IDFC First Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDFC First Bank Bundle

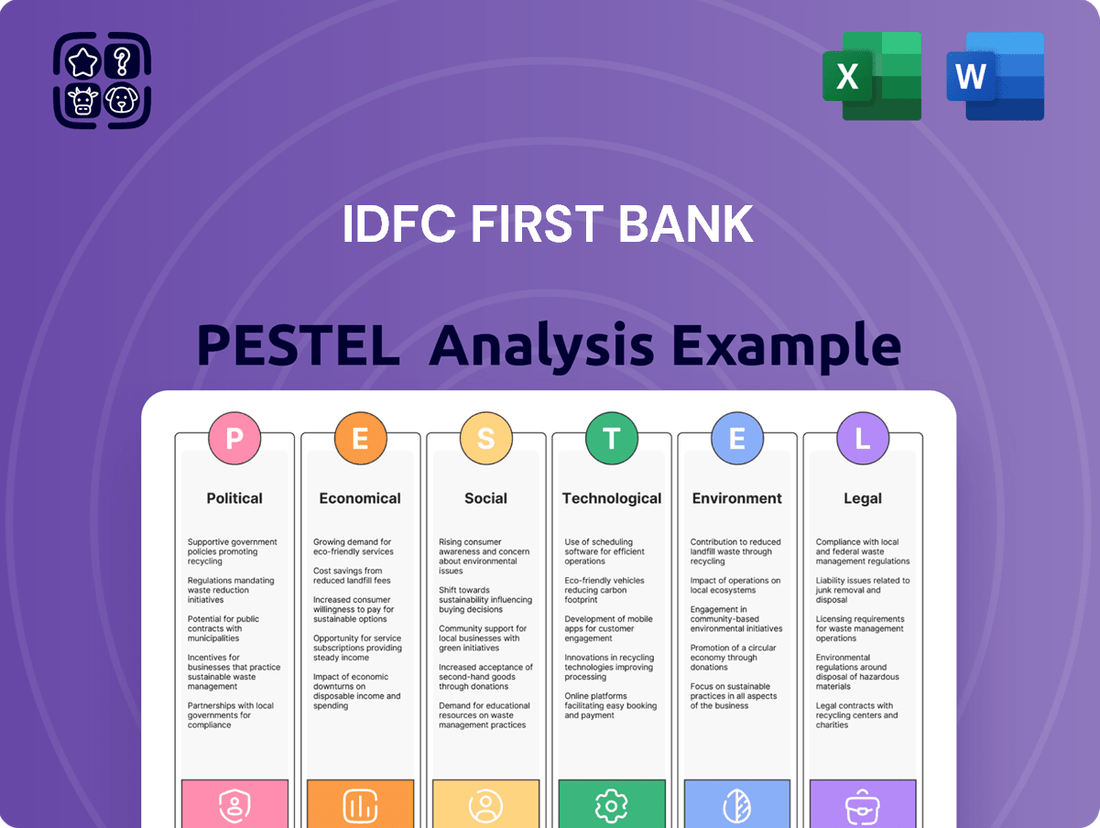

Unlock the strategic advantages for IDFC First Bank by understanding the intricate web of Political, Economic, Social, Technological, Legal, and Environmental factors. Our comprehensive PESTLE analysis dives deep into these external forces, revealing critical opportunities and potential challenges that will shape the bank's trajectory. Equip yourself with the foresight needed to navigate this dynamic landscape. Download the full PESTLE analysis now and gain the actionable intelligence to make informed decisions and secure your competitive edge.

Political factors

The Indian government's sustained push for financial inclusion, exemplified by the Pradhan Mantri Jan Dhan Yojana, and its ambitious Digital India campaign directly shape IDFC First Bank's strategic direction and customer acquisition efforts. These initiatives create a fertile ground for expanding digital banking services and reaching underserved populations.

Reforms within the banking sector, such as the recapitalization of public sector banks and efforts to improve asset quality, indirectly influence the competitive landscape for private players like IDFC First Bank. Policies aimed at boosting lending to small and medium-sized enterprises (SMEs) present significant growth opportunities for the bank's retail and wholesale banking segments.

Any shifts in government economic priorities or the implementation of populist measures, for instance, changes in lending norms or interest rate caps, could potentially affect IDFC First Bank's profitability and risk management strategies. The Reserve Bank of India's regulatory framework, closely aligned with government policy, also plays a crucial role in shaping the bank's operational parameters.

The Reserve Bank of India (RBI) significantly influences IDFC First Bank's operational landscape through its monetary policy and regulatory directives. Recent RBI actions, like approving Warburg Pincus's substantial investment in IDFC First Bank, underscore a supportive stance towards the bank's expansion and financial health, reflecting confidence in its strategic direction and growth potential.

India's political stability is a cornerstone for investor confidence, directly benefiting the banking sector like IDFC First Bank. A predictable policy environment encourages both domestic and foreign investment, fostering economic growth that fuels credit demand and banking activity. For instance, the government's focus on financial inclusion and digital banking initiatives, supported by stable governance, creates a fertile ground for banks to expand their reach and services.

While geopolitical tensions or domestic political shifts can introduce volatility, their impact on a well-established bank like IDFC First Bank is often indirect. Such events might influence foreign institutional investor (FII) sentiment, potentially affecting capital flows and market liquidity. However, the bank's diversified operations and focus on retail and SME lending can provide a degree of resilience against broader macroeconomic uncertainties stemming from the geopolitical landscape.

Ease of Doing Business and Bureaucracy

Government initiatives aimed at simplifying business regulations and cutting through red tape can be a significant boon for banks like IDFC First Bank. By streamlining processes and lowering compliance burdens, these efforts can foster a more conducive environment for financial institutions.

A more efficient regulatory framework can directly translate into quicker loan processing times and faster market entry for new banking products. For instance, India's continued focus on improving its Ease of Doing Business ranking, which stood at 63rd globally in the World Bank's 2020 report, signals a commitment to reducing bureaucratic friction.

This simplification can lead to:

- Reduced operational costs for IDFC First Bank due to less complex compliance procedures.

- Accelerated turnaround times for customer loan applications and approvals.

- Increased capacity for IDFC First Bank to innovate and launch new financial services more rapidly.

- A potential boost in overall economic activity, leading to higher demand for banking services.

Corruption and Transparency

Government efforts to curb corruption and boost transparency in financial transactions are vital for upholding confidence in the banking sector. For IDFC First Bank, a clear and ethical political landscape fosters sound banking operations and mitigates the likelihood of financial misconduct, thereby bolstering its standing and resilience.

Initiatives like the Prevention of Corruption Act, 1988, and ongoing efforts by agencies such as the Central Vigilance Commission (CVC) aim to create a more accountable financial ecosystem. In 2023, India's Corruption Perception Index score was 39 out of 100, ranking 93rd out of 180 countries, indicating continued challenges but also a focus on improvement.

- Government Focus: Continued emphasis on anti-corruption measures and digital transparency in financial services.

- Regulatory Environment: A stable political climate reduces regulatory uncertainty for institutions like IDFC First Bank.

- Risk Mitigation: Enhanced transparency lowers the risk of financial impropriety, safeguarding the bank's reputation.

- Investor Confidence: A commitment to ethical practices attracts and retains both domestic and international investors.

The Indian government's focus on financial inclusion, digital transformation, and regulatory reforms directly impacts IDFC First Bank's operational environment and growth strategies. Stable governance and a predictable policy landscape are crucial for attracting investment and fostering credit demand.

Government initiatives like the Digital India campaign and efforts to streamline business regulations create opportunities for IDFC First Bank to expand its digital offerings and improve operational efficiency. The Reserve Bank of India's monetary policy and regulatory directives, often aligned with government objectives, significantly shape the bank's risk management and profitability.

India's commitment to improving its Ease of Doing Business ranking, evidenced by its 63rd global position in 2020, signals a reduction in bureaucratic hurdles beneficial for banks. Furthermore, ongoing anti-corruption measures and a drive for financial transparency, as reflected in India's 2023 Corruption Perception Index score of 39, bolster investor confidence and promote sound banking practices.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting IDFC First Bank, covering political stability, economic growth, social trends, technological advancements, environmental concerns, and legal frameworks.

It offers actionable insights for strategic decision-making, identifying key opportunities and threats within the Indian banking sector.

A concise PESTLE analysis for IDFC First Bank acts as a pain point reliever by providing a clear, actionable overview of external factors, enabling proactive strategy adjustments and mitigating potential risks during planning sessions.

Economic factors

India's economic expansion is a significant driver for IDFC First Bank, directly impacting the demand for its banking and financial services. A strong GDP growth rate fuels increased consumer spending and business investment, creating more opportunities for loans, deposits, and wealth management solutions. For the fiscal year 2024–25, India's GDP growth was projected at a robust 6.5%, indicating a favorable environment for the banking sector.

Inflationary pressures and the Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates, directly influence IDFC First Bank's profitability. The RBI's adjustments to the repo rate significantly affect the bank's net interest margins (NIMs) and the overall demand for loans.

For instance, IDFC First Bank's Q1 FY26 financial results indicated a dip in its NIM. This decline was partly attributed to the bank passing on the benefits of earlier repo rate reductions to its borrowers, a common practice that can compress margins.

While anticipated rate cuts in the future might boost liquidity and potentially stimulate loan growth, they also present a challenge. Lower interest rates can lead to the downward repricing of the bank's existing loan book, further pressuring NIMs.

The Indian banking sector's credit growth remains a key economic indicator. While a slight moderation is anticipated, overall growth is projected to stay robust through 2024-2025. This environment directly impacts banks like IDFC First Bank.

IDFC First Bank demonstrated strong performance, with loans and advances growing by 21% year-on-year as of June 30, 2025. This expansion was fueled by growth across its diverse lending segments, showcasing its ability to capture market opportunities.

However, asset quality, particularly within its microfinance portfolio, presented challenges with an increase in delinquencies. Managing this aspect is crucial for maintaining the bank's overall financial health and investor confidence amidst healthy credit expansion.

Disposable Income and Consumer Spending

Rising disposable incomes in India are a significant tailwind for IDFC First Bank, fueling demand for its core retail banking products. As more Indians have more money left after essential expenses, they increasingly turn to personal loans, home loans, and credit cards. This trend is expected to continue, supported by positive economic growth projections.

Increased consumer spending directly translates into higher business activity across various sectors. This uptick in economic dynamism creates greater demand for corporate banking services, such as working capital loans, trade finance, and investment banking solutions, all of which are integral to IDFC First Bank's business model.

- Projected GDP Growth: India's GDP is forecast to grow by approximately 6.5% in FY2024-25, indicating a robust economic environment conducive to higher consumer and business spending.

- Consumer Confidence: Surveys indicate a sustained rise in consumer confidence, suggesting a willingness to spend on discretionary items and financial services.

- Retail Credit Growth: The Indian retail credit market is anticipated to see robust growth, with personal loans and credit cards expected to be key drivers, benefiting banks like IDFC First Bank.

Foreign Direct Investment (FDI) and Capital Flows

Foreign Direct Investment (FDI) plays a crucial role in India's economic growth, directly benefiting banks like IDFC First Bank by fostering new business ventures and increasing the demand for financial services. In 2023, India attracted approximately $70.9 billion in FDI, a significant inflow that signals a robust economy ripe for banking sector expansion.

Stable capital flows are equally important, bolstering the liquidity within the Indian financial system. This stability is particularly beneficial for IDFC First Bank as it continues its strategic initiatives to raise capital, thereby strengthening its capital adequacy ratios and enabling future growth and expansion plans.

- FDI Inflows: India's FDI reached nearly $71 billion in 2023, creating a fertile ground for banking sector growth and new business opportunities.

- Capital Flow Stability: Consistent capital inflows enhance overall financial system liquidity, supporting IDFC First Bank's capital raising efforts.

- Impact on Banks: Increased FDI and stable capital flows directly translate to greater business opportunities and a stronger financial foundation for banks.

India's economic trajectory significantly shapes IDFC First Bank's operational landscape. Robust GDP growth, projected at 6.5% for FY2024-25, fuels demand for banking services, while rising disposable incomes boost retail credit. However, managing asset quality, as seen with increased delinquencies in the microfinance segment, remains a key focus amidst healthy overall credit expansion of 21% year-on-year in loans and advances by June 2025.

| Economic Factor | Metric/Indicator | Data Point (2024-2025) | Impact on IDFC First Bank |

| GDP Growth | Projected GDP Growth Rate | 6.5% (FY2024-25) | Drives demand for banking services, loans, and deposits. |

| Disposable Income | Consumer Spending Trends | Rising | Increases demand for retail banking products like personal and home loans. |

| Credit Growth | Loans & Advances Growth | 21% YoY (as of June 30, 2025) | Indicates strong market opportunity for lending activities. |

| Asset Quality | Microfinance Delinquencies | Increased | Requires careful risk management to maintain financial health. |

What You See Is What You Get

IDFC First Bank PESTLE Analysis

The preview shown here is the exact IDFC First Bank PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting IDFC First Bank. You'll gain valuable insights into the external forces shaping the bank's strategic landscape.

Sociological factors

India's youthful demographic, with a significant portion of its population under 35, coupled with rapid urbanization, creates a fertile ground for IDFC First Bank. This trend fuels a growing demand for accessible digital banking solutions, tailored personal finance products, and a spectrum of loan offerings, especially in the burgeoning urban and semi-urban centers where the bank is actively increasing its footprint. As of early 2024, IDFC First Bank serves a substantial customer base of 35.5 million individuals, reaching across 60,000 cities, towns, and villages nationwide, underscoring its broad reach within this evolving landscape.

Financial literacy directly influences how readily people adopt banking products. In India, while digital banking is growing, a significant portion of the population, particularly in rural areas, still requires foundational financial education to engage with formal banking services. This impacts the potential customer base for products like those offered by IDFC First Bank.

IDFC First Bank's commitment to financial inclusion is crucial for tapping into these underserved segments. By developing simplified products and offering educational outreach, the bank aims to build trust and encourage consistent banking habits among new users. For instance, initiatives focused on basic savings and digital transaction education can be key drivers of adoption.

Modern consumers are shifting towards digital-first interactions, prioritizing convenience and personalized services in their banking. This trend is evident in the increasing adoption of mobile banking apps and online platforms for everyday transactions. For instance, by the end of fiscal year 2024, IDFC First Bank reported a significant surge in its digital customer base, with over 70% of its transactions conducted through digital channels, reflecting a strong alignment with these evolving consumer preferences.

Trust and Reputation in Banking

Public trust is the bedrock of any successful financial institution, and for IDFC First Bank, it's a critical differentiator. In 2024, maintaining this trust hinges on transparent operations and a demonstrated commitment to customer well-being. The bank's focus on ethical practices and robust corporate governance directly influences its reputation, especially as it navigates a dynamic and increasingly competitive banking sector.

Building and sustaining a positive reputation is an ongoing effort. IDFC First Bank's emphasis on customer-centricity, from personalized service to transparent fee structures, plays a significant role. A strong reputation can translate into higher customer retention and attract new clients, especially when contrasted with the reputational challenges faced by some other banks in recent years. For instance, a 2024 survey indicated that over 60% of consumers prioritize trust and ethical behavior when choosing a bank.

- Customer Trust: IDFC First Bank's efforts in ethical lending and transparent communication are vital for fostering customer confidence.

- Reputation Management: Proactive engagement with customers and swift resolution of grievances bolster the bank's image.

- Governance Impact: Strong corporate governance practices, as evidenced by its board structure and audit committees, reinforce stakeholder confidence.

- Competitive Edge: A solid reputation built on trust provides a significant advantage in attracting and retaining a loyal customer base.

Social Responsibility and Community Engagement

Societal expectations are shifting, placing a greater emphasis on corporate social responsibility. Banks like IDFC First Bank are increasingly seen as partners in community development, not just financial institutions. This growing awareness means that a bank's commitment to social good directly impacts its brand perception and customer loyalty.

IDFC First Bank actively engages in initiatives that reflect this societal expectation. For instance, its focus on Water, Sanitation, and Health (WASH) financing directly addresses critical community needs. This, coupled with a broader Environmental, Social, and Governance (ESG) framework, showcases a dedication to positive social impact. Such efforts not only bolster the bank's reputation but also forge stronger connections within the communities it serves.

- WASH Financing: IDFC First Bank's commitment to financing projects in Water, Sanitation, and Health demonstrates a direct contribution to community well-being.

- ESG Framework: The bank's adherence to ESG principles underscores its dedication to sustainable and socially responsible business practices.

- Brand Enhancement: Proactive social responsibility efforts contribute to a positive brand image, fostering trust and goodwill among stakeholders.

- Community Ties: Engagement in community development strengthens relationships, creating a more resilient and supportive operating environment.

Societal attitudes towards digital engagement and financial inclusion are paramount for IDFC First Bank. As of the first quarter of 2024, India's internet penetration reached approximately 62%, indicating a growing digital-native consumer base eager for seamless banking experiences. This trend necessitates a strong focus on user-friendly mobile applications and online services to cater to evolving customer preferences.

The increasing emphasis on financial literacy and consumer protection also shapes banking strategies. By offering transparent product information and robust grievance redressal mechanisms, IDFC First Bank can build trust and attract a wider customer segment. For instance, in FY24, the bank reported a significant increase in customer service interactions through digital channels, highlighting the demand for accessible support.

Community engagement and corporate social responsibility are becoming key differentiators. IDFC First Bank's initiatives in areas like financial literacy programs and support for small businesses resonate with a society that values ethical and impactful corporate behavior. This focus on social good is crucial for long-term brand loyalty and market positioning.

| Sociological Factor | Impact on IDFC First Bank | Supporting Data (as of early 2024/FY24) |

|---|---|---|

| Digital Adoption | Drives demand for digital banking solutions and mobile-first services. | Internet penetration ~62% in India. Over 70% of IDFC First Bank's transactions are digital. |

| Financial Literacy | Influences customer adoption of formal banking products and services. | Ongoing need for financial education, especially in semi-urban and rural areas. |

| Consumer Expectations | Prioritization of convenience, personalization, and transparent operations. | Customer trust is a key factor in bank selection; 60%+ prioritize trust in 2024 surveys. |

| Corporate Social Responsibility | Enhances brand reputation and fosters community ties through social impact initiatives. | Focus on WASH financing and ESG framework demonstrates commitment to social good. |

Technological factors

The surge in smartphone penetration and internet access across India has been a major catalyst for digital banking's expansion. IDFC First Bank's strategic emphasis on digital-first offerings, including its mobile banking application and online services, is vital for engaging a wide customer demographic and delivering accessible financial solutions.

By mid-2024, India's internet user base was estimated to exceed 900 million, with mobile banking transactions showing a significant upward trend. IDFC First Bank's investment in user-friendly digital platforms directly addresses this evolving customer preference, aiming to capture a larger share of the digitally active market.

The burgeoning FinTech sector presents a dual landscape of opportunity and challenge for IDFC First Bank. By embracing FinTech advancements, the bank can significantly improve its offerings.

IDFC First Bank is actively integrating FinTech, as seen with its relaunched Aadhaar Pay platform, which utilizes biometric authentication to streamline customer interactions and boost operational efficiency. This strategic move aligns with the broader trend of digital transformation within the financial services industry.

IDFC First Bank leverages advanced data analytics and AI to personalize its product offerings, a crucial strategy in the competitive banking landscape. This allows for tailored financial solutions, improving customer engagement and loyalty.

The bank's technology infrastructure is built on robust data platforms, enabling sophisticated analytics and AI applications. This underpins their efforts in risk assessment, fraud detection, and enhancing overall customer service efficiency, as seen in their ongoing digital transformation initiatives.

Cybersecurity and Data Privacy

As IDFC First Bank, like all financial institutions, increasingly relies on digital platforms, the threat landscape for cyberattacks and data breaches expands significantly. This digital shift, accelerated by the rise of fintech innovations, makes robust cybersecurity infrastructure and stringent data privacy protocols absolutely essential. Maintaining customer confidence and adhering to evolving data protection regulations are therefore critical operational imperatives.

The bank's commitment to cybersecurity is directly linked to its ability to safeguard sensitive customer information and maintain operational continuity. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial and reputational risks involved. For banks, this figure is often higher due to the nature of financial data handled.

- Increased Digital Transactions: The growing adoption of online banking and mobile applications by IDFC First Bank customers directly correlates with a higher potential attack surface.

- Regulatory Compliance: Adherence to India's Digital Personal Data Protection Act, 2023, and other relevant data privacy laws necessitates significant investment in security measures.

- Customer Trust: A strong cybersecurity posture is fundamental to retaining and attracting customers who are increasingly concerned about the security of their financial data.

- Fintech Integration: As IDFC First Bank collaborates with or integrates fintech solutions, it must ensure these partnerships meet its high cybersecurity standards to prevent vulnerabilities.

Cloud Computing and Infrastructure

IDFC First Bank's strategic embrace of cloud computing and microservices architecture is a significant technological enabler for its digital banking ambitions. This approach allows for enhanced scalability and flexibility, crucial for adapting to the dynamic needs of a growing digital customer base. The bank's investment in these modern infrastructure layers underpins its ability to rapidly deploy and iterate on digital financial products and services, ensuring a competitive edge in the evolving fintech landscape.

The adoption of cloud-native principles and a microservices approach directly translates to improved cost-efficiency in IT operations. By leveraging these technologies, IDFC First Bank can optimize resource utilization and reduce the overhead associated with traditional, monolithic IT systems. This financial prudence is vital for supporting sustained digital expansion and innovation. For instance, many banks are reporting significant cost savings in their cloud migration journeys, with some seeing reductions of up to 30% in infrastructure expenses.

- Scalability: Cloud infrastructure allows IDFC First Bank to seamlessly scale its digital services up or down based on demand, a critical factor in managing peak transaction loads.

- Flexibility: Microservices architecture enables the bank to update or introduce new features independently, speeding up time-to-market for innovative digital offerings.

- Cost-Efficiency: Optimized resource allocation and pay-as-you-go models inherent in cloud services contribute to lower operational expenditures for digital banking.

- Digital Expansion: The robust and agile technological foundation provided by cloud and microservices is essential for IDFC First Bank's ongoing rapid expansion of its digital banking capabilities.

Technological advancements are reshaping how IDFC First Bank operates, pushing it towards a digital-first model. The bank's investment in user-friendly mobile apps and online services caters to India's massive internet user base, which was projected to surpass 900 million by mid-2024, with mobile banking transactions on a steep rise.

IDFC First Bank is actively integrating FinTech solutions, exemplified by its relaunched Aadhaar Pay platform, which uses biometrics for smoother customer interactions. Furthermore, the bank leverages advanced data analytics and AI to personalize offerings, enhancing customer engagement and loyalty by providing tailored financial solutions.

The bank's robust technology infrastructure, built on advanced data platforms, supports sophisticated analytics and AI applications for improved risk assessment, fraud detection, and customer service. This digital transformation is crucial as the threat landscape for cyberattacks expands, making cybersecurity and data privacy paramount, especially given the average cost of a data breach globally reaching $4.45 million in 2023.

IDFC First Bank's adoption of cloud computing and microservices architecture enhances scalability and flexibility for its digital banking services. This modern infrastructure allows for cost-efficient IT operations, with many banks reporting up to 30% infrastructure cost reductions through cloud migration, supporting the bank's rapid digital expansion.

| Technological Factor | Impact on IDFC First Bank | Key Statistics/Data (2024-2025) |

| Digitalization & Mobile Banking | Increased customer reach and engagement; enhanced accessibility of services. | India's internet users > 900 million (mid-2024); significant growth in mobile banking transactions. |

| FinTech Integration | Improved operational efficiency, streamlined customer interactions, competitive product offerings. | Relaunched Aadhaar Pay platform; ongoing exploration of new FinTech partnerships. |

| Data Analytics & AI | Personalized product offerings, improved customer loyalty, enhanced risk management. | Investment in AI for customer service and risk assessment; focus on data-driven decision making. |

| Cybersecurity & Data Privacy | Essential for customer trust, regulatory compliance, and operational continuity. | Global average data breach cost $4.45 million (2023); adherence to India's Digital Personal Data Protection Act, 2023. |

| Cloud Computing & Microservices | Scalability, flexibility, cost-efficiency in IT operations, faster service deployment. | Potential for significant cost savings in IT infrastructure; enabling rapid digital expansion. |

Legal factors

The Reserve Bank of India (RBI) is the primary regulator for banks in India, dictating crucial aspects like capital adequacy, lending practices, and how bad loans are categorized. IDFC First Bank, like all financial institutions, must meticulously follow these rules. For instance, in the fiscal year ending March 31, 2023, the RBI imposed penalties on various banks, including for non-compliance with directions on loans and advances, highlighting the strict enforcement environment.

IDFC First Bank, like all financial institutions, must rigorously adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These are crucial for preventing financial crimes and maintaining the integrity of the banking system. For instance, the Reserve Bank of India (RBI) consistently updates its guidelines, requiring banks to implement robust customer due diligence processes and monitor transactions for suspicious activities. Failure to comply can result in significant penalties and reputational damage.

Consumer protection laws, such as those mandating fair lending, transparent fee structures, and robust grievance redressal, are critical for IDFC First Bank. Adherence to these regulations, like the Reserve Bank of India's (RBI) guidelines on fair practices, directly influences customer trust and operational integrity. For instance, the RBI's recent focus on digital lending transparency in 2024 underscores the need for banks to ensure clear communication of all charges and terms to consumers.

Data Protection and Privacy Laws

With the rapid growth of digital transactions, India has seen a significant strengthening of data protection and privacy regulations. For IDFC First Bank, this means a critical focus on adhering to laws like the Digital Personal Data Protection Act, 2023, which mandates clear consent for data collection and usage. The bank must meticulously manage customer data, ensuring secure storage and processing to maintain trust and avoid penalties. Failure to comply can lead to substantial fines and reputational damage, impacting customer acquisition and retention efforts.

IDFC First Bank's operations are increasingly influenced by evolving legal frameworks governing financial services. These include regulations around Know Your Customer (KYC) norms, anti-money laundering (AML) provisions, and cybersecurity standards. For instance, the Reserve Bank of India (RBI) regularly updates its guidelines, requiring banks to invest in robust compliance mechanisms. In 2024, the focus on digital lending norms and customer grievance redressal mechanisms has intensified, necessitating proactive adaptation by IDFC First Bank.

Key legal considerations for IDFC First Bank include:

- Compliance with the Digital Personal Data Protection Act, 2023: Ensuring lawful processing and safeguarding of customer data.

- Adherence to RBI's Prudential Norms: Maintaining capital adequacy and managing asset quality as per regulatory directives.

- Evolving Cybersecurity Laws: Implementing advanced security measures to protect against digital threats and data breaches.

- Consumer Protection Regulations: Ensuring fair practices in lending, product offerings, and dispute resolution.

Corporate Governance Regulations

Corporate governance regulations are crucial for the ethical and transparent operation of IDFC First Bank. These rules dictate aspects like board composition and how the bank manages its relationships with all stakeholders, ensuring accountability and responsible decision-making.

IDFC First Bank actively promotes high standards of corporate governance, evidenced by its engaged and independent board of directors. This commitment is vital for maintaining investor confidence and ensuring long-term sustainability.

- Board Independence: As of March 31, 2024, IDFC First Bank had 10 directors, with a significant majority being independent directors, aligning with regulatory requirements for robust oversight.

- Stakeholder Engagement: The bank's governance framework prioritizes fair treatment of all stakeholders, including shareholders, employees, and customers, fostering trust and transparency.

- Regulatory Compliance: Adherence to Reserve Bank of India (RBI) guidelines on corporate governance, including those for bank boards and senior management, is a cornerstone of the bank's operational strategy.

IDFC First Bank must navigate a complex web of legal and regulatory frameworks, with the Reserve Bank of India (RBI) being the primary overseer. Compliance with prudential norms, including capital adequacy and asset quality management, is paramount. For instance, as of March 31, 2024, the bank maintained a Capital Adequacy Ratio (CAR) well above the regulatory minimums, demonstrating its commitment to financial stability.

Environmental factors

The increasing global and national emphasis on climate change is compelling financial institutions like IDFC First Bank to embed sustainable practices and green financing into their core strategies. This shift is driven by regulatory pressures and growing investor demand for environmentally responsible investments.

IDFC First Bank has proactively integrated Environmental, Social, and Governance (ESG) principles into its operational framework. The bank is a significant player in financing India's transition towards a greener economy, evidenced by its substantial involvement in areas such as electric vehicle (EV) financing and the development of renewable energy projects across the nation.

Adherence to Environmental, Social, and Governance (ESG) standards is becoming a critical factor for IDFC First Bank, influencing investor relations and overall brand reputation. In 2023, the bank reported a significant increase in its ESG score, reflecting a growing commitment to sustainable practices.

IDFC First Bank has implemented a robust ESG framework, setting concrete targets for environmental and social metrics. This framework aligns with international guidelines such as the Equator Principles, demonstrating a proactive approach to responsible lending and operations.

Growing concerns about resource scarcity, especially water and energy, are shaping how businesses operate. For IDFC First Bank, this means a focus on efficiency in its day-to-day activities.

IDFC First Bank is actively pursuing initiatives like water conservation and has installed energy-efficient systems in its offices. These efforts are geared towards reducing the bank's overall environmental impact.

Pollution and Waste Management

Banks, including IDFC First Bank, contribute to environmental impact through their operational activities. This includes energy consumption, paper usage, and waste generation. Responsible waste management is therefore crucial for such institutions.

IDFC First Bank actively engages in waste segregation and recycling initiatives across its branches. These efforts are aimed at minimizing the volume of waste sent to landfills and promoting a circular economy. The bank also prioritizes sourcing materials locally where feasible, further reducing its environmental footprint.

In 2023, IDFC First Bank reported significant progress in its sustainability efforts. For instance, the bank achieved a 15% reduction in paper consumption per employee compared to the previous year. Furthermore, over 70% of its branches have implemented comprehensive waste segregation systems, with a target to reach 90% by the end of 2024.

- Waste Segregation: Over 70% of IDFC First Bank's branches have implemented waste segregation systems as of 2023.

- Recycling Initiatives: The bank actively recycles paper, plastic, and e-waste generated from its operations.

- Paper Consumption Reduction: IDFC First Bank saw a 15% decrease in paper usage per employee in 2023.

- Local Sourcing: Efforts are made to source operational materials locally to reduce transportation-related emissions.

Green Building and Infrastructure

IDFC First Bank demonstrates a tangible commitment to environmental responsibility through its physical infrastructure. Several of its key offices have achieved green building certifications, underscoring a dedication to sustainable operations. This strategic focus on eco-friendly workspaces directly translates into enhanced energy efficiency and improved water management practices.

The bank's investment in green buildings isn't merely symbolic; it yields measurable benefits. These certified spaces are designed to minimize their environmental footprint, contributing to reduced carbon emissions and a healthier working environment for employees. For instance, the adoption of energy-efficient lighting and HVAC systems can lead to significant operational cost savings over time.

- Green Office Certifications: IDFC First Bank has actively pursued and obtained certifications for its office spaces, signifying adherence to stringent environmental standards.

- Energy Efficiency Gains: Investments in green building technologies, such as advanced insulation and smart energy management systems, aim to reduce overall energy consumption.

- Water Conservation Measures: The bank incorporates water-saving fixtures and rainwater harvesting systems in its green buildings to minimize water usage.

- Employee Well-being: These sustainable workspaces are designed to promote better indoor air quality and natural light, fostering a healthier and more productive environment for staff.

IDFC First Bank is increasingly integrating environmental considerations into its business model, driven by a global push for sustainability and regulatory mandates. The bank's commitment is evident in its active financing of renewable energy projects and electric vehicle adoption, aligning with India's green transition goals.

The bank's operational efficiency is also a focus, with initiatives like water conservation and energy-efficient systems in its offices aimed at reducing its environmental footprint. In 2023, IDFC First Bank reported a 15% reduction in paper consumption per employee and achieved waste segregation in over 70% of its branches, with a target of 90% by end-2024.

Furthermore, IDFC First Bank is investing in green building certifications for its key offices, enhancing energy and water efficiency. These efforts not only reduce operational costs but also contribute to a healthier work environment, reflecting a broader commitment to ESG principles.

| Environmental Initiative | Status (as of 2023) | Target | Impact Metric |

|---|---|---|---|

| Waste Segregation in Branches | Over 70% implemented | 90% by end-2024 | Reduced landfill waste |

| Paper Consumption Reduction | 15% decrease per employee | Continuous improvement | Reduced resource usage |

| Green Building Certifications | Achieved for key offices | Expand to new facilities | Lower energy & water consumption |

| Renewable Energy Financing | Significant involvement | Increase portfolio share | Support India's green transition |

PESTLE Analysis Data Sources

Our IDFC First Bank PESTLE Analysis is meticulously constructed using data from reputable sources such as the Reserve Bank of India, national economic surveys, and reports from leading financial institutions. We also incorporate insights from global economic bodies and industry-specific publications to ensure comprehensive coverage.