IGO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGO Bundle

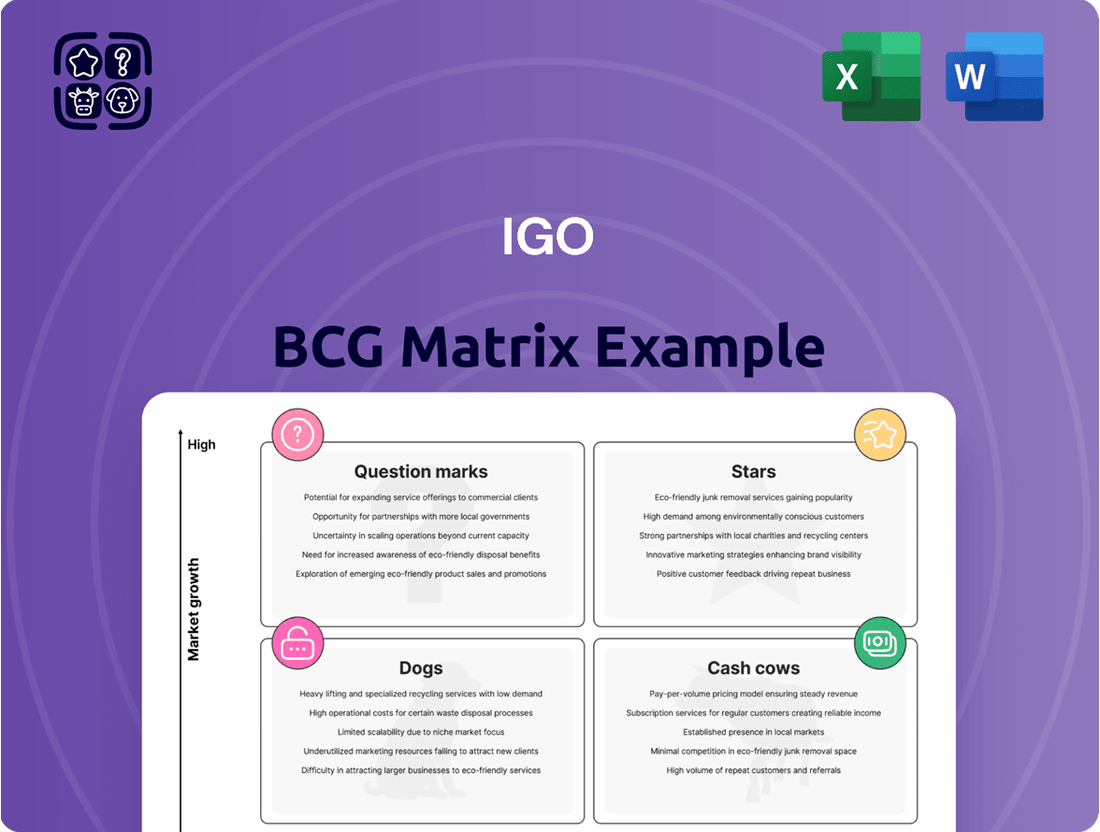

Uncover the strategic positioning of a company's product portfolio with the BCG Matrix, a powerful tool that categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This insightful framework helps businesses make informed decisions about resource allocation and future investments. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your product mix and drive sustainable growth.

Stars

IGO holds a significant 24.99% indirect stake in the Greenbushes Lithium Operation, a globally recognized leader as the world's largest hard rock lithium mine. This operation is instrumental to IGO's strategic focus on clean energy metals.

Despite a recent downturn in lithium market prices, Greenbushes continues to exhibit robust margins and impressive cash flow generation. This financial resilience underscores its importance as a cornerstone asset for IGO's expansion plans.

The ongoing Chemical Grade Plant 3 (CGP3) expansion at Greenbushes is projected to boost spodumene concentrate production capacity by an additional 500,000 tonnes per annum (tpa) by the second quarter of fiscal year 2026. This expansion further cements Greenbushes' position as a star performer within IGO's portfolio.

IGO is strategically prioritizing metals vital for the clean energy revolution, specifically nickel, lithium, and copper. This focus aligns perfectly with the accelerating global demand for electric vehicles and renewable energy storage solutions.

CEO Ivan Vella has highlighted this deliberate shift, aiming to cultivate a robust and varied portfolio centered around these essential battery metals. For instance, in the fiscal year 2023, IGO's nickel production reached approximately 27,000 tonnes, showcasing their established operational capacity in a key clean energy metal.

IGO's commitment to exploration is a cornerstone of its strategy, aiming to unearth the critical metals essential for the clean energy transition. This forward-looking approach ensures a pipeline of future resources. For instance, in the 2023 financial year, IGO reported significant exploration expenditure, with a substantial portion allocated to greenfield and brownfield projects across its Australian portfolio.

The company's active exploration at sites like Cosmos and Copper Wolf exemplifies this drive for organic growth. These projects are meticulously managed to identify and advance high-potential targets, underscoring IGO's belief in the power of discovery to fuel long-term success. In 2024, IGO continued to expand its exploration footprint, actively seeking out new opportunities in prospective regions.

Nova Nickel-Copper-Cobalt Operation (Until late 2026)

The Nova Nickel-Copper-Cobalt Operation, slated for closure in late 2026, has been a cornerstone for IGO, consistently delivering robust nickel, copper, and cobalt output. Its significant contributions to the company's revenue and EBITDA, even with a limited remaining operational window, firmly place it in the Star category of the BCG matrix.

Despite its approaching end-of-life, Nova's current strong operational performance and healthy cash flow generation solidify its position. For instance, in the fiscal year 2023, Nova's nickel production reached 28,214 tonnes, with copper at 13,392 tonnes and cobalt at 1,034 tonnes. This sustained output underscores its Star status, representing a valuable, though temporary, asset.

- High Market Share: Nova has historically held a significant share in the nickel, copper, and cobalt markets due to its high-grade ore.

- Strong Revenue Contribution: The operation has been a major revenue and EBITDA generator for IGO.

- Limited Growth Potential: Its projected end of life in late 2026 limits future growth prospects.

- Cash Flow Generation: Despite its finite life, Nova continues to generate substantial cash flow in the near term.

Commitment to Operational Efficiency and Sustainability

IGO’s dedication to improving how it runs its operations and its commitment to sustainability are key. This focus not only makes the company stronger for the future but also appeals to investors looking for responsible companies. By getting the most out of its current mines and projects, IGO is well-positioned to meet the increasing global need for metals crucial to clean energy.

- Operational Efficiency: IGO actively seeks to streamline processes, reduce waste, and adopt new technologies to lower production costs and boost output.

- Sustainability Focus: The company prioritizes environmental stewardship, social responsibility, and good governance (ESG) in all its activities.

- Clean Energy Metals: IGO’s portfolio includes significant holdings in nickel and lithium, vital components for electric vehicle batteries and renewable energy storage.

- Market Demand: In 2024, the demand for battery metals remained robust, driven by the accelerating global transition to electric vehicles and cleaner energy sources.

Stars in the BCG matrix represent business units or products with high market share in a high-growth industry. For IGO, its significant stake in the Greenbushes Lithium Operation clearly positions it as a Star. Despite market fluctuations, Greenbushes consistently demonstrates strong financial performance and is undergoing expansion, further solidifying its Star status.

The Nova Nickel-Copper-Cobalt Operation, though nearing its operational end, also qualifies as a Star due to its historical high market share and substantial revenue contribution. Even with its projected closure in late 2026, Nova's current strong cash flow generation and output, such as its 28,214 tonnes of nickel in fiscal year 2023, underscore its value as a Star asset during its remaining life.

IGO's strategic focus on clean energy metals like nickel and lithium, coupled with its active exploration efforts in 2024, aims to cultivate future Stars. The company's commitment to operational efficiency and sustainability further enhances its potential to develop and maintain Star performers in the evolving market for critical minerals.

| Asset | Category | Key Characteristics | 2023 Data Highlights |

|---|---|---|---|

| Greenbushes Lithium Operation | Star | High market share in lithium, high growth industry, strong cash flow, expansion underway (CGP3) | World's largest hard rock lithium mine, robust margins |

| Nova Nickel-Copper-Cobalt Operation | Star | High market share (historically), strong revenue/EBITDA, limited growth potential (closure late 2026), strong near-term cash flow | Nickel: 28,214 tonnes; Copper: 13,392 tonnes; Cobalt: 1,034 tonnes |

What is included in the product

The BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

A clear BCG Matrix visualizes portfolio health, easing the pain of resource allocation uncertainty.

Cash Cows

The Greenbushes Lithium Operation, in which IGO holds an indirect stake, is a prime example of a cash cow within the BCG matrix. It consistently generates robust margins and significant cash flows for the company, underscoring its importance to IGO's financial health.

This operation's primary revenue stream comes from the sale of spodumene concentrate. Despite potential volatility in lithium market prices, Greenbushes remains a dependable generator of cash, providing stability and funding for other ventures.

For instance, in the fiscal year 2023, IGO's share of Greenbushes' EBITDA was approximately AUD 1.1 billion, highlighting its substantial cash-generating capability.

The Greenbushes joint venture is a prime example of a cash cow for IGO. Its consistent ability to generate substantial dividends underscores its maturity and strong cash-generating capacity.

In March 2024, the Greenbushes joint venture distributed a significant US$110 million dividend to its partners, including IGO. This substantial payout highlights the venture's robust financial performance and its role as a reliable source of surplus cash.

This surplus cash generated by Greenbushes can be strategically deployed to fuel growth initiatives in other IGO business segments or returned directly to shareholders, enhancing overall shareholder value.

The Nova Operation, prior to its projected closure in late 2026, is a significant contributor to IGO's financial health, consistently generating cash. Its established nickel, copper, and cobalt production, even with a finite lifespan, bolsters IGO's overall liquidity.

In the fiscal year 2023, Nova reported a robust EBITDA of AUD 294 million, underscoring its strong cash-generating capability. This consistent performance solidifies its role as a cash cow for IGO, providing a stable financial base.

Optimized Capital Expenditure at Greenbushes

IGO has strategically adjusted its fiscal 2025 capital expenditure for Greenbushes, signaling a commitment to optimizing investments. This means the focus is on maintaining current production levels rather than pursuing aggressive new growth initiatives for this mature asset.

This disciplined capital allocation approach is designed to preserve the high profit margins and robust cash flow that Greenbushes consistently delivers. By avoiding significant expansion, IGO ensures the asset's efficiency and financial strength.

- Fiscal 2025 Capex Adjustment: IGO revised its capital expenditure plans for Greenbushes, prioritizing optimization over expansion.

- Focus on Productivity: The strategy centers on maintaining current operational output, reflecting the asset's mature stage.

- Profit Margin Preservation: This disciplined approach supports sustained high profit margins from the Greenbushes operation.

- Strong Cash Flow Generation: The optimization efforts are geared towards ensuring continued strong cash flow from this key asset.

Existing Production of Nickel, Copper, and Cobalt

The established production of nickel, copper, and cobalt from IGO's existing operations, notably the Nova mine, serves as a significant cash cow. This ongoing output generates a reliable revenue stream, underpinning the company's financial stability in the short to medium term. These mature assets, despite navigating fluctuating commodity prices, demand comparatively lower investment for continued production and market presence when contrasted with nascent projects.

In 2024, IGO's Nova operation continued to be a cornerstone, demonstrating resilience in its nickel and copper production. For the fiscal year ended June 30, 2024, Nova produced approximately 28,100 tonnes of nickel and 10,300 tonnes of copper in concentrate. This consistent output, even amidst a challenging market environment, highlights its role as a reliable generator of cash flow for the company.

- Nova's Nickel Production: Approximately 28,100 tonnes in FY24.

- Nova's Copper Production: Approximately 10,300 tonnes in FY24.

- Cobalt Contribution: While not separately itemized in the same production figures, cobalt is a valuable co-product of the nickel-copper concentrate, contributing to overall revenue.

- Cash Generation: The steady output from Nova directly translates into consistent cash inflows, supporting IGO's financial health and enabling investment in growth opportunities.

Cash cows represent mature, high-market-share products or operations that generate more cash than they consume. These are the reliable income generators, often requiring minimal investment to maintain their position. For IGO, both the Greenbushes Lithium Operation and the Nova Operation have historically fit this description, providing stable financial contributions.

The Greenbushes operation, a joint venture, consistently delivers substantial returns. Its role as a cash cow is evident in the significant dividends it distributes, such as the US$110 million paid in March 2024. This consistent cash generation allows IGO to fund other strategic initiatives or return value to shareholders.

Similarly, the Nova Operation, despite its approaching closure, has been a robust cash cow. Its nickel, copper, and cobalt production, exemplified by approximately 28,100 tonnes of nickel and 10,300 tonnes of copper produced in fiscal year 2024, has provided a stable financial base.

IGO's strategic capital allocation for Greenbushes in fiscal year 2025, focusing on optimization rather than expansion, further solidifies its cash cow status. This approach aims to preserve the high profit margins and strong cash flow from this mature asset.

| Operation | Key Products | FY23 EBITDA (IGO Share) | FY24 Production (IGO Share) | Recent Dividend Distribution |

|---|---|---|---|---|

| Greenbushes Lithium Operation | Spodumene Concentrate | ~AUD 1.1 billion | N/A (Spodumene sales) | US$110 million (March 2024) |

| Nova Operation | Nickel, Copper, Cobalt | ~AUD 294 million | ~28,100 t Nickel, ~10,300 t Copper | N/A (Contributions to overall cash flow) |

What You See Is What You Get

IGO BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the comprehensive strategic tool ready for your immediate use. You can confidently assess its value knowing that the final deliverable mirrors this preview precisely, offering a professional and actionable framework for analyzing your business portfolio.

Dogs

The Forrestania nickel operation, now in care and maintenance, clearly fits the 'dog' category in the BCG matrix. This signifies a product with a low market share and minimal growth potential in the current market landscape.

IGO's decision to transition Forrestania reflects a significant downturn; the operation's production and revenue have seen a substantial decrease. For instance, in the first half of fiscal year 2024, Forrestania contributed only A$13.5 million in revenue, a stark contrast to previous periods, and the company has withheld future guidance for this asset.

The Cosmos Nickel Project, under IGO's portfolio, has been placed on care and maintenance, halting mining and processing operations. This strategic shift indicates the project is no longer a significant cash drain but also not contributing to revenue, positioning it as a potential divestment candidate within the BCG framework.

IGO has recorded a significant pre-tax impairment of around $115 million. This charge directly impacts the book value of its exploration assets, specifically those in the Fraser Range and Western Gawler regions.

This substantial write-down indicates that these particular exploration projects are not currently meeting the company's financial expectations. It signals that the capital invested in these ventures isn't generating the anticipated returns and their future viability is uncertain.

Kwinana Lithium Hydroxide Plant 2 (LHP2)

The Kwinana Lithium Hydroxide Plant 2 (LHP2) project, developed by IGO, has been discontinued. This decision stems from a thorough evaluation of its operational performance and economic feasibility, signaling a shift away from a project that was a cash drain without a clear path to profitability. The cessation of works on LHP2 represents a significant impairment for IGO.

This situation places LHP2 squarely in the Dogs quadrant of the BCG matrix. Projects in this category typically have low market share and low growth prospects, often requiring significant cash to maintain but generating little return. For IGO, this means reallocating resources from LHP2 to more promising ventures.

In 2024, IGO reported a substantial impairment related to LHP2, impacting its financial results. While specific figures can fluctuate, such impairments often run into hundreds of millions of dollars, reflecting the sunk costs and the write-off of the asset's book value.

- Project Status: Discontinued, with all works on LHP2 ceased.

- Reason for Discontinuation: Poor operational performance and lack of economic viability.

- BCG Matrix Classification: Dogs, characterized by low market share and low growth, consuming cash without generating profit.

- Financial Impact: Significant impairment charges recorded by IGO, impacting financial statements in 2024.

Certain Discontinued Exploration Projects

IGO Limited, a prominent diversified metals company, has recently undertaken a strategic review of its exploration portfolio. This review has identified certain discontinued exploration projects that will no longer receive further investment. This decision is expected to significantly reduce IGO's overall exploration expenditure.

These discontinued projects represent past investments that, following thorough evaluation, are no longer deemed commercially viable. IGO plans to either divest these assets or write them off from its books. For example, in the fiscal year 2024, IGO reported exploration expenditure of approximately AUD 40 million, and the discontinuation of these projects is anticipated to lead to a material portion of this figure being reallocated or expensed.

- Strategic Portfolio Realignment: IGO is actively pruning its exploration pipeline to focus resources on higher-potential opportunities.

- Financial Impact: The discontinuation of these projects will result in a material reduction in exploration spend for the upcoming fiscal year.

- Asset Management: Past investments in these projects will be managed through divestment or write-offs, reflecting a commitment to capital discipline.

- Focus on Viability: The decision underscores IGO's rigorous approach to assessing project viability and optimizing resource allocation.

IGO's Forrestania nickel operation, now on care and maintenance, and the discontinued Kwinana Lithium Hydroxide Plant 2 (LHP2) both exemplify 'Dogs' in the BCG matrix. These assets have low market share and minimal growth prospects, requiring cash but generating little to no return. IGO's strategic decisions to cease operations and record significant impairments, such as the $115 million pre-tax impairment on exploration assets in 2024, highlight the financial impact of these 'Dog' assets.

The classification of these projects as 'Dogs' indicates a need for careful capital allocation, with IGO likely reallocating resources from these underperforming ventures to more promising opportunities within its portfolio. The cessation of works on LHP2, for instance, signifies a move away from a cash drain without a clear path to profitability.

In fiscal year 2024, Forrestania contributed only A$13.5 million in revenue, underscoring its 'Dog' status. Similarly, the significant impairment charges related to LHP2 reflect the sunk costs and write-off of its book value, further solidifying its position in this category.

These discontinued exploration projects, which represented a material portion of IGO's approximately AUD 40 million exploration expenditure in FY24, are being managed through divestment or write-offs, demonstrating a commitment to capital discipline and focusing on assets with clear viability.

Question Marks

The Copper Wolf joint venture, where IGO is increasing its stake to 70%, represents a classic question mark in the BCG matrix. While the project in Arizona boasts a globally significant copper-molybdenum system with high growth potential, its current market share is minimal due to its early exploration and development stage.

IGO's increased investment, focusing on exploration and development, signals a strategic move to bolster this potential star. As of late 2024, the project's value is largely tied to future projections rather than current revenue, a hallmark of question mark assets needing substantial capital to potentially become market leaders.

The Yeneena Copper Project, a joint venture between IGO and Encounter Resources in Western Australia, likely falls into the question mark category of the BCG matrix for IGO. While IGO recently withdrew from a farm-in agreement, the project's focus on copper, a metal vital for the clean energy transition, indicates significant future potential. However, its current status within IGO's portfolio suggests a low market share and a need for substantial ongoing investment to determine its future success.

IGO is actively pursuing new greenfields lithium exploration targets, including promising areas within the Cosmos Project and Forrestania Project. These ventures are currently undergoing soil sampling and drilling programs to assess their potential.

These exploration efforts represent strategic investments in the rapidly expanding lithium market. However, they are characterized by their early-stage nature, with uncertain commercial viability and a significant need for capital to delineate viable resources.

Other Early-Stage Exploration Projects

IGO's exploration efforts extend beyond its current producing assets to encompass a range of greenfield projects targeting key commodities like nickel, copper, cobalt, gold, and rare earth elements. These ventures, situated in regions such as the Kimberley and Fraser Range, represent the company's commitment to long-term growth.

These early-stage exploration projects are categorized as Question Marks within the BCG matrix. They are characterized by significant upfront investment in exploration activities, with no guarantee of a return. For instance, in fiscal year 2023, IGO's exploration expenditure was approximately AUD 50 million, a substantial portion of which was directed towards these nascent projects.

- High Risk, High Reward: These projects carry substantial geological and market risk, but a successful discovery could lead to a future cornerstone asset.

- Cash Consumption: Exploration is an ongoing cost that drains cash reserves, impacting near-term profitability until a discovery is commercialized.

- Low Market Share: Currently, these projects have no market share as they are not yet in production or contributing revenue.

- Uncertain Returns: The ultimate economic viability and market demand for any discovered resources remain highly speculative.

Kwinana Lithium Hydroxide Plant 1 (LHP1) Performance Improvement

While the Kwinana Lithium Hydroxide Plant 2 (LHP2) has been temporarily paused, IGO is concentrating its efforts on enhancing the operational performance of the Kwinana Lithium Hydroxide Plant 1 (LHP1).

LHP1 is positioned within the rapidly expanding lithium hydroxide market, a sector with significant growth potential. Despite current hurdles in production output and cost management, successful performance improvements at LHP1 could lead to a substantial increase in market share and profitability.

This strategic focus on LHP1 makes it a prime candidate for a Question Mark in the BCG matrix, representing a high-potential asset that requires careful management and investment to realize its full value.

- Market Position: Operates in the high-growth lithium hydroxide market.

- Current Status: Facing challenges with production and cost efficiency.

- Strategic Focus: IGO is prioritizing performance improvements for LHP1.

- Potential: Successful enhancements could significantly boost market share and profitability.

Question Marks represent assets with low market share but high growth potential, requiring significant investment to determine their future. IGO's exploration projects, such as new greenfields lithium targets, exemplify this category. These ventures, like those at the Cosmos and Forrestania Projects, are in early stages, with uncertain commercial viability and substantial capital needs to define resources.

The Copper Wolf joint venture, where IGO is increasing its stake to 70%, also fits the Question Mark profile. Despite its globally significant copper-molybdenum system and high growth potential, its current market share is minimal due to its early exploration and development phase. IGO's increased investment signals a strategic effort to nurture this potential star.

Similarly, the Yeneena Copper Project, a joint venture with Encounter Resources, is a Question Mark for IGO, especially after the company withdrew from a farm-in agreement. The project's focus on copper, crucial for the clean energy transition, offers future potential, but its current status within IGO's portfolio indicates a low market share and a need for ongoing investment.

The Kwinana Lithium Hydroxide Plant 2 (LHP2) pause shifts focus to LHP1, which, despite operational challenges, operates in the high-growth lithium hydroxide market. IGO's prioritization of LHP1's performance improvements makes it a prime Question Mark, a high-potential asset needing careful management and investment to unlock its full value.

| Asset | Category | Market Growth | Market Share | IGO's Investment Focus |

|---|---|---|---|---|

| Copper Wolf JV | Question Mark | High | Minimal | Exploration & Development |

| Yeneena Copper Project | Question Mark | High (Copper for energy transition) | Minimal | Needs further assessment |

| Greenfields Lithium Exploration (Cosmos, Forrestania) | Question Mark | Very High | None (Early Stage) | Soil sampling, drilling |

| Kwinana Lithium Hydroxide Plant 1 (LHP1) | Question Mark | Very High | Low to Moderate (Operational Challenges) | Performance improvements |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position strategic business units.