Intermediate Capital Group Plc (ICP:LSE) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intermediate Capital Group Plc (ICP:LSE) Bundle

Unlock the full strategic blueprint behind Intermediate Capital Group Plc (ICP:LSE)'s business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse investment strategies and captures market share in the private debt and equity landscape. Ideal for investors and strategists seeking actionable insights into their success.

Partnerships

Intermediate Capital Group (ICG) relies heavily on a global network of fund investors and capital providers, primarily institutional players like pension funds and insurance companies. These entities are the bedrock of ICG's operations, committing substantial capital across its diverse investment strategies.

These institutional investors are vital as they provide the necessary funds for ICG to execute its private markets investment strategies. Their commitment allows ICG to deploy capital effectively, generating returns for both the investors and the firm itself.

ICG's strong relationships with these capital providers are evident in its fundraising success. For instance, the firm raised an impressive $24 billion in the fiscal year 2025, underscoring the trust and confidence these investors place in ICG's management capabilities.

Intermediate Capital Group (ICG) cultivates robust relationships with the management teams of its portfolio companies. These partnerships extend beyond mere financial investment, offering crucial strategic guidance and operational expertise to foster growth and long-term value creation.

ICG actively collaborates with these management teams to implement strategic initiatives and drive operational enhancements. This hands-on approach is central to ICG's strategy for maximizing the potential of its investments, as evidenced by their consistent track record of successful value realization.

Intermediate Capital Group (ICG) frequently partners with co-investors and financial institutions to strengthen its investment capacity and manage risk across diverse opportunities. This collaborative approach is crucial for undertaking larger-scale transactions that might otherwise be beyond a single entity's scope.

For example, ICG actively engages with leading private equity managers, not only through fund commitments but also by participating in direct co-investments. This strategy allows ICG to leverage the expertise of its partners while expanding its own investment reach and enhancing its overall deal execution capabilities.

Wealth Management Intermediaries

Intermediate Capital Group (ICG) actively collaborates with wealth management intermediaries to tap into the expanding wealth market. These partnerships are crucial for ICG to broaden its client reach, especially among high-net-worth individuals.

By leveraging these intermediaries, ICG can offer specialized private equity products, such as its new Core Private Equity evergreen strategy, to a wider audience. This distribution channel enables ICG to access new investors efficiently, bypassing the need for extensive direct retail operations.

- Expanded Client Base: Intermediaries provide access to a significant pool of high-net-worth investors.

- Product Distribution: Facilitates the offering of differentiated products like evergreen private equity strategies.

- Cost-Effective Reach: Reduces the need for direct, resource-intensive retail client acquisition.

- Market Penetration: Crucial for ICG's strategy to penetrate the growing wealth management sector.

Service Providers and Advisors

Intermediate Capital Group (ICG) leverages a robust network of external service providers to navigate the complexities of private markets. These include legal counsel for transaction structuring and due diligence, financial advisors for valuation and deal execution, and operational consultants to assess portfolio company performance. For instance, in 2024, ICG continued to engage top-tier law firms and accounting specialists, essential for ensuring regulatory adherence and mitigating risks across its diverse fund structures.

These partnerships are fundamental to ICG's ability to execute transactions efficiently and effectively. Specialized expertise from these third parties underpins critical functions such as compliance, risk management, and the intricate analysis required for private debt and equity investments. The firm's commitment to rigorous supplier engagement ensures these vital support functions are consistently met.

- Legal Advisors: Facilitate transaction documentation, regulatory compliance, and dispute resolution.

- Financial Advisors: Provide valuation services, financial modeling, and capital markets expertise.

- Operational Consultants: Assist in portfolio company performance improvement and strategic planning.

- Risk Management Specialists: Offer insights into market, credit, and operational risks.

ICG's key partnerships extend to co-investors and financial institutions, enabling larger transactions and risk diversification. They also collaborate with wealth management intermediaries to access high-net-worth individuals and distribute specialized products like their Core Private Equity evergreen strategy.

Furthermore, ICG relies on a network of external service providers, including legal counsel, financial advisors, and operational consultants, to manage transaction complexities, ensure regulatory compliance, and assess portfolio company performance. For example, in fiscal year 2025, ICG raised $24 billion, highlighting the strength of these capital provider relationships.

| Partnership Type | Key Role | Example Contribution/Data Point |

| Capital Providers (Institutional Investors) | Fund ICG's investment strategies | Raised $24 billion in fiscal year 2025 |

| Portfolio Company Management Teams | Provide strategic guidance and operational expertise | Drive value creation through hands-on collaboration |

| Co-investors & Financial Institutions | Enhance investment capacity and manage risk | Enable participation in larger-scale transactions |

| Wealth Management Intermediaries | Expand client reach to high-net-worth individuals | Facilitate distribution of products like Core Private Equity |

| External Service Providers (Legal, Financial, Operational) | Support transaction execution, compliance, and performance assessment | Engaged top-tier firms in 2024 for regulatory adherence and risk mitigation |

What is included in the product

Intermediate Capital Group (ICG) leverages its expertise in private debt and private equity to provide flexible capital solutions to mid-market companies, generating fees and investment returns through its diverse fund strategies.

This model focuses on institutional investors and high-net-worth individuals as key customer segments, accessed through direct relationships and intermediaries, delivering value via tailored investment products and strong performance.

Intermediate Capital Group Plc's Business Model Canvas acts as a pain point reliever by streamlining complex investment processes, offering accessible capital solutions to underserved mid-market companies.

It simplifies the often-arduous journey for businesses seeking growth capital, providing a clear and efficient pathway to funding.

Activities

Fundraising and capital raising are core to Intermediate Capital Group's operations, involving the consistent gathering of funds from a diverse global client base across various investment strategies. This crucial activity fuels the company's investment capabilities and ensures ongoing business development.

ICG demonstrated significant success in this domain, raising an impressive $24 billion in fiscal year 2025. This substantial inflow of capital not only broadened the firm's product offerings but also contributed to a growing and engaged client base, underscoring its fundraising prowess.

ICG's core activity revolves around sourcing and executing investment opportunities across its diverse strategies. This includes actively seeking out compelling deals in private debt, credit, equity, and real assets, leveraging its extensive network and deep market knowledge. The firm's origination platform is crucial in identifying and securing these investments, ensuring capital is deployed effectively on behalf of its clients.

In 2024, ICG continued to demonstrate robust deployment capabilities. For instance, the firm made significant commitments to structured capital solutions and expanded its presence in European direct lending, reflecting a strategic focus on growth areas. These activities underscore ICG's commitment to actively managing and growing its assets under management.

Post-investment, ICG actively manages its portfolio, collaborating with company leadership to foster growth and implement operational enhancements. The firm's strategy centers on guiding these businesses toward development and long-term, sustainable value creation.

This hands-on approach involves providing strategic direction and diligent oversight to optimize investment returns. For instance, in 2023, ICG's portfolio companies collectively generated strong performance, with a significant portion of its funds demonstrating robust growth trajectories.

Divestment and Realisation

Divestment and realization are core to ICG's strategy, focusing on exiting investments to generate returns for clients and shareholders. This process is critical for realizing profits and enhancing the firm's overall performance. Successfully exiting investments directly impacts ICG's ability to generate long-term value and attract future capital.

ICG's ability to achieve profitable exits is directly linked to its performance fees. For instance, in the first half of 2024, ICG reported significant fundraising and deployment, with a strong focus on realizing value from its existing portfolio. The firm's commitment to active portfolio management ensures that divestments are strategically timed to maximize returns.

- Strategic Exits: ICG actively manages its portfolio, identifying optimal times to divest assets and crystallize gains for its investors.

- Performance Fees: Successful divestments directly contribute to the performance fees earned by ICG, a key driver of profitability.

- Value Generation: Realizing value through divestments is fundamental to ICG's business model, demonstrating its capability to grow capital over the long term.

- Portfolio Turnover: In 2023, ICG completed a number of significant exits, reflecting a healthy pace of portfolio turnover and successful value realization.

Product Development and Strategy Expansion

Intermediate Capital Group (ICG) actively cultivates new investment strategies and products to align with shifting client needs. For instance, the development of the ICG Core Private Equity wealth-focused strategy and the introduction of new Real Estate Asia funds exemplify this commitment. This proactive approach involves bolstering current operational capacities while simultaneously venturing into novel market segments for diversification and growth.

ICG's strategic expansion is underpinned by a continuous innovation cycle. In 2024, the firm continued to refine its product suite, aiming to capture emerging opportunities across various asset classes. This focus on development is crucial for maintaining a competitive edge and addressing the sophisticated demands of its global investor base.

- Product Innovation: Launching strategies like the Core Private Equity wealth-focused strategy and new Real Estate Asia funds.

- Capability Scaling: Expanding existing operational strengths to support new product offerings.

- Market Expansion: Venturing into new geographical regions and asset classes to diversify revenue streams.

- Client Demand Alignment: Ensuring product development directly addresses evolving investor preferences and market trends.

ICG's key activities center on fundraising, investment origination and execution, active portfolio management, and strategic divestments. The firm also focuses on developing new investment strategies and products to meet evolving client demands and market opportunities.

In fiscal year 2025, ICG raised $24 billion, demonstrating its strong fundraising capabilities. The firm actively deployed capital in 2024, with significant commitments to structured capital solutions and European direct lending, showcasing its ability to execute investment opportunities effectively.

| Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Fundraising | Gathering capital from global clients across strategies. | $24 billion raised in FY25. |

| Investment Origination & Execution | Sourcing and executing deals in private debt, credit, equity, and real assets. | Commitments to structured capital solutions and European direct lending. |

| Portfolio Management | Collaborating with company leadership for growth and operational enhancements. | Portfolio companies collectively generated strong performance in 2023. |

| Divestment & Realization | Exiting investments to generate returns and realize profits. | Significant exits completed in 2023, contributing to performance fees. |

| Product Development | Creating new investment strategies and products. | Launched Core Private Equity wealth-focused strategy and new Real Estate Asia funds. |

What You See Is What You Get

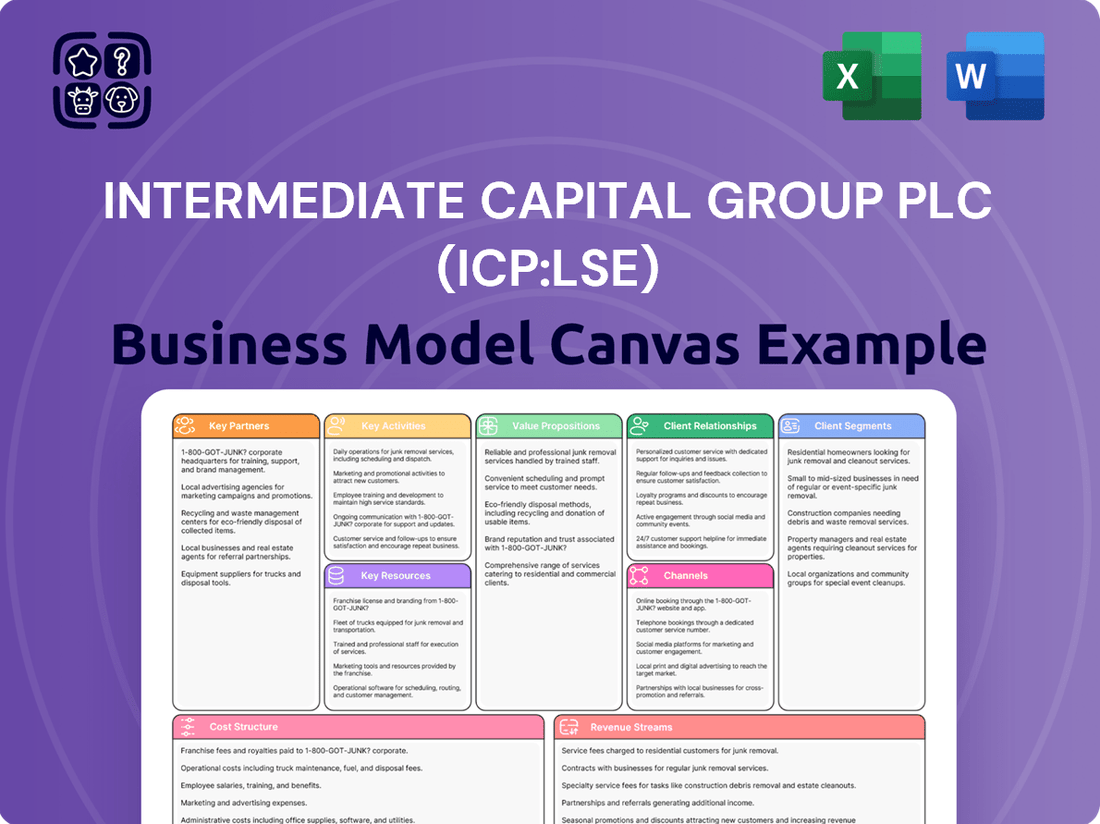

Business Model Canvas

The Business Model Canvas for Intermediate Capital Group Plc (ICP:LSE) that you are previewing is the actual document you will receive upon purchase. This means you are seeing a direct snapshot of the comprehensive analysis, including all key sections detailing their value propositions, customer segments, revenue streams, and cost structures, presented in its final, ready-to-use format.

Resources

Intermediate Capital Group Plc's (ICG:LSE) Assets Under Management (AUM) reached $112 billion by the end of fiscal year 2025. This substantial AUM is a critical financial resource, directly fueling the firm's revenue streams through management fees and bolstering its capacity to make new investments.

A significant portion of ICG's AUM is classified as fee-earning. This metric is particularly important as it represents the capital that actively generates recurring revenue for the company, providing a stable financial foundation.

The continued growth in ICG's AUM is a clear indicator of robust client confidence and a strong, competitive position within the alternative asset management market.

Intermediate Capital Group Plc's (ICG) human capital is a cornerstone of its business model. As of Fiscal Year 2025, the firm boasts a global team of 686 permanent employees, a significant portion of whom are seasoned investment professionals.

This deep bench of expertise is crucial for ICG's ability to originate and manage private market investments. Their collective experience and proven track record are instrumental in identifying and capitalizing on attractive opportunities across various sectors.

ICG places a strong emphasis on talent management, focusing on attracting, retaining, and developing high-performing individuals. This commitment ensures the continued strength of their investment capabilities and their competitive edge in the market.

Intermediate Capital Group (ICG) strategically deploys its balance sheet capital to co-invest alongside its managed funds. This practice, often referred to as having 'skin in the game,' directly aligns ICG's financial interests with those of its clients, fostering trust and demonstrating commitment to fund performance.

This internal capital pool is also a crucial engine for innovation, enabling ICG to seed and scale nascent investment strategies. By providing the initial financial backing, ICG can nurture and grow new product offerings, expanding its market reach and diversification.

As of December 31, 2023, ICG reported total equity attributable to shareholders of approximately £3.3 billion. This substantial capital base provides the flexibility needed to pursue opportunistic investments and underpins the company's capacity for sustained future growth and strategic development.

Proprietary Origination Platform

Intermediate Capital Group Plc (ICG:LSE) leverages its proprietary origination platform as a cornerstone of its business model, enabling it to source unique investment opportunities across global private debt, credit, equity, and real asset markets. This established network and sophisticated approach are critical for identifying and accessing deals that might otherwise remain undiscovered.

The platform's success directly translates into securing attractive investments for ICG's various funds, underpinning its ability to generate competitive returns for its investors. Its global reach allows for a diversified pipeline of potential transactions.

- Global Deal Sourcing: ICG's platform provides access to a wide spectrum of investment opportunities worldwide.

- Differentiated Opportunities: It is designed to identify and secure investments that stand out in the market.

- Fund Performance: The effectiveness of this origination capability is directly linked to the success of ICG's investment funds.

Strong Track Record and Brand Reputation

Over three decades, Intermediate Capital Group (ICG) has cultivated an exceptional track record in generating value and fostering growth through its responsible and innovative investment strategies. This sustained performance and robust brand reputation are critical assets, serving to attract new clients and ease the process of capital raising.

ICG's established success in the global alternative asset management sector positions it as a preferred manager. As of the first half of 2024, ICG reported assets under management (AUM) of £77.7 billion, a testament to its ability to attract and retain investor capital.

- Proven Performance: ICG’s consistent ability to deliver strong returns over an extended period.

- Brand Recognition: A well-respected name in the financial industry, fostering trust and credibility.

- Client Attraction: The track record and reputation are key drivers for securing new mandates and partnerships.

- Fundraising Advantage: A strong brand makes it easier to raise capital for new funds and strategies.

ICG's proprietary origination platform is key to its business, allowing it to find unique investment opportunities globally in private debt, credit, equity, and real assets. This network helps secure attractive deals for its funds, driving competitive returns. As of the first half of 2024, ICG's Assets Under Management (AUM) stood at £77.7 billion, underscoring its success in attracting capital.

| Key Resource | Description | Relevance |

| Proprietary Origination Platform | Global network for sourcing private market investment opportunities. | Access to differentiated deals, driving fund performance. |

| Assets Under Management (AUM) | £77.7 billion (H1 2024). | Indicates client confidence and scale, generating management fees. |

| Human Capital | 686 employees (FY2025), including experienced investment professionals. | Crucial for deal origination, management, and strategy execution. |

| Balance Sheet Capital | £3.3 billion equity (as of Dec 31, 2023). | Enables co-investment, strategy seeding, and opportunistic investments. |

| Track Record & Brand Reputation | Over three decades of value generation and growth. | Attracts clients, facilitates fundraising, and builds trust. |

Value Propositions

Intermediate Capital Group (ICG) provides clients with a wide array of private market investment opportunities. This includes diverse strategies within private debt, credit, equity, and real assets, encompassing specialized sectors such as structured capital and private equity secondaries. This broad access allows investors to tailor their capital allocation to align with their unique risk and return objectives.

ICG's assets under management are strategically organized across five distinct asset classes, further segmented into three core business verticals. This structure facilitates a clear and comprehensive approach to managing its extensive portfolio and delivering specialized investment solutions to its global client base.

Intermediate Capital Group (ICG) offers clients the core value of generating attractive risk-adjusted returns by investing in growing companies. This means they aim to make money while carefully managing the potential downsides.

ICG strives for outstanding investment performance, using its deep knowledge and a structured approach to picking investments. This commitment to strong results is crucial for keeping existing clients and bringing in new ones.

For instance, as of the first half of 2024, ICG reported assets under management of €77.4 billion, with a significant portion allocated to its core private debt strategies, which are designed to deliver these risk-adjusted returns.

ICG offers a broad spectrum of adaptable capital solutions, crucial for companies navigating diverse economic landscapes. This flexibility is key to their strategy, enabling businesses to secure the right type of funding for their specific growth phases.

These solutions encompass senior debt, subordinated debt, private equity, and real asset financing, all customized to meet individual corporate requirements. This comprehensive offering ensures ICG can support companies through various stages of their development.

For instance, ICG's direct lending strategies have been a significant driver of their business. In 2024, the firm continued to deploy capital effectively across its strategies, demonstrating its capacity to provide substantial financial backing to its corporate clients.

Alignment of Interests (Skin in the Game)

Intermediate Capital Group (ICG) reinforces client trust by co-investing its own capital alongside client funds, a practice known as having 'skin in the game.' This direct commitment signals ICG's vested interest in the success of its investment strategies and the performance of portfolio companies.

This alignment of interests is a cornerstone of ICG's value proposition, directly contributing to shareholder returns through its own balance sheet participation. For instance, ICG's direct investment portfolio is a key driver of its profitability.

- Skin in the Game: ICG invests its own capital, aligning its interests with clients.

- Trust and Confidence: This commitment reassures clients of ICG's dedication to successful outcomes.

- Shareholder Returns: Direct investment in portfolios generates profits for ICG shareholders.

- 2024 Data: ICG's commitment to co-investment remains a core element of its strategy, as evidenced by its continued deployment of balance sheet capital across various funds. Specific figures on the exact amount of co-investment in 2024 are integral to understanding the scale of this commitment.

Long-Term Sustainable Value Creation

Intermediate Capital Group Plc (ICG) is dedicated to building enduring value for all stakeholders through a strategy rooted in responsible investment. This means actively partnering with businesses to foster their growth and enhance their worth over the long haul.

Central to this approach are robust governance standards and a firm commitment to Environmental, Social, and Governance (ESG) principles. ICG’s ambition to be a net zero asset manager by 2040 underscores this dedication to sustainable practices.

- Focus on Growth: ICG works with portfolio companies to drive sustainable expansion and improve operational efficiency.

- Responsible Investment: ESG principles are integrated into investment decisions, ensuring long-term viability and positive impact.

- Shareholder Value: The firm aims to deliver consistent, long-term returns to its investors through strategic asset management.

- Net Zero Commitment: ICG is actively pursuing a net zero target by 2040, aligning its operations with global climate goals.

ICG provides clients with access to a diverse range of private market investment strategies, including private debt, credit, equity, and real assets. This broad offering allows investors to customize their portfolios to meet specific risk and return objectives.

The firm's value proposition centers on generating attractive risk-adjusted returns by investing in growing companies, underpinned by deep expertise and a structured investment process. This focus on performance is key to client retention and acquisition.

ICG demonstrates its commitment through co-investment, aligning its interests with clients and reinforcing trust. This 'skin in the game' approach directly contributes to shareholder returns by participating in portfolio profits.

The firm is dedicated to building enduring value through responsible investment, integrating ESG principles and aiming for net zero asset management by 2040. This commitment ensures long-term viability and positive impact for portfolio companies and stakeholders.

| Metric | Value (as of H1 2024) | Significance |

|---|---|---|

| Assets Under Management (AUM) | €77.4 billion | Demonstrates scale and client trust in ICG's investment strategies. |

| Core Business Verticals | Five distinct asset classes | Highlights the breadth of ICG's investment capabilities. |

| Net Zero Target | By 2040 | Underscores commitment to sustainable and responsible investment practices. |

Customer Relationships

Intermediate Capital Group Plc (ICG) cultivates long-term partnerships, viewing client relationships as enduring collaborations rather than mere transactions. This strategy fosters deep trust and a nuanced understanding of evolving client needs, crucial for sustained success.

This commitment to enduring relationships is a cornerstone of ICG's business model, directly enabling their consistent ability to raise and deploy capital across multiple fund cycles. For instance, ICG's fundraising performance in 2024 demonstrates this, with significant capital raised for new strategies, reflecting strong investor confidence built over years of partnership.

Intermediate Capital Group Plc (ICG) prioritizes strong client connections through dedicated coverage teams and a proactive investor relations department. This ensures consistent engagement with their worldwide clientele.

ICG actively communicates transparent financial results and hosts investor seminars, offering valuable resources for both shareholders and debtholders. For instance, in their 2024 fiscal year, ICG reported fee-paying AUM growth to £77.4 billion, underscoring the importance of clear communication in managing this expanding base.

This consistent and informative communication strategy fosters trust and keeps clients well-informed and supported, reinforcing ICG's commitment to its investor relationships.

ICG cultivates strong client relationships by providing highly customized investment solutions. They deeply understand each client's unique risk tolerance and return goals, aligning them with suitable private market strategies. This bespoke approach is facilitated by ICG's extensive range of products, allowing for precise matching to individual needs.

Performance and Trust-Based Engagement

ICG's customer relationships are anchored in delivering strong investment performance and cultivating deep trust. The firm focuses on generating attractive risk-adjusted returns, a core tenet for its clients, which include institutional investors and high-net-worth individuals. In 2024, ICG continued to demonstrate this commitment, with its funds generally performing well against benchmarks in challenging market conditions.

This consistent outperformance and a proven history of creating value are crucial for bolstering client confidence and securing ongoing capital commitments. For instance, ICG's ability to raise significant capital for its latest funds, such as its European Direct Lending fund, underscores the trust investors place in its strategy and execution. This performance-driven trust is paramount in the competitive landscape of alternative asset management.

- Performance Focus: ICG prioritizes generating superior risk-adjusted returns for its investors.

- Trust Building: Consistent delivery of value creation strengthens client confidence and encourages long-term partnerships.

- Capital Commitments: Strong performance directly translates into increased capital commitments from existing and new investors.

- Alternative Asset Management: Trust and performance are foundational elements in securing and retaining capital in this sector.

Stakeholder Engagement and Transparency

ICG prioritizes open communication with its clients, shareholders, and the investment community. This commitment to transparency is a cornerstone of their stakeholder relationships.

- Regular Financial Reporting: ICG provides detailed financial reports, ensuring stakeholders have access to up-to-date performance data. For instance, their 2024 interim results highlighted strong revenue growth and robust asset under management.

- Annual General Meetings (AGMs): AGMs serve as a key platform for direct engagement, allowing stakeholders to ask questions and receive insights from management.

- Direct Communication Channels: ICG maintains various channels, including investor relations portals and dedicated contact points, to facilitate ongoing dialogue and address stakeholder inquiries promptly.

- Fostering Trust: This consistent dedication to openness builds enduring trust and strengthens ICG's relationships across its diverse stakeholder base.

ICG's customer relationships are built on a foundation of delivering strong investment performance and fostering deep trust. The firm focuses on generating attractive risk-adjusted returns, a core tenet for its diverse client base, which includes institutional investors and high-net-worth individuals. In 2024, ICG continued to demonstrate this commitment, with its funds generally performing well against benchmarks in challenging market conditions, a key factor in securing ongoing capital commitments.

This consistent outperformance and a proven history of creating value are crucial for bolstering client confidence and securing ongoing capital commitments. For instance, ICG's ability to raise significant capital for its latest funds, such as its European Direct Lending fund, underscores the trust investors place in its strategy and execution, a vital element in the competitive alternative asset management sector.

ICG cultivates strong client relationships by providing highly customized investment solutions, deeply understanding each client's unique risk tolerance and return goals. This bespoke approach, facilitated by ICG's extensive range of products, allows for precise matching to individual needs, reinforcing the value proposition for its global clientele.

ICG prioritizes open communication with its clients, shareholders, and the investment community, ensuring transparency through detailed financial reports and direct engagement platforms. For example, their 2024 interim results highlighted strong revenue growth and robust asset under management, demonstrating a commitment to keeping stakeholders well-informed and supported.

| Key Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Performance Driven Trust | Delivering consistent, attractive risk-adjusted returns builds client confidence. | Funds generally performed well against benchmarks in challenging 2024 market conditions. |

| Customized Solutions | Tailoring investment strategies to individual client needs. | Utilizing a broad product range to match specific risk tolerance and return goals. |

| Open Communication | Maintaining transparency through regular reporting and direct engagement. | 2024 interim results showed strong revenue growth and robust fee-paying AUM growth to £77.4 billion. |

| Long-Term Partnerships | Viewing client relationships as enduring collaborations. | Successful fundraising for new strategies in 2024 reflects sustained investor confidence. |

Channels

Intermediate Capital Group (ICG) leverages its dedicated direct sales and investor relations teams as a crucial channel for engaging with a global base of institutional clients. These teams are instrumental in cultivating relationships with entities like pension funds and insurance companies, directly facilitating capital raising efforts and providing ongoing client servicing.

These direct interactions are the bedrock of ICG's fundraising strategy, ensuring consistent communication and a deep understanding of client needs. In 2024, ICG reported significant inflows from institutional investors, underscoring the effectiveness of this direct engagement model in attracting and retaining capital.

ICG strategically partners with wealth management intermediaries to tap into the burgeoning private wealth market. This approach bypasses a direct retail strategy, allowing ICG to efficiently distribute its private market offerings, like the ICG Core Private Equity strategy, to high-net-worth individuals.

These intermediaries serve as a crucial distribution channel, significantly broadening ICG's client base by accessing new segments within the wealth management ecosystem. This allows for a more targeted and effective reach into a market that is experiencing substantial growth.

ICG's corporate website serves as a primary hub for disseminating financial results, annual reports, and strategic insights. This digital platform ensures shareholders, debtholders, and the wider market have ready access to crucial information, fostering transparency and engagement. For instance, ICG's 2024 annual report, detailing its performance and outlook, is readily downloadable, offering a comprehensive overview of its operations and financial health.

Industry Conferences and Events

Industry conferences and events are vital for Intermediate Capital Group Plc (ICG) to engage with the financial community. Participation in key gatherings like IPEM Paris and SuperReturn International allows ICG to directly interact with potential and current investors, as well as business partners. These platforms are instrumental in demonstrating the firm's deep understanding of market dynamics and its investment capabilities.

These events offer invaluable networking opportunities, enabling ICG to strengthen relationships and identify new business prospects. By actively participating, ICG enhances its brand visibility and reinforces its position as a leading alternative asset manager. For instance, in 2024, attendance at major global private markets conferences provided ICG with direct access to over 5,000 industry professionals, facilitating crucial business development conversations.

- Client Engagement: Direct interaction with a broad base of potential and existing Limited Partners (LPs) and General Partners (GPs).

- Thought Leadership: Opportunities to present on market trends and ICG's investment strategies, enhancing firm reputation.

- Networking: Building and maintaining relationships within the private markets ecosystem.

- Business Development: Identifying and pursuing new investment opportunities and capital raising initiatives.

Financial News and Media Outlets

Intermediate Capital Group (ICG) leverages financial news and media outlets to disseminate crucial information. This includes announcing their financial results, detailing strategic shifts, and sharing market perspectives. For example, in their 2024 fiscal year, ICG reported a 15% increase in assets under management to £77 billion, a significant figure amplified through these channels.

Their engagement with media helps cultivate a favorable public image, which is vital for attracting new investors and maintaining a strong presence within the investment community. This broad reach ensures that key stakeholders are informed about ICG's performance and future direction.

ICG actively uses press releases and news articles as primary tools to communicate with the market. These official announcements are designed to provide timely and accurate updates, fostering transparency and trust among investors and analysts.

- Financial Results: Regular updates on performance, such as the 2024 reported pre-tax profit of £650 million, are shared.

- Strategic Developments: Major announcements regarding new fund launches or acquisitions are disseminated widely.

- Market Insights: ICG shares its views on economic trends and investment opportunities, positioning itself as a thought leader.

- Investor Relations: Media acts as a conduit for communicating with current and potential investors, enhancing visibility and engagement.

ICG's channels are diverse, encompassing direct sales and investor relations for institutional clients, and strategic partnerships with wealth management intermediaries to reach high-net-worth individuals. Their corporate website serves as a transparent hub for financial reporting, while industry conferences and media outlets amplify their market presence and thought leadership. These channels collectively ensure broad engagement and information dissemination to key stakeholders.

| Channel | Purpose | Key Activities/Examples | 2024 Data/Impact |

| Direct Sales & Investor Relations | Institutional client engagement & capital raising | Relationship building with pension funds, insurers; direct communication | Significant inflows reported from institutional investors |

| Wealth Management Intermediaries | Accessing private wealth market | Distributing private market offerings to HNWIs | Broadened client base into growing wealth segments |

| Corporate Website | Information dissemination & transparency | Publishing financial results, annual reports, strategic insights | 2024 annual report readily available for comprehensive overview |

| Industry Conferences & Events | Market engagement & networking | Participating in IPEM Paris, SuperReturn; presenting market trends | Direct access to over 5,000 industry professionals in 2024 |

| Financial News & Media | Market communication & brand building | Announcing results, strategic shifts, sharing market perspectives | Reported 15% AUM increase to £77bn amplified through media |

Customer Segments

Institutional investors, including major pension funds and insurance companies, represent Intermediate Capital Group's (ICG) cornerstone customer segment, forming the bulk of their client roster. These entities are drawn to ICG's offerings because they prioritize sustained, reliable returns, aligning perfectly with the long-term nature of private market investments and their own extended liability horizons.

ICG's ability to tailor its diverse investment strategies ensures it effectively meets the specific allocation requirements of these substantial institutional clients. As of the first half of 2024, ICG reported €77.1 billion in Assets Under Management (AUM), with a significant portion originating from these core institutional partners.

Sovereign wealth funds and university endowments represent a crucial customer segment for Intermediate Capital Group (ICG). These institutions, characterized by their long-term investment horizons, actively seek diversified returns beyond conventional public markets. In 2024, global sovereign wealth fund assets were estimated to exceed $10 trillion, with endowments also managing substantial capital pools, making them significant players in alternative investments.

ICG's diverse alternative asset strategies, including private debt and private equity, align perfectly with the mandates of these sophisticated investors. They are drawn to ICG's ability to generate both capital appreciation and stable income streams, essential for meeting their long-term financial objectives and preserving capital.

Intermediate Capital Group (ICG) is actively engaging the high-net-worth (HNW) segment, primarily by partnering with wealth management intermediaries. This strategic approach allows ICG to reach affluent individuals seeking diversification into private markets.

The demand from HNW individuals for access to private market investments, typically reserved for institutional players, is a key driver for ICG's product development. For instance, ICG's Assets Under Management (AUM) in its private markets division reached £67.1 billion as of December 31, 2023, reflecting this growing investor interest.

Products like ICG's Core Private Equity strategy are specifically designed to meet this burgeoning demand. This focus on wealth-centric solutions underscores ICG's commitment to broadening its investor base beyond traditional institutional clients.

Corporates and Owners of Real Assets

Corporates and owners of real assets are key customers for Intermediate Capital Group (ICG), seeking tailored capital solutions beyond traditional banking. These businesses often require financing for significant strategic moves like acquisitions, expansion projects, or recapitalizations. ICG's ability to provide flexible and bespoke financing structures makes it an attractive partner for companies needing capital for growth or operational adjustments.

ICG's offerings are designed to meet the diverse financial needs of these clients. For instance, in 2024, ICG continued to deploy capital across various sectors, providing debt and equity solutions that support corporate development. Their flexibility allows them to structure deals that align with the specific risk appetites and strategic objectives of their corporate clients.

- Acquisition Financing: Supporting companies looking to expand through mergers and acquisitions.

- Growth Capital: Providing funds for organic growth initiatives, product development, and market expansion.

- Recapitalizations: Assisting businesses in restructuring their balance sheets to optimize capital structure and financial flexibility.

- Real Asset Financing: Offering capital for infrastructure, real estate, and other tangible asset-backed investments.

Fund-of-Funds and Other Asset Managers

Intermediate Capital Group (ICG) also caters to fund-of-funds and other asset managers looking to diversify their portfolios. These clients leverage ICG's specialized funds to gain exposure to niche areas like private equity secondaries or direct lending, aligning with their broader investment objectives.

For instance, in 2024, ICG continued to attract institutional capital, with a significant portion of its assets under management originating from large pension funds and sovereign wealth funds, many of which operate as sophisticated asset allocators and may utilize fund-of-funds structures.

- Targeted Exposure: Fund-of-funds and asset managers seek access to ICG's proven track record and specialized strategies, such as those in private debt and private equity.

- Portfolio Diversification: These clients integrate ICG's funds into their existing portfolios to achieve broader diversification and potentially enhance risk-adjusted returns.

- Access to Niche Markets: ICG provides these managers with a gateway to less liquid or more complex alternative asset classes where direct investment might be challenging.

Intermediate Capital Group (ICG) serves a diverse client base, with institutional investors like pension funds and insurance companies forming its core. These clients are attracted to ICG's ability to deliver consistent, long-term returns through private market investments, a crucial aspect given their extended liability profiles.

Sovereign wealth funds and university endowments represent another significant customer group, seeking diversification beyond traditional public markets. ICG's tailored strategies in private debt and equity appeal to these sophisticated investors aiming for both capital appreciation and stable income, essential for their long-term financial mandates.

ICG also engages high-net-worth individuals, primarily through wealth management intermediaries, offering them access to private markets. Furthermore, corporates and owners of real assets are key clients, requiring bespoke financing solutions for growth, acquisitions, and recapitalizations, with ICG providing flexible debt and equity structures.

Finally, fund-of-funds and other asset managers utilize ICG's specialized strategies to diversify their own portfolios, gaining exposure to niche areas within private markets and enhancing their overall risk-adjusted returns.

| Customer Segment | Key Needs | ICG's Offering Alignment |

|---|---|---|

| Institutional Investors | Reliable, long-term returns | Private debt, private equity strategies |

| Sovereign Wealth Funds & Endowments | Diversification, capital appreciation, income | Alternative asset strategies |

| High-Net-Worth Individuals | Access to private markets | Partnerships with wealth managers, core private equity |

| Corporates & Real Asset Owners | Bespoke financing for growth, M&A | Flexible debt and equity solutions |

| Fund-of-Funds & Asset Managers | Portfolio diversification, niche market access | Specialized funds, proven track record |

Cost Structure

Personnel costs represent a substantial component of Intermediate Capital Group Plc's (ICG) overall expenses. These costs encompass salaries, wages, bonuses, and benefits for their global workforce, which is essential for a knowledge-intensive firm like ICG.

Attracting and retaining highly skilled investment professionals and support staff is paramount to ICG's success, directly impacting their ability to generate returns. In fiscal year 2025, ICG reported having 686 permanent employees, underscoring the significant investment in human capital.

Operating expenses for Intermediate Capital Group Plc (ICG) cover the costs of managing its global asset management operations. These include significant outlays for office space across its international locations, essential utilities, and the robust IT infrastructure required to support its trading and client services. In 2024, ICG's commitment to its global presence and technological advancement directly impacts these operational costs.

Marketing and client relations are crucial for ICG's business development, involving substantial investment in outreach and relationship management to attract and retain investors. Furthermore, general administrative overheads, encompassing salaries for its professional staff and regulatory compliance, form a significant portion of the expense base. Efficient management of these operational costs is paramount for sustaining ICG's profitability in the competitive asset management landscape.

Intermediate Capital Group's (ICG) fund management and investment-related costs are intrinsically tied to its alternative asset management operations. These include expenses for rigorous due diligence on potential investments, transaction fees for executing deals, and legal costs associated with structuring and closing transactions.

Furthermore, ongoing portfolio monitoring and the implementation of value creation strategies within its portfolio companies also contribute to these costs. For instance, in the fiscal year ending March 31, 2024, ICG reported operating expenses of £493.1 million, reflecting the significant investment required to manage its diverse fund strategies and support its portfolio companies.

Compliance and Regulatory Costs

As a regulated financial institution, Intermediate Capital Group (ICG) faces significant expenses tied to adhering to diverse financial regulations across multiple operating regions. These costs encompass legal and consultancy fees, alongside the operational expenses of its internal compliance teams. For instance, in 2024, the global financial services industry saw a marked increase in regulatory spending, with many firms allocating a larger portion of their budgets to compliance functions to navigate evolving rules.

Maintaining robust governance structures is paramount for ICG to ensure operational integrity and investor confidence. This commitment translates into ongoing investments in systems, training, and personnel dedicated to regulatory adherence. The need for specialized expertise in areas like anti-money laundering (AML) and know-your-customer (KYC) procedures contributes to these overheads.

- Legal and Advisory Fees: Costs associated with external legal counsel and regulatory consultants to interpret and implement new regulations.

- Internal Compliance Department: Salaries and operational costs for dedicated compliance officers and staff.

- Technology and Systems: Investment in software and platforms to monitor transactions, manage risk, and report to regulators.

- Training and Development: Ongoing education for employees to stay abreast of regulatory changes and best practices.

Technology and Platform Investment

Intermediate Capital Group (ICG) strategically invests in its technology and operating platform to bolster its capabilities and efficiency, serving a global client base. These investments are vital for scaling operations, expanding marketing reach, and ultimately enhancing its capacity to deliver strong investment returns.

In 2024, ICG continued its focus on digital transformation, with significant allocations towards enhancing its data analytics and client reporting tools. This commitment ensures the firm remains at the forefront of technological advancements in the alternative asset management sector.

- Technology Investment Focus: Continued upgrades to proprietary data platforms and client relationship management systems.

- Efficiency Gains: Streamlining operational workflows through automation and enhanced digital tools.

- Client Service Enhancement: Providing advanced analytics and reporting capabilities to a growing global investor base.

- Scalability Support: Building a robust technological infrastructure to support future business growth and new product offerings.

Intermediate Capital Group Plc's (ICG) cost structure is heavily influenced by its personnel, operating expenses, fund management activities, and regulatory compliance. In fiscal year 2024, ICG reported operating expenses of £493.1 million, highlighting the significant investment in managing its global asset management operations.

Personnel costs, including salaries and benefits for its 686 employees in 2025, are a major expense, essential for attracting top talent in the knowledge-intensive asset management sector. Technology investments are also crucial for operational efficiency and client service, with a continued focus on digital transformation and data analytics in 2024.

| Cost Category | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Personnel Costs | Salaries, bonuses, benefits for global workforce | Significant investment in human capital |

| Operating Expenses | Office space, utilities, IT infrastructure | £493.1 million reported operating expenses |

| Fund Management Costs | Due diligence, transaction fees, legal costs | Essential for deal execution and portfolio management |

| Regulatory and Compliance | Legal fees, compliance staff, technology for adherence | Increased spending across the financial services industry in 2024 |

| Technology Investment | Data analytics, client reporting tools, digital transformation | Focus on enhancing capabilities and efficiency |

Revenue Streams

Management fees form the bedrock of Intermediate Capital Group's (ICG) revenue generation. These fees, calculated as a percentage of the assets they manage or the capital committed to their funds, offer a consistent and predictable income stream. This makes them a crucial element of ICG's financial stability, as they are generally insulated from the day-to-day ups and downs of the market.

For the fiscal year 2025, ICG reported a substantial £604 million in management fees, marking a significant 19% increase. This growth underscores the expanding scale of their operations and the trust investors place in their management capabilities.

Intermediate Capital Group (ICG) generates revenue through performance fees, often called carried interest. These fees are earned when ICG's investment funds surpass a predetermined minimum rate of return, known as a hurdle rate.

While these fees are less predictable due to market fluctuations, they offer substantial upside potential for ICG. In fiscal year 2025, performance fees contributed £86 million to the company's total fee income, typically making up 10-15% of that total.

Intermediate Capital Group (ICG) earns significant returns from its proprietary investment portfolio, where it co-invests with clients across its diverse strategies. This 'skin in the game' commitment, a cornerstone of their business model, not only fosters trust by aligning ICG's interests with those of its investors but also generates a distinct revenue stream through investment income and capital appreciation.

This self-funded portfolio plays a crucial role in seeding new investment strategies and scaling existing ones, demonstrating ICG's proactive approach to growth and innovation. For instance, in the fiscal year ending March 31, 2024, ICG reported a notable increase in its investment portfolio's value, contributing directly to its overall financial performance and underscoring the importance of this revenue stream.

Advisory and Consulting Fees

While not a primary revenue driver, Intermediate Capital Group (ICG) may earn advisory and consulting fees. These fees can arise from leveraging their extensive expertise in private markets and corporate finance to support portfolio companies with strategic planning and execution. This represents an ancillary income stream stemming from their deep industry knowledge and network.

These fees are typically generated on a project basis or as part of ongoing advisory relationships. For instance, ICG's specialists might assist a portfolio company in optimizing its capital structure or navigating complex M&A transactions. Such services, while not the core fund management income, contribute to the overall revenue diversification.

For the fiscal year ending March 31, 2024, ICG reported total revenue of £1,436 million. While specific figures for advisory and consulting fees are not broken out separately, this segment would fall under the broader umbrella of fee-related income, which is a crucial component of their diversified revenue model.

- Ancillary Income: Advisory and consulting fees are a secondary revenue stream for ICG.

- Expertise Leverage: Fees are generated by applying ICG's private markets and corporate finance knowledge.

- Portfolio Company Support: Services often focus on strategic initiatives and capital structure optimization.

- Revenue Diversification: This stream complements core fund management income, contributing to overall financial stability.

Dividend Income from Holdings

Intermediate Capital Group Plc (ICG) generates revenue through dividend income from its diverse investment portfolio, especially from its credit and equity strategies. These dividends are a key component of its Net Investment Returns (NIR), bolstering its financial performance and providing a steady cash flow.

For instance, ICG's robust performance in the fiscal year ending March 31, 2024, saw its assets under management grow. While specific dividend figures from individual holdings are not always broken out publicly, the overall increase in investment income reflects successful capital deployment and the positive impact of dividends received from its portfolio companies.

- Dividend Income: Received from equity and credit investments within ICG's portfolio.

- Contribution to NIR: A significant element of Net Investment Returns, enhancing overall profitability.

- Cash Flow Generation: Provides a reliable cash inflow, supporting balance sheet strength and operational flexibility.

- Fiscal Year 2024 Impact: Increased AUM and investment income reflect the positive contribution of dividends to ICG's financial results.

Intermediate Capital Group (ICG) diversifies its revenue streams through various channels beyond core management and performance fees. These include income generated from its proprietary investment portfolio, where ICG co-invests alongside clients. Additionally, advisory and consulting fees are earned by leveraging their expertise to support portfolio companies, contributing to revenue diversification.

For the fiscal year ending March 31, 2024, ICG reported total revenue of £1,436 million, showcasing the combined impact of these varied income sources. The company's strategy of co-investment, as highlighted by the increase in its investment portfolio's value during the same period, demonstrates a commitment to aligning interests and generating direct returns.

| Revenue Stream | Fiscal Year 2025 (Reported) | Fiscal Year 2024 (Reported) |

|---|---|---|

| Management Fees | £604 million | N/A |

| Performance Fees | £86 million | N/A |

| Total Revenue | N/A | £1,436 million |

Business Model Canvas Data Sources

The Intermediate Capital Group Plc Business Model Canvas is informed by a blend of financial disclosures, investor relations materials, and industry analysis. These sources provide a comprehensive view of their operations, market position, and strategic direction.