Idemitsu Kosan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Idemitsu Kosan Bundle

Discover how Idemitsu Kosan masterfully blends its product offerings, pricing strategies, place in the market, and promotional efforts to fuel its global success. This analysis goes beyond the surface, revealing the intricate interplay of each P.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Idemitsu Kosan, perfect for business professionals and students seeking actionable strategic insights. Save valuable research time and gain a competitive edge.

Product

Idemitsu Kosan's product portfolio is anchored by a comprehensive suite of refined petroleum products, including gasoline, kerosene, and diesel fuel, vital for everyday consumption and economic engine. These are foundational to their operations and market presence.

Beyond fuels, lubricants represent a significant and long-standing segment for Idemitsu Kosan, catering to crucial industrial and marine engine needs. This area has been a cornerstone of their business since the company's early days, demonstrating sustained commitment and expertise.

In 2023, Idemitsu Kosan's Petroleum Products segment reported sales of approximately ¥2,519.6 billion, highlighting the substantial volume and economic impact of their fuel offerings. Their lubricant business, while smaller, remains a strategic pillar, contributing to their diversified energy solutions.

Idemitsu Kosan's Petrochemicals and Functional Materials segment is a cornerstone of their diversified business, extending well beyond traditional fuel offerings. They are a major supplier of fundamental chemicals, including olefins like ethylene and propylene, and aromatics such as benzene, para-xylene, and styrene monomer. These essential building blocks are crucial for numerous downstream chemical industries, serving both domestic Japanese markets and international clients.

The company's strategic focus on functional materials highlights a dedication to innovation and value-added products. This segment caters to a wide array of industries, showcasing Idemitsu's adaptability and forward-thinking approach in developing specialized materials that meet evolving market demands. For instance, their functional films are utilized in displays and electronics, a sector experiencing robust growth.

Idemitsu Kosan is strategically positioning its Renewable Energy Solutions to align with the global energy transition. This involves significant investment in and operation of diverse alternative energy sources, including solar, biomass, wind, and geothermal power. The company's objective is to substantially boost the proportion of non-fossil fuel contributions to its overall energy generation.

By 2030, Idemitsu Kosan aims for renewable energy to account for 30% of its total power generation capacity. This ambition is supported by ongoing projects like the development of a large-scale offshore wind farm in Akita Prefecture, expected to commence operations by 2028 and generate approximately 800,000 megawatt-hours of electricity annually, enough to power around 260,000 homes.

Advanced Battery Materials

Idemitsu Kosan's product strategy for advanced battery materials centers on high-growth, future-oriented components. They are actively developing key materials like lithium sulfide, a crucial intermediate for solid electrolytes in next-generation all-solid-state batteries. This focus directly addresses the increasing demand for safer, higher-performance batteries in the electric vehicle sector.

This strategic product development aligns with Idemitsu's commitment to sustainable solutions. By investing in materials for all-solid-state batteries, they are positioning themselves as a key player in the evolving electric mobility landscape. The company anticipates significant market growth in this area, driven by global decarbonization efforts and advancements in battery technology.

Key aspects of their advanced battery materials product strategy include:

- Focus on Next-Generation Technologies: Development of materials like lithium sulfide for all-solid-state batteries, targeting improved safety and energy density.

- Market Alignment: Directly addressing the burgeoning demand for advanced EV battery components, a critical area for automotive sustainability.

- Strategic Investment: Allocating resources to R&D and production capabilities for these future-oriented materials to secure a competitive edge.

- Supply Chain Integration: Aiming to become a vital supplier of essential raw materials within the rapidly expanding battery manufacturing ecosystem.

Carbon Neutrality Solutions

Idemitsu Kosan is actively pursuing carbon neutrality solutions to support societal transitions. A key product is Idemitsu Carbon Offset Fuel B5 Diesel, which integrates low-carbon energy sources with carbon credits, aiming to reduce environmental impact. This initiative aligns with the company's broader 'Energy one step ahead' strategy.

Further demonstrating their commitment, Idemitsu is investing in future energy technologies. This includes the research and development of synthetic fuels, hydrogen, and ammonia. These advanced energy carriers are seen as crucial components for achieving a sustainable, carbon-neutral future, reflecting a forward-looking approach to energy provision.

- Idemitsu Carbon Offset Fuel B5 Diesel: Combines low-carbon energy with carbon credits.

- Future Energy Development: Exploring synthetic fuels, hydrogen, and ammonia.

- Strategic Initiative: Part of the 'Energy one step ahead' plan for carbon neutrality.

Idemitsu Kosan's product strategy is a dynamic blend of established energy staples and forward-looking innovations. Their core offerings include a wide range of refined petroleum products, such as gasoline and diesel, which formed the backbone of their ¥2,519.6 billion petroleum products segment in 2023. This is complemented by a robust lubricants business catering to industrial and marine applications.

The company is aggressively expanding into advanced materials and renewable energy, aiming for 30% of its power generation to come from renewables by 2030. Key developments include materials for next-generation batteries, like lithium sulfide, and investments in synthetic fuels, hydrogen, and ammonia as part of their carbon neutrality goals.

| Product Category | Key Offerings | 2023 Segment Sales (JPY Billion) | Strategic Focus |

|---|---|---|---|

| Refined Petroleum Products | Gasoline, Kerosene, Diesel | ~2,519.6 | Core business, essential for economic activity |

| Lubricants | Industrial and Marine Lubricants | N/A (part of Petroleum Products) | Long-standing expertise, critical industrial applications |

| Petrochemicals & Functional Materials | Olefins (Ethylene, Propylene), Aromatics (Benzene), Functional Films | N/A (part of Chemicals segment) | Building blocks for industries, value-added materials |

| Renewable Energy Solutions | Solar, Biomass, Wind, Geothermal | N/A (growing segment) | Energy transition, aiming for 30% renewables by 2030 |

| Advanced Battery Materials | Lithium Sulfide (for all-solid-state batteries) | N/A (emerging segment) | Next-generation EV batteries, safety and performance |

| Carbon Neutrality Solutions | Carbon Offset Fuel B5 Diesel, Synthetic Fuels, Hydrogen, Ammonia | N/A (strategic initiatives) | Societal transition, future energy carriers |

What is included in the product

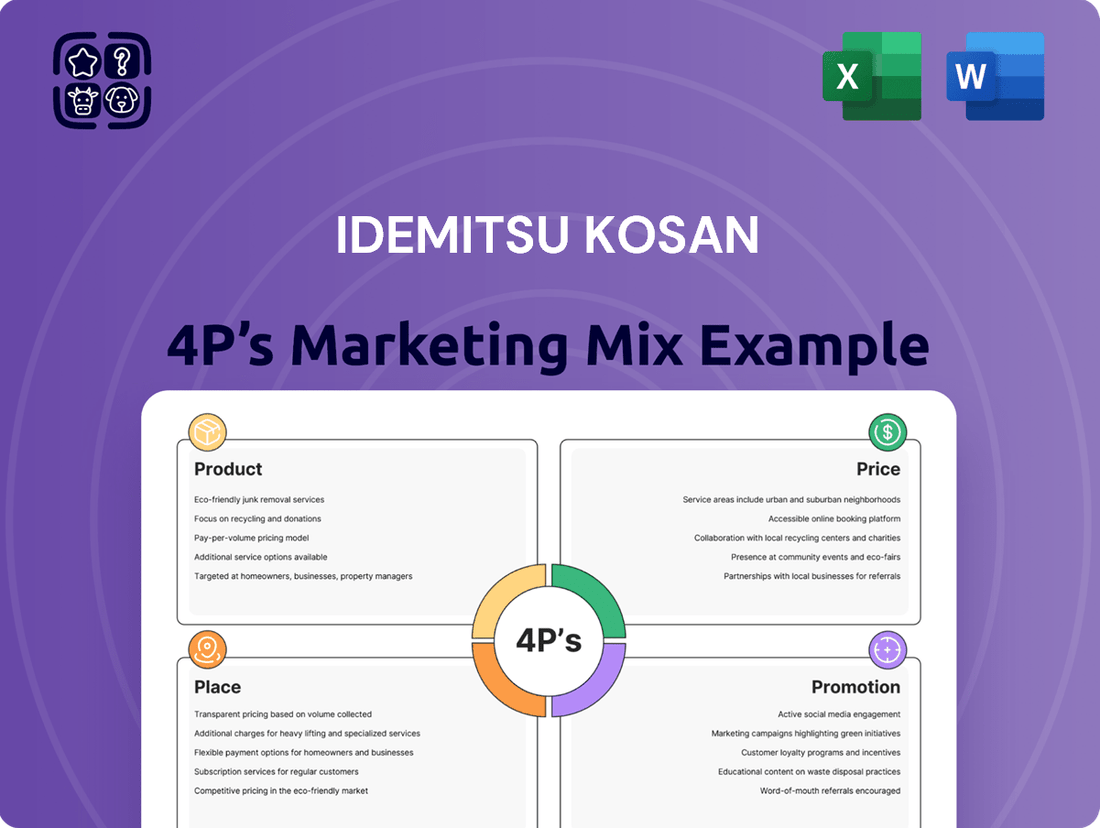

This analysis provides a comprehensive breakdown of Idemitsu Kosan's marketing strategies across Product, Price, Place, and Promotion, offering insights into their market positioning and competitive advantages.

Provides a clear, actionable framework to address market challenges by strategically aligning product, price, place, and promotion for Idemitsu Kosan.

Simplifies complex marketing decisions by offering a structured approach to identify and resolve customer pain points through optimized 4Ps strategies.

Place

Idemitsu Kosan's extensive domestic distribution network is a cornerstone of its marketing strategy. This network includes refineries, oil terminals, and approximately 6,000 service stations operating under the apollostation brand across Japan.

This vast physical infrastructure ensures a stable and reliable supply of fuel to a broad consumer base and various industries nationwide. The sheer scale of this network, with thousands of touchpoints, is critical for market penetration and accessibility.

Idemitsu Kosan has strategically expanded its international footprint, notably strengthening its market share in Southeast Asia and Europe. This global expansion has been a key driver of its overall revenue growth, demonstrating the effectiveness of its international market strategy.

The company's global operations encompass vital areas such as oil exploration and production. Furthermore, Idemitsu Kosan actively engages in the sale of oil products across numerous Asian markets, solidifying its presence in critical energy sectors.

Idemitsu Kosan is strategically evolving its refining and petrochemical complexes into 'CNX centers' to drive carbon neutrality. This initiative represents a significant shift in how the company views and utilizes its physical production assets, aiming for a more sustainable operational model.

A key aspect of this transformation involves consolidating ethylene facilities with strategic partners. For instance, their Chiba complex is a focal point, with efforts to streamline operations and enhance production efficiency by sharing resources and expertise.

This consolidation is a direct response to evolving market dynamics and the increasing demand for more sustainable and efficient petrochemical production. By optimizing these core facilities, Idemitsu Kosan aims to reduce its environmental footprint while maintaining competitive output.

Direct Sales and Business-to-Business (B2B) Channels

Idemitsu Kosan actively pursues direct sales channels, supplying petroleum products, petrochemicals, and lubricants to a diverse range of industrial clients. This B2B focus is crucial for their bulk product distribution.

The company also cultivates wholesale electricity power business, demonstrating a strategic move into energy infrastructure. Furthermore, Idemitsu has invested in ventures to directly provide clean energy solutions to commercial and industrial customers, particularly in the growing Southeast Asian market.

- Direct Industrial Sales: Idemitsu supplies petroleum, petrochemicals, and lubricants directly to businesses.

- Wholesale Power: They engage in wholesale electricity sales, serving power companies.

- Clean Energy Partnerships: Investments in Southeast Asia aim to supply clean energy to commercial and industrial sectors, reflecting a 2024/2025 market trend towards sustainable energy solutions.

Online and E-commerce Platforms

Idemitsu Kosan is strategically leveraging online and e-commerce platforms to broaden its global footprint, particularly for niche offerings like its plant-based racing engine oil. This digital pivot is crucial for reaching new customer bases in key Southeast Asian and Australian markets.

The company's adoption of business process as a service (BPaaS) for marketing, logistics, and customer support underscores a commitment to efficient, digitally-enabled operations. This approach is vital for managing the complexities of international e-commerce.

- Digital Expansion: Targeting markets like Singapore, Thailand, Malaysia, and Australia for specialized product sales via online channels.

- BPaaS Integration: Utilizing outsourced business processes to streamline e-commerce operations, from initial marketing to final delivery and customer care.

- E-commerce Growth: The global e-commerce market for automotive lubricants is projected to see continued growth, with digital channels becoming increasingly important for specialty product distribution. For instance, the Asia-Pacific automotive lubricants market alone was valued at approximately $28.5 billion in 2023 and is expected to expand further, with a growing segment driven by online sales.

Idemitsu Kosan's physical presence is defined by its extensive domestic network of approximately 6,000 apollostation service stations, complemented by refineries and oil terminals ensuring broad accessibility. Internationally, the company has solidified its market share in Southeast Asia and Europe, actively engaging in oil exploration, production, and product sales across numerous Asian markets. Furthermore, Idemitsu is transforming its refining and petrochemical complexes into 'CNX centers' to advance carbon neutrality, exemplified by the consolidation of ethylene facilities at its Chiba complex to enhance efficiency and sustainability.

| Asset Type | Domestic Network | International Focus | Sustainability Initiatives |

|---|---|---|---|

| Service Stations | ~6,000 (apollostation) | N/A | N/A |

| Refineries/Terminals | Extensive domestic | Southeast Asia, Europe | Transformation into 'CNX centers' |

| Petrochemical Facilities | N/A | N/A | Ethylene facility consolidation (e.g., Chiba complex) |

| Exploration & Production | N/A | Key Asian markets | N/A |

Full Version Awaits

Idemitsu Kosan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Idemitsu Kosan's 4P's Marketing Mix is fully complete and ready for immediate use.

Promotion

Idemitsu Kosan's commitment to sustainability is a key aspect of its marketing mix, particularly under the promotion umbrella. Their Integrated Report and ESG Data Book clearly articulate these efforts, showcasing a dedication to sustainable development goals.

The company is actively working towards a carbon-neutral society by 2050, a significant undertaking that involves substantial investment in green technologies and a focus on reducing their carbon footprint. This proactive stance resonates with an increasingly environmentally conscious market.

For instance, Idemitsu Kosan has set targets to reduce greenhouse gas emissions. In fiscal year 2023, they reported a reduction in Scope 1 and 2 emissions, demonstrating tangible progress towards their ambitious climate goals, a crucial detail for stakeholders evaluating their CSR performance.

Idemitsu Kosan actively pursues product-specific marketing, notably with the December 2024 launch of IDEMITSU IFG Plantech Racing, the world's first API-certified, plant-based racing engine oil. This innovation targets a niche market segment seeking sustainable high-performance lubricants.

Strategic partnerships are crucial for Idemitsu's forward-looking strategy, exemplified by its collaboration with Toyota Motor on solid-state battery development. This alliance aims to commercialize cutting-edge automotive technologies, positioning Idemitsu at the forefront of next-generation energy solutions and enhancing its brand visibility in emerging markets.

Idemitsu Kosan actively engages in industry dialogues and initiatives focused on the energy transition and sustainability. This positions them as a forward-thinking leader in the evolving energy landscape.

Their commitment to innovation is evident through participation in projects like agrivoltaics, which merges agriculture with solar power generation, and the development of cutting-edge advanced materials. For instance, in 2023, Idemitsu Kosan announced advancements in their OLED materials, a key area for future growth.

Investor Relations and Financial Communications

Idemitsu Kosan prioritizes investor relations and financial communications by providing comprehensive data, including detailed financial results and strategic presentations. This transparency aims to enhance understanding of their growth trajectory and corporate value among a broad spectrum of financially-literate stakeholders, from individual investors to financial professionals.

The company's commitment to clear communication is evident in its readily accessible investor relations materials, designed to foster trust and attract sustained investment. For instance, during the fiscal year ending March 2024, Idemitsu Kosan reported net sales of ¥4,839.6 billion and an operating income of ¥327.8 billion, figures that are crucial for investors assessing performance.

- Financial Transparency: Regular dissemination of financial results and presentations.

- Investor Engagement: Materials designed to explain growth strategies and corporate value.

- Audience Focus: Catering to individual investors, financial professionals, and business strategists.

- Performance Metrics: Highlighting key financial data, such as FY2024 sales and operating income, to inform investment decisions.

Brand Recognition and Community Engagement

Idemitsu Kosan reinforces brand recognition through its widespread apollostation network, a familiar sight for many consumers. This consistent presence at the point of sale is crucial for everyday brand recall.

Beyond the forecourt, Idemitsu Kosan actively cultivates community engagement and brand affinity through various corporate citizenship and cultural initiatives. These efforts aim to build a positive societal image and foster deeper connections with the public.

Notable examples include the Idemitsu Art Award, which supports emerging artists, and various music events. These cultural sponsorships not only contribute to society but also associate the Idemitsu brand with creativity and cultural enrichment, enhancing its appeal beyond its core business operations.

For instance, in 2023, Idemitsu Kosan continued its support for the arts and community, reflecting a strategic approach to building a brand that resonates on multiple levels. This multifaceted engagement strategy is key to maintaining relevance and loyalty in a competitive market.

Idemitsu Kosan's promotional efforts center on its sustainability narrative and technological innovation. By highlighting its commitment to carbon neutrality by 2050 and showcasing advancements like plant-based racing engine oil and solid-state battery development with Toyota, the company targets environmentally conscious consumers and forward-thinking industry partners.

The company also leverages its extensive apollostation network for brand visibility and engages in cultural sponsorships, such as the Idemitsu Art Award, to build community affinity and associate the brand with creativity. This dual approach aims to strengthen brand recognition and foster positive societal connections.

Financial transparency is a key promotional tool, with Idemitsu Kosan providing detailed investor relations materials. For the fiscal year ending March 2024, the company reported net sales of ¥4,839.6 billion and operating income of ¥327.8 billion, offering concrete data for stakeholders.

| Key Promotional Focus | Initiatives/Examples | Target Audience | Supporting Data/Context |

|---|---|---|---|

| Sustainability & Carbon Neutrality | Commitment to carbon-neutral society by 2050; reduction of Scope 1 & 2 emissions (FY2023) | Environmentally conscious consumers, investors, business strategists | Demonstrates tangible progress towards climate goals. |

| Product Innovation | Launch of IDEMITSU IFG Plantech Racing (Dec 2024); collaboration with Toyota on solid-state batteries | Niche market segments, automotive industry stakeholders | Positions Idemitsu at the forefront of next-generation energy solutions. |

| Brand Visibility & Community Engagement | Widespread apollostation network; Idemitsu Art Award; music events | General consumers, art and culture enthusiasts | Fosters community affinity and positive societal image. |

| Investor Relations & Financial Communication | Comprehensive financial results and strategic presentations; clear communication materials | Individual investors, financial professionals, academic stakeholders | FY2024 Net Sales: ¥4,839.6 billion; Operating Income: ¥327.8 billion. |

Price

Idemitsu Kosan navigates a fiercely competitive petroleum landscape where pricing is a constant balancing act. In 2024, the average price of Brent crude oil fluctuated significantly, impacting their downstream product costs and retail pricing strategies for gasoline, kerosene, and diesel. This dynamic environment necessitates agile pricing models to maintain market share against both domestic and international competitors.

For its specialized products, such as advanced petrochemicals and functional materials, Idemitsu Kosan likely employs value-based pricing. This strategy aligns with the significant R&D investments and the unique, long-term benefits these offerings provide to customers, particularly in the evolving energy sector.

This approach is especially pertinent for Idemitsu Kosan's innovative solutions supporting the energy transition. By pricing based on the value delivered, the company can capture the premium associated with cutting-edge technology and its contribution to sustainability goals.

Idemitsu Kosan's pricing strategy is intrinsically linked to its drive for capital efficiency and production optimization. By consolidating ethylene facilities, the company aims to streamline operations and reduce costs, which in turn allows for more competitive pricing. In fiscal year 2023, Idemitsu Kosan reported a net sales of ¥4,569.4 billion, demonstrating the scale of their operations and the impact of cost management on their market position.

Long-Term Agreements and Project-Based Pricing

Idemitsu Kosan structures its renewable energy and B2B solutions through long-term power purchase agreements (PPAs). This project-based pricing model allows for customized negotiations reflecting the unique scale, duration, and specific needs of each commercial and industrial client.

This approach ensures stable revenue streams and fosters strong client relationships. For instance, in 2024, Idemitsu Kosan finalized a significant PPA for a solar farm project, securing a fixed price per megawatt-hour over a 20-year term, demonstrating the commitment to long-term value.

- Project-Specific Negotiation: Pricing is tailored to individual project parameters, including capacity and location.

- Long-Term Commitment: PPAs typically span 15-25 years, providing revenue predictability.

- Risk Mitigation: Fixed pricing in PPAs helps both Idemitsu and its B2B clients manage energy cost volatility.

- B2B Focus: This strategy primarily targets commercial and industrial entities seeking reliable, long-term energy supply.

Dividend Policy and Shareholder Returns

Idemitsu Kosan's approach to shareholder returns, particularly its dividend policy, is a crucial aspect of its overall marketing mix, influencing investor perception and stock valuation. The company's financial health, including its net income and cash flow generation, directly dictates its capacity to reward shareholders.

For the fiscal year ending March 2024, Idemitsu Kosan reported a consolidated net income attributable to owners of the parent of ¥202.5 billion. This robust performance underpins its commitment to providing attractive shareholder returns.

- Dividend Payout: Idemitsu Kosan aims to maintain a stable and increasing dividend, reflecting its confidence in future earnings.

- Financial Performance Impact: Strong net income and healthy cash flows are foundational to the company's ability to sustain and grow dividend payments.

- Investor Attraction: A consistent and competitive dividend policy enhances the attractiveness of Idemitsu Kosan's stock, drawing in income-seeking investors.

- Shareholder Value: By balancing reinvestment for growth with dividend distributions, the company seeks to maximize long-term shareholder value.

Idemitsu Kosan's pricing strategy for refined petroleum products is largely dictated by global commodity markets, with gasoline and diesel prices closely tracking Brent crude oil benchmarks. For fiscal year 2023, Idemitsu Kosan's net sales reached ¥4,569.4 billion, indicating the significant volume of products sold and the sensitivity of their revenue to price fluctuations.

In contrast, their advanced materials and petrochemicals often utilize value-based pricing, reflecting the substantial R&D investment and unique performance characteristics offered. This is particularly true for solutions supporting the energy transition, where premium pricing can be justified by sustainability benefits and technological innovation.

For renewable energy projects, Idemitsu Kosan employs project-specific pricing through long-term Power Purchase Agreements (PPAs). These contracts, often spanning 15-25 years, allow for customized rates based on project scale, location, and client needs, ensuring stable revenue streams. For example, a significant solar farm PPA finalized in 2024 secured a fixed price per megawatt-hour over a 20-year term.

| Product Segment | Pricing Strategy | Key Factors | Example/Data Point |

|---|---|---|---|

| Refined Petroleum Products | Market-Based / Cost-Plus | Brent Crude Oil Prices, Competition | Net Sales FY2023: ¥4,569.4 billion |

| Specialty Petrochemicals & Functional Materials | Value-Based | R&D Investment, Performance Benefits, Sustainability | N/A (proprietary) |

| Renewable Energy (PPAs) | Project-Specific / Contractual | Project Scale, Duration, Client Needs, Location | 20-year PPA for solar farm (2024) |

4P's Marketing Mix Analysis Data Sources

Our Idemitsu Kosan 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, financial disclosures, and investor relations materials. We also incorporate insights from industry publications, market research reports, and competitive intelligence to ensure a holistic view of their strategies.