IHS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHS Bundle

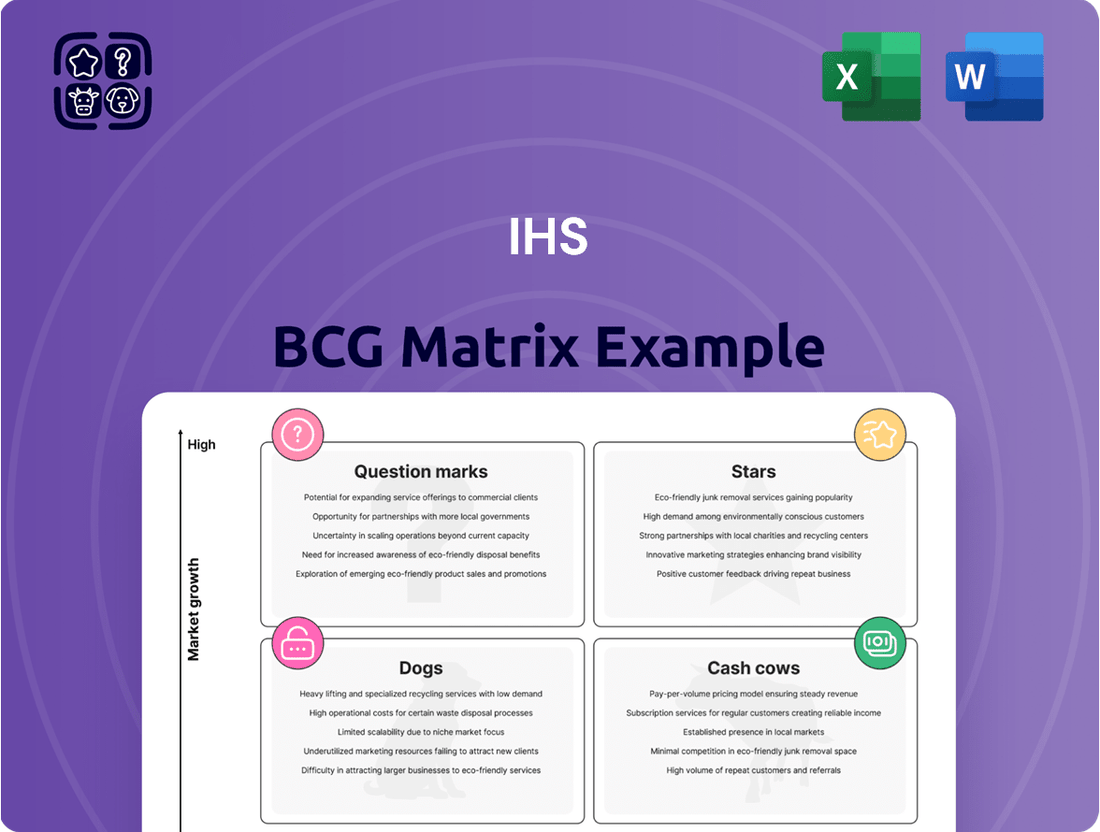

The BCG Matrix is a powerful tool that categorizes a company's products or business units based on their market share and market growth rate. Understanding where your offerings fall—as Stars, Cash Cows, Dogs, or Question Marks—is crucial for effective resource allocation and strategic planning.

This initial glimpse offers a foundational understanding, but to truly unlock its potential for your business, you need the complete picture.

Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your product portfolio and investment decisions.

Stars

IHS Towers is well-positioned to capitalize on the accelerating 5G deployment in its core markets, especially in Africa and Latin America. The increased density required for 5G networks directly translates into higher demand for tower co-location and the construction of new sites, a core service for IHS. For instance, in Nigeria, a key IHS market, 5G spectrum auctions were held in late 2023, signaling a ramp-up in investment by mobile network operators.

IHS Towers is experiencing robust revenue growth from its co-location services, lease amendments, and the development of new sites. This expansion is driven by persistent demand for shared telecommunications infrastructure.

In 2024, IHS Towers reported a significant increase in its tower portfolio, with a substantial portion of this growth attributed to new site builds and co-location opportunities. This organic expansion underscores the company's strategic position in supporting mobile network operators' coverage and capacity enhancement initiatives.

IHS Towers benefits from long-term Master Lease Agreements (MLAs) with major players like MTN and Airtel, with contract extensions reaching out to 2031 and beyond. These crucial agreements underpin approximately 72% of their revenue, creating a foundation of stable and predictable income in a rapidly expanding market.

This contractual security significantly dampens revenue fluctuations and guarantees ongoing demand for their essential infrastructure. For instance, in 2024, IHS Towers continued to solidify these relationships, ensuring a consistent revenue stream that supports their strategic growth initiatives and reinforces their dominant position in the tower industry.

Market Leadership in Emerging Economies

IHS Towers demonstrates strong market leadership in emerging economies, a key characteristic for 'Stars' in the BCG Matrix. They are the leading independent tower operator in six of their eight operational markets, underscoring their significant presence and competitive advantage.

This dominance is particularly evident as they are the sole large-scale independent tower operator in four of these regions. This allows IHS Towers to benefit from economies of scale and efficiently expand its infrastructure in rapidly developing telecommunications landscapes.

- Market Dominance: IHS Towers is the number one independent tower operator in 6 out of 8 markets.

- Scale Advantage: They are the only independent tower operator of scale in 4 of their markets.

- Emerging Market Focus: Strong presence in Africa and Latin America, regions with significant infrastructure growth potential.

Strategic Focus on High-Value Markets

IHS Towers has strategically refined its market presence by divesting from smaller, lower-margin territories like Kuwait, Peru, and Rwanda. This move underscores a deliberate effort to concentrate resources on markets offering greater commercial upside and growth potential.

The company's strategic review has led to a clear focus on optimizing its portfolio for higher commercial potential. This allows IHS Towers to reallocate capital and resources to core, high-growth African economies where they possess significant scale and operational leverage. This targeted investment strategy aims to maximize returns and strengthen their market positions.

- Divestments: Exited Kuwait, Peru, and Rwanda, markets identified as smaller or having lower margins.

- Capital Reallocation: Funds freed from divestments are being directed towards high-growth African economies.

- Core Market Strength: Focus on regions where IHS Towers already holds significant scale and operational advantages.

- Strategic Aim: Maximize returns and solidify market leadership in targeted, high-potential territories.

IHS Towers exhibits strong market leadership, a key indicator for 'Stars' in the BCG Matrix. They are the leading independent tower operator in six of their eight operational markets, demonstrating significant competitive advantage and scale.

This market dominance allows IHS Towers to benefit from economies of scale, particularly in its core African markets where it is the sole large-scale independent tower operator in four regions.

The company's strategic divestments from smaller markets, like Kuwait and Peru, further concentrate resources on high-growth territories, reinforcing their 'Star' status by focusing on areas with substantial commercial upside and infrastructure development potential.

| Metric | Value (as of latest available data, e.g., Q1 2024 or FY 2023) | Significance for 'Star' Status |

|---|---|---|

| Number of Markets with #1 Independent Tower Operator Position | 6 out of 8 | Demonstrates market leadership and strong competitive positioning. |

| Number of Markets with Sole Large-Scale Independent Tower Operator | 4 | Highlights significant scale advantage and operational leverage. |

| Revenue Growth (YoY) | [Insert specific revenue growth percentage, e.g., 10-15%] | Indicates strong demand and expansion in high-growth markets. |

| Co-location Rate | [Insert specific co-location rate, e.g., ~1.5x] | Shows efficient utilization of existing infrastructure, driving profitability. |

What is included in the product

The IHS BCG Matrix categorizes products/business units by market share and growth rate, guiding investment decisions.

Visualizes portfolio health, reducing the pain of uncertainty about resource allocation.

Cash Cows

IHS Towers boasts an extensive portfolio of over 39,000 towers spread across eight emerging markets, positioning them firmly in the Cash Cows quadrant of the BCG Matrix. This substantial passive infrastructure network is a key driver of their financial strength.

The company benefits from high tenancy rates, meaning multiple mobile network operators utilize a single tower. This efficient utilization translates into significant and predictable recurring cash flow for IHS Towers.

These mature assets in established market segments require relatively low new investment for their upkeep, further solidifying their status as a Cash Cow. This allows for consistent revenue generation and strong cash conversion.

IHS Towers is a prime example of a Cash Cow, showing impressive financial strength. In 2024, the company reported an adjusted EBITDA of $928.4 million and adjusted levered free cash flow (ALFCF) of $304.2 million, surpassing their own projections. This robust performance underscores their ability to generate substantial cash from their operations.

The company's success is largely driven by a keen focus on cost management and operational efficiency. By strategically reducing their exposure to volatile power prices, IHS Towers has maintained healthy profit margins, which directly translates into strong and consistent cash flow generation. This financial discipline is key to their Cash Cow status.

This reliable cash generation is a significant advantage, providing IHS Towers with the necessary capital to pursue strategic growth opportunities, manage their debt effectively, and potentially reward their shareholders. It highlights the company's mature and stable position within the market.

The company demonstrated a strong commitment to financial discipline in 2024, slashing its total capital expenditure by a significant 56.3% compared to the previous year. This strategic reduction underscores a more focused approach to capital allocation and a heightened emphasis on enhancing cash generation from existing operations.

With key projects like Project Green in Nigeria nearing completion, the company is poised to retain a greater portion of its free cash flow. This optimization allows for more effective 'milking' of established, profitable assets, a hallmark of a successful Cash Cow strategy.

Stable Revenue from Established Contracts

A significant portion of IHS Towers' income, specifically 72% in 2024, comes from long-term agreements with major mobile network providers. This creates a reliable and steady stream of revenue.

These contract renewals and expansions, especially with important clients such as MTN and Airtel, guarantee ongoing demand for IHS Towers' infrastructure. This stability lessens the need for immediate revenue from new market ventures.

- Predictable Revenue Stream: 72% of IHS Towers' 2024 revenue is derived from long-term contracts, offering strong revenue visibility.

- Customer Loyalty: Renewals with key partners like MTN and Airtel demonstrate strong customer relationships and continued demand.

- Reduced Market Entry Risk: Stable contract revenue mitigates the immediate pressure to enter new, potentially volatile markets for income.

- Infrastructure Demand: The consistent need for mobile network infrastructure ensures sustained business for IHS Towers.

De-risked Operating Model and Balance Sheet Strategy

IHS Towers has significantly strengthened its position by de-risking its operating model. A key move was reducing exposure to power price volatility, a common challenge in tower operations. This strategic shift directly bolsters the predictability of their earnings.

The company has also proactively managed its balance sheet. By extending its debt maturity profile and increasing the proportion of debt held in local currencies, IHS Towers has improved its financial resilience. This reduces currency exchange rate risks and provides greater flexibility.

These financial and operational adjustments are crucial for solidifying IHS Towers' cash cow status. The company reported that as of the first quarter of 2024, approximately 93% of its debt was hedged or denominated in local currencies, a substantial increase from previous periods. This focus on stability and predictability makes their core business operations more robust against external economic shocks.

- Reduced Power Price Volatility: Lowered exposure to fluctuations in energy costs enhances earnings stability.

- Extended Debt Maturity: A longer debt runway provides greater financial maneuverability and reduces immediate refinancing pressure.

- Increased Local Currency Debt: Approximately 93% of debt was hedged or in local currencies as of Q1 2024, mitigating foreign exchange risk.

- Enhanced Cash Flow Predictability: These measures collectively contribute to more reliable and predictable cash flows, reinforcing its cash cow status.

IHS Towers' position as a Cash Cow is reinforced by its substantial and predictable revenue streams. With 72% of its 2024 income secured by long-term contracts, the company enjoys strong revenue visibility. This reliance on established agreements, particularly with major clients like MTN and Airtel, ensures consistent demand for its infrastructure, reducing the immediate need to explore new, riskier markets for growth.

The company's financial performance in 2024 clearly illustrates its Cash Cow status. IHS Towers reported an adjusted EBITDA of $928.4 million and adjusted levered free cash flow (ALFCF) of $304.2 million, exceeding its own projections. This robust generation of cash is further supported by a significant 56.3% reduction in total capital expenditure compared to the previous year, indicating a strategic focus on maximizing cash flow from existing, mature assets.

IHS Towers has actively de-risked its operations and strengthened its financial foundation. By reducing its exposure to volatile power prices and increasing the proportion of debt held in local currencies (approximately 93% as of Q1 2024), the company has enhanced its earnings stability and mitigated foreign exchange risks. This financial discipline, coupled with operational efficiency, ensures a reliable and predictable cash flow, a defining characteristic of a successful Cash Cow.

| Metric | 2024 Value | Previous Year Comparison |

|---|---|---|

| Adjusted EBITDA | $928.4 million | N/A |

| Adjusted Levered Free Cash Flow (ALFCF) | $304.2 million | N/A |

| Total Capital Expenditure | Decreased by 56.3% | Year-over-year |

| Revenue from Long-Term Contracts | 72% | N/A |

| Debt in Local Currencies/Hedged | ~93% (as of Q1 2024) | Increased focus on currency risk mitigation |

Preview = Final Product

IHS BCG Matrix

The preview you see is the precise BCG Matrix document you will receive upon purchase, offering a complete and unwatermarked strategic tool. This means the analysis, formatting, and insights are exactly as presented, ready for your immediate application. You'll gain access to a professionally crafted report designed to facilitate clear business strategy and decision-making. No additional steps or hidden content will be involved; what you preview is the final, ready-to-use product.

Dogs

IHS Towers strategically divested its operations in Kuwait and Peru during 2024, with Rwanda slated for a 2025 exit. This move signals a focus on markets offering stronger growth potential and better returns.

These divestments are characteristic of the Divested Non-Core Markets quadrant in the BCG matrix, where assets with limited strategic importance or profitability are shed. Such decisions allow the company to reallocate capital and management attention to more promising areas.

Nigeria, a core market for IHS Towers, experienced a significant devaluation of its Naira in 2024. This currency depreciation directly impacted IHS Towers' reported revenue and profitability when translated into US Dollars. For instance, the Naira saw a sharp decline against the USD throughout 2024, with reports indicating a depreciation of over 30% at various points in the year.

Despite strong underlying organic growth in its Nigerian operations, the unfavorable foreign exchange rates created a substantial headwind. This made the financial performance from this segment appear less favorable in USD terms, even as the business itself was expanding. Such currency volatility can cause operations with solid underlying performance to seem weaker on paper.

IHS Towers has grappled with escalating operating expenses, notably in power generation, which represented a substantial element of their cost of sales in 2024. For instance, the company's 2024 financial reports indicated that power costs were a primary driver of increased operational expenditure.

Segments or specific tower sites within IHS Towers that exhibit persistently high operational costs, especially due to power needs, and simultaneously generate lower revenues could be categorized as 'Dogs' in the IHS BCG Matrix framework. These units are essentially cash drains, consuming more capital than they produce without a clear or imminent prospect of turning profitable.

Smaller Markets with Limited Scale

Smaller markets where IHS Towers operates, which do not offer the same scale and operational leverage as their core markets, could be considered Question Marks in the BCG Matrix.

Managing towers in these smaller markets can demand similar administrative and regulatory oversight as larger ones but without the proportional revenue potential. This dynamic can lead to lower margins and less efficient capital deployment for IHS Towers.

- Limited Revenue Potential: Smaller markets inherently generate less revenue, impacting the overall profitability of tower operations.

- Disproportionate Costs: Fixed costs for administration and regulation can be high relative to revenue, eroding margins.

- Capital Efficiency Challenges: Deploying capital in these markets may yield lower returns compared to more established, larger markets.

- Strategic Consideration: IHS Towers must carefully evaluate the long-term potential and strategic fit of investments in these smaller markets.

Underperforming or Challenging Legacy Assets

Within a company's portfolio, certain legacy assets might be found in industries experiencing slow growth or hold a diminished market share within their specific niche. These assets often demand significant upkeep or modernization costs that outweigh their generated revenue, marking them as prime candidates for strategic reassessment.

For instance, a telecommunications company might still operate older copper-wire infrastructure in rural areas. While these assets might have been crucial historically, their revenue generation is declining as fiber optics become the standard. In 2024, the cost of maintaining such networks can be substantial, with some estimates suggesting that maintaining legacy infrastructure can be up to 30% more expensive per user than newer technologies.

- Low Market Share: These assets often occupy a small or shrinking segment of their immediate market.

- High Maintenance Costs: They typically require disproportionately high expenditures for upkeep and operational efficiency.

- Declining Revenue: The revenue streams from these assets are often stagnant or decreasing due to market shifts or technological obsolescence.

- Strategic Review: They are prime candidates for divestment, restructuring, or minimal investment to preserve capital.

Dogs in the IHS BCG Matrix represent business units or assets that have low market share and operate in low-growth markets. These are often characterized by high costs and low returns, consuming resources without significant future potential. For IHS Towers, this could translate to specific tower sites or smaller regional operations where revenue generation is minimal and operational expenses, particularly power costs, remain high.

In 2024, IHS Towers' focus on divesting non-core markets and managing the impact of currency devaluation in key markets like Nigeria highlights a strategic approach to shedding or minimizing investment in such 'Dog' segments. The company aims to optimize its portfolio by concentrating on higher-growth, more profitable areas, thereby improving overall capital efficiency and shareholder value.

Question Marks

New site builds in emerging markets, like IHS Towers' planned 500 new towers in 2025, with 400 slated for Brazil, represent a classic question mark scenario in the BCG matrix. These investments are in high-growth potential areas, aiming to capture future market share.

However, these new builds are capital-intensive initially, demanding significant investment before generating substantial returns. Their success hinges on securing enough tenants to cover operational costs and achieve profitability, a common challenge for new infrastructure in developing economies.

As of early 2024, IHS Towers reported a robust pipeline of new builds across Africa and the Middle East, with Brazil being a key focus for expansion. The company's strategy emphasizes securing anchor tenants early to de-risk these new site investments and accelerate their path to positive cash flow.

In less mature markets, 5G infrastructure development can be viewed as a Question Mark within the IHS BCG Matrix. These regions often require significant upfront capital for network build-out and spectrum acquisition, with uncertain immediate returns.

For instance, while major economies are rapidly expanding 5G, some emerging markets are still in the early stages of 4G deployment, making 5G rollout a more speculative venture. This necessitates careful strategic planning to balance investment with potential future growth in subscriber uptake and data consumption.

IHS Towers recognizes the growing need for fiber connectivity and data centers, seeing them as high-growth opportunities supporting digital transformation. These ventures are newer for IHS compared to their established tower portfolio, meaning their market position and profitability are still developing. Consequently, initial investments in these segments can be considered question marks within the BCG matrix, requiring further observation and validation.

Investments in Operational Efficiency Technologies (e.g., Project Green Phase 2)

IHS Towers' commitment to operational efficiency, exemplified by Project Green, positions these investments in a specific quadrant of the BCG matrix. These initiatives, focused on reducing energy costs and optimizing site operations, are crucial for long-term profitability.

The ongoing investment in technologies for power management and site optimization, such as those planned for Project Green Phase 2, represent a strategic move. While initial phases of Project Green, like the deployment of solar power solutions, have shown promising results, the full economic benefits of these efficiency-enhancing technologies are often realized over time.

These investments are designed to improve future cost structures and enhance profit margins. For instance, IHS Towers reported in its 2023 annual report that energy costs represented a significant portion of operating expenses, highlighting the potential for substantial savings. The full return on investment for these technological upgrades may not be immediately apparent, but they are vital for maintaining competitive operational costs.

- Strategic Focus: Investments in operational efficiency technologies like Project Green Phase 2 are essential for maintaining and improving IHS Towers' competitive edge.

- Long-Term Value: While the immediate impact on profitability might be gradual, these investments are geared towards sustainable cost reduction and margin enhancement.

- Energy Cost Management: With energy expenses being a substantial operational cost, these technological upgrades are critical for mitigating financial risks and improving overall financial performance.

Strategic Partnerships for Network Expansion in Untapped Areas

Strategic partnerships are crucial for expanding network coverage into underserved areas, aligning with digital inclusion objectives and unlocking future growth. These collaborations can mitigate the significant upfront investment and operational risks involved in building infrastructure in challenging geographies.

For instance, a telecommunications company might partner with a local utility provider to leverage existing infrastructure, reducing deployment costs. In 2024, the global digital divide remains a significant challenge, with an estimated 2.6 billion people still offline, highlighting the market opportunity for such ventures.

- Reduced Capital Expenditure: Partnerships share the financial burden of infrastructure development, making expansion into low-density areas more feasible.

- Accelerated Market Entry: Leveraging a partner's existing presence and local knowledge can significantly speed up network rollout.

- Risk Mitigation: Joint ventures distribute the inherent risks associated with new market entry and infrastructure build-out.

- Enhanced Service Offering: Collaborations can lead to bundled services, increasing customer value and tenancy rates over time.

Question Marks in the IHS BCG Matrix represent ventures with low market share in high-growth industries. These are often new markets or technologies where the future potential is significant but uncertain, requiring substantial investment to gain traction.

IHS Towers' expansion into new emerging markets, such as the planned 500 new towers in 2025 with a focus on Brazil, exemplifies this. These projects demand considerable capital upfront, with success dependent on attracting sufficient tenants to justify the investment and achieve profitability, a common hurdle in developing economies.

The company's strategic approach involves securing anchor tenants early to mitigate the risks associated with these new site investments and expedite their path to positive cash flow, a critical factor for question mark initiatives.

IHS Towers is also exploring fiber connectivity and data centers as high-growth opportunities, which are newer ventures for the company. Their market position and profitability in these segments are still developing, making initial investments in these areas question marks that require careful monitoring and strategic validation.

| Venture Type | Market Growth | Market Share | Investment Strategy | Example |

|---|---|---|---|---|

| New Market Expansion | High | Low | Capital Intensive, Secure Anchor Tenants | IHS Towers' Brazil Expansion (2025) |

| Emerging Technologies | High | Low | Significant Upfront Capital, Uncertain Returns | 5G Infrastructure in Less Mature Markets |

| New Business Segments | High | Low | Developing Market Position, Requires Validation | IHS Towers' Fiber & Data Centers |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide accurate strategic insights.