Iamgold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iamgold Bundle

Explore the core strategies driving Iamgold's operations with our comprehensive Business Model Canvas. Understand their customer segments, value propositions, and revenue streams to gain a competitive edge.

Unlock the full strategic blueprint behind Iamgold's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

IAMGOLD actively pursues joint ventures, a strategy exemplified by its 70% ownership in the Côté Gold Mine alongside Sumitomo Metal Mining Co. Ltd. This collaboration allows for the significant sharing of capital investment burdens, a critical factor in the substantial financial outlay required for major mining projects.

These partnerships are vital for pooling operational expertise, bringing together diverse skill sets and knowledge bases to optimize mining processes and efficiency. By sharing the risks inherent in large-scale developments, IAMGOLD can undertake more ambitious projects than it might alone.

Iamgold prioritizes cultivating robust relationships with local communities and Indigenous groups, recognizing their critical role in a responsible mining operation. This commitment is exemplified through ongoing engagement with entities such as the Mattagami First Nation, focusing on dialogue around economic opportunities, social well-being, security measures, and any potential resettlement considerations.

These partnerships are essential for securing and maintaining a social license to operate, a crucial element for project sustainability. By actively involving these stakeholders, Iamgold aims to foster mutual benefit and contribute positively to local development, aligning operational goals with community aspirations.

Iamgold's engagement with government and regulatory bodies in Canada and West Africa is crucial for obtaining necessary permits and licenses. This collaboration ensures adherence to evolving mining legislation and environmental standards, vital for operational continuity.

In 2024, Iamgold continued its focus on regulatory compliance, a cornerstone of its business model. The company's operations, particularly in regions like Burkina Faso and Senegal, necessitate close cooperation with local and national authorities to navigate complex legal frameworks and secure the social license to operate.

Suppliers and Contractors

Iamgold's success hinges on strong relationships with suppliers and contractors who provide essential equipment, maintenance, and specialized technical expertise for exploration, development, and production. These partnerships ensure the company has access to the resources and skilled labor needed to operate efficiently across its global mining sites.

In 2024, Iamgold continued to leverage these strategic alliances. For instance, its collaboration with equipment providers ensures the availability of critical machinery like excavators and haul trucks, which are fundamental to maintaining production targets. The company also relies on specialized contractors for services ranging from drilling and blasting to geological surveying, all vital for unlocking resource potential and optimizing extraction processes.

These key partnerships are crucial for managing operational costs and mitigating risks. By securing reliable suppliers and experienced contractors, Iamgold can better forecast expenses and ensure the timely execution of projects, ultimately contributing to its overall financial performance and operational stability.

- Equipment Provision: Ensuring access to specialized mining machinery and vehicles.

- Maintenance Services: Maintaining the operational readiness of all mining equipment.

- Technical Support: Providing expertise in areas like geology, engineering, and environmental management.

- Logistics and Supply Chain: Facilitating the timely delivery of materials and components to remote mine sites.

NGOs and Social Development Organizations

IAMGOLD collaborates with non-governmental organizations (NGOs) and social development groups to enhance community well-being. These partnerships extend IAMGOLD's positive impact beyond its mining operations, focusing on critical areas like healthcare and social programs.

For instance, partnerships with organizations like Project CURE enable IAMGOLD to facilitate the delivery of essential medical supplies to communities near its operations. This support is crucial for improving local healthcare infrastructure and patient outcomes.

In 2024, IAMGOLD continued its commitment to social development through various community investment programs. These initiatives often involve partnerships with local and international NGOs to ensure effective resource allocation and program delivery. The company's community investment in 2023, for example, totaled $12.8 million, with a significant portion directed towards health and social infrastructure projects, often managed in collaboration with specialized organizations.

Key aspects of these partnerships include:

- Facilitating access to healthcare: Providing medical equipment and supplies through organizations like Project CURE.

- Supporting community programs: Investing in education, sanitation, and economic development initiatives in collaboration with local NGOs.

- Enhancing operational sustainability: Building stronger community relations and social license to operate through shared development goals.

- Leveraging expertise: Partnering with NGOs that possess specialized knowledge in areas like public health or environmental conservation.

IAMGOLD strategically engages with joint venture partners, such as Sumitomo Metal Mining Co. Ltd. for the Côté Gold Mine, to share substantial capital investments and operational expertise. This approach is crucial for managing the significant financial burdens and risks associated with large-scale mining projects, allowing for more ambitious undertakings and optimized mining processes.

Cultivating strong ties with local communities and Indigenous groups, like the Mattagami First Nation, is paramount for securing a social license to operate. These relationships focus on dialogue regarding economic benefits, social well-being, and security, ensuring mutual benefit and project sustainability.

Collaborations with governments and regulatory bodies are essential for navigating complex legal frameworks, obtaining permits, and adhering to evolving environmental standards in regions like Canada and West Africa. This ensures operational continuity and compliance.

IAMGOLD relies on robust relationships with suppliers and contractors for critical equipment, maintenance, and specialized technical services. In 2024, the company continued to leverage these alliances, ensuring access to machinery and skilled labor vital for efficient operations and resource unlocking.

Partnerships with NGOs and social development groups, such as Project CURE, enhance community well-being through initiatives in healthcare and social programs. IAMGOLD's 2023 community investment of $12.8 million, with a focus on health and social infrastructure, highlights the impact of these collaborations.

What is included in the product

A detailed overview of Iamgold's business model, outlining its core operations and strategic positioning within the gold mining industry.

This model highlights key aspects like resource extraction, stakeholder relationships, and revenue generation, providing a clear picture of their approach to sustainable mining.

IAMGOLD's Business Model Canvas serves as a crucial pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling stakeholders to quickly grasp key value propositions and customer segments.

It effectively addresses the pain of information overload by condensing IAMGOLD's multifaceted strategy into a digestible format, facilitating faster decision-making and alignment across the organization.

Activities

IAMGOLD's key activities in gold exploration and development are centered on discovering new gold deposits and progressing existing projects. This includes everything from initial resource definition to conducting thorough feasibility studies, ensuring a steady stream of potential future production and opportunities for growth.

In 2024, IAMGOLD continued to focus on advancing its key development projects, such as the Côté Gold project in Canada, which is expected to be a significant contributor to future output. The company’s strategic approach involves meticulous geological analysis and rigorous technical assessments to de-risk projects and build a robust pipeline.

Iamgold's key activities include the significant undertaking of constructing new mines, such as the Côté Gold Mine in Canada, and systematically increasing their production capacity. This ramp-up phase is crucial for transitioning from development to steady-state operations, aiming to achieve projected output and profitability targets.

The Côté Gold Mine, a major focus for Iamgold, commenced commercial production in the first quarter of 2024. By the end of the first quarter of 2024, the mine had produced approximately 25,000 ounces of gold, with expectations for increased output throughout the year as the ramp-up progresses.

IAMGOLD's core activity revolves around the responsible extraction of gold from its operational mines, notably the Essakane mine in Burkina Faso and the Westwood mine in Canada. These operations focus on efficient and safe ore extraction, followed by processing and refining to yield high-quality, marketable gold.

In 2024, IAMGOLD's Essakane mine continued to be a significant contributor, producing approximately 377,000 ounces of gold. The Westwood mine, while facing some operational challenges, also contributed to the company's overall output, demonstrating the ongoing commitment to maximizing resource recovery through advanced mining techniques.

Environmental and Social Management

IAMGOLD's key activities include implementing robust Environmental, Social, and Governance (ESG) practices. This involves dedicated efforts in water stewardship, protecting biodiversity, and fostering strong community engagement. The company aims for a 'Zero Harm' culture, underscoring its commitment to responsible mining operations and building trust with all stakeholders.

These ESG initiatives are crucial for IAMGOLD's long-term sustainability and social license to operate. For instance, in 2023, the company reported investing approximately $20 million in community development programs across its operations, demonstrating a tangible commitment to its social responsibilities.

Key activities supporting their ESG strategy include:

- Water Management: Implementing advanced water treatment technologies and recycling programs to minimize freshwater consumption and discharge impacts.

- Biodiversity Conservation: Developing and executing biodiversity action plans to protect and rehabilitate ecosystems in and around mining sites.

- Community Relations: Engaging proactively with local communities through dialogue, employment opportunities, and support for local businesses and infrastructure.

- Health and Safety: Maintaining rigorous safety protocols and training to achieve a 'Zero Harm' environment for employees and contractors.

Financial Management and Capital Allocation

Iamgold’s financial management focuses on efficiently handling its debt and ensuring sufficient liquidity to meet its obligations. This involves careful monitoring of cash flows and managing working capital effectively. For instance, in Q1 2024, the company reported cash and cash equivalents of $460 million, providing a solid foundation for its operations.

Strategic capital allocation is paramount for Iamgold’s sustained growth and development. This includes funding ongoing mining operations, investing in new expansion projects to increase production, and allocating resources to exploration activities to discover new gold deposits. The company’s capital expenditure for 2024 was projected to be between $350 million and $390 million, reflecting its commitment to growth initiatives.

- Debt Management: Iamgold actively manages its debt portfolio to optimize its capital structure and minimize financial risk.

- Liquidity: Maintaining adequate cash reserves and access to credit facilities is essential for operational stability and meeting short-term financial needs.

- Capital Allocation: Funds are strategically directed towards sustaining existing operations, enhancing production capacity, and exploring for future resource potential.

- Investment in Growth: Significant capital is earmarked for projects like the development of the Côté Gold mine, a key driver of future production.

IAMGOLD's key activities encompass the full spectrum of gold mining, from initial exploration and discovery to the responsible operation of producing mines and the development of new projects. This integrated approach ensures a continuous pipeline of resources and production capacity.

The company's 2024 operational focus included advancing the Côté Gold project in Canada, which achieved commercial production in Q1 2024, contributing approximately 25,000 ounces of gold in its initial quarter. Simultaneously, IAMGOLD continued efficient extraction and processing at its established mines, such as the Essakane mine in Burkina Faso, which produced around 377,000 ounces of gold in 2024.

Furthermore, IAMGOLD prioritizes robust Environmental, Social, and Governance (ESG) practices, investing in community programs and implementing advanced water management and biodiversity conservation strategies. Financially, the company managed its debt and liquidity, with $460 million in cash and cash equivalents reported in Q1 2024, while strategically allocating capital, projecting $350 million to $390 million in capital expenditures for 2024 to support growth and development initiatives.

| Activity | Description | 2024 Highlights |

|---|---|---|

| Exploration & Development | Discovering and advancing new gold deposits. | Continued progress on Côté Gold project. |

| Mine Operations | Extraction and processing of gold from producing mines. | Essakane: ~377,000 oz gold; Côté Gold: ~25,000 oz gold (Q1 2024). |

| ESG Implementation | Responsible mining practices and community engagement. | Focus on water stewardship, biodiversity, and community investment. |

| Financial Management | Debt management, liquidity, and capital allocation. | $460M cash & equivalents (Q1 2024); $350M-$390M projected CapEx. |

Full Document Unlocks After Purchase

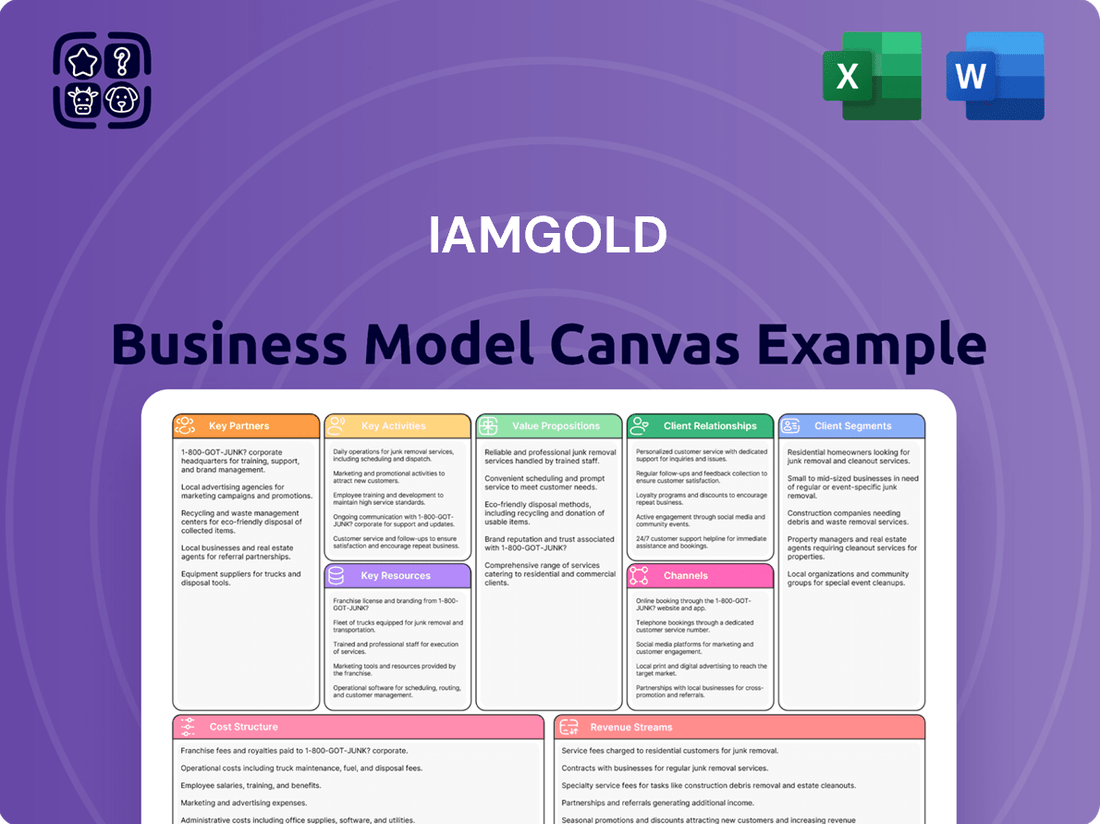

Business Model Canvas

The Iamgold Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the real structure, content, and formatting that will be delivered to you, ensuring complete transparency. Once your order is processed, you'll gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

Iamgold's core asset lies in its gold mineral reserves and resources. These are the quantifiable amounts of gold that can be economically extracted from their mines and exploration sites. Key projects contributing to this include Côté Gold, Essakane, Westwood, and Nelligan.

As of the first quarter of 2024, Iamgold reported total attributable proven and probable gold mineral reserves of 4.2 million ounces. Additionally, their measured and indicated mineral resources stood at 7.1 million ounces, providing a substantial foundation for future production and growth.

Iamgold's extensive land packages in West Africa and Canada are foundational to its operations and future growth. These strategically located assets, including mines and exploration prospects, provide the necessary foundation for resource development and discovery.

In 2024, Iamgold continued to manage significant landholdings, with a focus on securing and maintaining tenure over prospective geological terrains. This secure land access is paramount for both ongoing mining activities and the crucial exploration efforts aimed at uncovering new mineral resources.

IAMGOLD's mining infrastructure and equipment are the bedrock of its operations, encompassing processing plants, heavy machinery, and tailings management facilities. These physical assets are crucial for the efficient extraction and processing of gold ore from its various mine sites.

In 2024, IAMGOLD continued to invest in maintaining and upgrading its fleet of heavy mining equipment, essential for ore haulage and site development. The company's processing plants are designed to handle the specific ore characteristics of each mine, ensuring optimal recovery rates.

Tailings management facilities are a significant component of the infrastructure, requiring ongoing oversight and investment to ensure environmental compliance and operational safety. These facilities are critical for the responsible disposal of byproducts from the gold extraction process.

Skilled Workforce and Human Capital

Iamgold's skilled workforce is a cornerstone of its operations. As of early 2024, the company employs approximately 3,700 individuals. This team possesses critical expertise across geology, mining engineering, mineral processing, and essential support functions. Their collective knowledge directly impacts operational efficiency and the maintenance of high safety standards across all sites.

The human capital at Iamgold is not just a number; it represents a deep well of experience vital for navigating the complexities of the mining industry. This expertise is fundamental to successful exploration, resource development, and the sustainable extraction of minerals.

- Workforce Size: Approximately 3,700 employees as of early 2024.

- Core Expertise: Geology, mining engineering, processing, and support functions.

- Impact: Drives operational efficiency and safety.

Financial Capital and Liquidity

Iamgold's access to financial capital is crucial for its mining operations and growth. This includes managing its cash reserves, utilizing revolving credit facilities, and generating free cash flow to fund everything from daily operations to significant capital expenditures and new strategic projects.

In 2024, Iamgold's financial health is directly tied to its ability to secure and manage these capital resources effectively. A strong free cash flow generation capability is particularly important for reinvesting in existing mines and exploring new opportunities.

- Cash and Cash Equivalents: Iamgold maintains cash and cash equivalents to meet short-term obligations and fund immediate needs.

- Revolving Credit Facilities: Access to credit lines provides flexibility for managing working capital and unexpected expenses.

- Free Cash Flow Generation: The company's ability to generate positive free cash flow from its operations is a key indicator of its financial strength and capacity for investment.

- Debt Management: Prudent management of its debt obligations ensures financial stability and access to future financing.

Iamgold's key resources are its substantial gold mineral reserves and resources, extensive land packages, robust mining infrastructure, a skilled workforce, and access to financial capital. These elements collectively form the foundation for its current operations and future development strategies.

The company's mineral reserves and resources, particularly at projects like Côté Gold, Essakane, Westwood, and Nelligan, are critical. As of Q1 2024, Iamgold held 4.2 million ounces in proven and probable reserves and 7.1 million ounces in measured and indicated resources, underscoring its resource base.

Its operational capacity is further supported by mining infrastructure and equipment, including processing plants and heavy machinery, essential for efficient gold extraction. The company's approximately 3,700 employees as of early 2024 provide the necessary expertise in geology, engineering, and processing, driving operational efficiency and safety.

Financial capital, including cash reserves, credit facilities, and free cash flow generation, is vital for funding operations, capital expenditures, and exploration initiatives, ensuring the company's continued viability and growth potential.

| Key Resource | Description | 2024 Data/Status |

|---|---|---|

| Mineral Reserves & Resources | Quantifiable gold deposits economically extractable. | Q1 2024: 4.2M oz proven/probable reserves; 7.1M oz measured/indicated resources. |

| Land Packages | Strategically located mining and exploration sites. | Focus on securing tenure in West Africa and Canada for ongoing operations and discoveries. |

| Mining Infrastructure & Equipment | Processing plants, heavy machinery, tailings facilities. | Ongoing investment in fleet maintenance and upgrades; plants designed for specific ore characteristics. |

| Skilled Workforce | Expertise in geology, engineering, processing, and support. | Approx. 3,700 employees (early 2024) driving efficiency and safety. |

| Financial Capital | Cash, credit facilities, free cash flow generation. | Essential for operations, capex, and strategic projects; strong free cash flow is key for reinvestment. |

Value Propositions

IAMGOLD ensures a dependable flow of gold to the market. In 2024, the company achieved attributable gold production of 667,000 ounces. This consistent output provides crucial stability for those relying on gold supply.

Looking ahead, IAMGOLD anticipates further strengthening its market presence. Projections for 2025 indicate an increase in attributable gold production, expected to range between 735,000 and 820,000 ounces. This upward trend underscores the company's commitment to a reliable and growing gold supply.

Iamgold's commitment to responsible and sustainable mining practices is a core value proposition. The company actively pursues high Environmental, Social, and Governance (ESG) standards, fostering a 'Zero Harm' culture across its operations. This dedication resonates strongly with investors and stakeholders who increasingly prioritize ethical and environmentally sound investments.

A key element of this commitment is Iamgold's robust water stewardship framework. In 2023, the company reported on its water management initiatives, aiming to minimize its environmental footprint and ensure responsible water usage. This focus on sustainability is crucial for long-term viability and stakeholder trust.

IAMGOLD's growth potential is strongly anchored in the Côté Gold Mine. This project is on track for a significant ramp-up, with projections indicating a potential doubling of its production by 2025. This expansion offers a compelling organic growth narrative for investors.

The anticipated increase in output from Côté Gold is a key value driver. By 2025, the mine's enhanced operational capacity is expected to substantially boost IAMGOLD's overall production figures. This makes the company an attractive prospect for those looking for expanding operational footprints in the mining sector.

Strong Financial Performance and Cost Management

IAMGOLD is prioritizing robust financial performance through diligent cost management. The company anticipates its All-In Sustaining Costs at Côté Gold to decrease, targeting a range of $1,350 to $1,500 per ounce by 2025. This strategic cost reduction, coupled with the achievement of record revenues, underscores a clear commitment to enhancing profitability and delivering tangible value to its shareholders.

This focus on operational efficiency and revenue generation directly translates into a stronger financial foundation for IAMGOLD.

- Projected AISC at Côté Gold: $1,350 - $1,500 per ounce in 2025.

- Financial Goal: Enhanced profitability and shareholder value creation.

- Key Driver: Strategic cost reduction and record revenue generation.

Diversified Asset Base

Iamgold's diversified asset base is a cornerstone of its business model, offering significant resilience. Operating mines in both North America, specifically at Côté Gold and Westwood, and in West Africa, with the Essakane mine, provides crucial geographical diversification. This spreads operational and political risks across different regions, enhancing stability.

This geographic spread directly contributes to a more stable and predictable production profile. For instance, in 2023, Essakane in Burkina Faso continued to be a significant contributor, while development at Côté Gold in Canada progressed towards its anticipated production ramp-up. This balance helps cushion against any single-region disruptions.

- Geographic Spread: Operations in Canada (Côté Gold, Westwood) and Burkina Faso (Essakane).

- Risk Mitigation: Reduces reliance on any single operating jurisdiction.

- Production Stability: Offers a more consistent output stream, less susceptible to localized issues.

- Resilience: Enhances the company's ability to weather regional challenges.

IAMGOLD provides a consistent and growing supply of gold, with 2024 attributable production reaching 667,000 ounces and projections for 2025 indicating a range of 735,000 to 820,000 ounces.

The company's commitment to responsible mining is demonstrated through strong ESG standards and a focus on water stewardship, fostering trust with stakeholders.

Significant growth is anticipated from the Côté Gold Mine, with potential for production to double by 2025, offering a compelling organic growth story.

IAMGOLD prioritizes financial health through cost management, targeting All-In Sustaining Costs at Côté Gold between $1,350 and $1,500 per ounce in 2025, alongside record revenue generation.

| Value Proposition | Key Metric/Data Point | Impact |

|---|---|---|

| Reliable Gold Supply | 2024 Attributable Production: 667,000 oz | Market stability |

| Growth Potential | 2025 Attributable Production Projection: 735,000 - 820,000 oz | Expanding market presence |

| Sustainability Commitment | Focus on ESG and Water Stewardship | Stakeholder trust and long-term viability |

| Côté Gold Expansion | Potential production doubling by 2025 | Organic growth driver |

| Financial Performance | Projected 2025 Côté Gold AISC: $1,350 - $1,500/oz | Enhanced profitability |

Customer Relationships

IAMGOLD fosters strong investor relations by maintaining an open dialogue through regular news releases, comprehensive financial reports, and engaging investor presentations. A dedicated investor relations team ensures accessibility and responsiveness to shareholder inquiries.

The company prioritizes transparency, utilizing quarterly earnings calls and webcasts as direct communication channels to share performance updates and strategic direction, fostering trust and understanding among its stakeholders.

As of the first quarter of 2024, IAMGOLD reported a net loss of $58 million, a figure that underscores the importance of clear communication regarding operational challenges and future outlook to its investors.

Iamgold actively engages host communities through continuous dialogue on economic, social, and security matters. This includes dedicated community development programs and fulfilling resettlement commitments, reflecting a deep-seated dedication to local prosperity and a core principle of Zero Harm.

IAMGOLD's customer relationships focus on its direct buyers, primarily refiners and financial institutions, rather than individual consumers. These relationships are built on trust and reliability, ensuring consistent delivery of gold and strict adherence to all contractual agreements. For instance, in 2024, IAMGOLD's consistent production and supply chain management were critical to maintaining these vital partnerships.

Industry Associations and Peer Collaboration

Iamgold actively engages with industry associations like the World Gold Council and the Prospectors & Developers Association of Canada (PDAC). These memberships facilitate the exchange of best practices in areas such as environmental stewardship and operational efficiency. In 2024, the PDAC convention saw record attendance, highlighting the sector's commitment to collaboration and knowledge sharing.

Peer collaboration allows Iamgold to benchmark its performance and adopt innovative solutions. For instance, discussions within these forums can lead to the adoption of new technologies for mineral processing, potentially improving recovery rates. Such partnerships are crucial for navigating evolving regulatory landscapes and promoting a sustainable mining future.

- Industry Association Engagement: Participation in organizations like the World Gold Council and PDAC fosters best practice sharing.

- Peer Collaboration Benefits: Enables benchmarking, adoption of new technologies, and improved operational efficiencies.

- Advocacy and Environment: Contributes to a more positive and sustainable mining sector through collective efforts.

- Knowledge Exchange: Facilitates learning on critical issues like environmental compliance and safety protocols.

Supplier and Contractor Collaboration

Iamgold focuses on building enduring partnerships with its crucial suppliers and contractors. This strategic approach is fundamental to maintaining a steady flow of necessary materials and specialized services, directly impacting the company's operational smoothness and cost-effectiveness. By fostering these collaborations, Iamgold aims to drive innovation in mining techniques and equipment, ensuring they remain at the forefront of the industry.

These relationships are vital for securing a dependable supply chain, which is a cornerstone of efficient mining operations. For instance, in 2024, Iamgold continued to emphasize its commitment to responsible sourcing and contractor management across its portfolio, including its Essakane mine in Burkina Faso and its Westwood mine in Canada. The company's supplier diversity initiatives, aiming to increase engagement with local and diverse businesses, also contribute to community development and supply chain resilience.

- Long-Term Partnerships: Cultivating stable relationships with key suppliers and contractors to ensure consistent access to resources and expertise.

- Operational Efficiency: Leveraging supplier collaboration to streamline mining processes and reduce operational downtime.

- Innovation in Mining: Working with partners to adopt and develop new technologies and services that enhance extraction and processing.

- Supply Chain Reliability: Guaranteeing a steady and predictable flow of materials, equipment, and specialized labor to support ongoing mining activities.

IAMGOLD's customer relationships are primarily with direct buyers like refiners and financial institutions, built on trust and reliability in gold delivery and contract adherence. In 2024, consistent production and supply chain management were crucial for these vital partnerships.

Channels

IAMGOLD’s primary revenue stream flows from the direct sale of its refined gold output to major refiners and established bullion dealers worldwide. This established channel ensures efficient monetization of their mined resources.

In 2023, IAMGOLD reported total gold sales of 416,000 ounces, generating approximately $816 million in revenue. This highlights the significance of these direct sales to their overall financial performance.

Iamgold leverages its official investor relations website and various online platforms as primary channels to share crucial information. These platforms are vital for disseminating news releases, quarterly and annual financial reports, investor presentations, and sustainability reports, ensuring transparency and accessibility for all stakeholders.

In 2024, the company continued to prioritize digital communication, with its investor relations website serving as a central hub for real-time updates. This digital presence is essential for reaching a global investor base and providing them with the data needed for informed decision-making.

IAMGOLD's presence on major stock exchanges like the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) serves as a crucial channel for capital raising and investor engagement. These listings allow for the seamless buying and selling of IAMGOLD shares, directly impacting its valuation and liquidity. As of early 2024, the company's market capitalization fluctuated, reflecting investor sentiment and the broader commodity market trends.

Industry Conferences and Events

IAMGOLD actively participates in key mining industry conferences and investor events. This engagement is crucial for showcasing operational achievements, outlining future growth plans, and highlighting their commitment to sustainability to a vital audience of financial experts and potential investors. For instance, in 2024, IAMGOLD's presence at events like the Denver Gold Show and the Precious Metals Summit in Beaver Creek provided direct platforms to communicate their strategic vision.

These events serve as a vital channel for IAMGOLD to:

- Present operational updates and financial performance metrics.

- Discuss exploration successes and development pipeline.

- Engage with the investment community and potential strategic partners.

- Reinforce their ESG (Environmental, Social, and Governance) commitments.

Media and Financial News Outlets

IAMGOLD leverages a wide array of media and financial news outlets to broadcast its corporate updates. This strategic approach ensures that crucial information, such as quarterly earnings reports and significant operational developments, reaches a broad audience. For instance, in the first quarter of 2024, IAMGOLD reported revenue of $347 million, a figure that was widely disseminated through financial news channels.

These channels are vital for maintaining transparency and accessibility for investors, analysts, and the general public. By distributing news releases and financial results through platforms like Bloomberg, Reuters, and major financial news websites, IAMGOLD facilitates informed decision-making within the investment community. The company's commitment to timely and accurate reporting through these outlets underscores its dedication to stakeholder engagement.

- Dissemination of Information: News releases and financial results are distributed to ensure broad reach.

- Audience Engagement: Targets investors, analysts, and the general public.

- Transparency: Facilitates informed decision-making through accessible corporate data.

- Key Financial Data: Q1 2024 revenue reached $347 million, highlighting the importance of these channels for financial reporting.

IAMGOLD's communication channels are multifaceted, focusing on direct sales of gold, investor relations, stock exchange listings, industry events, and broad media dissemination. These channels collectively ensure efficient revenue generation, transparent stakeholder engagement, and broad market awareness of the company's performance and strategy.

| Channel | Purpose | Key Activities/Data (2024 Focus) |

|---|---|---|

| Direct Gold Sales | Revenue generation | Sales to refiners/dealers; 2023 sales: 416,000 oz |

| Investor Relations Website & Online Platforms | Information dissemination | News releases, financial reports, presentations; Central hub for real-time updates |

| Stock Exchange Listings (NYSE, TSX) | Capital raising, investor engagement | Share trading, liquidity, market capitalization monitoring |

| Industry Conferences & Investor Events | Showcasing achievements, networking | Presentations at events like Denver Gold Show; Engaging with investors and partners |

| Media & Financial News Outlets | Broadcasting corporate updates | Dissemination of earnings, operational news via Bloomberg, Reuters; Q1 2024 revenue: $347 million |

Customer Segments

Institutional investors, encompassing entities like mutual funds, pension funds, and hedge funds, represent a crucial customer segment for IAMGOLD. These sophisticated investors deploy substantial capital and are primarily driven by robust financial performance, clear growth trajectories, and increasingly, strong Environmental, Social, and Governance (ESG) credentials. For instance, as of early 2024, many large pension funds are actively increasing their allocations to resource sectors, seeking stable returns and diversification, making IAMGOLD's operational efficiency and long-term development plans key attractors.

Individual investors, encompassing both everyday retail participants and high-net-worth individuals, are a key customer segment for IAMGOLD. These investors are primarily driven by the prospect of capital appreciation through IAMGOLD's stock performance and seek to gain exposure to the dynamic gold market. For instance, in 2024, IAMGOLD's share price experienced fluctuations, reflecting broader market sentiment and company-specific developments, which these investors closely monitor.

Central banks, such as the U.S. Treasury and the European Central Bank, are significant purchasers of gold bullion, often acquiring it to diversify their foreign exchange reserves and as a hedge against inflation. In 2023, central banks were net buyers of gold, adding 1,037 metric tons, marking the second consecutive year of record-breaking purchases, according to the World Gold Council.

Jewelers represent a substantial segment of the gold market, using bullion as the primary raw material for crafting jewelry. The demand from the jewelry sector is often influenced by consumer sentiment and economic conditions, with India and China typically being the largest markets for gold jewelry. Global jewelry demand in 2023 reached 2,185.8 metric tons.

Industrial users, including electronics manufacturers and dentists, also purchase gold for its unique conductive and biocompatible properties. While a smaller portion of overall demand, this segment provides a steady, albeit niche, market for gold. The electronics industry, for instance, relies on gold for its corrosion resistance and conductivity in high-end components.

Financial Analysts and Advisors

Financial analysts and advisors are key stakeholders who scrutinize IAMGOLD's performance to guide their clients' investment decisions. They need access to comprehensive financial statements, operational data, and forward-looking guidance to conduct thorough valuations, often utilizing discounted cash flow (DCF) models.

For instance, in 2024, analysts closely watched IAMGOLD's production figures and cost management, particularly in light of fluctuating gold prices. IAMGOLD's Q1 2024 results reported total gold production of 155,000 ounces, with an all-in sustaining cost (AISC) of $1,350 per ounce. These figures are critical for analysts assessing the company's profitability and competitive positioning.

- Detailed Financial Reporting: Analysts require timely and accurate financial reports, including income statements, balance sheets, and cash flow statements, to perform their assessments.

- Operational Transparency: Access to production volumes, reserve reports, and cost structures is essential for understanding IAMGOLD's operational efficiency and potential.

- Guidance and Outlook: Forward-looking statements regarding production targets, capital expenditures, and market expectations help analysts build their financial models and forecasts.

- Valuation Metrics: Analysts rely on metrics like earnings per share (EPS), price-to-earnings (P/E) ratios, and enterprise value to market capitalization (EV/EBITDA) to compare IAMGOLD with its peers.

Local Communities and Indigenous Peoples

Local communities and Indigenous Peoples are vital stakeholders, acting as 'customers' for IAMGOLD's social license to operate. Their engagement is crucial, necessitating transparent communication and robust community development programs. For instance, in 2024, IAMGOLD continued its commitment to local employment, with a significant portion of its workforce sourced from communities near its operations, reflecting a direct benefit. The company also focuses on responsible resource management, aiming to minimize environmental impact and ensure long-term sustainability for these groups.

IAMGOLD's approach involves proactive engagement and partnership building. This includes supporting local infrastructure projects and educational initiatives. In 2024, the company reported investments in various community projects, such as improving access to clean water and supporting local businesses. These efforts are designed to foster mutual benefit and build trust, recognizing that the company's success is intertwined with the well-being of the communities in which it operates.

The company's strategy acknowledges that while these groups may not be direct financial customers in the traditional sense, their support is paramount. This translates into a focus on:

- Building trust through open and consistent dialogue with community leaders and members.

- Investing in socio-economic development programs tailored to local needs, such as skills training and entrepreneurship support.

- Ensuring environmental stewardship and responsible land use practices that protect natural resources for future generations.

- Respecting Indigenous rights and traditional knowledge, incorporating these into operational planning and decision-making.

IAMGOLD's customer segments extend beyond direct purchasers of gold to include vital stakeholders whose support is essential for its operations. These include institutional investors, individual investors, central banks, jewelers, and industrial users, each with distinct motivations and requirements.

Financial analysts and advisors are crucial intermediaries, requiring detailed operational and financial data to inform their clients' investment strategies. Local communities and Indigenous Peoples are also key, representing a demand for social license to operate, which IAMGOLD addresses through engagement and development programs.

| Customer Segment | Primary Motivation | Key Data Needs | 2023/2024 Relevance |

|---|---|---|---|

| Institutional Investors | Financial Performance, ESG | Operational efficiency, growth plans, ESG reports | Increased allocation to resource sectors |

| Individual Investors | Capital Appreciation | Stock performance, market sentiment | Monitoring share price fluctuations |

| Central Banks | Reserve Diversification, Inflation Hedge | Gold market trends, bullion demand | Record-breaking net purchases in 2023 |

| Jewelers | Raw Material | Consumer sentiment, economic conditions | Global jewelry demand reached 2,185.8 metric tons in 2023 |

| Industrial Users | Material Properties | Specific applications (e.g., electronics) | Steady demand for conductivity and biocompatibility |

| Financial Analysts | Valuation, Client Advice | Financial statements, production data, cost management | Q1 2024 production: 155,000 oz; AISC: $1,350/oz |

| Local Communities/Indigenous Peoples | Social License to Operate | Community development, environmental stewardship | Focus on local employment and infrastructure projects in 2024 |

Cost Structure

Operating costs, often referred to as cash costs, are the direct expenses incurred in getting gold out of the ground and ready for sale. These include the wages for the people working at the mines, the electricity or fuel needed to power the operations, the materials used up in the mining and processing, and the upkeep of the equipment. For Iamgold, this covers their key sites: Côté Gold, Essakane, and Westwood.

Looking ahead to 2025, Iamgold has provided guidance that their consolidated cash costs are expected to fall within the range of $1,200 to $1,350 per ounce of gold sold. This figure is crucial for understanding the profitability of their operations, as it represents the baseline expense for each ounce produced.

All-in Sustaining Costs (AISC) for Iamgold represent the comprehensive expenses associated with maintaining their current gold production. This metric includes not only the direct cash costs of mining but also crucial elements like sustaining capital expenditures, general and administrative expenses, and ongoing exploration efforts. It provides a more holistic view of the true cost of keeping operations running efficiently.

Looking ahead to 2025, Iamgold has provided guidance for its consolidated AISC, projecting a range between $1,625 and $1,800 per ounce sold. This forecast underscores the company's commitment to transparency by detailing the full spectrum of costs required to sustain their existing production levels in the coming year.

Capital expenditures are a major component of IAMGOLD's cost structure, covering both maintaining current operations and investing in future growth. This includes essential spending on equipment upkeep and managing tailings at existing mines, as well as the significant investments needed for new projects. For instance, the development of the Côté Gold project represents a substantial expansion capital outlay.

Looking ahead, IAMGOLD has projected its total capital expenditures for 2025 to be around $310 million. This figure encompasses the ongoing costs associated with extending the life of current mines and the capital required for developing new, potentially high-yield operations, ensuring the company's long-term production capacity.

Exploration and Development Costs

Iamgold's cost structure heavily features exploration and development expenses, which are crucial for discovering new mineral deposits and advancing existing projects through evaluation and feasibility stages. These investments are fundamental to securing the company's future growth pipeline.

In 2024, Iamgold continued to invest significantly in these areas. For instance, their exploration and evaluation expenditures were reported to be approximately $84.3 million for the year ended December 31, 2024. This figure reflects the ongoing commitment to identifying and de-risking future mining opportunities.

- Exploration Expenditures: Costs incurred in searching for mineral deposits, including geological surveys and drilling.

- Development Expenditures: Costs related to bringing identified mineral deposits into production, such as feasibility studies and mine planning.

- Project Advancement: Funding for advancing projects through various stages, from initial discovery to pre-feasibility and feasibility studies.

- Future Growth Investment: These costs are a direct investment in the company's long-term asset base and potential revenue streams.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at IAMGOLD encompass the essential corporate overheads that support the entire organization. These costs include salaries for administrative personnel, rent and utilities for corporate offices, legal and consulting fees, and other operational expenses not directly linked to the physical extraction of minerals. For instance, in 2023, IAMGOLD reported G&A expenses of $127 million, reflecting the ongoing management and support functions required to operate a global mining enterprise.

IAMGOLD has been actively working to streamline its G&A structure. A key initiative has been the consolidation of corporate functions, aiming to create greater efficiencies and better align administrative support with the company's evolving asset portfolio. This strategic move is designed to reduce redundancy and improve the cost-effectiveness of its non-mining operations.

- Corporate Overhead: Includes executive salaries, corporate office rent, and IT infrastructure.

- Administrative Staff Salaries: Compensation for finance, HR, legal, and other support departments.

- Professional Services: Costs for external legal counsel, auditors, and consultants.

- Office Expenses: Utilities, supplies, and maintenance for non-operational facilities.

Iamgold's cost structure is multifaceted, encompassing direct operational expenses, sustaining capital, exploration, and administrative functions. These elements are crucial for understanding the company's profitability and its strategic investments in future production.

In 2024, the company's exploration and evaluation expenditures reached approximately $84.3 million, highlighting a significant commitment to discovering and de-risking future mining opportunities. This investment is fundamental to securing long-term growth.

Looking ahead to 2025, Iamgold projects consolidated cash costs between $1,200 and $1,350 per ounce, and All-in Sustaining Costs (AISC) between $1,625 and $1,800 per ounce. These forecasts provide a clear benchmark for operational efficiency.

Capital expenditures for 2025 are estimated at $310 million, supporting both the maintenance of existing mines and the development of new projects like Côté Gold.

| Cost Category | 2024 (Actual/Estimate) | 2025 (Guidance) | Key Components |

| Cash Costs | N/A | $1,200 - $1,350 per ounce | Mining, processing, labor, fuel, materials |

| All-in Sustaining Costs (AISC) | N/A | $1,625 - $1,800 per ounce | Cash Costs + sustaining capital, G&A, exploration |

| Capital Expenditures | N/A | ~$310 million | Mine maintenance, Côté Gold development, project advancement |

| Exploration & Evaluation | ~$84.3 million | N/A | Geological surveys, drilling, feasibility studies |

| General & Administrative (G&A) | 2023: $127 million | N/A | Corporate overhead, administrative salaries, professional services |

Revenue Streams

IAMGOLD's core revenue generation comes from selling the gold it mines. In 2024, this stream was particularly strong, bringing in a record $1,633.0 million from the sale of 699,000 ounces of gold.

IAMGOLD has historically leveraged gold prepay arrangements, securing upfront cash by committing to future gold deliveries. These arrangements provided crucial early-stage financing for projects.

The company finalized its last delivery under these agreements in June 2025, marking the conclusion of this specific funding mechanism.

While IAMGOLD primarily focuses on gold extraction, the mining process can sometimes yield other valuable minerals as by-products. The sale of these by-products represents an additional, albeit often secondary, revenue stream for the company.

For instance, during gold mining, minerals like copper or silver can be incidentally extracted. In 2023, IAMGOLD's operations did not report significant by-product sales as a material revenue driver, with the company's financial performance being overwhelmingly tied to gold prices.

Investment Income

IAMGOLD generates investment income from its holdings of cash, cash equivalents, and short-term investments. This income stream, while typically secondary to its core mining operations, provides a stable, albeit smaller, contribution to overall revenue. For instance, in the first quarter of 2024, IAMGOLD reported interest income and investment gains, reflecting the returns earned on its treasury assets.

The company's approach to managing these liquid assets aims to balance liquidity needs with the generation of modest returns. This strategy is particularly important during periods of capital expenditure or when managing working capital efficiently.

- Investment Income Sources: Interest earned on cash balances, returns from short-term marketable securities.

- Q1 2024 Performance: IAMGOLD's financial reports detail the specific amounts earned from these investment activities.

- Strategic Importance: Contributes to financial stability and supports operational flexibility.

Asset Sales and Divestitures

IAMGOLD strategically monetizes non-core assets to bolster its financial position. A prime example is the divestiture of its interest in the Karita Gold Project in Guinea, a move designed to streamline operations and focus on core mining activities.

These asset sales are crucial for generating liquidity and reinvesting in higher-potential projects. For instance, in 2023, IAMGOLD completed the sale of its stake in the Cote Gold project, which generated significant proceeds contributing to its overall financial health.

- Divestiture of Non-Core Assets: Periodically selling off assets or project interests that do not align with the company's primary strategic focus.

- Liquidity Generation: Asset sales provide immediate cash flow, enhancing financial flexibility.

- Strategic Repositioning: Allows IAMGOLD to concentrate resources on its most promising mining ventures and exploration opportunities.

IAMGOLD's primary revenue stream is the sale of gold, which generated $1,633.0 million in 2024 from selling 699,000 ounces. While historically significant, gold prepay arrangements, used for project financing, concluded with the final delivery in June 2025. The sale of by-product minerals, such as copper or silver, is a secondary revenue source, though it was not a material driver in 2023. Investment income from cash and short-term investments also contributes, as seen with interest and investment gains reported in Q1 2024.

| Revenue Stream | 2023 (Estimate/Implied) | 2024 (Actual) | Notes |

|---|---|---|---|

| Gold Sales | (Not specified) | $1,633.0 million (699,000 oz) | Core revenue driver. |

| Gold Prepay Arrangements | (Active) | Concluded June 2025 | Financing mechanism, no longer active. |

| By-product Sales | Not Material | (Not specified) | Secondary revenue, not significant in 2023. |

| Investment Income | (Implied) | Reported in Q1 2024 | Interest and investment gains on liquid assets. |

Business Model Canvas Data Sources

The Iamgold Business Model Canvas is informed by a combination of internal financial reports, operational data from its mining sites, and extensive market research on gold prices and demand. These sources ensure a comprehensive understanding of the company's current state and future potential.