Idemitsu Kosan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Idemitsu Kosan Bundle

Curious about Idemitsu Kosan's market standing? This glimpse into their BCG Matrix reveals the strategic positioning of their diverse product portfolio. Understand which ventures are fueling growth and which might require a second look.

Unlock the full potential of this analysis by purchasing the complete Idemitsu Kosan BCG Matrix. Gain detailed quadrant placements, actionable insights into market share and growth rates, and a clear roadmap for optimizing your investments.

Don't miss out on the comprehensive breakdown that will empower your strategic decision-making. Secure your copy today and transform raw data into a powerful competitive advantage.

Stars

Idemitsu Kosan is heavily investing in lithium sulfide, a key component for all-solid-state batteries. This strategic move is underscored by plans for a substantial production plant, slated for completion by June 2027, signaling a strong commitment to this burgeoning technology.

This development is intrinsically linked to their collaboration with Toyota, targeting the commercialization of electric vehicles powered by solid-state batteries between 2027 and 2028. This positions Idemitsu Kosan favorably within a high-growth market, with the potential to capture a significant market share in the emerging solid-state battery sector.

Idemitsu Kosan is strategically positioning its Sustainable Aviation Fuel (SAF) production as a potential Star in the BCG Matrix. The company is committed to building a domestic SAF supply chain in Japan, with an ambitious goal of producing 500,000 kiloliters annually by 2030.

To achieve this, Idemitsu is investigating diverse feedstocks and advanced technologies such as Alcohol-to-Jet (ATJ) and Hydroprocessed Esters and Fatty Acids (HEFA). Their collaborative efforts, including a partnership with Petronas, are crucial for scaling up production and securing necessary resources.

The global aviation industry's increasing focus on decarbonization creates a significant and rapidly expanding market for SAF. Idemitsu aims to capture a substantial market share in this high-growth sector, leveraging its technological advancements and strategic alliances.

Idemitsu Kosan is actively developing its renewable energy sector, focusing on solar, wind, and geothermal power. The company is making significant investments in large-scale projects both within Japan and across international markets. This strategic expansion aims to capture growth in the global shift towards cleaner energy sources.

A key initiative is Idemitsu's push into agrivoltaics, combining solar power generation with agricultural activities. They are targeting multi-gigawatt solar portfolios, indicating a strong commitment to high-growth segments within the renewable energy landscape. For example, by the end of fiscal year 2023, Idemitsu had already secured rights for solar power generation facilities totaling approximately 1.2 GW.

Low-Carbon Hydrogen and Ammonia Supply Chain

Idemitsu Kosan is actively developing a low-carbon hydrogen and ammonia supply chain, targeting fuel and raw material applications. This strategic move places them in a rapidly expanding market essential for achieving carbon neutrality goals.

The company is involved in significant production projects and is building import and receiving infrastructure. For instance, in 2024, Idemitsu announced its participation in a project aiming to produce green ammonia using renewable energy sources in Australia, with initial production targeted for the latter half of the decade. This initiative underscores their commitment to securing stable, large-scale supply.

- Market Focus: Establishing robust supply chains for low-carbon hydrogen and ammonia for fuel and industrial feedstock.

- Strategic Investments: Participating in large-scale production projects and developing crucial import/receiving terminal infrastructure.

- Growth Potential: Positioning within the high-growth sector vital for global decarbonization efforts.

- 2024 Developments: Involvement in Australian green ammonia production projects signifies tangible progress in securing future supply.

Carbon Capture, Utilization, and Storage (CCUS) Solutions

Idemitsu Kosan is actively investing in and developing Carbon Capture, Utilization, and Storage (CCUS) technologies. This strategic focus positions them to capitalize on the growing demand for industrial decarbonization solutions. The company's commitment is demonstrated through joint studies and investments in venture capital funds focused on CCUS innovation, signaling an ambition for market leadership in this high-growth sector.

CCUS is recognized as a critical pathway for industries to achieve net-zero emissions targets. Idemitsu's proactive engagement in this area, including collaborations on CO2 capture and utilization projects, aligns with global environmental imperatives. The company's early-stage investment strategy in CCUS ventures underscores its foresight in anticipating and shaping future energy landscapes.

- Market Growth: The global CCUS market is projected to reach hundreds of billions of dollars by 2030, driven by regulatory pressures and corporate sustainability goals.

- Idemitsu's Investment: Idemitsu has allocated significant capital towards CCUS research, development, and pilot projects, aiming to build a robust portfolio of technologies and operational capabilities.

- Strategic Partnerships: The company is forging partnerships with technology providers and industrial emitters to accelerate the deployment of CCUS solutions.

- Innovation Focus: Idemitsu's venture capital investments target startups developing next-generation CCUS technologies, including direct air capture and advanced CO2 utilization methods.

Idemitsu Kosan's investments in Sustainable Aviation Fuel (SAF) and its development of low-carbon hydrogen and ammonia supply chains are positioned as Stars. The company's ambitious SAF production target of 500,000 kiloliters annually by 2030, coupled with its exploration of diverse feedstocks and technologies, highlights its strong market potential. Similarly, its active development of a low-carbon hydrogen and ammonia supply chain, including participation in Australian green ammonia projects in 2024, places it in a crucial, high-growth sector essential for global decarbonization.

| Business Unit | Market Growth | Idemitsu's Position | BCG Category |

| Sustainable Aviation Fuel (SAF) | High (driven by aviation decarbonization) | Expanding production capacity, diverse feedstock research, strategic partnerships | Star |

| Low-Carbon Hydrogen & Ammonia | High (essential for carbon neutrality) | Developing supply chains, participating in green ammonia projects (e.g., Australia, 2024) | Star |

What is included in the product

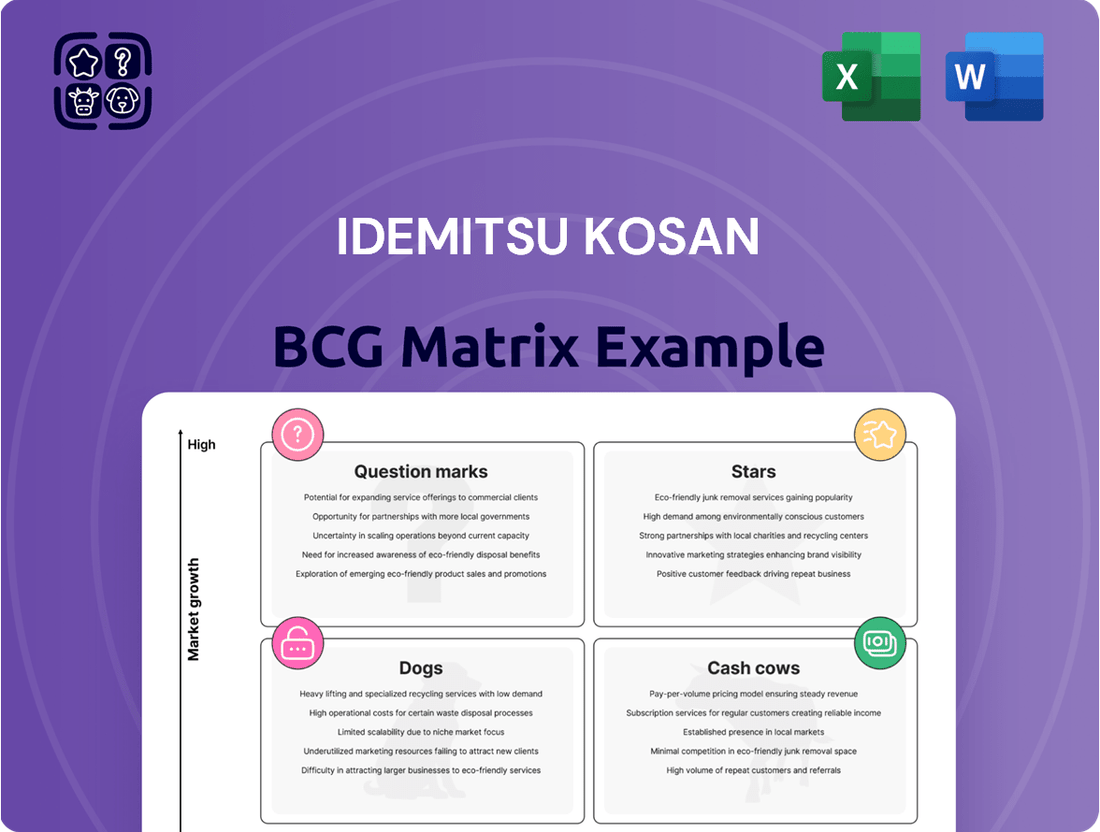

The Idemitsu Kosan BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear Idemitsu Kosan BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

This BCG Matrix offers a streamlined, export-ready design for effortless integration into strategic presentations.

Cash Cows

Idemitsu Kosan's petroleum refining and sales segment, despite the global energy transition, remains a robust cash generator. In fiscal year 2023, this segment contributed significantly to the company's net sales, showcasing its enduring importance even as the market matures.

This division holds a substantial market share within the petroleum industry, a sector characterized by stability rather than rapid expansion. The consistent, strong cash flow generated here is crucial, acting as the financial engine that fuels Idemitsu's investments in new, high-growth ventures and research into sustainable energy solutions.

Idemitsu Kosan's lubricants business is a strong Cash Cow, benefiting from its significant market share, especially in the Asia-Pacific region. This segment is characterized by a mature yet stable market, ensuring consistent revenue streams and healthy profit margins with minimal need for extensive promotional spending.

The Boggabri Mine in Australia represents a significant Cash Cow for Idemitsu Kosan. Despite the company's broader strategy to reduce coal exposure, Boggabri is prioritized for its competitive edge and ability to deliver stable, high-margin output. This positions it firmly in a high market share, low-growth segment, a classic Cash Cow profile.

In the fiscal year ending March 2024, Idemitsu Kosan reported that its Australian coal operations, including Boggabri, contributed significantly to its overall profitability, even as the company navigates a global shift away from fossil fuels. This mine's consistent performance underscores its role in generating substantial, reliable cash flow for the parent company, requiring minimal reinvestment to maintain its productive capacity.

Basic Chemicals (Petrochemicals)

Idemitsu Kosan's basic chemicals segment, particularly petrochemicals, is a cornerstone of its operations, reflecting a mature market where the company maintains a solid presence. Despite facing headwinds such as declining production volumes, this segment continues to be a reliable generator of cash for the company.

In fiscal year 2023, Idemitsu Kosan reported that its Petrochemical segment's sales revenue stood at approximately ¥1,244.5 billion, underscoring its substantial contribution to the company's overall financial performance. This segment's stability, even amidst market fluctuations, highlights its role as a cash cow within the broader business portfolio.

- Mature Market Position: Idemitsu holds an established market position in basic chemicals, providing a stable revenue stream.

- Cash Generation: The segment contributes significantly to overall cash flow, supporting other business areas.

- Sales Revenue: In FY2023, the Petrochemical segment generated ¥1,244.5 billion in sales revenue.

- Market Challenges: The segment navigates challenges including market pressures and a decline in production volumes.

Power Generation (Natural Gas Thermal Power)

Idemitsu Kosan's natural gas thermal power generation business functions as a Cash Cow within its portfolio. These highly efficient plants operate in a mature energy market, providing a stable electricity supply and predictable cash flow.

Leveraging existing infrastructure, this segment offers a lower environmental impact compared to other fossil fuels, contributing to Idemitsu's diversified energy strategy. For the fiscal year ending March 2024, Idemitsu Kosan reported consolidated revenue of approximately ¥4,481 billion, with its energy segment, including power generation, being a significant contributor.

- Stable Cash Flow: Natural gas power generation generates consistent revenue streams due to established demand.

- Mature Market Position: Idemitsu benefits from its presence in a well-developed energy sector.

- Infrastructure Leverage: Existing power plant assets minimize the need for substantial new capital investment.

- Environmental Consideration: Natural gas offers a comparatively cleaner alternative among fossil fuels, aligning with evolving energy policies.

Idemitsu Kosan's petroleum refining and sales, lubricants, Boggabri Mine, basic chemicals, and natural gas thermal power generation all represent significant Cash Cows. These segments operate in mature, stable markets where Idemitsu holds strong positions, generating consistent and reliable cash flow with relatively low investment needs. This financial strength is vital for funding the company's growth initiatives and its transition towards renewable energy sources.

| Segment | Market Characteristic | Idemitsu's Position | Cash Flow Contribution |

| Petroleum Refining & Sales | Mature, Stable | Significant Market Share | Robust Cash Generator |

| Lubricants | Mature, Stable | Strong Market Share (esp. Asia-Pacific) | Consistent Revenue, Healthy Margins |

| Boggabri Mine (Coal) | Mature, Low Growth | Competitive Edge, High Market Share | Stable, High-Margin Output |

| Basic Chemicals (Petrochemicals) | Mature | Solid Presence | Reliable Cash Generator (FY2023 Sales: ¥1,244.5 billion) |

| Natural Gas Thermal Power | Mature Energy Market | Highly Efficient Plants | Predictable Cash Flow (Energy Segment Revenue Contributor) |

Preview = Final Product

Idemitsu Kosan BCG Matrix

The Idemitsu Kosan BCG Matrix preview you are viewing is precisely the final, complete document you will receive upon purchase. This means the analysis, formatting, and strategic insights are identical to the version you will download, ensuring no surprises and immediate usability for your business planning.

Dogs

Idemitsu Kosan has strategically decided to decommission or reduce its refining capacity, a move that places these operations squarely in the Dogs category of the BCG Matrix. A prime example is the cessation of operations at their Yamaguchi refinery by March 2024, marking a significant shift in their asset utilization strategy.

These formerly vital refining assets now face a market characterized by low growth and declining demand. Idemitsu's focus has pivoted towards repurposing these facilities rather than sustaining their traditional refining functions, signaling a potential path towards divestiture or transformation into new ventures.

Idemitsu Kosan's older, less efficient coal mines are categorized as Dogs in the BCG Matrix. The company has signaled a strategic shift, stating its intention to not develop new coal mines or increase production through significant investments after fiscal year 2023. This aligns with the termination of operations at certain mines, such as the Muswellbrook mine.

These assets are characterized by low growth potential and a declining market share or profitability. Idemitsu's actions demonstrate a clear move to divest or phase out these less competitive operations, focusing resources on more promising business segments.

Traditional petroleum product sales within Idemitsu Kosan's domestic Japanese market are facing a challenging future. Projections indicate a substantial drop in oil demand in Japan by 2030 and continuing thereafter, signaling a shrinking customer base for these core products.

While the petroleum division as a whole remains a significant cash generator, certain specific product lines or sales within particular regions of Japan are experiencing particularly steep declines. These segments, characterized by limited growth potential, fit the profile of a 'dog' within the BCG matrix, requiring careful management and strategic consideration.

Underperforming International Oil and Gas Exploration Projects

Underperforming international oil and gas exploration projects within Idemitsu Kosan's portfolio would be classified as Dogs in the BCG Matrix. These are ventures that likely have a low market share in their respective regions and are operating in a mature or declining market, or facing significant operational hurdles. For instance, a project in a politically volatile area with high extraction costs and diminishing reserves would fit this description, draining capital without promising future returns.

These "Dog" projects are characterized by their inability to generate substantial profits or growth. Idemitsu Kosan, like many energy companies, faces the challenge of managing such assets. In 2024, the global oil and gas exploration sector saw continued pressure on profitability due to price volatility and increasing regulatory scrutiny, making it harder for marginal projects to survive.

Specific characteristics of these underperforming Idemitsu projects could include:

- Low Production Volumes: Projects failing to meet projected output targets, leading to high per-barrel costs.

- High Operational Expenses: Increased costs associated with extraction, transportation, or maintenance in challenging environments.

- Geopolitical Risks: Operations in regions with political instability or unfavorable regulatory changes impacting profitability and future investment.

- Declining Market Demand: Projects focused on fossil fuels in markets increasingly shifting towards renewable energy sources.

Legacy Infrastructure with High Maintenance Costs

Idemitsu Kosan's legacy infrastructure, particularly older refining facilities and distribution networks not aligned with new energy ventures, falls into the "Dog" category of the BCG Matrix. These assets demand substantial capital for ongoing maintenance and upgrades, yet offer limited potential for future growth or market share expansion. For instance, in 2024, Idemitsu Kosan continued to face challenges in optimizing its traditional petrochemical operations, which, while still generating some revenue, are increasingly burdened by high operational expenditures and environmental compliance costs.

These underperforming assets represent a drain on financial resources that could otherwise be allocated to more promising areas like renewable energy or advanced materials. The company's 2024 financial reports likely highlighted the significant investment required to maintain these older plants, diverting funds from strategic growth initiatives. The diminishing returns from these legacy operations underscore the need for careful divestment or repurposing strategies.

- Legacy Infrastructure: Older refining and petrochemical plants not integrated into new energy strategies.

- High Maintenance Costs: Significant ongoing investment required to keep these facilities operational and compliant.

- Diminishing Returns: Assets provide limited contribution to future growth or market share expansion.

- Capital Tie-up: Funds are locked in these underperforming areas, hindering investment in more dynamic business segments.

Idemitsu Kosan's older, less efficient coal mines, such as the Muswellbrook mine which ceased operations, are categorized as Dogs. The company's decision to not develop new coal mines after fiscal year 2023 signifies a strategic withdrawal from these low-growth, declining market segments.

These assets are characterized by low growth potential and a shrinking market share. Idemitsu's actions demonstrate a clear move to divest or phase out these less competitive operations, focusing resources on more promising business segments.

Traditional petroleum product sales in Japan, facing a projected demand drop by 2030, represent "dog" segments within the petroleum division. While the division is a cash generator, specific product lines or regional sales are experiencing steep declines, requiring careful management.

Underperforming international oil and gas exploration projects, particularly those with high extraction costs and diminishing reserves in volatile areas, are classified as Dogs. The global oil and gas exploration sector in 2024 continued to face profitability pressures, making marginal projects harder to sustain.

| Asset Category | Idemitsu Kosan Example | BCG Matrix Classification | Key Characteristics | 2024 Context/Action |

|---|---|---|---|---|

| Decommissioned Refineries | Yamaguchi Refinery (ceased March 2024) | Dog | Low growth, declining demand, repurposing focus | Strategic shift away from traditional refining capacity |

| Coal Mines | Muswellbrook Mine (terminated operations) | Dog | Low growth, declining market, no new development post-FY2023 | Phasing out less competitive operations |

| Domestic Petroleum Sales | Specific product lines/regions in Japan | Dog | Shrinking customer base, declining demand | Facing significant demand drop projections |

| Underperforming E&P Projects | Projects in volatile regions with high costs | Dog | Low market share, high operational expenses, geopolitical risks | Continued pressure on profitability in the sector |

Question Marks

Idemitsu Kosan's agrivoltaics projects, integrating solar energy with farming, represent a strategic move into a nascent but promising sector. The company's planned 2 MW project in Japan exemplifies this commitment, aiming to harness dual benefits from land use.

Within the BCG framework, agrivoltaics would likely be classified as a Question Mark. While the concept offers significant growth potential by optimizing land and resource utilization, it currently faces challenges such as relatively low market share and the need for substantial upfront investment to demonstrate scalability and widespread market acceptance.

Idemitsu's 'Idemitsu Carbon Offset Fuel B5 Diesel' represents a new entrant in the burgeoning decarbonized solutions market. This product, which integrates low-carbon energy with carbon credits, is positioned to tap into increasing demand for environmentally friendly fuels.

While the market for such solutions is expanding, Idemitsu's B5 Diesel currently holds a minimal market share. Its future success hinges on demonstrating widespread adoption and achieving robust profitability, crucial factors for its placement within the BCG matrix.

Idemitsu Kosan's integrated CO2 supply chain for CCUS hubs, particularly its joint studies in the Tomakomai area targeting a 2030 large-scale solution, positions it within the "Question Mark" category of the BCG Matrix. This strategic initiative targets a high-growth potential market for carbon capture and storage.

While the long-term demand for CCUS is projected to expand significantly, driven by net-zero commitments, Idemitsu currently holds a low market share in this nascent sector. The substantial upfront investment required for infrastructure development, coupled with the complexities of regulatory approvals and establishing a robust CO2 transportation and storage network, represent significant hurdles.

The success of this venture hinges on Idemitsu's ability to secure partnerships, navigate evolving policy landscapes, and demonstrate the economic viability of large-scale CO2 capture and utilization or storage. For instance, global CCUS investment is expected to reach hundreds of billions of dollars by 2030, highlighting the market's potential but also the capital intensity involved.

Next-Generation Biofuels beyond SAF

While Sustainable Aviation Fuel (SAF) is Idemitsu Kosan's current star performer, the company's strategic vision extends to other next-generation biofuels. These emerging technologies, utilizing diverse feedstocks such as grasses and agricultural waste, tap into a high-growth market that is still in its nascent stages of development.

These ventures, though promising for future market share, are currently characterized by low market penetration. They demand substantial investment in research and development, alongside significant capital outlay to scale production and establish robust supply chains.

- Market Potential: The global advanced biofuels market, excluding SAF, is projected to reach USD 150 billion by 2030, driven by sustainability mandates and technological advancements.

- Idemitsu's Focus: Idemitsu is exploring advanced biofuels from non-food biomass, aiming to diversify its renewable energy portfolio beyond traditional sources.

- Investment Needs: Developing these next-generation biofuels requires significant R&D funding, with pilot projects often costing tens to hundreds of millions of dollars.

- Technological Hurdles: Challenges remain in efficient conversion processes and cost-competitiveness compared to fossil fuels, necessitating ongoing innovation.

Advanced Materials for Electronics (beyond batteries)

Idemitsu Kosan's exploration into advanced materials for electronics, beyond their significant battery material ventures, positions them in the question mark quadrant of the BCG matrix. This segment represents nascent technologies with high growth potential but currently low market penetration. The company is actively researching and developing materials crucial for next-generation electronic devices.

These materials are targeted at rapidly expanding tech markets, including advanced displays, high-speed semiconductors, and flexible electronics. For instance, Idemitsu is involved in developing organic light-emitting diode (OLED) materials, a sector that saw global market revenue reach approximately $20 billion in 2023 and is projected to continue strong growth.

- OLED Materials: Idemitsu is a key player in developing and supplying high-performance materials for OLED displays, used in smartphones, televisions, and wearables. The OLED market is expected to grow at a CAGR of over 15% in the coming years.

- Semiconductor Materials: The company is also investing in advanced materials for semiconductor manufacturing, such as photoresists and high-purity chemicals, essential for producing smaller, faster, and more efficient microchips. The semiconductor materials market is projected to reach over $100 billion by 2027.

- Flexible and Wearable Electronics: Idemitsu is exploring materials that enable the creation of bendable, stretchable, and transparent electronic components, tapping into the burgeoning market for wearable technology and innovative device form factors.

Idemitsu Kosan's ventures into agrivoltaics, advanced biofuels beyond SAF, integrated CO2 supply chains for CCUS, and new electronic materials all fit the Question Mark profile in the BCG matrix. These initiatives represent significant future growth potential but currently have low market share and require substantial investment to prove their viability and scalability. Success hinges on navigating technological hurdles, securing funding, and adapting to evolving market and regulatory landscapes.

| Business Area | BCG Quadrant | Market Potential | Idemitsu's Market Share | Key Challenges |

|---|---|---|---|---|

| Agrivoltaics | Question Mark | Growing demand for dual land use | Nascent | Upfront investment, demonstrating scalability |

| Advanced Biofuels (ex-SAF) | Question Mark | USD 150 billion by 2030 (global advanced biofuels) | Low | R&D, scaling production, cost-competitiveness |

| Integrated CO2 Supply Chain (CCUS) | Question Mark | High growth driven by net-zero commitments | Low | Infrastructure investment, regulatory approvals, economic viability |

| New Electronic Materials | Question Mark | USD 20 billion (OLED market 2023), >15% CAGR | Low | Technological development, market penetration |

BCG Matrix Data Sources

Our Idemitsu Kosan BCG Matrix is built on a foundation of verified market intelligence, integrating financial disclosures, industry growth forecasts, and competitor performance data to deliver actionable strategic insights.