Iamgold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

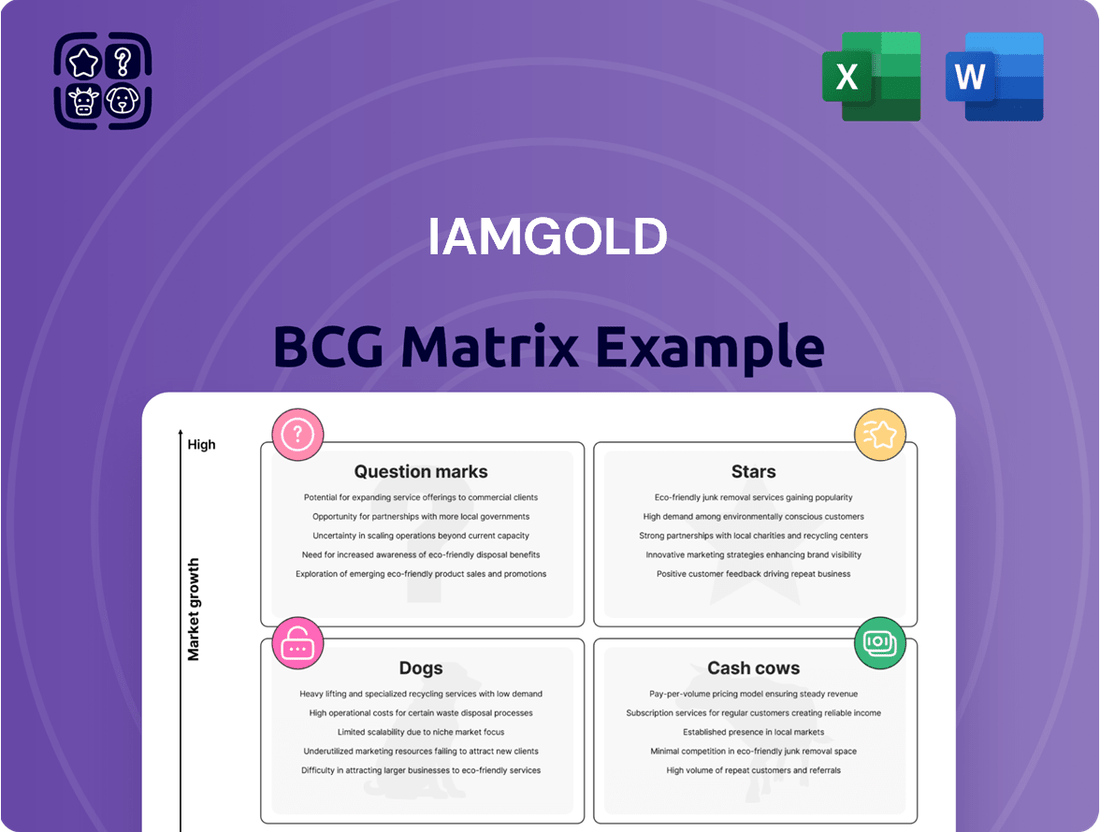

IAMGOLD's current product portfolio is a dynamic mix, with some assets showing strong growth potential and others generating stable returns. Understanding their placement within the BCG Matrix is crucial for informed investment decisions.

This preview offers a glimpse into their strategic positioning, but for a complete picture of their Stars, Cash Cows, Dogs, and Question Marks, you need the full analysis. Purchase the complete BCG Matrix to unlock detailed quadrant placements and actionable insights that will guide your next strategic moves.

Stars

The Côté Gold Mine, a major growth engine for IAMGOLD, began production in March 2024 and reached commercial production by August 2024. This facility is a prime example of a star asset within the company's portfolio, showing substantial upward momentum.

Production is slated to double in 2025 as the mine efficiently ramps up to its target throughput of 36,000 tonnes per day, a milestone expected by the fourth quarter of 2025. This aggressive expansion trajectory highlights Côté Gold's status as a critical asset with considerable growth prospects.

IAMGOLD is positioned for substantial growth, with analysts forecasting an impressive annual revenue increase of 22.7%. This upward trajectory is significantly bolstered by the anticipated ramp-up of its Côté Gold project, a key driver for expanding its market presence.

This robust growth outlook suggests IAMGOLD is capitalizing on favorable market conditions within the gold sector. The company’s strategic investments, particularly in Côté Gold, are expected to translate into a stronger competitive standing and a larger share of the global gold market.

The Côté Gold mine is poised to become a significant player, projected to be among Canada's largest operating gold mines upon reaching full production. This strategic asset, located in a low-risk jurisdiction, positions IAMGOLD for enhanced market influence within the Canadian gold sector.

Gosselin Zone Exploration and Resource Expansion

The Gosselin zone, situated right next to the Côté Gold deposit, is showing promising signs of growth. Ongoing exploration and drilling efforts are successfully identifying further gold mineralization, which is great news for Iamgold.

This expansion of resources is key to potentially boosting the overall reserve base and extending the operational life of the Côté Gold complex. This directly supports the company's long-term growth strategy.

- Resource expansion at Gosselin zone continues to uncover gold mineralization.

- Drilling programs are focused on delineating extensions adjacent to the Côté Gold deposit.

- Potential exists to increase the overall reserve base and extend mine life for the Côté Gold complex.

- This expansion contributes to Iamgold's long-term growth objectives.

Strong Attributable Production Increase

IAMGOLD experienced a significant boost in its production capabilities in 2024. The company saw a notable 43% jump in its attributable gold production, reaching an impressive 667,000 ounces for the year.

This surge was largely driven by the successful and efficient ramp-up of operations at the Côté Gold mine. This achievement highlights IAMGOLD's strategic execution and its capacity to expand output, positioning it more strongly within the competitive gold market.

- Attributable Gold Production Increase (2024): 43%

- Total Attributable Gold Production (2024): 667,000 ounces

- Key Growth Driver: Côté Gold mine ramp-up

The Côté Gold Mine is IAMGOLD's prime star asset, having commenced production in March 2024 and achieving commercial production by August 2024. Its production is set to double in 2025 as it ramps up to 36,000 tonnes per day by Q4 2025. This growth is expected to drive a 22.7% annual revenue increase for IAMGOLD, solidifying its market position.

| Asset | Status | Production (2024 Attributable) | Growth Potential |

|---|---|---|---|

| Côté Gold Mine | Star | Significant contribution to 667,000 ounces (+43% YoY) | Doubling production in 2025, resource expansion at Gosselin zone |

What is included in the product

This BCG Matrix analysis categorizes Iamgold's business units, guiding strategic decisions on investment, divestment, and resource allocation.

The Iamgold BCG Matrix offers a clear, visual breakdown of their portfolio, alleviating the pain of uncertainty by pinpointing strategic growth opportunities.

Cash Cows

The Essakane mine in Burkina Faso stands as a cornerstone of IAMGOLD's portfolio, demonstrating remarkable consistency. In 2024, it surpassed expectations, yielding 409,000 attributable ounces of gold, a testament to its robust operational performance.

This significant output makes Essakane a critical contributor to IAMGOLD's overall gold production. As a mature asset in a stable market, its reliable performance solidifies its position as a cash cow, generating substantial and predictable revenue for the company.

IAMGOLD's mine-site free cash flow was robust in Q1 2025, reaching $139.6 million. This figure highlights the company's ability to generate substantial cash from its mining operations.

This strong cash generation is a key indicator of IAMGOLD's operational efficiency and the profitability of its mine sites. It provides the company with the financial flexibility to pursue various strategic objectives.

The generated free cash flow can be deployed for reinvestment into existing or new projects, strengthening the company's asset base and future growth prospects. It also allows for effective debt management and the potential to return value to shareholders.

The Westwood mine in Canada has demonstrated a remarkable turnaround, a key factor in IAMGOLD's financial performance. In 2024, this operation generated a substantial $94.4 million in mine-site free cash flow.

This significant cash generation highlights the mine's enhanced operational efficiency and its capacity to be a strong contributor to the company's overall cash position, even as it operates in a more mature phase.

High All-in Sustaining Costs Management

Iamgold's established mines, such as Essakane and Westwood, are demonstrating effective cost management strategies. Despite general cost escalations, these mature operations have strived to keep their cash costs and all-in sustaining costs (AISC) within their projected guidance. This focus on controlling expenses in these core assets is crucial for sustaining healthy profit margins and ensuring consistent cash flow generation.

For instance, in 2024, Essakane reported AISC within its expected range, contributing significantly to Iamgold's overall financial stability. Similarly, Westwood's cost performance in 2024 has shown resilience, reflecting the company's commitment to operational efficiency even in its more established assets. This disciplined approach to managing costs at these mines underpins their role as cash cows within the company's portfolio.

- Essakane's AISC in 2024 remained within guidance, supporting its cash cow status.

- Westwood also demonstrated cost control efforts in 2024, contributing to stable cash flow.

- Effective management of sustaining costs in mature mines is vital for maintaining profitability.

- These cost-conscious operations are key to Iamgold's ability to generate consistent cash.

Record Revenues from Gold Sales

IAMGOLD's performance in the first quarter of 2025 highlights its robust gold operations. The company reported record revenues totaling $477.1 million during this period. This impressive figure was primarily fueled by strong gold sales volumes and a beneficial average realized gold price.

These high revenue figures from IAMGOLD's active mines clearly position them as significant cash cows within the company's portfolio. Their consistent ability to generate substantial income underscores their maturity and established market presence.

- Record Q1 2025 Revenues: IAMGOLD generated $477.1 million in revenue.

- Key Drivers: Strong gold sales volumes and a favorable average realized gold price contributed to this record.

- Cash Cow Status: The high revenue generation from operating mines signifies their role as reliable cash cows.

IAMGOLD's established mines, like Essakane and Westwood, are performing strongly as cash cows. Essakane produced 409,000 attributable ounces in 2024, exceeding expectations and highlighting its consistent contribution. Westwood also showed resilience, generating $94.4 million in mine-site free cash flow in 2024, demonstrating an operational turnaround.

These mature assets benefit from effective cost management, with Essakane's All-in Sustaining Costs (AISC) remaining within guidance in 2024, reinforcing their reliable profitability. The company's overall mine-site free cash flow reached $139.6 million in Q1 2025, underscoring the strong cash generation capabilities of these core operations.

| Mine | 2024 Attributable Gold Production (ounces) | 2024 Mine-Site Free Cash Flow | Q1 2025 Mine-Site Free Cash Flow (Company Total) | 2024 AISC (within guidance) |

|---|---|---|---|---|

| Essakane | 409,000 | N/A | N/A | Yes |

| Westwood | N/A | $94.4 million | N/A | Yes |

| IAMGOLD (Total) | N/A | N/A | $139.6 million | N/A |

Delivered as Shown

Iamgold BCG Matrix

The Iamgold BCG Matrix you are previewing is the identical, fully polished document you will receive upon purchase. This comprehensive analysis, meticulously crafted to illuminate Iamgold's strategic positioning, will be delivered to you without any watermarks or placeholder content. You can confidently expect the exact same detailed breakdown of their business units, ready for immediate integration into your strategic planning or presentation needs.

Dogs

IAMGOLD has strategically shed non-core assets, including its Rosebel interests and West African exploration assets like Bambouk. These divestitures, with transactions finalized in 2023 and 2024, indicate a focus on optimizing capital allocation by offloading assets that were not delivering sufficient returns.

While IAMGOLD's Essakane and Westwood mines are currently strong gold producers, they are not without their challenges. Both operations are experiencing rising operational costs. For Essakane, located in Burkina Faso, this includes increased local expenses and significant security costs, which are a growing concern in the region.

These escalating costs, if they outpace production gains or favorable gold price movements, pose a risk to the long-term profitability of these assets. Should these cost pressures continue to mount without corresponding revenue increases, these mines could transition into the 'dog' category of the BCG matrix, meaning they could start consuming more cash than they generate.

IAMGOLD's legacy gold prepay obligations are a significant factor in its BCG matrix, specifically impacting its cash flow. In the first quarter of 2025, the company fulfilled 37,500 ounces under these agreements.

These prepayments are a drag because they require IAMGOLD to sell gold at prices considerably lower than current market rates. This discount means the company is essentially locking in future gold sales at unfavorable terms, which limits its potential revenue and cash generation.

Westwood Production Decrease in Q1 2025

Westwood's attributable gold production saw a notable dip in Q1 2025, reaching 24,000 ounces. This is a decrease from the 32,000 ounces produced in the first quarter of 2024. While 2024 was a strong year for the mine, this downward trend warrants attention.

This production decline, if it persists, could signal that Westwood is entering a mature phase within its life cycle. Assets in this stage often experience lower growth and a smaller market share unless strategic interventions are implemented. The BCG matrix would likely place Westwood in the 'dog' category if this trend continues without a clear turnaround strategy.

- Q1 2025 Attributable Gold Production: 24,000 ounces

- Q1 2024 Attributable Gold Production: 32,000 ounces

- Production Change: -25%

- Potential BCG Matrix Classification: Dog (if trend persists)

Risk of Operational Challenges in West Africa

Operating in West Africa, especially in regions like Burkina Faso where Iamgold's Essakane mine is located, exposes the company to significant geopolitical and security risks. These factors can directly impact operational stability and increase costs, potentially affecting profitability.

While Essakane has historically been a strong performer, its classification within the BCG matrix is sensitive to these external pressures. For instance, in 2023, Essakane produced 364,000 ounces of gold, contributing significantly to Iamgold's overall output. However, any escalation in regional instability or a substantial rise in security-related expenditures could erode its profitability.

- Essakane's 2023 gold production: 364,000 ounces.

- Geopolitical risks in Burkina Faso: Ongoing security concerns and potential for operational disruptions.

- Impact on profitability: Increased security costs or operational interruptions could shift Essakane's position from a potential star or cash cow to a dog.

- Sensitivity to external factors: The mine's performance is highly dependent on maintaining a stable operating environment.

IAMGOLD's Westwood mine, with a 25% drop in attributable gold production from 32,000 ounces in Q1 2024 to 24,000 ounces in Q1 2025, faces potential classification as a dog. This decline, coupled with rising operational costs at Essakane, could signal a shift towards assets that consume more cash than they generate.

The company's legacy gold prepay obligations also strain cash flow, forcing sales at below-market rates. If these cost pressures and production challenges persist without strategic intervention, both Westwood and potentially Essakane could be categorized as dogs in the BCG matrix.

Essakane's 2023 production of 364,000 ounces highlights its past strength, but ongoing geopolitical risks in Burkina Faso and rising security costs pose a threat to its profitability. These factors could push it into the dog category if they significantly impact its cash generation.

| Asset | Q1 2024 Production (oz) | Q1 2025 Production (oz) | Change (%) | BCG Matrix Risk |

| Westwood | 32,000 | 24,000 | -25% | Dog (if trend continues) |

| Essakane | N/A (364,000 in 2023) | N/A | N/A | Dog (due to rising costs & risks) |

Question Marks

IAMGOLD's early-stage exploration projects, like those at Nelligan and other targets in the Côté district of Canada, are positioned as potential future growth drivers. These ventures are characterized by their high potential but currently hold a small market share within the company's overall portfolio.

Significant capital investment is necessary to advance these projects through exploration and development phases, a key characteristic of 'Question Marks' in the BCG matrix. For instance, IAMGOLD has outlined substantial exploration budgets for its Canadian assets, with a focus on de-risking these early-stage opportunities.

The Gosselin zone, situated right next to the Côté Gold deposit, holds promising inferred and indicated resources. However, it's still in the early stages, with ongoing drilling to better define and convert these resources.

While Gosselin shows potential, it’s considered a question mark for Iamgold's BCG Matrix. Significant investment is needed to bring it from a resource stage to a fully operational and producing part of the Côté complex, meaning it won't contribute immediate cash flow.

Côté Gold, a key asset for IAMGOLD, is navigating its ramp-up phase with a clear objective: achieving operational stability and consistent throughput. The focus remains on refining maintenance strategies to proactively address wear and tear, a critical aspect for long-term asset health.

Despite positive momentum, sustaining a 90% throughput rate in late 2024 proved challenging due to ramp-up related issues. This highlights Côté Gold's significant growth potential but also underscores its current status as a cash-intensive operation requiring substantial management focus to reach its full operational and financial stride.

Need for Continued Capital Investment in Development

IAMGOLD's strategic positioning, particularly concerning its Côté Gold project, highlights the critical need for ongoing capital investment. The company's 2025 guidance forecasts sustaining capital costs at $290 million, with an additional $20 million earmarked for expansion capital. This significant reinvestment is essential for Côté Gold to achieve its full production potential and to fuel future exploration endeavors.

This continuous capital requirement, a hallmark of businesses needing substantial funding to achieve growth, places IAMGOLD's Côté Gold project within the 'question marks' category of the BCG matrix. These are ventures with high market growth potential but low market share, demanding significant investment to capture market position.

- Sustaining Capital: $290 million projected for 2025 to maintain current operations.

- Expansion Capital: $20 million allocated for 2025, primarily for Côté Gold's ramp-up.

- Exploration Funding: Ongoing investment needed to discover and develop future resource bases.

- Cash Reinvestment: A substantial portion of generated cash is channeled back into development, characteristic of 'question mark' assets.

Potential for Future Acquisitions and Partnerships

IAMGOLD's future growth hinges on strategic moves, placing potential acquisitions and partnerships firmly in the question mark category of the BCG matrix. These ventures are crucial for expanding the company's resource base and driving domestic growth in 2025. However, their ultimate success in boosting market share and profitability remains uncertain, contingent on careful planning and effective integration.

Consideration for future acquisitions and partnerships is vital for IAMGOLD's continued expansion and market presence. These strategic alliances are currently viewed as question marks because their potential to significantly alter market share and financial performance is not yet quantifiable. The company's ability to successfully identify, acquire, and integrate new assets or forge strong partnerships will be the determining factor in their transition from question marks to stars or even cash cows.

- Resource Expansion: IAMGOLD may explore acquiring exploration assets or smaller producing mines to bolster its reserves.

- Strategic Alliances: Partnerships could offer access to new technologies or geographic regions, mitigating exploration risks.

- Market Share Impact: Successful integration of acquired assets or effective collaboration can lead to increased production and market share.

- Profitability Uncertainty: The financial returns from these ventures are speculative until operational efficiencies and market conditions are realized.

IAMGOLD's early-stage projects, like those in the Côté district, represent potential future growth but currently have a small market share, fitting the 'question mark' profile. These ventures require significant investment to advance, as seen in IAMGOLD's substantial exploration budgets for its Canadian assets, aimed at de-risking these early-stage opportunities.

Côté Gold, while showing strong potential, is in a ramp-up phase, demanding considerable capital. IAMGOLD's 2025 guidance forecasts $290 million in sustaining capital and $20 million for expansion capital, underscoring its cash-intensive nature. This continuous reinvestment is characteristic of 'question marks' needing funding to achieve growth and capture market position.

Potential acquisitions and partnerships are also categorized as question marks, as their impact on market share and profitability is not yet certain. Successful integration or collaboration is key for these ventures to transition from uncertain prospects to significant contributors to IAMGOLD's portfolio.

| Asset/Strategy | BCG Category | Market Growth | Market Share | Investment Need |

| Nelligan Exploration | Question Mark | High | Low | High |

| Gosselin Zone | Question Mark | High | Low | High |

| Côté Gold (Ramp-up) | Question Mark | High | Low (relative to potential) | High ($290M sustaining + $20M expansion in 2025) |

| Future Acquisitions/Partnerships | Question Mark | Uncertain | Uncertain | Variable |

BCG Matrix Data Sources

Our IAMGOLD BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on gold market trends, and competitor analysis to ensure reliable insights.