Idemitsu Kosan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Idemitsu Kosan Bundle

Idemitsu Kosan navigates a complex energy landscape, facing significant pressure from established competitors and the ever-present threat of new entrants. Understanding the delicate balance of buyer power and supplier influence is crucial for their strategic positioning.

The complete report reveals the real forces shaping Idemitsu Kosan’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Idemitsu Kosan's reliance on crude oil and natural gas means its bargaining power is significantly influenced by the concentration of raw material suppliers. Major energy producers, often grouped in entities like OPEC+, hold considerable sway over global pricing and supply availability. This concentration can lead to less favorable terms for Idemitsu if these suppliers choose to exert their leverage.

Switching crude oil and natural gas suppliers presents significant hurdles for Idemitsu Kosan, involving substantial costs and intricate logistical challenges. Refineries are typically engineered for particular crude oil grades, and alterations necessitate considerable technical modifications, potentially causing operational downtime and escalating expenses. This inherent inflexibility grants existing suppliers increased leverage.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Idemitsu Kosan. While Idemitsu is actively diversifying into renewable energy, its foundational petroleum and petrochemical operations remain heavily reliant on fossil fuels. The current reality is that large-scale, economically feasible substitutes for crude oil and natural gas, essential for refining and petrochemical manufacturing, are limited in the short to medium term. This scarcity inherently grants considerable bargaining power to the suppliers of these traditional energy resources.

Supplier's Product Differentiation

Crude oil and natural gas are fundamentally commoditized, offering limited differentiation based on product quality alone. This generally weakens supplier bargaining power. However, Idemitsu Kosan, like other refiners, can experience shifts in this power dynamic.

While the core product is undifferentiated, suppliers can gain leverage through factors like delivery reliability, favorable financing, or integrated logistics. These services can create a competitive edge, allowing certain suppliers to command better terms.

The geopolitical climate significantly impacts supplier power. Japan's substantial reliance on Middle Eastern crude, for instance, grants Middle Eastern oil-producing nations considerable influence. Similarly, the supply of Russian LNG to Japan, though subject to international sanctions and evolving relationships, also represents a critical dependency.

- Commoditized Nature: Crude oil and natural gas offer little inherent product differentiation, reducing supplier leverage based on quality.

- Service Differentiation: Reliability, financing, and logistics can differentiate suppliers, increasing their bargaining power.

- Geopolitical Influence: Japan's dependence on Middle Eastern crude and its evolving relationship with Russian LNG highlight the significant impact of geopolitics on supplier power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, particularly major oil and gas producers, could significantly alter the competitive landscape for companies like Idemitsu Kosan. If these producers were to move into refining or petrochemicals, they would become direct competitors, thereby increasing their bargaining power.

While large-scale forward integration by global crude oil suppliers is not a widespread phenomenon, some national oil companies do possess integrated operations. This presents a potential, though often indirect, threat to Idemitsu by creating new competitive pressures or influencing market dynamics.

- Forward Integration Risk: Major oil producers integrating into refining and petrochemicals would directly challenge Idemitsu's core businesses.

- National Oil Company Influence: Some national oil companies already operate integrated models, offering a precedent for this type of strategic move.

- Market Leverage: Successful forward integration by suppliers could grant them greater leverage over downstream players by controlling both supply and processing.

Idemitsu Kosan faces significant supplier bargaining power due to the concentrated nature of crude oil and natural gas producers, coupled with the high costs and logistical complexities of switching suppliers. The limited availability of economically viable substitutes for fossil fuels further strengthens this power, as demonstrated by Japan's substantial reliance on Middle Eastern crude, which grants significant influence to those nations.

| Factor | Impact on Idemitsu Kosan | Supporting Data/Context (as of recent data leading up to July 2025) |

|---|---|---|

| Supplier Concentration | High | OPEC+ nations consistently influence global oil supply and pricing. In 2023, Middle Eastern countries accounted for approximately 70% of Japan's crude oil imports, highlighting a significant dependency. |

| Switching Costs | High | Refinery retooling for different crude grades can cost hundreds of millions of dollars and lead to extended downtime, making supplier changes economically prohibitive. |

| Availability of Substitutes | Low (for core operations) | While Idemitsu invests in renewables, its primary refining capacity relies on fossil fuels. Large-scale, cost-competitive alternatives to crude oil for existing infrastructure are not yet widespread. |

| Geopolitical Influence | Significant | Japan's energy security is heavily tied to imports. Fluctuations in supply or pricing from major exporting regions, such as the Middle East, directly impact Idemitsu. |

What is included in the product

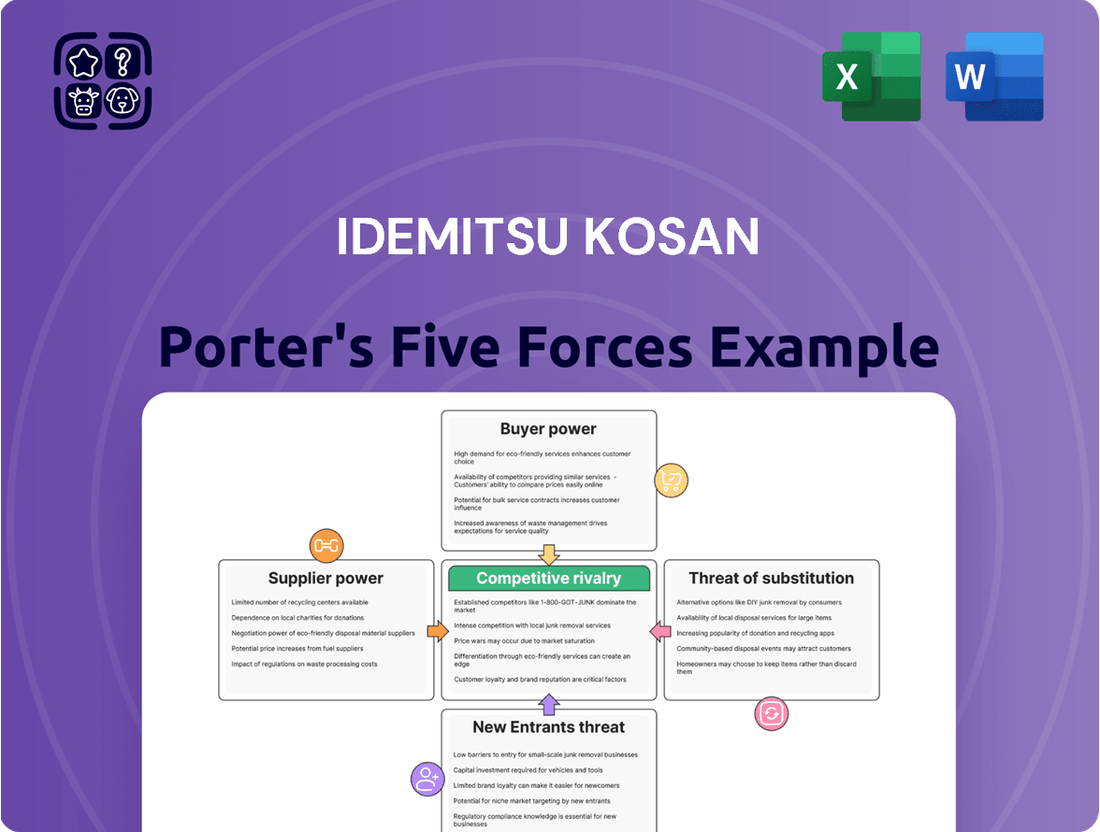

This analysis meticulously dissects the competitive forces impacting Idemitsu Kosan, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive model of Idemitsu Kosan's Porter's Five Forces, allowing for scenario planning and strategic adjustments.

Customers Bargaining Power

Customers for petroleum products like gasoline and diesel are highly sensitive to price changes, particularly in a competitive market such as Japan. This means Idemitsu Kosan faces pressure to keep its prices low.

The Japanese government's extension of subsidies on fuel and electricity until April 2024 underscores this consumer price sensitivity. These measures are designed to cushion consumers from volatile energy costs, further limiting Idemitsu's capacity to absorb and pass on rising expenses.

Idemitsu Kosan's customer base is quite varied, encompassing industrial businesses, commercial operations, and individual drivers at its numerous service stations. For large industrial clients and distributors who buy in substantial quantities, their significant purchasing volume naturally grants them increased bargaining power. This allows them to negotiate more favorable pricing and contract terms, potentially impacting Idemitsu's margins.

The bargaining power of customers is significantly influenced by the availability of substitute products. For Idemitsu Kosan, the rise of electric vehicles (EVs) and the increasing adoption of renewable energy sources like solar and wind power directly challenge the demand for traditional petroleum products. This broadens customer choices and lessens their reliance on gasoline and diesel.

Idemitsu's strategic investments in renewable energy and carbon-free technologies, such as hydrogen and biofuels, demonstrate an awareness of this trend. For instance, by 2023, Idemitsu had announced plans to invest heavily in green hydrogen production, aiming to capture a share of this emerging market and mitigate the impact of declining fossil fuel demand.

Buyer's Information and Transparency

In Japan's mature market, consumers of petroleum products benefit from significant information transparency. This allows them to easily compare prices and product specifications across various Idemitsu Kosan competitors, directly increasing their leverage.

This heightened buyer awareness means Idemitsu Kosan must remain competitive on pricing and quality to retain customers. For instance, in 2024, the average retail gasoline price in Japan fluctuated, with consumers actively seeking out the best deals, demonstrating their responsiveness to price differentials.

- Informed Consumers: Japanese consumers have access to extensive online resources and price comparison websites for fuel.

- Price Sensitivity: Fluctuations in global oil prices, reported daily by sources like the Ministry of Economy, Trade and Industry (METI), directly impact consumer purchasing decisions.

- Commoditized Products: Gasoline and other refined petroleum products are largely undifferentiated, making price the primary competitive factor for many buyers.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Idemitsu Kosan is generally low, particularly for individual consumers. However, large industrial clients or utility providers might explore this if the economics shifted significantly. For instance, a major industrial user of refined petroleum products could theoretically invest in their own refining capabilities, but the immense capital investment and complex regulatory environment make this a substantial barrier.

While large-scale backward integration is improbable, smaller-scale energy self-sufficiency efforts by major customers could still impact Idemitsu. The sheer scale of investment required for refining operations, often in the billions of dollars, acts as a significant deterrent. Idemitsu's 2024 financial reports indicate substantial ongoing capital expenditures in existing refining and petrochemical facilities, highlighting the inherent cost of such operations.

- Limited Threat from Individual Consumers: Individual car owners or small businesses lack the scale and resources to engage in backward integration.

- Potential for Large Industrial Clients: Major industrial consumers or utility companies possess the financial capacity, though the capital intensity remains a major hurdle.

- High Capital Intensity of Refining: Building and operating a refinery requires billions of dollars in investment, making it economically unfeasible for most customers.

- Regulatory Hurdles: Navigating the complex environmental and safety regulations associated with energy production and refining presents another significant barrier to entry.

Customers for Idemitsu Kosan, especially individual drivers in Japan, exhibit strong price sensitivity due to the commoditized nature of gasoline and diesel. This sensitivity is amplified by readily available price comparison tools, forcing Idemitsu to maintain competitive pricing. The government's fuel subsidies, extended into 2024, further reinforce this pressure by limiting Idemitsu's ability to pass on costs.

Large industrial clients and distributors wield significant bargaining power due to their substantial purchase volumes, enabling them to negotiate favorable terms. The growing availability of substitutes, such as electric vehicles and renewable energy sources, also empowers customers by offering alternatives and reducing reliance on Idemitsu's core products. Idemitsu's strategic investments in green hydrogen by 2023 reflect an acknowledgment of this shifting customer preference.

| Factor | Impact on Idemitsu Kosan | Evidence/Example (2023-2024) |

|---|---|---|

| Price Sensitivity | High | Consumers actively sought best deals on gasoline in 2024 due to price fluctuations. |

| Information Availability | High | Online price comparison websites provide transparency for fuel purchases. |

| Substitute Products | Growing | Idemitsu's investment in green hydrogen (announced by 2023) addresses EV and renewable energy trends. |

| Buyer Volume | Significant for Industrial Clients | Large clients negotiate better pricing, impacting Idemitsu's margins. |

Preview the Actual Deliverable

Idemitsu Kosan Porter's Five Forces Analysis

This preview showcases the comprehensive Idemitsu Kosan Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing in-depth insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the threat of substitutes.

Rivalry Among Competitors

The Japanese energy market, especially for refining and petroleum products, is dominated by a few major domestic companies. This creates an oligopolistic environment where competition is quite fierce among these large players.

Idemitsu Kosan itself is recognized as the second-largest refiner in Japan. This market concentration means that Idemitsu faces significant rivalry from other substantial entities within the sector.

For instance, Japan Petroleum Exploration is one of Idemitsu Kosan's publicly listed competitors, highlighting the presence of other significant, well-established companies vying for market share in the same industry.

Japan's refining sector is experiencing a downward trend in domestic fuel demand. This is largely driven by demographic shifts, including an aging and shrinking population, alongside a broader move towards cleaner energy sources. This mature market environment naturally escalates competition among existing players.

While gasoline and other core petroleum products are often seen as commodities, Idemitsu Kosan actively works to differentiate itself. This includes leveraging its strong brand reputation built over decades, maintaining an extensive network of service stations, and offering value-added products such as high-performance lubricants and specialized industrial chemicals.

Despite these efforts, for basic fuel sales, price competition remains a significant driver for consumers. In 2024, Idemitsu Kosan, like its peers, navigates this dynamic by balancing brand building with competitive pricing strategies across its retail operations.

Exit Barriers

The refining industry, including companies like Idemitsu Kosan, faces substantial exit barriers due to its highly capital-intensive nature. Significant sunk costs are tied up in specialized infrastructure and equipment, making it economically challenging to simply cease operations. This discourages companies from leaving the market, even when profitability is low, which in turn intensifies competitive rivalry as firms remain committed to their existing assets.

These high exit barriers mean that companies are incentivized to find alternative uses for their facilities rather than abandoning them. For instance, Idemitsu Kosan's strategic decision to transform its Yamaguchi refinery into a green energy hub by March 2024, instead of outright closure, highlights this trend. This repurposing of assets is a direct consequence of the difficulty and cost associated with exiting the refining business.

- High Capital Investment: The refining sector requires massive upfront investment in plants and machinery, creating a significant financial commitment.

- Specialized Assets: Refining infrastructure is highly specialized, limiting its resale value or alternative applications, thus increasing exit costs.

- Operational Commitments: Long-term contracts and labor agreements can also contribute to the difficulty of exiting the market smoothly.

- Environmental Regulations: Decommissioning and environmental remediation at refinery sites can incur substantial costs, further deterring immediate exit.

Strategic Objectives of Competitors

Japanese competitors are also navigating significant energy transitions, mirroring Idemitsu’s focus on carbon neutrality. This shared objective often translates into strategic realignments, potentially fostering collaborations in burgeoning green energy markets or, conversely, sparking more intense rivalry as companies vie for dominance in these new sectors.

Idemitsu's proactive business structure reforms and investments in carbon-neutral initiatives, such as agrivoltaics and hydrogen, are met by similar strategic maneuvers from its peers. For instance, ENEOS Holdings, another major Japanese energy company, has also announced substantial investments in renewable energy and hydrogen production, aiming to diversify its portfolio beyond traditional fossil fuels.

- ENEOS Holdings' 2023 renewable energy investment target was approximately ¥1 trillion (roughly $7 billion USD).

- Idemitsu Kosan’s 2024 fiscal year plan includes significant capital expenditure for its green business segment, though specific figures are often detailed in quarterly reports.

- The Japanese government’s commitment to achieving carbon neutrality by 2050 incentivizes all domestic energy companies to accelerate their transition strategies.

Competitive rivalry within Japan's refining sector is intense, characterized by a few dominant domestic players like Idemitsu Kosan and ENEOS Holdings. This oligopolistic structure, coupled with declining domestic fuel demand due to demographic shifts and the energy transition, forces companies to compete fiercely on price and differentiation.

Idemitsu Kosan, as Japan's second-largest refiner, actively differentiates through its brand, service station network, and specialized products, but price competition remains crucial in 2024 for basic fuel sales. High exit barriers, such as massive capital investments and specialized assets, keep companies committed to the market, further intensifying rivalry.

Both Idemitsu and its rivals, like ENEOS, are investing heavily in carbon-neutral initiatives, with ENEOS targeting around ¥1 trillion for renewable energy in 2023. This shared pursuit of new energy markets can lead to either collaboration or heightened competition as firms vie for leadership in emerging green sectors.

| Competitor | Primary Focus | 2023 Renewable Investment (Approx.) |

| Idemitsu Kosan | Refining, Petrochemicals, Green Energy | Significant Capital Expenditure for Green Business Segment (2024 FY) |

| ENEOS Holdings | Oil & Gas, Renewables, Hydrogen | ¥1 trillion (approx. $7 billion USD) |

| Japan Petroleum Exploration | Oil & Gas Exploration and Production | Focus on domestic exploration and energy security |

SSubstitutes Threaten

The most significant threat of substitution for Idemitsu Kosan's traditional petroleum business stems from the increasing availability and adoption of alternative energy sources. These include solar, wind, geothermal, and biomass, all of which are gaining traction as viable energy options.

Japan's commitment to carbon neutrality by 2050 is a major driver behind this shift, actively encouraging a move away from fossil fuels. Projections indicate that renewables will form a substantial part of the energy mix by fiscal year 2030, directly impacting demand for petroleum products.

The price-performance ratio of renewable energy technologies, such as solar and wind power, continues to improve, making them a more compelling alternative to fossil fuels. For instance, the global average cost of electricity from solar photovoltaics dropped by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). This trend directly challenges the cost-effectiveness of traditional energy sources like those supplied by Idemitsu Kosan.

Government incentives and subsidies play a crucial role in shaping the competitive landscape. In Japan, while fossil fuels may benefit from certain support mechanisms, the increasing global and domestic push for decarbonization means that subsidies for renewable energy are also significant, further enhancing the attractiveness of these substitutes. This dynamic makes it essential for Idemitsu Kosan to monitor not just the base cost of energy but also the impact of policy on the final price for consumers.

Customers are increasingly open to alternatives, especially in the energy sector. This shift is fueled by growing environmental awareness and government pushes for cleaner options. For instance, the global electric vehicle market alone was valued at approximately $380 billion in 2023 and is projected to grow significantly, indicating a strong customer willingness to adopt substitute technologies.

The development of charging infrastructure for electric vehicles and fueling stations for hydrogen vehicles directly supports this customer propensity to substitute away from traditional fossil fuels. Idemitsu Kosan's investment in renewable energy projects and carbon-neutral initiatives, such as their involvement in offshore wind power and sustainable aviation fuel, directly addresses this trend, aiming to capture market share as customer preferences evolve.

Technological Advancements in Substitutes

Rapid technological progress is significantly boosting the appeal and effectiveness of alternatives to traditional fuels. Innovations in battery storage, hydrogen fuel cell technology, and more efficient solar and wind power systems are making these options increasingly competitive. This trend directly challenges the long-term demand for petroleum-based products, a core offering for companies like Idemitsu Kosan.

Idemitsu Kosan is actively responding to these technological shifts. The company's strategic investments, for instance, in agrivoltaics (combining agriculture with solar power generation) and grid-scale battery storage solutions, underscore its acknowledgment of this evolving landscape. These initiatives aim to diversify its energy portfolio and mitigate the risks associated with a declining reliance on fossil fuels.

- Battery Storage Advancements: The cost of lithium-ion battery packs for electric vehicles has fallen by over 90% since 2010, making EVs a more viable substitute for gasoline-powered cars.

- Hydrogen Economy Growth: Global investment in hydrogen production and infrastructure is projected to reach hundreds of billions of dollars by 2030, signaling a strong push towards hydrogen as a clean energy carrier.

- Renewable Energy Efficiency Gains: The levelized cost of electricity from solar photovoltaic (PV) has decreased by approximately 89% between 2010 and 2022, enhancing its competitiveness against conventional power sources.

Regulatory and Policy Support for Substitutes

Japan's commitment to decarbonization, evidenced by its ambitious emissions reduction targets, directly fuels the threat of substitutes for traditional energy sources like those offered by Idemitsu Kosan. Government policies actively encourage the adoption of renewable energy technologies, making alternatives more attractive and economically viable.

These supportive regulatory frameworks, including subsidies and tax incentives for solar, wind, and other clean energy projects, effectively lower the barrier to entry for substitute providers. For instance, Japan aims for carbon neutrality by 2050, a goal that necessitates a significant shift away from fossil fuels.

- Government Mandates: Japan's national policies prioritize renewable energy integration into the power grid.

- Financial Incentives: Substantial subsidies and tax credits are available for renewable energy installations, reducing upfront costs for consumers and businesses.

- Decarbonization Targets: Clear, legally binding targets for greenhouse gas emission reductions compel a move towards cleaner energy alternatives.

- Investment in R&D: Public funding supports research and development in advanced renewable energy technologies, further enhancing their competitiveness.

The threat of substitutes for Idemitsu Kosan's core petroleum business is significant and growing, driven by advancements in alternative energy technologies and a global push towards decarbonization. The increasing competitiveness of renewables, coupled with supportive government policies in Japan, makes these alternatives increasingly attractive to consumers and businesses.

The improving price-performance ratio of technologies like solar and wind, alongside the expansion of electric vehicle infrastructure, directly challenges demand for fossil fuels. For example, the global average cost of solar PV electricity dropped by approximately 89% between 2010 and 2022.

Idemitsu Kosan's strategic investments in areas like offshore wind and sustainable aviation fuel demonstrate an awareness of this evolving landscape and an effort to adapt to changing market demands and environmental priorities.

| Substitute Technology | Cost Reduction (2010-2022) | Projected Growth/Investment |

|---|---|---|

| Solar PV Electricity | ~89% | Continued cost declines |

| Electric Vehicles (Battery Cost) | >90% | Global market valued at $380 billion in 2023 |

| Hydrogen Production/Infrastructure | N/A | Projected global investment in hundreds of billions by 2030 |

Entrants Threaten

The petroleum refining and petrochemical sectors demand colossal upfront investments, often running into billions of dollars, for facilities, advanced machinery, and extensive supply chains. This immense capital requirement acts as a formidable barrier, effectively discouraging potential new players from entering the market.

For instance, building a new, modern refinery can cost upwards of $10 billion. Idemitsu Kosan, with its established and vast network of refineries, distribution channels, and research facilities, already possesses a significant competitive edge that new entrants would struggle to replicate.

The threat of new entrants is significantly lowered by the immense difficulty in establishing a comprehensive distribution network for petroleum products. This includes not only the physical presence of service stations but also the complex industrial supply chains required for bulk delivery and storage. For instance, in 2024, the capital investment for building a single modern service station can range from $1 million to $3 million USD, not including the upstream infrastructure.

Idemitsu Kosan, as an established player, already possesses a vast and integrated network of service stations and robust supply chains spanning key Asian markets. This existing infrastructure provides a substantial competitive advantage, making it incredibly costly and time-consuming for any newcomer to replicate the same reach and efficiency. In 2023, Idemitsu operated over 6,000 service stations across Japan and other Asian countries, a testament to its entrenched distribution power.

Existing players in the oil and gas industry, like Idemitsu Kosan, benefit immensely from economies of scale. This means they can produce and refine oil at a much lower cost per barrel due to their massive operations. For example, Idemitsu’s integrated refining and petrochemical complexes allow for efficient feedstock utilization and optimized production processes, driving down unit costs.

New companies trying to enter this market would face a significant hurdle. They would need to make massive upfront investments to build comparable facilities and achieve the same level of operational efficiency. Without this scale, their per-unit production costs would be considerably higher, making it difficult to compete with established giants like Idemitsu, who in fiscal year 2023 reported consolidated revenue of ¥5.3 trillion (approximately $35 billion USD at an average exchange rate for that period).

Government Policy and Regulations

The Japanese energy sector is heavily regulated, with strict environmental standards, safety protocols, and licensing requirements. For instance, the Ministry of Economy, Trade and Industry (METI) oversees energy policy, and compliance with its directives is mandatory. These regulations create substantial barriers to entry, increasing the capital and operational costs for any new company aiming to enter the market.

Furthermore, Japan's ambitious carbon neutrality goals, targeting net-zero emissions by 2050, mean that new entrants would likely need to invest heavily in green technologies and sustainable practices. This requirement adds another layer of complexity and cost, potentially deterring new players who may lack the necessary expertise or financial backing to navigate these advanced environmental mandates.

- Stringent Environmental Standards: Compliance with emissions limits and waste management regulations.

- Safety Requirements: Adherence to rigorous safety protocols for energy infrastructure and operations.

- Licensing Procedures: Obtaining necessary permits and approvals from government bodies like METI.

- Carbon Neutrality Push: Focus on renewable energy and low-carbon technologies as a prerequisite for market entry.

Brand Loyalty and Switching Costs for Customers

While not as pronounced as in some consumer goods sectors, Idemitsu Kosan benefits from established brand recognition and existing relationships with its industrial clientele. This creates a tangible level of brand loyalty, making it harder for newcomers to capture market share. For instance, in 2024, Idemitsu Kosan continued to leverage its long-standing reputation in the petrochemical and energy sectors, a key factor in retaining its customer base.

Moreover, for certain industrial customers, transitioning to a new supplier can entail significant logistical challenges and pre-existing contractual commitments. These switching costs act as a considerable barrier, deterring potential new entrants from easily entering Idemitsu Kosan's operating markets. The complexity of supply chain integration and the need for specialized handling of products, such as lubricants or specialized chemicals, often mean that the cost and effort of switching are substantial.

- Brand Loyalty: Idemitsu Kosan's established reputation in the energy and petrochemical industries fosters customer loyalty.

- Industrial Relationships: Long-term partnerships with industrial clients are a significant retention factor.

- Switching Costs: Logistical complexities and contractual obligations for industrial customers represent barriers to entry for new suppliers.

- Market Inertia: The effort and expense involved in changing suppliers discourage new entrants from aggressively targeting Idemitsu Kosan's established customer base.

The threat of new entrants in the petroleum refining and petrochemical sectors, where Idemitsu Kosan operates, is significantly mitigated by the immense capital required for establishing operations. Building a new refinery can easily exceed $10 billion in 2024, a sum that deters most potential competitors. Furthermore, Idemitsu's extensive, established distribution network, including over 6,000 service stations in Asia as of 2023, presents a substantial hurdle for newcomers aiming for market penetration.

Economies of scale also play a crucial role, allowing Idemitsu to maintain lower per-unit production costs. For instance, Idemitsu's consolidated revenue in fiscal year 2023 was ¥5.3 trillion, highlighting its operational scale. New entrants would struggle to match this efficiency without massive upfront investment.

Stringent regulatory environments in Japan, overseen by bodies like the Ministry of Economy, Trade and Industry, add further barriers through compliance with environmental standards, safety protocols, and licensing. The nation's push towards carbon neutrality by 2050 necessitates significant investment in green technologies, increasing the cost and complexity for any new player.

Finally, Idemitsu Kosan benefits from brand loyalty and strong industrial relationships, making it difficult for new entrants to attract and retain customers. The switching costs for industrial clients, involving logistical complexities and contractual obligations, further solidify Idemitsu's market position.

| Barrier Type | Description | Example for Idemitsu Kosan |

|---|---|---|

| Capital Requirements | High upfront investment for facilities and technology. | New refinery construction costs exceeding $10 billion (2024). |

| Distribution Network | Establishing widespread and efficient supply chains. | Operated over 6,000 service stations across Asia (2023). |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | FY2023 consolidated revenue of ¥5.3 trillion. |

| Regulatory Hurdles | Compliance with environmental, safety, and licensing laws. | Adherence to METI regulations and carbon neutrality goals. |

| Brand Loyalty & Switching Costs | Customer retention due to reputation and integration. | Long-standing industrial relationships and logistical integration challenges for competitors. |

Porter's Five Forces Analysis Data Sources

Our Idemitsu Kosan Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Idemitsu's official annual reports, investor presentations, and filings with regulatory bodies like the Tokyo Stock Exchange. We also incorporate industry-specific reports from reputable market research firms and energy sector publications to provide a comprehensive view of the competitive landscape.