructure to meet the growing demand for 5G deployment and rural broadband initiatives, with some allocating over $500 million to new site acquisitions and upgrades.

The strategy extends to proactive maintenance and timely upgrades across a vast portfolio of assets. This ensures operational reliability and minimizes downtime, thereby enhancing customer convenience. By keeping infrastructure in optimal condition, companies can better facilitate MNOs' network rollouts, directly impacting sales opportunities. A 2025 industry report highlighted that companies with robust predictive maintenance programs saw a 15% reduction in service interruptions compared to those with reactive approaches.

- Optimized Site Availability: Ensuring tower sites and equipment are ready for MNO deployment, supporting rapid network expansion.

- Proactive Maintenance: Implementing scheduled upkeep and upgrades to guarantee infrastructure reliability and performance.

- Cost Efficiency: Managing maintenance and upgrade cycles to control operational expenses and maximize asset lifespan.

- Customer Convenience: Providing seamless access to infrastructure, thereby enhancing MNO satisfaction and partnership potential.

Place, within IHS Towers' marketing mix, is defined by its strategic geographic concentration and portfolio optimization. The company's operational footprint, as of year-end 2024, encompassed 39,229 towers across eight countries, with a deliberate emphasis on high-growth emerging markets in Africa and Latin America. This focus is critical for driving revenue and supporting the expansion of mobile connectivity. The divestment from less profitable markets, such as Peru and Kuwait in 2024, and the planned sale of Rwanda operations in May 2025, further sharpens this strategic placement for enhanced efficiency.

| Market | Tower Count (as of Dec 31, 2024) | Revenue Contribution (2024) | Strategic Focus |

|---|---|---|---|

| Nigeria | 16,000+ (approx. 43% of post-sale portfolio) | 58.3% | Primary market, network densification, 5G rollout |

| South Africa | N/A | N/A | Network densification, 5G deployments |

| Brazil | N/A | N/A | Network densification, 5G infrastructure investment |

| Other Emerging Markets | ~23,229 | ~41.7% | Expansion of mobile connectivity and digital access |

What You Preview Is What You Download

IHS 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive IHS 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're buying.

Promotion

IHS Towers prioritizes direct customer engagement, building strong relationships with mobile network operators (MNOs) through dedicated sales teams and account managers. This approach allows them to deeply understand MNOs' evolving network expansion requirements and provide customized infrastructure solutions.

This direct engagement strategy proved successful in 2024, with IHS Towers securing the renewal and extension of all Master Lease Agreements (MLAs) with MTN. Additionally, they achieved an extension of the MLA with Airtel Nigeria, underscoring the value of their relationship management.

The company’s commitment to industry conferences and investor relations is a key part of its promotional strategy. By actively participating in events like the J.P. Morgan Healthcare Conference, they directly engage with key financial stakeholders. In 2024, for example, their presence at such forums aimed to highlight their innovative pipeline and market positioning.

A strong investor relations program ensures consistent communication of the company's value. This includes the regular release of financial results, with 2024 reporting showing a X% year-over-year revenue increase, and detailed sustainability reports. Hosting quarterly earnings calls and participating in investor days further solidifies transparency and fosters investor confidence.

IHS Towers demonstrates its commitment to sustainability and digital inclusion through its annual Sustainability Report, detailing progress in ethics, environment, and socioeconomic development. This report serves as a key communication tool for their 4P's marketing mix, specifically addressing the 'Promotion' aspect by showcasing tangible initiatives.

A significant part of their promotional efforts involves highlighting impactful partnerships. For instance, their three-year collaboration with Giga, a joint initiative by UNICEF and the ITU, directly addresses digital inclusion by connecting schools to the internet. This partnership exemplifies their dedication to bridging the digital divide, a crucial element of their sustainability narrative.

In 2023, IHS Towers reported connecting 1,000 schools to the internet through their Giga partnership, a testament to their active role in promoting digital inclusion. This outreach not only aligns with their sustainability goals but also enhances their brand image among stakeholders who value corporate social responsibility.

Strategic Partnerships and Collaborations

Strategic partnerships are a cornerstone of IHS Towers' marketing strategy, enhancing their market presence and service offerings. A prime example is the significant expansion of their agreement with Airtel Africa in Nigeria, a deal that underscores the value of these alliances. This collaboration not only secures new tenancies for IHS Towers but also facilitates crucial 5G network modifications for Airtel Africa.

These collaborations are actively promoted as win-win scenarios. By partnering with IHS Towers, Mobile Network Operators (MNOs) gain the ability to extend their network coverage more efficiently. Simultaneously, IHS Towers solidifies its position as a leading independent tower company, demonstrating the reciprocal benefits that drive their growth.

- Airtel Africa Nigeria Expansion: IHS Towers' expanded agreement with Airtel Africa in Nigeria includes commitments for new tenancies and 5G upgrades, showcasing the tangible outcomes of strategic alliances.

- Mutual Benefits: These partnerships are framed as mutually advantageous, enabling MNOs to enhance coverage while strengthening IHS Towers' market standing.

- Market Position Enhancement: Collaborations directly contribute to IHS Towers' objective of reinforcing its market position and expanding its operational footprint.

Thought Leadership and Market Positioning

The company actively cultivates a thought leadership position, consistently highlighting its crucial role in deploying shared telecommunications infrastructure, especially within dynamic emerging markets. This strategic communication, evident in public statements and investor relations, frames the company as a vital enabler of mobile connectivity.

By emphasizing its contribution to economic expansion and social progress, the company reinforces its brand identity as a fundamental infrastructure provider. This positioning is supported by tangible growth metrics; for instance, in 2024, the company expanded its tower portfolio by 15% across key African markets, directly impacting connectivity for an estimated 50 million new users.

- Market Leadership: Positions itself as a primary driver of shared telecom infrastructure in emerging economies.

- Economic Impact: Highlights its role in fostering mobile penetration and supporting economic development.

- Infrastructure Focus: Reinforces its brand as a critical enabler of digital connectivity.

- Growth Trajectory: Demonstrates expansion through increased tower deployments and user reach.

IHS Towers leverages strategic partnerships and direct customer engagement as key promotional tools. Their active participation in industry events and robust investor relations program, including detailed sustainability reports and earnings calls, enhances transparency and investor confidence. These efforts highlight their role in expanding digital inclusion and economic growth, as evidenced by their 2023 Giga partnership success in connecting 1,000 schools.

| Initiative | Key Metric/Outcome | Year | Promotional Impact |

|---|---|---|---|

| MTN MLA Renewal/Extension | All MLAS renewed and extended | 2024 | Demonstrates strong customer relationships and service value |

| Airtel Nigeria MLA Extension | MLA extended | 2024 | Underscores relationship management success |

| Giga Partnership | 1,000 schools connected to internet | 2023 | Showcases commitment to digital inclusion and CSR |

| Tower Portfolio Expansion | 15% increase in tower portfolio | 2024 | Highlights growth and market leadership in emerging markets |

Price

Long-term lease agreements are the backbone of IHS Towers' revenue generation, providing a stable and predictable income. These contracts, typically with Mobile Network Operators (MNOs), often feature built-in escalators, allowing for annual price adjustments to account for inflation and other economic shifts.

This contractual structure is crucial for mitigating economic volatility and ensuring consistent revenue. As of 2024, a significant 72% of IHS Towers' revenue was already secured under these long-term contracts, highlighting the company's reliance on and success with this pricing strategy.

The colocation-based pricing model directly reflects the economics of shared infrastructure. As more Mobile Network Operators (MNOs) occupy space on a single tower, the cost of that tower is spread across a larger tenant base, significantly lowering the per-tenant expense. For instance, in 2024, tower companies often reported that adding a new tenant to an existing site could increase site revenue by 30-50% while only marginally increasing operating costs.

Power indexation is a crucial pricing strategy, particularly for businesses with substantial energy expenditures. For instance, in 2024, many industrial manufacturers are incorporating clauses that automatically adjust prices based on a pre-determined energy index, shielding them from sharp increases in electricity or fuel costs.

In parallel, foreign exchange (FX) considerations are paramount, especially in emerging markets. Nigeria, for example, has experienced significant currency depreciation in recent years. To counter this, companies are implementing FX reset mechanisms on contracts, ensuring that dollar-denominated revenues are protected against a weakening Naira, thereby stabilizing profitability.

Competitive and Value-Based Pricing

IHS Towers employs a competitive pricing strategy, ensuring their infrastructure and services are priced in line with the value delivered to Mobile Network Operators (MNOs). This approach considers critical factors like the extensive network coverage they provide, the high capacity of their sites, and the significant operational cost savings MNOs achieve by outsourcing tower management. Their pricing is a direct reflection of their standing as a premier independent tower operator in their key markets.

For instance, in emerging markets, the cost per site for MNOs can be significantly reduced compared to self-ownership, often seeing savings of 20-30% on operational expenditures. IHS Towers' pricing models are designed to be flexible, often incorporating long-term contracts with built-in escalators tied to inflation or service level agreements, ensuring predictable revenue streams while maintaining attractiveness for their clients.

Key pricing considerations include:

- Site Lease Fees: Based on location, capacity, and power solutions.

- Colocation Fees: Charges for additional tenants sharing a tower.

- Service Level Agreements (SLAs): Pricing tied to uptime guarantees and maintenance responsiveness.

- Managed Services Premiums: Additional fees for advanced services like power management and security.

Strategic Asset Disposals and Capital Allocation

The company's pricing strategy is intrinsically linked to its financial health and how it manages its capital. By strategically divesting assets, the company aims to streamline operations and enhance profitability.

Recent asset disposals, such as those in Kuwait, Peru, and Rwanda, represent a calculated move to exit markets with lower margins. This focus on higher-margin opportunities is a key component of optimizing capital allocation and strengthening the balance sheet.

These disposals, while reducing the overall number of towers, are designed to improve financial performance metrics. For instance, by Q1 2024, the company reported a significant reduction in its debt-to-equity ratio following these strategic sales.

- Asset Disposals: Sales completed in Kuwait, Peru, and Rwanda by early 2024.

- Strategic Rationale: Focus on higher-margin markets and improved financial performance.

- Financial Impact: Strengthened balance sheet and optimized capital allocation.

- Market Adjustments: Reduced tower count to concentrate on core, profitable segments.

IHS Towers' pricing is fundamentally built on long-term lease agreements, ensuring predictable revenue streams. These contracts often include escalators to account for inflation, a critical feature given that 72% of their 2024 revenue was already secured this way. The colocation model means more tenants on a tower lower per-tenant costs, with new tenants potentially boosting site revenue by 30-50% in 2024 while only slightly increasing operational expenses.

Power indexation and FX reset mechanisms are also key, protecting against energy cost spikes and currency depreciation, especially in markets like Nigeria. IHS Towers prices competitively, reflecting the value of their extensive network, high site capacity, and the operational savings they offer MNOs, who can see 20-30% savings on operational expenditures compared to self-ownership.

| Pricing Component | Description | 2024 Relevance/Example |

|---|---|---|

| Site Lease Fees | Based on location, capacity, and power solutions. | Core revenue driver, often with inflation escalators. |

| Colocation Fees | Charges for additional tenants sharing a tower. | Increases site revenue by 30-50% per new tenant. |

| Service Level Agreements (SLAs) | Pricing tied to uptime guarantees and maintenance responsiveness. | Ensures service quality and customer retention. |

| Managed Services Premiums | Additional fees for advanced services like power management and security. | Value-added services that enhance pricing power. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a robust blend of primary and secondary data sources. We meticulously gather information from official company websites, product catalogs, and press releases to understand the Product and Promotion strategies. For Price and Place, we analyze competitor pricing, retail distribution channels, and e-commerce platform data.