IDFC First Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDFC First Bank Bundle

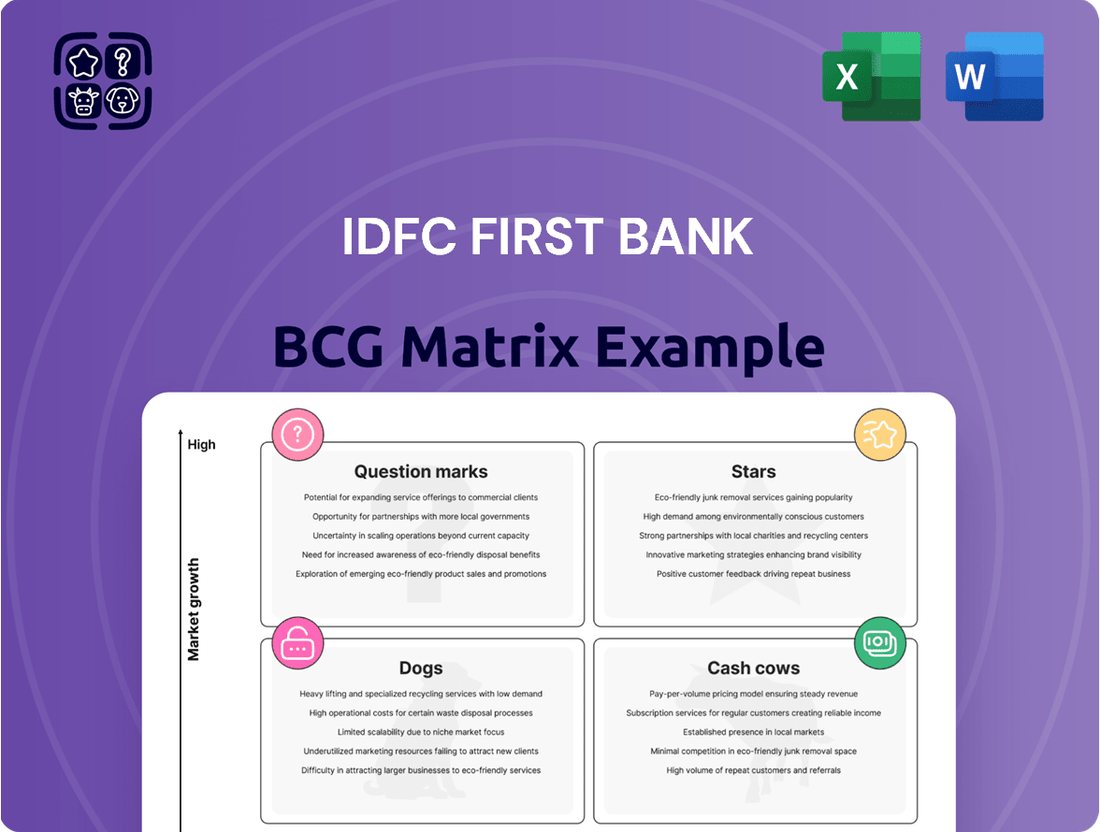

Curious about IDFC First Bank's strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market stars, which are reliable cash cows, and which might be underperforming. This snapshot is just the beginning of understanding their product portfolio's potential.

Unlock the full strategic advantage by purchasing the complete IDFC First Bank BCG Matrix report. Gain granular insights into each quadrant, understand the growth prospects and market share of their key products, and equip yourself with actionable recommendations for optimizing their portfolio.

Don't miss out on the detailed breakdown and strategic roadmap. For a comprehensive understanding of IDFC First Bank's market dynamics and informed investment decisions, secure your full BCG Matrix today!

Stars

The Retail, Rural, and MSME (RRMSME) loan book is a cornerstone of IDFC First Bank's growth strategy, consistently expanding at double-digit rates year-on-year. This granular portfolio is a key contributor to the bank's overall loan book expansion, reflecting a strong market presence in its chosen customer bases.

IDFC First Bank's deliberate emphasis on this segment highlights its commitment to capturing opportunities in India's expanding retail and small business financing landscape. The bank's robust performance in RRMSME underscores its leadership in a dynamic and growing market.

As of March 31, 2024, IDFC First Bank reported its retail, rural, and MSME loan book stood at INR 1,37,619 crore, representing a significant 24% year-on-year growth. This segment now constitutes a substantial 69% of the bank's total loan book, showcasing its dominance and strategic importance.

IDFC First Bank is aggressively pursuing a strategy of being a technology-first entity, pouring significant resources into digital transformation and customer-focused platforms. This approach is evident in its highly-rated mobile banking app, which has secured a strong global position, signaling robust user adoption and a rapidly expanding digital customer base.

IDFC First Bank's credit card segment is a strong performer, showing impressive growth. By the first quarter of fiscal year 2026, the bank had issued 3.8 million credit cards, a testament to its expanding reach.

This product line is experiencing robust year-on-year growth, consistently adding new cardholders and indicating a deepening market penetration. The aggressive expansion here points to significant potential and a growing market share in India's competitive credit card landscape.

FASTag Services

FASTag Services represent a clear star for IDFC First Bank. The bank has solidified its position as the largest issuer bank for FASTags in India, boasting over 19.1 million FASTags in force as of Q1 FY26. This significant market share in the growing digital toll collection sector underscores its star status.

The ongoing expansion of FASTag adoption nationwide fuels sustained high growth for this crucial banking service. The convenience and efficiency offered by FASTags continue to drive user acquisition, ensuring a robust future for this offering within the bank's portfolio.

- Market Dominance: IDFC First Bank is the leading FASTag issuer in India.

- Growth Trajectory: Over 19.1 million FASTags were in force by Q1 FY26, indicating strong user adoption.

- Ecosystem Expansion: The digital toll collection sector is rapidly growing, benefiting FASTag services.

- Future Potential: Continued adoption ensures sustained high growth for FASTag services.

Wealth Management Services

IDFC First Bank's Wealth Management services are a notable component within its broader portfolio, exhibiting robust expansion. The bank has achieved significant growth in this segment, with its Assets Under Management (AUM) surging by 34% year-on-year. This impressive growth trajectory saw the AUM surpass the ₹50,000 crore mark by Q1 FY26, underscoring a strong market position.

This expansion in wealth management indicates IDFC First Bank's successful penetration into a high-growth financial sector. The consistent rise in AUM is a testament to both its ability to attract new affluent clients and to deepen relationships with its existing customer base, thereby increasing the assets it manages.

- Assets Under Management (AUM) growth: 34% year-on-year.

- AUM milestone: Crossed ₹50,000 crore in Q1 FY26.

- Sectoral presence: Strong and expanding in the wealth management market.

- Growth drivers: Market share gains and increasing affluent customer base.

FASTag Services are a clear star for IDFC First Bank, holding the position as the largest issuer bank in India. By Q1 FY26, over 19.1 million FASTags were in force, demonstrating significant market dominance and user adoption within the rapidly expanding digital toll collection sector.

The credit card segment is also a star performer, with IDFC First Bank issuing 3.8 million credit cards by Q1 FY26, reflecting robust year-on-year growth and increasing market penetration in a competitive landscape.

Wealth Management services shine with a 34% year-on-year growth in Assets Under Management (AUM), surpassing ₹50,000 crore by Q1 FY26. This indicates successful client acquisition and deepening relationships within the high-growth financial sector.

| Business Unit | BCG Category | Key Metrics (as of Q1 FY26) | Growth Drivers |

|---|---|---|---|

| FASTag Services | Star | Largest issuer bank; 19.1M+ FASTags in force | Digital toll collection expansion; User convenience |

| Credit Cards | Star | 3.8M cards issued | Aggressive expansion; Deepening market penetration |

| Wealth Management | Star | 34% YoY AUM growth; ₹50,000Cr+ AUM | Affluent client acquisition; Deepening customer relationships |

What is included in the product

This BCG Matrix overview provides strategic insights into IDFC First Bank's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The IDFC First Bank BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

IDFC First Bank has demonstrated impressive growth in its retail deposits, a vital component of its funding strategy. These deposits, especially from Current Account Savings Accounts (CASA), represent a stable and cost-effective source of capital. For instance, as of March 31, 2024, the bank's total deposits reached ₹2.65 trillion, with retail deposits forming a substantial ₹1.68 trillion of this amount.

The increasing proportion of retail deposits, which stood at 63.5% of total deposits by the end of the fiscal year 2024, highlights the bank's success in attracting and retaining a broad customer base. This strong retail franchise provides a reliable funding base, reducing reliance on more volatile wholesale funding sources and supporting consistent lending operations.

Home loans at IDFC First Bank are a cornerstone, acting as a dependable cash cow. While not experiencing hyper-growth, this segment forms a substantial and stable portion of the bank's overall lending. For instance, as of March 31, 2024, IDFC First Bank's retail home loan book stood at a significant ₹30,000 crore, demonstrating its considerable market presence.

This steady performance translates into consistent interest income for the bank. Home loans typically carry a lower risk profile compared to unsecured lending products, contributing to their reliability as a cash generator. The maturity of this market segment means predictable cash flows, underpinning its 'cash cow' status within the BCG matrix.

Vehicle loans are a strong performer for IDFC First Bank, acting as a reliable cash cow. This segment consistently contributes to the bank's overall loan portfolio, demonstrating healthy growth even in a mature market.

As of the fiscal year ending March 31, 2024, IDFC First Bank reported a robust growth in its retail loan book, with vehicle loans forming a significant and stable component. The bank’s total advances grew by approximately 24% year-on-year, underscoring the steady demand and consistent cash flow generated by this segment.

Established Business Banking and MSME Loans

IDFC First Bank's established business banking and MSME loan portfolio acts as a stable cash cow, generating consistent revenue beyond its high-growth retail segments. While not experiencing the same rapid expansion as newer digital ventures, these traditional lending areas are crucial to the bank's financial health. They reliably contribute to net interest income and overall profitability, forming a bedrock for the bank's operations.

These segments provide a predictable income stream, underpinning the bank's ability to invest in growth areas. For instance, as of the fiscal year ending March 31, 2024, IDFC First Bank reported a substantial Net Interest Income, with a significant portion derived from its diverse loan book, including corporate and MSME exposures.

- Steady Revenue Generation: Business and MSME loans provide a consistent and predictable income stream for IDFC First Bank.

- Foundational Contribution: These segments form a core part of the bank's lending activities, supporting overall financial stability.

- Profitability Driver: They consistently contribute to the bank's net interest income and overall profitability.

- FY24 Performance: IDFC First Bank's Net Interest Income for the fiscal year ending March 31, 2024, reflects the strength of its diversified loan portfolio, including these established segments.

Existing Branch Network and Customer Base

IDFC First Bank's extensive network, boasting over 1,000 branches across India as of early 2024, coupled with a rapidly expanding customer base, forms a robust foundation for its Cash Cow status. This physical presence, complementing its digital initiatives, ensures broad accessibility and fosters customer trust, leading to consistent deposit growth and reliable service delivery.

The bank's strategy leverages this established infrastructure to effectively cross-sell a wider range of products and services, thereby deepening existing customer relationships and generating stable operational cash flows. For instance, in Q3 FY24, IDFC First Bank reported a significant increase in its retail deposits, reaching ₹1.35 lakh crore, a testament to the strength of its customer base and branch network.

- Branch Network: Over 1,000 branches as of early 2024.

- Customer Base: Continually growing, providing a stable platform.

- Deposit Mobilization: Consistent and reliable, evidenced by ₹1.35 lakh crore in retail deposits in Q3 FY24.

- Cross-Selling Potential: High due to established relationships and physical presence.

IDFC First Bank's retail home loan portfolio is a prime example of a cash cow. This segment, while not exhibiting explosive growth, provides a substantial and predictable stream of interest income. As of March 31, 2024, the bank's retail home loan book stood at ₹30,000 crore, showcasing its established presence and consistent revenue generation from this lower-risk lending area.

Vehicle loans also function as a reliable cash cow for IDFC First Bank. This segment consistently contributes to the bank's loan portfolio, demonstrating steady demand and generating predictable cash flows. The bank's overall retail loan book saw robust growth, with vehicle loans forming a stable and significant component, reflecting their dependable performance.

Established business banking and MSME loan portfolios are crucial cash cows for IDFC First Bank. These traditional lending areas provide a stable income stream, contributing significantly to the bank's net interest income and overall profitability. This consistent performance underpins the bank's financial health and its capacity to invest in growth opportunities.

| Segment | Role in BCG Matrix | Key Financial Indicator (as of Mar 31, 2024) | Contribution to Bank |

|---|---|---|---|

| Retail Home Loans | Cash Cow | ₹30,000 crore (Retail Home Loan Book) | Stable interest income, predictable cash flows |

| Vehicle Loans | Cash Cow | Part of robust retail loan book growth (approx. 24% YoY advances growth) | Consistent cash generation, stable portfolio component |

| Business & MSME Loans | Cash Cow | Significant portion of Net Interest Income | Reliable revenue stream, supports overall profitability |

What You’re Viewing Is Included

IDFC First Bank BCG Matrix

The IDFC First Bank BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing IDFC First Bank's business units across the BCG Matrix's quadrants, is ready for immediate strategic application without any watermarks or demo content. You'll gain access to the complete, professionally designed report, enabling you to effectively assess and plan for each of the bank's product lines or services. This is the actual, analysis-ready file you'll download, empowering your strategic decision-making.

Dogs

The microfinance portfolio at IDFC First Bank has been a notable area of concern, characterized by a substantial contraction in its size. This segment's shrinking proportion within the bank's overall loan book signifies a reduced market presence in microfinance.

This strategic shift has led to a de-emphasis on microfinance, as the portfolio has acted as a drag on the bank's profitability. For instance, by the end of the fiscal year 2023-24, the bank had actively reduced its exposure to this segment, aiming to improve its overall asset quality and financial performance.

Legacy Infrastructure Loans represent a historical portfolio that IDFC First Bank has been actively reducing. This segment now comprises a very small fraction of the bank's total funded assets, underscoring a strategic move to exit or significantly limit exposure to this low-growth, higher-risk area.

The shrinking proportion of legacy infrastructure loans clearly positions them as a 'dog' within the bank's portfolio. This decline is a direct result of the bank's conscious strategy to divest from or minimize its involvement with these less profitable or problematic assets, aiming to improve overall portfolio health and profitability.

High-cost legacy borrowings, prior to IDFC First Bank's strategic shift to retail deposits, represented a significant drag on profitability. These liabilities, often characterized by higher interest rates, contributed to a less efficient cost of funds for the bank.

The bank has been diligently working to reduce its exposure to these legacy borrowings. For instance, by the end of the fiscal year 2023, IDFC First Bank had significantly reduced its reliance on such instruments, aiming to improve its net interest margins.

This segment of liabilities, due to its inefficiency and lower profitability compared to newer, lower-cost funding sources, firmly places it in the 'dog' category within the BCG matrix framework for IDFC First Bank.

Underperforming Niche Lending Products (if any)

While IDFC First Bank's recent performance has been strong, any underperforming niche lending products would be categorized as Dogs in a BCG Matrix. These are segments with low market share and little to no growth, consuming resources without delivering adequate returns. The bank's strategic focus on retail and wholesale banking, with a particular emphasis on unsecured retail loans, suggests a deliberate move away from less profitable or riskier niche areas. For instance, if a specific segment like certain types of corporate or SME lending experienced persistent high non-performing assets (NPAs) or failed to attract significant volume, it would fit this description.

Although specific underperforming niche products are not explicitly highlighted in public financial disclosures, the bank's ongoing portfolio review and diversification efforts imply that such segments, if they exist, are actively managed. For example, a hypothetical niche product that saw its market share decline from 2% to 1% between FY23 and FY24, while also experiencing a rise in its specific NPA ratio, would be a prime candidate for this category. The bank's commitment to enhancing its retail franchise, evidenced by a 25% year-on-year growth in retail assets under management as of December 2023, indicates a strategic reallocation of capital towards more promising areas.

- Low Growth Segments: Hypothetical niche lending products that have shown less than 5% annual growth in loan book size over the past two fiscal years.

- Asset Quality Concerns: Segments where the specific NPA ratio has consistently exceeded the bank's average NPA ratio, potentially indicating underlying issues.

- Capital Inefficiency: Products tying up significant capital with low return on assets (RoA), failing to contribute meaningfully to overall profitability.

- Strategic Divestment Potential: Areas where the bank might consider reducing exposure or exiting if they do not align with future growth strategies.

Inefficient Traditional Processes (pre-digital transformation)

Before its significant digital transformation, IDFC First Bank likely relied on traditional, paper-heavy operational methods. These processes, characterized by manual approvals and physical document handling, were inherently slower and more resource-intensive, leading to lower operational efficiency and potentially impacting customer experience.

As the bank embraces a fully digital and paperless future, these legacy systems and workflows are being categorized as 'dogs' within the BCG framework. They represent outdated operational segments that are either being systematically retired or undergoing substantial automation to streamline operations and reduce costs.

This shift is crucial for improving the bank's cost-to-income ratio. For instance, by automating processes that previously required extensive manual intervention, IDFC First Bank can significantly cut down on operational expenses. In 2023, the bank reported a cost-to-income ratio of 72.4%, and the move away from inefficient traditional processes is a key driver for reducing this figure in the coming years.

- Legacy Systems: Traditional, paper-based customer onboarding and loan processing.

- Manual Workflows: Reliance on physical paperwork and manual data entry.

- Reduced Efficiency: Longer turnaround times for services compared to digital alternatives.

- Phased Out Operations: Areas being automated or replaced to align with digital strategy.

The 'Dogs' in IDFC First Bank's portfolio represent segments with low market share and minimal growth, often requiring significant resources without generating proportional returns. These are typically legacy portfolios or niche products that no longer align with the bank's strategic growth objectives. The bank's active management of these segments involves either divesting from them or significantly reducing exposure to improve overall financial health.

For instance, legacy infrastructure loans, which have seen a substantial reduction in their share of total funded assets, are a prime example of a 'Dog'. Similarly, high-cost legacy borrowings, prior to the shift towards retail deposits, also fit this category due to their inefficiency. The bank's focus on digital transformation also means that outdated, manual operational processes are being phased out, effectively categorizing them as 'Dogs' that are being replaced by more efficient digital solutions.

These 'Dog' segments, by their nature, are characterized by low profitability and often present asset quality concerns. The bank's strategy is to reallocate capital from these underperforming areas to more promising segments, such as its growing retail and wholesale banking operations. This strategic pruning is essential for enhancing the bank's overall profitability and return on assets.

By identifying and managing these 'Dog' segments, IDFC First Bank aims to optimize its resource allocation and improve its competitive positioning in the financial market. The bank's commitment to a digital-first approach and its focus on expanding its retail franchise are key indicators of its strategy to move away from these low-growth, low-return areas.

Question Marks

IDFC First Bank's wholesale book, while experiencing robust year-on-year growth, especially noted in Q1 FY26 with a significant uptick, currently forms a smaller segment of the bank's overall loan portfolio when contrasted with its leading retail operations. This accelerated expansion signifies considerable growth prospects.

The rapid scaling of the wholesale segment necessitates vigilant oversight regarding its long-term stability, the caliber of its assets, and its capacity for sustained profitability, particularly in the wake of such swift development. Continued strategic investment and astute management are crucial to elevate this segment into a 'Star' performer within the BCG matrix.

IDFC First Bank is actively exploring AI for enhanced customer service and blockchain for transaction efficiency. These are forward-thinking projects poised for significant growth in the rapidly advancing fintech landscape.

While these technologies represent high-potential areas, their current impact on the bank's revenue may be modest. Significant investment and successful market adoption are crucial for these initiatives to become major contributors to IDFC First Bank's financial performance.

IDFC First Bank is actively pursuing expansion into rural and semi-urban markets, aiming to tap into significant growth opportunities presented by financial inclusion efforts and previously underserved populations. This strategic move is designed to broaden the bank's customer base and capture new market segments.

As of the fiscal year ending March 31, 2024, IDFC First Bank reported a substantial increase in its branch network, with a particular focus on expanding its reach into these tier 3 and tier 4 centers. The bank's commitment to these areas is underscored by its efforts to provide accessible banking services and tailored financial products to meet the unique needs of these communities, aligning with broader national financial inclusion agendas.

While these markets hold immense potential, the bank acknowledges the substantial investment required for infrastructure development, targeted outreach programs, and the creation of localized product offerings. These investments are crucial for building a strong market presence and achieving sustainable growth in these emerging territories, classifying them as potential 'Stars' or 'Cash Cows' depending on the pace of market penetration and profitability.

Newer Credit Product Lines within Diversified Portfolio

IDFC First Bank's expansion into 25 distinct product lines signifies a strategic move to capture diverse market segments. Newer credit products, often catering to emerging customer groups or specialized industries, currently hold a smaller market share but possess significant growth potential. These are akin to 'question marks' in a BCG matrix, demanding careful resource allocation to nurture their development.

For instance, IDFC First Bank has been actively developing its retail and wholesale banking operations. While established products form the core, the bank's focus on expanding its digital offerings and tailored loan solutions for small and medium enterprises (SMEs) falls into this category. These initiatives require substantial investment in technology and marketing to build brand awareness and customer adoption.

- High Growth Potential: Newer credit products targeting niche markets or specific customer segments are positioned for rapid expansion.

- Limited Market Share: These products currently represent a smaller portion of the bank's overall loan portfolio.

- Strategic Investment Needed: Significant capital and marketing efforts are required to scale these offerings and establish market presence.

- Focus on Profitability: The bank must strategically nurture these 'question marks' to convert them into profitable ventures.

UPI Services for NRI Customers Across 12 Countries

IDFC First Bank's recent expansion of UPI services to Non-Resident Indians (NRIs) across 12 countries positions it squarely in a high-growth segment of international remittances and banking. This strategic move targets a significant, yet often underserved, market. The bank's objective is to secure a foothold in this burgeoning sector, capitalizing on the increasing demand for seamless cross-border transactions.

While the exact current market share among NRIs and its revenue contribution are still in their early stages, the potential is substantial. The global remittance market is a massive opportunity, with India being a major recipient. For instance, India received an estimated $125 billion in remittances in 2023, highlighting the scale of the opportunity. To fully tap into this, IDFC First Bank will need to invest heavily in marketing, customer acquisition, and robust technological infrastructure to ensure a smooth user experience.

- Market Potential: The global remittance market continues to grow, with India consistently being one of the top recipient countries.

- Strategic Importance: Offering UPI to NRIs addresses a key need for convenient international transactions, enhancing the bank's service portfolio.

- Investment Required: Significant marketing and infrastructure investment is anticipated to build awareness and operational capacity for this new offering.

- Early Stage Growth: The current market share and revenue impact are likely minimal, indicating this is a long-term growth play for the bank.

IDFC First Bank's new product lines, such as specialized credit offerings for niche markets and expanded digital services for SMEs, currently represent a smaller portion of its overall business. These initiatives require substantial investment to gain traction and market share.

The bank's strategic expansion into rural and semi-urban areas, while promising for financial inclusion, also falls into this category. These ventures demand significant upfront capital for infrastructure and localized product development.

Similarly, the recent launch of UPI services for Non-Resident Indians (NRIs) in 12 countries is a high-potential area with limited current market penetration. The global remittance market is vast, with India receiving an estimated $125 billion in 2023, underscoring the opportunity for IDFC First Bank to capture a share.

These 'question marks' are critical for future growth, but their success hinges on effective resource allocation, targeted marketing, and achieving customer adoption to eventually transition into 'Stars' or 'Cash Cows'.

| Category | Description | Market Share | Growth Potential | Investment Needs |

|---|---|---|---|---|

| New Credit Products | Targeting niche markets/customer segments | Low | High | High |

| SME Digital Solutions | Tailored loan and digital banking for SMEs | Low | High | High |

| Rural/Semi-Urban Expansion | Financial inclusion in underserved areas | Low | High | High |

| NRI UPI Services | Cross-border remittances and banking | Low | High | High |

BCG Matrix Data Sources

Our IDFC First Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.