Indian Hotels Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

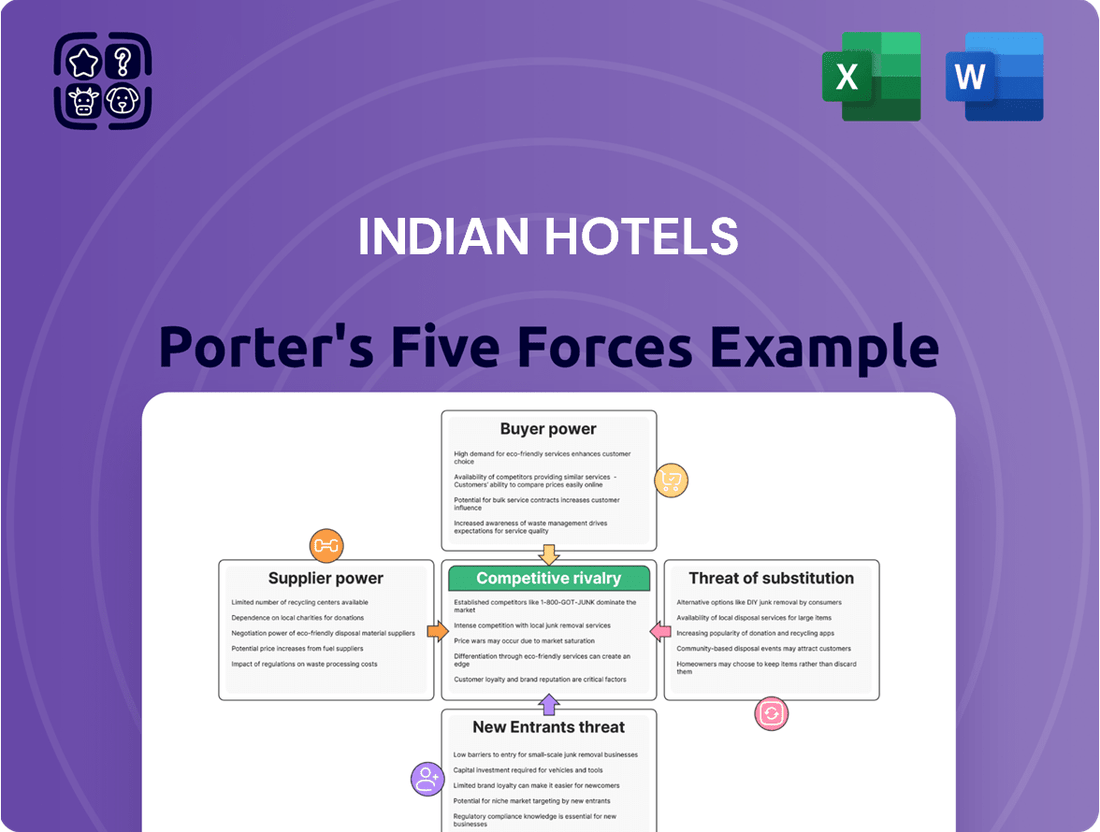

Indian Hotels faces significant competitive pressures from rivals and the constant threat of new entrants in the hospitality sector. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic market. The availability of substitutes also presents a challenge to their established position.

The full Porter's Five Forces Analysis reveals the real forces shaping Indian Hotels’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Indian Hotels Company Limited (IHCL) sources essential raw materials like food, beverages, and cleaning supplies, which are often undifferentiated commodities. This lack of unique features means suppliers have less leverage to dictate terms, as their products are easily replaced by competitors. For instance, the price of common food staples can fluctuate based on broader market conditions rather than specific supplier innovations.

Indian Hotels Company Limited (IHCL), despite its robust brand, faces a notable degree of supplier power due to its reliance on local sources for fresh produce. Approximately 60% of its food and beverage procurement comes from these local suppliers. This significant dependence can empower suppliers, especially in areas with limited availability or seasonal variability of specific produce.

In 2024, this dependency translates into potential price leverage for local farmers and distributors. For instance, during periods of adverse weather impacting crop yields, the bargaining power of suppliers of essential items like certain vegetables or fruits can increase substantially, potentially affecting IHCL's cost of goods sold in its food and beverage operations.

Indian Hotels Company Limited (IHCL) benefits from its strong brand reputation, which significantly mitigates the bargaining power of its suppliers. For instance, the Taj brand, a flagship of IHCL, was recognized as one of the world's strongest hotel brands in 2024, highlighting its premium market standing. This established reputation grants IHCL considerable negotiation leverage.

Suppliers are often eager to partner with a globally recognized and respected hospitality leader like IHCL. This desire for association allows IHCL to secure more favorable terms and pricing for its goods and services, effectively reducing the suppliers' ability to dictate terms and potentially increasing IHCL's profit margins.

Potential for Backward Integration

Indian Hotels Company Limited (IHCL) can explore backward integration, such as establishing its own farms for produce or directly sourcing from local agricultural communities. This would reduce dependence on external suppliers for critical items like fresh food and beverages. For instance, in 2023-24, IHCL’s cost of materials consumed was a significant portion of its operating expenses, highlighting the potential impact of direct sourcing on profitability.

By controlling more of its supply chain, IHCL could effectively negotiate better terms, potentially lowering input costs and mitigating the impact of supplier price hikes. This strategy directly challenges the bargaining power of suppliers by creating alternative, in-house supply options. This move could also ensure greater quality control and consistency across its diverse hotel portfolio.

- Backward Integration Potential: IHCL can develop in-house agricultural capabilities or establish direct sourcing networks.

- Cost Reduction: Direct sourcing can lead to lower procurement costs for key inputs like food and beverages.

- Mitigating Supplier Power: Reduced reliance on external suppliers diminishes their ability to dictate prices.

- Quality Control: In-house operations allow for enhanced oversight of input quality and consistency.

Impact of Specialised Services and Technology Providers

Suppliers offering specialized services and technology, like advanced property management systems or unique guest experience platforms, can wield significant bargaining power. For Indian Hotels Company Limited (IHCL), this is evident when sourcing bespoke software solutions or high-end amenities. The niche nature of these offerings and the costs associated with switching providers can create dependencies, impacting IHCL's operational flexibility and cost structure.

For instance, a specialized hotel management software provider might command higher prices if IHCL finds it difficult to integrate a new system or retrain staff. In 2024, the hospitality tech market saw continued consolidation, potentially strengthening the position of leading providers. IHCL's strategic sourcing and long-term vendor partnerships are crucial to mitigate these supplier-driven pressures.

- Niche Technology Providers: Suppliers of specialized software, such as AI-driven revenue management systems or advanced guest personalization platforms, can exert considerable influence due to the unique capabilities and integration complexities.

- High Switching Costs: For IHCL, the expense and disruption involved in changing providers for critical services like booking engines or loyalty program management can lock them into existing supplier relationships, reducing their leverage.

- Quality and Exclusivity: Suppliers of premium, exclusive products, such as designer toiletries or unique F&B ingredients, may have stronger bargaining power, especially if these items are integral to IHCL's brand positioning and guest satisfaction.

- Strategic Partnerships: IHCL's approach to managing these specialized suppliers often involves building strategic, long-term relationships rather than purely transactional ones, aiming for mutual benefit and reduced price volatility.

While IHCL's strong brand reputation offers some leverage, its reliance on local suppliers for fresh produce, representing about 60% of its F&B procurement, grants these suppliers significant bargaining power. This is particularly true in 2024, where seasonal variations and localized supply chain disruptions can lead to price increases for essential items, directly impacting IHCL's cost of goods sold.

Suppliers of specialized technology, such as advanced property management systems, also hold considerable sway due to high switching costs and the integration complexities involved. The hospitality tech market's consolidation in 2024 further bolsters the position of key providers, creating potential dependencies for IHCL.

| Supplier Type | Impact on IHCL | 2024 Context | Mitigation Strategy |

|---|---|---|---|

| Local Produce Suppliers | Moderate to High Bargaining Power | ~60% F&B sourced locally; weather impacts yields. | Backward integration, direct sourcing networks. |

| Specialized Tech Providers | High Bargaining Power | Consolidation in hospitality tech market. | Long-term vendor partnerships, strategic sourcing. |

| Commodity Suppliers (e.g., cleaning supplies) | Low Bargaining Power | Undifferentiated products, easily substituted. | Bulk purchasing, competitive bidding. |

What is included in the product

This analysis of Indian Hotels identifies the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on the company's profitability and strategic positioning.

Instantly assess competitive pressures from rivals, new entrants, suppliers, buyers, and substitutes, enabling proactive strategies for Indian Hotels.

Customers Bargaining Power

Customers in India's mid-market and economy hotel segments, like those choosing IHCL's Ginger brand, exhibit strong price sensitivity. This means they actively seek the best value, frequently comparing rates across different booking sites and readily switching to more affordable choices. In 2024, the average daily rate (ADR) for economy hotels in India hovered around ₹2,500-₹3,500, a figure highly scrutinized by budget-conscious travelers.

Corporate clients and large group organizers wield significant negotiation power, frequently securing preferential rates and discounts. For instance, Indian Hotels Company Limited (IHCL) disclosed that corporate bookings represented 30% of its overall revenue in the last fiscal year. These substantial clients typically negotiate average discounts ranging from 15% to 20%, which heightens the competitive pressure among hotel chains.

The proliferation of online travel agencies (OTAs) and digital booking platforms has significantly amplified customer bargaining power in the Indian hospitality sector. These platforms offer unparalleled price transparency, allowing travelers to easily compare rates and amenities across numerous hotel brands. In 2023, online travel bookings in India were projected to reach approximately $10.5 billion, highlighting the immense reach of these intermediaries.

While Indian Hotels Company Limited (IHCL) leverages these platforms for bookings, the ease with which customers can switch between hotels based on competitive pricing and readily available online reviews empowers them to negotiate better deals. This dynamic forces hotels to be more competitive, potentially impacting profit margins if not managed strategically.

Influence of Loyalty Programs and Brand Stickiness

Indian Hotels Company Limited (IHCL) leverages its robust loyalty programs, such as the Taj Innercircle, to significantly diminish the bargaining power of its customers. These programs, spanning brands like Taj, Vivanta, and Ginger, encourage repeat patronage by offering exclusive benefits and rewards, thereby increasing customer stickiness. This strategic approach makes customers less sensitive to price competition and more inclined to remain loyal to IHCL properties, effectively reducing their ability to negotiate better terms.

IHCL's loyalty initiatives are a cornerstone in building brand stickiness, a crucial factor in mitigating customer bargaining power. For instance, the Taj Innercircle program offers tiered benefits, from room upgrades to exclusive dining experiences, creating a compelling reason for customers to consistently choose IHCL. This focus on customer retention through added value minimizes the impact of price-sensitive customers seeking alternatives, as evidenced by the continued strong occupancy rates across IHCL's portfolio.

- Brand Loyalty: IHCL's loyalty programs cultivate a dedicated customer base, reducing price sensitivity and the inclination to switch to competitors.

- Repeat Business: Incentives within programs like Taj Innercircle drive repeat bookings, solidifying customer relationships and diminishing individual bargaining leverage.

- Reduced Price Negotiation: By offering tangible value beyond the room rate, IHCL effectively limits customers' ability to negotiate lower prices.

- Customer Retention: The focus on rewarding loyal customers ensures a stable demand, even in competitive market conditions.

Demand for Experiential and Personalized Stays

Customers are increasingly prioritizing unique, personalized, and experiential travel, especially in the luxury segment. This trend grants them greater bargaining power as they seek out offerings that go beyond standard accommodation. For instance, in 2023, the global luxury travel market was valued at approximately $1.5 trillion, with a significant portion driven by experiential components.

Indian Hotels Company Limited (IHCL) is well-positioned to address this demand. Its extensive portfolio, featuring heritage palaces and contemporary resorts, allows it to offer highly differentiated and memorable experiences. This focus on unique offerings can mitigate price sensitivity, as customers are willing to pay a premium for curated journeys and personalized service, thereby reducing their overall bargaining power on price alone.

- Experiential Demand: The global experiential travel market is projected to reach over $2.5 trillion by 2028, indicating a strong customer preference for unique activities and immersive stays.

- Personalization Focus: Surveys in 2024 show that over 70% of travelers are willing to pay more for personalized travel experiences.

- IHCL's Portfolio Advantage: IHCL's diverse brands, from Taj's luxury to Vivanta's contemporary feel, cater to a wide range of experiential preferences, enhancing customer loyalty and reducing the ability to bargain on price for these specialized offerings.

Customers in India's mid-market and economy hotel segments, like those choosing IHCL's Ginger brand, exhibit strong price sensitivity. This means they actively seek the best value, frequently comparing rates across different booking sites and readily switching to more affordable choices. In 2024, the average daily rate (ADR) for economy hotels in India hovered around ₹2,500-₹3,500, a figure highly scrutinized by budget-conscious travelers.

Corporate clients and large group organizers wield significant negotiation power, frequently securing preferential rates and discounts. For instance, Indian Hotels Company Limited (IHCL) disclosed that corporate bookings represented 30% of its overall revenue in the last fiscal year. These substantial clients typically negotiate average discounts ranging from 15% to 20%, which heightens the competitive pressure among hotel chains.

The proliferation of online travel agencies (OTAs) and digital booking platforms has significantly amplified customer bargaining power in the Indian hospitality sector. These platforms offer unparalleled price transparency, allowing travelers to easily compare rates and amenities across numerous hotel brands. In 2023, online travel bookings in India were projected to reach approximately $10.5 billion, highlighting the immense reach of these intermediaries.

While Indian Hotels Company Limited (IHCL) leverages these platforms for bookings, the ease with which customers can switch between hotels based on competitive pricing and readily available online reviews empowers them to negotiate better deals. This dynamic forces hotels to be more competitive, potentially impacting profit margins if not managed strategically.

IHCL's loyalty initiatives are a cornerstone in building brand stickiness, a crucial factor in mitigating customer bargaining power. For instance, the Taj Innercircle program offers tiered benefits, from room upgrades to exclusive dining experiences, creating a compelling reason for customers to consistently choose IHCL. This focus on customer retention through added value minimizes the impact of price-sensitive customers seeking alternatives, as evidenced by the continued strong occupancy rates across IHCL's portfolio.

Customers are increasingly prioritizing unique, personalized, and experiential travel, especially in the luxury segment. This trend grants them greater bargaining power as they seek out offerings that go beyond standard accommodation. For instance, in 2023, the global luxury travel market was valued at approximately $1.5 trillion, with a significant portion driven by experiential components.

Indian Hotels Company Limited (IHCL) is well-positioned to address this demand. Its extensive portfolio, featuring heritage palaces and contemporary resorts, allows it to offer highly differentiated and memorable experiences. This focus on unique offerings can mitigate price sensitivity, as customers are willing to pay a premium for curated journeys and personalized service, thereby reducing their overall bargaining power on price alone.

| Customer Segment | Bargaining Power Drivers | Impact on IHCL | 2024 Data/Trend |

|---|---|---|---|

| Economy & Mid-Market Travelers | Price Sensitivity, Rate Comparison | Pressure on ADR, need for competitive pricing | Economy ADR: ₹2,500-₹3,500 |

| Corporate & Group Bookings | Volume, Negotiation Leverage | Demand for discounts (15-20%), significant revenue share (30%) | Corporate bookings: 30% of revenue |

| Online Travel Agency (OTA) Users | Price Transparency, Ease of Switching | Increased competition, potential margin erosion | Online Travel Bookings (India 2023): ~$10.5 billion |

| Luxury & Experiential Seekers | Desire for Unique/Personalized Experiences | Willingness to pay premium, reduced price focus | Global Luxury Travel Market (2023): ~$1.5 trillion |

Preview Before You Purchase

Indian Hotels Porter's Five Forces Analysis

This preview showcases the complete Indian Hotels Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry. The document you see here is the exact, professionally written analysis you'll receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

The Indian hospitality sector is a battleground with formidable domestic rivals like Oberoi Hotels and ITC Hotels, alongside global giants such as Marriott, Hyatt, and Accor. This intense rivalry, particularly in the premium and luxury segments, means Indian Hotels Company Limited (IHCL) must constantly innovate and carve out unique offerings to stand out.

For instance, in 2023, the Indian luxury hotel market saw RevPAR (Revenue Per Available Room) grow significantly, with many established brands reporting strong occupancy rates, underscoring the demand and the competitive pressure to capture market share.

Competitors are significantly increasing their presence in India's Tier 2 and 3 cities, driven by a surge in domestic tourism. This expansion directly challenges Indian Hotels Company Limited (IHCL) as it also targets these growing markets.

This aggressive growth by rivals intensifies the battle for market share and skilled employees. For instance, in 2024, the Indian hospitality sector saw a notable increase in new hotel openings in these secondary cities, with several major chains announcing ambitious expansion plans, further heating up the competitive landscape.

Competitive rivalry within the Indian hospitality sector is intensifying as many players, including Indian Hotels Company Limited (IHCL), increasingly embrace asset-light growth models. This strategy, focusing on management contracts and operating leases, allows for faster expansion and reduced capital expenditure, making it a common approach across the industry.

This widespread adoption of asset-light strategies shifts the competitive battleground from asset ownership to brand strength and operational excellence. For instance, IHCL's management contracts grew by 12% in FY24, showcasing this trend. Competitors are vying for prime locations and strong brand recognition to secure these lucrative contracts, driving up the cost and effort required to gain market share.

Price and Service-Based Competition Across Segments

Competitive rivalry is intense across all of Indian Hotels Company Limited's (IHCL) segments, from upscale luxury properties to its more budget-friendly lean luxe offerings. Hotels actively compete not only on price but also on the quality of service, the range of amenities provided, and the uniqueness of their guest experiences. This dynamic necessitates constant adaptation and innovation to stay ahead in the market.

IHCL has demonstrated a notable ability to command a premium in its Average Room Rate (ADR) even when the broader market experiences downturns, underscoring its strong competitive positioning. However, this advantage requires continuous strategic focus and operational excellence to sustain against market pressures.

- Price and Service: Competition is fierce on both pricing strategies and the delivery of exceptional customer service across all hotel categories.

- Segment Diversity: IHCL faces rivals in luxury, upscale, mid-scale, and budget segments, each with its own set of competitive dynamics.

- ADR Premium: In FY24, IHCL maintained a strong ADR, reflecting its brand equity and service differentiation, a key factor in its competitive advantage.

- Market Volatility: Despite its strengths, the company must remain vigilant as market-wide fluctuations can impact pricing power and demand.

Impact of MICE and Wedding Tourism

The Meetings, Incentives, Conferences, and Exhibitions (MICE) and wedding tourism sectors are powerful engines for demand in India's hospitality industry. These segments offer significant revenue potential for hotels, leading to heightened competition as establishments strive to secure these lucrative group bookings. Hotels frequently bundle services and engage in aggressive pricing strategies to win these large-scale events.

In 2024, India's MICE market was projected to reach approximately USD 4.5 billion, showcasing its substantial economic impact and the intense competition it fosters among hotels. Similarly, the Indian wedding market, a major contributor to tourism, is estimated to be worth over USD 50 billion annually, with a significant portion spent on venue and hospitality services. This drives hotels to offer attractive packages and personalized experiences to capture a share of this high-value market.

- MICE Market Growth: India's MICE sector is a key demand driver, with significant revenue potential.

- Wedding Tourism Value: The Indian wedding market represents a substantial spending segment for hotels.

- Competitive Strategies: Hotels employ bundled services and competitive pricing to attract large MICE and wedding groups.

- Market Size Data: The MICE market was projected around USD 4.5 billion in 2024, while the wedding market exceeds USD 50 billion annually.

Competitive rivalry is fierce in India's hospitality sector, with both domestic players like Oberoi and ITC, and international brands such as Marriott and Hyatt vying for market share. This competition extends to Tier 2 and 3 cities, which are experiencing a boom in domestic tourism, driving aggressive expansion by rivals. IHCL's asset-light growth strategy, focusing on management contracts, intensifies competition as brands compete on operational excellence and brand strength for these lucrative agreements.

IHCL maintains a strong Average Room Rate (ADR) premium, even during market downturns, highlighting its brand equity and service differentiation. However, this advantage requires continuous strategic focus to counter market pressures. The company's rivals are also increasingly adopting asset-light models, with IHCL's management contracts growing by 12% in FY24, indicating a shift in competitive focus to brand and operational capabilities.

The MICE and wedding tourism sectors are significant demand drivers, leading to intense competition as hotels offer bundled services and aggressive pricing to secure group bookings. India's MICE market was projected around USD 4.5 billion in 2024, and the wedding market exceeds USD 50 billion annually, making these segments crucial for revenue generation and competitive positioning.

| Metric | FY24 (IHCL) | Industry Trend |

|---|---|---|

| Management Contract Growth | 12% | Increasing adoption of asset-light models |

| MICE Market Size (Projected) | USD 4.5 billion (2024) | Significant revenue potential, driving competition |

| Wedding Market Value (Annual) | > USD 50 billion | High-value segment, requiring tailored hotel offerings |

SSubstitutes Threaten

The growing appeal of homestays and boutique guesthouses, particularly for leisure and experiential travel, presents a significant threat of substitution for traditional hotels in India. These alternatives often provide a more personalized and immersive local experience, attracting travelers who value authenticity over standardized hotel offerings.

In 2023, the Indian homestay market saw substantial growth, with platforms like Airbnb reporting a significant increase in bookings, indicating a shift in consumer preference. This trend is further amplified by the rise of luxury villas and unique accommodations that cater to niche markets seeking exclusivity and distinctiveness, directly challenging the market share of established hotel chains.

Service apartments are emerging as a significant substitute for traditional hotels, especially for extended stays. These accommodations often feature kitchenettes and separate living areas, appealing to business travelers and families needing longer-term lodging. This trend can divert a considerable portion of the market away from hotels focused on shorter stays.

In 2023, the Indian serviced apartment market saw substantial growth, with revenue projected to reach USD 1.1 billion by 2028, indicating a strong demand for these alternatives. For instance, brands like Oakwood and Lemon Tree Hotels are expanding their serviced apartment offerings, directly competing for guests who might otherwise book conventional hotel rooms for longer durations.

The rise of online short-term rental platforms like Airbnb and Booking.com presents a significant threat of substitutes for traditional hotels in India. These platforms offer a vast selection of accommodations, ranging from budget-friendly rooms to entire homes, appealing to a broad spectrum of travelers. While Indian Hotels Company Limited (IHCL) primarily focuses on the mid-priced to luxury segments with its full-service offerings, these platforms can still siphon off leisure travelers seeking unique experiences or cost-effective alternatives. For instance, in 2023, the short-term rental market in India continued its robust growth, with platforms reporting substantial increases in listings and bookings, directly impacting the demand for conventional hotel rooms, especially for shorter stays and leisure purposes.

Availability of Alternative Leisure and Wellness Options

Consumers increasingly seek unique experiences beyond just lodging. This includes a surge in demand for standalone wellness retreats, specialized spas, and adventure tourism providers. These alternatives offer distinct leisure and relaxation opportunities, directly competing with traditional hotel services.

The Indian market, in particular, shows a strong upward trend in these substitute sectors. For instance, the Indian wellness tourism market was projected to reach approximately $9.1 billion in 2023, highlighting significant consumer spending on non-hotel-based wellness activities. This growth indicates a substantial threat as consumers allocate discretionary income towards these specialized experiences.

- Growing Demand for Experiential Travel: Consumers are prioritizing unique experiences over mere accommodation.

- Rise of Niche Wellness Providers: Standalone spas and wellness retreats offer specialized services that directly compete.

- Adventure Tourism as an Alternative: Activities like jungle safaris and trekking provide leisure options outside of traditional hotel stays.

- Market Data: The Indian wellness tourism market's projected $9.1 billion value in 2023 underscores the scale of these substitutes.

Shift Towards 'Bleisure' Travel and Work-from-Anywhere

The growing trend of 'bleisure' travel and remote work presents a significant threat of substitutes for traditional hotel offerings. Travelers increasingly seek accommodations that seamlessly integrate work and leisure, potentially favoring alternatives like serviced apartments or co-living spaces equipped with robust Wi-Fi, dedicated workspaces, and recreational facilities.

This shift means that the competitive landscape expands beyond conventional hotels. For instance, in 2024, the global flexible workspace market was projected to grow, indicating a rising demand for environments that cater to both productivity and comfort outside of a traditional office setting. Indian Hotels Company Limited (IHCL) must therefore consider how its properties can adapt to attract these evolving traveler needs.

Here's how this impacts IHCL:

- Evolving Traveler Preferences: The blending of business and leisure means guests might seek properties offering more than just a room; they want integrated experiences.

- Competition from Non-Traditional Lodging: Serviced apartments and co-living spaces can offer attractive packages for extended stays, combining living and working amenities.

- Need for Adaptable Offerings: IHCL's hotels may need to enhance business facilities, offer flexible workspaces, and incorporate leisure amenities to remain competitive.

- Market Diversification: Understanding and catering to the 'bleisure' segment is crucial for maintaining market share and attracting new customer demographics.

The threat of substitutes for Indian Hotels Company Limited (IHCL) is substantial, driven by the growing popularity of homestays, boutique guesthouses, and serviced apartments. These alternatives cater to travelers seeking unique experiences, personalized service, and extended-stay convenience, directly impacting IHCL's market share, especially in the leisure and business segments.

In 2023, the Indian homestay market experienced significant growth, with platforms like Airbnb reporting a notable increase in bookings, signaling a shift in consumer preferences towards more authentic, localized stays. Similarly, the serviced apartment sector in India was projected to reach USD 1.1 billion by 2028, highlighting a strong demand for accommodations offering home-like amenities for longer durations.

The rise of online travel agencies and short-term rental platforms offers a wide array of choices, from budget-friendly rooms to entire homes, attracting a broad spectrum of travelers. These platforms can divert leisure travelers who prioritize unique experiences or cost-effectiveness, even impacting IHCL's luxury segment through alternative luxury villa rentals.

Furthermore, the increasing demand for experiential travel, including wellness retreats and adventure tourism, presents another layer of substitution. The Indian wellness tourism market alone was projected to reach approximately $9.1 billion in 2023, indicating significant consumer spending on specialized leisure activities outside of traditional hotel offerings.

| Substitute Category | Key Features | Impact on IHCL | 2023 Market Indicator |

| Homestays & Boutique Guesthouses | Personalized, authentic local experiences | Siphons leisure travelers seeking uniqueness | Significant increase in bookings on platforms like Airbnb |

| Serviced Apartments | Kitchenettes, separate living areas, extended-stay convenience | Attracts business travelers and families for longer durations | Projected market value of USD 1.1 billion by 2028 |

| Online Rental Platforms (e.g., Airbnb) | Vast selection, varied price points, unique properties | Offers cost-effective and distinct alternatives, especially for short stays | Robust growth in listings and bookings |

| Wellness Retreats & Adventure Tourism | Specialized relaxation, unique activities, immersive experiences | Competes for discretionary spending on leisure | Indian wellness tourism market projected at $9.1 billion |

Entrants Threaten

The Indian hotel industry, particularly the upscale and luxury segments where Indian Hotels Company Limited (IHCL) thrives, demands a formidable initial capital outlay. This includes significant expenses for prime land acquisition, sophisticated construction, and the crucial development of a strong brand reputation. For instance, building a new five-star hotel in a metropolitan Indian city can easily cost upwards of ₹500 crore to ₹1000 crore, creating a substantial hurdle for aspiring entrants.

Indian Hotels Company Limited (IHCL) benefits from significant brand loyalty, especially with its Taj brand, recognized as one of the world's strongest hotel brands in 2024. This established reputation makes it difficult for new players to gain traction.

New entrants must overcome the hurdle of building brand trust and replicating IHCL's extensive network of properties and deeply ingrained customer loyalty. Competing against such established relationships requires substantial investment and time.

The Indian hospitality sector faces significant regulatory hurdles that act as a barrier to new entrants. Obtaining necessary permits, licenses, and adhering to stringent environmental and safety standards can be a complex and expensive undertaking. For instance, obtaining a hotel license in India can involve multiple clearances from local municipal bodies, fire departments, and health authorities, often requiring substantial time and investment.

Access to Distribution Channels and Talent

New entrants face significant hurdles in securing prime distribution channels. Established players like Indian Hotels Company Limited (IHCL) have cultivated strong relationships with global travel agencies, online travel aggregators, and corporate booking systems. For instance, in 2024, major hotel chains continued to dominate bookings through these established networks, making it difficult for newcomers to gain visibility and favorable placement. This access is crucial for driving occupancy rates and revenue.

Attracting and retaining top hospitality talent presents another substantial barrier. The Indian hospitality sector, particularly in 2024, continued to see high demand for experienced professionals, from general managers to specialized culinary staff. IHCL, with its strong brand reputation and extensive training programs, is well-positioned to attract and retain this talent. New entrants must invest heavily in recruitment and retention strategies to compete for skilled individuals, which can significantly increase their initial operating costs.

- Distribution Channel Access: Newcomers struggle to match the established relationships IHCL has with global travel agencies and corporate booking platforms, limiting their reach.

- Talent Acquisition: Attracting and retaining skilled hospitality professionals is challenging due to high demand and the established employer brand of existing players like IHCL.

- Brand Loyalty: Existing brands benefit from customer loyalty, making it harder for new entrants to capture market share without significant marketing investment.

Increasing Supply in Key Markets

The threat of new entrants in the Indian hotel market is amplified by a significant increase in supply. While demand continues to rise, the pipeline of new hotel projects and room additions, especially in premium and upscale segments, is substantial. This influx of new inventory, with thousands of rooms entering the market in 2024 and projections for continued growth into 2025, makes it more challenging for new players to establish a foothold and gain market share.

- Growing Supply Pipeline: Thousands of new hotel rooms are expected to enter the Indian market in 2024 and 2025, particularly in the premium and upscale segments.

- Intensified Competition: This surge in supply directly increases competition, making it harder for new entrants to capture market share.

- Focus on Tier 2/3 Cities: Expansion is also notable in emerging Tier 2 and Tier 3 cities, diversifying competitive landscapes beyond major metros.

The threat of new entrants in the Indian hotel market, especially for IHCL, is moderate, primarily due to high capital requirements and established brand loyalty. While the market is attractive, the sheer cost of establishing a new luxury hotel, often exceeding ₹500 crore in major cities, acts as a significant deterrent. Furthermore, brands like Taj have cultivated deep customer trust, making it difficult for newcomers to gain immediate traction.

However, the increasing supply pipeline, with thousands of new rooms entering the market in 2024 and projected growth into 2025, does intensify competition. This expansion, even into Tier 2 and Tier 3 cities, means new players can emerge in different geographical areas, potentially fragmenting market share.

Regulatory complexities and the challenge of securing prime distribution channels also contribute to the barrier. New entrants must navigate intricate licensing processes and build relationships with travel agencies, which established players like IHCL already possess. The talent acquisition challenge further adds to the cost and difficulty for new companies entering the fray.

| Barrier | Impact on New Entrants | IHCL Advantage |

|---|---|---|

| Capital Investment | High (₹500 Cr+ for 5-star) | Established financial resources |

| Brand Loyalty | Significant hurdle | Strong Taj brand recognition (top global brand in 2024) |

| Regulatory Hurdles | Complex and time-consuming | Experience navigating Indian regulations |

| Distribution Access | Challenging to replicate | Existing strong relationships with OTAs and corporate clients |

| Talent Acquisition | Costly and competitive | Reputation as an employer of choice |

Porter's Five Forces Analysis Data Sources

Our Indian Hotels Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and government tourism statistics to capture the full competitive landscape.