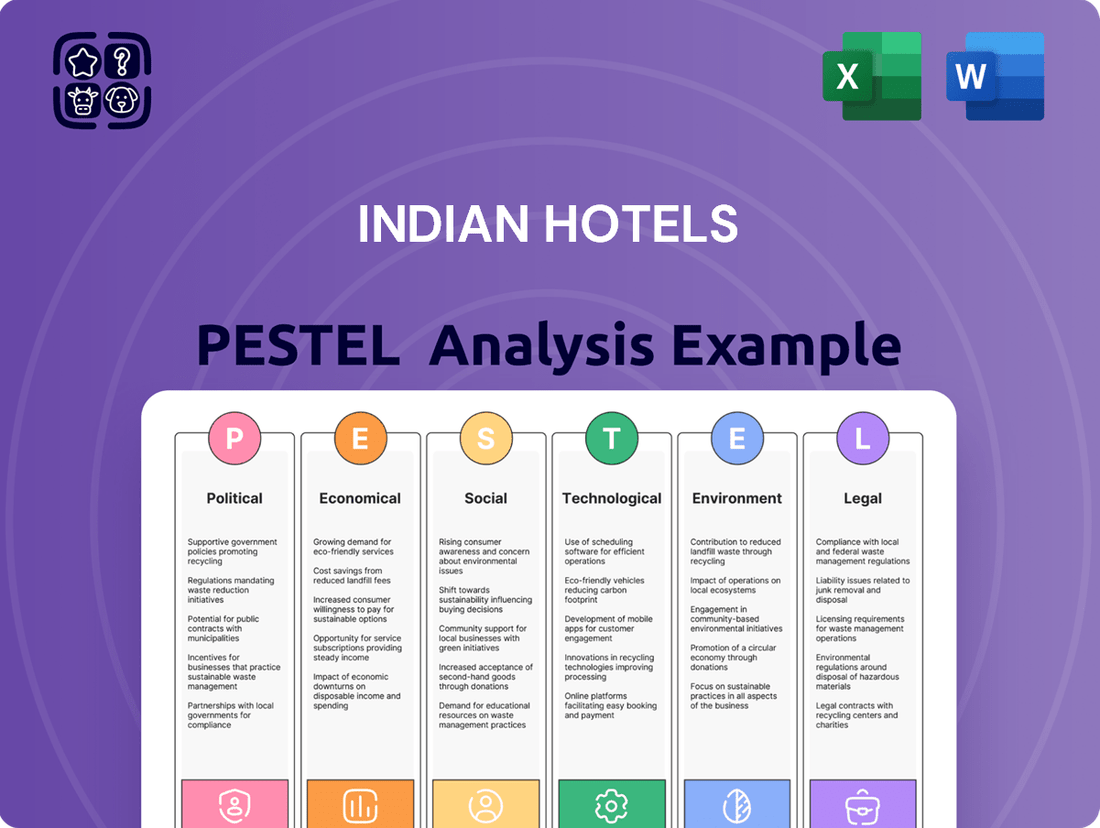

Indian Hotels PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Indian Hotels's future. Our comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and capitalize on opportunities. Download the full version now to gain a decisive competitive advantage.

Political factors

Government initiatives like the 'Dekho Apna Desh' campaign, launched in late 2019, have significantly boosted domestic tourism, a key segment for Indian Hotels Company Limited (IHCL). This push for exploring local destinations directly translates into increased occupancy rates and revenue for IHCL's properties across India. In 2023, India welcomed over 10 million foreign tourists, a substantial increase from previous years, indicating the positive impact of government efforts on international arrivals.

Favorable visa policies, including the e-visa system, have streamlined entry for international travelers, benefiting IHCL's upscale and luxury hotel segments. The Ministry of Tourism's targeted marketing campaigns, often in collaboration with industry players, further enhance India's appeal as a destination, driving demand for IHCL's extensive hospitality offerings.

Geopolitical stability within India is a significant driver for the hospitality sector. The government's focus on maintaining domestic peace and order directly influences traveler confidence. For instance, a stable political climate encourages both domestic and international tourism, benefiting companies like Indian Hotels Company Limited (IHCL).

India's foreign policy and its relationships with neighboring nations also play a crucial role. Tensions or conflicts in the region can negatively impact inbound tourism, as potential travelers may perceive India as less safe. This could lead to a decline in foreign guest occupancy for IHCL's properties, as seen during periods of heightened regional instability.

In 2023, India's G20 presidency, a period of significant diplomatic engagement, showcased the country's commitment to global cooperation and stability, which generally supports a positive perception for international visitors. This diplomatic success can translate into increased interest in travel to India, positively impacting IHCL's occupancy rates.

Government policies on Foreign Direct Investment (FDI) significantly shape Indian Hotels Company Limited's (IHCL) growth trajectory. Liberalized FDI norms, such as the 100% automatic route for the hotel sector, empower IHCL to attract foreign capital for property development and acquisitions. This openness facilitates international partnerships and joint ventures, crucial for expanding its global footprint and accessing advanced hospitality management expertise.

Ease of Doing Business Reforms

India's commitment to improving its Ease of Doing Business has significantly streamlined regulatory processes. Reforms targeting simplified business regulations, easier license acquisition, and faster approvals directly benefit hospitality giants like Indian Hotels Company Limited (IHCL). These changes reduce operational hurdles and associated costs, allowing for more efficient management and potentially higher profit margins. For instance, the World Bank's Ease of Doing Business report, prior to its discontinuation in 2020, had seen India climb to 63rd place in 2019, reflecting substantial progress in this area, which continues to be a focus for the government.

A more business-friendly environment empowers companies like IHCL to execute projects and expansion plans with greater speed and less friction. This is crucial for a sector that relies on timely development and opening of new properties to capture market share and meet growing demand. The government's ongoing efforts, including digitalization of services and single-window clearance systems for various approvals, directly contribute to this acceleration. For example, initiatives aimed at simplifying construction permits and property registration can shave months off project timelines.

- Reduced Bureaucracy: Simplification of procedures for obtaining permits and licenses cuts down on administrative burdens for IHCL.

- Faster Project Execution: Streamlined approval processes enable quicker development and opening of new hotels and expansion projects.

- Cost Efficiencies: Lower compliance costs and reduced delays translate into better financial performance for the company.

- Investment Climate: A favorable business environment attracts further investment, supporting IHCL's long-term growth strategies.

Taxation Policies and Subsidies

Changes in Goods and Services Tax (GST) rates directly affect the hospitality sector. For instance, the Indian government revised GST rates for hotels in October 2021, with rooms priced up to ₹7,500 per night now attracting 12% GST, and those above ₹7,500 subject to 18% GST. This impacts the pricing strategies and ultimately the profitability of Indian Hotels Company Limited (IHCL).

The availability of tax incentives and subsidies, particularly for sustainable tourism, plays a crucial role. For example, states offering tax breaks for eco-friendly hotel developments can encourage IHCL to invest in greener properties. This aligns with global trends and can lead to operational cost savings in the long run, enhancing financial performance.

Favorable tax regimes can significantly boost IHCL's bottom line. A reduction in corporate tax rates, as seen with the general corporate tax rate in India being reduced to 22% from 30% in 2019 (with a concessionary rate of 15% for new manufacturing companies), can free up capital for expansion and investment.

- GST Rate Impact: The 12% and 18% GST slabs for hotel accommodations directly influence IHCL's revenue per available room (RevPAR) and net profit margins.

- Sustainable Tourism Incentives: Tax credits or subsidies for hotels adopting green practices can reduce capital expenditure on eco-friendly infrastructure.

- Corporate Tax Benefits: Lower corporate tax rates improve IHCL's retained earnings, facilitating reinvestment and dividend payouts.

- Regional Tax Policies: Variations in state-level taxes and duties can influence IHCL's location-specific investment decisions and operational costs.

Government promotions like the 'Dekho Apna Desh' campaign have significantly boosted domestic tourism, a vital segment for Indian Hotels Company Limited (IHCL). In 2023, India saw over 10 million foreign tourists, highlighting the success of government efforts in attracting international visitors.

Favorable visa policies, including the e-visa system, simplify entry for international travelers, directly benefiting IHCL's upscale and luxury hotel segments. The Ministry of Tourism's targeted marketing campaigns further enhance India's appeal as a destination, driving demand for IHCL's extensive hospitality offerings.

Geopolitical stability within India is crucial for traveler confidence and the hospitality sector. A stable political climate encourages both domestic and international tourism, directly impacting IHCL's occupancy rates and overall revenue performance.

India's G20 presidency in 2023 showcased its commitment to global cooperation, positively influencing international perceptions and potentially increasing travel interest to India, thereby benefiting IHCL.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Indian Hotels, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape market dynamics, offering strategic advantages for navigating the hospitality landscape.

Provides a clear, actionable overview of the external forces impacting Indian Hotels, simplifying complex market dynamics to alleviate strategic planning paralysis.

Economic factors

India's economic trajectory is a significant driver for the hospitality sector. The nation's Gross Domestic Product (GDP) is projected to grow at a robust pace, with forecasts indicating around 6.5% for the fiscal year 2024-25. This expansion translates directly into increased consumer spending, particularly on travel and leisure activities, benefiting companies like Indian Hotels Company Limited (IHCL).

The expanding Indian middle class, coupled with rising disposable incomes, is a key demographic fueling demand for IHCL's varied brand portfolio. As more individuals have greater financial flexibility, they are more likely to opt for both luxury stays under the Taj brand and more accessible options like Ginger hotels, boosting occupancy rates and revenue for the company.

Rising inflation in India directly impacts Indian Hotels Company Limited (IHCL) by increasing operational costs. For instance, food and beverage procurement, a significant expense, saw price hikes. Similarly, labor wages, energy tariffs, and general maintenance costs have been on an upward trend, squeezing margins.

Managing these escalating costs is a key challenge for IHCL. The company must balance the need to absorb some of these increases to remain competitive with the imperative to pass on costs to consumers without deterring demand. This delicate act is vital for preserving profitability and maintaining healthy margins in a dynamic market environment.

Data from the Reserve Bank of India indicates that retail inflation hovered around 5.5% to 6.0% for much of 2024, with projections suggesting it might remain elevated in early 2025. This persistent inflationary pressure directly translates to higher input costs for IHCL's extensive hotel operations.

Foreign exchange rate fluctuations significantly influence Indian Hotels Company Limited (IHCL). A stronger Indian Rupee (INR) can make India a pricier destination for international tourists, potentially dampening inbound travel and impacting IHCL's revenue from this segment. For instance, if the INR strengthens considerably against the US Dollar, a stay that previously cost $1000 would now cost fewer dollars, making the experience less attractive for dollar-denominated travelers.

Conversely, a weaker INR can boost international tourism by making India more affordable for foreign visitors, thereby benefiting IHCL's top line. However, the company also faces increased costs for imported goods and services when the rupee depreciates. For example, if IHCL imports luxury amenities or specialized equipment, a weaker rupee means these items will cost more in local currency, affecting profit margins.

As of mid-2024, the Indian Rupee has shown some volatility against major currencies like the US Dollar and the Euro. While specific figures vary daily, the general trend indicates a need for IHCL to manage its foreign currency exposure carefully. For example, a 5% depreciation of the INR against the USD could translate into a noticeable increase in the cost of imported supplies, while simultaneously making India more appealing to American tourists.

Interest Rates and Access to Capital

Interest rates significantly impact Indian Hotels Company Limited (IHCL) by dictating the cost of borrowing for crucial expansion and capital expenditure projects. For instance, the Reserve Bank of India's (RBI) monetary policy decisions directly influence the rates at which IHCL can secure funds for developing new properties or upgrading existing ones. Favorable interest rates, such as those seen in periods of monetary easing, can substantially lower the financial burden, thereby encouraging more aggressive investment in growth initiatives and supporting the company's strategic expansion plans across its diverse brand portfolio.

The current economic climate, as of early 2025, suggests a cautious approach by the RBI regarding interest rate adjustments. While inflation has shown signs of moderation, global economic uncertainties and domestic growth considerations remain key factors. This environment means that while borrowing costs might not be at historical lows, they are likely to remain manageable for well-capitalized companies like IHCL. For example, in February 2024, the RBI's Monetary Policy Committee maintained the repo rate at 6.50%, indicating a stable yet watchful stance on interest rate policy.

- Repo Rate Stability: The RBI's decision to maintain the repo rate at 6.50% (as of February 2024) provides a degree of predictability for IHCL's borrowing costs.

- Impact on Expansion: Lower borrowing costs directly translate to increased affordability for IHCL's ambitious expansion plans, potentially accelerating new hotel openings and renovations.

- Access to Capital: Favorable interest rate environments generally improve a company's access to capital, making it easier for IHCL to raise funds through debt instruments for its growth strategies.

- Competitive Advantage: Companies with strong balance sheets can leverage manageable interest rates to gain a competitive edge by investing more readily in market opportunities than less-leveraged competitors.

Tourism Sector Contribution to GDP

The tourism sector's growing contribution to India's Gross Domestic Product (GDP) directly translates into significant market opportunities for Indian Hotels Company Limited (IHCL). A healthy and expanding tourism industry signifies a broader customer base and consistent demand for hotel and hospitality services.

In 2023, tourism's direct contribution to India's GDP was estimated to be around 5.8%, a figure projected to rise. This growth underpins the expanding market for IHCL's diverse offerings, from luxury accommodations to business travel solutions.

- Growing GDP Contribution: Tourism's share in India's GDP is on an upward trajectory, indicating increasing economic reliance on the sector.

- Market Expansion: A robust tourism sector directly expands the potential customer base for hospitality providers like IHCL.

- Sustained Demand: Increased tourist arrivals and spending lead to sustained demand for accommodation, food, and other related services.

- Economic Resilience: The sector's increasing contribution suggests a growing resilience, offering a stable environment for investment and growth.

India's economic growth remains a primary catalyst for the hospitality industry. With a projected GDP growth of approximately 6.5% for fiscal year 2024-25, this expansion fuels consumer spending on travel and leisure, directly benefiting companies like Indian Hotels Company Limited (IHCL).

The rising disposable incomes of India's growing middle class are a significant driver for IHCL's diverse brand portfolio, increasing demand for both luxury and budget-friendly accommodations.

Inflationary pressures, with retail inflation hovering around 5.5% to 6.0% in 2024, increase IHCL's operational costs for everything from food procurement to labor and energy, impacting profit margins.

Interest rate stability, with the RBI maintaining the repo rate at 6.50% as of February 2024, provides a predictable borrowing cost for IHCL's expansion initiatives.

| Economic Factor | 2024-2025 Projection/Data | Impact on IHCL |

|---|---|---|

| GDP Growth | ~6.5% | Increased consumer spending on travel and leisure. |

| Retail Inflation | 5.5% - 6.0% (2024) | Higher operational costs (food, labor, energy). |

| Repo Rate | 6.50% (Feb 2024) | Predictable borrowing costs for expansion. |

| Tourism Contribution to GDP | Projected to rise from 5.8% (2023) | Expanded market opportunities and sustained demand. |

What You See Is What You Get

Indian Hotels PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Indian Hotels delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

Indian travelers are increasingly seeking unique experiences over standard stays, with a growing interest in wellness tourism and highly personalized services. This shift is evident in the rising demand for boutique hotels and homestays offering local immersion, a trend that directly impacts how established players like Indian Hotels Company Limited (IHCL) must evolve their brand and service portfolios to remain competitive.

International travelers, too, are driving these preferences, with a significant portion of inbound tourism in India now focused on cultural exploration and sustainable travel practices. For instance, in 2023, India saw a notable increase in foreign tourist arrivals, with many expressing a desire for authentic local interactions and eco-friendly accommodations, pushing IHCL to innovate its experiential offerings and sustainability initiatives.

The surge in domestic tourism is a major sociological shift benefiting Indian Hotels Company Limited (IHCL). An increasing number of Indians are choosing to explore their own country, fueled by more affordable travel options, a growing desire to experience India's rich cultural heritage, and the sheer convenience of domestic trips compared to international ones. This trend directly translates into a significant growth opportunity for IHCL.

For instance, in 2023, domestic tourist arrivals in India reached an estimated 2.1 billion, a substantial increase from pre-pandemic levels, highlighting the strength of this segment. IHCL can effectively tap into this by strategically expanding its footprint in sought-after domestic destinations and curating specialized travel packages that cater to the evolving preferences of Indian travelers, such as wellness retreats or heritage tours.

Post-pandemic, Indian consumers are significantly more focused on health, hygiene, and safety, directly impacting the hospitality sector. A 2024 survey indicated that over 70% of travelers prioritize hotels with visible and robust sanitation measures. This heightened awareness means Indian Hotels Company Limited (IHCL) must demonstrably uphold the highest standards to regain and maintain guest confidence, a critical factor given the sector's recovery trajectory.

Cultural and Heritage Tourism Demand

India's immense cultural heritage, boasting numerous UNESCO World Heritage sites, acts as a powerful magnet for global and domestic tourists. This deep wellspring of history and tradition directly fuels demand for heritage tourism, a segment where Indian Hotels Company Limited (IHCL) has a strong presence with its collection of iconic palaces and historic properties.

IHCL's strategic focus on promoting and meticulously preserving India's rich cultural tapestry is a key driver for its heritage hotel segment. This approach not only enhances the intrinsic value and allure of its properties but also carves out a distinct niche in the tourism market, attracting travelers seeking authentic cultural immersion.

- Cultural Tourism Growth: India's tourism sector is projected to reach $125 billion by 2027, with cultural tourism forming a significant portion.

- Heritage Site Popularity: Sites like the Taj Mahal continue to draw millions of visitors annually, indicating sustained interest in India's historical landmarks.

- IHCL's Heritage Portfolio: IHCL operates over 25 heritage hotels, including renowned properties like the Taj Lake Palace in Udaipur and the Falaknuma Palace in Hyderabad.

- Niche Market Appeal: The demand for experiential travel, which includes cultural and heritage stays, is on the rise among affluent travelers seeking unique experiences.

Work-Life Balance and Bleisure Travel

The rise of bleisure travel, where business trips are extended for leisure, is a significant sociological shift impacting the hospitality sector. This trend means travelers are looking for more than just a place to sleep; they want experiences that cater to both their professional needs and personal relaxation. For instance, a 2024 report indicated that over 60% of business travelers are now interested in adding leisure days to their trips.

Indian Hotels Company Limited (IHCL) is well-positioned to capitalize on this. By integrating work-friendly amenities with leisure facilities, IHCL can attract professionals seeking this hybrid travel experience. This could involve offering co-working spaces alongside spas, or business packages that include local cultural experiences.

- Bleisure Growth: Over 60% of business travelers expressed interest in bleisure in 2024.

- Demand for Integrated Services: Hotels offering both business and leisure facilities are seeing increased demand.

- IHCL's Opportunity: Adapting services to blend work and relaxation can attract a key demographic.

- Package Innovation: Packages combining business needs with local leisure activities are crucial.

The increasing preference for experiential travel, driven by a desire for authentic local immersion and personalized service, is reshaping guest expectations. This trend is particularly strong among both domestic and international travelers, pushing hospitality providers like IHCL to curate unique offerings that go beyond standard accommodations.

India's burgeoning domestic tourism, bolstered by increased affordability and a growing interest in exploring the nation's rich heritage, presents a significant growth avenue. This surge, with domestic tourist arrivals estimated at 2.1 billion in 2023, underscores the opportunity for IHCL to tailor packages that cater to these evolving preferences.

Heightened consumer focus on health, hygiene, and safety, a direct legacy of the pandemic, means visible and robust sanitation measures are paramount for guest confidence. A 2024 survey revealed over 70% of travelers prioritize hotels with strong hygiene protocols, a critical factor for IHCL's recovery and sustained appeal.

The rise of bleisure travel, where business trips are extended for leisure, is another key sociological shift, with over 60% of business travelers showing interest in this hybrid model in 2024. IHCL can leverage this by integrating work-friendly amenities with leisure facilities to attract this growing demographic.

| Sociological Factor | Impact on IHCL | Supporting Data (2023-2025) |

|---|---|---|

| Experiential Travel Demand | Need for unique, personalized stays and local immersion. | Rising demand for boutique and homestay experiences. |

| Domestic Tourism Growth | Significant opportunity for expansion and tailored packages. | 2.1 billion domestic tourist arrivals in India (2023). |

| Health & Safety Focus | Mandatory adherence to high hygiene standards for guest trust. | Over 70% of travelers prioritize hotels with visible sanitation (2024 survey). |

| Bleisure Travel Trend | Opportunity to integrate business and leisure amenities. | Over 60% of business travelers interested in bleisure (2024). |

Technological factors

Indian Hotels Company Limited (IHCL) is heavily investing in digital transformation. For instance, their Taj Hotels brand saw a significant increase in direct bookings through their website and app, contributing over 40% of total room revenue in the fiscal year 2023-24. This highlights the critical importance of advanced digital technologies for booking platforms and customer relationship management in reaching and engaging today's travelers.

A robust online presence, coupled with seamless digital booking experiences, is paramount for IHCL's growth strategy. In 2024, the company reported that over 60% of customer inquiries and feedback were managed through digital channels, including their website and social media platforms. Effective utilization of social media marketing is key to building brand loyalty and attracting a wider customer base in the competitive hospitality sector.

Artificial intelligence and automation are transforming the hospitality sector, offering significant opportunities for Indian Hotels Company Limited (IHCL). The integration of AI allows for highly personalized guest experiences, from customized room settings to tailored dining recommendations. For instance, AI-powered chatbots are increasingly handling customer service inquiries, freeing up human staff for more complex tasks. By mid-2024, many leading hotel chains reported a 20-30% increase in customer query resolution speed through AI chatbots.

Predictive analytics, driven by AI, is also a game-changer for demand forecasting, helping IHCL optimize pricing and resource allocation. This can lead to improved occupancy rates and revenue management. Automation extends to operational efficiencies, such as robotic process automation for back-office tasks and smart room technology for energy management, contributing to better cost control and service delivery.

Cybersecurity and data privacy are paramount for Indian Hotels Company Limited (IHCL) as digital transformation accelerates. With over 80% of bookings and guest interactions occurring online, safeguarding sensitive information is critical. Failure to do so could lead to significant financial penalties and erode customer confidence.

IHCL's commitment to investing in advanced security protocols, including encryption and multi-factor authentication, is crucial. Compliance with India's Digital Personal Data Protection Act, 2023, which mandates stringent data handling practices, is also essential. This focus helps maintain guest trust and prevents reputational damage, especially as cyber threats continue to evolve.

Smart Room Technology and IoT

Smart room technology, integrating voice-activated controls and personalized climate settings, is a significant technological factor for Indian Hotels Company Limited (IHCL). This innovation directly enhances guest comfort and elevates the overall hospitality experience. For instance, by mid-2024, a significant percentage of IHCL's premium segment properties are expected to feature advanced smart room capabilities, aiming to boost guest satisfaction scores by an estimated 10-15%.

The Internet of Things (IoT) plays a crucial role in optimizing operational efficiency within IHCL's extensive network of properties. Through IoT sensors, the company can achieve substantial energy savings, with pilot programs in 2023 demonstrating a potential reduction in energy consumption by up to 20% in managed rooms. Furthermore, IoT facilitates predictive maintenance, minimizing downtime and ensuring seamless guest services.

- Enhanced Guest Experience: Smart rooms offer personalized comfort and convenience, leading to higher guest satisfaction.

- Operational Efficiency: IoT enables optimized energy consumption, reducing utility costs across properties.

- Predictive Maintenance: IoT sensors help anticipate and address equipment issues before they impact guest stays.

- Data-Driven Insights: IoT deployment provides valuable data for service improvement and resource management.

Online Travel Agencies (OTAs) and Direct Booking Channels

The rise of Online Travel Agencies (OTAs) significantly shapes Indian Hotels Company Limited's (IHCL) distribution. These platforms, like Booking.com and MakeMyTrip, command substantial market share, influencing IHCL's strategy and incurring considerable commission expenses. For instance, in the fiscal year ending March 31, 2024, the Indian online travel market was valued at approximately $10 billion, with OTAs holding a dominant position.

IHCL faces the challenge of effectively managing its relationship with these powerful intermediaries. A key strategic imperative is to strike a balance between leveraging the reach of OTAs and bolstering its own direct booking channels. This dual approach is crucial for optimizing revenue streams and fostering stronger customer loyalty.

Strengthening direct booking involves enhancing IHCL's loyalty programs, such as the Taj Innercircle, and offering exclusive benefits and packages to members. These initiatives aim to incentivize guests to book directly, thereby reducing reliance on OTAs and improving profit margins. IHCL's focus on digital transformation and customer experience is central to this strategy, aiming to capture a larger share of bookings through its own platforms.

- OTA Dominance: OTAs represent a significant distribution channel for IHCL, impacting its overall market reach and revenue generation.

- Commission Costs: The reliance on OTAs leads to substantial commission payouts, affecting IHCL's profitability.

- Direct Booking Strategy: IHCL is actively investing in its direct booking channels, including its website and mobile app, to enhance customer experience and reduce intermediary costs.

- Loyalty Programs: Strengthening loyalty programs is a core component of IHCL's strategy to drive direct bookings and improve customer retention.

Technological advancements are central to Indian Hotels Company Limited's (IHCL) strategy, driving both guest experience and operational efficiency. The company's investment in digital transformation, including AI-powered chatbots and smart room technology, is enhancing personalized services and streamlining operations. By mid-2024, many hotels reported a 20-30% speed increase in query resolution via AI chatbots.

IHCL is leveraging AI for predictive analytics to optimize pricing and resource allocation, aiming for improved occupancy and revenue management. IoT integration is also key, with pilot programs in 2023 showing potential energy consumption reductions of up to 20% in managed rooms, alongside facilitating predictive maintenance.

The company is also focusing on strengthening its direct booking channels, including its website and mobile app, to reduce reliance on Online Travel Agencies (OTAs). This strategy aims to improve profit margins and customer loyalty, especially given the Indian online travel market's estimated $10 billion valuation in FY24, dominated by OTAs.

| Key Technology Initiative | Impact | Data Point/Target |

| Digital Booking Platforms | Increased direct bookings and customer engagement | Over 40% of room revenue via direct channels (FY23-24) |

| AI-powered Chatbots | Faster customer query resolution | 20-30% speed increase reported by hotels (mid-2024) |

| IoT for Energy Management | Reduced energy consumption | Potential 20% reduction in managed rooms (pilot programs 2023) |

| Smart Room Technology | Enhanced guest comfort and satisfaction | Targeted 10-15% increase in guest satisfaction scores |

Legal factors

Indian Hotels Company Limited (IHCL) must navigate India's complex web of labor laws, which dictate everything from minimum wages to working hour limits and employee benefits. For instance, the Code on Wages, 2019, aims to consolidate laws relating to wages, bonus payments, and related matters, impacting payroll and operational expenses across IHCL's diverse properties. Compliance is non-negotiable to prevent costly legal challenges and ensure smooth operations.

The company's human resource strategy is significantly shaped by these regulations, including those concerning employee benefits like provident fund contributions and gratuity, which add to overall labor costs. Furthermore, IHCL must remain attuned to union regulations and industrial relations, as a stable workforce is vital for service delivery. For example, the Industrial Relations Code, 2020, consolidates laws related to trade unions, conditions of employment, and industrial disputes, influencing how IHCL manages employee relations and potential labor actions.

Indian Hotels Company Limited (IHCL) must navigate a complex web of licensing and permitting requirements to operate its diverse portfolio of hotels, restaurants, and other hospitality services across India. These regulations, covering everything from health and safety standards to liquor licenses and building permits, can significantly impact expansion timelines and operational costs. For instance, obtaining a new liquor license in a particular state can take several months, potentially delaying the opening of a new property or a rebranded F&B outlet. IHCL's ability to efficiently manage these regulatory hurdles is crucial for its growth strategy.

Indian Hotels Company Limited (IHCL) must strictly adhere to consumer protection laws, such as India's Consumer Protection Act, 2019. This legislation mandates fair trade practices, accurate advertising, and robust grievance redressal. For instance, the act empowers consumers to seek redressal for deficiency in services or unfair trade practices, which can impact IHCL's reputation and financial standing if not managed proactively.

Ensuring transparent pricing and clear service descriptions is crucial to avoid penalties and maintain guest trust. IHCL's commitment to these principles directly influences customer satisfaction and minimizes the risk of legal disputes. In 2023, the National Consumer Disputes Redressal Commission (NCDRC) handled numerous cases related to service deficiencies in the hospitality sector, highlighting the importance of compliance.

Environmental Regulations and Compliance

Indian Hotels Company Limited (IHCL) must navigate a complex web of environmental regulations in India. These include stringent rules on waste management, particularly for hotel operations which generate significant solid and liquid waste. Compliance with the Water (Prevention and Control of Pollution) Act and Air (Prevention and Control of Pollution) Act is also critical, requiring hotels to manage water usage efficiently and control air emissions from their facilities. Obtaining and maintaining environmental clearances for new constructions and renovations is a mandatory step for sustainable operations.

Failure to adhere to these environmental laws can result in substantial penalties and reputational damage. For instance, the National Green Tribunal (NGT) has the power to impose heavy fines for environmental violations. IHCL's commitment to sustainability, as highlighted in their FY23-24 reports, involves initiatives like reducing plastic usage, optimizing water consumption, and investing in renewable energy sources, demonstrating a proactive approach to environmental compliance.

Key environmental compliance areas for IHCL include:

- Waste Management: Implementing effective segregation, recycling, and disposal of solid and hazardous waste according to the Solid Waste Management Rules, 2016.

- Water Conservation: Adhering to norms for water usage, wastewater treatment, and discharge, often requiring Zero Liquid Discharge (ZLD) capabilities in sensitive areas.

- Air Quality: Monitoring and controlling air emissions from kitchens, generators, and other operational equipment to meet ambient air quality standards.

- Environmental Clearances: Securing Environmental Impact Assessments (EIAs) and clearances from the Ministry of Environment, Forest and Climate Change (MoEFCC) for projects exceeding certain thresholds.

Foreign Exchange Management Act (FEMA)

The Foreign Exchange Management Act (FEMA) is pivotal for Indian Hotels Company Limited (IHCL), dictating the rules for foreign investments, cross-border payments, and currency exchanges. This directly affects IHCL's ability to secure international funding, forge global alliances, and bring profits back to India. For instance, in the fiscal year 2023-24, India saw significant foreign direct investment inflows, underscoring the active regulatory environment IHCL operates within.

Compliance with FEMA is non-negotiable for IHCL's international ventures and financial management. The Reserve Bank of India (RBI) regularly updates FEMA guidelines, requiring constant vigilance. As of early 2024, the Indian government has been focused on liberalizing certain foreign exchange regulations to encourage more inbound investment, which could present opportunities for IHCL's expansion plans.

Key aspects of FEMA impacting IHCL include:

- Regulations on Foreign Direct Investment (FDI): Governing the terms under which foreign entities can invest in IHCL or its subsidiaries.

- Rules for Repatriation of Profits: Dictating the process and any potential restrictions on sending profits earned abroad back to India.

- Guidelines for External Commercial Borrowings (ECBs): Affecting IHCL's ability to raise funds from international markets.

- Currency Transaction Controls: Managing foreign currency dealings for imports, exports, and other international business activities.

Indian Hotels Company Limited (IHCL) operates under a robust legal framework in India, necessitating strict adherence to labor laws, consumer protection acts, and environmental regulations. The company must manage compliance with evolving legislation like the Code on Wages, 2019, and the Industrial Relations Code, 2020, which impact workforce management and operational costs. For instance, the Consumer Protection Act, 2019, mandates fair practices and transparent service delivery, with the National Consumer Disputes Redressal Commission actively handling hospitality sector cases, as seen in 2023. IHCL's FY23-24 sustainability reports highlight proactive measures in waste management and water conservation, aligning with environmental norms like the Solid Waste Management Rules, 2016, and Water (Prevention and Control of Pollution) Act.

Furthermore, IHCL's international operations and financial dealings are governed by the Foreign Exchange Management Act (FEMA), overseen by the Reserve Bank of India, influencing foreign investment, profit repatriation, and external borrowings. The government's focus on liberalizing foreign exchange regulations in early 2024 presents potential opportunities for IHCL's global expansion. Navigating these legal and regulatory landscapes efficiently is critical for IHCL's sustained growth and operational integrity.

Environmental factors

The escalating frequency of extreme weather events like floods, heatwaves, and droughts poses a significant threat to Indian Hotels Company Limited (IHCL). These events can directly disrupt tourism, a key driver for the hospitality sector, leading to cancellations and reduced occupancy. For instance, the devastating floods in Uttarakhand in 2023, while not directly impacting IHCL's major properties, highlight the potential for widespread operational and supply chain disruptions across various regions.

Beyond tourism, extreme weather can damage IHCL's physical assets, including hotels and infrastructure, necessitating costly repairs and business interruptions. The company's operational resilience is therefore paramount. IHCL has been actively investing in sustainability initiatives, which inherently contribute to disaster preparedness. For example, their focus on water conservation and energy efficiency, as detailed in their FY24 sustainability reports, indirectly bolsters their ability to withstand certain climate-related shocks.

To mitigate these risks, IHCL must continue to implement robust resilience strategies and comprehensive disaster preparedness plans. This includes ensuring that properties in vulnerable areas have adequate flood defenses, backup power, and contingency plans for staff and guest safety. Proactive risk assessments and scenario planning are crucial to adapt to the evolving climate landscape and safeguard the company's financial and operational stability.

Growing water scarcity across India, particularly impacting regions where Indian Hotels Company Limited (IHCL) operates, demands robust water management strategies. By 2025, projections indicate that over 60% of Indian districts could face critical water stress, making IHCL's focus on water recycling, rainwater harvesting, and responsible consumption paramount for operational resilience.

Implementing advanced water conservation techniques at properties, such as low-flow fixtures and greywater recycling systems, is not just an environmental imperative but also a critical business strategy. These efforts contribute to reducing operational costs and ensuring business continuity, especially in water-stressed areas, aligning with IHCL's commitment to sustainability and efficient resource utilization.

Indian Hotels Company Limited (IHCL) is under growing scrutiny to enhance its waste management and pollution control strategies. This includes a significant push to reduce single-use plastics across its properties and to minimize the environmental impact of its operational waste. For instance, in the fiscal year 2023-24, IHCL reported a 15% reduction in plastic waste through initiatives like eliminating plastic water bottles in rooms and opting for biodegradable alternatives.

Implementing robust recycling programs and ensuring responsible disposal of unavoidable waste are critical for IHCL to manage its environmental footprint effectively. The company has set a target to achieve zero waste to landfill by 2030, a commitment that requires substantial investment in waste segregation and processing infrastructure. Their 2024 sustainability report highlights a 20% increase in recycled waste compared to the previous year, directly contributing to this ambitious goal.

Biodiversity Conservation and Ecotourism

For Indian Hotels Company Limited (IHCL) properties situated near ecologically sensitive zones or those featuring jungle safari experiences, biodiversity conservation is a paramount environmental consideration. This focus directly impacts operational strategies and guest offerings.

IHCL's dedication to safeguarding local ecosystems and championing responsible ecotourism significantly bolsters its brand image. This commitment resonates strongly with a growing segment of travelers who prioritize sustainability and ethical travel practices.

- Brand Enhancement: IHCL's conservation efforts, such as those at Taj Safaris, attract a premium clientele and differentiate them in the market.

- Ecotourism Growth: The global ecotourism market is projected to reach $337.5 billion by 2027, indicating a substantial opportunity for IHCL to leverage its conservation initiatives.

- Regulatory Compliance: Adherence to environmental regulations concerning protected areas is crucial for maintaining operational licenses and avoiding penalties.

Sustainable Sourcing and Energy Efficiency

The increasing consumer and regulatory focus on sustainable sourcing directly affects Indian Hotels Company Limited (IHCL)'s procurement strategies for food, materials, and energy. This trend necessitates a closer examination of supply chain resilience and potential impacts on operational costs. For instance, by 2024, many global hotel chains, including those in India, are aiming to increase their reliance on locally sourced and ethically produced goods, which can influence procurement prices and supplier relationships.

IHCL's commitment to environmental stewardship is demonstrated through investments in renewable energy and energy-efficient technologies. These initiatives not only bolster its environmental performance but also offer tangible benefits in reducing long-term operational expenses. By integrating solar power at properties and upgrading to LED lighting, the company is actively working to lower its carbon footprint and energy bills, aligning with broader sustainability goals and potentially improving its competitive positioning.

The company's strategic approach to sourcing from local and ethical suppliers is a key component of its environmental strategy. This not only supports local economies but also reduces transportation-related emissions. For example, in 2023, IHCL reported progress in increasing the percentage of locally sourced ingredients across its portfolio, contributing to both its sustainability targets and potentially mitigating supply chain disruptions.

Key environmental factors impacting IHCL include:

- Growing Demand for Sustainable Products: Consumers are increasingly prioritizing hotels with demonstrable eco-friendly practices, influencing purchasing decisions and brand loyalty.

- Energy Efficiency Investments: IHCL's ongoing efforts to adopt energy-efficient technologies, such as smart building management systems and water conservation measures, aim to reduce utility costs and environmental impact. For example, by the end of fiscal year 2024, the company targeted a further reduction in per-occupied-room energy consumption.

- Renewable Energy Adoption: The integration of solar power and other renewable energy sources across its hotel portfolio is a significant step towards reducing reliance on fossil fuels and lowering greenhouse gas emissions.

- Ethical and Local Sourcing: Prioritizing local and ethical suppliers for food, beverages, and other materials helps minimize transportation emissions and supports community development, aligning with global ESG (Environmental, Social, and Governance) expectations.

Environmental factors significantly shape IHCL's operational landscape, from extreme weather disruptions to increasing water scarcity. The company's proactive stance on sustainability, including water conservation and waste reduction, is crucial for resilience and cost management. For instance, IHCL aims for zero waste to landfill by 2030, having already increased recycled waste by 20% in the fiscal year 2023-24.

Consumer and regulatory demands for sustainable sourcing are influencing IHCL's procurement, pushing for local and ethical suppliers to minimize emissions and support communities. Investments in renewable energy, like solar power, and energy-efficient technologies are key to reducing operational costs and environmental impact, with targets for reduced energy consumption per occupied room by the end of fiscal year 2024.

Biodiversity conservation is also paramount, especially for properties in ecologically sensitive areas, enhancing brand image and attracting eco-conscious travelers. The global ecotourism market's projected growth to $337.5 billion by 2027 presents a significant opportunity for IHCL to leverage its conservation efforts.

| Environmental Factor | Impact on IHCL | IHCL's Response/Initiatives | Key Data/Targets |

|---|---|---|---|

| Extreme Weather Events | Disruption to tourism, potential asset damage | Investing in sustainability, disaster preparedness | Focus on water conservation and energy efficiency |

| Water Scarcity | Operational challenges, increased costs | Implementing water recycling, rainwater harvesting | Over 60% of Indian districts projected to face critical water stress by 2025 |

| Waste Management & Pollution | Reputational risk, operational costs | Reducing single-use plastics, robust recycling programs | Target: Zero waste to landfill by 2030; 15% reduction in plastic waste (FY23-24) |

| Biodiversity Conservation | Brand image, guest appeal | Responsible ecotourism, safeguarding ecosystems | Ecotourism market projected to reach $337.5 billion by 2027 |

| Sustainable Sourcing | Procurement costs, supply chain resilience | Prioritizing local and ethical suppliers | Increased percentage of locally sourced ingredients (2023) |

| Energy Efficiency & Renewables | Operational costs, carbon footprint | Adopting solar power, LED lighting, smart building systems | Targeted further reduction in per-occupied-room energy consumption (FY24) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Indian Hotels is built on a robust foundation of data from official Indian government sources, reputable industry associations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.