Intermediate Capital Group Plc (ICP:LSE) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intermediate Capital Group Plc (ICP:LSE) Bundle

Intermediate Capital Group Plc (ICP:LSE) is navigating a dynamic market, and understanding its position within the BCG Matrix is crucial for investors. This analysis will reveal which of their offerings are generating substantial cash (Cash Cows), which are poised for rapid growth (Stars), those with uncertain futures (Question Marks), and those that may be underperforming (Dogs).

Don't miss out on the complete picture! Purchase the full BCG Matrix report for Intermediate Capital Group Plc to gain a clear, actionable understanding of their product portfolio's strategic positioning and unlock informed investment decisions.

Stars

Intermediate Capital Group's Senior Debt Partners fund, a recent $17 billion raise, exemplifies a Star in the private debt landscape. This significant capital infusion highlights strong investor confidence and ICG's prowess in direct lending.

The fund's focus on European direct lending targets a market demonstrating robust growth potential. This strategic alignment positions ICG to capitalize on evolving credit needs and attractive yields within the region.

The ICG Strategic Equity Fund V, a key component of Intermediate Capital Group Plc, is a prime example of a Star product. This fund successfully raised $11 billion, significantly surpassing its initial fundraising target, which underscores its strong market position and investor confidence.

Its specialization in GP-led secondary transactions places it in a high-growth segment of the private equity market. This strategy involves acquiring portfolios of existing private equity investments directly from general partners, a trend that has seen increasing investor appetite due to its potential for attractive returns and efficient capital deployment.

Intermediate Capital Group's (ICG) European Corporate and Mid-Market strategies are foundational to its diversified growth. These strategies leverage ICG's market-leading positions and strong client relationships, evidenced by significant capital commitments. For instance, in the first half of 2024, ICG raised €13.3 billion in new capital, with European strategies playing a crucial role.

These core strategies are vital for ICG's fee-related earnings, reflecting their consistent ability to deploy capital effectively. The firm’s European mid-market focus, in particular, continues to benefit from a fragmented market ripe for consolidation and private capital solutions. ICG’s assets under management in Europe reached €46.7 billion by the end of September 2024, underscoring the scale and success of these operations.

Private Equity Secondaries Platform

The private equity secondaries market, encompassing both Strategic Equity and LP Secondaries, is a significant growth engine for Intermediate Capital Group (ICG). This segment has demonstrated robust expansion, with ICG solidifying its standing as a prominent force through successful fundraising and effective capital deployment.

ICG's commitment to the secondaries market is evident in its strategic positioning and operational success. The firm has consistently attracted substantial capital commitments, enabling it to capitalize on attractive investment opportunities within this dynamic sector.

- Strong Growth Trajectory: The global private equity secondaries market is projected to continue its upward trend, with transaction volumes expected to reach new heights in the coming years.

- ICG's Market Leadership: ICG has successfully raised significant capital for its secondaries funds, demonstrating strong investor confidence and its ability to deploy capital efficiently.

- Strategic Equity and LP Secondaries: Both components of ICG's secondaries platform are performing exceptionally well, reflecting broad market demand and the firm's expertise across different secondary transaction types.

- Deployment Success: ICG has a proven track record of deploying capital effectively in the secondaries market, generating attractive returns for its investors.

Global Alternative Asset Management Platform

Intermediate Capital Group Plc's (ICP:LSE) global alternative asset management platform is a clear Star in the BCG Matrix. As of March 2025, its Assets Under Management (AUM) reached an impressive $112 billion, demonstrating substantial growth and market presence.

This expansive platform, with operations in over 20 global locations, highlights ICG's ability to tap into diverse private markets. Its broad reach allows for the effective deployment of capital and the attraction of a wide range of institutional and retail clients seeking alternative investment opportunities.

- Global Reach: Operates across more than 20 locations worldwide.

- Significant AUM: Managed $112 billion as of March 2025.

- Diverse Expertise: Covers various private market strategies.

- Client Attraction: Appeals to a broad spectrum of investors.

Intermediate Capital Group's (ICG) Strategic Equity and LP Secondaries businesses are clear Stars within its BCG Matrix. These segments have shown exceptional fundraising success, with the Strategic Equity Fund V raising $11 billion, exceeding its target. The firm's deep expertise in GP-led secondaries and LP portfolio acquisitions positions it to capitalize on the growing demand for liquidity in private markets.

ICG's European Corporate and Mid-Market strategies also shine as Stars. These core operations are fundamental to the firm's earnings, consistently attracting significant capital. By the end of September 2024, ICG's assets under management in Europe reached €46.7 billion, reflecting strong deployment and market penetration.

The firm's Senior Debt Partners fund, a recent $17 billion raise, further exemplifies a Star. This substantial capital infusion into European direct lending underscores investor confidence and ICG's leading position in a high-growth market segment.

ICG's overall global alternative asset management platform is a Star, managing $112 billion in AUM as of March 2025. This broad platform, with operations in over 20 locations, demonstrates ICG's capacity to attract diverse investors and deploy capital effectively across various private market strategies.

| Segment | Fundraising Success (Examples) | Market Position/Growth Drivers | AUM/Capital Raised (Recent) |

|---|---|---|---|

| Strategic Equity Fund V | Raised $11 billion (exceeded target) | GP-led secondaries, high growth segment | $11 billion |

| European Corporate & Mid-Market | €13.3 billion raised in H1 2024 | Market leadership, fragmented market | €46.7 billion (Europe AUM as of Sep 2024) |

| Senior Debt Partners | $17 billion raise | European direct lending, strong investor confidence | $17 billion |

| Global Alternative Asset Management | N/A (Platform-wide) | 20+ global locations, diverse strategies | $112 billion (AUM as of Mar 2025) |

What is included in the product

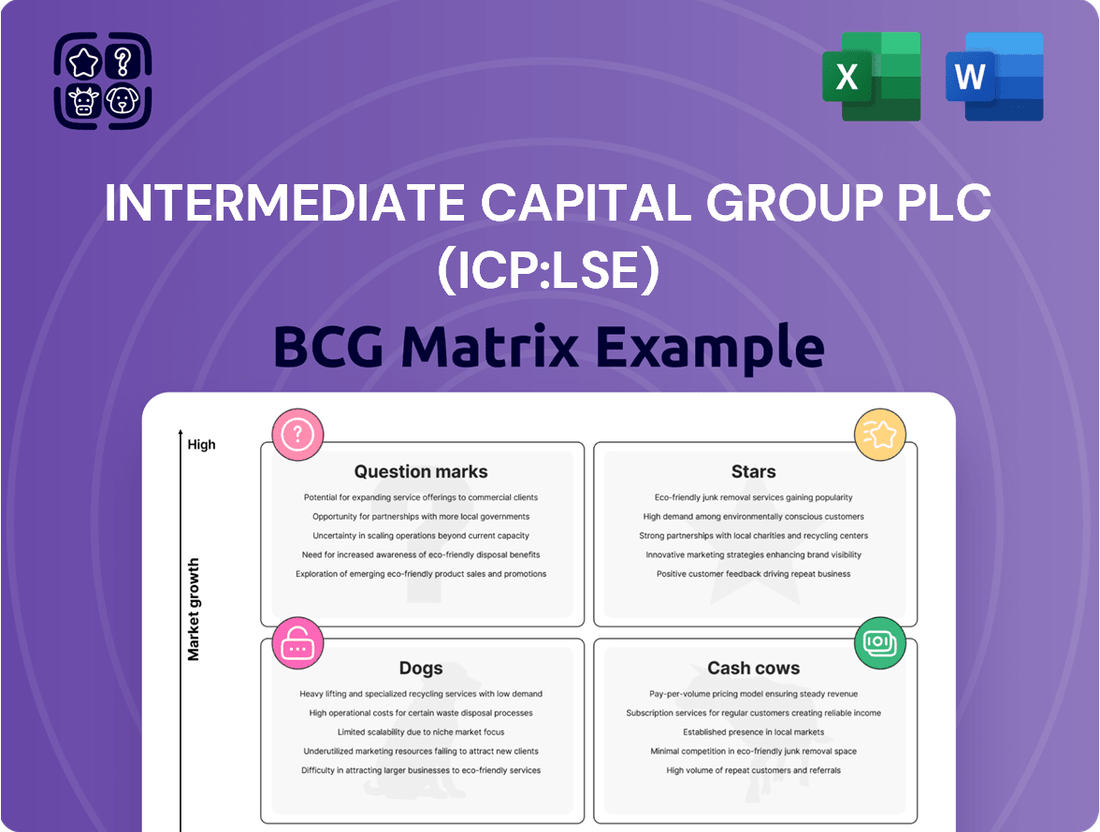

ICP's BCG Matrix analysis reveals a portfolio with potential Stars and Cash Cows, alongside units requiring strategic review.

The BCG Matrix for Intermediate Capital Group Plc (ICP:LSE) provides a clear visual roadmap, alleviating the pain of strategic uncertainty by identifying core business units and guiding resource allocation.

Cash Cows

Intermediate Capital Group's (ICG) established private debt portfolio, especially its senior debt funds, is a prime example of a Cash Cow. These mature strategies benefit from a strong market position, consistently delivering predictable income streams.

In 2024, ICG's Assets Under Management (AUM) in its Private Debt segment reached approximately £38.2 billion, reflecting the significant scale and maturity of this business. The consistent fee generation from these large, stable pools of capital underpins their Cash Cow status, providing a reliable foundation for the firm's overall financial performance.

Intermediate Capital Group Plc's (ICG:LSE) structured capital strategies represent a significant Cash Cow within its BCG Matrix. These strategies, a substantial component of ICG's fee-earning Assets Under Management (AUM), generate consistent and dependable income streams.

The stability of these Cash Cows stems from their well-established market positions and loyal client relationships, ensuring resilient revenue generation even in less dynamic market segments. As of the first half of 2024, ICG reported that its Fee Related Earnings (FRE) growth was driven by its strong performance in credit and capital solutions, which encompass structured capital.

Intermediate Capital Group Plc (ICG:LSE) benefits significantly from its long-tenured relationships with institutional clients, including major pension funds and insurance companies. These established partnerships are a cornerstone of ICG's business model, functioning as a key Cash Cow within its BCG Matrix.

These deep-rooted client connections translate into a consistent and predictable inflow of committed capital. For instance, as of the first half of 2024, ICG reported €77.5 billion in assets under management (AUM), a testament to the sustained trust and investment from its client base.

The stability provided by these relationships underpins ICG's financial performance through recurring management fees and performance-related income. This reliable revenue stream allows ICG to confidently allocate resources to growth initiatives while maintaining strong financial health.

Core Fund Management Fees

ICG's core fund management fees represent a significant Cash Cow, driven by its substantial fee-earning Assets Under Management (AUM). As of March 2025, this AUM stood at an impressive $75 billion.

This consistent income stream is a bedrock of ICG's financial performance, offering predictability and stability. These fees are typically calculated as a percentage of the committed capital or net asset value, making them a reliable revenue generator.

- Base Management Fees: A percentage of the $75 billion AUM as of March 2025.

- Resilience: Income is relatively stable, less susceptible to market volatility.

- Predictability: Forms a core, dependable revenue component for ICG.

Diversified Income Streams

Intermediate Capital Group Plc (ICP:LSE) demonstrates a Cash Cow profile, largely due to its exceptionally diversified income streams. The company actively generates revenue across multiple asset classes, including structured capital, private equity, private debt, credit, and real assets. This broad exposure significantly mitigates risk by lessening dependence on any single market segment, thereby fostering a stable and predictable profit generation engine.

This strategic diversification is a key driver of ICG's Cash Cow status. By operating across different financial sectors, ICG can weather market downturns in one area while capitalizing on opportunities in others. For instance, in 2024, ICG reported strong performance in its private debt strategies, which helped offset more challenging conditions in certain private equity markets.

- Diversified Revenue: ICG's income is not reliant on a single asset class, providing resilience.

- Stable Profitability: The spread across structured capital, private equity, private debt, credit, and real assets ensures consistent profit generation.

- Reduced Market Dependency: Diversification shields ICG from the volatility of any one specific market.

- Robust Financial Foundation: The multi-asset approach builds a strong base for sustained earnings.

ICG's established private debt and structured capital strategies are clear Cash Cows, generating consistent fee income from mature, well-positioned businesses. These segments benefit from strong market presence and long-standing client relationships, ensuring predictable revenue streams.

The firm's substantial Assets Under Management (AUM) in these areas, reaching approximately £38.2 billion in Private Debt and €77.5 billion total AUM as of H1 2024, highlight their scale and stability. This consistent fee generation, including Fee Related Earnings (FRE) growth driven by credit and capital solutions in 2024, forms a reliable financial foundation for ICG.

| Segment | Status | Key Drivers | 2024 Data Point |

|---|---|---|---|

| Private Debt | Cash Cow | Market position, predictable income | £38.2 billion AUM |

| Structured Capital | Cash Cow | Fee-earning AUM, client relationships | Contributed to FRE growth |

| Core Fund Management | Cash Cow | Large AUM, recurring fees | $75 billion AUM (March 2025) |

What You’re Viewing Is Included

Intermediate Capital Group Plc (ICP:LSE) BCG Matrix

The BCG Matrix for Intermediate Capital Group Plc (ICP:LSE) that you are previewing is the definitive report you will receive upon purchase, offering a comprehensive strategic overview. This document is not a sample but the actual, fully formatted analysis, ready for immediate application in your business planning. You can expect the same level of detail and professional presentation that will empower your strategic decision-making. This preview assures you that the purchased report is complete, accurate, and designed for impactful strategic insights into ICP's portfolio.

Dogs

Underperforming legacy assets within Intermediate Capital Group Plc's (ICG) portfolio represent older funds or investments situated in low-growth markets. These assets have consistently generated subpar returns with limited potential for future improvement, often due to failing to adapt to evolving market trends or operating within structurally declining sectors. Such holdings are a natural occurrence in a large, diversified investment firm like ICG.

Niche strategies with limited scalability, often categorized as Dogs in a BCG matrix, represent areas where Intermediate Capital Group Plc (ICG:LSE) might be investing resources without seeing substantial growth in Assets Under Management (AUM) or profitability. These strategies typically cater to very specific market segments or employ specialized investment approaches that haven't attracted widespread investor interest or demonstrated a clear path to expansion. For instance, a fund focused on a highly specialized micro-cap sector with limited deal flow might fall into this category.

As of the first half of 2024, ICG reported total AUM of €73.4 billion, a figure that reflects the success of its core strategies. However, within this vast portfolio, there could be smaller, less impactful strategies that are not contributing proportionally to this growth. For example, a strategy with less than €100 million in AUM that has seen minimal net inflows over the past two years, despite active management, would be a prime candidate for re-evaluation as a Dog.

Investments in stagnant real estate sub-sectors, like older office buildings or traditional retail spaces, could be considered Dogs within ICG's portfolio. These assets often face declining demand and limited growth potential, impacting their market share and profitability. For instance, the ongoing shift towards remote work has put pressure on traditional office occupancy rates. In 2024, vacancy rates in some major commercial real estate markets remained elevated, signaling continued challenges for these asset classes.

Credit Strategies with High Default Rates

Credit strategies with high default rates, often found in distressed debt or subprime lending, represent the 'Dogs' within a BCG Matrix framework for Intermediate Capital Group Plc (ICP:LSE). These segments typically demand significant capital for restructuring and workout processes, yet offer limited growth prospects and consistently underperform. For instance, in 2024, certain private credit funds focused on highly leveraged middle-market companies might exhibit default rates exceeding 10%, significantly higher than the average for more diversified credit portfolios.

These 'Dog' strategies are characterized by their persistent need for active management and capital infusion, often yielding negative or minimal returns on investment. They can tie up valuable resources that could otherwise be deployed in more promising growth areas of the business. For example, if a specific distressed debt portfolio within ICP's management experienced a 15% default rate in the first half of 2024, it would likely fall into this category.

- High Default Rates: Strategies with default rates consistently above 8% in 2024, particularly in sectors like unsecured consumer lending or highly cyclical industries.

- Resource Drain: These portfolios require substantial operational and legal resources for recovery, diverting attention from higher-potential investments.

- Low Growth Prospects: Limited opportunities for capital appreciation or market expansion in the underlying assets.

- Suboptimal Returns: Often deliver negative or near-zero returns after accounting for the costs of management and restructuring.

Non-Core, Divestment Candidates

In the context of Intermediate Capital Group Plc's (ICG) BCG Matrix, business units or product lines classified as Dogs represent those deemed non-core to the company's long-term strategy. These segments typically exhibit low market share and limited growth potential, prompting ICG to consider divestment. This strategic move aims to free up capital for reinvestment in higher-performing or more promising business areas.

For ICG, identifying and divesting Dog assets is crucial for optimizing resource allocation. By shedding these underperforming units, the firm can sharpen its focus on core competencies and growth opportunities. For instance, if ICG were to divest a legacy private equity fund with declining investor interest and limited deal flow, it would represent a classic Dog scenario.

- Divestment Rationale: Units with low profitability and minimal strategic alignment are prime candidates for divestment, allowing ICG to streamline operations.

- Capital Reallocation: Proceeds from divesting Dog assets can be channeled into strategic growth initiatives, such as expanding into new private debt markets or technology-driven investment platforms.

- Focus Enhancement: Removing non-core businesses sharpens ICG's overall strategic direction, enabling greater concentration on areas with higher potential returns.

Dogs in ICG's portfolio are strategies with low growth and low market share, often requiring significant resources without commensurate returns. These could include niche funds or legacy assets in declining sectors, such as older real estate properties. For example, a private credit fund with a 2024 default rate exceeding 10% would be a prime candidate for re-evaluation.

These underperforming segments, like specific distressed debt portfolios showing high default rates, drain capital and management attention. ICG's total AUM reached €73.4 billion in H1 2024, highlighting the need to prune less effective strategies.

Divesting these 'Dog' assets allows ICG to reallocate capital towards higher-growth areas, enhancing strategic focus. This streamlining is essential for optimizing resource allocation and improving overall portfolio performance.

For instance, a legacy private equity fund with declining investor interest and limited deal flow exemplifies a 'Dog' that ICG might consider divesting to free up capital for more promising ventures.

Question Marks

Intermediate Capital Group (ICG) is expanding its real assets portfolio with newer strategies, including a planned Infrastructure Asia fund. This move into infrastructure in a growing region like Asia signifies a strategic push into markets with significant long-term potential. These emerging strategies are positioned as potential future growth drivers for the firm.

While the real assets sector, particularly infrastructure, offers substantial growth prospects, ICG's foray into Asia represents a new frontier. These ventures are in potentially competitive landscapes, necessitating considerable capital outlay and strategic execution to establish a strong market presence and capture market share.

The ICG Core Private Equity fund, a recent addition to Intermediate Capital Group's offerings, is positioned as a Question Mark within the BCG matrix. This strategy is specifically tailored for wealth investors, aiming to tap into the burgeoning demand for alternative investments within this segment.

Launched to broaden ICG's footprint in the rapidly expanding wealth management sector, its market penetration and ultimate success remain uncertain. As of early 2024, the global alternative investment market for high-net-worth individuals is experiencing significant growth, with reports indicating a compound annual growth rate of over 10% in recent years, suggesting a favorable macro environment for such products.

First-time funds launched by Intermediate Capital Group (ICG) in entirely new geographic markets, such as their reported expansion into Real Estate Asia, represent significant strategic bets. These ventures are inherently question marks within the BCG framework, demanding substantial upfront capital for market penetration, regulatory navigation, and building investor confidence. For instance, establishing a presence in a market like India or Southeast Asia requires deep local understanding and robust distribution networks, mirroring the characteristics of a question mark needing careful nurturing.

Niche or Opportunistic Credit Strategies

While the private credit market remains robust, Intermediate Capital Group (ICG) may be exploring niche or opportunistic credit strategies. These could focus on emerging sectors with significant growth potential but also inherent higher risk. For instance, ICG might consider specialized lending in areas like decarbonization technology financing or supply chain resilience solutions, which require deep sector expertise and substantial capital to establish a foothold.

Such strategies are akin to 'Question Marks' in the BCG matrix, demanding careful evaluation. ICG's success in these areas will depend on its ability to accurately assess risk, build scalable platforms, and attract co-investors. The firm's existing infrastructure and investment acumen position it well to navigate these complexities, potentially unlocking attractive returns as these nascent markets mature.

- Emerging Sector Focus: Targeting high-growth but high-risk areas like green energy infrastructure debt or specialized technology financing.

- Capital Intensity: Requiring significant upfront investment to build expertise and market presence in new credit sub-sectors.

- Risk-Return Profile: Balancing the potential for outsized returns with the elevated risks associated with unproven markets and borrowers.

Investments in Early-Stage Technology within Portfolio Companies

Investments in early-stage technology within Intermediate Capital Group Plc's (ICP:LSE) portfolio companies represent a classic "Question Mark" in the BCG matrix. These ventures, while potentially offering substantial future growth, are characterized by high risk and limited current market penetration.

For instance, a portfolio company heavily invested in a nascent AI-driven diagnostic tool might fit this category. While the long-term market for AI in healthcare is projected to grow significantly, the specific technology's efficacy and market acceptance are still being established. ICG's exposure here means these investments could either become future stars or fail to gain traction, demanding careful monitoring and strategic support.

In 2024, the venture capital landscape saw continued interest in deep tech and AI, with global funding reaching hundreds of billions. However, early-stage tech companies often require substantial capital infusion for research, development, and market entry, amplifying the inherent risks associated with unproven technologies.

- High Growth Potential: Early-stage tech can revolutionize industries, offering exponential returns if successful.

- Significant Risk: Technological obsolescence, regulatory hurdles, and market adoption challenges are prevalent.

- Low Current Market Share: These ventures are typically in their infancy, with limited revenue and market presence.

- Strategic Importance: Such investments align with ICG's strategy to capture future market leaders, but require active management to de-risk and scale.

ICG's new wealth investor-focused private equity fund and its expansion into Asian real assets are classified as Question Marks. These initiatives target high-growth potential but face market uncertainty and require substantial capital for establishment.

Investments in early-stage technology, particularly in AI and deep tech, also fall into this category. While offering significant future returns, these ventures carry high risks due to unproven technologies and market adoption challenges.

The firm's exploration of niche credit strategies, such as financing decarbonization technology, are also Question Marks. These require deep sector expertise and capital to navigate evolving markets and associated risks.

These Question Mark strategies demand rigorous analysis and active management to convert their potential into market leadership and profitable growth.

BCG Matrix Data Sources

Our BCG Matrix for Intermediate Capital Group Plc is built on robust financial statements, industry growth forecasts, and competitor analysis to accurately position its business units.