IGO Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGO Bundle

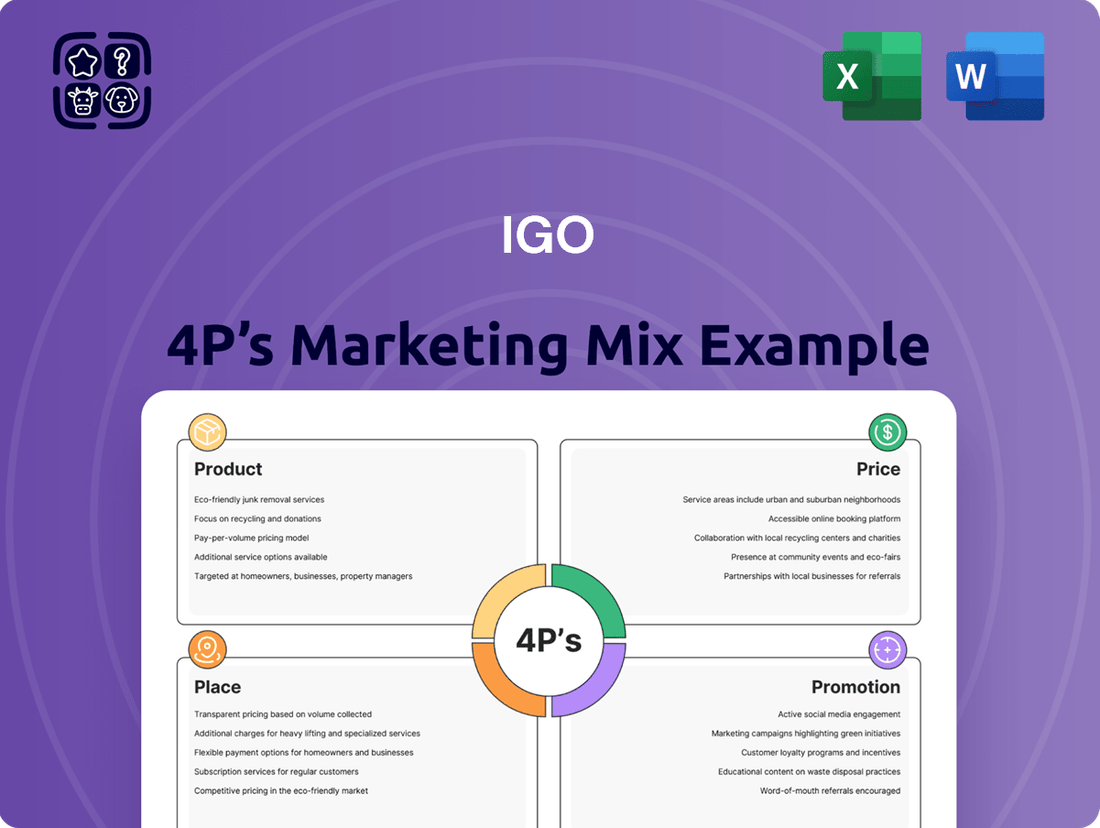

Discover the core of IGO's marketing strategy with our 4Ps analysis, revealing how their product, price, place, and promotion intertwine for market dominance. This snapshot offers a glimpse into their success, but the real insights lie within the full report.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix analysis for IGO, dissecting their product innovation, pricing tactics, distribution channels, and promotional campaigns. Go beyond the surface and gain actionable strategies for your own business.

Product

IGO's core products – nickel, lithium, and copper – are the bedrock of the clean energy revolution. These metals are indispensable for electric vehicle batteries, grid-scale energy storage, and the sprawling infrastructure required for renewable power generation. For instance, the demand for lithium-ion batteries, a key application for lithium and nickel, is projected to grow significantly, with the global market expected to reach hundreds of billions of dollars by 2027.

The company’s strategic focus on these high-demand commodities directly aligns with the urgent global imperative for decarbonization. This positioning allows IGO to capitalize on the substantial growth anticipated in sectors like electric vehicles, where battery raw material costs are a significant component, and renewable energy installations that rely heavily on copper for conductivity.

IGO's product offering fundamentally starts with the upstream mining and exploration of critical minerals. This involves the direct extraction of valuable metals from the earth, forming the very foundation of their business.

IGO is committed to securing future supply through significant investment in exploration activities. This includes both expanding on existing known mineral deposits (brownfield) and searching for entirely new ones (greenfield) across Australia, a key region for mineral discovery.

For instance, in the fiscal year 2023, IGO reported significant exploration expenditure, with approximately AUD 76.9 million allocated to exploration and evaluation activities, underscoring their dedication to discovering new resource opportunities.

IGO's 49% stake in Tianqi Lithium Energy Australia (TLEA) is a cornerstone of its lithium strategy, with TLEA holding a majority 51% interest in the Greenbushes Operation. This partnership provides IGO with significant exposure to the world's largest hard rock lithium mine, a critical source of spodumene concentrate.

Greenbushes, a globally recognized leader in lithium production, yields spodumene concentrate, the essential raw material for manufacturing lithium-ion batteries. In the fiscal year 2023, Greenbushes produced approximately 1.5 million dry metric tonnes of spodumene concentrate, with IGO's share contributing substantially to its revenue streams.

Nickel Concentrates (Nova Operation)

IGO's Nova Nickel Operation, located in Western Australia, is a wholly owned and operated asset that serves as a cornerstone for its nickel production. This operation yields valuable nickel, copper, and cobalt concentrates, crucial for the burgeoning electric vehicle battery market. While the Forrestania Nickel Operation is moving into care and maintenance in 2024-2025 as its resources deplete, Nova's consistent output ensures IGO maintains a significant presence in the nickel supply chain.

The Nova operation is a vital contributor to IGO's financial performance, with its nickel concentrates being a primary revenue driver. For the fiscal year 2023, Nova produced 28,442 tonnes of nickel in concentrate, alongside 12,986 tonnes of copper and 998 tonnes of cobalt in concentrate. This production profile positions Nova as a key asset in a market increasingly focused on critical minerals for a sustainable future.

- Nova Operation: Wholly owned and operated by IGO in Western Australia.

- Product Mix: Produces nickel, copper, and cobalt concentrates.

- Strategic Importance: Remains a key nickel producer as Forrestania transitions to care and maintenance (2024-2025).

- FY23 Production: 28,442 tonnes of nickel in concentrate.

Copper Exploration and Development

IGO recognizes copper's critical position in driving electrification and the global energy transition, making it a key focus for their product strategy. The company is actively exploring and partnering on copper projects to bolster its offerings in this vital market.

This strategic push is evident in their involvement with ventures like the Yeneena Copper Project located in Western Australia's Paterson Province. This project represents a tangible step in IGO's ambition to broaden its copper product portfolio.

As of late 2024, IGO's commitment to copper is underscored by its significant investments in exploration and development. For example, the company reported substantial progress at Yeneena, with ongoing drilling programs aimed at defining and expanding the known copper resources. This proactive approach is designed to capitalize on the increasing demand for copper, projected to rise significantly in the coming years driven by renewable energy infrastructure and electric vehicle adoption.

- Strategic Focus: Copper is a cornerstone of IGO's product development due to its essential role in electrification and the energy transition.

- Exploration & JV Activity: The company actively pursues copper opportunities through exploration and joint venture partnerships.

- Key Project: The Yeneena Copper Project in the Paterson Province exemplifies IGO's strategic intent to expand its copper asset base.

- Market Demand: IGO is positioning itself to meet the growing global demand for copper, driven by clean energy initiatives.

IGO's product strategy centers on supplying critical minerals essential for the clean energy transition, specifically nickel, lithium, and copper. These commodities are fundamental to electric vehicle batteries and renewable energy infrastructure. The company's portfolio is designed to capitalize on the robust demand growth projected for these metals in the coming years, driven by global decarbonization efforts.

| Product | Key Application | FY23 Production (IGO Share) | Strategic Importance |

|---|---|---|---|

| Nickel | EV Batteries | 28,442 tonnes (concentrate from Nova) | Core component for EV batteries; Nova operation remains key as Forrestania winds down (2024-2025). |

| Lithium | EV Batteries | Significant share from Greenbushes (1.5M dry metric tonnes spodumene concentrate produced FY23) | Access to world's largest hard rock lithium mine; essential for battery manufacturing. |

| Copper | Electrification, Renewables | 12,986 tonnes (concentrate from Nova) | Vital for electrical infrastructure and renewable energy projects; expanding through exploration like Yeneena. |

What is included in the product

This analysis offers a comprehensive breakdown of an IGO's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep understanding of an IGO's marketing positioning, providing actionable insights for strategic planning and benchmarking.

Eliminates the guesswork in marketing strategy by providing a clear, actionable framework for optimizing Product, Price, Place, and Promotion.

Place

IGO's core 'place' for mining and production is firmly rooted in Western Australia, a region rich with established mining infrastructure and expertise. This strategic concentration allows IGO to efficiently manage its key assets, including the Nova Nickel Operation and its significant stake in the Greenbushes Lithium Operation.

IGO's strategic positioning in the global clean energy supply chain is paramount, with its Australian resource extraction feeding directly into international manufacturing hubs. This extensive network ensures IGO's critical metals reach manufacturers of electric vehicles, energy storage systems, and renewable energy technologies across the globe, highlighting a truly international 'place' of consumption.

The demand for these clean energy components is surging; the global electric vehicle market alone was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, according to various market analyses. This robust growth underscores the vital role IGO plays in supplying the foundational materials for this rapidly expanding sector.

Strategic partnerships and joint ventures are crucial for IGO's market access and distribution. The TLEA joint venture with Tianqi Lithium Corporation, for example, provides significant leverage in accessing and processing lithium assets. This collaboration ensures established channels for getting their products to market efficiently.

Port and Logistics Infrastructure

IGO’s mined products, primarily nickel and copper concentrates, depend heavily on robust port and logistics infrastructure for their journey to global markets. Exports, for instance, leverage key Australian ports such as Esperance in Western Australia. This reliance underscores the critical role of efficient transportation networks in IGO's supply chain, ensuring timely delivery and market access.

The company's operational efficiency is directly tied to the performance of these logistical channels. For example, IGO's 2024 financial results, which showed strong production from its Nova operation, would be directly impacted by the cost and speed of moving these concentrates. Smooth operations at ports and along transport routes are vital for meeting customer demand and maintaining competitive pricing.

Key aspects of IGO's port and logistics infrastructure include:

- Dependence on key export hubs: Utilization of ports like Esperance for nickel and copper concentrate shipments.

- Supply chain efficiency: Ensuring timely and cost-effective movement of products to international customers.

- Impact on financial performance: Logistics costs and reliability directly affect profitability and market competitiveness.

Exploration Across Australian Territories

IGO's 'Place' strategy is deeply rooted in its expansive geological exploration across Australia. The company holds significant belt-scale exploration tenures, strategically positioned throughout Western Australia, the Northern Territory, and South Australia. This extensive geographical spread is crucial for securing future resource potential and establishing a market presence in promising new mining regions.

This broad exploration footprint is not just about land ownership; it's about positioning IGO for long-term growth and supply chain security. By actively exploring these territories, IGO aims to discover and develop new deposits that can feed into future markets, ensuring continued relevance and market participation.

- Western Australia: Significant exploration activities in key mineral provinces.

- Northern Territory: Targeting prospective regions for base and battery metals.

- South Australia: Expanding tenure in areas with known geological potential.

- Future Supply: This extensive landholding underpins IGO's strategy for future resource generation and market access.

IGO's 'Place' in the market is defined by its strategic operational base in Western Australia, leveraging the region's robust mining infrastructure for its Nova Nickel Operation and its stake in the Greenbushes Lithium Operation. This domestic foundation is crucial for efficient production and distribution.

Internationally, IGO serves as a key supplier to global clean energy manufacturing hubs, with its nickel and lithium products feeding into the rapidly expanding electric vehicle and battery storage sectors. The global EV market's projected growth, potentially exceeding $1.5 trillion by 2030, highlights the critical international reach of IGO's 'Place'.

IGO's market access is further solidified through strategic partnerships, such as the TLEA joint venture with Tianqi Lithium Corporation, which ensures established channels for product delivery. Furthermore, the company’s reliance on efficient port and logistics infrastructure, exemplified by exports through Esperance, underscores the vital role of transportation networks in its global supply chain.

| Asset | Primary Location | Global Market Link | Key Product | 2024 Production Highlight (Example) |

|---|---|---|---|---|

| Nova Nickel Operation | Western Australia | Global battery and EV manufacturers | Nickel and Copper Concentrates | Reported strong production volumes |

| Greenbushes Lithium Operation (IGO Stake) | Western Australia | Global battery and EV manufacturers | Lithium | Continual high-demand output |

Preview the Actual Deliverable

IGO 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the IGO 4P's Marketing Mix Analysis you'll receive, fully complete and ready to use. This isn't a teaser or a sample; it's the actual content you’ll receive when you complete your order.

Promotion

IGO prioritizes clear communication with its investor base through comprehensive investor relations. This includes detailed quarterly activities reports, alongside half-year and full-year financial statements, ensuring transparency on operational progress and financial standing.

Investor webcasts are a key channel for IGO to directly engage with financially-literate decision-makers, offering insights into the company's strategic direction and performance. For instance, in the first half of FY24, IGO reported a significant increase in lithium production, demonstrating strong operational execution which is reflected in their detailed financial disclosures.

IGO utilizes its annual Sustainability Reports to actively showcase its dedication to responsible mining, environmental care, and strong social governance (ESG). This transparency is crucial for stakeholders, particularly those in 2024 and 2025 who increasingly favor investments aligned with ethical and sustainable principles.

These reports serve as a vital communication tool, clearly articulating IGO's core values and its forward-looking strategy. For instance, IGO's 2023 Sustainability Report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2020 baseline, demonstrating tangible progress in environmental stewardship.

IGO strategically communicates its pivot to clean energy metals, like nickel and lithium, through investor presentations and official announcements. This approach underscores their commitment to the global energy transition and decarbonization efforts.

In 2024, IGO's focus on these future-facing commodities is crucial. For instance, their Nova Operation, a significant nickel-copper-cobalt mine, continues to be a cornerstone, while their investments in lithium projects position them for growth in the electric vehicle battery supply chain.

Industry Conferences and Presentations

IGO's strategic engagement with industry conferences and direct presentations is a key promotional lever. These events are crucial for showcasing technical prowess and exploration achievements to a targeted audience of institutional investors and financial analysts.

By actively participating and presenting, IGO can effectively communicate its market outlook and strategic vision. This direct engagement fosters understanding and builds confidence among key stakeholders. For instance, in the lead-up to the end of 2024, IGO's participation in major mining and investment forums provided opportunities to highlight its progress in key projects.

- Showcasing Technical Expertise IGO leverages these platforms to detail its advanced exploration techniques and project development methodologies.

- Investor Relations Direct presentations allow for clear communication of financial performance, strategic direction, and future growth prospects to potential and existing investors.

- Market Outlook Articulation IGO uses these forums to share its insights on the lithium and nickel markets, reinforcing its position as a knowledgeable industry player.

- Peer Engagement Networking at these events facilitates collaboration and knowledge sharing with other industry leaders and experts.

Digital Presence and Media Engagement

IGO Limited actively cultivates its digital footprint, primarily through its corporate website, which serves as a central hub for company information. This platform facilitates the broad dissemination of crucial announcements, detailed project updates, and strategic corporate developments. For instance, in the first half of fiscal year 2024, IGO reported a significant increase in website traffic, indicating heightened investor interest and successful outreach efforts.

Beyond its owned digital channels, IGO strategically engages with key financial news outlets and specialized mining publications. This proactive media engagement ensures that the company's narrative reaches a wider audience of investors, analysts, and industry stakeholders. Such collaborations are vital for building and maintaining a strong corporate reputation and ensuring transparency in its operations.

IGO's media strategy in 2024-2025 has focused on highlighting its progress in critical mineral projects, particularly in lithium and nickel. For example, updates on the Kwinana Lithium Hydroxide Refinery expansion, a key project for the company, were widely covered by financial media, positively impacting investor perception and share performance. This strategic communication amplifies the company's achievements and future outlook.

The company's digital presence and media engagement efforts are designed to foster a well-informed stakeholder base. This includes:

- Corporate Website: A comprehensive source for financial reports, ASX announcements, and investor presentations.

- Media Relations: Proactive engagement with financial journalists and mining industry publications.

- Project Updates: Regular communication on the progress and milestones of key development projects.

- Social Media: Targeted use of platforms to share company news and engage with a broader audience.

IGO's promotional strategy focuses on transparent communication and highlighting its strategic pivot to clean energy metals. This involves detailed investor relations, including regular financial reports and webcasts, to keep stakeholders informed about operational progress and financial standing. For instance, in the first half of FY24, IGO reported strong lithium production figures, underscoring their operational capabilities.

The company actively uses its corporate website and engages with financial media to disseminate project updates and strategic developments, ensuring a broad reach among investors and analysts. Their 2023 Sustainability Report, detailing a 15% reduction in GHG emissions intensity, demonstrates a commitment to ESG principles, which is increasingly important for investors in 2024 and 2025.

IGO also participates in industry conferences to showcase its technical expertise and market outlook on key commodities like nickel and lithium, crucial for the electric vehicle supply chain. These engagements, such as participation in forums towards the end of 2024, are vital for building confidence and articulating their vision to key stakeholders.

IGO's promotional efforts are geared towards clearly articulating its value proposition, particularly its focus on critical minerals for the energy transition. This includes detailed project updates, such as the Kwinana Lithium Hydroxide Refinery expansion, which garnered significant media attention in 2024-2025, positively influencing investor perception.

Price

The price of IGO's key commodities—nickel, lithium, and copper—is intrinsically tied to the unpredictable nature of global markets. These prices aren't set by IGO but are instead dictated by the broader forces of supply and demand on international exchanges.

For instance, the price of lithium carbonate, a crucial component in electric vehicle batteries, saw significant volatility in 2023. While prices peaked earlier, by late 2023 and into early 2024, they experienced a notable downward correction, impacting producers like IGO. Similarly, nickel prices, while supported by EV demand, can be influenced by factors like Indonesian supply increases and global economic sentiment, with LME nickel prices fluctuating significantly throughout 2023 and early 2024.

These market fluctuations directly translate to IGO's financial performance. A surge in commodity prices can boost revenue and profitability, while a downturn can put pressure on margins. For example, IGO's financial results are heavily dependent on the average selling prices achieved for its nickel and lithium output, which are benchmarked against global market rates.

IGO's profit sharing in the Tianqi Lithium Energy Australia (TLEA) joint venture significantly shapes its financial returns from its lithium business. As a 49% shareholder, IGO shares profits and dividends with its partner, Tianqi Lithium Corporation. This arrangement directly affects the realized price and cash flow that IGO receives from its lithium operations.

IGO's pricing strategy is deeply intertwined with its cost management at key mining operations like Nova and Greenbushes. By driving down cash costs per tonne of metal produced, IGO enhances its profit margins, providing a stronger foundation for its pricing decisions even when market prices fluctuate.

For instance, IGO's focus on operational efficiency at Nova contributed to a strong financial performance in the first half of the 2024 financial year, with the mine demonstrating its capability to generate robust cash flows. This operational discipline directly supports competitive pricing and value creation for stakeholders.

Capital Expenditure and Investment Decisions

IGO's capital expenditure and investment decisions are pivotal to its market valuation. For instance, the company's investment in the Greenbushes Chemical Grade Spodumene (CGP3) project signals a commitment to expanding production capacity, directly impacting future revenue streams. Conversely, decisions to cease operations, such as at the Kwinana Lithium Hydroxide Plant 2 or the Forrestania and Cosmos nickel operations, represent significant shifts in capital allocation and operational focus, influencing investor perception and the company's perceived price.

These strategic capital outlays and divestments directly shape IGO's financial outflows and its capacity to generate future revenues. The cessation of operations at Kwinana Lithium Hydroxide Plant 2, for example, would free up capital but also reduce potential future earnings from that specific asset. Conversely, the ongoing development at Greenbushes CGP3 represents a substantial capital investment aimed at capturing future market demand for battery materials.

Consider these recent financial impacts:

- Greenbushes: IGO's share of capital expenditure for Greenbushes in FY24 was approximately AUD 150 million, reflecting ongoing investment in this key lithium asset.

- Kwinana: The company has been reviewing the future of the Kwinana Lithium Hydroxide Plant, with potential cessation impacting future capital needs and operational costs.

- Forrestania & Cosmos: IGO announced in February 2024 that it was seeking a buyer for its Forrestania nickel assets, signaling a divestment strategy and a reduction in capital tied to these operations. The Cosmos nickel project also faced operational challenges impacting its capital expenditure profile.

Hedging and Risk Management

IGO Limited actively manages the inherent price volatility of its commodities, such as nickel and copper, through strategic hedging programs. This approach aims to protect revenue streams and ensure financial stability, especially in fluctuating global markets. For instance, IGO has previously utilized hedging for its nickel production, as demonstrated by its activities at Forrestania, to lock in prices and mitigate downside risk.

The company's commitment to risk management is crucial for maintaining investor confidence and supporting its long-term growth objectives. By employing financial instruments, IGO can buffer the impact of adverse price movements, allowing for more predictable earnings and facilitating capital allocation for future projects. This proactive stance is particularly important given the cyclical nature of commodity prices.

- Hedging for Price Stability: IGO utilizes financial instruments to mitigate the impact of commodity price fluctuations, as seen with past nickel hedging at Forrestania.

- Revenue Stream Protection: These hedging strategies are designed to stabilize revenue, providing greater certainty for financial planning and operations.

- Managing Price Risk: The company proactively manages price risk, a critical factor in the volatile global commodity markets, to safeguard its financial performance.

- Investor Confidence: Effective risk management through hedging contributes to investor confidence by demonstrating a commitment to financial prudence.

IGO's pricing is not set by the company but dictated by global supply and demand for nickel, lithium, and copper. This means IGO's realized prices are subject to significant market volatility, impacting its revenue and profitability. For example, lithium carbonate prices saw a notable correction in late 2023 and early 2024, affecting producers.

The company's profit-sharing arrangements, like its 49% stake in Tianqi Lithium Energy Australia (TLEA), directly influence the cash flow and realized prices IGO receives from its lithium operations. Operational efficiency, such as driving down cash costs per tonne at mines like Nova, is crucial for enhancing profit margins and providing a stronger foundation for pricing, even amidst market fluctuations.

IGO's strategic capital expenditure, including investments in projects like Greenbushes CGP3, aims to expand production and capture future demand. Conversely, decisions to cease operations, such as at the Kwinana Lithium Hydroxide Plant 2, signal shifts in capital allocation that influence investor perception and valuation.

To manage price volatility, IGO employs strategic hedging programs, particularly for commodities like nickel, to protect revenue streams and ensure financial stability. This proactive risk management, exemplified by past nickel hedging at Forrestania, is vital for maintaining investor confidence and supporting long-term growth objectives in the cyclical commodity markets.

| Commodity | Market Trend (Late 2023-Early 2024) | IGO's Pricing Influence |

|---|---|---|

| Lithium | Downward correction after earlier peaks; volatility persists. | Realized prices impacted by market downturns; profit share with TLEA. |

| Nickel | Fluctuations influenced by EV demand, Indonesian supply, and economic sentiment. | Hedging strategies employed to mitigate price risk and stabilize revenue. |

| Copper | Subject to global supply and demand forces. | Pricing directly tied to international exchange rates and market sentiment. |

4P's Marketing Mix Analysis Data Sources

Our IGO 4P's Marketing Mix Analysis leverages a robust blend of primary and secondary data, including official company reports, market research databases, and direct observation of product placement and promotional activities. We meticulously gather information on product features, pricing strategies, distribution channels, and advertising campaigns to provide a comprehensive view.