International Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Airlines Bundle

Navigate the complex global aviation landscape with our PESTLE analysis of International Airlines. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full analysis now and gain a competitive edge.

Political factors

Government aviation policies, including air traffic control, airport slot allocations, and route permissions, directly shape IAG's operational capabilities and growth prospects. For instance, the European Union's ongoing efforts to harmonize air traffic management through initiatives like the Single European Sky aim to improve efficiency, potentially reducing delays and fuel burn for IAG's European operations.

Shifts in these regulations, whether imposing new limitations or fostering greater openness, can profoundly influence profitability and access to key markets. The UK's post-Brexit aviation framework, for example, continues to evolve, impacting IAG's access to certain routes and requiring strategic adjustments to its network planning.

Regulatory stability is crucial for IAG's long-term strategic planning. Uncertainty surrounding future policy changes, such as potential carbon taxes or noise restrictions at major hubs like London Heathrow, can deter significant capital investments in fleet modernization or route development, impacting the group's competitive positioning.

International trade relations and bilateral air service agreements are crucial for International Airlines Group (IAG). These agreements dictate where IAG's airlines, like British Airways and Iberia, can operate and under what terms. For instance, the Open Skies agreement between the EU and the US, which came into full effect in 2008, significantly liberalized air travel, allowing for greater route flexibility and competition.

Geopolitical shifts and trade disputes can directly impact these arrangements. A breakdown in diplomatic relations or the imposition of trade tariffs could lead to renegotiations or even the suspension of air service agreements, potentially closing off key markets for IAG. The ongoing trade tensions between major global economies in 2024 highlight the sensitivity of the aviation sector to such international policy shifts.

IAG's extensive global network makes it particularly vulnerable to changes in international diplomacy and trade policy. For example, in 2023, the UK's continued divergence from EU regulations post-Brexit meant that air service agreements between the UK and non-EU countries were subject to separate bilateral negotiations, impacting IAG's operational planning.

Geopolitical instability, including conflicts and terrorism, poses a significant threat to international airlines like IAG. For instance, the ongoing conflict in Eastern Europe has led to significant airspace closures and rerouting, increasing fuel costs and flight times for many carriers. In 2023, the International Air Transport Association (IATA) estimated that such disruptions added billions to airline operating expenses globally.

IAG's vast network necessitates continuous monitoring of evolving geopolitical risks. The company must adapt to potential route closures and changing security landscapes, which can directly impact passenger confidence and demand for travel to affected regions. For example, travel advisories issued by governments in response to regional tensions can drastically reduce bookings, as seen with a 15% drop in bookings to certain Middle Eastern destinations during periods of heightened regional instability in late 2024.

Brexit and Regional Policy Divergence

Brexit continues to cast a long shadow over the international airline industry, particularly for groups like IAG (International Airlines Group). The ongoing implications of the UK’s departure from the European Union are reshaping regulatory frameworks, affecting critical areas such as traffic rights, ownership stipulations, and the ease of labor movement between the UK and EU member states. This divergence necessitates that IAG meticulously navigates a complex web of legal and operational requirements for its key airlines, British Airways and Iberia.

The ability of IAG to operate seamlessly across its European network is directly influenced by these evolving political dynamics. For instance, the UK's continued adherence to its own aviation regulations, separate from the EU's common framework, means IAG must manage distinct compliance standards. This can translate into increased administrative burdens and potentially higher operational costs as they adapt to differing rules on safety, environmental standards, and passenger rights.

Looking ahead, future policy decisions regarding aviation access and trade pacts between the UK and the EU remain a paramount political consideration for IAG. The nature of these agreements will directly impact route profitability, competitive positioning, and the overall strategic direction of the group. For example, any shifts in bilateral air service agreements could alter IAG's ability to deploy its fleet efficiently across its most lucrative markets.

- Traffic Rights: Post-Brexit, UK airlines, including British Airways, operate under a specific UK-EU aviation agreement, which grants reciprocal traffic rights but may differ in scope from the previous EU-wide freedoms.

- Ownership Rules: EU regulations typically require airlines operating within the EU to be majority-owned and controlled by EU nationals. IAG, as a Spanish-registered entity with significant UK operations, must continually monitor and comply with these ownership structures to maintain its operating licenses.

- Labor Mobility: The free movement of labor between the UK and EU has been curtailed by Brexit. This impacts IAG's ability to easily transfer pilots, cabin crew, and maintenance staff between its UK and EU bases, potentially leading to recruitment challenges and increased costs for securing necessary personnel.

Subsidies and State Aid Policies

Government subsidies and state aid can significantly distort competition in the airline industry. For instance, during the COVID-19 pandemic, many national carriers received substantial financial support from their respective governments. While IAG, as a publicly traded entity, typically operates without such direct aid, these policies can create an uneven playing field. This support often allows subsidized airlines to maintain operations, pricing, and fleet development in ways that non-subsidized competitors cannot match, impacting market share and profitability.

These interventions can be particularly pronounced during economic downturns or specific crises, where governments may prioritize national airlines for strategic or employment reasons. For example, reports from 2020 and 2021 indicated billions in state aid packages for airlines across Europe, including significant sums for carriers that compete directly with IAG's subsidiaries like British Airways and Iberia. Such financial injections can enable competitors to offer lower fares or invest in new routes, directly challenging IAG's market position.

- Uneven Playing Field: State aid to national carriers can disadvantage IAG's subsidiaries by allowing competitors to operate with lower cost structures.

- Market Distortion: Subsidies can lead to artificial pricing and route development, impacting fair market competition.

- Competitive Impact: Policies supporting competitors, especially during economic crises, can erode IAG's market share and profitability.

- Advocacy Need: Monitoring and advocating against distortive state interventions remain crucial political considerations for IAG.

Government aviation policies, including air traffic control and route permissions, significantly shape IAG's operations. For instance, the EU's Single European Sky initiative aims to boost efficiency, potentially lowering costs for IAG. Conversely, regulatory shifts, like the UK's post-Brexit aviation framework, can impact IAG's market access and necessitate strategic network adjustments.

Geopolitical shifts and trade disputes directly influence international air service agreements, which are vital for IAG's global network. The ongoing trade tensions in 2024 highlight the sector's sensitivity to international policy changes, potentially leading to renegotiated or suspended agreements and impacting key markets for IAG.

Geopolitical instability, such as conflicts, leads to airspace closures and rerouting, increasing operational costs for airlines like IAG. IATA estimated in 2023 that such disruptions added billions to global airline operating expenses, forcing IAG to adapt to changing security landscapes and potential drops in passenger demand to affected regions.

Government subsidies can distort competition, creating an uneven playing field for IAG. Billions in state aid were provided to European airlines during 2020-2021, allowing subsidized competitors to potentially offer lower fares or invest more aggressively, directly challenging IAG's market position.

What is included in the product

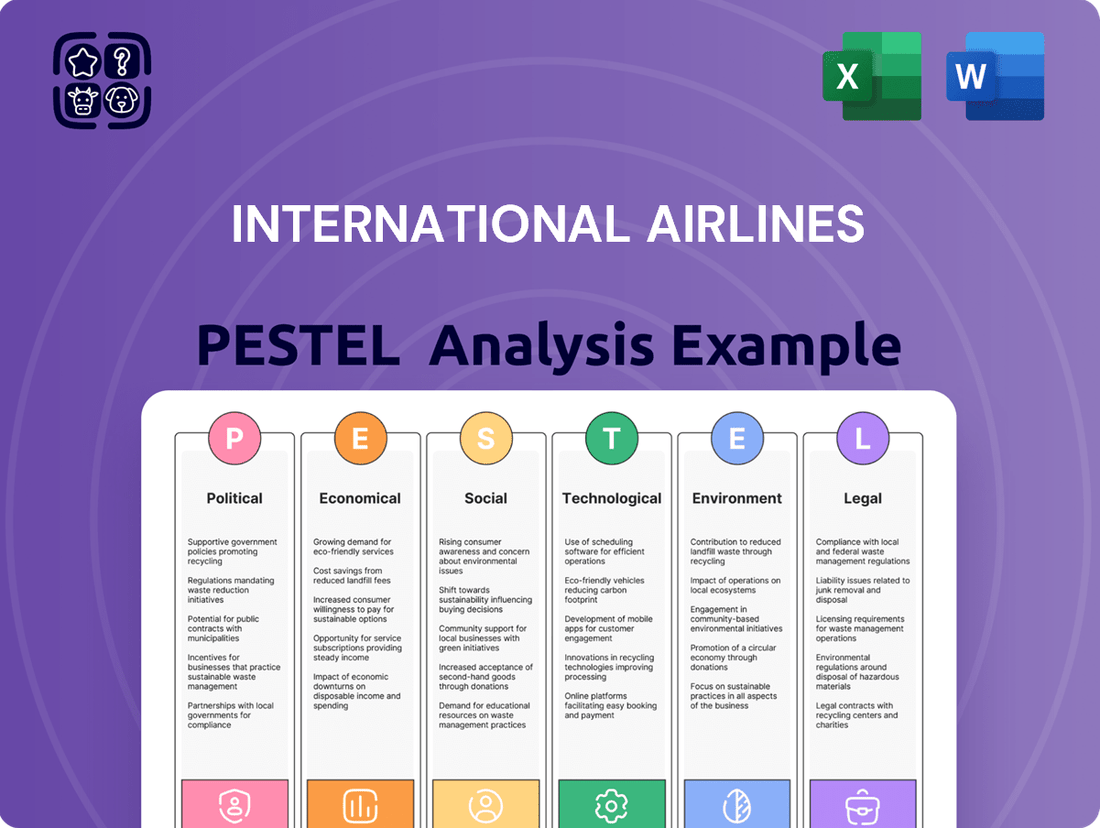

This PESTLE analysis provides a comprehensive examination of the external forces impacting the International Airlines industry, dissecting Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making, enabling stakeholders to navigate industry challenges and capitalize on emerging opportunities.

A clear, actionable summary of the International Airlines PESTLE analysis that highlights key external factors impacting the industry, enabling proactive strategy development and risk mitigation.

Economic factors

Global economic growth significantly shapes demand for air travel. In 2024, the IMF projected global growth at 3.2%, a steady rate that supports both leisure and business travel. This economic stability translates to higher disposable incomes for consumers and increased corporate spending on travel, directly benefiting airlines like IAG.

When economies expand, consumer confidence rises, leading to more vacation bookings. Similarly, businesses tend to increase travel for meetings, conferences, and client relations. This dual demand boost is critical for IAG's revenue streams, impacting passenger numbers and cargo volumes. For instance, a robust global economy in 2024 has generally seen a recovery in international travel compared to the pandemic years.

Conversely, economic slowdowns or recessions present considerable challenges. During such periods, consumers cut back on discretionary spending, including airfare, and businesses reduce travel budgets to control costs. This can result in lower load factors and pressure on ticket prices, impacting IAG's profitability. The World Bank noted in early 2025 that while global growth is expected to remain stable, regional variations and potential shocks could still dampen travel demand in certain markets.

Jet fuel represents a substantial portion of an airline's operating expenses, making International Airlines Group (IAG) particularly susceptible to shifts in global oil prices. For instance, in the first half of 2024, jet fuel costs averaged around $2.50 per gallon, a notable increase from the previous year, directly impacting IAG's cost structure.

Sharp increases in fuel prices can severely diminish profit margins if airlines haven't effectively hedged against these movements or managed to pass the increased costs onto passengers. IAG's hedging strategies aim to mitigate this, but extreme volatility, such as the Brent crude oil price surge to over $90 per barrel in early 2025, presents ongoing challenges.

The consistency and forecastability of fuel expenses are therefore crucial economic considerations that shape IAG's operational expenditures and how it sets its ticket prices. The airline industry closely monitors geopolitical events and supply-demand dynamics that influence crude oil markets, as these directly translate into IAG's financial performance.

Currency exchange rate fluctuations significantly impact International Airlines Group (IAG) due to its multinational operations. As IAG generates revenue and incurs costs in numerous currencies, its financial performance is inherently exposed to the volatility of these exchange rates.

For instance, a strengthening British Pound or Euro can diminish the competitiveness of IAG's airlines in markets where their fares are priced in weaker currencies. Conversely, it can also reduce the translated value of earnings generated from operations outside the Eurozone and the UK, affecting overall profitability. In 2023, IAG reported a net profit of €1.8 billion, a substantial increase from a loss in the previous year, highlighting the sensitivity of its earnings to global economic conditions, including currency movements.

To navigate this economic factor, IAG employs sophisticated currency hedging strategies. These strategies are crucial for mitigating the financial risks associated with adverse currency movements, aiming to stabilize earnings and protect profit margins against unpredictable exchange rate volatility in the 2024-2025 period.

Inflation and Interest Rates

Rising inflation in 2024 and projected into 2025 directly impacts International Airlines Group (IAG) by escalating operational expenses. Fuel, a significant cost component, has seen volatility, with Brent crude oil prices fluctuating, impacting direct operating costs. Labor, maintenance, and airport handling fees also tend to rise with general price levels, squeezing profit margins.

Higher interest rates, a consequence of central banks combating inflation, present a challenge for IAG's capital-intensive business model. For instance, if the Bank of England base rate, which influences borrowing costs, remains elevated through 2025, the cost of financing new aircraft acquisitions or major fleet upgrades will increase. This can affect IAG's ability to invest in fleet modernization and expansion, potentially impacting its long-term competitiveness.

- Increased Operating Costs: Fuel and labor cost increases due to inflation, as seen in the UK's inflation rate hovering around 3% in early 2024, directly affect IAG's bottom line.

- Higher Borrowing Costs: Elevated interest rates impact the financing of IAG's extensive fleet, potentially increasing debt servicing expenses and reducing capital available for investment.

- Impact on Investment Decisions: The combined pressure of rising costs and borrowing expenses may force IAG to re-evaluate or delay capital expenditure plans, such as new aircraft orders or route expansions.

Competitive Landscape and Pricing Pressure

The international airline sector is characterized by fierce competition, with many airlines battling for passengers, which inevitably drives down ticket prices. This intense rivalry means airlines must be incredibly strategic about their pricing. For instance, in the first quarter of 2024, the International Air Transport Association (IATA) reported that while demand remained strong, the average fare per passenger kilometer saw a slight decrease compared to the previous year as airlines worked to fill capacity.

Economic downturns can intensify this pricing pressure significantly. During periods of reduced consumer spending or business travel, airlines often resort to more aggressive discounting to ensure their planes are as full as possible. This was evident in late 2023 and early 2024, where many carriers offered promotional fares to stimulate demand amidst global economic uncertainties.

- Intense Rivalry: The global airline market features a high number of carriers, leading to constant competition for market share.

- Pricing Pressure: This competition directly translates into pressure on ticket prices, with airlines frequently adjusting fares to remain competitive.

- Economic Impact: Economic slowdowns can amplify pricing pressure as airlines use lower fares to boost load factors during periods of lower demand.

- Yield Management: Companies like IAG must continuously analyze competitor pricing and market trends to protect their revenue per passenger mile and overall profitability.

Global economic growth is a primary driver for the airline industry, influencing both leisure and business travel demand. The IMF projected global growth at 3.2% for 2024, a rate that supports increased consumer spending and corporate travel budgets. This economic stability translates into higher passenger volumes and cargo business for International Airlines Group (IAG).

Fluctuations in jet fuel prices directly impact IAG's operating costs. With fuel averaging around $2.50 per gallon in early 2024, price volatility, such as Brent crude exceeding $90 per barrel in early 2025, presents ongoing challenges for profitability. IAG's hedging strategies are crucial in mitigating these cost impacts.

Currency exchange rate volatility significantly affects IAG's financial results due to its multinational operations. A stronger Pound Sterling or Euro can reduce the competitiveness of fares priced in weaker currencies and decrease the translated value of foreign earnings. IAG utilizes currency hedging to manage these risks and stabilize earnings.

Inflationary pressures in 2024 and 2025 are escalating IAG's operational expenses, including fuel, labor, and maintenance costs. Higher interest rates, a response to inflation, also increase borrowing costs for fleet financing, potentially impacting capital expenditure on new aircraft and route expansion.

| Economic Factor | Impact on IAG | Data Point (2024/2025) |

| Global Economic Growth | Drives demand for leisure and business travel | IMF projected 3.2% global growth in 2024 |

| Jet Fuel Prices | Significant operating expense, impacts profitability | Average ~$2.50/gallon (H1 2024); Brent crude >$90/barrel (early 2025) |

| Currency Exchange Rates | Affects revenue and cost translation, competitiveness | IAG reported €1.8 billion net profit in 2023, sensitive to currency movements |

| Inflation and Interest Rates | Increases operating costs and borrowing costs | UK inflation ~3% (early 2024); elevated interest rates impact fleet financing |

What You See Is What You Get

International Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your International Airlines PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for the international airline industry.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed PESTLE analysis tailored for international airlines.

Sociological factors

Consumer travel habits are in constant flux, significantly impacting airlines like IAG. The surge in remote work, for instance, has led to a noticeable decline in traditional business travel. In 2023, for example, a significant portion of companies continued to embrace hybrid work models, reducing the need for frequent corporate trips. This shift necessitates airlines to re-evaluate their business class offerings and focus more on leisure markets.

Furthermore, there's a pronounced trend towards experiential leisure travel. Travelers are increasingly seeking unique adventures and cultural immersion rather than just a destination. This evolving preference means IAG needs to tailor its routes and onboard experiences to cater to these desires, potentially by offering packages or partnerships that enhance the travel journey beyond just transportation.

Post-pandemic, we've also seen notable changes, such as a preference for domestic or shorter-haul flights. While international travel is recovering, many consumers still exhibit caution or a desire for more accessible trips. For example, data from early 2024 indicated a stronger rebound in intra-European travel compared to long-haul routes. This trend requires IAG to strategically adjust its network, perhaps by increasing frequencies on popular shorter routes or introducing new short-haul destinations to capture this demand.

Global demographic shifts are fundamentally reshaping air travel demand. For instance, the burgeoning middle class in Asia, particularly in China and India, is a significant driver of future passenger growth. By 2024, the Asian Development Bank projected that Asia’s middle class could reach 3.5 billion people, a substantial increase from previous years, translating to more disposable income for travel.

Conversely, many developed nations are experiencing an aging population. This demographic trend necessitates airlines like IAG to adapt their services, potentially offering more comfortable seating, specialized assistance, and tailored travel packages for older travelers. Understanding these evolving age demographics is crucial for route planning and service customization.

Urbanization further impacts passenger flows. As more people move to cities, major urban centers become key hubs for air travel, both for business and leisure. This trend, evident globally with over half the world's population now living in urban areas according to the UN, means airlines must focus on expanding connectivity to and from these growing metropolitan regions.

Public perception of health and safety is paramount for airlines, especially following global health events. For instance, the International Air Transport Association (IATA) reported that passenger confidence in air travel safety has remained high, with 83% of travelers in a late 2023 survey feeling safe on board. This directly influences booking decisions and willingness to fly.

International Airlines Group (IAG) must therefore prioritize and clearly communicate its rigorous health and safety protocols. Investments in advanced cabin cleaning, improved air filtration systems, and flexible booking options are crucial to rebuilding and maintaining passenger trust. The psychological impact of past health crises continues to shape travel behavior, making transparency in safety measures a key differentiator.

Demand for Sustainable and Ethical Travel

Societal expectations are shifting, with a growing demand for businesses, including airlines, to prioritize sustainability and ethical practices. This trend significantly impacts consumer choices, as travelers are increasingly conscious of the environmental footprint associated with their journeys. For instance, a 2024 survey indicated that over 60% of travelers consider sustainability when booking flights, a notable increase from previous years.

Airlines like IAG are responding to this by investing in crucial areas to meet these evolving values. This includes significant capital allocation towards sustainable aviation fuels (SAFs), with IAG aiming for 10% SAF usage by 2030. Furthermore, fleet modernization is a key strategy, with the introduction of more fuel-efficient aircraft like the Airbus A320neo family, which can reduce emissions by up to 15% per flight. Communicating these environmental initiatives transparently is also vital to build trust and cater to this conscious consumer base.

- Growing Consumer Awareness: Over 60% of travelers now consider sustainability when booking flights, a key driver for airline strategy.

- Investment in SAFs: IAG's commitment to achieving 10% SAF usage by 2030 underscores the industry's response to environmental concerns.

- Fleet Modernization: The adoption of fuel-efficient aircraft, such as the Airbus A320neo, contributes to a 15% reduction in per-flight emissions.

- Ethical Operations: Beyond environmental impact, consumers also scrutinize labor practices and corporate social responsibility, influencing brand loyalty.

Customer Experience Expectations and Digitalization

Customers now expect a fully digital travel journey, from booking to post-flight engagement. This means airlines like IAG must offer intuitive online platforms, mobile apps with real-time flight tracking, and digital check-in options. For instance, in 2024, over 80% of air travelers globally preferred digital self-service options for managing their bookings and check-ins.

Personalization driven by data analytics is also a key expectation. Travelers anticipate tailored offers, relevant updates, and a seamless experience across all touchpoints. IAG's investment in digital capabilities aims to meet this, with a focus on enhancing customer loyalty through personalized communication and services. By mid-2025, data suggests that airlines offering personalized digital experiences could see a 15-20% increase in customer retention.

- Digital Convenience: Customers demand easy online booking, mobile check-in, and real-time flight updates.

- Personalization: Expectations are high for tailored offers and communication based on travel history.

- In-Flight Connectivity: Reliable Wi-Fi and digital entertainment are increasingly becoming standard expectations.

- Brand Perception: A strong digital presence directly influences customer satisfaction and brand loyalty.

Societal values are increasingly prioritizing sustainability, with over 60% of travelers in 2024 considering environmental impact when booking. Airlines like IAG are responding by investing in sustainable aviation fuels, aiming for 10% usage by 2030, and modernizing fleets with fuel-efficient aircraft like the Airbus A320neo, which reduce emissions by up to 15%. Ethical operations and corporate social responsibility are also becoming key factors influencing brand loyalty.

Technological factors

The ongoing development of more fuel-efficient aircraft, exemplified by new generation models from Airbus and Boeing, significantly influences International Airlines Group's (IAG) operating expenses and environmental impact. For instance, the Airbus A320neo family offers up to 20% fuel burn reduction compared to its predecessors, directly translating to lower costs and emissions per flight.

IAG's strategic investment in these advanced technologies, such as the Boeing 787 Dreamliner and Airbus A350, enables substantial reductions in fuel consumption and carbon emissions per passenger. This not only bolsters economic performance through cost savings but also enhances the group's sustainability profile, a critical factor for attracting environmentally conscious travelers and investors.

Fleet modernization remains a crucial technological imperative for IAG, with the group consistently evaluating and integrating the latest aircraft advancements. As of early 2024, IAG continues to take delivery of new, more efficient aircraft, aiming to replace older, less economical models and further optimize its operational efficiency and environmental stewardship.

Technological advancements are fundamentally reshaping the airline industry, particularly in how customers interact with carriers and how airlines operate. Online booking platforms, mobile apps for check-in and boarding passes, and sophisticated in-flight entertainment systems are now standard expectations, directly impacting the customer journey. For instance, by 2024, it's estimated that over 70% of airline bookings will occur online, a significant jump from previous years, highlighting the critical role of digital channels.

International Airlines Group (IAG), like many major carriers, is heavily investing in digitalization to create a more seamless and personalized experience for passengers. This includes automating processes like check-in and baggage tracking, which not only boosts efficiency but also frees up staff for more complex customer service tasks. The airline group reported a significant increase in digital adoption among its passengers in 2023, with mobile app usage for booking and management up by 15% year-on-year.

The integration of Artificial Intelligence (AI) is a growing frontier, with airlines exploring its use in everything from predictive maintenance to personalized customer service. AI-powered chatbots are handling an increasing volume of customer inquiries, improving response times and reducing operational costs. IAG is piloting AI solutions to analyze passenger data, aiming to offer more tailored travel options and improve operational insights, potentially leading to a 10% reduction in customer service handling time by the end of 2025.

Big data analytics and AI are revolutionizing airline operations, impacting everything from how tickets are priced to how planes are maintained. International Airlines Group (IAG) can harness these tools to refine flight paths, tailor marketing to individual customers, and even predict maintenance needs before they become major problems. For instance, AI-driven dynamic pricing can adjust fares in real-time based on demand, potentially increasing revenue. In 2024, the airline industry saw significant investment in AI for operational efficiency, with some carriers reporting up to a 15% reduction in fuel costs through optimized routing.

Cybersecurity and Data Protection

As airlines like IAG lean more on digital platforms for everything from booking to flight management, cybersecurity becomes a critical technological hurdle. The risk of cyberattacks is a major concern, necessitating substantial investment in safeguarding passenger data and essential operational systems.

Protecting sensitive information from breaches is paramount. For instance, the global average cost of a data breach in 2024 reached $4.73 million, a figure that underscores the financial and reputational damage airlines can face. IAG, therefore, must prioritize advanced cybersecurity defenses.

Compliance with evolving data protection laws, such as the General Data Protection Regulation (GDPR), presents an ongoing technological and legal challenge. Non-compliance can lead to significant fines, impacting profitability and operational continuity.

- Increased reliance on digital systems amplifies cyberattack risks.

- Significant investment in robust cybersecurity measures is essential for protecting passenger data and operations.

- Compliance with data protection regulations like GDPR remains a continuous challenge.

Sustainable Aviation Fuel (SAF) and Alternative Propulsion Development

The development of Sustainable Aviation Fuel (SAF) is accelerating, with a projected global production capacity of 6.5 billion liters by the end of 2024, a significant increase from previous years. This advancement is critical for airlines like IAG to meet their ambitious decarbonization targets, aiming for 10% SAF usage by 2030. The ongoing research into electric and hydrogen propulsion systems also signals a transformative shift, though widespread adoption for long-haul flights remains a longer-term prospect.

The investment in SAF is not just about environmental compliance; it's a strategic move to diversify fuel sources and mitigate the volatility of fossil fuel prices. For instance, IAG has committed to investing €400 million in SAF and related technologies, underscoring the financial commitment required for this technological transition. This focus on SAF production and alternative propulsion is reshaping the future of airline fleet composition and operational strategies.

- SAF Production Growth: Global SAF production capacity is expected to reach 6.5 billion liters by the end of 2024.

- Airline Investment: IAG's €400 million investment highlights significant financial commitment to SAF and related technologies.

- Decarbonization Targets: The industry aims for 10% SAF usage by 2030, driving technological advancements.

- Future Fleet Potential: Electric and hydrogen aircraft represent long-term possibilities for decarbonizing air travel.

Technological advancements are continuously improving aircraft efficiency, with new models like the Airbus A320neo family offering up to a 20% fuel burn reduction. This directly lowers operating costs and environmental impact for airlines like IAG. The group's strategic adoption of aircraft such as the Boeing 787 Dreamliner and Airbus A350 further slashes fuel consumption per passenger, enhancing both economic performance and sustainability credentials.

Digitalization is transforming customer interaction, with online bookings expected to exceed 70% of airline reservations by 2024. IAG's investment in mobile apps and automated processes, which saw a 15% year-on-year increase in passenger usage in 2023, aims to create a more seamless travel experience.

AI is increasingly utilized for predictive maintenance and personalized customer service, with IAG piloting solutions that could reduce customer service handling time by 10% by the end of 2025. Big data analytics also enable dynamic pricing and optimized flight paths, with the industry seeing up to a 15% reduction in fuel costs through such optimizations in 2024.

The airline industry faces significant cybersecurity risks, with the global average cost of a data breach reaching $4.73 million in 2024, necessitating robust defenses and compliance with regulations like GDPR.

Sustainable Aviation Fuel (SAF) production is projected to reach 6.5 billion liters by the end of 2024, supporting industry goals like IAG's commitment to 10% SAF usage by 2030. IAG's €400 million investment in SAF highlights the financial drive towards decarbonization, with electric and hydrogen propulsion systems representing future possibilities.

| Technology Area | Key Advancement/Trend | Impact on Airlines (e.g., IAG) | Relevant Data/Projections (2024-2025) |

|---|---|---|---|

| Aircraft Efficiency | New generation aircraft (e.g., A320neo) | Reduced fuel burn (up to 20%), lower operating costs, reduced emissions | Ongoing fleet modernization; delivery of new, efficient aircraft continues |

| Digitalization & Customer Experience | Online booking, mobile apps, AI chatbots | Improved customer journey, operational efficiency, personalized services | >70% online bookings expected by 2024; 15% YoY increase in IAG mobile app usage (2023) |

| Data Analytics & AI | Predictive maintenance, dynamic pricing, route optimization | Enhanced operational insights, revenue generation, cost savings | AI piloting for 10% customer service time reduction by end-2025; up to 15% fuel cost reduction via optimized routing (2024) |

| Cybersecurity | Data protection, threat mitigation | Safeguarding passenger data, operational integrity, regulatory compliance | Average data breach cost: $4.73 million (2024); ongoing GDPR compliance efforts |

| Sustainable Aviation Fuel (SAF) & Propulsion | SAF production, electric/hydrogen propulsion | Decarbonization, fuel source diversification, long-term fleet strategy | 6.5 billion liters SAF production capacity projected by end-2024; IAG investing €400 million in SAF |

Legal factors

International Airlines Group (IAG) navigates a complex legal landscape shaped by international aviation law and numerous bilateral air service agreements. These agreements, often updated, dictate traffic rights, flight frequencies, and market access between countries, directly influencing IAG's route profitability and expansion capabilities. For instance, the Open Skies agreements, like the one between the EU and the US, have significantly liberalized air travel, benefiting carriers like IAG by reducing restrictions.

Compliance with varying safety standards and liability regulations across different jurisdictions is paramount for IAG's global operations. Failure to adhere to these international mandates, such as those set by the International Civil Aviation Organization (ICAO), can result in significant penalties and operational disruptions. The airline industry's safety record remains a key focus, with continuous updates to regulations impacting everything from aircraft maintenance to pilot training.

Disputes or changes in these bilateral agreements can have a substantial impact on IAG's strategic planning and operational freedom. For example, a renegotiation of an air service agreement could alter IAG's ability to operate specific routes or increase competition on existing ones, potentially affecting its market share and revenue streams. The ongoing evolution of these legal frameworks requires constant monitoring and adaptation by IAG's legal and strategic teams.

As a significant player, IAG faces rigorous competition and antitrust laws across its operating regions, particularly in the EU and UK. These regulations directly influence its ability to pursue mergers, acquisitions, and strategic partnerships, demanding thorough legal review to prevent monopolistic behaviors. For instance, the European Commission's scrutiny of airline alliances and potential route sharing agreements highlights the ongoing oversight of competitive practices.

International Airlines Group (IAG) airlines must navigate a complex web of consumer protection laws, with regulations like EU261 significantly impacting operations. These rules mandate compensation for flight delays, cancellations, and denied boarding, creating substantial financial liabilities. For instance, in 2023, airlines operating within the EU faced claims totaling billions of euros due to widespread disruptions.

Compliance with these passenger rights legislation is not merely a legal obligation but a crucial element of brand management. Failure to adhere to these stringent rules can result in hefty fines and severe reputational damage. IAG's proactive approach to managing passenger claims, as evidenced by their customer service initiatives, is vital for mitigating these risks and fostering passenger trust.

Labor Laws and Industrial Relations

International Airlines Group (IAG) must navigate a complex web of labor laws and industrial relations across its numerous operating countries. In 2024, for instance, the airline industry continued to see ongoing negotiations and potential disputes concerning pilot and cabin crew contracts, impacting operational schedules and labor costs. Changes in employment legislation, such as mandated rest periods or new pension regulations, can also lead to significant adjustments in staffing models and overall expenditure.

Managing a diverse, multinational workforce presents inherent challenges related to differing union strengths and collective bargaining agreements. For example, in early 2025, reports indicated continued union activity and potential industrial action within some European carriers, highlighting the persistent need for proactive engagement and compliance with local labor standards. Failure to adequately address these can result in disruptions, as seen in past instances of strikes affecting flight operations.

- Navigating Diverse Labor Laws: IAG operates in countries with varying employment protection laws, minimum wage standards, and working condition regulations, requiring constant legal vigilance.

- Union Relations and Collective Bargaining: The group must manage relationships with multiple trade unions representing different employee groups, with collective bargaining agreements influencing wage structures and work rules.

- Impact of Labor Disputes: Strikes or industrial actions, such as those experienced by competitors in 2024 impacting thousands of flights, can lead to substantial financial losses and reputational damage.

- Legislative Changes: Evolving employment legislation, including potential shifts in contract types or benefits mandates, necessitates continuous adaptation of HR policies and operational planning.

Data Privacy and Cybersecurity Regulations

International Airlines Group (IAG) faces significant legal challenges related to data privacy and cybersecurity. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, impose stringent requirements on how passenger data is collected, processed, and stored. These laws necessitate comprehensive data security protocols and transparent practices.

Non-compliance with these evolving legal frameworks can result in severe financial penalties. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. IAG must invest in robust cybersecurity measures and ensure clear consent mechanisms for data usage to mitigate these risks and maintain customer trust.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Data Processing: Strict rules on collecting, storing, and using passenger information.

- Cybersecurity Investment: Ongoing need for advanced security measures to protect sensitive data.

- Reputational Risk: Data breaches can lead to significant damage to brand image and customer loyalty.

International aviation law and bilateral air service agreements are critical legal frameworks governing IAG's operations, dictating market access and route rights. The ongoing liberalization of air travel, exemplified by EU-US Open Skies agreements, continues to shape competitive dynamics. Staying compliant with international safety standards, such as those from ICAO, and varying liability regulations across jurisdictions is essential for operational continuity and avoiding significant penalties.

Environmental factors

The airline industry, including International Airlines Group (IAG), is under significant pressure to decarbonize, with IAG aiming for net-zero emissions by 2050. This commitment requires careful management of a complex web of international and national regulations designed to curb carbon output.

Key regulatory frameworks like the EU Emissions Trading System (ETS) and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) directly impact operational costs by imposing charges on carbon emissions. For instance, the EU ETS saw carbon prices fluctuate significantly in 2024, impacting airlines operating within the bloc.

Achieving these ambitious climate targets necessitates substantial financial outlays. Airlines must invest heavily in sustainable aviation fuels (SAFs), which are currently more expensive than conventional jet fuel, and in modernizing their fleets with more fuel-efficient aircraft. Operational improvements, such as optimized flight paths and ground operations, also play a crucial role in reducing emissions.

Airports and communities near them are increasingly focused on reducing aircraft noise, resulting in tighter regulations and operational limits, especially during nighttime hours. This trend directly impacts International Airlines Group (IAG) by potentially altering flight schedules, how they deploy their aircraft, and their ability to access key airports like London Heathrow and Madrid.

For instance, by 2024, many European airports have implemented or are strengthening night-time curfews and noise limits, forcing airlines to adjust their schedules. IAG's response includes investing in newer, quieter aircraft models, which can significantly reduce noise footprints. The airline group’s fleet modernization efforts, including the introduction of the Airbus A320neo family, are partly driven by these environmental pressures, aiming to meet stricter noise standards and improve operational efficiency.

Environmental concerns for airlines like International Airlines Group (IAG) significantly involve managing waste generated during flights and at ground facilities. This includes everything from catering leftovers and passenger cabin trash to by-products from aircraft maintenance. IAG, like its peers, faces increasing pressure to develop and implement robust waste reduction, recycling, and resource efficiency strategies throughout its operations.

These initiatives are not just about meeting environmental targets; they are increasingly tied to broader corporate social responsibility objectives and offer tangible benefits in reducing operational costs. For instance, by improving fuel efficiency, airlines can directly cut down on emissions and also reduce the amount of fuel they need to purchase, which is a significant expense. In 2024, the aviation industry is actively exploring innovations in sustainable aviation fuels (SAFs) and more efficient aircraft designs to tackle these environmental pressures head-on.

Public and Investor Pressure for Sustainability

Environmental advocacy groups, the public, and investors are increasingly demanding airlines demonstrate robust commitments to sustainability. This pressure directly impacts an airline's brand perception, customer loyalty, and ability to secure financing. For instance, in 2024, a significant portion of airline investors are actively scrutinizing Environmental, Social, and Governance (ESG) performance, with a growing number divesting from companies failing to meet sustainability benchmarks. Therefore, transparent reporting on environmental metrics and proactive implementation of green initiatives are crucial for meeting these stakeholder expectations.

Meeting these expectations involves tangible actions and clear communication. Airlines that prioritize sustainability often see improved brand image and stronger customer loyalty, particularly among younger demographics. For example, surveys conducted in late 2024 indicated that over 60% of air travelers consider an airline's sustainability efforts when making booking decisions. This trend underscores the financial imperative for airlines to invest in eco-friendly technologies and operational efficiencies.

- Growing Investor Demand: Institutional investors are increasingly integrating ESG factors into their investment decisions, impacting capital availability for airlines.

- Consumer Preferences: A significant and growing percentage of travelers, especially millennials and Gen Z, favor airlines with demonstrable sustainability commitments.

- Regulatory Scrutiny: Heightened public and governmental focus on climate change translates into increased regulatory oversight and potential penalties for non-compliance with environmental standards.

- Brand Reputation: Proactive environmental reporting and initiatives can significantly enhance an airline's brand image, fostering trust and loyalty among customers and stakeholders.

Impact of Extreme Weather Events

Climate change is undeniably amplifying the frequency and severity of extreme weather occurrences, including intense storms, prolonged heatwaves, and widespread wildfires. These environmental shifts directly impact airline operations, causing significant disruptions. For instance, in 2024, the aviation industry experienced numerous flight cancellations and delays attributed to severe weather, with some estimates suggesting billions in economic losses globally due to these disruptions.

These events lead to tangible operational challenges for International Airlines Group (IAG), manifesting as flight delays, outright cancellations, and a subsequent surge in operational costs associated with rerouting, passenger reaccommodation, and aircraft repositioning. The financial strain from these disruptions can be substantial, impacting profitability and customer satisfaction.

Consequently, bolstering operational resilience through adaptive planning and infrastructure upgrades to effectively manage these escalating environmental challenges is no longer optional but a critical imperative for airlines like IAG. This includes investing in advanced weather forecasting and developing more robust contingency plans.

- Increased flight disruptions: Extreme weather events directly cause delays and cancellations, impacting schedules and passenger experience.

- Rising operational costs: Rerouting, passenger care, and aircraft repositioning due to weather add significant expenses.

- Need for resilience: Adapting infrastructure and operational plans to mitigate weather-related impacts is crucial for sustained operations.

The airline sector faces increasing pressure to reduce its environmental footprint, with a significant focus on decarbonization efforts and the adoption of sustainable aviation fuels (SAFs). These initiatives are driven by both regulatory mandates and growing investor and consumer demand for greener operations.

The financial implications are substantial, requiring considerable investment in new technologies and operational adjustments to meet net-zero targets by 2050. For instance, the cost of SAFs remains a key challenge, though their adoption is seen as crucial for long-term sustainability.

Furthermore, the industry must contend with stricter noise regulations at airports and escalating operational costs stemming from climate change-induced extreme weather events, which caused billions in losses globally in 2024 alone.

| Environmental Factor | Impact on Airlines (e.g., IAG) | 2024/2025 Data/Trends |

|---|---|---|

| Decarbonization & SAFs | Increased operational costs, fleet modernization needs, regulatory compliance | SAF prices remained higher than conventional jet fuel; IAG committed to increasing SAF usage. |

| Noise Regulations | Flight schedule adjustments, fleet deployment changes, investment in quieter aircraft | Many European airports strengthened night-time curfews and noise limits; IAG invested in A320neo family aircraft. |

| Extreme Weather | Flight disruptions, increased operational expenses, need for resilience planning | Billions in global economic losses from weather-related disruptions in 2024; airlines investing in advanced weather forecasting. |

| Waste Management | Pressure for robust recycling and resource efficiency strategies | Growing focus on reducing catering waste and cabin trash; airlines implementing enhanced recycling programs. |

PESTLE Analysis Data Sources

Our International Airlines PESTLE Analysis is meticulously constructed using data from leading international organizations like the IATA and ICAO, alongside reports from aviation consultancies and economic forecasting firms. This ensures a comprehensive understanding of global trends impacting the industry.