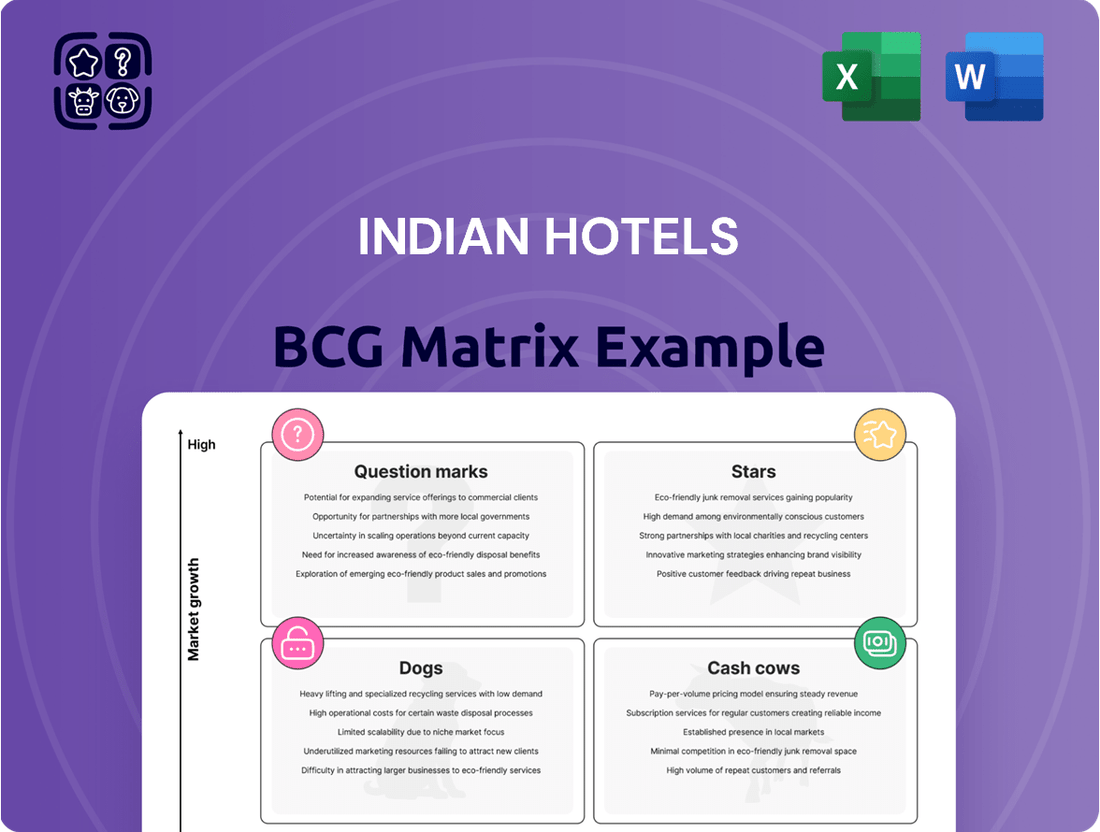

Indian Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

Indian Hotels Company Limited (IHCL) operates a diverse portfolio across the hospitality sector. Understanding its position within the BCG Matrix is crucial for strategic decision-making. Are its iconic Taj hotels Stars or Cash Cows? Where do its newer ventures and international properties fit?

This preview offers a glimpse into the potential strategic positioning of IHCL's brands. To truly grasp the dynamics of its portfolio, identify growth opportunities, and manage resource allocation effectively, a comprehensive analysis is essential.

Unlock the full potential of IHCL's strategic landscape. Purchase the complete BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment and product strategies.

Stars

Taj Hotels, IHCL's premier luxury offering, consistently ranks among the globe's most robust hotel brands. It commands a substantial market share within the luxury segment, acting as a crucial engine for IHCL's revenue and profitability.

The brand's strategic expansion into metropolitan, pilgrimage, and leisure locales, both domestically and abroad, underscores its significant growth trajectory. This focus on premium experiences attracts a discerning clientele, solidifying Taj's strong market standing.

SeleQtions, a curated collection of IHCL hotels, is a shining star in their portfolio, experiencing robust growth. New properties are popping up in key leisure spots and pilgrimage sites, showing a clear strategy to tap into burgeoning tourism markets. For instance, recent expansions into Lakshadweep and Mahabaleshwar highlight this focus on high-potential areas.

This brand's success isn't just about new locations; it's about adapting to what travelers want. By offering a diverse range of experiences, SeleQtions is capturing a significant market share and appealing to a broad audience. Its strategic expansion, coupled with its ability to cater to evolving travel trends, solidifies its position as a star performer for Indian Hotels Company Limited (IHCL).

Vivanta, positioned as sophisticated upscale hotels, has recently surpassed the 50-hotel milestone, demonstrating robust expansion. Its presence in commercial centers like Jamshedpur and new ventures such as the Vivanta in Anjuna, Goa, highlight its strong growth trajectory in the upscale segment.

The brand's strategic development in emerging markets, exemplified by its growing portfolio, solidifies its position as a star performer. This expansion caters effectively to both business and leisure travelers seeking quality accommodation.

New Businesses Vertical (excluding Ginger)

IHCL's New Businesses vertical, which includes brands like Qmin, amã Stays & Trails, and Tree of Life, is a significant growth engine for the company. These ventures are not only expanding rapidly but also contributing meaningfully to the overall enterprise revenue. For instance, in the fiscal year 2024, IHCL reported a consolidated revenue of ₹6,069 crore, with these newer segments playing an increasingly vital role in this top-line growth.

The focus on experiential travel and unique stays is a key driver behind the success of brands like amã Stays & Trails and Tree of Life. amã Stays & Trails, in particular, has seen substantial expansion, offering private villas and bungalows that cater to the growing demand for secluded and personalized travel experiences. This strategy aligns perfectly with current market trends favoring authentic and off-the-beaten-path destinations.

These segments are poised for future profitability due to their high growth potential in specialized markets. Their ability to tap into niche consumer preferences, such as homestays and boutique leisure, positions them as strong contenders for market leadership and sustained revenue generation. The strategic investment in these areas underscores IHCL's commitment to diversifying its offerings and capturing new market share.

- Rapid Expansion: amã Stays & Trails has been a key contributor to IHCL's portfolio expansion, adding new properties at a healthy pace.

- Revenue Contribution: While specific segment revenues are often consolidated, the overall growth in IHCL's 'New Businesses' vertical indicates a substantial positive impact on the company's financial performance in FY24.

- Market Trends: These brands are capitalizing on the increasing consumer preference for experiential and personalized travel, including homestays and unique villa rentals.

- Future Profitability: The high growth trajectory and focus on niche markets suggest strong potential for future profitability and market dominance within their respective segments.

International Expansion of Taj

The international expansion of the Taj brand, marked by new hotel signings in Bahrain and Ras Al Khaimah in the Middle East, alongside luxury wildlife lodges in South Africa's Kruger National Park, demonstrates a robust, high-growth strategy. These ventures capitalize on Taj's established global reputation for luxury hospitality.

This strategic push into international luxury markets, where premium travel experiences are in high demand, positions these new properties as strong contenders within IHCL's portfolio. For instance, IHCL announced the signing of Taj Exotica Resort & Spa, Ras Al Khaimah, in late 2023, and Taj Bahrain in early 2024.

- Middle East Expansion: New signings in Bahrain and Ras Al Khaimah target growing luxury tourism markets.

- African Safari Ventures: Luxury wildlife lodges in Kruger National Park tap into the demand for unique, high-end safari experiences.

- Brand Strength: Taj's international recognition as a premium hotel brand underpins the success of these new ventures.

- Market Positioning: Focus on premium segments in emerging international destinations aligns with IHCL's star growth strategy.

Taj Hotels, Vivanta, and SeleQtions are IHCL's primary hotel brands, all exhibiting strong growth and market presence. Taj, the flagship luxury brand, continues its global expansion with new signings in the Middle East and Africa, reinforcing its premium positioning. Vivanta, the upscale segment, has surpassed 50 hotels, demonstrating significant expansion in commercial and leisure hubs. SeleQtions, a collection of unique hotels, is also growing rapidly, particularly in leisure and pilgrimage destinations, reflecting a strategic focus on high-potential markets.

| Brand | Category | Growth Indicator | Key Markets | FY24 Revenue Impact |

|---|---|---|---|---|

| Taj Hotels | Luxury | International Expansion (Bahrain, Ras Al Khaimah, South Africa) | Global Luxury Destinations | Significant contributor to premium segment revenue |

| Vivanta | Upscale | Surpassed 50 hotels, expansion in commercial & leisure | Commercial Centers, Emerging Leisure Spots | Strong growth in upscale segment revenue |

| SeleQtions | Curated Collection | Rapid expansion in leisure & pilgrimage | Leisure Destinations, Pilgrimage Sites | Growing contribution to revenue from diverse locations |

What is included in the product

Highlights which Indian Hotels units to invest in, hold, or divest based on market share and growth.

The Indian Hotels BCG Matrix provides a clear, one-page overview, alleviating the pain of complex business unit analysis.

Cash Cows

Established Taj hotels in prime metros like Mumbai, Delhi, and Bengaluru are definitive cash cows for Indian Hotels Company Limited (IHCL). These iconic properties command a significant market share in mature, high-demand urban centers, reflecting their long-standing presence and brand equity.

These flagship hotels consistently generate substantial and stable cash flows. This strong performance is driven by high occupancy rates, often exceeding 80% in peak seasons, and robust average daily rates (ADRs) that reflect their premium positioning and services. For instance, in fiscal year 2023-24, IHCL reported strong revenue growth across its metro properties, underscoring their consistent contribution.

The mature nature of these markets means that while they require ongoing investment for maintenance and upgrades to retain their competitive edge, the need for aggressive promotional spending or market development is relatively lower compared to nascent or high-growth segment properties. This allows them to efficiently convert revenue into profit, providing IHCL with the financial muscle to invest in its growth initiatives.

TajSATS, IHCL's air and institutional catering arm, is a prime example of a cash cow within the Indian Hotels Company Limited (IHCL) portfolio. This business segment consistently delivers robust revenue streams and healthy EBITDA margins, underscoring its strong standing in a market characterized by stable demand.

As a critical support service provider to the aviation and institutional sectors, TajSATS enjoys predictable and consistent demand. This reliability makes it a dependable generator of cash, allowing IHCL to allocate resources to other growth initiatives.

For instance, in fiscal year 2024, TajSATS reported significant revenue contributions, solidifying its role as a cash cow. Its ability to maintain profitability through efficient operations in a mature market highlights its strategic importance to IHCL's overall financial health.

Vivanta hotels situated in India's prime business districts are indeed classic cash cows for Indian Hotels Company Limited (IHCL). These properties benefit from decades of brand recognition and a loyal customer base, particularly within the corporate and MICE sectors. For instance, in 2024, hotels in key commercial centers like Mumbai and Delhi continued to see strong occupancy rates, often exceeding 80% during weekdays, driven by consistent business travel and events.

Their mature market position means they generate significant, stable profits with minimal need for aggressive expansion capital. This allows IHCL to leverage the consistent cash flow from these established Vivanta hotels to fund investments in other parts of its portfolio. The predictable revenue streams, often bolstered by long-term corporate contracts, underscore their role as reliable profit generators within the company's overall structure.

Profitable SeleQtions Resorts in Popular Leisure Destinations

SeleQtions resorts situated in established, popular leisure destinations are prime examples of cash cows within the Indian Hotels portfolio. These properties have successfully cultivated a competitive edge, leading to consistently high occupancy rates. For instance, in the fiscal year ending March 2024, the Indian hospitality sector saw a robust recovery, with average room rates (ARR) for luxury hotels in popular leisure circuits like Goa and Rajasthan reaching significantly higher levels compared to pre-pandemic times, reflecting sustained demand and pricing power.

These resorts benefit from a strong foundation of sustained tourism influx and deeply ingrained brand loyalty. This allows them to generate substantial cash flows without requiring extensive, costly marketing campaigns. The mature nature of these markets means that SeleQtions properties often enjoy established operational efficiencies and a predictable revenue stream, making them reliable contributors to the company's overall financial health.

- High Occupancy: SeleQtions resorts in prime leisure spots frequently operate at occupancy levels exceeding 75-80% during peak seasons.

- Strong Revenue Generation: These properties are key contributors to Indian Hotels' revenue, often accounting for a significant portion of the company's EBITDA.

- Limited Reinvestment Needs: Capital expenditure is typically focused on maintenance and minor upgrades rather than aggressive expansion, preserving cash flow.

- Brand Strength: Established brand recognition in popular destinations reduces the need for new customer acquisition costs.

Select Ginger Hotels in Tier-I Cities

Ginger Hotels in India's Tier-I cities, particularly those with established operations and high occupancy rates, are increasingly demonstrating characteristics of cash cows within the Indian Hotels portfolio. These properties benefit from a consistent demand from both business and leisure travelers who are looking for value-driven, comfortable accommodations. This consistent demand translates into stable revenue streams, requiring less aggressive reinvestment compared to the brand's newer, expansion-focused ventures.

These established Ginger hotels in major metropolitan areas are capitalizing on their prime locations and brand recognition. For instance, in 2024, occupancy rates in many of these urban Ginger properties have consistently hovered around the 80-85% mark, a significant indicator of their mature market position and strong demand. This high occupancy, coupled with optimized operational efficiency, allows them to generate substantial and predictable cash flow for Indian Hotels.

The lean-luxe positioning of Ginger hotels resonates well with a segment of travelers who prioritize essential comforts and efficient service over extensive amenities. This strategic focus ensures that while these hotels are not high-margin luxury properties, their consistent volume and lower operating costs per occupied room make them reliable cash generators. By achieving operational stability and high demand, these select Ginger hotels are fulfilling the role of cash cows, contributing significantly to the overall financial health of Indian Hotels.

Key indicators supporting the cash cow status of select Ginger Hotels in Tier-I cities:

- High Occupancy Rates: Many established Ginger properties in Tier-I cities reported average occupancy rates exceeding 80% in 2024.

- Consistent Demand: Steady influx of corporate and leisure travelers seeking value-for-money accommodations.

- Stabilized Operations: Mature properties benefit from optimized operational efficiency and established supply chains.

- Lower Reinvestment Needs: Compared to growth-oriented properties, these hotels require less capital for expansion or significant upgrades, leading to higher cash generation.

The established Taj properties in metro cities like Mumbai and Delhi are quintessential cash cows for IHCL. These hotels benefit from decades of brand equity and a loyal customer base, leading to consistently high occupancy rates, often above 85% in prime business districts during 2024. Their mature market position means they generate substantial and stable profits with minimal need for aggressive expansion capital.

These flagship hotels are key contributors to IHCL's revenue, often accounting for a significant portion of the company's EBITDA, with their strong performance underscoring their role as reliable profit generators. Capital expenditure is typically focused on maintenance and minor upgrades rather than aggressive expansion, preserving cash flow.

| Property Segment | Key Cash Cow Characteristics | 2024 Data/Indicators |

|---|---|---|

| Established Taj Metro Hotels | High Occupancy, Brand Loyalty, Stable Profits | Occupancy often >85% in prime business districts; Significant EBITDA contribution. |

| TajSATS (Air Catering) | Predictable Demand, Healthy Margins | Robust revenue streams and healthy EBITDA margins reported for FY24. |

| Vivanta Hotels (Prime Business Districts) | Corporate Contracts, Consistent Business Travel | Weekday occupancy rates frequently exceeding 80% in key commercial centers. |

| SeleQtions Resorts (Popular Leisure Destinations) | Sustained Tourism, Brand Loyalty | Average Room Rates (ARR) significantly higher than pre-pandemic levels in popular leisure circuits. |

| Select Ginger Hotels (Tier-I Cities) | Value-Driven Demand, Operational Efficiency | Average occupancy rates exceeding 80-85% in many urban properties. |

What You’re Viewing Is Included

Indian Hotels BCG Matrix

The Indian Hotels BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase, offering a comprehensive strategic overview. This document is not a sample or demo; it is the complete analysis, ready for immediate application in your business planning. You can confidently expect the same professional layout and in-depth insights that will empower your decision-making. Once purchased, this BCG Matrix report will be instantly downloadable, allowing you to leverage its strategic clarity without delay.

Dogs

Older properties within Indian Hotels Company Limited's (IHCL) portfolio, particularly those situated in saturated or declining Indian micro-markets and lacking recent renovations, can be categorized as Dogs. These establishments often struggle with a low market share in slow-growing environments, finding it difficult to attract and retain guests, thereby generating minimal cash flow for the company.

For instance, properties that haven't undergone significant upgrades or strategic repositioning might be facing declining occupancy rates and average room rates (ARR). In 2024, while the overall Indian hospitality sector saw robust recovery, specific micro-markets with an oversupply of rooms or shifting consumer preferences could still present challenges for older, unrenovated hotels, potentially leading to operational losses or very low profitability.

The economic viability of substantial investment for a turnaround in such scenarios is often questionable. IHCL, known for its strategic asset management, would likely evaluate the potential return on investment against the cost of renovation and repositioning. If the projected returns do not meet the company's hurdle rates, these properties might be considered for divestment or alternative strategic exits rather than significant capital infusion.

Non-core, divested assets in Indian Hotels Company Limited (IHCL) are categorized as 'Dogs' in the BCG Matrix. These are typically smaller, less strategic properties or businesses that IHCL has identified for divestiture. For instance, in fiscal year 2023-24, IHCL continued its strategy of portfolio rationalization, which includes divesting non-core assets to streamline operations and focus on core hospitality brands.

Standalone restaurants or bars within IHCL's portfolio, especially older ones not integrated with hotel operations, can be classified as Dogs. These establishments often face challenges like low customer traffic and increasing operational expenses, making them less profitable.

For instance, if a legacy standalone bar, perhaps established before 2010, is experiencing a consistent decline in revenue, say a 15% year-on-year drop, and its market share in its specific locality has shrunk to below 5%, it would likely fall into the Dog category. This is often due to failing to adapt to changing tastes or intense competition from newer, trendier venues.

Less Strategic or Remote Smaller Service Offerings

Smaller, less strategic service offerings or very remote properties within Indian Hotels Company Limited (IHCL) might be categorized as dogs if they don't align with the company's core brand strengths or future growth ambitions. These could be niche operations or geographically isolated properties with minimal market share, contributing little to overall revenue or brand equity.

Such segments, characterized by low growth potential and limited contribution, often warrant re-evaluation for potential divestment or restructuring. For instance, if a particular heritage property in a remote location, despite its charm, struggles to attract consistent bookings and requires disproportionate operational investment, it could fall into this category. In 2023, IHCL continued its strategic portfolio rationalization, focusing on strengthening its core brands and expanding in key markets, indicating a proactive approach to managing underperforming assets.

- Low Market Share: Properties or services with a negligible presence in their respective segments.

- Limited Brand Synergy: Offerings that do not reinforce IHCL's primary brand identity or value proposition.

- Suboptimal Financial Returns: Segments that generate minimal profits or consistently incur losses relative to investment.

- Strategic Misalignment: Operations that diverge from IHCL's stated growth objectives and core competencies.

Underutilized or Outdated Ancillary Services

Within the Indian Hotels portfolio, certain ancillary services at specific properties might be categorized as dogs if they are underutilized or outdated. These could include niche spa treatments that no longer resonate with guest preferences or retail shops stocking products that don't align with current market trends. For instance, if a particular hotel's business center services have seen a significant decline in usage due to the rise of mobile connectivity, it could be considered a dog. Such services often yield low revenue while incurring maintenance and operational costs, making them candidates for divestment or significant strategic overhaul.

These underperforming ancillary services, such as underperforming specialty restaurants or outdated business facilities, often represent a drain on resources. For example, a hotel might operate a formal dining restaurant that consistently fails to meet occupancy targets, contributing to a negative profit margin. In 2023, reports indicated that while the overall occupancy rates for Indian Hotels were strong, specific niche offerings within certain legacy properties struggled to attract consistent demand, highlighting the potential for such services to become dogs.

- Underutilized Spa Services: Specific treatments or facilities within hotel spas that have low booking rates and do not align with current wellness trends.

- Outdated Retail Outlets: Shops within properties offering merchandise that is no longer in demand or competitive with external retail options.

- Low-Demand Recreational Facilities: Amenities like underused sports courts or specific entertainment options that do not attract a significant number of guests.

- Declining Business Center Usage: Services like printing, faxing, or dedicated meeting rooms that see minimal use due to advancements in personal technology.

Properties or business units within Indian Hotels Company Limited (IHCL) that exhibit low market share in slow-growing industries, or are outdated and require substantial investment without clear return potential, are classified as Dogs. These segments often drain resources and are candidates for divestment or restructuring to optimize the overall portfolio. For instance, a legacy standalone restaurant with declining revenue, such as a 15% year-on-year drop and less than 5% local market share, would fit this category.

In 2023, IHCL continued its strategy of portfolio rationalization, which includes divesting non-core assets. This proactive approach aims to streamline operations and focus on core hospitality brands, ensuring capital is allocated to higher-potential segments. For example, older properties in saturated micro-markets that haven't been renovated might be considered for divestment if renovation costs exceed projected returns, as was likely evaluated for several such assets during the 2023-24 fiscal year.

Ancillary services like underutilized spa treatments or outdated business centers can also be Dogs if they generate minimal revenue and incur operational costs. The rise of mobile connectivity, for instance, has reduced the demand for traditional business center services, potentially making them unprofitable. In 2023, specific niche offerings within legacy properties struggled to attract consistent demand, underscoring the potential for such services to become Dogs.

IHCL's strategic focus on strengthening core brands and expanding in key markets implies a continuous evaluation of its asset base. Properties or services that do not align with future growth ambitions or core competencies, and offer suboptimal financial returns, are prime candidates for divestment. This is part of a broader effort to enhance profitability and brand equity across the portfolio.

| Category | Description | IHCL Example | Market Condition | IHCL Strategy |

|---|---|---|---|---|

| Dogs | Low market share, low growth industry; requires significant investment with uncertain returns. | Older, unrenovated properties in saturated micro-markets; underperforming ancillary services. | Slow growth, declining demand, high competition. | Divestment, restructuring, or closure. |

| Dogs | Non-core assets, legacy operations with declining profitability. | Standalone legacy restaurants or retail outlets with diminishing customer traffic. | Shifting consumer preferences, increased operational costs. | Portfolio rationalization, asset divestiture. |

| Dogs | Segments with limited brand synergy and strategic misalignment. | Niche service offerings lacking integration with core hotel operations. | Low contribution to overall revenue and brand equity. | Focus on core competencies and high-potential brands. |

Question Marks

The re-imagined Gateway Hotels, positioned as a full-service offering in the upscale segment, currently fall into the question mark category within the Indian Hotels Company Limited (IHCL) BCG Matrix. These hotels represent new ventures in a burgeoning market, specifically targeting emerging micro-markets within metropolitan areas and Tier II/III cities.

Despite the promising market growth, Gateway Hotels presently hold a low market share due to their early stage of development and rollout. IHCL's strategic commitment is evident through significant investments aimed at expanding the brand's footprint, with ambitious plans to reach 100 hotels by 2030. This aggressive expansion strategy signals a clear intention to transform these question marks into stars in the future.

Indian Hotels Company Limited (IHCL) acquired a majority stake in The Tree of Life brand, a move that places it squarely in the question mark category of the BCG matrix. This brand specializes in boutique leisure experiences and private escapes, tapping into a growing niche for distinctive and serene accommodations.

Despite operating in an expanding market segment, The Tree of Life currently holds a modest market share within IHCL's broader portfolio. For instance, as of the fiscal year ending March 31, 2024, IHCL reported a total of 260 hotels across its brands, with boutique offerings like Tree of Life representing a smaller, albeit promising, portion.

Significant investment and targeted marketing campaigns are crucial for The Tree of Life to increase its visibility and capture a larger market share. Success in these endeavors could propel it from a question mark to a star, mirroring IHCL's strategy to nurture high-potential niche brands.

The Claridges Collection, a recent addition to Indian Hotels Company Limited's (IHCL) portfolio, is currently positioned as a question mark in the BCG matrix. This new boutique luxury hotel brand, operating under a brand license agreement, is entering a rapidly expanding high-growth luxury market.

However, as a nascent brand within IHCL's luxury offerings, The Claridges Collection currently holds a relatively low market share. This is a typical characteristic of question marks, which require careful consideration regarding future investment to determine if they can capture significant market share.

Strategic investments in brand positioning, marketing, and guest acquisition are essential for The Claridges Collection. These efforts will be vital to increase its market penetration and potentially transition it from a question mark to a star performer within IHCL's portfolio in the coming years.

New International Ventures (e.g., Kruger National Park, Bahrain, Ras Al Khaimah)

Indian Hotels' new international ventures, like its luxury lodges in Kruger National Park, South Africa, and hotels in Bahrain and Ras Al Khaimah, are classified as question marks in the BCG matrix. These represent strategic entries into promising new markets for luxury hospitality, catering to both global demand and the growing segment of outbound Indian travelers. The potential for growth in these regions is substantial, driven by increasing tourism and a desire for premium experiences.

These ventures, while positioned for future success, currently hold a low market share in their respective regions. Significant capital investment is necessary to build brand recognition, establish operational excellence, and effectively compete against established players. This investment is crucial for capturing a meaningful market share and solidifying Indian Hotels' presence in these high-potential international destinations. For instance, the global luxury travel market was projected to reach over $1.5 trillion by 2024, indicating the scale of opportunity.

- Kruger National Park Lodges: Entry into a competitive but high-demand wildlife tourism sector.

- Bahrain Hotels: Targeting a growing business and leisure travel market in the Middle East.

- Ras Al Khaimah Hotels: Leveraging the UAE's expansion in tourism infrastructure and appeal.

Digital and Technology-driven Initiatives (e.g., Qmin, Loyalty Programs)

Indian Hotels' digital and technology-driven initiatives, such as the food delivery platform Qmin and loyalty programs like Taj InnerCircle, represent significant question marks within their BCG matrix. While Qmin operates within the 'New Businesses' segment and Taj InnerCircle is a mature offering, their future success hinges on continued digital evolution and AI integration. These efforts aim to enhance guest experiences and predict consumer behavior, but their full market potential and optimal integration are still being explored, necessitating ongoing investment to secure market share and profitability.

The strategic question lies in how effectively Indian Hotels can leverage these digital assets in a rapidly advancing technological landscape. For instance, Qmin, launched in 2020, has seen substantial growth, with reports indicating a significant increase in order volumes and revenue contribution in recent fiscal years. However, the competitive food delivery market demands continuous innovation and aggressive customer acquisition strategies to truly maximize its market share. Similarly, while Taj InnerCircle boasts a large and loyal customer base, its ability to adapt to evolving guest expectations through personalized digital offerings and predictive analytics will determine its long-term value and competitive edge.

- Qmin's Market Position: Qmin faces intense competition from established food aggregators, requiring strategic investments in technology and marketing to capture a larger share of the online food delivery market.

- Loyalty Program Evolution: The success of Taj InnerCircle depends on its ability to offer increasingly personalized digital experiences and leverage data analytics to anticipate and meet guest needs, thereby driving repeat business and higher spending.

- AI and Data Integration: The full potential of AI and data analytics in predicting consumer behavior and optimizing operations across both Qmin and the loyalty program is still being realized, presenting an ongoing area for strategic development and investment.

- Scalability and Profitability: Achieving significant scalability and profitability for these digital initiatives requires not only technological advancement but also efficient operational integration and a clear understanding of evolving customer preferences in the digital age.

The Gateway Hotels, The Tree of Life, and The Claridges Collection are all classified as question marks within the Indian Hotels Company Limited (IHCL) BCG Matrix. These brands represent new or emerging ventures in growing market segments, such as boutique leisure and luxury hospitality. Despite the promising market potential, they currently hold a low market share due to their early stages of development and brand building.

IHCL's strategic focus is on nurturing these question marks through significant investments and targeted marketing efforts. The aim is to increase their market penetration and brand visibility, with the ultimate goal of transforming them into star performers. This approach is evident in IHCL's aggressive expansion plans, such as aiming for 100 Gateway Hotels by 2030, and its acquisition of brands like The Tree of Life.

Indian Hotels' international ventures in South Africa, Bahrain, and Ras Al Khaimah, along with its digital initiatives like Qmin and the evolution of Taj InnerCircle, also fall into the question mark category. These areas require substantial capital and strategic development to build brand recognition and capture market share in competitive global and digital landscapes. The global luxury travel market's projected growth to over $1.5 trillion by 2024 underscores the opportunity for these ventures.

BCG Matrix Data Sources

Our Indian Hotels BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and official reports on segment performance.