Iamgold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

Navigate the complex external forces impacting Iamgold's operations. Our PESTLE analysis delves into the political stability of mining regions, economic fluctuations affecting commodity prices, and technological advancements in extraction. Understand how social license to operate and environmental regulations shape the company's strategy. Download the full version to gain actionable intelligence and secure your competitive advantage.

Political factors

IAMGOLD's operations in Burkina Faso and Canada are directly influenced by the political landscapes of these regions. Political stability and consistent mining policies are crucial for maintaining licenses, managing taxation, and ensuring uninterrupted operations. For instance, Burkina Faso's president has recently voiced concerns about potential permit withdrawals for non-compliant mining firms, underscoring the inherent risks associated with political shifts in operating jurisdictions.

IAMGOLD has emphasized its commitment to compliance and fostering a positive relationship with the Burkina Faso government, aiming to mitigate these political uncertainties. However, the company's reliance on these regions means that any significant political instability or adverse policy changes, such as unexpected tax increases or new regulatory burdens, could materially impact its financial performance and project timelines. The contrast between Canada's established regulatory framework and Burkina Faso's evolving political environment presents a key area of focus for risk management.

Changes in mining legislation and royalty structures directly affect IAMGOLD's operational costs and profit margins. For example, Burkina Faso's updated 2024 mining code is designed to boost state involvement and gold mining revenue, potentially increasing the company's financial outlays.

Global trade policies, including tariffs and import/export regulations, directly impact IAMGOLD's operational costs and market access. For instance, shifts in trade agreements between key gold-producing nations and major consuming markets can alter demand dynamics. The World Trade Organization (WTO) reported that global trade growth was projected to be 2.6% in 2024, a slight improvement from previous years, but still subject to geopolitical uncertainties.

Sanctions imposed on certain countries can disrupt supply chains for mining equipment and consumables, potentially increasing costs and lead times for IAMGOLD. Furthermore, international agreements related to resource extraction and taxation can influence the profitability of operations in various jurisdictions. Geopolitical tensions, such as ongoing conflicts or trade disputes, can create volatility in the gold price, a key factor for IAMGOLD's revenue.

IAMGOLD's commitment to international Environmental, Social, and Governance (ESG) standards is crucial. Adherence to frameworks like the UN Guiding Principles on Business and Human Rights and the Task Force on Climate-related Financial Disclosures (TCFD) is increasingly scrutinized by investors. For example, in 2023, the World Gold Council reported that ESG considerations were becoming a significant driver in investment decisions within the precious metals sector.

Security Risks in West Africa

IAMGOLD's operations in West Africa, particularly in Burkina Faso, face significant security risks stemming from terrorism and civil unrest. These volatile conditions can directly impact operational continuity and employee well-being, as evidenced by the ongoing security challenges in the Sahel region. For instance, the U.S. Department of State frequently issues travel advisories for Burkina Faso due to these risks, underscoring the heightened security concerns for businesses operating there.

While IAMGOLD cultivates a robust relationship with the local government to mitigate these threats, the inherent instability remains a persistent factor. Such security challenges can lead to increased operational costs, including security personnel and infrastructure, and pose a direct risk of project delays or stoppages. Investors closely monitor the geopolitical landscape in Burkina Faso, recognizing the potential for disruptions to IAMGOLD's mining activities.

- Terrorism and Civil Unrest: Burkina Faso has experienced a notable increase in terrorist attacks and internal conflicts in recent years, impacting various sectors, including mining.

- Operational Disruptions: Security incidents can force temporary shutdowns, hinder supply chain logistics, and necessitate costly security measures, affecting production targets.

- Employee Safety: Ensuring the safety of personnel in a high-risk environment is paramount and requires substantial investment in security protocols and training.

- Investor Perception: The ongoing security situation in Burkina Faso is a key consideration for investors evaluating the risk-reward profile of IAMGOLD's assets in the region.

Indigenous and Community Relations Policies

Government policies regarding Indigenous rights and community engagement significantly influence IAMGOLD's operations, particularly in Canada where its Côté Gold mine is situated on Treaty 9 territory. These policies dictate the framework for collaboration and impact assessment.

IAMGOLD's proactive approach to fostering meaningful partnerships and community investment is essential for its social license to operate. This commitment aligns with recognized industry standards, such as the Mining Association of Canada's Towards Sustainable Mining (TSM) Indigenous and Community Relationships Protocol.

- Treaty 9 Territory: IAMGOLD's Côté Gold project is located on land subject to Treaty 9 agreements in Ontario, Canada.

- TSM Protocol: The company adheres to the Mining Association of Canada's TSM protocol for Indigenous and Community Relationships, emphasizing collaboration and transparency.

- Community Investment: IAMGOLD's engagement includes direct community investment initiatives, aiming to create shared value with local and Indigenous communities.

Political stability in Burkina Faso remains a critical factor for IAMGOLD, as the government's mining policies, including the 2024 mining code, directly impact revenue and operational costs. Conversely, Canada offers a more stable regulatory environment, though evolving Indigenous rights policies require careful navigation.

Security concerns in Burkina Faso, driven by terrorism and civil unrest, pose significant operational risks, potentially leading to disruptions and increased security expenditures. These geopolitical tensions can also influence global gold prices, affecting IAMGOLD's revenue streams.

IAMGOLD's adherence to international ESG standards and its engagement with local communities, particularly Indigenous groups in Canada, are vital for maintaining its social license to operate and investor confidence.

The World Bank projected Sub-Saharan Africa's GDP growth at 3.4% for 2024, highlighting regional economic trends that can influence mining investment, while Canada's economic outlook for 2024 was around 1.5% GDP growth.

What is included in the product

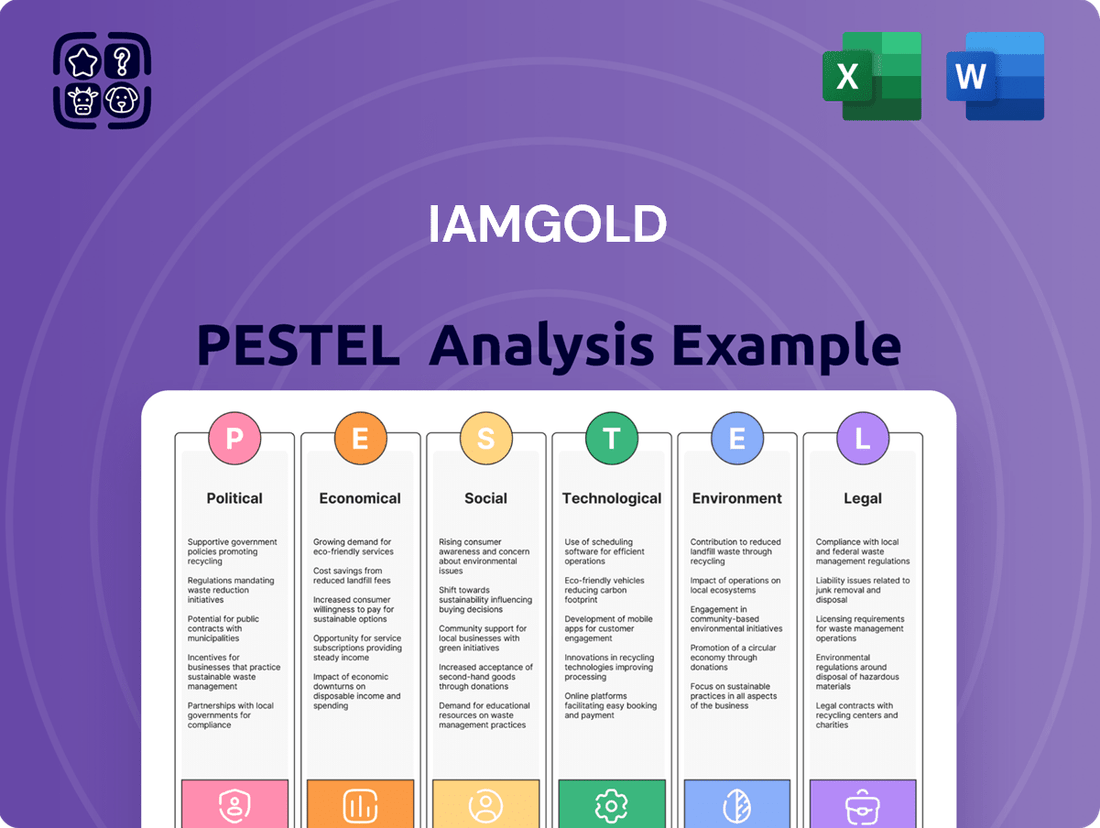

This PESTLE analysis examines the external macro-environmental factors impacting Iamgold across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces shape Iamgold's operational landscape and strategic decision-making.

Provides a concise version of Iamgold's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

The price of gold is a fundamental economic factor for IAMGOLD, directly influencing its revenue streams. In 2025, the gold market has demonstrated robust performance, with prices climbing above $3,400 per ounce. This upward trend presents a significant opportunity for the company.

However, this strong performance is accompanied by inherent volatility, which can create substantial fluctuations in IAMGOLD's profitability. The company's capacity to leverage these higher gold prices is paramount for its financial success.

It's important to note that past prepayment agreements have sometimes restricted IAMGOLD's ability to fully benefit from previous price surges, highlighting the strategic importance of managing such financial arrangements in the current market environment.

Rising operational costs, particularly for energy, labor, and essential supplies, present a significant challenge to IAMGOLD's profitability. These escalating expenses directly impact the company's bottom line, making efficient management crucial for sustained success.

IAMGOLD is actively pursuing cost optimization strategies, with a keen focus on its new Côté Gold mine. The expectation is that as Côté Gold stabilizes and ramps up production, its cash costs will trend downwards, enhancing overall operational efficiency and profitability.

IAMGOLD's capacity to fund its development initiatives, like the Côté Gold mine ramp-up, is a critical economic consideration. The company's financial health directly impacts its ability to bring new projects online and expand operations.

Effective management of capital expenditures is paramount for IAMGOLD to meet its production goals and ensure long-term expansion. This involves careful planning and execution of investments in mining infrastructure and technology.

For 2024, IAMGOLD anticipates Côté Gold will contribute significantly to its overall production, with the first full year of operation expected to yield substantial gold ounces, bolstering the company's output and revenue streams.

Currency Exchange Rates

Fluctuations in currency exchange rates significantly affect IAMGOLD's financial performance. As the company operates in multiple countries, the value of the Canadian dollar, West African CFA franc, and the US dollar (its reporting currency) directly influences its reported revenues and expenses. For instance, a stronger US dollar relative to the Canadian dollar can boost reported earnings when converting Canadian operations, but a weaker US dollar can have the opposite effect.

These currency movements can directly impact profit margins. If IAMGOLD's costs are incurred in a currency that strengthens against the US dollar, its expenses will rise in dollar terms, squeezing profitability. Conversely, if its revenues are generated in a currency that strengthens, this can provide a tailwind to earnings. For example, during the first quarter of 2024, IAMGOLD reported that currency impacts, combined with other factors, contributed to variances in its financial results, highlighting the sensitivity of its operations to these shifts.

- Impact on Revenue: A stronger local currency where IAMGOLD operates can decrease the US dollar value of sales.

- Impact on Costs: A weaker local currency can reduce the US dollar cost of operations and capital expenditures.

- Reporting Currency Sensitivity: IAMGOLD's reliance on the US dollar for reporting means that cross-currency translations are a constant consideration.

- Hedging Strategies: The company may employ hedging strategies to mitigate some of the risks associated with currency volatility, although these can also incur costs.

Access to Capital and Debt Management

IAMGOLD's financial health hinges on its ability to access capital and manage its debt. While the company has demonstrated liquidity, a substantial debt burden can create headwinds for its stock, even when operations are performing well.

As of the first quarter of 2024, IAMGOLD reported total debt of approximately $1.2 billion. This level of indebtedness requires careful management to ensure continued investment in its mining projects and to avoid impacting profitability through interest expenses.

- Debt Servicing: The company must consistently generate sufficient cash flow to meet its debt obligations, which can limit discretionary spending on exploration or expansion.

- Capital Markets Access: IAMGOLD's ability to raise additional funds through equity or debt offerings is crucial for funding future growth initiatives, but a high debt-to-equity ratio could make this more challenging and expensive.

- Interest Rate Sensitivity: Fluctuations in interest rates can directly impact the cost of servicing its existing debt and the terms of any new financing, potentially affecting financial performance.

- Liquidity Position: Maintaining adequate liquidity is paramount to navigate operational challenges and capitalize on market opportunities without being overly reliant on debt.

The price of gold is a primary economic driver for IAMGOLD, directly impacting its revenue. By mid-2025, gold prices have seen a notable increase, exceeding $3,400 per ounce. This favorable market condition offers IAMGOLD a significant opportunity to bolster its financial performance.

However, this market strength is also characterized by volatility, which can lead to substantial swings in IAMGOLD's profitability. The company's ability to capitalize on these elevated gold prices is critical for its financial success.

Rising operational costs, particularly for energy, labor, and key supplies, pose a considerable challenge to IAMGOLD's profitability. These increasing expenses directly affect the company's bottom line, making efficient cost management essential for sustained success.

IAMGOLD's financial health is closely tied to its access to capital and its debt management. As of the first quarter of 2024, the company reported total debt of approximately $1.2 billion, necessitating careful management to support project investments and mitigate interest expenses.

| Economic Factor | Impact on IAMGOLD | 2024/2025 Data/Trend |

|---|---|---|

| Gold Price | Directly influences revenue and profitability. | Prices surpassed $3,400/oz by mid-2025, showing robust performance but inherent volatility. |

| Operational Costs | Affects profit margins and overall efficiency. | Rising costs for energy, labor, and supplies are a challenge; Côté Gold ramp-up aims for cost reduction. |

| Currency Exchange Rates | Impacts reported revenues and expenses due to international operations. | Fluctuations affect profit margins; Q1 2024 results showed sensitivity to currency movements. |

| Access to Capital & Debt | Crucial for funding growth and managing operations. | $1.2 billion in total debt (Q1 2024) requires careful management; interest rate sensitivity is a factor. |

Preview the Actual Deliverable

Iamgold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—a comprehensive PESTLE analysis of Iamgold, detailing Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a deep dive into the external forces shaping Iamgold's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for stakeholders and investors alike.

Sociological factors

IAMGOLD places significant importance on building strong relationships with the communities where it operates, recognizing that this is crucial for maintaining its social license to operate. This proactive approach includes actively engaging with Indigenous communities through genuine partnerships and investing in local development initiatives to address their specific needs and concerns.

In 2024, IAMGOLD formalized its commitment to community support by establishing a Community Investment Standard. This standard mandates that at least 75% of its community investment spending be directed towards strategic priorities identified in collaboration with local stakeholders, ensuring impact and relevance.

IAMGOLD places a strong emphasis on health and safety, aiming for a 'Zero Harm' environment for its workforce and contractors. This commitment is central to its operations and corporate responsibility.

The company actively works to enhance its safety culture and performance year-on-year. For instance, IAMGOLD reported a reduction in its Total Recordable Injury Frequency Rate (TRIFR) during 2024, demonstrating tangible progress in its safety initiatives.

IAMGOLD's operational continuity hinges on robust labor relations and effective management of its approximately 3,700-strong global workforce. This necessitates a commitment to fair labor practices, ongoing employee development, and proactive resolution of potential disputes to ensure a stable and skilled team. For instance, in 2023, IAMGOLD reported a total recordable injury frequency rate of 0.76 per 200,000 hours worked, highlighting a focus on safety, a key component of good labor relations.

Local Employment and Economic Contribution

IAMGOLD plays a vital role in bolstering local economies by creating jobs and sourcing goods and services from nearby suppliers. In 2023, the company reported employing approximately 3,000 individuals directly, with a significant portion of these roles located in the communities where its mines operate. This direct employment not only provides livelihoods but also stimulates local spending and economic activity.

Beyond direct employment, IAMGOLD's commitment to community empowerment is evident in its strategic investments and local procurement practices. The company actively seeks to engage local businesses for its operational needs, thereby fostering broader economic development. For instance, in Côte d'Ivoire, IAMGOLD's Essakane mine reported spending over $70 million with local suppliers in 2023, directly benefiting Ivorian businesses.

- Job Creation: IAMGOLD directly employs thousands globally, with a substantial number in host communities.

- Local Procurement: The company prioritizes sourcing from local businesses, injecting capital into regional economies.

- Community Investment: IAMGOLD invests in social programs and infrastructure, aiming to enhance the quality of life for residents.

Human Rights and Supply Chain Due Diligence

IAMGOLD's commitment to human rights and supply chain due diligence is paramount, especially given its operations in regions like Burkina Faso, which are often conflict-affected or high-risk. The company actively conducts assessments to pinpoint and address potential issues such as forced labor and child labor within its extensive supply chains.

In 2023, IAMGOLD reported on its ongoing efforts to embed human rights considerations into its procurement processes. This includes supplier questionnaires and risk assessments designed to identify potential violations. For instance, their supplier code of conduct explicitly prohibits forced and child labor, aligning with international standards.

- Due Diligence Implementation: IAMGOLD conducts regular risk assessments of its suppliers, with a focus on identifying human rights risks in high-risk operational areas.

- Supplier Code of Conduct: The company enforces a supplier code of conduct that strictly prohibits forced labor and child labor, requiring suppliers to adhere to these principles.

- Mitigation Strategies: Where risks are identified, IAMGOLD implements mitigation strategies, which can include corrective action plans for suppliers or, in severe cases, termination of business relationships.

- Reporting and Transparency: The company aims for transparency in its human rights due diligence efforts, reporting on progress and challenges in its annual sustainability reports.

IAMGOLD's social license to operate is deeply intertwined with its community engagement and investment strategies. By prioritizing local development and establishing clear community investment standards, the company aims to foster positive relationships and ensure its operations benefit the areas where it works. For example, in 2024, IAMGOLD committed to directing at least 75% of its community investment spending towards locally identified strategic priorities.

The company's commitment extends to robust labor relations and a strong safety culture, aiming for zero harm. This focus is reflected in tangible improvements, such as a reported reduction in its Total Recordable Injury Frequency Rate (TRIFR) during 2024. IAMGOLD also emphasizes fair labor practices and employee development to maintain a stable and skilled workforce, as evidenced by its 2023 TRIFR of 0.76 per 200,000 hours worked.

Economically, IAMGOLD significantly contributes to local economies through job creation and local procurement. In 2023, the company directly employed approximately 3,000 individuals, many in host communities, and spent over $70 million with local suppliers in Côte d'Ivoire alone through its Essakane mine.

IAMGOLD also actively addresses human rights risks within its supply chains, particularly in high-risk regions. The company implements due diligence processes, including supplier questionnaires and risk assessments, and enforces a supplier code of conduct that prohibits forced and child labor, with mitigation strategies in place for identified risks.

| Sociological Factor | IAMGOLD Action/Data (2023/2024 Focus) | Impact/Significance |

|---|---|---|

| Community Relations | Established Community Investment Standard (2024): 75% of spending directed to local priorities. | Ensures community investments are relevant and impactful, strengthening social license. |

| Health & Safety Culture | Reported reduction in Total Recordable Injury Frequency Rate (TRIFR) in 2024. | Demonstrates commitment to workforce well-being and operational safety. |

| Labor Relations | Maintained a TRIFR of 0.76 per 200,000 hours worked (2023). | Highlights focus on safe working conditions and supports stable labor environment. |

| Economic Contribution (Local) | Employed ~3,000 globally (2023), with significant local presence. Spent >$70M with local suppliers (Essakane, 2023). | Directly boosts local economies through employment and procurement. |

| Human Rights Due Diligence | Supplier Code of Conduct prohibits forced/child labor; ongoing risk assessments. | Mitigates human rights risks in supply chains, especially in high-risk areas. |

Technological factors

IAMGOLD's Côté Gold project exemplifies the transformative power of automation, featuring a fully automated haulage fleet. This technological leap is designed to boost operational efficiency and cut costs, directly impacting profitability.

The integration of such advanced technologies is crucial for modern mining, enabling higher throughput and safer working environments. This strategic modernization is a key driver for IAMGOLD in optimizing its production capabilities.

IAMGOLD leverages cutting-edge exploration technologies and sophisticated software to pinpoint new gold deposits and enhance the delineation of its existing reserves. This proactive approach to resource identification is critical for ensuring the company's long-term viability and expansion.

The company's commitment to continuous investment in exploration technology directly fuels its resource sustainability and growth trajectory. For instance, the successful delineation of the Côté Gold project's significant gold resources, estimated at 10.0 million ounces in the Measured and Indicated categories as of year-end 2023, highlights the effectiveness of these advanced techniques.

IAMGOLD is actively pursuing energy efficiency and renewable energy integration to cut costs and lessen its environmental footprint. The company is crafting specific energy and emissions strategies for each of its operational sites. This proactive approach targets reductions in both energy consumption and overall emissions.

Data Analytics and Operational Optimization

IAMGOLD is increasingly leveraging data analytics to refine its mining operations. This focus aims to boost efficiency and reduce costs by predicting equipment maintenance needs and optimizing extraction processes. For example, by analyzing vast datasets from its mines, the company can identify patterns that lead to better resource allocation and fewer unexpected downtimes, directly impacting profitability.

A key initiative for IAMGOLD, with plans extending into 2025-2026, involves establishing comprehensive energy management information systems. These systems are crucial for monitoring and controlling energy consumption across all mining sites. By gaining granular insights into energy usage, IAMGOLD can implement targeted strategies to reduce its carbon footprint and operational expenses, a critical factor in the current economic climate.

- Predictive Maintenance: Implementing data-driven models to forecast equipment failures, thereby reducing costly unscheduled downtime.

- Operational Efficiency: Utilizing analytics to optimize drilling, blasting, and hauling cycles, leading to higher throughput.

- Energy Management: Establishing systems to track and manage energy consumption, targeting a reduction in both environmental impact and operational costs.

- Resource Optimization: Employing data analysis to improve the accuracy of ore body modeling and mine planning, maximizing resource recovery.

Tailings Management and Water Treatment Technologies

IAMGOLD is actively investing in advanced technologies for tailings management and water treatment to address environmental concerns and meet stringent regulations. For instance, in 2023, the company reported progress on its water management framework, aiming to optimize water use across its operations. This includes exploring innovative solutions like passive water treatment infrastructure, which can significantly reduce operational costs and environmental footprint.

The company's commitment to technological advancement in this area is crucial for sustainability. By adopting cutting-edge methods, IAMGOLD seeks to not only comply with environmental standards but also to set new benchmarks. This focus on innovation is particularly important given the increasing global scrutiny on mining's environmental impact, with many jurisdictions tightening regulations around water discharge and waste disposal.

IAMGOLD's efforts in water management are aligned with industry trends that emphasize circular economy principles within mining. This involves:

- Implementing advanced filtration and dewatering technologies for tailings, reducing water content and improving storage stability.

- Exploring the use of recycled water in processing operations to minimize freshwater intake.

- Investing in research and development for novel water treatment methods, such as bioremediation, to handle complex contaminants.

- Deploying real-time monitoring systems to track water quality and manage discharges effectively.

IAMGOLD's adoption of automated haulage at Côté Gold, a significant project, underscores a commitment to technological advancement for efficiency and cost reduction. This automation is a key element in optimizing production, aiming for higher throughput and improved safety, crucial for competitiveness in the 2024-2025 mining landscape.

The company is also heavily invested in leveraging data analytics for predictive maintenance and operational optimization. By analyzing vast datasets, IAMGOLD aims to minimize unscheduled downtime and enhance extraction processes, directly impacting profitability. This data-driven approach is central to their strategy for the upcoming years.

Furthermore, IAMGOLD is prioritizing energy efficiency and renewable energy integration, with specific strategies being developed for its sites through 2025-2026. This focus on reducing energy consumption and emissions is vital for both cost management and environmental stewardship, aligning with evolving industry standards.

Technological advancements are also critical in IAMGOLD's tailings and water management strategies. Implementing advanced filtration and exploring recycled water use are key initiatives to meet stringent environmental regulations and promote circular economy principles within their operations.

Legal factors

IAMGOLD's operations are heavily influenced by a complex web of national and local mining laws and regulations across its key jurisdictions, particularly Canada and West Africa. Failure to comply with these mandates, including obtaining and maintaining necessary permits, can result in severe penalties such as substantial fines, temporary or permanent operational shutdowns, and even the revocation of essential mining licenses.

The company has publicly stated its commitment to operating in compliance with all applicable permits in Burkina Faso, where it operates the Essakane mine. For instance, in 2023, Essakane produced 389,000 ounces of gold, underscoring the operational scale and the critical need for regulatory adherence to sustain such output. Navigating these legal frameworks is paramount to IAMGOLD's continued ability to extract resources and generate revenue.

Iamgold must rigorously adhere to environmental legislation concerning water usage, air emissions, and land reclamation. Failure to comply can result in significant fines and operational disruptions, impacting profitability and reputation.

Securing and retaining environmental permits for all operational sites and expansion initiatives is a continuous legal obligation. For instance, as of early 2024, the company was navigating permit renewals for its Côté Gold project in Canada, a process involving detailed environmental impact assessments and stakeholder consultations.

IAMGOLD must rigorously adhere to health and safety legislation across all its operating regions, a critical factor for worker protection and avoiding legal repercussions. This includes compliance with regulations like the Occupational Safety and Health Act (OSHA) in the United States, and similar frameworks globally, which dictate standards for workplace safety and hazard mitigation. For instance, in 2023, the mining industry globally saw a continued focus on reducing lost-time injury frequency rates (LTIFR), with companies striving for single-digit figures, reflecting the ongoing pressure to meet and exceed safety benchmarks.

Corporate Governance and Reporting Standards

IAMGOLD operates under strict corporate governance and financial reporting standards mandated by Canadian and U.S. regulatory bodies, including stock exchanges. These regulations ensure transparency and accountability in their operations and disclosures. For instance, IAMGOLD's 2024 Sustainability Report details their commitment to transparent reporting on Environmental, Social, and Governance (ESG) practices, a key area of focus for investors and regulators alike.

Compliance with these legal frameworks is critical for maintaining investor confidence and market access. This includes adherence to accounting principles and disclosure requirements that shape how the company communicates its financial performance and operational impacts. The company's adherence to these standards is regularly reviewed by auditors and regulatory agencies.

Key legal factors influencing IAMGOLD include:

- Compliance with Canadian Securities Administrators (CSA) regulations and U.S. Securities and Exchange Commission (SEC) rules.

- Adherence to International Financial Reporting Standards (IFRS) for financial reporting.

- Fulfilling disclosure obligations regarding material changes and operational risks.

- Meeting ESG reporting guidelines as outlined in their sustainability reports, reflecting growing legal and stakeholder expectations.

Contractual Obligations and Joint Venture Agreements

Iamgold's operations are deeply influenced by contractual obligations, particularly within its joint ventures. A prime example is the Côté Gold mine, a significant undertaking with Sumitomo Metal Mining Co. Ltd. Navigating these agreements and proactively managing any potential disputes forms a critical legal layer for the company.

These contractual frameworks dictate operational responsibilities, revenue sharing, and decision-making processes, all of which require meticulous legal oversight. In 2023, Iamgold reported that the Côté Gold project, a 70%-owned joint venture with Sumitomo Metal Mining, was progressing towards its first gold pour, underscoring the importance of these agreements in achieving operational milestones.

- Joint Venture Governance: Iamgold's Côté Gold mine operates under a joint venture agreement with Sumitomo Metal Mining, requiring adherence to specific terms and conditions.

- Dispute Resolution: The company must have robust legal mechanisms in place to manage and resolve any contractual disagreements that may arise from these partnerships.

- Regulatory Compliance: Ensuring all joint venture activities comply with relevant mining and corporate laws in the operating jurisdictions is a constant legal imperative.

IAMGOLD's legal landscape is defined by strict adherence to mining, environmental, health, and safety regulations across its global operations, particularly in Canada and West Africa. Non-compliance can lead to significant financial penalties, operational halts, and license revocations. For instance, in 2023, the company’s Essakane mine in Burkina Faso produced 389,000 ounces of gold, highlighting the scale of operations dependent on sustained legal compliance.

The company also faces rigorous corporate governance and financial reporting standards, including those from the Canadian Securities Administrators and the U.S. SEC, necessitating transparent ESG reporting. Joint venture agreements, such as the one for the Côté Gold mine with Sumitomo Metal Mining, add another layer of legal complexity, requiring careful management of contractual obligations and dispute resolution.

| Legal Factor | Description | 2023/2024 Relevance |

| Mining Laws | Compliance with permits, licenses, and operational regulations in Canada and West Africa. | Essakane mine production of 389,000 oz gold in 2023 underscores operational scale and compliance needs. |

| Environmental Regulations | Adherence to legislation on water, air emissions, and land reclamation. | Navigating permit renewals for Côté Gold project in early 2024 involved detailed environmental impact assessments. |

| Health & Safety | Meeting global workplace safety standards to protect workers and avoid legal issues. | Industry focus in 2023 on reducing lost-time injury frequency rates to single digits. |

| Corporate Governance | Compliance with CSA and SEC rules, including transparent ESG reporting. | IAMGOLD's 2024 Sustainability Report details ESG commitments, a key focus for investors and regulators. |

| Contractual Obligations | Managing joint venture agreements, like Côté Gold with Sumitomo Metal Mining. | Côté Gold project, a 70%-owned JV, progressed towards its first gold pour in 2023, highlighting agreement importance. |

Environmental factors

IAMGOLD is actively addressing climate change by focusing on reducing its greenhouse gas (GHG) emissions. The company has established clear goals, aiming for a 30% absolute reduction in Scope 1 and 2 emissions by 2030, referencing a 2021 baseline.

This commitment extends to an aspirational target of achieving net-zero emissions by 2050, demonstrating a long-term strategy for environmental stewardship in its mining operations.

IAMGOLD's mining operations are inherently water-intensive, making effective water management crucial. The company acknowledges its reliance on water and the potential impact on local resources, particularly in areas facing scarcity.

The company is actively developing a comprehensive water management framework. This initiative aims to reduce overall water consumption and minimize the environmental footprint of its operations, especially in regions like Burkina Faso where its Essakane mine is located and water stress is a significant concern.

For instance, at the Essakane mine, IAMGOLD has been implementing strategies to improve water efficiency. In 2023, the company reported progress in its water stewardship efforts, though specific reduction targets and achievements related to water scarcity mitigation are continuously being refined as part of its ongoing environmental, social, and governance (ESG) commitments.

IAMGOLD's mining operations inherently interact with local ecosystems, posing risks to biodiversity. The company is actively engaged in minimizing these impacts through dedicated land management strategies and comprehensive reclamation projects. For instance, their goal is to achieve a net-positive impact on biodiversity at select operational sites by 2025, reflecting a commitment to environmental stewardship beyond mere mitigation.

Tailings and Waste Management

Properly managing mining waste, especially tailings, is a major environmental challenge for Iamgold. The company is actively developing strategies to address this, focusing on long-term sustainability. This includes implementing passive water treatment systems, which aim to lower ongoing maintenance needs and enhance environmental performance.

Iamgold's commitment to responsible waste management is crucial for its operational license and public perception. For instance, in 2023, the company reported ongoing investments in environmental initiatives, though specific figures for tailings management upgrades were not detailed in their latest public disclosures. The focus on passive treatment suggests a move towards more cost-effective and environmentally sound solutions.

- Environmental Stewardship: Iamgold prioritizes minimizing the environmental impact of its operations, particularly concerning tailings.

- Passive Water Treatment: The company is exploring and implementing passive water treatment infrastructure to reduce long-term maintenance burdens.

- Operational Efficiency: These initiatives are designed to improve environmental outcomes while also potentially lowering operational costs related to waste management.

Energy Consumption and Renewable Energy Adoption

IAMGOLD's environmental impact is significantly tied to its energy consumption across its mining operations. The company is actively engaged in evaluating its energy usage patterns and pinpointing opportunities for decarbonization. This includes a strategic focus on transitioning towards energy sources with lower emissions or embracing renewable energy alternatives.

In 2023, IAMGOLD reported that its Scope 1 and Scope 2 greenhouse gas (GHG) emissions were approximately 1.05 million tonnes of CO2 equivalent. The company has set targets to reduce these emissions, aiming for a 30% reduction in absolute Scope 1 and 2 GHG emissions by 2030 compared to a 2022 baseline. This commitment underscores a growing emphasis on integrating sustainable energy practices into their operational framework.

- Energy Efficiency Initiatives: IAMGOLD is implementing measures to improve energy efficiency at its sites, such as optimizing grinding circuits and upgrading equipment.

- Renewable Energy Projects: The company is exploring and developing projects for renewable energy integration, including solar power installations at some of its mines.

- Decarbonization Strategy: IAMGOLD's strategy involves a phased approach to reduce reliance on fossil fuels, with a long-term vision for a lower-carbon operational footprint.

- Reporting and Transparency: The company is committed to transparently reporting its environmental performance, including energy consumption and GHG emissions, to stakeholders.

IAMGOLD is actively working to reduce its environmental footprint, with a focus on greenhouse gas (GHG) emissions and water management. The company has set ambitious targets, including a 30% absolute reduction in Scope 1 and 2 emissions by 2030 from a 2022 baseline, and aims for net-zero by 2050.

Water scarcity is a key concern, particularly at its Essakane mine in Burkina Faso, prompting the development of a comprehensive water management framework to reduce consumption and environmental impact.

Biodiversity and waste management, especially tailings, are also priorities, with initiatives like net-positive biodiversity impact goals by 2025 and the implementation of passive water treatment systems for waste. These efforts are crucial for operational sustainability and maintaining a positive public image.

| Environmental Factor | IAMGOLD's Approach | Key Targets & Data (as of latest available, typically 2023/2024) |

| GHG Emissions | Reducing Scope 1 & 2 emissions through energy efficiency and renewable energy exploration. | Target: 30% absolute reduction by 2030 (vs. 2022 baseline). 2023 emissions: ~1.05 million tonnes CO2e. |

| Water Management | Developing comprehensive framework to reduce water consumption and impact, especially in water-stressed regions. | Focus on improving water efficiency at sites like Essakane. Ongoing refinement of reduction targets. |

| Biodiversity | Minimizing impact through land management and reclamation projects. | Goal: Net-positive impact on biodiversity at select sites by 2025. |

| Waste Management (Tailings) | Implementing strategies for long-term sustainability, including passive water treatment systems. | Focus on cost-effective and environmentally sound waste solutions. Ongoing investments in environmental initiatives. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for IAMGOLD is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry analysis firms. We draw insights from economic reports, environmental regulations, technological advancements, and geopolitical developments to provide a comprehensive view.