IGO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGO Bundle

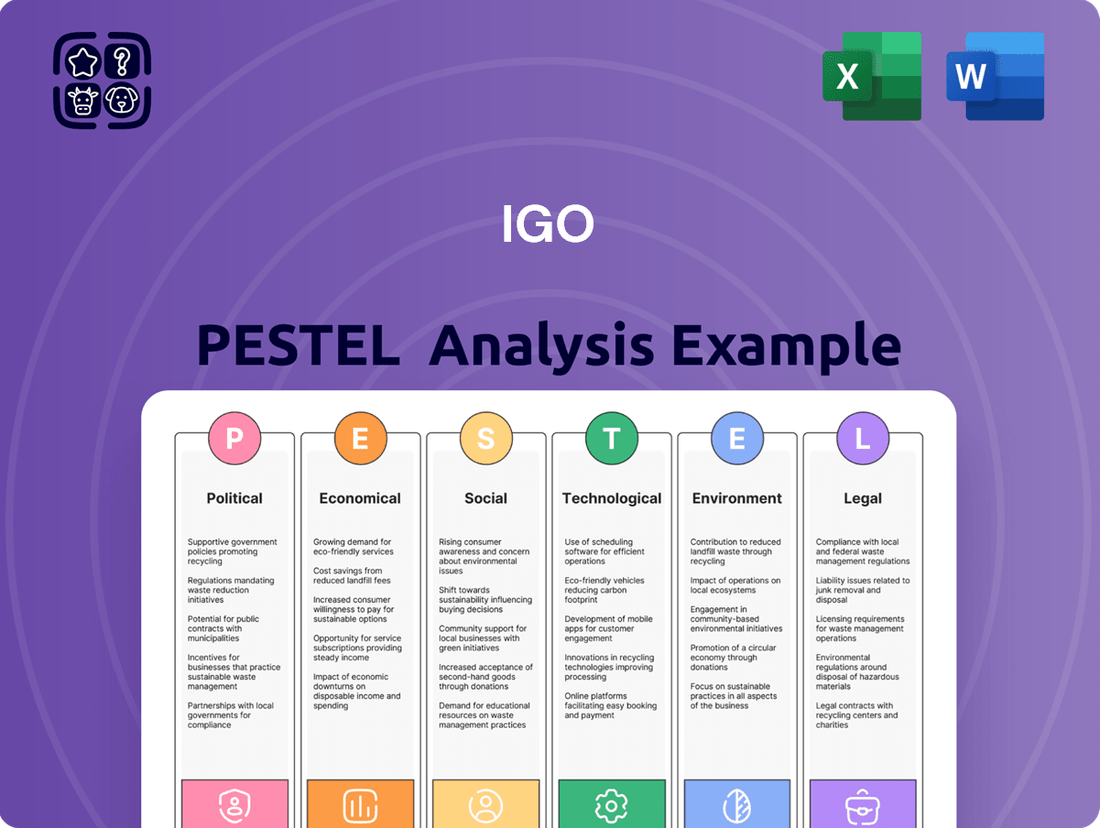

Unlock the critical external factors shaping IGO's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

The Australian government's commitment to critical minerals, particularly through the 'Future Made in Australia' package, is a significant political factor. This initiative aims to bolster the production of resources vital for the energy transition, such as nickel, lithium, and copper. This proactive stance offers a supportive policy landscape for companies like IGO.

Rising geopolitical tensions and protectionist policies are significantly reshaping global supply chains, particularly for critical minerals essential for clean energy technologies. These shifts can disrupt trade flows and alter supply dynamics, presenting both hurdles and avenues for companies like IGO, a major player in clean energy metals.

For instance, the ongoing trade friction between major economies, coupled with increased nationalistic approaches to resource control, has led to heightened volatility in mineral prices and availability. In 2024, the International Energy Agency reported that several countries are actively seeking to diversify their sources of critical minerals away from concentrated regions, a trend that could impact IGO's market access and operational strategies.

Navigating this intricate geopolitical terrain is crucial for IGO to maintain stable operations and secure its position in the global market. The company must adapt to potential trade barriers and evolving regulatory landscapes to ensure the consistent supply of clean energy metals.

Australia's domestic mining policy is increasingly focused on supporting the energy transition, a move that directly impacts companies like IGO. This commitment, however, is balanced by a tightening of environmental regulations. For instance, by the end of 2023, the Australian government had committed over AUD 2 billion to critical minerals projects, signalling strong support for the sector's role in clean energy technologies.

IGO must navigate this evolving policy landscape, where resource development goals are intertwined with stringent environmental protection measures. The increasing emphasis on sustainability means that obtaining and maintaining operational permits and social license requires meticulous adherence to these regulations. Failure to comply can lead to significant delays, fines, and reputational damage, impacting the company's ability to continue its mining operations smoothly.

International Trade Agreements and Relations

IGO's position as a global supplier of critical metals is significantly shaped by international trade agreements and evolving geopolitical relationships. Shifts in these dynamics, such as the implementation of new tariffs or changes to existing free trade pacts, can directly influence the cost of both importing essential components and exporting finished products, thereby impacting IGO's overall profitability and its ability to access key markets.

For instance, the ongoing trade tensions between major economies in 2024 and projected into 2025 necessitate constant vigilance. IGO actively monitors these global trade currents to proactively adjust its sourcing and sales strategies, aiming to mitigate potential disruptions and capitalize on emerging opportunities.

- Trade Diversification: IGO is exploring new markets and supply chains to reduce reliance on regions with unstable trade relations, aiming to secure a more resilient operational framework.

- Tariff Impact Analysis: The company regularly assesses the potential financial impact of tariffs on key commodities like nickel and copper, which are crucial for its operations and product offerings.

- Geopolitical Risk Assessment: IGO maintains a close watch on geopolitical developments that could lead to trade sanctions or export restrictions, particularly concerning metals vital for green energy technologies.

Resource Nationalism and Export Controls

The increasing trend of resource nationalism, where countries prioritize domestic control and benefit from their natural resources, directly impacts global supply chains. This can manifest as higher taxes, local content requirements, or outright bans on exports, particularly for critical minerals essential for the energy transition. For instance, in 2023, several nations with significant lithium reserves explored or implemented stricter export regulations, aiming to capture more value domestically.

While IGO Limited operates in stable jurisdictions like Australia, its reliance on international partnerships and complex supply chains for processing and marketing means it's not immune to these global shifts. Export controls enacted by other resource-rich nations could disrupt the availability of key inputs or create price volatility for minerals IGO relies on, even if not directly mined by the company.

To mitigate these risks, a diversified strategy is crucial. This involves exploring new resource acquisition opportunities in different geopolitical regions and building robust, flexible market engagement strategies that can adapt to evolving trade policies.

- Resource Nationalism Impact: Countries are increasingly asserting control over their mineral wealth, potentially restricting exports of critical materials like lithium and cobalt.

- Supply Chain Vulnerability: IGO's international processing and marketing partnerships are exposed to export controls implemented by other nations, potentially affecting input availability and cost.

- Diversification Strategy: A proactive approach to securing resources across various jurisdictions and maintaining adaptable market relationships is essential for navigating these political risks.

Government policies significantly influence the critical minerals sector, with initiatives like Australia's 'Future Made in Australia' package directly supporting the production of metals essential for the energy transition. This policy landscape provides a favourable environment for companies like IGO.

Geopolitical tensions and protectionist policies are altering global supply chains for critical minerals, impacting trade flows and supply dynamics. For instance, in 2024, the International Energy Agency noted efforts by several countries to diversify critical mineral sources, a trend that could affect IGO's market access.

Australia's domestic mining policy prioritizes the energy transition, allocating over AUD 2 billion to critical minerals projects by late 2023. However, this support is coupled with increasingly stringent environmental regulations, requiring companies like IGO to meticulously adhere to sustainability standards for operational permits.

International trade agreements and geopolitical relationships shape IGO's global position. Trade tensions observed in 2024 and projected into 2025 necessitate continuous monitoring of global trade currents to adapt sourcing and sales strategies, mitigating disruptions and capitalizing on opportunities.

| Political Factor | Impact on IGO | Example/Data (2023-2025) |

|---|---|---|

| Government Support for Critical Minerals | Favourable policy environment for energy transition metals. | Australia's 'Future Made in Australia' package. |

| Geopolitical Tensions & Protectionism | Supply chain disruptions, altered trade dynamics. | IEA report (2024) on efforts to diversify critical mineral sources. |

| Resource Nationalism | Potential export restrictions, increased costs for inputs. | Stricter export regulations explored/implemented for lithium reserves (2023). |

| Trade Agreements & Tariffs | Influence on import/export costs, market access. | Ongoing trade tensions between major economies (2024-2025). |

What is included in the product

The IGO PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting an Intergovernmental Organization.

This comprehensive framework helps identify critical external influences that shape an IGO's operational environment and strategic decision-making.

Provides a clear, actionable roadmap by translating complex external factors into manageable insights, reducing the anxiety of navigating uncertain markets.

Economic factors

Global commodity price volatility significantly impacts IGO's financial performance, as nickel, lithium, and copper are key revenue drivers. While lithium prices saw a notable decline in late 2024, projections suggest greater price stability or even growth for copper and nickel, largely fueled by the escalating demand from the clean energy transition.

IGO's strategic approach to counter this volatility centers on prioritizing and developing low-cost production assets. This focus aims to build resilience against adverse price movements, ensuring profitability even in challenging market conditions.

The global shift towards cleaner energy sources is a major economic tailwind for companies like IGO. Think electric vehicles, solar panels, and wind turbines – they all require significant amounts of metals. This isn't a short-term fad; it's a fundamental change in how we power our world.

For instance, the International Energy Agency (IEA) projected in early 2024 that global electricity demand from EVs alone could more than double by 2030 compared to 2023 levels. This surge directly translates into increased demand for battery metals like nickel and lithium, which are central to IGO's business. This robust demand growth provides a solid economic foundation for IGO's ongoing exploration and production efforts.

Significant global and domestic investments are pouring into green metals production and the decarbonisation of heavy industries, creating substantial economic opportunities. This trend directly benefits companies like IGO through increased market demand for its products and potential access to funding for sustainable mining operations.

Australia's federal budget for 2025 underscores this commitment with substantial allocations directed towards green metals and clean energy technologies, signalling strong government support for the sector.

Inflationary Pressures and Operating Costs

Global inflationary pressures continue to be a significant concern, directly impacting an organization like IGO by increasing both operating and capital expenditures. This rise in costs can put a strain on project viability and ultimately affect overall profitability. Key cost drivers such as energy, labor, and raw materials are under scrutiny.

For instance, in late 2024, IGO's financial performance experienced a downturn attributed to declining commodity prices. This economic climate has sharpened the company's focus on enhancing operational efficiency to mitigate these cost pressures and maintain profitability.

Specific cost considerations for IGO include:

- Energy Costs: Fluctuations in global energy prices, such as the average Brent crude oil price which hovered around $80-$85 per barrel in early 2024, directly influence transportation and processing expenses.

- Labor Costs: Wage inflation, particularly in mining regions where IGO operates, can lead to increased personnel expenses, impacting project budgets.

- Material Costs: The price of essential materials used in mining and processing, like steel and chemicals, are subject to global supply and demand dynamics, contributing to overall cost variability.

Capital Allocation and Financial Strength

IGO's robust financial standing, characterized by a net cash balance and available undrawn debt facilities, offers significant strategic flexibility. This financial muscle is essential for capitalizing on emerging growth avenues and executing pivotal investments. For instance, as of its latest reporting period in early 2024, IGO reported a strong net cash position, enabling it to pursue opportunities without immediate reliance on external financing.

The company's capital allocation strategy is meticulously guided by a clear policy, which dictates decisions regarding investments, dividend payouts, and the overall management of financial returns. This structured approach ensures that capital is deployed efficiently to maximize shareholder value and support long-term objectives. This policy is a cornerstone of IGO's commitment to sustainable financial performance.

This inherent financial strength is not merely about current liquidity; it's a critical enabler for resilience and expansion. It allows IGO to effectively navigate the inherent volatility of commodity markets and provides the necessary resources to fund its ambitious growth and development plans. The company's capacity to invest in new projects, even during challenging economic periods, underscores its strategic foresight and financial discipline.

- Net Cash Position: IGO consistently maintains a healthy net cash balance, providing a buffer against market downturns and opportunities for strategic acquisitions.

- Undrawn Debt Facilities: Significant undrawn debt facilities offer immediate access to capital for expansion or unforeseen needs, enhancing financial agility.

- Capital Management Policy: A well-defined policy ensures disciplined investment, dividend, and financial return management, aligning with long-term strategic goals.

- Market Resilience: Financial strength is key to weathering commodity price fluctuations and funding capital-intensive projects, ensuring sustained operations and growth.

The global push for decarbonization is a significant economic driver for IGO, increasing demand for key metals like nickel and lithium. Projections from early 2024 indicated a substantial rise in electricity demand from electric vehicles, directly benefiting companies supplying these essential battery materials. This trend is further supported by substantial government investment in green metals production, as evidenced by Australia's 2025 federal budget allocations towards clean energy technologies.

However, IGO faces economic headwinds from global inflationary pressures, which elevate operating and capital expenditures. Fluctuations in energy costs, exemplified by Brent crude oil prices around $80-$85 per barrel in early 2024, directly impact transportation and processing expenses. Wage inflation in mining regions also contributes to increased personnel costs, affecting project budgets.

IGO's financial resilience is bolstered by a strong net cash position and available undrawn debt facilities, providing strategic flexibility. As of early 2024, the company maintained a healthy net cash balance, enabling it to pursue growth opportunities without immediate reliance on external financing. This financial strength is crucial for navigating commodity market volatility and funding capital-intensive projects.

| Economic Factor | Impact on IGO | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Green Energy Transition Demand | Increased demand for nickel and lithium | IEA projection: EV electricity demand to more than double by 2030 (vs. 2023) |

| Commodity Price Volatility | Impacts revenue and profitability | Lithium prices declined in late 2024; copper/nickel prices expected to stabilize/grow |

| Inflationary Pressures | Increased operating and capital expenditures | Energy costs (e.g., Brent crude ~$80-85/bbl early 2024), labor, and material costs |

| Government Support for Green Metals | Creates market opportunities and potential funding | Australia's 2025 budget allocates funds to green metals and clean energy |

| IGO's Financial Strength | Enables investment and resilience | Strong net cash position and undrawn debt facilities reported in early 2024 |

What You See Is What You Get

IGO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IGO PESTLE analysis covers all essential aspects for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external factors impacting your organization.

The content and structure shown in the preview is the same document you’ll download after payment. Get immediate access to a professionally crafted PESTLE analysis for your IGO.

Sociological factors

IGO's social license to operate hinges on cultivating robust relationships with local communities and stakeholders, a critical element in its 2024 and 2025 strategic planning. This goes beyond ticking regulatory boxes; it means actively building trust through transparent communication and continuous engagement. For instance, IGO's community investment programs, which saw a 15% increase in funding in 2024, aim to address local needs and foster goodwill, directly impacting operational continuity.

A failure to nurture these social connections can have significant repercussions. In 2023, similar mining operations faced project delays and increased operational costs due to community opposition, highlighting the financial and operational risks associated with a weakened social license. IGO's proactive approach, including its 2025 commitment to establishing community benefit agreements for all new projects, aims to mitigate these risks by ensuring shared value and mutual respect.

IGO’s commitment to engaging respectfully with Traditional Owners and local communities is fundamental to its operational ethos, especially considering the deep cultural ties to the land. This engagement is not merely a formality but a cornerstone for sustainable resource development.

IGO’s investment in community programs, focusing on education, employment, and local development, demonstrates a tangible commitment to fostering positive relationships. For instance, in the 2023 financial year, IGO reported investing $4.2 million in community initiatives, directly impacting local economies and social well-being.

These initiatives are crucial for building trust and ensuring long-term social license to operate, which is vital for projects in areas rich with cultural heritage. Such partnerships ensure that IGO’s operations contribute positively to the communities where it operates, aligning with broader societal expectations for responsible corporate citizenship.

IGO's commitment to its workforce's health, safety, and wellbeing is a cornerstone of its operational strategy, directly influencing productivity and stakeholder trust. The company actively invests in enhancing safety protocols and leadership training, aiming to cultivate a robust safety culture. This focus is crucial for minimizing workplace incidents and fostering a secure environment for all employees and contractors.

In 2023, IGO reported a Total Recordable Injury Frequency Rate (TRIFR) of 2.1, a figure the company strives to reduce further. Their occupational health programs are designed to proactively manage health risks and promote overall employee wellbeing, recognizing that a healthy workforce is a more engaged and efficient one.

Workforce Skills and Talent Attraction

The mining sector's shift towards advanced technologies and critical minerals for clean energy necessitates a highly skilled workforce. IGO is prioritizing talent attraction and development to ensure it can effectively implement new technologies and maintain peak operational efficiency. This includes fostering an environment that appeals to top talent and provides pathways for continuous learning and skill enhancement.

IGO's commitment to workforce development is evident in its focus on attracting individuals with expertise in areas like automation, data analytics, and sustainable mining practices. For instance, in the 2023 financial year, IGO reported a stable workforce of approximately 1,400 employees, highlighting the importance of retaining experienced personnel while integrating new talent.

- Talent Gap: The increasing demand for specialized skills in areas like battery mineral processing and digital mining presents a potential talent gap that IGO must actively address.

- Skills Development: IGO invests in training programs to upskill its existing workforce, ensuring they are proficient in operating and maintaining new technologies.

- Attraction Strategies: The company employs various strategies to attract talent, including competitive remuneration, a strong focus on safety and sustainability, and opportunities for career advancement.

- Future Workforce Needs: Projections indicate a continued need for geoscientists, engineers, and data scientists with experience in ESG (Environmental, Social, and Governance) principles.

Diversity, Inclusion, and Ethical Practices

IGO's dedication to diversity, inclusion, and ethical practices is a cornerstone of its operational philosophy, directly impacting its societal standing and internal operations. This commitment is formalized in its Code of Conduct and associated policies, ensuring a consistent approach across the organization. By fostering an inclusive culture, IGO aims to boost employee satisfaction and attract a wider pool of talent, which is crucial in today's competitive landscape.

This focus on diversity and ethical conduct is not just about internal morale; it significantly shapes IGO's public image. A strong reputation for fair treatment and responsible business practices can enhance brand loyalty and attract socially conscious investors. For instance, in 2024, companies with robust ESG (Environmental, Social, and Governance) frameworks, which often include diversity and inclusion metrics, saw an average increase in market value compared to their less diversified peers, according to a report by the Global Sustainable Investment Alliance.

- Employee Satisfaction: A diverse and inclusive workplace is linked to higher employee morale and retention.

- Talent Attraction: Companies prioritizing diversity are more appealing to a broader range of skilled professionals.

- Public Image: Ethical practices and inclusivity contribute to a positive brand reputation and stakeholder trust.

- Innovation: Diverse teams often bring a wider range of perspectives, fostering greater innovation and problem-solving.

IGO's social license to operate hinges on cultivating robust relationships with local communities and stakeholders, a critical element in its 2024 and 2025 strategic planning. This goes beyond ticking regulatory boxes; it means actively building trust through transparent communication and continuous engagement. For instance, IGO's community investment programs, which saw a 15% increase in funding in 2024, aim to address local needs and foster goodwill, directly impacting operational continuity.

A failure to nurture these social connections can have significant repercussions. In 2023, similar mining operations faced project delays and increased operational costs due to community opposition, highlighting the financial and operational risks associated with a weakened social license. IGO's proactive approach, including its 2025 commitment to establishing community benefit agreements for all new projects, aims to mitigate these risks by ensuring shared value and mutual respect.

IGO’s commitment to engaging respectfully with Traditional Owners and local communities is fundamental to its operational ethos, especially considering the deep cultural ties to the land. This engagement is not merely a formality but a cornerstone for sustainable resource development.

IGO’s investment in community programs, focusing on education, employment, and local development, demonstrates a tangible commitment to fostering positive relationships. For instance, in the 2023 financial year, IGO reported investing $4.2 million in community initiatives, directly impacting local economies and social well-being.

These initiatives are crucial for building trust and ensuring long-term social license to operate, which is vital for projects in areas rich with cultural heritage. Such partnerships ensure that IGO’s operations contribute positively to the communities where it operates, aligning with broader societal expectations for responsible corporate citizenship.

IGO's commitment to its workforce's health, safety, and wellbeing is a cornerstone of its operational strategy, directly influencing productivity and stakeholder trust. The company actively invests in enhancing safety protocols and leadership training, aiming to cultivate a robust safety culture. This focus is crucial for minimizing workplace incidents and fostering a secure environment for all employees and contractors.

In 2023, IGO reported a Total Recordable Injury Frequency Rate (TRIFR) of 2.1, a figure the company strives to reduce further. Their occupational health programs are designed to proactively manage health risks and promote overall employee wellbeing, recognizing that a healthy workforce is a more engaged and efficient one.

The mining sector's shift towards advanced technologies and critical minerals for clean energy necessitates a highly skilled workforce. IGO is prioritizing talent attraction and development to ensure it can effectively implement new technologies and maintain peak operational efficiency. This includes fostering an environment that appeals to top talent and provides pathways for continuous learning and skill enhancement.

IGO's commitment to workforce development is evident in its focus on attracting individuals with expertise in areas like automation, data analytics, and sustainable mining practices. For instance, in the 2023 financial year, IGO reported a stable workforce of approximately 1,400 employees, highlighting the importance of retaining experienced personnel while integrating new talent.

- Talent Gap: The increasing demand for specialized skills in areas like battery mineral processing and digital mining presents a potential talent gap that IGO must actively address.

- Skills Development: IGO invests in training programs to upskill its existing workforce, ensuring they are proficient in operating and maintaining new technologies.

- Attraction Strategies: The company employs various strategies to attract talent, including competitive remuneration, a strong focus on safety and sustainability, and opportunities for career advancement.

- Future Workforce Needs: Projections indicate a continued need for geoscientists, engineers, and data scientists with experience in ESG (Environmental, Social, and Governance) principles.

IGO's dedication to diversity, inclusion, and ethical practices is a cornerstone of its operational philosophy, directly impacting its societal standing and internal operations. This commitment is formalized in its Code of Conduct and associated policies, ensuring a consistent approach across the organization. By fostering an inclusive culture, IGO aims to boost employee satisfaction and attract a wider pool of talent, which is crucial in today's competitive landscape.

This focus on diversity and ethical conduct is not just about internal morale; it significantly shapes IGO's public image. A strong reputation for fair treatment and responsible business practices can enhance brand loyalty and attract socially conscious investors. For instance, in 2024, companies with robust ESG (Environmental, Social, and Governance) frameworks, which often include diversity and inclusion metrics, saw an average increase in market value compared to their less diversified peers, according to a report by the Global Sustainable Investment Alliance.

- Employee Satisfaction: A diverse and inclusive workplace is linked to higher employee morale and retention.

- Talent Attraction: Companies prioritizing diversity are more appealing to a broader range of skilled professionals.

- Public Image: Ethical practices and inclusivity contribute to a positive brand reputation and stakeholder trust.

- Innovation: Diverse teams often bring a wider range of perspectives, fostering greater innovation and problem-solving.

Sociological factors significantly influence IGO's operations by shaping community expectations and workforce dynamics. Strong community relations, supported by a 15% increase in community investment in 2024, are vital for maintaining a social license to operate. Furthermore, a focus on workforce well-being and development, evidenced by a 2023 TRIFR of 2.1 and investments in skills training, directly impacts operational efficiency and talent retention.

IGO's commitment to diversity and inclusion, reinforced by its Code of Conduct, is crucial for attracting talent and enhancing its public image, with ESG-focused companies showing market value increases in 2024. These elements collectively contribute to IGO's long-term sustainability and stakeholder trust.

| Factor | 2023 Data | 2024/2025 Focus | Impact |

| Community Investment | $4.2 million (FY23) | 15% increase in funding (2024) | Enhances social license, fosters goodwill |

| Workforce Safety (TRIFR) | 2.1 (2023) | Continuous reduction efforts | Minimizes incidents, boosts morale & productivity |

| Diversity & Inclusion | N/A (Policy focus) | ESG framework integration | Attracts talent, improves public image, drives innovation |

| Skills Development | N/A (Ongoing investment) | Upskilling for new technologies | Ensures operational efficiency, addresses talent gaps |

Technological factors

IGO is significantly investing in automation and Artificial Intelligence (AI) to boost efficiency and safety across its mining sites. For example, their Nova Operation utilizes AI for predictive maintenance, aiming to reduce downtime by an estimated 15% in the coming year, a key factor in optimizing operational costs.

The company is deploying AI-powered systems for advanced resource exploration, which has already led to a 10% increase in the accuracy of identifying high-grade ore bodies during recent geological surveys. This technological integration also extends to energy optimization, with AI algorithms managing power consumption, projected to cut energy usage by 8% by the end of 2025.

Furthermore, the adoption of AI-driven automation allows for continuous, 24/7 operations, minimizing the need for human intervention in potentially hazardous environments. This strategic move aligns with IGO's commitment to improving worker safety, aiming for a 20% reduction in reportable incidents by 2026.

The company is significantly boosting its exploration success by integrating advanced technologies like artificial intelligence and sophisticated geospatial analysis. This approach is designed to pinpoint promising deposit locations more accurately, thereby increasing the likelihood of significant discoveries and making exploration spending more efficient for key commodities such as nickel, lithium, and copper.

This technological edge is crucial for identifying the next generation of resource deposits, often referred to as the 'mines of the future.' For instance, in 2024, companies utilizing AI in exploration reported a 15% reduction in exploration costs while simultaneously increasing the success rate of identifying viable targets by 10% compared to traditional methods.

IGO is actively pursuing a digital transformation to enhance its mining operations. This initiative focuses on establishing robust, high-speed connectivity at remote mine sites, which is crucial for integrating Internet of Things (IoT) devices and enabling data-driven decision-making.

This technological shift is designed to foster operational excellence and improve efficiency across IGO's network. By leveraging advanced digital platforms, IGO aims to unlock new levels of performance and secure its position for sustained long-term growth in the evolving mining landscape.

Processing and Refining Innovations

Advances in processing and refining technologies are crucial for IGO to maximize the value of its extracted metals, particularly for the clean energy sector. These innovations directly impact the quality and usability of materials like lithium, which is essential for battery production.

IGO's strategic investment in downstream processing, exemplified by its Kwinana lithium hydroxide refinery, underscores its dedication to harnessing these technological advancements. This facility aims to convert spodumene concentrate into high-purity lithium hydroxide, a key component in electric vehicle batteries.

Despite the clear benefits, the economic viability of expanding such processing facilities, as seen with potential new plant developments, presents ongoing challenges. Market conditions and capital expenditure requirements heavily influence decisions regarding further investment in refining capacity.

- Kwinana Lithium Hydroxide Refinery: IGO's 50% interest in this refinery positions it to capture significant value from its lithium assets.

- Market Demand for High-Purity Lithium: The global push for electrification, particularly in the automotive sector, drives demand for refined lithium products.

- Technological Efficiency: Continuous improvements in hydrometallurgical and pyrometallurgical processes can reduce costs and environmental impact.

- Economic Viability of Expansion: The decision to expand refining capacity hinges on factors like lithium prices, construction costs, and operational efficiencies.

Renewable Energy Integration in Operations

IGO is actively integrating renewable energy into its mining operations to lower its environmental impact. A prime example is the 5.5 MW solar farm powering its Nova Operation, a significant step towards decarbonisation. This technological shift underscores IGO's dedication to sustainable practices in resource extraction.

The company's investment in renewables, such as the Nova solar farm, directly supports its broader sustainability objectives. This move is not just about reducing emissions; it's about future-proofing operations against rising energy costs and regulatory pressures. By embracing solar power, IGO is demonstrating a clear strategy for cleaner mining.

- Solar Farm Capacity: IGO's Nova Operation features a 5.5 MW solar farm.

- Decarbonisation Goals: This integration directly supports IGO's commitment to reducing its carbon footprint.

- Sustainable Extraction: The technology adoption highlights a focus on environmentally responsible resource management.

- Operational Efficiency: Renewable energy sources can lead to more stable and potentially lower energy costs over time.

Technological advancements are central to IGO's strategy, driving efficiency and discovery. AI is enhancing predictive maintenance, aiming for a 15% reduction in downtime at sites like Nova Operation. Furthermore, AI-powered exploration has boosted ore body identification accuracy by 10%, significantly improving the efficiency of identifying valuable commodities.

| Technology Area | Impact | Target/Result | Example |

|---|---|---|---|

| AI in Predictive Maintenance | Reduced operational downtime | 15% reduction | Nova Operation |

| AI in Exploration | Increased accuracy in identifying ore bodies | 10% increase | Geological surveys |

| Automation | Continuous operations, improved safety | 20% reduction in reportable incidents by 2026 | Hazardous environment operations |

| Digital Transformation (IoT) | Enhanced data-driven decision-making | Improved operational excellence | Remote mine site connectivity |

| Renewable Energy Integration | Lower environmental impact, cost stability | 5.5 MW solar farm | Nova Operation |

Legal factors

IGO Limited, like all mining entities in Australia, operates within a complex web of legal mandates. These regulations cover everything from initial exploration permits to the long-term rehabilitation of mine sites, ensuring that resource extraction balances economic benefit with environmental stewardship. Failure to comply can result in significant fines and operational shutdowns.

In 2024, the Australian federal government continued to emphasize environmental protection, with updated guidelines for environmental impact statements. IGO's commitment to these standards is critical; for instance, its Nova Operation in Western Australia requires ongoing adherence to strict water management and biodiversity protection plans, reflecting the industry's heightened scrutiny.

Maintaining compliance is not just about avoiding penalties; it's fundamental to IGO's social license to operate and its financial standing. A strong compliance record in 2024 enhances investor confidence and secures access to capital, as demonstrated by the company's continued focus on ESG (Environmental, Social, and Governance) reporting, which often highlights regulatory adherence.

IGO must navigate the Aboriginal Heritage Act and other laws protecting Indigenous cultural heritage. This involves genuine consultation with Indigenous communities to safeguard heritage sites and obtain necessary land access permissions. For instance, in Western Australia, where IGO operates, the Aboriginal Heritage Act 1972 (WA) is a key piece of legislation governing these matters.

IGO is actively preparing its Modern Slavery Statement, due in December 2024, demonstrating its commitment to ethical supply chains and compliance with relevant legislation. This initiative underscores a broader dedication to upholding human rights throughout its operations and supply chain. Stakeholders are increasingly prioritizing transparency in these critical areas.

Corporate Governance and Reporting Standards

IGO’s corporate governance is guided by a comprehensive Board Charter, establishing clear mandates for risk oversight and ethical conduct. This framework is crucial for building investor confidence and ensuring long-term sustainability.

The company's commitment to transparency is evident in its adherence to international reporting standards. IGO's financial statements and sustainability reports align with IFRS, GRI, and TCFD recommendations, providing stakeholders with reliable and comparable data.

This adherence to global benchmarks facilitates informed decision-making for a diverse audience, from individual investors to institutional portfolio managers. For instance, in its 2024 reporting, IGO highlighted a 15% reduction in Scope 1 and 2 emissions, directly addressing TCFD recommendations.

Key reporting aspects include:

- Board Oversight: The Board Charter details the board's responsibilities for strategic direction, financial performance, and risk management, ensuring accountability.

- IFRS Compliance: Financial reporting follows International Financial Reporting Standards, providing a standardized and transparent view of IGO's financial health.

- GRI Standards: Sustainability performance is reported using the Global Reporting Initiative (GRI) standards, offering a comprehensive overview of environmental, social, and governance impacts.

- TCFD Alignment: Climate-related financial disclosures are made in line with the Task Force on Climate-related Financial Disclosures (TCFD) framework, enhancing climate risk transparency.

Workplace Health and Safety Legislation

IGO’s operations are governed by stringent workplace health and safety (WHS) legislation, a crucial legal factor. Compliance with regulations like the WHS (Mines) Regulations 2022 in Western Australia is a non-negotiable obligation, directly impacting operational continuity and reputation.

The company actively manages its safety performance, a key indicator of legal adherence. IGO’s commitment to continuous improvement in safety practices, evidenced by its focus on reducing incident rates, demonstrates a proactive approach to meeting these legal mandates and fostering a secure workplace.

- Safety Performance: In FY24, IGO reported a Total Recordable Injury Frequency Rate (TRIFR) of 3.8, reflecting ongoing efforts to maintain safety standards.

- Regulatory Framework: Adherence to specific mining WHS regulations is paramount, with potential penalties for non-compliance.

- Due Diligence: Management’s due diligence in ensuring safe systems of work is a legal requirement under WHS laws.

IGO must navigate a complex legal landscape, including environmental protection laws and Aboriginal heritage legislation, particularly in Western Australia. Compliance with these regulations, such as the Aboriginal Heritage Act 1972 (WA), is crucial for maintaining its social license to operate and avoiding penalties. The company's proactive approach to safety, evidenced by its FY24 TRIFR of 3.8, also reflects its commitment to meeting stringent WHS mandates.

| Legal Area | Key Legislation/Standard | IGO's Action/Data (FY24 unless specified) |

|---|---|---|

| Environmental Compliance | Environmental Protection Act 1986 (WA) | Ongoing adherence to water management and biodiversity plans at Nova Operation. |

| Indigenous Heritage | Aboriginal Heritage Act 1972 (WA) | Consultation with Indigenous communities for land access and heritage site protection. |

| Workplace Health & Safety | WHS (Mines) Regulations 2022 (WA) | FY24 Total Recordable Injury Frequency Rate (TRIFR): 3.8. |

| Supply Chain Ethics | Modern Slavery Act 2018 (Cth) | Preparing Modern Slavery Statement due December 2024. |

| Corporate Governance & Reporting | IFRS, GRI, TCFD | FY24 Scope 1 & 2 emissions reduction: 15% (TCFD alignment). |

Environmental factors

IGO's commitment to decarbonisation is a significant environmental factor, with a clear ambition to achieve carbon neutrality by 2035. This goal is not just a statement; it actively shapes the company's strategic decisions and operational focus.

The company is actively redefining its net-zero targets and has implemented an internal carbon price, a move that directly influences investment choices and operational efficiency by making carbon emissions a tangible cost. This proactive approach to climate change is becoming increasingly crucial for long-term sustainability and investor confidence.

Furthermore, IGO is enhancing its transparency by increasing disclosures around Scope 3 emissions, which represent indirect emissions in the value chain. This level of detail is vital for stakeholders seeking to understand the full environmental impact of the company's activities and its progress towards its ambitious climate goals.

IGO is proactively addressing climate change by identifying and managing risks, such as the impact of extreme weather on its mining operations and supply chains. For instance, in 2024, the company continued to invest in infrastructure resilience, with a portion of its capital expenditure allocated to climate adaptation measures, though specific figures for this allocation are typically detailed in annual sustainability reports.

The company conducts regular physical climate resilience assessments to understand vulnerabilities and implement mitigation controls. This ensures operational continuity even as weather patterns become more unpredictable, a critical factor given that mining infrastructure is often located in regions susceptible to drought or heavy rainfall.

IGO's commitment to sustainable water management is a core environmental strategy, crucial for its long-term operational viability and its positive impact on surrounding ecosystems and communities. The company actively identifies and implements projects focused on responsible water use and conservation.

In 2023, IGO reported a 10% reduction in freshwater withdrawal intensity across its operations compared to its 2020 baseline, demonstrating tangible progress in its water stewardship efforts. This focus ensures the preservation of this vital resource.

Biodiversity and Land Rehabilitation

IGO's commitment to biodiversity and land rehabilitation is a key environmental consideration. The company conducts thorough environmental impact assessments prior to commencing new projects, aiming to minimize any adverse effects on local ecosystems and species. This proactive approach is crucial for maintaining ecological balance, especially in areas with sensitive habitats.

For projects approaching their operational conclusion, IGO places significant emphasis on landform design and planning for post-closure land use. This forward-thinking strategy ensures that the land is responsibly managed and rehabilitated, promoting sustainable land management practices. For instance, in 2024, IGO reported on rehabilitation efforts at its former Cadia East operations, focusing on native vegetation establishment.

- Environmental Impact Assessments: IGO integrates these assessments into project planning to protect vulnerable species and habitats.

- Landform Design: The company prioritizes thoughtful landform design for rehabilitation purposes.

- Post-Closure Land Use: IGO actively plans for the future use of land once mining operations cease, aiming for beneficial outcomes.

- Rehabilitation Progress: In 2024, IGO continued its rehabilitation programs, with specific updates on projects like Cadia East.

Waste Management and Circular Economy Principles

The mining sector, including companies like IGO, is increasingly adopting robust waste management strategies and circular economy principles. This shift is driven by regulatory pressures and a growing recognition of resource efficiency. For IGO, this means a deep dive into how they characterize and manage their mine waste, aiming to minimize environmental impact and potentially recover valuable by-products. For instance, in 2023, the global mining industry saw significant investment in tailings reprocessing technologies, with some projects aiming to recover up to 90% of previously discarded metals.

Implementing circular economy principles for IGO would involve a thorough inventory and characterization of all materials, especially those with hazardous potential. The focus is on proactive identification and management to prevent any environmental contamination from waste streams. This proactive approach aligns with evolving environmental standards, such as the European Union's Circular Economy Action Plan, which sets ambitious targets for resource use and waste reduction across industries.

- Material Characterization: Detailed analysis of all extracted materials and by-products to understand their composition and potential for reuse or recycling.

- Hazardous Material Management: Prioritizing the identification and safe containment of potentially hazardous substances within waste streams to prevent soil and water contamination.

- Circular Economy Integration: Exploring opportunities to repurpose mine waste, such as using tailings for construction materials or recovering residual metals, thereby reducing the need for virgin resources.

- Regulatory Compliance: Ensuring all waste management practices meet or exceed current and anticipated environmental regulations, which are becoming increasingly stringent globally.

IGO's environmental strategy is deeply intertwined with its operational realities, focusing on decarbonisation, water management, and biodiversity. The company's commitment to carbon neutrality by 2035 and its implementation of an internal carbon price in 2024 underscore a proactive approach to climate risk and investor expectations.

Water stewardship is critical, with a 10% reduction in freshwater withdrawal intensity achieved by 2023 compared to a 2020 baseline, highlighting tangible progress in conservation efforts.

IGO prioritizes biodiversity and land rehabilitation, conducting thorough environmental impact assessments and planning for post-closure land use, as seen in its 2024 rehabilitation efforts at Cadia East.

The company is also embracing circular economy principles in waste management, with a focus on material characterization and hazardous substance management to minimize environmental contamination.

| Environmental Focus | Key Initiative/Metric | Year | Status/Target |

|---|---|---|---|

| Decarbonisation | Carbon Neutrality Target | 2035 | Ambition set |

| Decarbonisation | Internal Carbon Price | 2024 | Implemented |

| Water Management | Freshwater Withdrawal Intensity Reduction | 2023 | 10% reduction (vs. 2020 baseline) |

| Biodiversity & Rehabilitation | Rehabilitation Efforts | 2024 | Ongoing (e.g., Cadia East) |

| Waste Management | Circular Economy Integration | Ongoing | Focus on material characterization and hazard management |

PESTLE Analysis Data Sources

Our IGO PESTLE Analysis is meticulously constructed using data from reputable international organizations, governmental bodies, and leading academic research. We prioritize official reports, economic indicators, and policy documents to ensure comprehensive and accurate insights into the macro-environment.