Intermediate Capital Group Plc (ICP:LSE) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intermediate Capital Group Plc (ICP:LSE) Bundle

Political stability and evolving regulations significantly impact Intermediate Capital Group Plc's (ICP:LSE) operational landscape, while economic shifts influence investment strategies and client confidence. Understanding these external forces is crucial for navigating the financial sector.

Gain a competitive edge by delving into the technological advancements and societal trends shaping Intermediate Capital Group Plc (ICP:LSE). Our PESTEL analysis provides the critical intelligence you need to anticipate market shifts and refine your strategy. Download the full version now for actionable insights.

Political factors

Escalating geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to pose significant risks to global economic stability and cross-border investment. These events can disrupt supply chains and create market volatility, directly impacting the performance of ICG's portfolio companies and their ability to operate efficiently.

The rise of trade protectionism, evidenced by the imposition of tariffs and non-tariff barriers by major economies, further complicates international business. For instance, the US imposed tariffs on a range of goods from China in 2023, impacting global trade flows and potentially increasing costs for businesses with international operations, including those within ICG's investment portfolio.

These shifts in trade policies and the potential for further conflicts create an unpredictable investment landscape, particularly for emerging markets where ICG often seeks growth opportunities. Market volatility stemming from these geopolitical factors can lead to reduced investment appetite and can affect the valuation of assets.

Regulatory changes significantly impact Intermediate Capital Group's (ICG) operations. For instance, in 2024, the European Union continued to refine its regulatory framework for alternative investment funds, potentially increasing compliance costs and affecting how ICG structures its deals. Stricter capital requirements or enhanced disclosure mandates could alter the economics of private equity and credit investments.

Political stability in the United Kingdom, a key market for Intermediate Capital Group (ICG), remained a focus through 2024. The general election scheduled for 2024, while creating some short-term policy uncertainty, is not expected to fundamentally alter the regulatory landscape for private capital. ICG's diversified geographic presence, including significant operations in North America and Europe, helps mitigate risks associated with localized political shifts.

Government Support for Private Markets

Government policies play a crucial role in shaping the private markets landscape, directly influencing firms like Intermediate Capital Group (ICG). Initiatives designed to encourage investment in alternative assets, such as tax breaks or regulatory streamlining, can significantly boost fundraising and deployment opportunities. Conversely, restrictions on certain investment types or increased compliance burdens can present headwinds.

In 2024 and looking ahead to 2025, governments globally are increasingly recognizing the importance of private capital for economic growth and innovation. This is leading to a greater focus on policies that foster a more robust private markets ecosystem. For instance, many jurisdictions are exploring ways to enhance the accessibility of private markets for retail investors, potentially broadening the investor base for firms like ICG.

- Tax Incentives: Governments may offer tax credits or preferential tax treatment for investments into private equity, venture capital, or private debt funds, making these asset classes more attractive.

- Regulatory Frameworks: Changes in regulations, such as those impacting pension fund allocations to alternatives or rules governing fundraising, can either facilitate or impede growth in private markets.

- Investor Accessibility: Policies aimed at democratizing access to private markets, potentially through regulated crowdfunding platforms or simplified investment vehicles, could expand ICG's potential client pool.

- Government-backed Funds: Some governments establish or co-invest in funds focused on specific sectors or strategic objectives, which can create direct opportunities for private market managers.

International Investment Treaties and Alliances

The evolving landscape of international investment treaties and alliances directly impacts Intermediate Capital Group Plc's (ICG) global strategy. For instance, the establishment or termination of such agreements can unlock or restrict ICG's ability to engage in cross-border transactions and expand its operations into new markets. This dynamic creates both opportunities and potential hurdles for the firm's investment activities.

Recent trends in politicized capital flows and the rise of 'friendshoring' initiatives are also shaping investment decisions. These geopolitical considerations can guide where ICG chooses to deploy its capital, potentially favoring regions aligned with its home country or key trading partners. For example, in 2024, global foreign direct investment (FDI) flows were projected to remain robust but with increasing selectivity influenced by geopolitical alignments.

- Treaty Impact: Changes in bilateral investment treaties (BITs) or multilateral trade agreements could alter ICG's access to certain markets or the legal protections afforded to its investments.

- Alliance Opportunities: New alliances might create platforms for co-investment or facilitate easier market entry for ICG's funds.

- Friendshoring Influence: The push for friendshoring could lead ICG to prioritize investments in countries with strong political and economic ties, potentially impacting its diversification strategies.

- Capital Flow Dynamics: Politicized capital flows can introduce volatility and require ICG to navigate complex regulatory environments shaped by international relations.

Government policies continue to shape the private markets, with initiatives to encourage alternative asset investment, like tax breaks, boosting fundraising for firms such as ICG. Conversely, increased compliance burdens present headwinds, though many jurisdictions are exploring ways to enhance private market accessibility for retail investors, potentially broadening ICG's client base by 2025.

What is included in the product

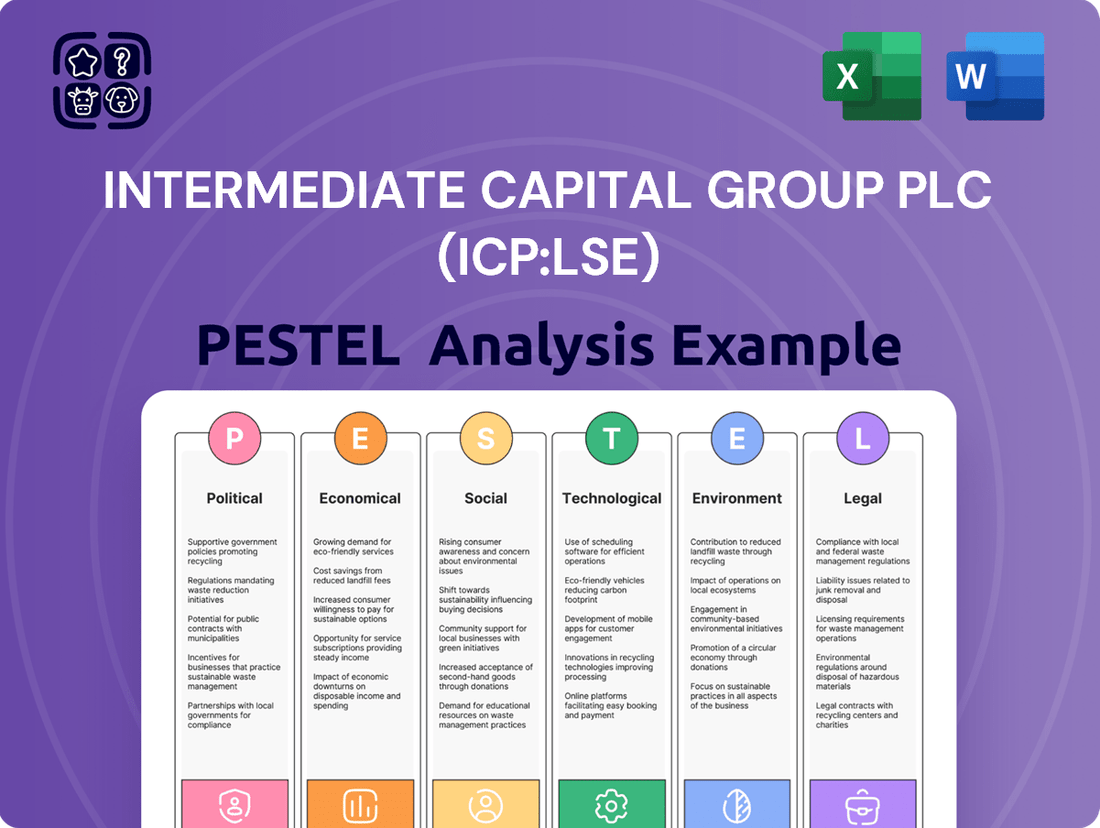

This PESTLE analysis examines the external macro-environmental factors impacting Intermediate Capital Group Plc (ICP:LSE), covering Political stability, Economic trends, Social shifts, Technological advancements, Environmental concerns, and Legal frameworks.

It provides a comprehensive overview of how these forces create both challenges and strategic opportunities for the company's operations and future growth.

This PESTLE analysis for Intermediate Capital Group Plc (ICP:LSE) acts as a pain point reliever by offering a clear, summarized overview of external factors, enabling swift identification of potential opportunities and threats that could impact strategic decision-making.

Economic factors

The interest rate environment is a critical driver for Intermediate Capital Group (ICG). As of mid-2024, central banks like the Bank of England and the Federal Reserve have maintained relatively high benchmark rates, impacting the cost of capital for ICG's clients and the yields available in private credit markets. For instance, the Bank of England's base rate remained at 5.25% through early 2024, a significant increase from previous years.

Sustained higher interest rates, while potentially increasing the attractiveness of private credit yields, also raise borrowing costs for the leveraged companies that ICG finances. This can put pressure on portfolio company profitability and debt servicing capabilities. Conversely, any anticipated rate cuts in late 2024 or 2025 could stimulate deal activity and refinancing opportunities, benefiting ICG's direct lending and secondary fund businesses.

The global economic outlook for 2024 and early 2025 presents a mixed picture for Intermediate Capital Group (ICG). While the IMF projected global GDP growth of 3.2% for 2024, a slight slowdown from 2023, recession risks remain a key consideration, particularly in developed economies. This environment directly impacts ICG's ability to generate returns across its private equity, debt, and real asset portfolios.

For instance, robust economic expansion typically fuels stronger performance in ICG's portfolio companies, leading to better earnings and higher valuations, which in turn facilitates successful exits. Conversely, an economic downturn, characterized by contracting GDP and rising unemployment, could increase the likelihood of defaults within ICG's credit strategies and depress asset values across all its investment classes.

As of mid-2024, while some regions show resilience, others face headwinds. The persistence of inflation and the resulting interest rate policies by central banks continue to shape the economic landscape, influencing borrowing costs and investment opportunities for ICG. Navigating these varied economic conditions is crucial for ICG's strategic decision-making and capital deployment.

Activity in public capital markets, crucial for Intermediate Capital Group Plc (ICG), directly influences its investment realization. A robust IPO and M&A environment in 2024 and early 2025 provides ICG with more lucrative exit opportunities for its private equity portfolio companies, potentially boosting investor returns.

Conversely, a subdued public market, characterized by fewer listings and reduced M&A deal flow, can force ICG to extend its holding periods for investments. This can delay distributions to clients and potentially impact the overall performance of its funds, as seen in periods of market uncertainty.

For instance, while global IPO volumes experienced a notable rebound in late 2023 and into 2024, reaching over $200 billion by mid-2024 according to various financial reports, the actual liquidity for private equity exits remains contingent on sustained investor appetite and favorable valuations. ICG's strategy is therefore closely tied to the ongoing health and accessibility of these public markets.

Inflationary Pressures and Cost of Capital

Inflationary pressures directly affect the operational costs for Intermediate Capital Group's (ICG) portfolio companies, potentially squeezing margins and impacting profitability. For instance, rising energy and raw material prices in 2024 and early 2025 have presented challenges across various sectors.

The real returns on ICG's investments can also be eroded by inflation. If investment yields do not keep pace with the rate of price increases, the purchasing power of those returns diminishes, making capital preservation and growth more difficult.

Managing inflation's impact on asset valuations is therefore paramount for ICG. Strategies that can hedge against or even capitalize on inflationary periods, such as investing in assets with inflation-linked revenues or those that can pass on increased costs, are crucial for maintaining investment performance.

- Inflation Impact: Persistent inflation in 2024 has seen key economic indicators like the Consumer Price Index (CPI) remain elevated in many developed markets, impacting consumer spending and business input costs.

- Cost of Capital: Central banks' responses to inflation, including interest rate hikes throughout 2023 and into 2024, have increased the cost of capital, making borrowing more expensive for ICG and its portfolio companies.

- Valuation Challenges: Higher discount rates stemming from increased interest rates and inflation expectations can lead to lower valuations for future cash flows, requiring careful recalibration of investment models.

- Strategic Adaptation: ICG's focus on private debt and alternative assets positions it to potentially benefit from higher yields, but successful navigation requires robust due diligence on companies' pricing power and operational resilience in inflationary environments.

Investor Appetite and Capital Allocation

Investor appetite for alternative assets remains robust, directly fueling Intermediate Capital Group's (ICG) fundraising efforts. Institutional investors, from pension funds to sovereign wealth funds, are increasingly seeking private debt and equity opportunities to enhance diversification and potentially achieve higher returns compared to traditional markets. This trend is particularly evident as we move through 2024 and into 2025, with many investors looking to allocate a larger portion of their portfolios to private markets.

Key factors influencing these allocation decisions include a heightened focus on liquidity, perceived performance advantages, and the strategic goal of diversification. For example, many large pension schemes are targeting allocations to private markets in the range of 10-20% by 2025, a significant increase from previous years. This demand translates into substantial capital for firms like ICG, enabling them to deploy capital across various strategies.

- Growing Demand for Alternatives: Institutional investors are actively increasing their exposure to private markets, with allocations to private equity and debt expected to continue their upward trajectory through 2025.

- Liquidity and Performance Drivers: Investor decisions are heavily influenced by the search for yield and diversification, often outweighing concerns about the illiquidity inherent in private assets.

- Fundraising Success for ICG: ICG's ability to attract capital is directly linked to its established track record and the broader market trend of institutional capital flowing into alternative asset classes.

- Strategic Allocation Shifts: Many large institutional investors have publicly stated goals to increase their private market allocations, with some aiming for double-digit percentages of their total assets under management by 2025.

The economic landscape for 2024 and early 2025 presents a complex environment for Intermediate Capital Group (ICG). Persistent inflation, while showing signs of moderation in some regions, continues to influence central bank policy, keeping interest rates elevated. For example, the Bank of England's base rate remained at 5.25% through early 2024, impacting borrowing costs.

These higher rates directly affect ICG's clients by increasing the cost of capital, potentially pressuring portfolio company profitability. Conversely, sustained higher yields in private credit markets can be attractive. The global economic outlook, with projected GDP growth of 3.2% for 2024 according to the IMF, suggests a generally stable but cautious growth environment, with recession risks a key consideration.

Activity in public capital markets, crucial for ICG's investment realizations, saw a rebound in IPO volumes exceeding $200 billion by mid-2024. However, the actual liquidity for private equity exits remains contingent on sustained investor appetite and favorable valuations, making ICG's strategy closely tied to market health.

| Economic Factor | 2024/2025 Outlook | Impact on ICG |

|---|---|---|

| Interest Rates | Elevated, with potential for cuts later in 2024/2025. Bank of England base rate at 5.25% (early 2024). | Increases cost of capital for clients; can boost private credit yields. |

| Global GDP Growth | Projected 3.2% for 2024 (IMF), with varied regional performance. | Influences portfolio company performance and asset valuations. |

| Inflation | Persistent, impacting input costs and real returns. | Erodes purchasing power of returns; requires focus on pricing power of portfolio companies. |

| Public Capital Markets Activity | Rebounding IPO volumes (>$200bn by mid-2024), but exit liquidity depends on sustained appetite. | Provides exit opportunities but requires careful monitoring of market sentiment and valuations. |

Same Document Delivered

Intermediate Capital Group Plc (ICP:LSE) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Intermediate Capital Group Plc (ICP:LSE) details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a comprehensive understanding of the external forces shaping ICP's strategic landscape.

Sociological factors

Intermediate Capital Group (ICG) faces a dynamic talent landscape where attracting and keeping top-tier investment professionals is paramount to maintaining its competitive advantage. The firm's success hinges on its ability to secure individuals with specialized financial acumen and robust analytical skills.

Workforce preferences are shifting, with a growing emphasis on flexible work models and a commitment to diversity, equity, and inclusion. ICG must adapt to these evolving demands to foster an environment that resonates with today's talent pool, ultimately impacting its ability to retain valuable employees.

A strong corporate culture is also a key differentiator. In 2024, reports indicate that companies with highly engaged employees, often a byproduct of a positive culture, experience 21% greater profitability. This underscores the importance of ICG cultivating an appealing and supportive work environment to secure its human capital.

Societal expectations are rapidly shifting, with a significant portion of investors now prioritizing Environmental, Social, and Governance (ESG) factors. For instance, a 2024 survey indicated that over 70% of institutional investors consider ESG performance when making allocation decisions, directly impacting capital availability.

Intermediate Capital Group Plc (ICG) must therefore demonstrate a robust commitment to responsible investing. Its success in integrating ESG principles across its strategies and within its portfolio companies is crucial for attracting this growing pool of capital and safeguarding its reputation in the market.

Long-term demographic trends, like aging populations in developed nations and a growing middle class in emerging markets, significantly shape demand for private market products. For instance, the global population aged 65 and over is projected to reach 1.5 billion by 2050, increasing the need for robust retirement solutions and income-generating assets, areas where private markets can offer attractive opportunities.

These demographic shifts are also driving a reallocation of capital. Individual investors, increasingly aware of the potential for higher returns and diversification, are allocating more to alternative assets. By the end of 2024, it's estimated that retail investor allocations to private markets could see a notable uptick, driven by a desire to supplement traditional public market investments, especially as interest rate environments evolve.

Public Perception of Private Equity

Public perception of private equity, including firms like Intermediate Capital Group (ICG), significantly influences regulatory approaches and investor trust. Negative portrayals in media or public discourse can lead to increased oversight, impacting operational flexibility and fundraising success. For instance, a 2024 survey indicated that while 45% of respondents viewed private equity positively for its role in business growth, 38% expressed concerns about job security and executive compensation within PE-backed companies.

Maintaining a positive public image is therefore crucial for ICG. This involves showcasing transparency in dealings, adopting robust responsible investment strategies, and actively demonstrating the positive societal contributions generated by its investments. Demonstrating a commitment to ESG (Environmental, Social, and Governance) principles is increasingly important, with a growing number of institutional investors, representing trillions in assets under management by 2025, prioritizing these factors in their allocation decisions.

The industry's ability to articulate its value proposition beyond financial returns, highlighting job creation, operational improvements, and innovation in portfolio companies, is key to shaping a more favorable narrative. Public understanding of the long-term, value-creation approach of private equity, as opposed to short-term profit extraction, can mitigate some of the inherent skepticism.

- Growing Investor Demand for ESG: By 2025, an estimated 70% of institutional investors are expected to have integrated ESG factors into their private equity due diligence.

- Media Scrutiny: High-profile deals and subsequent workforce reductions often attract significant negative media attention, impacting broader industry sentiment.

- Transparency Initiatives: Industry bodies are promoting greater transparency, with over 60% of major private equity firms reporting on ESG metrics by late 2024.

- Societal Impact Metrics: Demonstrating tangible benefits like job creation or carbon footprint reduction in portfolio companies is becoming a critical component of public relations.

Diversity and Inclusion Initiatives

The financial sector is increasingly prioritizing diversity and inclusion, reflecting a significant societal shift. Intermediate Capital Group (ICG) recognizes that robust diversity and inclusion initiatives are crucial for attracting top talent, fostering innovation through varied perspectives, and resonating with a wider range of clients and investors.

ICG's commitment to these principles can translate into tangible business benefits. For instance, by actively promoting gender diversity, ICG can tap into a larger pool of skilled professionals. Data from 2024 indicates that companies with greater gender diversity in leadership roles often exhibit stronger financial performance.

- Talent Acquisition: A diverse and inclusive culture makes ICG more attractive to a broader range of candidates, enhancing its ability to recruit skilled individuals.

- Innovation: Varied backgrounds and viewpoints within the workforce can lead to more creative problem-solving and innovative investment strategies.

- Client Relations: Demonstrating a commitment to diversity can improve ICG's appeal to a global and diverse client base, potentially leading to increased assets under management.

Societal expectations are increasingly focused on responsible business practices, with a significant emphasis on Environmental, Social, and Governance (ESG) factors influencing investment decisions. By 2025, it's projected that over 70% of institutional investors will integrate ESG criteria into their private equity due diligence, directly impacting capital availability for firms like Intermediate Capital Group (ICG).

Public perception of private equity is a critical factor, with a 2024 survey revealing that while 45% of respondents viewed private equity positively for its role in business growth, 38% expressed concerns regarding job security and executive compensation within PE-backed companies. This highlights the need for ICG to actively manage its public image by showcasing transparency and positive societal contributions.

Demographic shifts, such as aging populations in developed markets, are driving demand for private market products, as individuals seek robust retirement solutions. The global population aged 65 and over is expected to reach 1.5 billion by 2050, underscoring the long-term relevance of private markets for income-generating assets.

| Societal Factor | Relevance to ICG | Key Data Point (2024-2025) |

| ESG Integration | Influences capital allocation and investor trust. | 70% of institutional investors to integrate ESG by 2025. |

| Public Perception | Impacts regulatory scrutiny and fundraising. | 38% of public concerned about PE job security/compensation (2024). |

| Demographics | Shapes demand for alternative assets. | Global 65+ population to reach 1.5 billion by 2050. |

Technological factors

Intermediate Capital Group (ICG) is actively leveraging technology to boost its operational efficiency. By automating back-office functions and streamlining investment processes, ICG aims to manage its expanding assets under management (AUM) more effectively and stay competitive. This digital push is crucial for handling increased transaction volumes and ensuring robust data management.

The adoption of digital tools for reporting and compliance is a key component of ICG's technological strategy. For instance, in 2023, ICG reported a significant increase in its AUM, reaching €77.1 billion, which necessitates advanced digital solutions to maintain accuracy and meet regulatory requirements efficiently. This focus on technology directly supports their ability to scale operations smoothly.

Intermediate Capital Group (ICG) is increasingly leveraging advanced data analytics and AI to sharpen its investment edge. These technologies are instrumental in refining deal sourcing, improving risk assessment, and optimizing portfolio management, aiming for superior returns.

In 2024, the financial services sector saw significant growth in AI adoption, with reports indicating that firms utilizing AI in their investment processes experienced an average 8% increase in alpha generation compared to non-AI users. ICG's strategic focus on these tools positions it to capitalize on these trends.

AI's capacity for predictive modeling and sentiment analysis aids ICG in identifying emerging market opportunities and potential risks more effectively. This enhanced analytical capability is crucial for navigating the complexities of global private debt and equity markets.

Cybersecurity is a critical technological factor for Intermediate Capital Group (ICG). As a financial institution, ICG handles vast amounts of sensitive client and investment data, making robust protection against cyber threats absolutely essential. Maintaining client trust and adhering to increasingly stringent data privacy regulations, such as GDPR and similar frameworks globally, are paramount to ICG's operational integrity and reputation.

The financial services sector experienced a significant rise in cyberattacks. For instance, reports from 2023 indicated a substantial increase in ransomware attacks targeting financial firms, with average recovery costs escalating. ICG's investment in advanced cybersecurity infrastructure and continuous monitoring is therefore not just a compliance necessity but a core business requirement to safeguard its operations and the data entrusted to it.

Fintech Innovation and New Investment Platforms

Fintech innovation is reshaping the investment landscape, presenting both avenues for growth and potential challenges for Intermediate Capital Group (ICG). New platforms are democratizing access to previously exclusive markets, such as private equity and debt, potentially broadening ICG's investor base and deal flow.

These advancements can also introduce novel financing structures and digital solutions that compete with traditional intermediation models. For instance, the rise of digital lending platforms and crowdfunding for corporate finance could alter the competitive dynamics ICG operates within. The global fintech market size was estimated to be around $111.8 billion in 2023 and is projected to grow significantly, indicating a substantial shift in financial services delivery.

- Democratization of Private Markets: Fintech platforms are increasingly enabling retail and smaller institutional investors to access private equity and debt, areas where ICG is a major player.

- Innovative Financing Solutions: Digital platforms offer alternative and often faster financing options for businesses, potentially impacting traditional credit intermediation.

- Increased Competition: The proliferation of fintech startups specializing in alternative investments and lending poses a competitive threat by offering potentially lower fees or more streamlined processes.

- Data Analytics and AI: Fintech advancements in data analytics and artificial intelligence can enhance investment sourcing, due diligence, and portfolio management, areas ICG can leverage or be challenged by.

Cloud Computing and Infrastructure

Cloud computing is a significant technological enabler for Intermediate Capital Group (ICG). It provides a scalable and flexible IT infrastructure, crucial for supporting ICG's extensive global operations and managing vast amounts of data. This allows for agile responses to market changes and efficient resource allocation.

The reliability and security of cloud infrastructure are paramount. It underpins ICG's ability to conduct advanced analytics, which are essential for identifying investment opportunities and managing risk. Furthermore, a robust cloud environment facilitates a distributed workforce, enhancing collaboration and productivity across different geographies.

- Scalability: Cloud platforms allow ICG to easily scale its IT resources up or down based on demand, optimizing costs and performance.

- Data Management: Secure cloud storage and processing capabilities are vital for handling sensitive financial data and regulatory compliance.

- Global Operations: Cloud infrastructure supports seamless access and operations for ICG's teams worldwide, fostering efficient international business.

- Analytics: Advanced analytics, powered by cloud computing, enable deeper insights into market trends and investment performance.

Intermediate Capital Group (ICG) is heavily investing in technology to enhance its competitive edge, particularly through advanced data analytics and artificial intelligence. These tools are vital for refining deal sourcing, improving risk assessment, and optimizing portfolio management, aiming for superior returns in a dynamic market. The firm's strategic focus on AI positions it to capitalize on industry trends, with firms using AI in investment processes seeing an average 8% increase in alpha generation in 2024.

Legal factors

Intermediate Capital Group (ICG) navigates a dense regulatory landscape, particularly concerning private debt, credit, and equity. Compliance with rules such as Form PF and Form ADV is paramount. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize enhanced reporting for private fund advisors, impacting how ICG discloses its activities and assets under management.

The evolving landscape of Environmental, Social, and Governance (ESG) regulations presents a significant legal factor for Intermediate Capital Group (ICG). The EU's Sustainable Finance Disclosure Regulation (SFDR), for instance, mandates detailed reporting on sustainability risks and impacts, directly affecting how ICG structures and labels its investment products. As of early 2025, the continued expansion and tightening of these rules, including anticipated climate risk disclosure requirements, mean ICG must adapt its operational frameworks and transparency standards to remain compliant.

Intermediate Capital Group (ICG) must rigorously adhere to anti-money laundering (AML) and international sanctions regulations to prevent illicit financial activities. Failure to comply can result in substantial legal penalties and significant reputational harm. For instance, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the critical need for robust compliance.

Implementing strong compliance frameworks is essential for ICG to effectively monitor transactions and ensure thorough client onboarding processes. This proactive approach helps mitigate risks associated with financial crime and maintains the integrity of ICG's operations within the global financial system.

Data Privacy Regulations (e.g., GDPR)

Intermediate Capital Group (ICG) must adhere to stringent global data privacy regulations like the General Data Protection Regulation (GDPR) and similar frameworks worldwide. This compliance is critical for managing sensitive client and internal operational data securely, ensuring trust and avoiding significant penalties.

Failure to comply can result in substantial fines; for instance, GDPR violations can reach up to 4% of global annual turnover or €20 million, whichever is higher. ICG's commitment to protecting personal information and maintaining secure data processing practices is therefore a fundamental legal requirement for its operations in the 2024-2025 period.

- GDPR Compliance: ICG must ensure all data processing activities involving EU residents meet GDPR standards.

- Data Security Mandates: Legal obligations require robust security measures to prevent data breaches.

- Cross-Border Data Transfers: Navigating international data transfer rules, such as those related to the EU-US Data Privacy Framework, is crucial.

- Regulatory Scrutiny: Increased enforcement actions globally mean proactive compliance is paramount.

Corporate Governance Standards and Shareholder Rights

Evolving corporate governance standards are increasingly influencing how companies like Intermediate Capital Group (ICG) structure deals and manage their investments. This heightened focus on shareholder rights, especially during public and private acquisitions, means ICG must meticulously adhere to best practices. For instance, maintaining board independence and robust conflict of interest management are critical to ensuring investor confidence and regulatory compliance.

Recent regulatory shifts, such as the UK Corporate Governance Code's continued emphasis on board effectiveness and remuneration, directly impact ICG's operational framework. Companies are expected to demonstrate transparency in executive pay and provide clear accountability for decision-making processes. This scrutiny extends to the oversight of ICG's diverse portfolio, where ensuring strong governance at the subsidiary level is paramount.

- Board Independence: A significant portion of listed companies, including those ICG may interact with, are aiming for a majority of independent non-executive directors to enhance oversight.

- Shareholder Engagement: Investor activism is on the rise, with shareholders demanding greater say in corporate strategy and executive compensation, a trend ICG must navigate.

- Conflict of Interest Management: Clear policies and procedures are essential to address potential conflicts, particularly in complex transactions involving related parties.

- ESG Integration: Governance is a key pillar of Environmental, Social, and Governance (ESG) criteria, with investors increasingly linking strong governance to long-term financial performance.

Intermediate Capital Group (ICG) operates within a dynamic legal and regulatory framework, necessitating strict adherence to financial services laws. The firm must navigate evolving requirements for private fund advisors, including enhanced reporting mandates from bodies like the SEC, which intensified in 2024. Compliance with anti-money laundering (AML) and data privacy laws, such as GDPR, is also critical, with significant penalties for breaches, as evidenced by the billions in AML fines levied globally in 2023.

The increasing focus on Environmental, Social, and Governance (ESG) factors translates into legal obligations, particularly with regulations like the EU's SFDR, requiring detailed sustainability disclosures. Corporate governance standards are also tightening, demanding greater board independence and robust conflict of interest management, with investors increasingly scrutinizing executive pay and decision-making transparency, a trend expected to continue through 2025.

| Legal Area | Key Compliance Focus | 2024-2025 Impact |

|---|---|---|

| Financial Regulation | Private fund advisor reporting (e.g., Form PF, Form ADV) | Enhanced SEC scrutiny and disclosure requirements for private markets. |

| AML & Sanctions | Transaction monitoring, client onboarding | Billions in global AML fines in 2023 highlight risk of non-compliance. |

| Data Privacy | GDPR, cross-border data transfers (e.g., EU-US Data Privacy Framework) | Potential fines up to 4% of global turnover for violations; robust security essential. |

| Corporate Governance | Board independence, shareholder engagement, executive remuneration | Increased investor activism and demand for transparency in decision-making. |

Environmental factors

Climate change presents both physical risks, like extreme weather impacting real assets, and transition risks, stemming from shifts to a low-carbon economy, which can affect ICG's portfolio companies. For instance, a company heavily reliant on fossil fuels might face increased operational costs due to carbon pricing or declining market demand as greener alternatives gain traction. Managing these evolving environmental factors is critical for long-term investment performance.

ICG's focus on real assets means that physical climate risks, such as rising sea levels or increased frequency of natural disasters, could directly impact property values and infrastructure investments. Transition risks are also significant; for example, a 2024 report highlighted that companies in sectors like transportation and heavy industry are facing growing pressure to decarbonize, potentially leading to stranded assets if they fail to adapt. Therefore, rigorous assessment and mitigation strategies for these climate-related challenges are paramount for ICG's investment approach.

The increasing emphasis on sustainability is creating substantial opportunities for Intermediate Capital Group (ICG). This includes directing capital towards renewable energy projects and companies focused on developing sustainable infrastructure, aligning with the global shift towards a low-carbon economy.

In 2024, the sustainable investment market continued its robust growth, with global sustainable fund assets projected to reach trillions. For instance, assets under management in ESG-focused funds saw a significant uptick, demonstrating investor appetite for environmentally conscious strategies.

ICG's ability to identify and capitalize on these green investment trends, such as those in renewable energy technology and sustainable supply chains, will be crucial for its future performance and market positioning.

Resource scarcity, exacerbated by climate change, poses a significant risk to Intermediate Capital Group's (ICG) portfolio companies. For instance, disruptions in the availability of key raw materials can directly impact manufacturing costs and operational efficiency. A 2024 report highlighted that companies heavily reliant on water-intensive processes faced a 15% increase in operational expenses due to localized droughts.

ICG's strategy to mitigate these environmental factors involves prioritizing investments in businesses demonstrating robust supply chain resilience. This includes companies that have diversified their sourcing, adopted circular economy principles, or invested in technologies that reduce their environmental footprint. For example, ICG's recent investment in a sustainable packaging firm in late 2024 was driven by the company's innovative approach to reducing material waste and its strong supplier relationships, which are less susceptible to single-source disruptions.

Pollution and Environmental Regulations

Stricter environmental regulations significantly influence ICG's portfolio companies, particularly concerning pollution, waste management, and emissions. These rules can increase operational expenses and compliance requirements, as seen with the EU's increasing focus on carbon neutrality and circular economy principles, which are impacting various industrial sectors.

Adherence to evolving environmental standards is paramount for ICG's investments to mitigate financial penalties and safeguard their reputation. For instance, in 2024, the UK government continued to implement measures aimed at reducing industrial emissions, potentially affecting manufacturing and infrastructure-related businesses within ICG's holdings.

- Increased operational costs: Compliance with new pollution control technologies or waste disposal methods can add to overheads for portfolio companies.

- Risk of fines and legal action: Non-compliance with environmental laws, such as those related to air or water quality, can lead to substantial penalties.

- Reputational damage: Environmental incidents or poor performance can negatively impact brand image and investor confidence.

- Opportunities for sustainable businesses: Companies focused on eco-friendly solutions or green technologies may benefit from regulatory shifts.

Biodiversity Loss and Ecosystem Services

Growing investor focus on biodiversity loss and the economic value of ecosystem services presents a subtle but significant environmental factor. For a company like Intermediate Capital Group Plc, this translates to potential impacts on sectors heavily reliant on natural resources, influencing land use decisions and the long-term viability of certain portfolios. For instance, the UN Convention on Biological Diversity’s (CBD) COP15 in late 2022 set ambitious goals, with many nations committing to protecting 30% of land and sea by 2030, which could reshape investment landscapes in agriculture, forestry, and real estate.

These shifts can affect the operational costs and supply chain resilience of companies ICG might invest in. Consider the financial implications: a 2021 report by the World Economic Forum estimated that over half of the world's GDP, or $44 trillion, is moderately or highly dependent on nature and its services. This highlights the systemic risk that ecosystem degradation poses to investment returns across various industries.

Key considerations for ICG include:

- Impact on land-intensive investments: Changes in land use regulations driven by biodiversity protection goals could alter the value and usability of real estate or agricultural assets.

- Supply chain vulnerability: Industries dependent on natural resources, such as timber or fisheries, may face increased scrutiny and potential disruptions due to biodiversity concerns.

- Reputational and regulatory risk: Companies with poor environmental track records regarding biodiversity may face reputational damage and stricter regulatory oversight, affecting their attractiveness as investments.

- Emerging opportunities: Conversely, investments in sustainable land management, conservation projects, and nature-based solutions could offer new avenues for growth and impact.

Climate change poses significant physical and transition risks to ICG's portfolio, impacting real assets and necessitating adaptation for companies in carbon-intensive sectors. Resource scarcity, driven by climate events, directly affects operational costs and supply chain resilience, prompting ICG to favor businesses with diversified sourcing and circular economy practices. Stricter environmental regulations, particularly around emissions and waste, increase compliance costs and potential penalties, while also creating opportunities for sustainable businesses.

The growing awareness of biodiversity loss and ecosystem services presents risks to natural resource-dependent industries and can influence land-use decisions. For instance, the UN's goal to protect 30% of land and sea by 2030, a commitment many nations are working towards, could reshape agricultural and real estate investments. The World Economic Forum estimated in 2021 that over half of global GDP, approximately $44 trillion, relies on nature, underscoring the systemic risk of ecosystem degradation to investment returns.

ICG's investment strategy is increasingly influenced by these environmental factors, with a focus on identifying opportunities in renewable energy and sustainable infrastructure. The sustainable investment market saw robust growth in 2024, with assets in ESG-focused funds experiencing a significant uptick, reflecting investor demand for environmentally conscious strategies.

| Environmental Factor | Impact on ICG | Example/Data Point (2024/2025) |

|---|---|---|

| Climate Change (Physical & Transition Risks) | Affects real assets, increases operational costs for carbon-intensive firms. | Companies in transportation and heavy industry face pressure to decarbonize; potential for stranded assets if adaptation fails. |

| Resource Scarcity | Disrupts supply chains, increases manufacturing costs. | Water-intensive companies faced a 15% increase in operational expenses due to localized droughts in 2024. |

| Environmental Regulations | Increases compliance costs, potential for fines and reputational damage. | UK measures to reduce industrial emissions in 2024 could affect manufacturing and infrastructure holdings. |

| Biodiversity Loss | Impacts land-intensive investments, supply chain vulnerability. | Over half of global GDP ($44 trillion) depends on nature, highlighting systemic risk from ecosystem degradation. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Intermediate Capital Group Plc (ICP:LSE) is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.