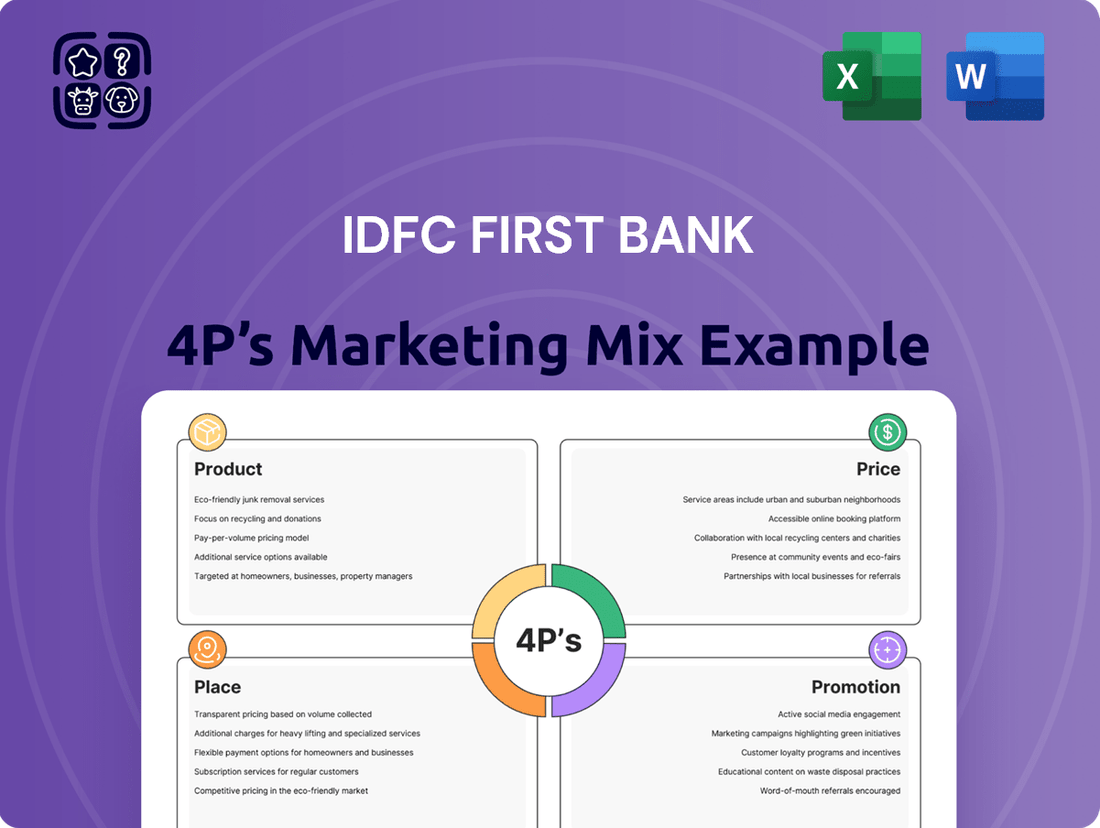

IDFC First Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDFC First Bank Bundle

IDFC First Bank's marketing mix is a carefully crafted strategy designed to attract and retain customers in the competitive banking landscape. Their product portfolio, competitive pricing, extensive distribution network, and targeted promotional activities all contribute to their market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering IDFC First Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

IDFC First Bank provides a wide array of financial products, serving both individual and business clients across India. Their offerings span essential banking like savings and current accounts, as well as a comprehensive suite of loan options. This integrated approach aims to address diverse financial requirements effectively.

IDFC First Bank's loan portfolio is notably diverse, spanning 25 distinct business lines. This broad diversification across its lending activities helps to mitigate concentration risk and provides a wide market reach.

Key growth engines for the bank's loan book in 2024 and 2025 are expected to be mortgage loans, vehicle financing, business banking, loans to Micro, Small, and Medium Enterprises (MSMEs), and wholesale lending.

This extensive range of loan products caters to a variety of customer needs, from individual homebuyers and vehicle purchasers to businesses of all sizes, demonstrating a comprehensive approach to financial solutions.

IDFC First Bank's product strategy heavily leans into digital-first solutions, aiming to revolutionize customer experience. Their mobile banking app, a cornerstone of this approach, boasts over 250 features, including advanced tools like goal-based investing and a personal finance manager, making it a comprehensive financial hub. This digital focus is further enhanced by plans to integrate Generative AI, promising more conversational and intuitive banking interactions.

The bank's commitment to digital accessibility is evident in its ability to serve diverse customer segments. Notably, IDFC First Bank extends its UPI services to NRI customers in 12 countries, demonstrating a global reach powered by its digital infrastructure. This expansion underscores their strategy to make banking services convenient and readily available, aligning with modern consumer expectations.

Wealth Management and Investment s

IDFC First Bank extends its offerings beyond traditional banking by providing comprehensive wealth management and investment solutions. Its Private Wealth Management Assets Under Management (AUM) have seen robust growth, indicating a strong uptake from clients looking to enhance their financial portfolios. This focus caters directly to customers aiming for efficient wealth accumulation and management.

The bank empowers customers to engage with mutual funds directly through its user-friendly mobile application, simplifying the investment process. Furthermore, IDFC First Bank equips its clients with a suite of diverse investment tools designed to support their financial objectives. This integrated approach ensures accessibility and ease of use for individuals seeking to grow their wealth.

- Growing AUM: IDFC First Bank's Private Wealth Management AUM has demonstrated significant expansion, reflecting increasing client trust and engagement in wealth-building strategies.

- Digital Investment Access: The bank's mobile app provides seamless access to mutual fund investments, making it convenient for customers to manage their assets on the go.

- Investment Tools: A variety of investment tools are available, supporting clients in making informed decisions and optimizing their investment performance.

- Customer Focus: These services are tailored to meet the needs of customers who prioritize efficient wealth growth and sophisticated investment management.

Specialized Card Offerings

IDFC First Bank's specialized card offerings are designed to attract and retain a broad customer base. They provide a variety of credit cards, with some variants being lifetime free, which is a significant draw for cost-conscious consumers. The bank also emphasizes the value of its reward points, which never expire, offering long-term benefits to cardholders.

A key differentiator is the zero-interest period on ATM cash withdrawals, extending up to 45 days. This feature provides considerable flexibility and potential savings for customers needing immediate cash access. For instance, in 2024, the bank continued to highlight these benefits as part of its customer acquisition strategy.

The bank has also been strategic in its pricing adjustments, introducing new add-on card fees and revising interest rate ranges. These changes reflect a dynamic approach to revenue generation and market positioning. Furthermore, IDFC First Bank is a prominent issuer of FASTags, a testament to its role in facilitating digital transactions and infrastructure development in India, with significant transaction volumes processed in 2024.

- Lifetime Free Variants: Certain credit card options are offered without annual fees, enhancing affordability.

- Never-Expiring Reward Points: Customers can accumulate and redeem rewards at their own pace.

- 45-Day Interest-Free ATM Withdrawals: A unique benefit offering short-term, interest-free cash access.

- FASTag Leadership: IDFC First Bank is a major player in electronic toll collection across India.

IDFC First Bank's product strategy is deeply rooted in a digital-first approach, aiming to offer a comprehensive suite of banking and investment solutions. This includes a robust mobile banking app with over 250 features, supporting everything from goal-based investing to personal finance management, and plans to integrate Generative AI for enhanced customer interaction.

The bank's loan portfolio is extensive, covering 25 business lines, with key growth drivers identified for 2024-2025 including mortgages, vehicle financing, business banking, MSME loans, and wholesale lending. This diversification caters to a wide spectrum of individual and business needs.

Beyond core banking, IDFC First Bank provides sophisticated wealth management services, evidenced by significant growth in Private Wealth Management Assets Under Management (AUM). Customers can also directly invest in mutual funds via the mobile app, supported by a range of investment tools.

Specialized card offerings, such as lifetime free credit cards and rewards points that never expire, along with a unique 45-day interest-free ATM withdrawal period, are key customer acquisition and retention tools. The bank also leads in FASTag issuance, facilitating digital toll payments.

| Product Category | Key Features | 2024/2025 Focus Areas | Digital Integration | Customer Benefit |

|---|---|---|---|---|

| Loans | 25 diverse business lines (mortgages, vehicle, MSME, wholesale) | Growth in mortgages, vehicle finance, MSME, business banking | Digital application and management | Comprehensive financing solutions |

| Digital Banking | Mobile app with 250+ features, UPI for NRIs in 12 countries | Generative AI integration, enhanced user experience | Core to service delivery | Convenience, accessibility, advanced financial tools |

| Wealth Management | Private Wealth Management, mutual fund access | Growing AUM, simplifying investment | Mobile app investment platform | Efficient wealth accumulation and management |

| Cards & Payments | Lifetime free cards, non-expiring rewards, 45-day interest-free ATM withdrawals, FASTag | Customer acquisition, digital transaction facilitation | Seamless payment processing | Value, flexibility, cost savings, digital convenience |

What is included in the product

This analysis provides a comprehensive overview of IDFC First Bank's marketing strategies, detailing its product offerings, pricing structures, distribution channels, and promotional activities.

It's designed for stakeholders seeking a clear understanding of IDFC First Bank's market positioning and competitive advantages.

IDFC First Bank's 4Ps analysis acts as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies address customer banking frustrations, offering a tangible solution to common financial anxieties.

This concise 4Ps breakdown serves as a powerful pain point reliever for stakeholders, quickly illustrating how IDFC First Bank's offerings directly alleviate customer concerns and build trust.

Place

IDFC First Bank has strategically expanded its physical footprint, boasting a network of over 1,000 branches across India as of early 2024, a significant increase post-merger. This growth is designed to enhance accessibility, particularly for customers in Tier 2, Tier 3 cities, and rural areas, offering traditional banking services. The bank has signaled its intent to maintain this momentum, targeting a 10% annual expansion of its branch network in the immediate future.

IDFC First Bank prioritizes its digital footprint, offering robust services via its well-regarded mobile app and website. This digital-first strategy ensures customers enjoy 24/7 access to banking, reducing reliance on physical branches for many everyday transactions. By March 2024, the bank reported a significant increase in digital transactions, with over 85% of savings account account opening happening digitally.

Further enhancing its digital reach, IDFC First Bank extends UPI services to Non-Resident Indian (NRI) customers in 12 countries, facilitating seamless transactions. This move underscores the bank's commitment to catering to a global customer base through accessible digital platforms.

IDFC First Bank complements its physical branches with a widespread ATM network, ensuring customers can access cash and perform essential banking tasks conveniently. This network is crucial for serving customers in both urban and semi-urban areas, offering a vital touchpoint for self-service banking.

As of early 2024, IDFC First Bank operates a significant number of ATMs across India, with recent reports indicating a network size of over 2,000 machines. This extensive reach provides customers with reliable access to funds and basic banking services, reinforcing the bank's commitment to customer convenience.

International Banking Unit (IBU)

IDFC First Bank's International Banking Unit (IBU) is strategically located at GIFT City, Gandhinagar. This positioning is crucial for serving international banking requirements and extending the bank's operational footprint beyond India's domestic market. The IBU facilitates seamless cross-border transactions and offers specialized services to a global clientele.

The establishment of the IBU at GIFT City underscores IDFC First Bank's commitment to global financial integration and its ambition to capture a significant share of international banking business. This move aligns with India's vision for GIFT City as a global financial hub, enabling the bank to leverage regulatory advantages and a conducive business environment.

- Location Advantage: GIFT City, India's first operational smart city and International Financial Services Centre (IFSC), provides a robust regulatory framework and tax benefits conducive to international banking operations.

- Service Expansion: The IBU enables IDFC First Bank to offer a comprehensive suite of services to non-resident Indians (NRIs), foreign portfolio investors (FPIs), and multinational corporations (MNCs) for their offshore banking needs.

- Market Reach: This presence allows the bank to tap into international capital markets and cater to the growing demand for sophisticated financial products and services from global businesses and investors.

- Strategic Growth: By operating from GIFT City, IDFC First Bank aims to enhance its foreign currency intermediation capabilities and contribute to the development of India as a global financial services destination.

Strategic Partnerships and Ecosystems

IDFC FIRST Bank actively cultivates strategic partnerships to broaden its service accessibility and embed itself within wider financial networks. A prime example is its MyFIRST Partner Referral Program, designed to incentivize individuals to refer personal loan applications. This initiative significantly bolsters the bank's distribution capabilities and drives customer acquisition.

These collaborations are crucial for expanding reach and integrating offerings. For instance, partnerships can facilitate access to new customer segments or complement existing product suites. By joining forces with other entities, IDFC FIRST Bank can create more comprehensive value propositions for its clientele, thereby strengthening its market position.

- Distribution Channel Expansion: Partnerships allow IDFC FIRST Bank to tap into new customer bases and sales channels, effectively extending its market reach beyond traditional banking branches.

- Enhanced Customer Acquisition: Programs like the MyFIRST Partner Referral Program leverage existing networks to generate qualified leads and acquire new customers more efficiently.

- Ecosystem Integration: By integrating services into broader financial ecosystems, the bank aims to become a more central part of customers' financial lives, offering a seamless experience across various needs.

- Product and Service Augmentation: Strategic alliances can enable the bank to offer complementary products or services, thereby enhancing its overall value proposition and customer retention.

IDFC First Bank's physical presence is robust, with over 1,000 branches by early 2024, focusing on expanding into Tier 2 and 3 cities. This physical network is complemented by a digital-first approach, with over 85% of savings account openings occurring online by March 2024, alongside a UPI service for NRIs in 12 countries. The bank also maintains over 2,000 ATMs nationwide for convenient access, and its International Banking Unit at GIFT City, Gandhinagar, positions it for global financial integration. Strategic partnerships, like the MyFIRST Partner Referral Program, further extend its distribution and customer acquisition capabilities.

What You Preview Is What You Download

IDFC First Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into IDFC First Bank's Product, Price, Place, and Promotion strategies. You'll gain an in-depth understanding of their marketing mix, ready for immediate application.

Promotion

IDFC First Bank's '#AlwaysYouFirst' brand promise, launched post-merger, signifies a significant shift towards a deeply customer-centric philosophy. This initiative leverages a powerful, people-driven strategy, enlisting influencers and celebrities to share personal narratives that resonate with a wider audience on social media platforms.

The campaign's success is evident in its ability to cultivate a strong brand identity, directly linking IDFC First Bank with a commitment to prioritizing customer needs and experiences. This approach aims to build trust and loyalty by showcasing authentic stories, thereby reinforcing the bank's dedication to its clientele.

IDFC First Bank actively engages in digital marketing, leveraging platforms like Facebook, LinkedIn, and YouTube for targeted campaigns. This approach is vital for reaching a digitally connected customer base and clearly communicating their unique product offerings. In 2024, the bank's digital ad spend saw a notable increase, reflecting a commitment to online visibility.

IDFC FIRST Bank's MyFIRST Partner Referral Program is a key promotional strategy, incentivizing existing customers to bring in new clients for personal loans. This program leverages the power of word-of-mouth, a highly effective and cost-efficient marketing channel, to drive customer acquisition. In 2023, referral programs across the financial services sector saw significant uptake, with many banks reporting that up to 20% of new customer acquisitions stemmed from these initiatives.

Financial Literacy Initiatives

IDFC First Bank actively champions financial literacy through its IDFC FIRST Academy, launched in January 2025. This digital platform provides accessible courses covering essential financial topics, designed to equip individuals with enhanced money management capabilities. By fostering financial knowledge, the bank cultivates trust and strengthens its relationship with both current and prospective customers.

The Academy's curriculum focuses on practical skills, aiming to demystify complex financial concepts. This proactive approach serves as a key promotional element, positioning IDFC First Bank as a supportive partner in its customers' financial journeys. The initiative directly contributes to building a more informed consumer base, which in turn can lead to increased engagement with the bank's products and services.

- Digital Platform: IDFC FIRST Academy, launched January 2025, offers online financial education.

- Empowerment Focus: Aims to improve financial management skills for individuals.

- Promotional Value: Builds trust and knowledge, enhancing customer relationships.

- Market Reach: Targets a broad audience seeking to improve their financial acumen.

Product-Specific Campaigns and Features

IDFC FIRST Bank's product-specific campaigns focus on tangible customer benefits. For instance, their lifetime free credit cards, a significant draw, often emphasize never-expiring rewards, providing ongoing value. This contrasts with many competitors who may have annual fees or reward expiry clauses.

The bank also actively promotes the ease of its digital offerings. Campaigns highlight the convenience of accessing personal loans and investing in mutual funds directly through their user-friendly mobile app. This digital-first approach caters to a growing demand for seamless, on-the-go financial management.

These targeted promotions are designed to attract new customers by clearly articulating the advantages and simplicity of their financial products. For example, in 2023, IDFC FIRST Bank reported a significant increase in its retail customer base, partly attributed to these feature-driven campaigns.

- Lifetime Free Credit Cards: Emphasizing no annual fees and rewards that don't expire.

- Digital Personal Loans: Highlighting quick application and disbursal processes via the mobile app.

- App-Based Mutual Fund Investments: Promoting easy access and management of investment portfolios.

- Customer Acquisition: These campaigns contributed to IDFC FIRST Bank's reported 25% year-on-year growth in retail advances as of Q3 FY24.

IDFC FIRST Bank's promotional efforts are multifaceted, encompassing a strong digital presence, customer referral programs, and financial literacy initiatives. The '#AlwaysYouFirst' campaign, utilizing social media influencers, aims to build a customer-centric brand image. Their MyFIRST Partner Referral Program incentivizes existing customers to acquire new ones, a strategy that proved effective across the financial sector in 2023, with referrals often accounting for up to 20% of new customer acquisitions.

The launch of IDFC FIRST Academy in January 2025 underscores a commitment to financial education, positioning the bank as a trusted partner. Product-specific campaigns, such as those for lifetime free credit cards and app-based loan applications, highlight tangible benefits and convenience, contributing to significant customer base growth. As of Q3 FY24, IDFC FIRST Bank reported a 25% year-on-year increase in retail advances, partly fueled by these targeted promotions.

| Promotional Strategy | Key Features/Initiatives | Impact/Data Point |

|---|---|---|

| Brand Campaign | #AlwaysYouFirst, influencer marketing | Builds customer-centric brand image |

| Referral Program | MyFIRST Partner Referral Program | Drives customer acquisition; sector saw 20% acquisition via referrals in 2023 |

| Financial Literacy | IDFC FIRST Academy (launched Jan 2025) | Enhances trust and customer relationships |

| Product Campaigns | Lifetime free credit cards, digital loans, app investments | Contributed to 25% YoY retail advance growth (Q3 FY24) |

Price

IDFC First Bank distinguishes itself by offering competitive interest rates on its diverse loan portfolio. For instance, personal loans can start as low as 9.99% per annum, while home loans are available from a compelling 7.95% per annum. These attractive rates are a significant draw for customers seeking affordable financing options.

The specific interest rate an individual receives is carefully determined by several key factors. These include the applicant's age, their income level, the nature of their job profile, their credit score, and their past loan repayment behavior. This personalized approach ensures that rates are aligned with individual risk profiles.

Furthermore, IDFC First Bank facilitates balance transfers, allowing customers to potentially move existing loans from other institutions to IDFC First Bank at more favorable interest rates. This strategic offering enhances the bank's value proposition by providing tangible savings opportunities for its clientele.

IDFC FIRST Bank is actively drawing in retail customers with its competitive savings account interest rates, reaching up to 7%. This aggressive pricing is a key component of their product strategy, designed to build a stable and substantial deposit base, which is vital for funding their lending activities.

IDFC First Bank champions a transparent fee structure, notably with its 'Zero-Fee Banking' initiative for everyday savings account services. This move, which gained traction through 2024, aims to build customer trust by eliminating common charges, making essential banking more accessible to a wider audience.

While certain credit card features and specific transactions do have associated fees, the bank's strategy focuses on minimizing ambiguity and hidden costs. This commitment to clarity enhances customer experience and supports financial inclusivity, a key differentiator in the competitive banking landscape.

Processing Fees and Charges

IDFC FIRST Bank structures its processing fees and charges to align with the specific loan products offered. These fees are designed to cover the administrative costs associated with loan origination and management, with variations depending on the loan's nature and size. For instance, personal loan processing fees can be as high as 2% of the borrowed amount, while home loan processing charges typically fall between Rs. 10,000 and Rs. 100,000.

Beyond initial processing, the bank also levies charges for specific events such as loan foreclosure or missed EMI payments. These ancillary charges are clearly communicated to customers upfront. For example, foreclosure charges on certain loan products might be around 4% of the outstanding principal.

The bank's fee structure also includes other charges, which are transparently disclosed to customers to ensure a clear understanding of the overall cost of borrowing. These can include documentation charges or administrative fees.

- Personal Loan Processing Fee: Up to 2% of the loan amount.

- Home Loan Processing Fee: Rs. 10,000 to Rs. 100,000.

- Foreclosure Charges: Applicable on select products, potentially around 4% of the outstanding principal.

- EMI Bounce Charges: Levied for each instance of a returned EMI.

Flexible Repayment and Credit Terms

IDFC FIRST Bank distinguishes itself with highly adaptable repayment schedules and credit conditions, enhancing customer convenience. For instance, personal loans can extend up to 5-7 years, while home loans offer repayment periods stretching to an impressive 30 years, catering to diverse financial capacities.

Beyond extended tenures, the bank provides flexible financing solutions. These include options for making partial payments on loans, a feature that can significantly ease the burden of regular installments for many borrowers.

Furthermore, IDFC FIRST Bank actively works to minimize financial penalties for early repayment. They notably waive prepayment penalties on select home loan products, a significant benefit for customers who may wish to settle their loans ahead of schedule, thereby saving on interest.

These customer-centric policies aim to broaden product accessibility and ensure loan management is as straightforward and manageable as possible.

- Flexible Repayment Tenures: Up to 5-7 years for personal loans, up to 30 years for home loans.

- Financing Options: Allows partial payments on loans.

- Prepayment Benefits: No prepayment penalties on certain home loan products.

- Customer Accessibility: Policies designed to make financial products more manageable.

IDFC First Bank's pricing strategy is highly competitive, with personal loans starting at 9.99% and home loans at 7.95% as of early 2024. Savings accounts offer attractive rates up to 7% to build a strong deposit base. The bank also emphasizes a transparent fee structure, including a 'Zero-Fee Banking' initiative for savings accounts, enhancing customer trust.

| Product | Starting Interest Rate (as of early 2024) | Savings Account Rate | Key Fee Initiative |

|---|---|---|---|

| Personal Loan | 9.99% p.a. | N/A | Processing fee up to 2% |

| Home Loan | 7.95% p.a. | N/A | Processing fee Rs. 10,000 - Rs. 100,000; No prepayment penalty on select products |

| Savings Account | N/A | Up to 7% p.a. | Zero-Fee Banking for everyday services |

4P's Marketing Mix Analysis Data Sources

Our IDFC First Bank 4P's Marketing Mix Analysis is built upon a foundation of verified data, encompassing official company disclosures, investor relations materials, and the bank's own digital platforms. We meticulously examine product offerings, pricing strategies, distribution channels, and promotional activities to provide a comprehensive view.