Idemitsu Kosan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Idemitsu Kosan Bundle

Gain a critical understanding of the external forces shaping Idemitsu Kosan's trajectory. Our PESTLE analysis meticulously dissects political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks impacting the energy giant. Equip yourself with actionable intelligence to forecast risks and identify emerging opportunities.

Unlock the full potential of your strategic planning with our comprehensive Idemitsu Kosan PESTLE analysis. This in-depth report provides expert insights into the complex interplay of external factors, empowering you to make informed decisions and gain a competitive advantage. Download the complete version now for immediate access to vital market intelligence.

Political factors

Japan's government has greenlit its 7th Strategic Energy Plan, charting a course towards carbon neutrality by 2050. This significant policy shift directly influences Idemitsu Kosan's long-term strategic planning, pushing for a balance between stable energy supply, economic growth, and decarbonization efforts.

The plan prioritizes renewable energy, targeting a 40-50% share in power generation by 2040. It also advocates for maximizing nuclear energy utilization, presenting both opportunities and challenges for Idemitsu's investments in traditional and emerging energy sectors.

Japan's commitment to decarbonization is accelerating with the introduction of Japan Climate Transition Bonds in February 2024, a move designed to channel 20 trillion yen towards Green Transformation (GX) over the next decade. This significant financial backing offers companies like Idemitsu Kosan a clear incentive and a strategic framework to invest in crucial decarbonization technologies and projects, directly supporting national environmental objectives.

The GX Promotion Act, effective since 2023, reinforces this governmental push by earmarking over 150 trillion yen for GX investments across both public and private sectors within the next ten years. This policy landscape creates a favorable environment for Idemitsu Kosan to pursue and finance its transition to a more sustainable business model, potentially unlocking new growth avenues and enhancing its long-term competitiveness.

Japan's proactive stance on PFAS contamination is set to significantly impact Idemitsu Kosan. A ban on 138 PFAS compounds commencing January 10, 2025, necessitates a strategic pivot towards safer alternatives across its petrochemical and functional materials divisions. This regulatory change demands careful reformulation of products and a thorough review of existing supply chains to ensure full compliance, presenting both operational hurdles and potential market advantages for companies embracing sustainable chemistry.

Further complicating the landscape, Japan's adoption of the National Plan of Action for implementing the Global Framework on Chemicals (GFC) in April 2025 will reshape chemical safety policies. This comprehensive overhaul will affect the entire manufacturing value chain, requiring Idemitsu Kosan to conduct rigorous compliance reviews and adapt its processes to meet evolving national and international chemical management standards.

Geopolitical Tensions and Energy Security

Global geopolitical risks remain a significant concern, directly impacting crude oil prices and the stability of supply chains. These factors are paramount for Idemitsu Kosan, given its core business in petroleum exploration, production, and refining. For example, the ongoing conflict in the Middle East has demonstrably increased the geopolitical risk premium embedded in oil prices, as seen in market volatility throughout 2024 and projections for 2025.

Japan's energy policy fundamentally centers on maintaining energy security. This focus shapes decisions regarding the nation's domestic energy mix and the cultivation of international partnerships, which in turn influences Idemitsu Kosan's import and export strategies. The government's continued emphasis on diversifying energy sources away from single suppliers is a key consideration for Idemitsu's long-term planning.

- Geopolitical Risk Premium: Fluctuations in oil prices in 2024, partly driven by Middle East tensions, have highlighted the sensitivity of Idemitsu Kosan's operations to geopolitical instability.

- Energy Security Focus: Japan's national energy strategy prioritizes stable supply, impacting Idemitsu's investment in diverse energy sources and international collaborations.

- Supply Chain Vulnerability: Disruptions stemming from global conflicts can affect the reliable flow of crude oil and refined products, a critical input for Idemitsu's refining segment.

International Cooperation and Trade Policies

Japan's active participation in international climate agreements, such as the Paris Agreement, and its domestic initiatives like the GX League, which saw 2,000 companies commit to carbon neutrality by 2050 as of early 2024, directly shape Idemitsu Kosan's global strategy. This commitment encourages Idemitsu's engagement in cross-border collaborations and influences its investment decisions in sustainable technologies.

Idemitsu Kosan's strategic investments in renewable energy projects in Southeast Asia, including a significant solar power development in Vietnam in partnership with local entities, underscore its alignment with regional decarbonization goals and evolving trade policies. These ventures, often supported by international financial institutions, highlight the company's proactive approach to capitalizing on green energy opportunities driven by global trade dynamics.

- International Climate Commitments: Japan's target of reducing greenhouse gas emissions by 46% from 2013 levels by 2030, aligning with global climate goals.

- GX League Participation: Over 2,000 companies joined the GX League by early 2024, signaling a strong domestic push for carbon neutrality that Idemitsu Kosan actively participates in.

- Southeast Asian Investments: Idemitsu's expansion into renewable energy in regions like Vietnam, aiming to contribute to their energy transition and leverage regional trade agreements.

- Partnerships in Renewables: Collaboration with international and local partners is crucial for Idemitsu's overseas renewable energy projects, reflecting a global trend in energy infrastructure development.

Japan's commitment to decarbonization, reinforced by its 7th Strategic Energy Plan targeting carbon neutrality by 2050, directly influences Idemitsu Kosan's strategic direction and investment in renewable energy sources. The plan's aim for a 40-50% renewable energy share by 2040 and increased nuclear utilization present both opportunities and challenges for the company's energy portfolio. Japan's introduction of Climate Transition Bonds in February 2024, channeling 20 trillion yen towards Green Transformation (GX) over the next decade, provides significant financial impetus for Idemitsu's decarbonization initiatives.

The GX Promotion Act, effective since 2023, earmarks over 150 trillion yen for GX investments, creating a favorable environment for Idemitsu to finance its transition to a sustainable business model. Furthermore, Japan's proactive stance on PFAS contamination, including a ban on 138 compounds from January 10, 2025, necessitates strategic reformulation of products and supply chain reviews for Idemitsu's petrochemical divisions.

Japan's adoption of the National Plan of Action for the Global Framework on Chemicals (GFC) in April 2025 will also necessitate rigorous compliance reviews and process adaptations across Idemitsu's manufacturing value chain. Geopolitical risks, particularly in the Middle East, have demonstrably impacted oil prices and supply chain stability throughout 2024, a critical factor for Idemitsu's core petroleum business.

Idemitsu Kosan's alignment with Japan's energy security focus shapes its import and export strategies, encouraging diversification away from single suppliers. The company's participation in the GX League, with over 2,000 companies committed to carbon neutrality by early 2024, and its investments in Southeast Asian renewable energy projects, such as solar power in Vietnam, underscore its response to global climate agreements and evolving trade policies.

What is included in the product

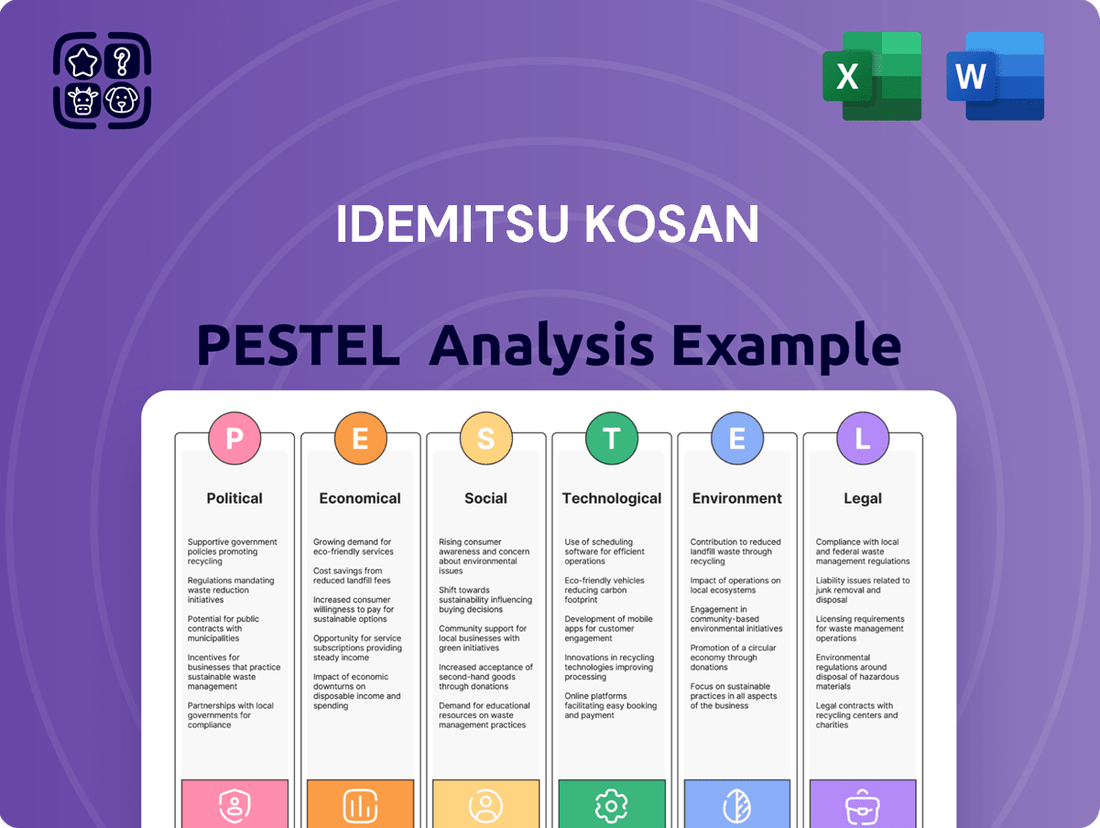

This Idemitsu Kosan PESTLE analysis provides a comprehensive review of the political, economic, social, technological, environmental, and legal factors impacting the company.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges within the global energy and petrochemical sectors.

The Idemitsu Kosan PESTLE analysis offers a streamlined, digestible format that acts as a pain point reliever by providing easily shareable summaries ideal for quick alignment across teams or departments.

This analysis serves as a pain point reliever by offering a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors readily understandable.

Economic factors

The global oil and gas market in 2024 is characterized by managed supply from OPEC+ and fluctuating demand. Oil prices have shown relative stability this year, though geopolitical tensions remain a constant threat. Idemitsu Kosan's performance in its petroleum division is closely tied to these price swings and the broader supply-demand dynamics.

While global oil demand growth softened in 2024, projections indicate an uptick in 2025. However, the outlook for 2026 suggests a tempering of this growth, influenced by a challenging economic climate and the increasing adoption of clean energy solutions.

Japan's electricity demand is set for an uptick by 2030, a significant change from earlier forecasts of decline. This surge is fueled by widespread digital transformation (DX) and green transformation (GX) initiatives across industries.

This evolving demand landscape, alongside government backing for renewable sources and nuclear power, will heavily influence Idemitsu Kosan's strategic investments in power generation and energy supply infrastructure.

While total energy consumption in Japan is anticipated to see a modest dip in fiscal year 2025, the consumption of non-fossil energy sources is consistently growing.

Idemitsu Kosan is making substantial investments in renewable energy and green technologies as a core part of its energy transition strategy. The company plans to reduce its fossil fuel business assets by 20% by 2030, aiming to lower the fossil fuel contribution to total profit from 95% to 70%.

This strategic pivot involves significant capital expenditure in areas such as sustainable aviation fuel (SAF), ammonia, and lithium solid electrolytes, which are expected to open up new revenue streams. Idemitsu Kosan's commitment is further demonstrated by its investments in agrivoltaics and other renewable energy projects.

Impact of Inflation and Economic Growth in Japan

Japan's economic growth is projected at 1.1% for fiscal year 2025, fueled by robust capital investment and sustained private consumption. This expansion directly impacts industrial activity and, consequently, energy demand, a key factor for Idemitsu Kosan.

While inflation is showing signs of moderation, the ongoing willingness of Japanese companies to invest and the positive trend in wage growth are vital contributors to the nation's economic recovery. These trends can bolster demand for Idemitsu Kosan's products and services.

Idemitsu Kosan's financial results, including net sales and operating income, are intrinsically linked to these macroeconomic forces. Furthermore, fluctuations in crude oil prices and their subsequent impact on inventory valuation present another significant variable affecting the company's performance.

- Projected GDP Growth (Fiscal Year 2025): 1.1%

- Key Growth Drivers: Capital investment and private consumption

- Inflation Trend: Slowing

- Impact on Idemitsu Kosan: Influenced by economic growth, energy demand, and crude oil inventory impacts

Carbon Pricing Mechanisms and GX Economic Transition Bonds

Japan's push to implement carbon pricing mechanisms, potentially as early as 2025, presents a significant economic factor for Idemitsu Kosan. A voluntary emission trading system and carbon levies on fossil fuels could directly increase operational expenses and necessitate accelerated investment in decarbonization technologies.

The government's intention to raise approximately ¥20 trillion through these carbon pricing initiatives for redeeming GX economic transition bonds highlights a large-scale financial commitment to the green transformation. This bond issuance will shape the availability and cost of capital for companies like Idemitsu Kosan engaging in transition activities.

- Accelerated Carbon Pricing: A cross-industry group is advocating for a 2025 launch of carbon pricing, impacting Idemitsu Kosan's cost structure.

- GX Bond Funding: ¥20 trillion in GX economic transition bonds will be redeemed via carbon pricing revenue, influencing the financial landscape for green investments.

- Operational Cost Impact: Carbon levies on fossil fuels could directly increase Idemitsu Kosan's operating expenditures.

- Investment Strategy Shift: The economic pressure from carbon pricing will likely drive Idemitsu Kosan's investment decisions towards emissions reduction projects.

Japan's economic trajectory in 2025, with a projected GDP growth of 1.1%, is a key economic driver for Idemitsu Kosan, directly influencing energy demand. The moderation of inflation, coupled with positive wage growth trends, supports consumer spending and industrial activity, further bolstering demand for the company's products and services.

The potential introduction of carbon pricing mechanisms in Japan, possibly as early as 2025, represents a significant economic shift. This could increase operational costs for Idemitsu Kosan through carbon levies on fossil fuels, accelerating the need for investments in decarbonization technologies.

Idemitsu Kosan's financial performance is intrinsically linked to macroeconomic factors such as crude oil price fluctuations, which impact inventory valuations and overall profitability. The company's strategic pivot towards renewable energy and green technologies, with a target to reduce fossil fuel business assets by 20% by 2030, is a direct response to these evolving economic and regulatory landscapes.

| Economic Factor | 2025 Projection/Status | Impact on Idemitsu Kosan |

|---|---|---|

| Projected GDP Growth (Japan) | 1.1% | Influences overall energy demand and industrial activity. |

| Inflation Trend | Moderating | Supports private consumption and economic recovery, potentially boosting demand. |

| Wage Growth Trend | Positive | Contributes to economic recovery and increased consumer spending. |

| Carbon Pricing Introduction | Possible by 2025 | Could increase operational costs via fossil fuel levies, driving investment in decarbonization. |

| GX Bond Issuance for Green Transformation | ¥20 trillion (to be redeemed) | Shapes capital availability and cost for green investments. |

Same Document Delivered

Idemitsu Kosan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Idemitsu Kosan delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping the energy and petrochemical industry.

Sociological factors

While Japan's 7th Strategic Energy Plan emphasizes nuclear power for energy stability and price predictability, companies like Idemitsu Kosan must monitor public sentiment. The Fukushima disaster significantly impacted public trust, and this remains a crucial consideration for the energy sector.

Public acceptance directly influences the speed of nuclear power plant restarts and potential future expansions. This, in turn, can subtly shift the overall energy mix, impacting the demand for alternative sources that Idemitsu Kosan might be involved with.

Societal expectations are increasingly prioritizing sustainability, directly impacting Idemitsu Kosan's strategic direction. Consumers are actively seeking out eco-friendly products and services, creating a fertile ground for Idemitsu's investments in alternative energy sources and cleaner fuels. This growing demand is projected to boost their renewable energy portfolio, while simultaneously influencing purchasing decisions away from traditional petroleum products.

Idemitsu Kosan's engagement in agrivoltaics, a practice that combines agriculture with solar power generation, is a clear demonstration of aligning with these evolving societal values. This initiative speaks to a broader societal concern for sustainable land use and renewable energy integration, positioning the company favorably within a market increasingly driven by environmental consciousness.

Idemitsu Kosan is making significant strides in workforce diversity, equity, and inclusion (DE&I). The company is actively working to create an environment where all employees, irrespective of gender, nationality, or other personal attributes, can fully utilize their potential. This focus on human capital enhancement is a key part of their strategy for long-term success.

Their commitment to DE&I has garnered external recognition. Idemitsu Kosan was designated a 'Nadeshiko Brand' for its efforts in promoting women's advancement in the workplace. Furthermore, in 2024, the company achieved the highest rating in the 'PRIDE Index,' a testament to their robust initiatives supporting LGBTQ+ employees. These accolades highlight their dedication to fostering an inclusive culture.

These DE&I initiatives are vital for Idemitsu Kosan in today's competitive landscape. By attracting and retaining a diverse talent pool, the company can tap into a wider range of perspectives and skills, driving innovation and adaptability within the energy sector. This inclusive approach is increasingly important for maintaining a strong and resilient workforce.

Occupational Safety and Health Management

Idemitsu Kosan's focus on occupational safety and health management is paramount, especially given its diverse energy operations from exploration to refining. This commitment directly influences employee well-being and operational continuity, aligning with societal demands for corporate responsibility. For instance, in 2023, the company reported a total recordable incident rate (TRIR) of 0.35 across its global operations, demonstrating a continuous effort to minimize workplace hazards.

Societal expectations for robust safety protocols are high for energy firms, and Idemitsu Kosan's performance in this area significantly shapes its public image and stakeholder trust. Effective health management not only protects its workforce but also underpins operational efficiency and reduces the risk of costly disruptions. The company's 2024 sustainability report highlighted a 10% reduction in lost-time injuries compared to the previous year, reflecting ongoing improvements in safety initiatives.

- Employee Well-being: Idemitsu Kosan prioritizes the health and safety of its approximately 15,000 employees worldwide, recognizing that a secure workforce is a productive workforce.

- Public Perception: Strong occupational safety records enhance Idemitsu Kosan's reputation as a responsible corporate citizen, crucial for maintaining social license to operate.

- Operational Efficiency: Minimizing accidents and health-related absences directly contributes to stable and efficient operations, avoiding production downtime and associated financial losses.

- Regulatory Compliance: Adherence to stringent occupational safety and health regulations, such as those mandated by Japan's Industrial Safety and Health Act, is a fundamental aspect of Idemitsu Kosan's operational framework.

Community Engagement and Corporate Citizenship

Idemitsu Kosan's commitment to corporate citizenship is evident through its active participation in community initiatives, particularly those focused on energy and mobility solutions. These efforts are crucial for maintaining a positive social license to operate, fostering goodwill, and strengthening relationships with stakeholders. For instance, the company's 'Furusato Project' directly supports regional revitalization, while environmental photo contests highlight their dedication to ecological awareness and stewardship.

These initiatives not only contribute to societal well-being but also enhance Idemitsu Kosan's brand reputation. By investing in local communities and environmental preservation, the company demonstrates its understanding of its broader social responsibilities. This proactive approach helps mitigate potential social risks and builds a foundation of trust with the public.

- Community Investment: Idemitsu Kosan’s 'Furusato Project' aims to revitalize local economies and preserve cultural heritage, directly impacting regional development.

- Environmental Stewardship: Initiatives like environmental photo contests engage the public in conservation efforts, aligning with global sustainability goals.

- Social License to Operate: Demonstrating corporate citizenship is vital for Idemitsu Kosan to maintain public acceptance and support for its operations, especially in sensitive sectors like energy.

Societal expectations around sustainability are a significant driver for Idemitsu Kosan, influencing demand for its renewable energy ventures. Consumers are increasingly favoring eco-friendly products, bolstering Idemitsu's investments in alternative energy and cleaner fuels, which are projected to grow. This shift directly impacts purchasing patterns, potentially reducing reliance on traditional petroleum products.

Idemitsu Kosan's commitment to diversity, equity, and inclusion (DE&I) is a key sociological factor. The company's designation as a 'Nadeshiko Brand' for promoting women in the workplace and its top rating in the 2024 PRIDE Index for LGBTQ+ support underscore its dedication to an inclusive culture. This focus on DE&I is crucial for attracting diverse talent, fostering innovation, and ensuring a resilient workforce.

The company's strong emphasis on occupational safety and health is vital for its public image and operational stability. With a total recordable incident rate (TRIR) of 0.35 globally in 2023 and a 10% reduction in lost-time injuries in 2024, Idemitsu demonstrates a commitment to employee well-being and minimizing workplace hazards. This adherence to safety standards is essential for maintaining stakeholder trust and operational efficiency.

Technological factors

Rapid advancements in renewable energy technologies, like perovskite and tandem solar cells, present substantial growth avenues for Idemitsu Kosan. Innovations in offshore and airborne wind turbines, alongside efficient green hydrogen production, are key areas where the company can leverage these technological leaps.

These cutting-edge technologies are crucial for Idemitsu Kosan's strategic pivot towards alternative energy, promising to boost project efficiency and lower operational costs. For instance, the global solar PV market is projected to reach $321 billion by 2028, demonstrating the immense scale of opportunity.

The advancement and widespread adoption of energy storage technologies, especially battery systems, are fundamental for incorporating variable renewable energy sources like solar and wind into power grids. Idemitsu Kosan's strategic investment in lithium solid electrolytes for batteries underscores their commitment to this vital sector, recognizing its importance for ensuring a consistent and reliable energy supply.

The global market for battery energy storage systems (BESS) is experiencing significant growth, with projections indicating a substantial increase in capacity by 2030. For instance, the BESS market was valued at approximately $15 billion in 2023 and is expected to reach over $70 billion by 2030, driven by the need for grid stability and renewable energy integration.

The energy sector's transformation is heavily influenced by digitalization and artificial intelligence (AI). These advancements are driving significant improvements in operational efficiency, reliability, and safety across industrial processes. For instance, AI and big data analytics are proving crucial for optimizing renewable energy sources, enabling predictive maintenance for wind turbines and solar farms, and facilitating smarter grid management. By 2024, the global AI in energy market was valued at over $2 billion and is projected to grow substantially as companies seek to leverage these capabilities.

AI-enabled hardware and software are particularly effective in optimizing grid performance by balancing supply and demand more effectively and reducing energy losses. Idemitsu Kosan can strategically integrate these cutting-edge technologies to enhance its diverse energy portfolio, from traditional oil and gas operations to its growing renewable energy ventures. The company's ability to adapt and implement AI solutions will be key to maintaining competitiveness and driving innovation in the evolving energy landscape.

Carbon Capture, Utilization, and Storage (CCUS)

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) and Carbon Dioxide Removal (CDR) are critical for Idemitsu Kosan's transition to carbon neutrality, particularly for its existing fossil fuel operations. These technologies offer a pathway to mitigate emissions from hard-to-abate sectors.

Japan's 7th Strategic Energy Plan, released in October 2021, underscores a strong governmental commitment to CCUS, designating it as a key technology for achieving decarbonization goals. This policy support creates a favorable environment for investment and deployment of CCUS infrastructure.

Idemitsu Kosan is actively exploring CCUS projects, including participation in initiatives aimed at developing large-scale carbon recycling hubs. For instance, the company is involved in projects targeting the capture of CO2 from its refining and petrochemical facilities.

- Government Support: Japan's 7th Strategic Energy Plan prioritizes CCUS, signaling a robust policy framework.

- Industry Initiatives: Idemitsu Kosan is engaged in collaborative CCUS projects to develop carbon recycling technologies.

- Emission Reduction Potential: CCUS is vital for decarbonizing Idemitsu's fossil fuel-dependent business segments.

- Technological Evolution: Ongoing R&D in CCUS and CDR is crucial for Idemitsu's long-term sustainability strategy.

Development of Cleaner Fuels (SAF, Ammonia)

Technological advancements in cleaner fuels, such as Sustainable Aviation Fuel (SAF) and ammonia, are critical for reducing emissions in challenging sectors. Idemitsu Kosan's strategic investments in these nascent fuel technologies underscore a commitment to innovation and the development of lower-carbon alternatives. This focus is essential for Idemitsu to adapt to evolving environmental regulations and market demands for sustainable energy solutions.

The commercialization of SAF is gaining momentum, with projections indicating significant growth in the coming years. For instance, the global SAF market was valued at approximately USD 2.8 billion in 2023 and is expected to expand considerably by 2030, driven by airline commitments and government mandates. Idemitsu Kosan's involvement in SAF production, including partnerships and feedstock development, positions them to capitalize on this expanding market. Their efforts are geared towards creating a more sustainable aviation industry, directly addressing the technological hurdle of decarbonizing air travel.

Ammonia, as a clean fuel, presents another significant technological frontier, particularly for shipping and power generation. The development of green ammonia, produced using renewable energy, offers a pathway to zero-emission operations. Idemitsu Kosan is exploring ammonia's potential, recognizing its role in broader decarbonization strategies. The global ammonia market is substantial, and the push for ammonia as a marine fuel, for example, is supported by initiatives aiming to reduce shipping's carbon footprint, a sector where Idemitsu has established operations.

- SAF Market Growth: The SAF market is projected to reach tens of billions of dollars by 2030, with Idemitsu Kosan actively participating in its supply chain development.

- Ammonia as a Future Fuel: Technological breakthroughs in green ammonia production and utilization are crucial for decarbonizing heavy industries like shipping, an area Idemitsu is investigating.

- Investment in R&D: Idemitsu's sustained investment in research and development for these cleaner fuels is vital for their long-term competitiveness and environmental stewardship.

Technological advancements in areas like advanced battery chemistries, hydrogen fuel cells, and smart grid integration are pivotal for Idemitsu Kosan's diversification into renewable energy. The company's investment in solid-state battery technology, for example, highlights a strategic focus on next-generation energy storage solutions that promise enhanced safety and energy density.

The rapid evolution of digital technologies, including AI and IoT, is transforming energy operations. These tools enable predictive maintenance, optimize energy distribution, and improve overall efficiency in both traditional and renewable energy sectors. Idemitsu Kosan's adoption of AI for optimizing its refining processes and managing renewable energy assets is a testament to this trend.

Innovations in carbon capture and utilization (CCU) technologies are crucial for Idemitsu Kosan to address emissions from its existing fossil fuel operations. The development of more efficient capture methods and viable utilization pathways for captured CO2 will be key to achieving its decarbonization targets.

The company is also investing in the development of sustainable aviation fuels (SAF) and ammonia as cleaner energy sources. These technologies are essential for decarbonizing hard-to-abate sectors like aviation and shipping, aligning with global environmental goals and creating new market opportunities for Idemitsu Kosan.

| Technology Area | Idemitsu Kosan Focus | Market Relevance (2024/2025 Data) | Strategic Importance |

|---|---|---|---|

| Renewable Energy Tech | Perovskite/Tandem Solar, Offshore/Airborne Wind, Green Hydrogen | Global solar PV market projected to reach $321B by 2028. Green hydrogen market expected significant growth. | Diversification, growth avenue, operational efficiency |

| Energy Storage | Lithium Solid Electrolytes for Batteries | Battery Energy Storage Systems (BESS) market valued ~$15B in 2023, projected >$70B by 2030. | Grid stability, renewable integration, consistent supply |

| Digitalization & AI | AI for process optimization, predictive maintenance | AI in energy market valued >$2B in 2024, with substantial projected growth. | Operational efficiency, reliability, safety, competitiveness |

| CCUS/CDR | CO2 capture from refining, carbon recycling hubs | Japan's 7th Strategic Energy Plan prioritizes CCUS. | Decarbonization of fossil fuels, emission mitigation |

| Cleaner Fuels | Sustainable Aviation Fuel (SAF), Ammonia | SAF market valued ~$2.8B in 2023, with significant expansion expected by 2030. | Decarbonizing hard-to-abate sectors, new market opportunities |

Legal factors

Idemitsu Kosan's operations are legally bound to conform to Japan's 7th Strategic Energy Plan. This plan, updated in 2021, outlines a clear path toward carbon neutrality by 2050, setting specific goals for increasing renewable energy sources. For instance, the plan targets a 36-38% share of electricity generation from renewables by fiscal year 2030.

A key legal factor is the revised stance on nuclear power; the 7th Strategic Energy Plan removes previous commitments to minimize its reliance, opening avenues for its increased utilization. This shift presents both compliance challenges and potential opportunities for Idemitsu Kosan as it navigates national energy policy.

Japan's commitment to reducing greenhouse gas emissions, targeting a 46% reduction by FY2030 and a 73% reduction by 2040, both from FY2013 levels, imposes significant operational constraints on Idemitsu Kosan. These stringent environmental regulations necessitate substantial investment in cleaner technologies and operational adjustments to comply with emission standards.

The introduction of carbon pricing mechanisms in Japan further amplifies the financial impact of these environmental mandates. Idemitsu Kosan must factor in the costs associated with carbon emissions, driving the need for efficiency improvements and a strategic shift towards lower-carbon energy sources to mitigate financial penalties and maintain competitiveness.

Japan's Chemical Substance Control Law (CSCL) and upcoming PFAS regulations present a significant legal landscape for Idemitsu Kosan. The ban on 138 PFAS compounds starting January 2025 and the April 2025 implementation of the Global Framework on Chemicals (GFC) necessitate robust compliance measures. These regulations directly impact Idemitsu Kosan's petrochemical and functional materials segments, demanding careful management of chemical substances across their entire lifecycle.

Land Use Regulations for Renewable Energy Projects

Land use regulations significantly impact renewable energy development for companies like Idemitsu Kosan. Stricter guidelines for large-scale solar projects, such as those implemented in Japan in April 2024, can directly influence project timelines and feasibility. For instance, new regulations may impose limitations on the size or location of solar farms, requiring Idemitsu Kosan to adapt its development strategies.

Navigating agricultural land regulations is also crucial, especially for agrivoltaic projects. The suspension of feed-in tariffs and premiums for certain agrivoltaic initiatives underscores the dynamic nature of these rules. Idemitsu Kosan must carefully monitor and comply with evolving agricultural land use policies to ensure the economic viability of its renewable energy ventures.

- Japan's April 2024 solar land use guidelines: These regulations aim to balance renewable energy expansion with environmental and agricultural concerns, potentially affecting the scale and siting of new solar installations.

- Agrivoltaic project policy shifts: The suspension of certain feed-in tariffs and premiums for agrivoltaic projects indicates a need for Idemitsu Kosan to assess project economics under revised support mechanisms.

- Impact on project development: Idemitsu Kosan must factor in these land use regulations to accurately forecast project costs, timelines, and potential returns on investment for its renewable energy portfolio.

Corporate Governance and Disclosure Requirements

Idemitsu Kosan, as a publicly traded entity, adheres to rigorous corporate governance standards and financial disclosure mandates. This includes the regular release of consolidated financial statements and comprehensive integrated reports, crucial for maintaining investor confidence and operational transparency.

These regulatory obligations are designed to foster accountability towards shareholders and a broad range of stakeholders. For instance, in its fiscal year ending March 2024, Idemitsu Kosan reported net sales of ¥4,603.7 billion, underscoring the scale of operations subject to these disclosures.

- Transparency: Regular financial reporting ensures stakeholders have access to accurate information about Idemitsu Kosan's performance.

- Accountability: Adherence to governance rules holds management responsible for their decisions and the company's actions.

- Investor Confidence: Compliance with disclosure requirements builds trust, attracting and retaining investment.

- Regulatory Compliance: Meeting these legal obligations is essential to avoid penalties and maintain its operating license.

Idemitsu Kosan operates within a dynamic legal framework shaped by Japan's commitment to decarbonization and environmental protection. The 7th Strategic Energy Plan, updated in 2021, mandates a significant increase in renewable energy, targeting a 36-38% share of electricity generation by FY2030, directly influencing Idemitsu's energy strategy.

Stricter environmental regulations, including a 46% greenhouse gas emission reduction target by FY2030 from FY2013 levels, necessitate substantial investments in cleaner technologies. Furthermore, the upcoming PFAS regulations, with a ban on 138 compounds starting January 2025 and the April 2025 implementation of the Global Framework on Chemicals, require careful management of chemical substances in its petrochemical and functional materials segments.

Land use regulations, particularly those concerning solar projects implemented in April 2024, and evolving agrivoltaic policies, impact the feasibility and economics of renewable energy developments. Idemitsu Kosan must navigate these rules to ensure project viability and compliance, as seen with the suspension of certain agrivoltaic feed-in tariffs.

As a publicly traded company, Idemitsu Kosan is bound by corporate governance and financial disclosure mandates, ensuring transparency and accountability to stakeholders. For instance, its fiscal year ending March 2024 reported net sales of ¥4,603.7 billion, highlighting the scale of operations subject to these rigorous reporting standards.

Environmental factors

Idemitsu Kosan is under substantial environmental pressure to achieve carbon neutrality by 2050, mirroring commitments made by the Japanese government and international bodies to slash greenhouse gas emissions. This global push significantly influences the company's operational direction, prompting a strategic pivot away from traditional fossil fuels.

The company is actively investing in renewable energy sources like solar and wind power, alongside developing and adopting cleaner technologies to reduce its carbon footprint. For instance, Idemitsu has been involved in projects like the Ishikari Offshore Wind Farm, aiming to contribute to Japan's renewable energy targets. By 2023, Japan's total renewable energy capacity reached over 130 GW, highlighting the growing market for such investments.

The global shift towards cleaner energy sources significantly impacts Idemitsu Kosan. The company is investing heavily in renewable energy, aiming to reduce its carbon footprint. For instance, by the end of fiscal year 2024, Idemitsu had plans to expand its renewable energy portfolio, targeting a significant increase in installed capacity for solar and wind power generation.

Idemitsu Kosan's commitment to geothermal, solar, and wind power development is a direct response to environmental pressures. This strategic pivot is crucial for aligning with international climate goals and domestic policies promoting decarbonization. Their efforts to expand renewable energy domestically and internationally are vital for mitigating the environmental impact of traditional fossil fuel reliance.

Idemitsu Kosan is actively pursuing a circular and recycling-oriented society by 2050, emphasizing sustainable resource management and waste minimization. This commitment is demonstrated through projects such as the recycling of solar power panels, a crucial step in managing the lifecycle of renewable energy infrastructure.

The company is also leveraging biomass power plants that utilize domestic timber, a strategy that not only reduces waste but also supports local economies and lowers carbon emissions. For instance, their operations in Hokkaido are designed to process wood waste, contributing to a more closed-loop system.

Biodiversity and Water Resource Management

Idemitsu Kosan, as an energy company, faces inherent risks and responsibilities concerning biodiversity and water resources. Its operations, from exploration to refining, can potentially affect ecosystems and water availability.

The company actively addresses these impacts through its sustainability strategies. For instance, Idemitsu Kosan's 2023 sustainability report highlights specific initiatives aimed at preserving biodiversity and ensuring responsible water usage across its global operations. This demonstrates a commitment to managing environmental impacts beyond just greenhouse gas emissions.

Key areas of focus for Idemitsu Kosan include:

- Biodiversity Conservation: Implementing measures to protect and restore ecosystems in areas of operation, including efforts to minimize habitat disruption.

- Water Resource Management: Focusing on reducing water consumption, improving water quality in discharged water, and promoting water recycling in its facilities.

- Environmental Impact Assessments: Conducting thorough assessments to understand and mitigate the potential effects of new projects on local biodiversity and water systems.

- Stakeholder Engagement: Collaborating with local communities and environmental organizations to ensure sustainable practices are aligned with regional needs and conservation goals.

Pollution Prevention and Chemical Management

Idemitsu Kosan's involvement in petrochemicals and energy products demands rigorous pollution prevention and chemical management. Japan's increasingly stringent regulations, particularly concerning substances like PFAS, highlight the critical need for the company to manage hazardous chemicals responsibly across its value chain.

The company's commitment to environmental sustainability is crucial, especially given the potential impact of its operations. For instance, in 2023, Idemitsu Kosan reported total environmental protection expenses of approximately ¥10.5 billion, reflecting investments in pollution control and chemical substance management systems.

- Regulatory Compliance: Idemitsu Kosan must adhere to Japan's Chemical Substances Control Law and other environmental regulations, ensuring safe handling and disposal of chemicals.

- PFAS Scrutiny: The global and domestic focus on per- and polyfluoroalkyl substances (PFAS) necessitates proactive measures to monitor, reduce, and potentially eliminate their use or release.

- Operational Risk Mitigation: Effective chemical management minimizes the risk of environmental incidents, protecting ecosystems and public health while avoiding significant financial penalties.

- Stakeholder Expectations: Investors and consumers increasingly expect companies to demonstrate strong environmental stewardship, making robust pollution prevention a key factor in maintaining corporate reputation and social license to operate.

Idemitsu Kosan faces significant environmental pressures, particularly the global drive towards carbon neutrality by 2050. This aligns with Japan's national commitments to reduce greenhouse gas emissions, pushing the company to transition away from fossil fuels and invest in cleaner alternatives.

The company is actively expanding its renewable energy portfolio, with a focus on solar and wind power. For instance, by the end of fiscal year 2024, Idemitsu planned to increase its installed capacity for these renewable sources, reflecting a strategic shift driven by environmental mandates and market opportunities. Japan's own renewable energy capacity surpassed 130 GW by 2023, underscoring the growth potential in this sector.

Beyond renewable energy generation, Idemitsu Kosan is committed to a circular economy, emphasizing resource management and waste reduction. This includes initiatives like recycling solar panels and utilizing biomass power plants that process local timber, thereby minimizing waste and carbon emissions.

Idemitsu Kosan's environmental stewardship extends to protecting biodiversity and managing water resources responsibly across its operations. The company's 2023 sustainability report details specific actions taken to conserve ecosystems and reduce water usage, demonstrating a comprehensive approach to environmental impact mitigation.

PESTLE Analysis Data Sources

Our Idemitsu Kosan PESTLE analysis is meticulously constructed using a blend of official government publications, international energy agency reports, and reputable financial news outlets. This ensures a comprehensive understanding of political, economic, and social factors impacting the energy sector.