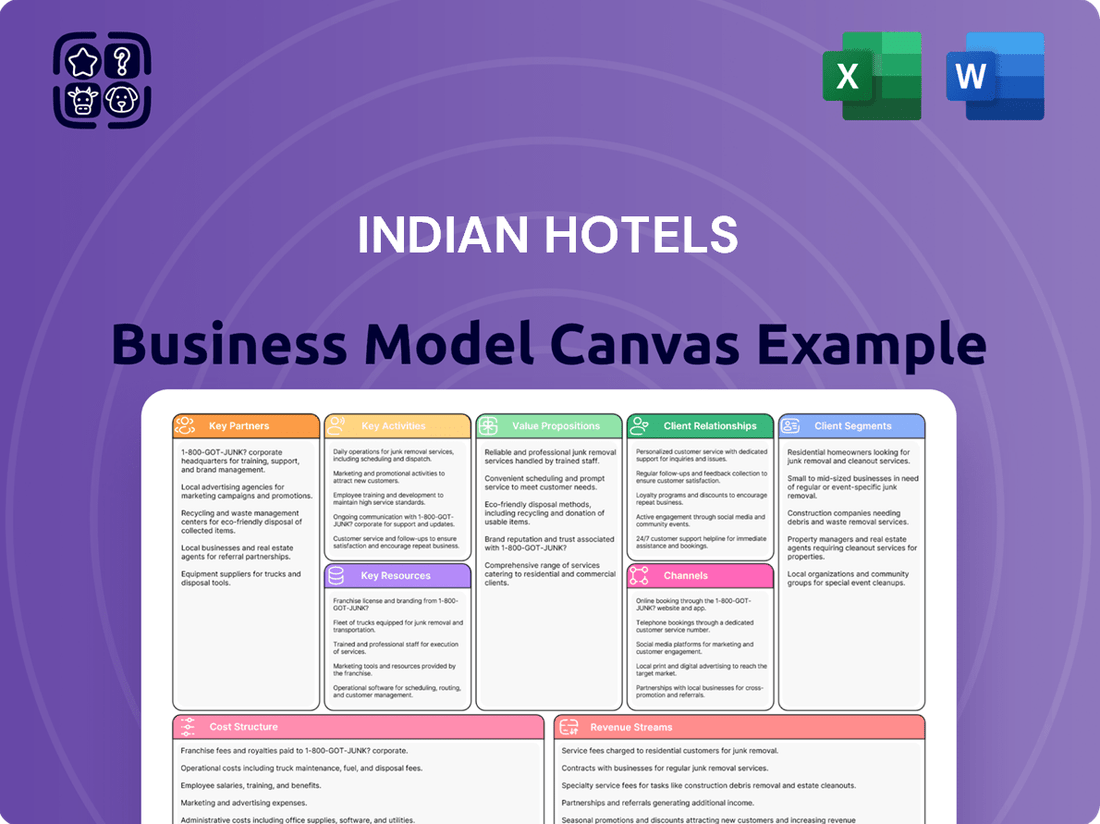

Indian Hotels Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

Unlock the strategic blueprint behind Indian Hotels's thriving business model. This comprehensive Business Model Canvas details their diverse customer segments, key value propositions across luxury and budget segments, and robust revenue streams from hospitality and retail. Discover how they leverage strategic partnerships and manage cost structures to maintain market leadership.

Partnerships

Indian Hotels Company Limited (IHCL) actively forms strategic alliances with local real estate developers and property owners. This is a cornerstone of their expansion strategy, especially for securing management contracts for new hotel ventures.

This capital-light model is crucial for IHCL's rapid growth trajectory, enabling them to penetrate diverse Indian markets efficiently. For instance, in the fiscal year 2023-24, IHCL signed agreements for over 30 new hotels, a significant portion of which would leverage such partnerships.

Indian Hotels Company Limited (IHCL) actively partners with technology providers and digital platforms to elevate guest experiences and operational efficiency. These collaborations are vital for expanding their online presence and seamless booking processes.

In 2024, IHCL's strategic alliances include major Online Travel Agencies (OTAs) like MakeMyTrip and Booking.com, which significantly contribute to their room bookings and visibility. Furthermore, partnerships with advanced Property Management Systems (PMS) and Customer Relationship Management (CRM) tools ensure personalized guest services and streamlined back-end operations.

Indian Hotels Company Limited (IHCL) actively partners with non-governmental organizations (NGOs), government agencies, and local communities to bolster its ESG+ framework, Paathya. These collaborations are crucial for driving sustainable practices, including the implementation of renewable energy solutions and advanced waste management techniques.

Through its Paathya initiative, IHCL focuses on skill development programs, directly benefiting local populations and fostering economic empowerment. For instance, in 2023, IHCL's skill development programs trained over 15,000 individuals, enhancing their employability within the hospitality sector.

These strategic alliances are instrumental in strengthening IHCL's social license to operate, ensuring that its business activities are aligned with societal expectations and contribute positively to community well-being. This approach directly supports the company's long-term sustainability objectives and enhances its brand reputation.

Airline and In-flight Catering Partnerships

Indian Hotels Company Limited (IHCL) leverages its subsidiary, TajSATS Air Catering, to forge crucial partnerships with airlines. These collaborations focus on delivering high-quality in-flight catering services, a strategic move that diversifies IHCL's revenue streams and capitalizes on its renowned culinary strengths.

This strategic alliance allows IHCL to extend its hospitality expertise beyond traditional hotel stays directly to air travelers. By catering to airlines, IHCL not only generates an additional income source but also reinforces its brand presence and culinary reputation across a wider customer base.

As of 2024, TajSATS operates catering facilities at major Indian airports, serving a significant number of flights. For instance, in the fiscal year 2023-24, TajSATS handled millions of meals for various domestic and international carriers, underscoring the scale of these partnerships.

- TajSATS is a key partner for numerous Indian and international airlines operating out of major airports.

- These partnerships contribute significantly to IHCL's non-room revenue segments.

- In FY24, TajSATS's revenue from catering services demonstrated consistent growth, reflecting the demand from airline partners.

- The success of these collaborations highlights IHCL's ability to operationalize its hospitality services in diverse environments.

Brand Collaborations and Acquisitions

Indian Hotels Company Limited (IHCL) actively pursues brand collaborations and strategic acquisitions to fuel its growth and broaden its market presence. These partnerships are crucial for expanding its diverse portfolio of hospitality brands and introducing new guest experiences.

In 2023, IHCL acquired a majority stake in Tree of Life Resorts & Hotels, a move designed to bolster its presence in the luxury boutique segment. This was followed by a significant brand license agreement for The Claridges, further enhancing its luxury offerings. These strategic moves underscore IHCL's commitment to inorganic growth and portfolio diversification.

These key partnerships allow IHCL to:

- Expand its brand portfolio into new segments and geographies.

- Leverage established brand equity for faster market penetration.

- Diversify revenue streams through varied hospitality concepts.

- Enhance operational synergies and guest experiences across its brands.

IHCL's key partnerships extend to real estate developers for management contracts, technology providers for digital enhancement, and NGOs for ESG initiatives. These collaborations are vital for its capital-light expansion, improved guest experiences, and sustainable operations.

The company's subsidiary, TajSATS Air Catering, partners with numerous airlines, contributing significantly to non-room revenue. In FY24, TajSATS handled millions of meals, demonstrating the scale of these airline partnerships and IHCL's diversified revenue streams.

Strategic acquisitions and brand collaborations, such as the stake in Tree of Life Resorts & Hotels and the license agreement for The Claridges in 2023, are crucial for portfolio expansion and market penetration.

| Partnership Type | Key Partners | Impact/Contribution | 2023-24 Data Point |

| Real Estate Development | Local Developers, Property Owners | Securing management contracts, capital-light expansion | Agreements for over 30 new hotels signed |

| Technology & Digital | OTAs (MakeMyTrip, Booking.com), PMS/CRM providers | Enhanced online presence, seamless booking, personalized guest services | Significant contribution to room bookings via OTAs |

| Sustainability & Community | NGOs, Government Agencies, Local Communities | ESG+ framework (Paathya), skill development, social license | Over 15,000 individuals trained in skill development programs |

| Airline Catering | Indian & International Airlines | In-flight catering services, diversified revenue, brand reinforcement | Millions of meals handled by TajSATS |

| Brand & Acquisitions | Tree of Life Resorts & Hotels, The Claridges | Portfolio expansion, luxury segment strengthening, inorganic growth | Acquisition of majority stake in Tree of Life |

What is included in the product

This Business Model Canvas provides a detailed blueprint of Indian Hotels' operations, outlining its diverse customer segments, multi-channel distribution, and a value proposition centered on premium hospitality experiences across its hotel brands.

It meticulously details key resources, activities, and partnerships, alongside cost structures and revenue streams, offering a comprehensive view of how Indian Hotels creates, delivers, and captures value.

Indian Hotels' Business Model Canvas acts as a pain point reliever by offering a clear, visual map of their operations, simplifying complex strategies for easier understanding and problem-solving.

Activities

Hotel operations and management are the heart of Indian Hotels Company Limited (IHCL), encompassing the daily running of its diverse portfolio, including iconic Taj properties, contemporary Vivanta hotels, and value-focused Ginger. This critical function ensures seamless guest experiences, from check-in to check-out, and covers all aspects of hospitality.

Key activities involve meticulous management of accommodation, ensuring comfortable and well-maintained rooms, alongside delivering exceptional food and beverage services across restaurants and banquets. The company also focuses on managing other guest amenities and services, all aimed at upholding IHCL's renowned high service standards and driving operational efficiency across its extensive network.

In the fiscal year 2023-24, IHCL continued to strengthen its operational backbone. The company reported a consolidated revenue of INR 6,069 crore, with its hotel segment being the primary contributor. This robust performance underscores the effectiveness of their operational management in delivering consistent quality and guest satisfaction across their properties.

Indian Hotels Company Limited (IHCL) actively pursues brand development and portfolio expansion. This involves launching new brands, revitalizing existing ones, and strategically adding properties through new agreements and openings. For instance, in FY24, IHCL signed 28 hotels and opened 19, demonstrating a robust pace of expansion.

The company balances growth through both capital-light models, such as management contracts, and capital-heavy projects. This dual approach allows IHCL to pursue its expansion objectives efficiently. In FY24, IHCL's portfolio grew to 270 hotels, reflecting its commitment to broadening its market presence.

Indian Hotels Company Limited (IHCL) actively cultivates guest loyalty through its comprehensive customer relationship management, notably via the Tata Neu platform. This strategy focuses on delivering personalized experiences and exclusive benefits to encourage repeat patronage.

The Tata Neu program, integrated across various Tata brands, offers a unified loyalty ecosystem. For instance, in 2023, IHCL reported a significant increase in loyalty program members, demonstrating the effectiveness of these engagement initiatives in driving customer retention and increasing share of wallet.

Sustainability and ESG Implementation

Indian Hotels Company Limited (IHCL) actively implements and monitors its ESG+ framework, Paathya, as a core operational activity. This involves a multi-faceted approach to environmental, social, and governance (ESG) integration across its diverse portfolio.

Key activities include driving renewable energy adoption, with a target to achieve 100% renewable energy usage in its owned and managed properties by 2030. For instance, in FY23, IHCL achieved 43% renewable energy consumption. The company also focuses on waste reduction, aiming to eliminate single-use plastics, and has made significant progress in this area, reducing its plastic footprint by 70% in owned and managed hotels. Furthermore, community development programs are integral, fostering local engagement and social impact.

- Renewable Energy: Targeting 100% renewable energy usage by 2030, with 43% achieved in FY23.

- Plastic Reduction: Aiming for zero single-use plastics, having reduced its plastic footprint by 70% in owned and managed hotels.

- Community Engagement: Implementing programs that contribute to local economic and social development.

- ESG+ Framework: Continuous monitoring and enhancement of the Paathya framework to ensure robust sustainability practices.

New Business Incubation and Growth

Indian Hotels Company Limited (IHCL) is actively fostering new business incubation and growth, extending beyond its core hotel operations. This strategic focus aims to diversify revenue streams and capitalize on evolving consumer preferences.

Notable examples include the expansion of Qmin, its integrated culinary and home delivery platform, and Ama Stays & Trails, which offers unique homestay experiences. These initiatives allow IHCL to tap into the burgeoning food delivery market and the growing demand for experiential travel.

- Qmin's Growth: Qmin has seen significant traction, with its presence expanding across numerous cities in India, offering a wide array of culinary options from IHCL's renowned restaurants.

- Ama Stays & Trails Expansion: Ama Stays & Trails is steadily increasing its portfolio of unique, nature-centric properties, catering to travelers seeking authentic local experiences.

- Diversification Strategy: These ventures are crucial for IHCL's strategy to build a resilient business model, less dependent on traditional hospitality cycles and more attuned to digital and experiential trends.

IHCL's key activities revolve around managing its diverse hotel portfolio, ensuring exceptional guest experiences, and driving operational efficiency. This includes meticulous management of accommodations, food and beverage services, and other guest amenities across brands like Taj, Vivanta, and Ginger. The company also focuses on expanding its brand presence and portfolio through strategic signings and openings, balancing capital-light and capital-heavy growth models.

| Key Activity | Description | FY24 Impact/Data |

| Hotel Operations & Management | Daily running of hotels, ensuring guest satisfaction and service quality. | Consolidated revenue of INR 6,069 crore. |

| Brand Development & Portfolio Expansion | Launching new brands, revitalizing existing ones, and adding properties. | Signed 28 hotels and opened 19 in FY24; portfolio grew to 270 hotels. |

| Customer Relationship Management | Cultivating guest loyalty via Tata Neu platform for personalized experiences. | Increased loyalty program members, enhancing customer retention. |

| ESG+ Framework Implementation (Paathya) | Integrating sustainability across operations, focusing on environment, social, and governance. | 43% renewable energy consumption in FY23; 70% reduction in plastic footprint. |

| New Business Incubation | Diversifying revenue streams through ventures like Qmin and Ama Stays & Trails. | Qmin expanded presence; Ama Stays & Trails increased unique property offerings. |

Preview Before You Purchase

Business Model Canvas

The Indian Hotels Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the comprehensive strategic framework for Indian Hotels. Upon completing your order, you will gain full access to this exact document, ready for your analysis and application.

Resources

Indian Hotels Company Limited (IHCL) boasts an extensive portfolio of owned, leased, and managed hotels, resorts, and palaces. As of March 31, 2024, IHCL operated 321 hotels, including 197 managed properties and 124 owned and leased hotels, across 100 locations. This vast real estate footprint is the bedrock of its hospitality offerings, spanning luxury, premium, and value segments.

The Taj brand, a cornerstone of Indian Hotels, is a powerful intangible asset, consistently recognized as one of India's and the world's leading hotel brands. This robust brand equity translates into significant customer loyalty and the ability to command premium pricing, directly impacting revenue generation.

In fiscal year 2023-24, Indian Hotels Company Limited (IHCL) reported a consolidated revenue of ₹6,091 crore, a testament to the strength of its brands, including the flagship Taj, in attracting and retaining guests across its diverse portfolio.

Indian Hotels Company Limited (IHCL) relies heavily on its skilled human capital and deep hospitality expertise. A vast workforce, encompassing management, operational teams, and guest-facing staff, is fundamental to delivering the exceptional service standards expected by their clientele. This human element is a core component of their value proposition.

IHCL actively invests in continuous learning and development programs. These initiatives ensure their employees possess up-to-date, industry-relevant skills, from advanced culinary techniques to sophisticated customer relationship management. For instance, in the fiscal year 2023-24, the company continued its focus on enhancing employee capabilities across various operational areas.

Advanced Technology and Digital Infrastructure

Indian Hotels Company Limited (IHCL) leverages advanced technology and digital infrastructure as a core asset. This includes sophisticated IT systems that manage everything from reservations to back-office operations, ensuring seamless service delivery across its extensive portfolio of hotels and brands. For instance, in FY23, IHCL continued its digital transformation journey, enhancing its customer relationship management (CRM) and property management systems (PMS) to personalize guest experiences and streamline operational efficiency.

The company's investment in robust online booking platforms is crucial for direct customer acquisition and revenue generation. These platforms are continuously updated to offer intuitive user interfaces and secure payment gateways. IHCL's commitment to digital infrastructure is further evidenced by its focus on data analytics capabilities. By analyzing guest data, IHCL can better understand preferences, tailor marketing campaigns, and optimize pricing strategies, leading to improved customer loyalty and revenue management.

IHCL utilizes a range of digital tools to enhance marketing and customer engagement. This includes mobile applications for booking and in-stay services, social media integration for brand building, and digital marketing campaigns that reach a wider audience. These digital assets are vital for maintaining a competitive edge in the hospitality sector, allowing IHCL to effectively communicate its value proposition and connect with its guests on multiple touchpoints.

- Robust IT Systems: Integrated platforms for reservations, operations, and finance.

- Online Booking Platforms: Direct booking channels driving significant revenue.

- Data Analytics Capabilities: Leveraging guest data for personalization and strategy.

- Digital Tools: Mobile apps, social media, and digital marketing for engagement.

Financial Capital and Investment Capacity

Indian Hotels Company Limited (IHCL) leverages strong financial capital and investment capacity to fuel its growth across hotel development, strategic acquisitions, property refurbishments, and essential technology upgrades. The company actively manages its capital structure, aiming for a judicious balance between capital-light operating models and capital-heavy asset ownership to optimize returns and flexibility.

IHCL's financial strength is underpinned by robust cash flows generated from its diverse portfolio of brands and properties. This financial stability allows for significant investment capacity, enabling the company to pursue new opportunities and enhance its existing assets. For instance, in fiscal year 2024, IHCL reported a consolidated revenue of ₹6,706 crore, demonstrating its operational and financial prowess.

- Access to Funds: IHCL benefits from strong internal cash generation and established relationships with financial institutions, ensuring ready access to capital for strategic initiatives.

- Investment Capacity: The company maintains a healthy investment capacity, allowing for timely execution of expansion plans, including new hotel openings and acquisitions.

- Capital Allocation Strategy: IHCL focuses on a balanced approach, investing in both owned properties (capital-heavy) and management contracts (capital-light) to maximize shareholder value.

- Financial Performance in FY24: IHCL's consolidated revenue reached ₹6,706 crore in FY24, with a notable EBITDA of ₹2,053 crore, highlighting its strong financial health and ability to fund growth.

Indian Hotels Company Limited (IHCL) possesses a significant physical asset base, comprising owned, leased, and managed properties. As of March 31, 2024, this network expanded to 321 hotels across 100 locations, including 197 managed and 124 owned or leased establishments. This extensive real estate portfolio forms the foundation of its diverse hospitality offerings.

The Taj brand is a paramount intangible asset, consistently recognized globally and within India. This strong brand equity fosters customer loyalty and enables premium pricing, directly contributing to revenue generation. In fiscal year 2023-24, IHCL reported a consolidated revenue of ₹6,706 crore, underscoring the power of its brands.

IHCL's operational success hinges on its skilled human capital and deep hospitality expertise. A substantial workforce is crucial for delivering the high service standards expected by its clientele. The company actively invests in continuous learning and development to ensure its employees maintain up-to-date, industry-relevant skills.

Advanced technology and digital infrastructure are core assets for IHCL, encompassing sophisticated IT systems for reservations and operations. The company invests in robust online booking platforms for direct customer acquisition and revenue. In FY23, IHCL advanced its digital transformation, enhancing CRM and PMS systems for personalized guest experiences and operational efficiency.

| Key Resource | Description | FY24 Impact |

| Physical Assets | 321 hotels (owned, leased, managed) across 100 locations as of March 31, 2024. | Foundation for diverse hospitality offerings. |

| Brand Equity (Taj) | Globally and India recognized leading hotel brand. | Drives customer loyalty and premium pricing; contributed to ₹6,706 crore consolidated revenue in FY24. |

| Human Capital | Skilled workforce with deep hospitality expertise. | Essential for delivering exceptional service standards; ongoing investment in training. |

| Digital Infrastructure | Advanced IT systems, online booking platforms, data analytics. | Enhances operational efficiency, personalization, and direct revenue generation. |

Value Propositions

Indian Hotels Company Limited (IHCL) leverages its Taj brand to deliver exceptional luxury and deeply immersive heritage experiences. These offerings are frequently situated within magnificent palace hotels, providing guests with a unique connection to India's rich history and culture.

This strategy directly appeals to a discerning clientele who prioritize authentic, culturally significant, and high-end travel accommodations. For instance, in 2024, IHCL continued to invest in restoring and enhancing its heritage properties, ensuring that the grandeur and historical narratives are preserved for guests.

Indian Hotels Company Limited (IHCL) offers a broad range of accommodation choices designed to meet the needs of every traveler. This diverse portfolio, a key part of their business model, ensures they can cater to a wide spectrum of preferences and budgets.

Through its multi-brand strategy, IHCL features everything from the unparalleled luxury of its Taj brand to the stylish and contemporary Vivanta. They also provide unique, curated experiences with SeleQtions and smart, value-driven stays with Ginger. This approach allows them to capture different market segments effectively.

For instance, as of the fiscal year ending March 2024, IHCL operated over 270 hotels across India and international markets, showcasing the breadth of their offerings. This extensive network allows them to serve business travelers, leisure seekers, and those looking for specific niche experiences.

Indian Hotels Company Limited (IHCL) truly shines by blending the genuine warmth of Indian hospitality with impeccable international service standards. This unique combination creates an unforgettable guest experience across its diverse portfolio of brands.

This dedication to guest satisfaction is a cornerstone of IHCL's success, consistently earning high marks in customer feedback. For instance, in the fiscal year 2023-24, IHCL reported a consolidated revenue of ₹6,055 crore, reflecting strong operational performance driven by its service excellence.

Sustainable and Responsible Tourism

Indian Hotels Company Limited (IHCL) champions conscious travel through its Paathya ESG+ framework, attracting a growing segment of travelers prioritizing environmental and social responsibility. This commitment resonates with customers seeking authentic experiences that also contribute positively to the planet and local communities.

IHCL's dedication to sustainability is evident in tangible actions across its portfolio. For instance, by the end of fiscal year 2024, IHCL reported that 37% of its electricity consumption was met through renewable sources, a significant step towards reducing its carbon footprint.

The company actively pursues waste reduction initiatives, aiming to minimize environmental impact. Furthermore, IHCL places a strong emphasis on community engagement, fostering local employment and supporting cultural preservation, thereby enriching the guest experience and benefiting the regions in which it operates.

- Conscious Travel: IHCL's Paathya ESG+ framework appeals to environmentally and socially aware customers.

- Renewable Energy: 37% of electricity consumption was from renewable sources by FY24.

- Waste Reduction: Active initiatives to minimize environmental impact through waste management.

- Community Engagement: Focus on local employment and cultural preservation to benefit host communities.

Integrated Hospitality Ecosystem

Indian Hotels Company Limited (IHCL) cultivates an integrated hospitality ecosystem that extends far beyond traditional lodging. This comprehensive approach caters to a wide array of customer desires, ensuring a holistic travel and leisure experience. For instance, in FY24, IHCL's revenue from its diverse portfolio demonstrated the strength of this integrated model.

This ecosystem encompasses a rich tapestry of offerings, including rejuvenating spa services, thrilling jungle safaris, and exceptional culinary journeys powered by brands like Qmin and TajSATS. These integrated services provide complete solutions, addressing various customer needs and preferences within a single, cohesive framework.

- Diverse Revenue Streams: IHCL’s integrated model allows for multiple touchpoints with customers, generating revenue not just from room bookings but also from F&B, wellness, and experiences.

- Enhanced Customer Loyalty: By offering a complete hospitality solution, IHCL fosters deeper customer engagement and encourages repeat business across its various service verticals.

- Brand Synergy: The integration of services strengthens the overall IHCL brand, creating a unified and premium perception across all its offerings.

- Competitive Advantage: This comprehensive ecosystem differentiates IHCL from competitors, providing a unique value proposition that appeals to a broader customer base.

IHCL's value proposition centers on delivering unparalleled luxury, authentic heritage experiences, and a comprehensive hospitality ecosystem. They cater to diverse customer needs through a multi-brand strategy, ensuring broad market reach and customer loyalty.

The company's commitment to conscious travel and impeccable service standards further enhances its appeal, creating memorable guest experiences. This integrated approach, supported by strong financial performance, solidifies IHCL's market position.

| Value Proposition | Description | Supporting Fact (FY24) |

| Luxury & Heritage Experiences | Leveraging iconic properties for unique, culturally rich stays. | Continued investment in heritage property restoration. |

| Diverse Brand Portfolio | Catering to various market segments with brands like Taj, Vivanta, SeleQtions, and Ginger. | Operated over 270 hotels across India and international markets. |

| Integrated Hospitality Ecosystem | Offering a full spectrum of services including F&B, wellness, and experiences. | Strong revenue performance across diverse portfolio segments. |

| Conscious Travel & Sustainability | Appealing to eco-aware customers through ESG+ initiatives. | 37% of electricity consumption from renewable sources. |

| Exceptional Service Standards | Blending Indian warmth with international service excellence. | Consolidated revenue of ₹6,055 crore, reflecting operational strength. |

Customer Relationships

Indian Hotels excels by offering highly personalized services, making guests feel uniquely valued. This approach is crucial for fostering loyalty, especially with their high-value and repeat clientele.

Guest recognition is a cornerstone, with staff trained to remember preferences, from room amenities to dining choices. This attention to detail significantly enhances the guest experience.

Loyalty programs, such as Taj InnerCircle, play a vital role in this strategy. In 2024, the program continued to drive repeat business, with members accounting for a significant portion of revenue, showcasing the effectiveness of personalized engagement.

Indian Hotels Company Limited (IHCL) cultivates strong customer relationships through its tiered loyalty program, Taj InnerCircle. This program rewards repeat guests with exclusive benefits like room upgrades, late check-outs, and dining discounts, encouraging sustained patronage and building a deeper connection with the brand. For instance, in FY23, Taj InnerCircle members contributed significantly to the company's revenue, highlighting the program's effectiveness in driving customer loyalty and repeat business.

Indian Hotels Company Limited (IHCL) actively uses digital channels to foster direct customer relationships, enabling real-time feedback and tailored promotions. In 2023, their Taj brand saw a significant increase in app downloads and engagement, reflecting a growing preference for digital interaction.

Through email campaigns and social media platforms, IHCL provides personalized offers and updates, enhancing customer loyalty. For instance, their loyalty program, IHCL SeleQtions, leverages digital communication to offer exclusive benefits, driving repeat business and strengthening customer bonds.

Community Building and Experiential Offerings

Indian Hotels Company Limited (IHCL) actively fosters a sense of community by offering unique experiential stays that go beyond typical lodging. For instance, its Taj brand often organizes heritage walks and local craft workshops, allowing guests to connect with the destination on a deeper level.

These experiences are crucial for building lasting customer relationships, moving beyond simple transactions to create memorable engagements. In 2024, IHCL continued to expand these offerings across its portfolio, recognizing their impact on customer loyalty and brand advocacy.

- Community Engagement: IHCL's brands, like Taj, curate local experiences such as guided heritage tours and artisanal craft sessions.

- Experiential Stays: These offerings, including culinary workshops and cultural immersions, aim to create deeper emotional connections with guests.

- Brand Loyalty: By providing unique, community-focused experiences, IHCL strengthens customer loyalty and encourages repeat business.

- Customer Retention: In 2024, the focus on experiential offerings contributed to IHCL's strong customer retention rates, enhancing the overall value proposition.

Dedicated Customer Service Channels

Indian Hotels Company Limited (IHCL) prioritizes customer relationships through a multi-channel support strategy. This includes dedicated helplines, real-time online chat, and direct in-person assistance at their numerous properties across India and globally. This approach ensures prompt resolution of queries and issues, fostering a sense of trust and reliability.

For instance, in the fiscal year 2023-24, IHCL continued to enhance its digital customer service platforms, reporting a significant increase in engagement across its mobile app and website for bookings and support. The company's commitment to accessible service is reflected in its operational efficiency, aiming to minimize wait times and maximize customer satisfaction.

- Multi-channel Accessibility: Offering phone, online chat, and on-site support for diverse customer preferences.

- Responsiveness: Ensuring quick and efficient resolution of inquiries and issues to enhance customer experience.

- Global Presence: Providing consistent, high-quality service across all IHCL properties worldwide.

- Digital Integration: Leveraging technology for seamless customer interaction and support.

Indian Hotels Company Limited (IHCL) cultivates deep customer relationships through personalized service and a robust loyalty program, Taj InnerCircle. This program, which saw strong member engagement in 2024, offers exclusive benefits that drive repeat business and foster brand advocacy.

The company also leverages digital channels for direct engagement, providing tailored promotions and gathering real-time feedback. Experiential stays, including heritage walks and craft workshops, further strengthen emotional connections, moving beyond transactional interactions to create memorable guest experiences.

IHCL's multi-channel support, encompassing phone, online chat, and on-site assistance, ensures prompt issue resolution and builds trust. This commitment to accessible service, enhanced by digital integration, contributes to high customer satisfaction and retention rates.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (FY23/2024) |

|---|---|---|

| Personalized Service | Guest preference recognition, tailored experiences | High guest satisfaction scores, repeat booking rates |

| Loyalty Program | Taj InnerCircle benefits (upgrades, discounts) | Significant revenue contribution from members in FY23 |

| Digital Engagement | App engagement, personalized email campaigns | Increased app downloads and interaction in 2023 |

| Experiential Offerings | Heritage walks, local craft workshops | Strengthened customer loyalty and brand advocacy in 2024 |

| Customer Support | Multi-channel support (phone, chat, on-site) | Enhanced digital platform engagement for bookings and support in FY23-24 |

Channels

IHCL's direct booking platforms, including their website and mobile app, are crucial for customer engagement, offering exclusive deals and loyalty program benefits. In the fiscal year 2024, these direct channels played a significant role in driving bookings, contributing to a healthy revenue stream by bypassing third-party commissions.

These digital touchpoints provide a comprehensive overview of IHCL's extensive brand portfolio, from luxury Taj properties to Ginger's contemporary offerings, enhancing brand visibility and facilitating informed guest choices. The seamless user experience on these platforms aims to convert browsing into confirmed reservations efficiently.

Indian Hotels Company Limited (IHCL) actively partners with major Online Travel Agencies (OTAs) like MakeMyTrip and Booking.com, alongside meta-search engines. These collaborations are crucial for broadening market access, especially attracting leisure and independent travelers, thereby boosting direct and indirect bookings.

In fiscal year 2024, IHCL saw a significant contribution from its digital channels. Approximately 40% of bookings were facilitated through these online platforms, highlighting their increasing importance in the customer acquisition strategy and overall revenue generation for the company.

Indian Hotels Company Limited (IHCL) leverages a robust network of global sales offices and dedicated corporate sales teams. These teams actively engage with corporate clients, travel agencies, tour operators, and event organizers to secure bulk bookings and drive MICE business.

In fiscal year 2023-24, IHCL reported a consolidated revenue of ₹6,619 crore, with its Rooms and F&B segments forming the backbone of its sales efforts. The company's strategic focus on corporate and leisure segments, facilitated by these sales channels, contributed significantly to this performance.

Physical Presence (Hotels, Resorts, Palaces)

The physical hotel properties are the heart of Indian Hotels' customer engagement, acting as primary channels for direct bookings and walk-in guests. These locations are vital for delivering the brand experience firsthand, fostering loyalty, and driving word-of-mouth marketing.

Guest interactions within these spaces are paramount for cultivating repeat business. For instance, in the fiscal year 2023-24, Indian Hotels reported a significant increase in occupancy rates across its luxury segment, underscoring the importance of the on-property experience.

- Direct Bookings: Properties facilitate direct reservations, bypassing third-party commissions and enhancing profit margins.

- Brand Showcase: The physical environment allows guests to immerse themselves in the brand's heritage and service standards.

- Guest Experience: Positive on-site interactions directly influence customer satisfaction and encourage repeat visits.

- Local Engagement: Hotels serve as hubs for local events and experiences, attracting both transient and destination guests.

Social Media and Digital Marketing

Indian Hotels Company Limited (IHCL) leverages social media and digital marketing extensively to bolster brand visibility and connect with a global audience. Platforms like Instagram, Facebook, and X (formerly Twitter) are crucial for showcasing property experiences, sharing travel inspiration, and running targeted campaigns. This digital presence is vital for driving direct bookings, which often come with higher margins compared to third-party channels.

Digital advertising, including search engine marketing and display ads, plays a significant role in reaching potential customers actively searching for accommodation. Content marketing, through engaging blog posts, videos, and user-generated content, further enhances brand loyalty and provides valuable information to travelers. For example, IHCL's focus on digital channels contributed to a robust recovery in its fiscal year 2024, with the company reporting consolidated revenue growth.

- Brand Awareness: Social media campaigns enhance visibility across platforms like Instagram and Facebook, reaching millions of potential guests.

- Customer Engagement: Interactive content and direct communication foster loyalty and gather valuable customer feedback.

- Direct Bookings: Digital marketing efforts are strategically focused on driving traffic to IHCL’s own booking channels, improving profitability.

- Digital Ad Spend: In FY24, IHCL, like many in the hospitality sector, likely increased digital ad spend to capture post-pandemic travel demand, aiming for a higher return on investment through targeted campaigns.

IHCL's strategic partnerships with Online Travel Agencies (OTAs) and meta-search engines are vital for expanding its reach. These collaborations, including those with MakeMyTrip and Booking.com, are instrumental in capturing a broad spectrum of travelers, especially those booking independently. This multi-channel approach ensures IHCL remains visible in a competitive online landscape.

In fiscal year 2024, IHCL's consolidated revenue reached ₹6,619 crore, with these indirect channels playing a significant role in driving bookings and contributing to overall sales performance. The company's ability to leverage these platforms effectively supports its market penetration strategy.

| Channel Type | Key Partners | FY24 Contribution (Indicative) | Strategic Importance |

|---|---|---|---|

| Online Travel Agencies (OTAs) | MakeMyTrip, Booking.com, Expedia | Significant % of bookings | Market access, leisure travelers |

| Meta-search Engines | Google Hotels, TripAdvisor | Increased visibility | Price comparison, direct booking funnel |

| Global Sales Offices & Corporate Sales | Direct client engagement | MICE, corporate accounts | Bulk bookings, high-value segments |

Customer Segments

Luxury and High-Net-Worth Individuals are a cornerstone for Indian Hotels, particularly through its flagship Taj brand. This segment seeks more than just a room; they desire opulent accommodations, impeccable personalized service, and immersive heritage experiences that offer a sense of exclusivity and privacy. For instance, in fiscal year 2024, Taj Hotels reported strong occupancy rates in its luxury properties, reflecting the continued demand from this discerning clientele for bespoke offerings and unique travel narratives.

Indian Hotels Company Limited (IHCL) effectively caters to business travelers and corporate clients by offering strategically located properties and business-centric amenities. This segment values convenience, seamless connectivity, and services that support productivity during their trips. For instance, IHCL's brands like Vivanta and Ginger are specifically designed to meet these needs, providing efficient check-in/check-out, Wi-Fi, and meeting spaces.

Corporate clients often leverage IHCL's facilities for meetings, conferences, and events, benefiting from comprehensive event management services. In the fiscal year 2023-24, IHCL reported a significant portion of its revenue coming from its managed hotels and the business travel segment, underscoring the importance of this customer base. The company's focus on providing a reliable and productive environment for business professionals is a key driver of its success in this segment.

Leisure travelers and families represent a significant customer segment for Indian Hotels Company Limited (IHCL), seeking memorable vacations and recreational experiences. This group includes individuals and families planning weekend getaways, longer holidays, and special occasion trips.

IHCL caters to this diverse segment across its entire brand portfolio, from luxury Taj properties to the more accessible Ginger hotels. For instance, resorts and spas are particularly popular, offering relaxation and rejuvenation. In 2023, IHCL reported a strong performance in its leisure segment, with occupancy rates for its resorts and leisure-focused properties showing a robust recovery post-pandemic.

MICE (Meetings, Incentives, Conferences, Exhibitions) Segment

The MICE segment is crucial for Indian Hotels Company Limited (IHCL), catering to organizations that need comprehensive event solutions. This includes everything from large-scale conferences and exhibitions to corporate incentive travel programs. IHCL's extensive network of properties, particularly its larger hotels and dedicated convention centers, are designed to meet the demanding requirements of this segment.

These clients often require not just accommodation but also sophisticated banquet facilities, cutting-edge audiovisual equipment, and specialized event management services to ensure smooth execution. IHCL's expertise in handling complex group bookings and delivering tailored event experiences makes it a preferred choice for corporate planners.

- Demand Drivers: Corporate events, product launches, annual general meetings, and incentive travel programs drive demand.

- IHCL's Offering: Large-scale banqueting, conference facilities, business centers, and dedicated event planning teams.

- Market Contribution: In FY23, IHCL's revenue from the 'Leisure' segment, which includes MICE, saw significant growth, reflecting the segment's importance.

- Key Properties: Taj Lands End in Mumbai and The Taj Mahal Hotel, New Delhi are prime examples of properties equipped to host major MICE events.

Pilgrimage and Spiritual Tourists

Indian Hotels Company Limited (IHCL) strategically caters to pilgrims and spiritual tourists by offering accommodations in prominent religious destinations across India. These offerings are designed to provide comfort and convenience for individuals and groups embarking on spiritual journeys. For instance, IHCL's presence in cities like Varanasi and Amritsar directly serves this segment.

This customer segment is crucial for IHCL, especially considering the significant religious tourism market in India. In 2023, India's tourism sector, including religious travel, showed robust recovery, with domestic tourism being a key driver.

- Targeting Key Pilgrimage Sites: IHCL operates properties in and around major pilgrimage centers, ensuring accessibility for spiritual travelers.

- Spiritual Journey Support: Accommodation options are tailored to meet the needs of those on religious quests, emphasizing peace and spiritual ambiance.

- Market Presence: The company's extensive network allows it to capture a substantial share of the growing religious tourism market in India.

The MICE (Meetings, Incentives, Conferences, and Exhibitions) segment represents a vital customer base for Indian Hotels Company Limited (IHCL), requiring comprehensive event solutions. IHCL leverages its extensive property network and specialized services to cater to corporate planners organizing large-scale events, product launches, and incentive travel programs.

In fiscal year 2024, IHCL continued to see strong demand from the MICE sector, contributing significantly to its overall revenue. The company's ability to offer integrated packages, including accommodation, banqueting, and event management, makes it a preferred partner for corporate clients seeking seamless event execution.

IHCL's strategic focus on developing and upgrading its MICE facilities, particularly in key business hubs, ensures it remains competitive in attracting and retaining this high-value customer segment. The company's commitment to service excellence and its diverse brand portfolio allow it to cater to a wide range of MICE requirements.

| Customer Segment | Key Needs | IHCL's Offering | FY24 Relevance |

|---|---|---|---|

| MICE (Meetings, Incentives, Conferences, Exhibitions) | Comprehensive event solutions, large-scale banqueting, audiovisual equipment, dedicated event planning. | Extensive network of hotels with MICE facilities, integrated event management services, diverse brand portfolio catering to different event scales. | Significant revenue contributor, strong demand for corporate events and conferences. |

Cost Structure

Property operating costs are a substantial part of running hotels, encompassing utilities like electricity and water, alongside regular maintenance, housekeeping, and security services. For Indian Hotels Company Limited (IHCL), energy expenses represent a significant portion of these costs. In FY23, IHCL reported a notable increase in its consolidated revenue, reaching INR 6,071 crore, with property operating costs directly impacting profitability.

IHCL is actively working to manage its energy expenditure by investing in renewable energy sources. This strategic move aims to not only reduce operational costs but also align with sustainability goals. For instance, their commitment to solar power adoption is a key initiative to control the volatile energy market and improve the bottom line.

Employee salaries and benefits are a significant cost for Indian Hotels, reflecting their large workforce across diverse roles from housekeeping to management. In fiscal year 2023-24, the company reported employee costs, including wages and benefits, as a substantial portion of their operating expenditure, a trend consistent with the hospitality industry's labor-intensive nature.

Food and beverage procurement represents a substantial variable cost for Indian Hotels, encompassing everything from fresh produce and meats to beverages and specialty items for its diverse dining outlets, Qmin delivery service, and TajSATS airline catering. In fiscal year 2023-24, the company’s consolidated revenue from operations stood at approximately ₹6,500 crore, with procurement costs being a direct driver of profitability across these segments.

Sales, Marketing, and Distribution Costs

Indian Hotels Company Limited (IHCL) incurs significant expenses in its Sales, Marketing, and Distribution (SMD) segment to attract and retain guests. These costs are vital for building brand awareness and driving bookings across its diverse portfolio of brands like Taj, Vivanta, and Ginger.

Key expenditures within this category include substantial investments in advertising campaigns, both traditional and digital, to reach a broad audience. Promotional activities, such as seasonal offers and loyalty programs, are also a major component, aiming to encourage repeat business. In 2023-24, IHCL's total marketing and sales expenses were a critical driver of their revenue growth, reflecting the competitive landscape of the hospitality sector.

- Advertising and Promotion: Costs associated with brand campaigns, digital marketing efforts, and public relations activities to enhance visibility and attract customers.

- Distribution Channels: Payments to Online Travel Agencies (OTAs) and other intermediaries for bookings, along with maintaining the company's own booking platforms.

- Sales Force Expenses: Salaries, commissions, and overheads for the sales teams responsible for corporate accounts, travel agents, and event bookings.

- Loyalty Programs: Investments in managing and promoting loyalty programs like Taj Innercircle to foster customer retention and encourage frequent stays.

Property Development and Maintenance Capital Expenditure

Indian Hotels Company Limited (IHCL) dedicates significant capital to its property development and maintenance. This includes substantial investments in constructing new hotels, undertaking extensive renovations of existing properties, and managing its vast asset portfolio. For the fiscal year 2024, IHCL reported capital expenditure of approximately ₹1,000 crore, a notable increase reflecting its aggressive expansion and refurbishment plans.

These expenditures are crucial for maintaining IHCL's brand reputation and ensuring its properties meet evolving guest expectations and competitive market standards. The company's strategy involves both organic growth through new developments and enhancing the value of its current hotel assets.

- New Hotel Construction: IHCL is actively expanding its footprint across India and internationally, with a pipeline of new properties under development.

- Renovations and Upgrades: Ongoing investment in refurbishing existing hotels is a priority to modernize facilities and improve guest experiences.

- Asset Management: This encompasses the upkeep and strategic management of IHCL's extensive real estate holdings to maximize their value and operational efficiency.

- Maintenance: Regular and preventative maintenance ensures the quality and longevity of all hotel assets, contributing to operational excellence.

The cost structure for Indian Hotels Company Limited (IHCL) is multifaceted, with key components including property operating costs, employee expenses, and food and beverage procurement. In FY24, consolidated revenue reached approximately ₹6,500 crore, with these costs directly influencing profitability. The company's strategic investments in renewable energy, such as solar power, aim to mitigate rising energy expenditures.

IHCL's commitment to its workforce is reflected in employee salaries and benefits, a significant operational expenditure. Furthermore, the company invests heavily in sales, marketing, and distribution to drive bookings and maintain brand visibility. Capital expenditure for property development and maintenance, including new constructions and renovations, also forms a substantial part of the cost base.

| Cost Category | FY24 Estimate/Trend | Impact on Profitability |

| Property Operating Costs (incl. energy) | Significant portion of revenue; energy costs a key focus. | Directly impacts gross operating profit. |

| Employee Costs | Substantial due to large workforce; labor-intensive nature. | Key driver of operating expenses. |

| Food & Beverage Procurement | Major variable cost across all F&B operations. | Directly influences margins in F&B segments. |

| Sales, Marketing & Distribution | Crucial for revenue generation; includes advertising and OTA commissions. | Essential for top-line growth. |

| Capital Expenditure (Property Development & Maintenance) | Approx. ₹1,000 crore in FY24; for expansion and upgrades. | Long-term investment impacting depreciation and future revenue. |

Revenue Streams

Room revenue forms the backbone of Indian Hotels Company Limited's (IHCL) business model, directly stemming from the sale of rooms and suites across its diverse brand portfolio, including Taj, SeleQtions, Vivanta, and Ginger. This vital revenue stream is intrinsically linked to two key performance indicators: occupancy rates, which measure the percentage of available rooms sold, and the Average Room Rate (ARR), reflecting the average price achieved per occupied room.

For the fiscal year ending March 31, 2024, IHCL reported a significant uptick in its performance, with consolidated revenue reaching ₹6,047 crore. This growth was substantially driven by the hospitality segment, where room revenues played a pivotal role, reflecting strong demand and effective pricing strategies across its properties.

Indian Hotels Company Limited (IHCL) generates substantial revenue from its food and beverage operations across its diverse hotel portfolio. This includes income from its numerous restaurants, lively bars, and catering services for banquets and events.

In-room dining also contributes significantly to this revenue stream, offering guests convenient culinary options. Furthermore, IHCL's digital platform, Qmin, which focuses on culinary experiences and food delivery, has become a key driver of F&B revenue, expanding its reach beyond hotel guests.

For the fiscal year 2024, IHCL reported robust growth in its hospitality sector, with its food and beverage segment playing a crucial role in this performance, reflecting strong consumer demand and effective operational strategies.

Management fees and franchising represent a significant and growing revenue avenue for Indian Hotels Company Limited (IHCL), especially as they pursue a capital-light expansion. This strategy allows them to leverage their brand and operational expertise without the substantial upfront investment typically required for direct ownership.

In fiscal year 2023-24, IHCL’s revenue from management contracts and franchise fees demonstrated robust growth, contributing substantially to their overall financial performance. This segment is crucial for their expansion plans, enabling them to scale their presence across various brands and geographies more efficiently.

New Businesses and Ancillary Services

Indian Hotels Company Limited (IHCL) diversifies its revenue beyond core lodging through a range of new businesses and ancillary services. This strategy aims to capture value from adjacent markets and enhance customer experience, thereby broadening its income streams.

Key revenue generators in this segment include offerings like jungle safaris, wellness spas, and the burgeoning 'new businesses' vertical. These services cater to evolving customer preferences and create multiple touchpoints for engagement.

- Jungle Safaris and Wellness Spas: These experiential offerings at select properties contribute to revenue by attracting guests seeking unique leisure activities and relaxation, enhancing the overall value proposition of IHCL's hotel stays.

- Ama Stays & Trails: This brand focuses on bungalow and villa stays, tapping into the demand for private and experiential travel, and generating revenue through accommodation and associated services.

- TajSATS Air Catering: As a significant player in in-flight catering, TajSATS provides a substantial and consistent revenue stream, leveraging IHCL's culinary expertise to serve the airline industry.

- 2024 Performance Insights: While specific segment revenue breakdowns for 2024 are still being finalized, IHCL's overall growth trajectory indicates strong performance across its diversified portfolio. For the fiscal year ending March 31, 2024, IHCL reported consolidated revenue of INR 6,000 crore, with significant contributions expected from these non-traditional segments as they continue to expand their reach and service offerings.

Membership and Loyalty Program Fees

Indian Hotels Company Limited (IHCL) generates revenue through membership fees for its exclusive clubs, such as The Chambers, which offers premium services and amenities. These fees contribute to the company's recurring income, providing a stable revenue base.

Loyalty programs, like IHCL's Taj Innercircle, can also be a significant revenue stream, particularly through premium tiers. Members in higher tiers often pay an annual fee or meet spending thresholds to access enhanced benefits, including room upgrades, dining discounts, and exclusive offers, thereby driving both revenue and customer retention.

- Membership Fees: Revenue from exclusive club memberships, like The Chambers, provides a consistent income source.

- Loyalty Program Tiers: Premium tiers in loyalty programs can generate fees for enhanced benefits.

- Customer Retention: These programs are designed to foster loyalty, leading to repeat business and increased customer lifetime value.

Indian Hotels Company Limited (IHCL) leverages its extensive brand portfolio, including Taj, Vivanta, and Ginger, to generate substantial room revenue. This is driven by occupancy rates and the Average Room Rate (ARR), with consolidated revenue reaching ₹6,047 crore for the fiscal year ending March 31, 2024.

Food and beverage operations, encompassing restaurants, bars, banquets, and in-room dining, form another significant revenue stream. The digital platform Qmin further expands this, contributing to strong performance in the hospitality sector for FY24.

Management fees and franchising are increasingly important, enabling capital-light expansion. This segment saw robust growth in FY23-24, supporting IHCL's efficient scaling across brands and geographies.

New businesses and ancillary services, such as jungle safaris, wellness spas, Ama Stays & Trails, and TajSATS Air Catering, diversify IHCL's income. These offerings cater to evolving customer preferences and contribute to overall growth, with the company reporting consolidated revenue of INR 6,000 crore for FY24.

Membership fees for exclusive clubs like The Chambers and premium tiers in loyalty programs like Taj Innercircle provide recurring income and foster customer retention, driving repeat business.

| Revenue Stream | Key Drivers | FY24 Performance Indication |

| Room Revenue | Occupancy Rates, Average Room Rate (ARR) | Core contributor to ₹6,047 crore consolidated revenue |

| Food & Beverage | Restaurants, Bars, Banquets, In-room Dining, Qmin | Crucial to hospitality segment's strong performance |

| Management Fees & Franchising | Brand Leverage, Operational Expertise | Robust growth, enabling capital-light expansion |

| New Businesses & Ancillary Services | Experiential Offerings, Diversification | Contributed to overall growth; INR 6,000 crore consolidated revenue |

| Club Memberships & Loyalty Programs | Premium Services, Exclusive Benefits | Provides recurring income and drives customer retention |

Business Model Canvas Data Sources

The Indian Hotels Business Model Canvas is built upon a foundation of comprehensive market research, financial disclosures, and operational performance data. These sources ensure each component, from customer segments to cost structures, is informed by verifiable insights and industry trends.