IHS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHS Bundle

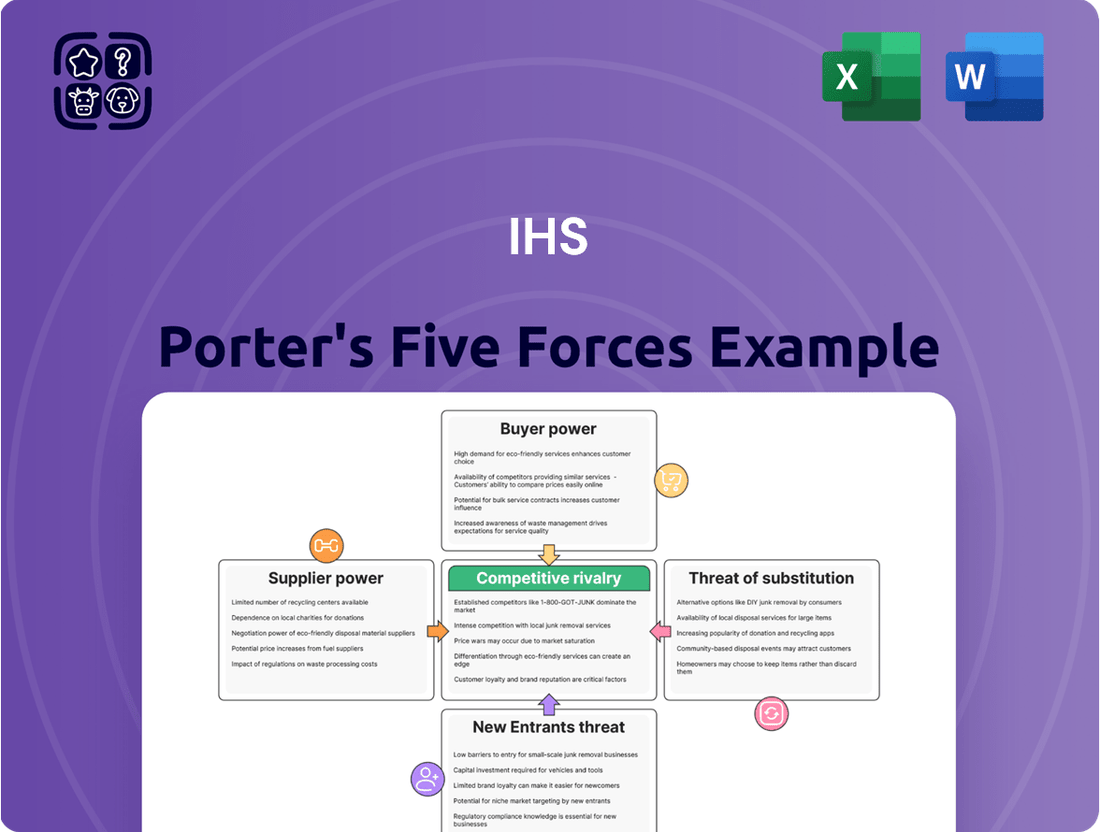

Understanding the competitive landscape for IHS is crucial for strategic success. Our Porter's Five Forces analysis unpacks the intense pressures from rivals, the power of suppliers and buyers, the looming threat of new entrants, and the ever-present danger of substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IHS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

IHS Towers faces a concentrated supplier market for critical network equipment like antennas and base stations. This means a limited number of specialized manufacturers hold considerable sway over pricing and contract terms.

For instance, the market for advanced 5G components is particularly consolidated, potentially increasing input costs for IHS Towers. In 2024, the global telecommunications equipment market saw significant price increases for certain specialized components due to these supply chain dynamics.

Suppliers of cutting-edge telecommunications technology, particularly those enabling 5G infrastructure, wield significant bargaining power. Their innovations are crucial for companies like IHS Towers to remain competitive in offering advanced connectivity solutions.

This reliance on specialized, high-performance technology means IHS Towers is often dependent on a limited number of suppliers. For instance, the global market for advanced 5G base station components is dominated by a few key players, giving them leverage in pricing and contract negotiations. This dependence can directly impact IHS Towers' capital expenditure and operational costs.

Switching from one major equipment supplier to another for IHS Towers can be a costly endeavor. These costs can include redesigning existing infrastructure, retraining personnel on new systems, and ensuring the compatibility of new equipment with their current network. For instance, in 2024, a significant network upgrade could easily run into millions of dollars in integration and testing alone.

These substantial switching costs effectively reduce IHS Towers' flexibility in choosing vendors. This situation inherently strengthens the bargaining power of their current suppliers, as the effort and expense required to change providers make staying with existing relationships more attractive, potentially locking IHS Towers into long-term vendor agreements.

Raw Material and Energy Costs

Suppliers of essential raw materials like steel and concrete, along with energy providers, hold significant sway over IHS Towers' costs, particularly when markets are unstable. For instance, in 2024, global steel prices experienced notable volatility, directly affecting the expense of constructing new towers and maintaining existing infrastructure. Similarly, the cost of diesel fuel, critical for powering many tower sites, can fluctuate rapidly, impacting operational budgets.

IHS Towers actively works to lessen the impact of these supplier-driven cost increases. Their strategy involves reducing direct exposure to energy price swings and transitioning towards contractual models that pass on or are indexed to these fluctuating costs. This approach aims to create more predictable expenditure, even amidst market turbulence.

- Steel Price Volatility: Global benchmark steel prices, a key input for tower construction, saw an average increase of 8-12% in the first half of 2024 compared to the prior year, impacting project budgets.

- Energy Cost Mitigation: IHS Towers' focus on renewable energy solutions and smart grid integration for its sites aims to reduce reliance on volatile diesel fuel costs, which averaged a 5% year-on-year increase in operating regions during 2024.

- Contractual Hedging: The company's push for pass-through or index-linked energy contracts in new agreements helps insulate its margins from sudden spikes in fuel or electricity prices.

Supplier Forward Integration Threat

The threat of suppliers integrating forward, while less common, could significantly bolster their bargaining power. Imagine equipment manufacturers, who currently supply infrastructure components, deciding to directly offer shared infrastructure services themselves. This move would allow them to bypass existing players like IHS Towers, though it represents a substantial capital investment and operational complexity.

For instance, in 2024, the telecommunications infrastructure market saw continued investment in new technologies, potentially creating opportunities for suppliers to explore such integration. Companies heavily involved in 5G deployment, for example, might consider offering managed services alongside their hardware. This theoretical scenario underscores the importance of fostering robust supplier relationships and strategic partnerships to mitigate such risks.

- Supplier Forward Integration Threat: Suppliers might integrate forward by offering shared infrastructure services directly, increasing their bargaining power.

- Example Scenario: Equipment manufacturers could enter the tower ownership and operation space, potentially bypassing existing tower companies.

- Complexity and Capital: This is a high-capital and operationally complex undertaking for suppliers.

- Mitigation Strategy: The threat emphasizes the need for strong supplier relationships and strategic partnerships.

Suppliers of specialized network equipment, like advanced 5G components, hold significant power due to market concentration and the critical nature of their innovations. This dependence can lead to higher input costs for IHS Towers, as seen with an approximate 8-12% increase in global steel prices during the first half of 2024, impacting tower construction budgets.

The substantial costs associated with switching suppliers, often running into millions for integration and testing in 2024, further solidify supplier leverage. This makes it more economical for IHS Towers to maintain existing relationships, effectively locking them into current vendor agreements and reinforcing supplier bargaining power.

Suppliers of raw materials and energy also wield considerable influence, particularly during periods of market instability. For instance, volatile diesel fuel costs, which saw a 5% year-on-year increase in operating regions during 2024, directly affect IHS Towers' operational expenses, highlighting the need for strategies like indexed energy contracts.

While less probable, the threat of suppliers integrating forward into shared infrastructure services could dramatically shift the power dynamic. This would allow them to bypass existing tower companies, although it represents a significant capital and operational challenge for potential entrants.

| Factor | Impact on IHS Towers | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration (5G Components) | Increased input costs, limited vendor options | Market dominated by a few key players. |

| Switching Costs | Reduced flexibility, vendor lock-in | Millions in integration/testing for network upgrades. |

| Raw Material & Energy Costs | Higher operational and construction expenses | Steel prices up 8-12% (H1 2024); Diesel fuel up 5% (2024). |

| Forward Integration Threat | Potential disintermediation by suppliers | Continued investment in telecom tech creates theoretical opportunities. |

What is included in the product

Analyzes the competitive intensity and profitability of the Indian healthcare services market by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

Quickly identify and address competitive threats with a visual breakdown of each force, making strategic planning less daunting.

Customers Bargaining Power

IHS Towers' customer base is notably concentrated, with Mobile Network Operators (MNOs) forming its primary clientele. This concentration means a few key clients hold significant sway.

For example, in 2024, IHS Towers' revenue was heavily dependent on MTN, accounting for 63% of its income. Airtel followed at 14%, with TIM and Orange each contributing 6%. This reliance on a small number of large customers grants them substantial bargaining power.

The potential loss of a major MNO client, such as MTN, would have a severe impact on IHS Towers' financial performance, including its revenue and profitability. This concentrated customer structure inherently strengthens the bargaining power of these MNOs.

Customers, primarily Mobile Network Operators (MNOs), face significant hurdles when considering a switch from IHS Towers' infrastructure. These challenges include the intricate process of relocating existing equipment, ensuring seamless network coverage during transition, and mitigating potential service interruptions, all of which contribute to high switching costs.

This inherent stickiness in IHS Towers' services means MNOs are deeply invested in their current infrastructure arrangements, making them less likely to seek alternatives. For instance, IHS Towers' Master Lease Agreements (MLAs) with major players like MTN and Airtel, which have been renewed, demonstrate the long-term commitment and dependency MNOs have on their established infrastructure.

Mobile Network Operators (MNOs) are highly sensitive to pricing for infrastructure services due to fierce competition in their own markets. This sensitivity drives them to negotiate aggressively for tower co-location and related services, as reducing operational expenditures is a constant priority. For instance, in 2024, average revenue per user (ARPU) for major MNOs in emerging markets often remained under $5, underscoring the pressure to keep costs down.

Potential for Customer Backward Integration

The potential for customers, specifically Mobile Network Operators (MNOs), to engage in backward integration by building their own tower infrastructure presents a significant, albeit often theoretical, threat. This would allow them to control a critical asset, potentially reducing reliance on third-party tower providers. However, the immense capital expenditure and the specialized operational expertise required for managing passive infrastructure typically deter MNOs from pursuing this path. For instance, the global tower market is valued in the hundreds of billions, with significant ongoing investment needed for maintenance and upgrades.

While MNOs generally prefer to concentrate on their core competencies of providing mobile services and network technology, the option of backward integration remains a bargaining chip. In 2024, the ongoing demand for 5G rollout and network densification continues to drive significant investment in tower infrastructure, making the cost of building and maintaining such assets even more substantial for individual MNOs. This high barrier to entry limits the practical exercise of this power for most players.

- High Capital Outlay: Building and maintaining tower infrastructure requires substantial upfront investment, often in the tens of millions of dollars per market.

- Operational Complexity: Managing passive infrastructure involves site acquisition, leasing, power, security, and regulatory compliance, diverting focus from core mobile operations.

- Focus on Core Business: Most MNOs find it more strategic and profitable to outsource tower management to specialized companies, allowing them to concentrate on service innovation and customer acquisition.

- Limited Practicality: The sheer scale and cost make backward integration an unattractive option for the vast majority of MNOs, thus tempering their bargaining power in this regard.

Demand for Infrastructure Sharing

The growing trend of Mobile Network Operators (MNOs) sharing infrastructure significantly impacts customer bargaining power. By collaborating on infrastructure, MNOs aim to reduce substantial capital expenditure and operational costs. This collective cost-saving measure can, paradoxically, empower their customers, as the benefits of shared infrastructure might translate into demands for more favorable contract terms.

IHS Towers, a prominent player in the telecom tower market, operates on a business model that inherently facilitates this infrastructure sharing. While this model is designed for efficiency, it also means that the MNOs who are IHS Towers' customers can leverage the shared cost benefits to negotiate better deals. The global telecom tower market is indeed witnessing a surge in tower-sharing agreements, a testament to this evolving industry dynamic.

Consider these key aspects of demand for infrastructure sharing:

- Increased MNO Collaboration: MNOs are increasingly entering into infrastructure sharing agreements to optimize resource utilization and lower operational expenses.

- Customer Leverage: The cost efficiencies gained through shared infrastructure provide MNO customers with greater leverage to negotiate favorable terms and pricing.

- Market Trend: Global tower-sharing agreements are on the rise, indicating a broader industry shift that strengthens the bargaining position of tower tenants.

- IHS Towers' Position: Companies like IHS Towers, built on this sharing model, must balance the benefits of shared infrastructure with customer demands for competitive pricing.

The bargaining power of IHS Towers' customers, primarily Mobile Network Operators (MNOs), is substantial due to customer concentration and the high costs associated with switching providers. In 2024, MTN alone represented 63% of IHS Towers' revenue, highlighting the significant influence a few key clients wield.

High switching costs, including equipment relocation and potential service disruptions, keep MNOs tied to existing infrastructure. Despite this, MNOs are highly price-sensitive, driven by competitive pressures in their own markets, with average revenues per user (ARPU) in emerging markets often below $5 in 2024, pushing them to negotiate aggressively.

While backward integration is a theoretical threat, the immense capital and operational expertise required make it impractical for most MNOs. The increasing trend of infrastructure sharing among MNOs, however, enhances their collective bargaining power by allowing them to leverage cost efficiencies for more favorable contract terms.

| Customer Dependency (2024) | Switching Cost Factors | MNO Price Sensitivity Driver |

| MTN: 63% of Revenue | Equipment Relocation | Low ARPU (e.g., <$5 in emerging markets) |

| Airtel: 14% of Revenue | Network Continuity | Intense Market Competition |

| TIM & Orange: 6% each | Service Interruption Mitigation | Need to reduce OpEx |

What You See Is What You Get

IHS Porter's Five Forces Analysis

This preview showcases the complete IHS Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document displayed here is the exact, professionally formatted analysis you’ll receive instantly after purchase, ensuring no surprises. You're looking at the final version, ready for immediate download and use to inform your strategic decisions.

Rivalry Among Competitors

The telecommunications infrastructure sector, particularly tower operations, features intense competition from major global entities such as American Tower Corporation and Cellnex Telecom, alongside formidable regional players. IHS Towers, a significant independent operator, faces these well-established, heavily capitalized competitors, especially in emerging markets where its strength lies.

The telecommunications tower industry is inherently capital-intensive. Building, acquiring, and maintaining these essential infrastructure assets demands substantial upfront investment. For instance, constructing a single tower can cost upwards of $50,000 to $100,000 or more, depending on location and features, with significant ongoing maintenance expenses.

This high capital requirement acts as a considerable barrier for new entrants, thus limiting the number of potential competitors. However, for existing players, it intensifies the rivalry as they must continually invest to expand and upgrade their networks to remain competitive. Companies like American Tower and Crown Castle, major players in the US market, reported billions in capital expenditures in 2023 to support 5G deployment and network densification.

The intense competition drives existing companies to focus on maximizing tenancy ratios, meaning getting as many mobile network operators to lease space on each tower as possible. Operational efficiency also becomes paramount to manage costs and generate returns on these massive investments, as seen in the ongoing efforts to optimize site acquisition and construction processes across the sector.

Mature markets can indeed see heightened competitive rivalry as saturation limits new growth, forcing existing players to compete more aggressively for market share. This often translates to price wars and increased marketing spend.

IHS Towers, however, strategically targets emerging markets across Africa and Latin America, areas that typically offer robust structural growth opportunities. For instance, in 2024, many African nations continued to see significant demand for digital infrastructure, with mobile penetration rates still climbing, presenting fertile ground for tower deployment.

Despite the growth potential, competition in these emerging markets is far from absent. Companies like IHS Towers face strong competition from local and international players alike, all vying for prime locations and lucrative build-to-suit contracts to expand their network coverage.

Pricing Pressure and Contract Renewals

Competitive rivalry in the tower infrastructure sector, particularly for companies like IHS Towers, frequently translates into significant pricing pressure. This is especially evident when contract renewals with major Mobile Network Operators (MNOs) are on the horizon.

To maintain and grow their customer base, tower companies are compelled to present competitive pricing structures and demonstrate enhanced value through additional services. Securing long-term contracts, a strategy IHS Towers has actively pursued, is crucial for creating revenue stability amidst this competitive landscape.

- IHS Towers' focus on long-term contracts with MNOs aims to mitigate pricing pressure during renewal periods.

- In 2023, IHS Towers reported a tenancy ratio of 1.7x, indicating an average of 1.7 tenants per tower, which influences their negotiation power.

- The company's strategy includes offering value-added services beyond basic colocation to differentiate itself and justify pricing.

Strategic Disposals and Acquisitions

The competitive rivalry within the telecommunications infrastructure sector is significantly shaped by strategic asset disposals and acquisitions. Companies actively manage their portfolios to enhance market positions and focus on core growth areas.

IHS Towers, for instance, has been actively involved in portfolio optimization. In 2024, the company completed the sale of its operations in Peru and Kuwait. Furthermore, IHS Towers agreed to sell its operations in Rwanda, signaling a strategic shift.

- Strategic Divestitures: IHS Towers' sales of Peruvian and Kuwaiti operations in 2024, alongside the agreement to divest Rwanda, highlight a trend of portfolio streamlining.

- Focus on Core Markets: These disposals allow IHS Towers to concentrate resources and investments on markets identified as having higher growth potential.

- Competitive Realignment: Such transactions alter the competitive landscape by consolidating assets and potentially creating new market dynamics for acquiring entities.

- Portfolio Optimization: The ongoing activity of buying and selling assets is a key strategy for players to maintain financial health and competitive advantage.

Competitive rivalry in the telecommunications tower sector is fierce, driven by a few large, well-capitalized global players and numerous regional competitors. This intensity is fueled by the capital-intensive nature of the industry, where significant ongoing investment is required to maintain and expand networks, as demonstrated by billions in capital expenditures by companies like American Tower and Crown Castle in 2023 for 5G upgrades.

To stay ahead, companies focus on maximizing tenancy ratios, with IHS Towers reporting 1.7 tenants per tower in 2023, and on operational efficiency. Pricing pressure is a constant, especially during contract renewals with mobile network operators, prompting strategies like offering value-added services to differentiate and secure long-term agreements.

Strategic portfolio management, including asset disposals and acquisitions, also plays a crucial role in competitive positioning. IHS Towers' 2024 divestitures of operations in Peru, Kuwait, and the agreement to sell its Rwandan business exemplify this trend, allowing for a sharper focus on higher-growth markets.

| Company | 2023 Capital Expenditures (approx.) | Key Markets | 2023 Tenancy Ratio (approx.) |

|---|---|---|---|

| American Tower | $1.5 billion+ | Global (US, Latin America, Africa, Asia) | 1.8x |

| Crown Castle | $1.6 billion+ | United States | 1.5x |

| IHS Towers | $0.5 billion+ | Africa, Latin America, Middle East | 1.7x |

| Cellnex Telecom | $1.0 billion+ | Europe | 1.6x |

SSubstitutes Threaten

The most significant threat of substitutes for IHS Towers comes from Mobile Network Operators (MNOs) opting to build and manage their own passive infrastructure. This approach, while demanding substantial capital, allows MNOs greater control over their network assets.

While tower sharing is prevalent, an MNO’s decision to self-build represents a direct alternative to leasing space on IHS Towers’ infrastructure. This is particularly relevant in markets where MNOs possess strong balance sheets or strategic imperatives to own their core assets, potentially impacting IHS Towers' tenancy ratios and revenue streams.

New infrastructure technologies like Distributed Antenna Systems (DAS) for large venues and small cells for urban areas can serve as partial substitutes for traditional macro towers, particularly for specific coverage needs. For instance, DAS can provide seamless indoor coverage in stadiums or office buildings, a function macro towers are less efficient at. IHS Towers, a major player, is actively addressing this by offering DAS solutions and installing small cells, demonstrating a proactive strategy to integrate these emerging technologies into their portfolio and thereby mitigate the direct substitution threat.

Satellite-based internet services, like Starlink, are emerging as potential substitutes for traditional terrestrial mobile infrastructure, especially in remote or underserved regions. While this technology is still developing for broad mobile use, it could influence the need for new mobile towers in specific locations.

Wi-Fi and Other Local Wireless Networks

Wi-Fi networks offer a viable alternative for data usage, particularly in areas with strong coverage, acting as a substitute for cellular data. This can reduce the reliance on mobile network operators (MNOs) for certain data-intensive activities, impacting the demand for cellular tower capacity. For instance, in 2024, the global Wi-Fi market was projected to continue its robust growth, with an increasing number of public Wi-Fi hotspots being deployed in urban centers, offering free or low-cost internet access.

While not a direct replacement for the core function of cellular towers, the prevalence of Wi-Fi influences how MNOs plan their network capacity. When users can seamlessly switch to Wi-Fi for large downloads or streaming, it alleviates pressure on cellular networks. This trend is supported by data showing that a significant portion of mobile data traffic, especially in developed markets, is offloaded to Wi-Fi networks. This substitution effect can indirectly affect the perceived need for additional tower infrastructure by MNOs.

- Wi-Fi as a Data Substitute: Wi-Fi in homes, offices, and public venues directly substitutes for cellular data for many users, especially for activities like streaming and large file downloads.

- Impact on Tower Capacity Demand: This substitution can reduce the overall data traffic on cellular networks, indirectly lowering the demand for increased tower capacity from Mobile Network Operators (MNOs).

- Market Trends: The global Wi-Fi market is expected to see continued expansion in 2024, with an increase in public Wi-Fi availability, further strengthening its position as a substitute.

Fiber Optic Network Expansion

While fiber optic networks are often seen as enhancing wireless infrastructure, their extensive expansion, especially for fixed wireless access and direct-to-home broadband, can present a threat of substitution. This is because these fiber deployments can reduce the need for traditional macro towers for last-mile connectivity. For instance, by 2024, global fiber-to-the-home (FTTH) connections were projected to exceed 900 million, illustrating the increasing reach of wired broadband alternatives.

However, the relationship is nuanced; fiber optic cables are also crucial for connecting these very same macro towers, providing the backhaul necessary for wireless services. This interdependence means that while fiber can offer an alternative, it also underpins the existing wireless structure. In 2023, major telecommunications companies continued to invest billions in fiber buildouts, with companies like AT&T and Verizon prioritizing these expansions, which simultaneously strengthens and potentially competes with their wireless tower assets.

- Threat of Fiber: Extensive fiber optic network expansion, particularly for fixed wireless and direct-to-home broadband, can reduce reliance on macro towers for last-mile connectivity.

- Complementary Role: Fiber optic networks are essential for the backhaul of wireless services, connecting macro towers and thus supporting the existing infrastructure.

- Investment Trends: Significant investments in fiber infrastructure by major telecom players in 2023 and 2024 highlight the growing presence of this alternative connectivity method.

- Market Dynamics: The dual role of fiber as both a substitute and a critical enabler creates a complex competitive landscape for wireless tower companies.

The threat of substitutes for tower companies like IHS Towers is multifaceted. While MNOs building their own infrastructure is a direct substitute, emerging technologies and alternative connectivity methods also pose challenges. These substitutes can reduce the perceived need for traditional tower leasing, impacting revenue streams.

Wi-Fi networks offer a significant substitution for cellular data usage, especially in areas with strong coverage, thereby lessening the demand for mobile network capacity. Furthermore, the expanding reach of fiber optic networks for fixed wireless access can reduce the necessity for macro towers in last-mile connectivity solutions. These trends highlight the dynamic nature of the telecommunications infrastructure landscape.

| Substitute Type | Description | Impact on Tower Demand | 2024 Data/Projections |

|---|---|---|---|

| MNO Self-Build | Operators building and managing their own passive infrastructure. | Directly reduces demand for tower leasing. | Capital expenditure by MNOs on infrastructure remains a key consideration. |

| Wi-Fi Networks | Alternative data access via wireless local area networks. | Offloads mobile data traffic, potentially reducing need for tower capacity expansion. | Global Wi-Fi market projected for robust growth, increasing public hotspot availability. |

| Fiber Optic Networks | Wired broadband for fixed wireless and direct-to-home services. | Can decrease reliance on macro towers for last-mile connectivity. | Global FTTH connections projected to exceed 900 million by 2024. |

| Small Cells/DAS | Localized wireless solutions for dense coverage needs. | Can substitute for macro towers in specific urban or venue-based scenarios. | IHS Towers actively integrating these into their portfolio. |

Entrants Threaten

The telecommunications tower industry presents a formidable barrier to entry due to the substantial capital required. Building a single tower can cost anywhere from $20,000 to $100,000 or more, depending on height and location. This immense upfront investment, encompassing land acquisition, construction, and essential infrastructure, significantly deters new players from entering the market.

Established players in the telecom tower industry, such as IHS Towers, benefit immensely from economies of scale and scope. This allows them to spread fixed costs over a larger operational base, leading to lower per-unit costs for services like site acquisition, construction, and maintenance. For instance, IHS Towers, with its extensive portfolio across Africa and the Middle East, can negotiate better terms with suppliers and optimize its supply chain more effectively than a newcomer.

New entrants face a significant hurdle in matching these cost efficiencies. Without a substantial existing portfolio of towers, they would struggle to achieve similar economies of scale, making it difficult to offer competitive pricing. This lack of scale directly impacts their ability to attract customers and gain market share, as established players can leverage their cost advantages to undercut new competitors.

The telecommunications industry presents substantial regulatory hurdles that act as a significant threat of new entrants. Obtaining licenses, permits, and crucial spectrum allocations in each country requires navigating complex legal frameworks and can be extremely costly. For instance, in 2024, the average cost of mobile spectrum auctions globally continued to be a major capital expenditure, with some countries seeing bids in the billions of dollars, effectively deterring smaller players.

Access to Key Customers (MNOs)

New entrants face a significant hurdle in gaining access to major Mobile Network Operators (MNOs), the primary customers for tower infrastructure. Building the necessary relationships and securing long-term contracts with these key players is paramount for any new tower company aiming for success.

Established tower companies already possess a strong foundation of trust and deep operational integration with MNOs. This existing rapport makes it exceedingly difficult for newcomers to penetrate the market and secure the vital business needed to thrive.

- Established Relationships: Incumbent tower providers have years of experience and proven reliability with MNOs.

- Contractual Lock-in: Long-term contracts with existing providers create barriers for new entrants.

- Operational Integration: MNOs are often deeply integrated with the systems and processes of current tower suppliers.

- Market Concentration: A few dominant MNOs control a large portion of the market, limiting opportunities for new players.

Limited Suitable Locations

The availability of suitable and permissible locations for new tower construction presents a significant hurdle for potential entrants. In 2024, urban areas, which offer the most lucrative customer bases, continue to face intense competition for limited land. This scarcity is exacerbated by increasingly stringent environmental regulations and zoning laws, making site acquisition a complex and costly endeavor.

This geographical constraint acts as a natural barrier to entry, effectively limiting the number of new players that can realistically establish a presence. For instance, in major metropolitan areas, the cost of acquiring even a small parcel of land suitable for a new tower can run into millions of dollars, a prohibitive expense for many startups. This situation is particularly acute in regions with high population density, where every available plot is already developed or heavily regulated.

- Limited Land Availability: Prime locations in densely populated urban centers are scarce and expensive.

- Regulatory Hurdles: Strict zoning laws and environmental permits add significant time and cost to site acquisition.

- High Capital Investment: The cost of securing suitable land can be a major deterrent for new entrants.

- Competitive Landscape: Existing players often control key locations, further restricting opportunities for newcomers.

The threat of new entrants in the telecommunications tower industry is significantly mitigated by high capital requirements, with tower construction costs ranging from $20,000 to over $100,000 per site in 2024. Established players like IHS Towers leverage economies of scale, achieving lower per-unit costs through their extensive portfolios, making it difficult for newcomers to compete on price.

Regulatory complexities, including expensive spectrum auctions that can reach billions of dollars in 2024, and the need for extensive licensing, also deter new entrants. Furthermore, securing access to major Mobile Network Operators (MNOs) is challenging due to existing long-term contracts and deep operational integration that incumbent providers already possess.

Limited availability of suitable land, especially in urban areas with high competition and stringent zoning laws in 2024, adds another layer of difficulty. The cost of acquiring prime locations can be prohibitive for new companies, further restricting their ability to enter and scale.

| Barrier | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | High upfront costs for tower construction and land acquisition. | Costs range from $20,000-$100,000+ per tower; significant deterrent. |

| Economies of Scale | Lower per-unit costs for established players with large portfolios. | IHS Towers' scale allows for better supplier terms and optimized supply chains. |

| Regulatory Hurdles | Complex licensing, permits, and spectrum allocation costs. | Spectrum auctions globally continue to be multi-billion dollar expenditures. |

| Customer Access | Difficulty in securing contracts with MNOs due to existing relationships. | Incumbents have proven reliability and deep integration with MNOs. |

| Site Availability | Scarcity and high cost of suitable land, especially in urban areas. | Urban land acquisition can cost millions; stringent zoning laws add complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a foundation of comprehensive data, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a robust understanding of competitive dynamics.