International Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Airlines Bundle

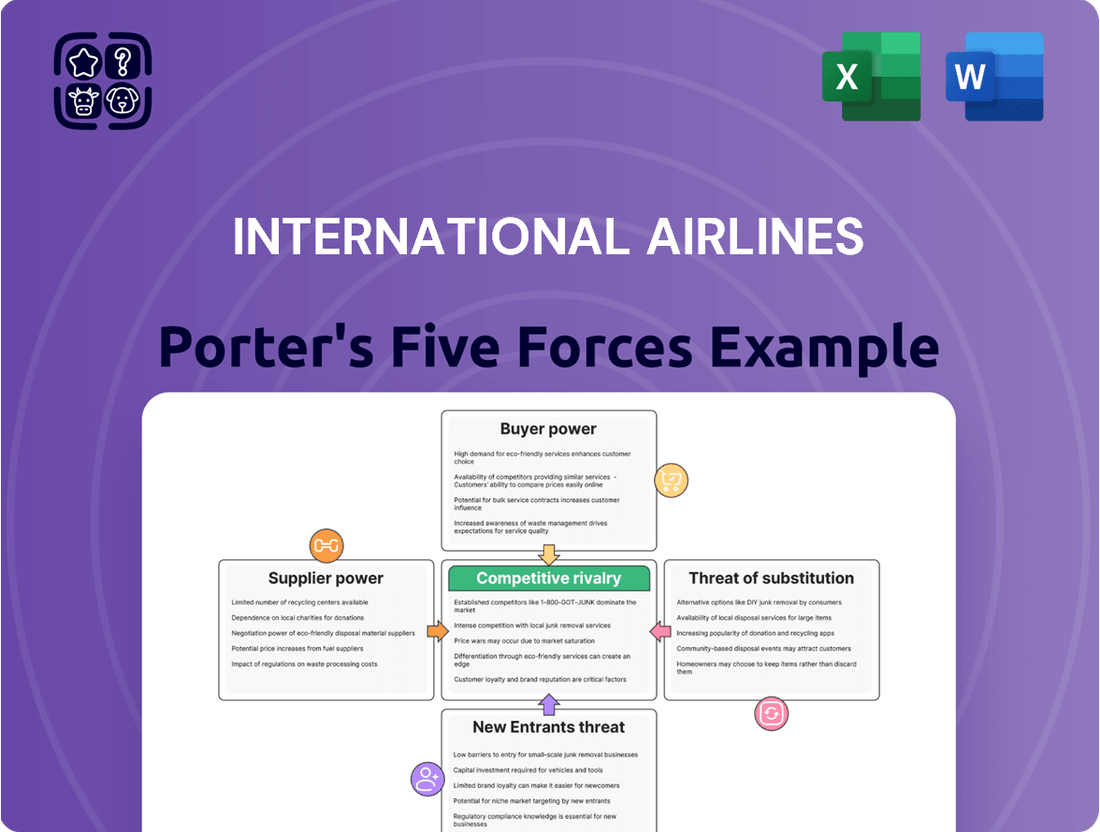

International Airlines operates in a dynamic industry shaped by powerful competitive forces. Understanding the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the pressure from substitute products is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore International Airlines’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The airline sector, including giants like IAG, faces substantial supplier power from a concentrated market. Boeing and Airbus dominate aircraft manufacturing, creating a duopoly that significantly shifts bargaining leverage. This limited supplier base allows them to exert considerable influence over pricing and delivery timelines, directly impacting IAG's strategic fleet planning and modernization efforts.

The high cost of jet fuel significantly amplifies the bargaining power of suppliers for international airlines. Fuel is a substantial operating expense, and its price is heavily influenced by global events and market forces, granting fuel providers considerable leverage. While projections suggest a slight decrease in average jet fuel prices for 2025 compared to 2024, the inherent volatility continues to pose a risk to airline profitability, including that of major carriers like IAG.

Specialized aircraft engine manufacturers wield considerable bargaining power. For instance, Rolls-Royce, a key supplier for the Boeing 787 Dreamliner, can significantly influence airline operations. When supply chain disruptions or maintenance issues occur, as seen with airlines like British Airways, it can directly impact aircraft availability and delivery schedules, thereby constraining an airline group's capacity and growth potential.

Skilled Labor and Pilot Unions

The bargaining power of skilled labor, especially pilots and maintenance crews, significantly impacts airlines. Unions representing these professionals can negotiate for higher wages, better benefits, and improved working conditions, directly influencing operational costs. For instance, in 2024, pilot shortages continued to be a concern for many carriers, allowing experienced pilots to command more favorable terms in their contract negotiations.

These negotiations can lead to increased labor expenses for airlines, affecting profitability. The potential for strikes or work stoppages, often a tactic used by unions during disputes, also grants them considerable leverage. Airlines must carefully manage these relationships to avoid disruptions that could lead to significant financial losses and reputational damage.

- High Demand for Pilots: A persistent global shortage of qualified pilots in 2024 meant airlines had to offer competitive compensation packages to attract and retain talent.

- Union Strength: Strong pilot and maintenance unions can collectively bargain for substantial wage increases and benefits, directly increasing an airline's cost structure.

- Operational Disruption Risk: The threat of labor disputes leading to flight cancellations or delays gives unions significant bargaining power over airline management.

Airport Infrastructure and Services

The bargaining power of suppliers in the airport infrastructure and services sector is significant for international airlines like IAG. Airports, air traffic control, and ground handling services frequently operate as regional monopolies or oligopolies. This market structure allows them to exert considerable influence through setting landing fees, gate charges, and other service costs, which are unavoidable expenses for airlines operating globally.

For instance, in 2024, major hub airports often saw increases in their aeronautical charges. Heathrow Airport, a key hub for IAG, has historically adjusted its charges. In early 2024, discussions around airport charges continued, reflecting the ongoing tension between airport operators seeking to recover infrastructure investments and airlines aiming to control operational costs. These fees directly impact an airline's cost base, making supplier negotiations critical.

- Monopolistic/Oligopolistic Control: Airports and related services often lack direct competition in specific regions, granting suppliers pricing power.

- Essential Services: Landing rights, gate access, and air traffic control are non-negotiable operational necessities for airlines.

- Cost Pass-Through: Airports can pass on infrastructure development and maintenance costs through higher fees, directly affecting airline profitability.

- Regulatory Influence: While regulated, airport charges can still be set at levels that reflect supplier bargaining strength, impacting airlines' cost structures.

The bargaining power of suppliers in the airline industry is a critical factor, particularly for large carriers like IAG. Concentrated markets in aircraft manufacturing, with Boeing and Airbus as dominant players, grant these suppliers significant leverage over pricing and delivery. Similarly, the essential nature of jet fuel, despite some price moderation in 2025 projections, remains a substantial cost driver where suppliers hold considerable sway due to market volatility.

Specialized component manufacturers, like those producing aircraft engines, also wield strong influence. Disruptions in their supply chains can severely impact an airline's operational capacity. Furthermore, the high demand for skilled labor, especially pilots in 2024, empowered unions to negotiate for better terms, directly increasing labor costs for airlines.

| Supplier Category | Key Players/Examples | Impact on Airlines |

| Aircraft Manufacturing | Boeing, Airbus | High pricing power, influence on delivery schedules |

| Jet Fuel | Global Oil Producers/Refiners | Price volatility impacts operating costs significantly |

| Aircraft Engines | Rolls-Royce, GE Aviation | Control over maintenance, parts availability, and technology |

| Skilled Labor (Pilots, Mechanics) | Airline Unions | Wage demands, benefits, potential for operational disruptions |

| Airport Services | Airport Authorities, Air Traffic Control | Landing fees, gate charges, essential operational costs |

What is included in the product

Analyzes the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes, all within the context of the global airline industry for International Airlines.

Effortlessly navigate competitive pressures by quickly identifying and mitigating threats from rivals, new entrants, buyers, suppliers, and substitutes.

Customers Bargaining Power

Customers in the airline industry wield significant power, largely due to their acute price sensitivity. The proliferation of online travel agencies and comparison websites empowers travelers to effortlessly identify the cheapest available flights, directly impacting airline pricing strategies. For instance, in 2024, the average airfare for a domestic round-trip ticket in the US saw fluctuations, with leisure travelers being particularly adept at leveraging these tools to secure the lowest possible prices.

The sheer number of airlines and the routes they operate significantly empower customers. With many carriers, including budget-friendly options, flying the same or similar paths, travelers can easily compare prices and services, forcing airlines to compete aggressively on cost and convenience. This abundance of choice directly translates into greater bargaining power for the consumer.

Consider the International Airlines Group (IAG), which owns brands like British Airways, Iberia, and Vueling. While this diverse portfolio allows IAG to serve various customer segments, it also means its own airlines often compete with each other on certain routes, a dynamic that further amplifies customer leverage. For instance, in 2023, IAG reported a significant increase in passenger numbers, reaching 115.6 million, highlighting the scale of its operations and the vast customer base it serves, all of whom benefit from these competitive pressures.

Loyalty programs, while designed to lock in customers and reduce their bargaining power, often become a double-edged sword in the airline industry. Their ubiquity means passengers can easily switch to airlines offering more lucrative rewards, effectively shifting power back to the consumer. For instance, in 2024, airlines continue to invest heavily in these programs, with many reporting significant portions of their revenue coming from loyalty members, highlighting both their success in retention and the ongoing need to offer compelling value to stay competitive.

Influence of Online Reviews and Social Media

The influence of online reviews and social media has significantly amplified the bargaining power of customers in the airline industry. Travelers can readily share their experiences, both positive and negative, across numerous platforms, creating a readily accessible and influential source of information for potential passengers. This collective voice empowers consumers, pushing airlines to prioritize service quality and customer satisfaction to manage their online reputation effectively. For instance, a study in early 2024 indicated that over 85% of consumers consider online reviews before booking travel, directly impacting airline choice and, by extension, pricing power.

This digital transparency means that a single negative experience, amplified through social media, can deter a substantial number of future customers. Airlines are therefore incentivized to address customer complaints swiftly and transparently to mitigate reputational damage. This dynamic shifts leverage towards the customer, as airlines must actively work to earn and maintain positive online sentiment, often leading to improved service offerings or more competitive pricing to attract and retain passengers.

- Amplified Customer Voice: Online platforms allow individual customer experiences to reach a wide audience, creating a collective bargaining force.

- Reputational Impact: Positive or negative reviews directly influence potential customers' booking decisions, forcing airlines to maintain high service standards.

- Data-Driven Decisions: In 2024, a significant majority of travelers rely on online reviews, giving customers substantial influence over airline market share and pricing.

Shift Towards Leisure Travel and Digital Experience

The shift towards leisure travel significantly strengthens customer bargaining power. Households continue to prioritize travel experiences, making airlines like IAG highly sensitive to customer preferences. In 2024, the global travel market saw a significant rebound, with leisure travel leading the recovery, demonstrating this ongoing consumer focus.

Customers are increasingly demanding seamless digital experiences throughout their journey. This includes user-friendly booking platforms, personalized in-flight entertainment, and efficient digital communication. Airlines that fail to meet these evolving digital expectations risk losing customers to competitors who offer superior online and mobile services, directly impacting IAG's competitive standing.

- Leisure Travel Dominance: Leisure travel accounted for a substantial portion of airline passenger volume in 2024, underscoring its importance to airline revenue.

- Digital Expectations: Surveys in late 2024 indicated that over 70% of travelers consider digital convenience a key factor in their airline choice.

- Competitive Pressure: Airlines are investing heavily in digital transformation to meet customer demands, creating a competitive landscape where digital offerings are a key differentiator.

Customers in the airline industry possess considerable bargaining power, primarily driven by their sensitivity to price and the ease with which they can compare options. The widespread availability of online comparison tools allows travelers to quickly find the most affordable flights, forcing airlines to maintain competitive pricing strategies. In 2024, the average domestic round-trip airfare in the U.S. experienced notable shifts, with leisure travelers adeptly utilizing these platforms to secure the lowest fares.

The abundance of airlines and the overlapping routes they serve further empower customers. With numerous carriers offering similar or identical travel paths, passengers can easily switch between providers based on price and service, compelling airlines to compete fiercely on cost and convenience. This extensive choice directly enhances consumer bargaining power.

Loyalty programs, while intended to retain customers, often backfire by enabling passengers to switch to airlines with more attractive rewards, thus shifting leverage back to the consumer. For instance, in 2024, airlines continue to invest significantly in these programs, with a substantial portion of revenue often linked to loyalty members, indicating both retention success and the ongoing need to offer compelling value.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Example |

|---|---|---|

| Price Sensitivity | High | Leisure travelers actively seek lowest fares using comparison sites. |

| Availability of Substitutes | High | Numerous airlines offer similar routes, increasing choice. |

| Switching Costs | Low | Easy to change airlines, especially with accessible loyalty programs. |

| Information Availability | High | Online reviews and social media heavily influence booking decisions (over 85% of consumers consider reviews). |

| Buyer Concentration | Low (Fragmented) | Millions of individual travelers, each with choice. |

Same Document Delivered

International Airlines Porter's Five Forces Analysis

This preview shows the exact, professionally written International Airlines Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual document, meaning what you see here is precisely what you'll be able to download and utilize without any surprises or placeholders. This is the complete, ready-to-use analysis file, fully formatted and ready for your strategic needs the moment you complete your purchase.

Rivalry Among Competitors

The international airline sector is incredibly competitive, featuring a vast array of carriers. This includes established legacy airlines offering full service, alongside newer ultra-low-cost carriers that focus on price. International Airlines Group (IAG), for instance, navigates this landscape with a multi-brand approach, encountering distinct competitive challenges from each segment of the market it serves.

The airline industry is notoriously competitive, often triggering price wars, particularly on high-demand routes. This intense pricing pressure can significantly squeeze profit margins for all carriers involved, including International Airlines Group (IAG).

In 2023, for instance, many airlines engaged in aggressive discounting to stimulate demand post-pandemic, leading to lower average fares. IAG's strategy of carefully managing its capacity growth and prioritizing routes with strong profitability is a vital tactic to mitigate the impact of these price wars and maintain financial health.

IAG's premium carriers, British Airways and Iberia, cultivate strong brand loyalty, a valuable asset in the competitive airline landscape. However, this loyalty faces a significant challenge from widespread price sensitivity, particularly in the short-haul and leisure travel segments. For instance, in 2024, budget carriers continued to gain market share on popular European routes, demonstrating that even established brands must remain price-aware.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures significantly shape competitive rivalry in the airline industry. Major carriers, like those within the Oneworld alliance which includes British Airways and Iberia, pool resources to offer expanded route networks and more integrated customer experiences. This collaborative approach intensifies pressure on airlines operating independently, forcing them to either join such networks or find alternative ways to compete globally. For instance, International Airlines Group (IAG) actively uses these partnerships to bolster its worldwide presence and service offerings.

These alliances allow airlines to share costs, codeshare on flights, and coordinate marketing efforts, effectively creating a larger, more competitive entity. This can lead to increased market share for alliance members and a more challenging environment for non-aligned airlines. The ability to offer a wider array of destinations and seamless connections through partner airlines is a powerful draw for travelers, directly impacting customer loyalty and booking decisions.

- Alliance Strength: Major alliances like Star Alliance, SkyTeam, and Oneworld represent a significant portion of global air traffic, with Oneworld alone serving over 1 billion passengers annually.

- Network Expansion: Through alliances, airlines can offer access to hundreds of destinations they do not fly to themselves, increasing their competitive reach.

- Cost Synergies: Joint ventures and alliances can lead to shared operational costs, such as maintenance and ground handling, improving efficiency and potentially lowering fares, thus intensifying price competition.

Focus on Customer Experience and Innovation

Competitive rivalry in the airline industry extends far beyond just ticket prices. Airlines are increasingly differentiating themselves through superior customer experiences, on-time performance, and enhanced cabin comfort. For instance, in 2024, airlines are heavily investing in in-flight entertainment upgrades and more sustainable travel options.

International Airlines Group (IAG) exemplifies this trend with substantial investments aimed at securing a competitive advantage. Their commitment is evident in their significant capital allocation towards improving customer experience touchpoints, bolstering IT infrastructure for seamless operations, and pioneering the use of sustainable aviation fuel (SAF). These strategic moves underscore the intense rivalry among carriers to attract and retain passengers in a dynamic market.

- Customer Experience Focus: Airlines are competing on factors beyond price, including on-time performance, cabin comfort, and in-flight entertainment.

- Innovation in Sustainability: Investments in sustainable aviation fuel (SAF) are a key differentiator in 2024.

- IAG's Strategic Investments: IAG is channeling resources into customer experience enhancements and IT infrastructure upgrades.

- Competitive Edge: These initiatives are designed to give airlines like IAG a distinct advantage in a highly competitive market.

Competitive rivalry in the international airline sector is fierce, driven by numerous carriers including legacy airlines and ultra-low-cost carriers. This intense competition frequently leads to price wars, especially on popular routes, which can severely impact profit margins. For example, in 2023, many airlines employed aggressive discounting strategies to boost post-pandemic demand, resulting in lower average fares.

Airlines are also differentiating themselves through customer experience, on-time performance, and cabin comfort. In 2024, significant investments are being made in areas like in-flight entertainment upgrades and sustainable travel options. International Airlines Group (IAG) is actively investing in customer experience, IT infrastructure, and sustainable aviation fuel (SAF) to gain a competitive edge.

Strategic alliances and joint ventures further intensify this rivalry. Major alliances like Oneworld, which includes IAG's British Airways and Iberia, offer expanded route networks and integrated customer experiences, putting pressure on independent carriers. These alliances allow for cost-sharing and coordinated marketing, creating a more formidable competitive unit.

| Metric | 2023 Data | 2024 Trend |

| Average Fare on High-Demand Routes | Decreased due to post-pandemic discounting | Continued price sensitivity, especially in leisure segments |

| Market Share of Budget Carriers (Europe) | Gaining share | Continued gains |

| Investment in In-flight Entertainment | Increasing | Significant upgrades expected |

| Investment in Sustainable Aviation Fuel (SAF) | Growing | Key differentiator |

SSubstitutes Threaten

For shorter intercity routes, particularly within Europe, high-speed rail and intercity buses present a tangible threat of substitution to airlines. These alternatives are increasingly appealing, especially to travelers prioritizing environmental impact and cost savings. For instance, the European rail network saw significant growth, with passenger numbers on high-speed lines often exceeding pre-pandemic levels by 2023, demonstrating a clear shift in travel preferences.

Virtual communication technologies like advanced video conferencing present a significant threat to the airline industry, particularly for business travel. These tools can effectively replace many in-person meetings, especially for shorter trips, thereby reducing the demand for flights.

While corporate travel saw an increase in 2024, it's important to note that it has not yet fully rebounded to its pre-pandemic levels. This ongoing gap impacts airlines like IAG, suggesting that the substitution effect from virtual communication is likely to persist.

For domestic and regional travel, particularly for families or groups, private car travel presents a compelling and cost-effective alternative to air travel, especially in areas boasting robust road infrastructure. This is a significant factor, as evidenced by the fact that in 2024, road transport accounted for approximately 75% of passenger-kilometers traveled within the European Union, highlighting its dominance for shorter journeys.

The flexibility offered by private cars, allowing for spontaneous stops and personalized itineraries, directly competes with the fixed schedules and routes of airlines. This is especially true for leisure travel where the journey itself can be part of the experience. For instance, the average car trip length in the US in 2023 was around 150 miles, a distance often manageable by car and potentially less convenient to fly for.

Cruise Lines and Other Leisure Travel Alternatives

Cruise lines and other leisure travel options present a significant threat of substitutes for airlines, particularly for vacationers. These alternatives offer distinct experiences and can attract travelers who might otherwise opt for air travel. For instance, the global cruise industry experienced a strong rebound in 2023, with passenger capacity increasing significantly over 2022 levels, signaling robust demand for this alternative form of leisure travel.

These substitutes appeal to different consumer preferences. While airlines offer speed and connectivity, cruise lines provide an all-inclusive, destination-focused experience. Other leisure travel alternatives, such as all-inclusive resorts or independent road trips, also compete for vacation budgets and time.

- Cruise Industry Growth: The cruise industry is projected to continue its growth trajectory, with major lines investing heavily in new ships and expanding itineraries, potentially capturing a larger share of the leisure travel market.

- All-Inclusive Packages: The popularity of all-inclusive vacation packages, often bundled with flights and accommodation, offers a convenient and price-competitive alternative to booking separate air travel and lodging.

- Shifting Consumer Preferences: Evolving traveler preferences, influenced by factors like sustainability concerns and a desire for unique experiences, can lead some consumers to choose land-based or sea-based vacations over traditional air travel.

Environmental Concerns and 'Flight Shaming'

Growing environmental awareness is a significant threat of substitutes for the airline industry. The concept of 'flight shaming' encourages travelers to consider more sustainable transport options, potentially impacting demand for air travel, especially for shorter routes where alternatives like high-speed rail are viable. For instance, in 2024, European rail networks continued to expand, offering competitive travel times and lower carbon footprints for many inter-city journeys.

This societal shift could influence long-term demand for air travel, as consumers increasingly prioritize environmental impact in their choices. While direct substitutes for long-haul international flights are limited, the growing preference for eco-friendly options could spur innovation in alternative transportation or encourage a reduction in non-essential air travel.

- Growing environmental awareness: Increased public concern over climate change.

- 'Flight Shaming' movement: Social pressure to reduce air travel.

- Viable alternatives: Expansion of high-speed rail and other eco-friendly transport.

- Impact on demand: Potential reduction in air travel, especially for shorter distances.

The threat of substitutes for airlines is multifaceted, encompassing high-speed rail, buses, private car travel, and even virtual communication for business trips. For leisure, cruise lines and all-inclusive resorts offer compelling alternatives. Growing environmental concerns also fuel the 'flight shaming' movement, pushing travelers towards more sustainable options like rail, especially for shorter intercity routes.

These substitutes directly impact airline demand. For example, in 2024, road transport still accounted for roughly 75% of passenger-kilometers within the EU, underscoring its dominance for shorter journeys. Similarly, the cruise industry saw a strong rebound in 2023, indicating a robust demand for alternative leisure travel experiences.

While virtual communication can replace some business travel, corporate travel in 2024 hadn't fully recovered to pre-pandemic levels, suggesting this substitution effect is ongoing. The flexibility of private car travel, with average trips around 150 miles in the US in 2023, also presents a convenient alternative to flying for many.

| Substitute | Key Appeal | Relevant Data Point (2023-2024) |

|---|---|---|

| High-Speed Rail | Environmental friendliness, cost, speed for intercity | European rail passenger numbers on high-speed lines often exceeded pre-pandemic levels by 2023. |

| Private Car Travel | Flexibility, cost-effectiveness for groups/families | Road transport accounted for ~75% of passenger-kilometers in the EU in 2024. Average US car trip length was ~150 miles in 2023. |

| Virtual Communication | Cost savings, convenience for business meetings | Corporate travel in 2024 had not fully rebounded to pre-pandemic levels. |

| Cruise Lines/Resorts | Unique experiences, all-inclusive packages | Global cruise industry passenger capacity increased significantly over 2022 levels in 2023. |

Entrants Threaten

The threat of new entrants in the airline industry is significantly dampened by the immense capital investment needed to even get off the ground. We're talking about billions of dollars just to acquire a fleet of modern aircraft, maintain them, build necessary infrastructure, and cover initial operational expenses. For instance, the average price of a new Boeing 737 MAX can range from $100 million to $130 million, and airlines typically operate dozens, if not hundreds, of aircraft.

This high barrier means that only well-funded entities, often backed by private equity or government support, can realistically consider entering the market. Established players like International Airlines Group (IAG), which includes British Airways and Iberia, benefit immensely from their existing, extensive fleets and established route networks, making it incredibly difficult for newcomers to compete on scale and efficiency from day one.

The aviation sector is a prime example of a market where strict regulatory hurdles significantly deter new entrants. Navigating the complex web of international and national aviation laws, including rigorous safety standards and extensive licensing procedures, demands substantial investment in time, capital, and expertise. For instance, obtaining an Air Operator Certificate (AOC) involves meticulous audits and proof of operational capability, a process that can take years and millions of dollars.

Established brand loyalty and network effects pose a significant barrier for new entrants in the airline industry. Incumbent carriers, such as those within the International Airlines Group (IAG) like British Airways and Iberia, have cultivated decades of strong brand recognition and deep customer loyalty, making it challenging for newcomers to attract and retain passengers. For instance, in 2024, major carriers continued to leverage their extensive route networks, offering a breadth of destinations and connectivity that new airlines struggle to replicate, thereby reinforcing customer preference and increasing switching costs.

Limited Access to Airport Slots and Infrastructure

Securing desirable airport slots and critical infrastructure at major global hubs presents a significant barrier for new airlines. This limited access directly impacts their ability to establish competitive routes and robust flight schedules, effectively deterring new entrants.

For instance, in 2023, London Heathrow (LHR), a key international gateway, operated at near-full capacity, with slot availability being a major constraint. The demand for slots often outstrips supply, making them a valuable and scarce commodity.

- Limited Slot Availability: Prime time slots at busy airports are highly sought after, with many major hubs operating at or near their physical capacity.

- Infrastructure Bottlenecks: Gate availability, check-in counters, and ground handling services can be constrained, especially during peak travel times.

- High Acquisition Costs: Acquiring or leasing existing slots can be prohibitively expensive for new airlines, adding substantial upfront capital requirements.

- Regulatory Hurdles: Airport authorities and national regulators often have complex processes for slot allocation, which can further delay or prevent new market entrants.

Economies of Scale and Cost Advantages of Incumbents

Existing airline giants leverage substantial economies of scale. For instance, in 2024, major carriers like Delta Air Lines reported operating revenues exceeding $40 billion, allowing for bulk purchasing of fuel and aircraft, which significantly lowers per-unit costs. This cost advantage is difficult for new airlines to replicate, creating a formidable barrier to entry.

These established players also benefit from widespread route networks and brand recognition, further solidifying their market position. A new entrant would face immense challenges in matching the operational efficiencies and marketing reach of incumbents, making price competition a steep uphill battle.

- Economies of Scale: Large airlines achieve lower costs per passenger mile due to high capacity utilization and bulk purchasing power.

- Cost Advantages: Incumbents benefit from established infrastructure, maintenance facilities, and experienced workforces, reducing operational overhead.

- Barriers to Entry: The capital required to establish a new airline with comparable scale and efficiency is exceptionally high, deterring potential new competitors.

The threat of new entrants for airlines like International Airlines Group (IAG) remains low due to substantial capital requirements and stringent regulatory frameworks. New airlines face billions in upfront costs for aircraft acquisition, maintenance, and operational setup, with new wide-body aircraft alone costing hundreds of millions. For example, a new Airbus A350 can cost upwards of $350 million. Furthermore, securing essential airport slots at major hubs, which are often at capacity, presents a significant hurdle.

| Barrier | Description | Example Data (2024/2025 Estimates) |

|---|---|---|

| Capital Requirements | High cost of aircraft, infrastructure, and initial operations. | New Boeing 777X: ~$440 million per aircraft. Initial fleet of 10 aircraft: ~$4.4 billion. |

| Regulatory Hurdles | Complex licensing, safety certifications, and international aviation laws. | Air Operator Certificate (AOC) process can take 1-3 years and cost millions. |

| Airport Slot Access | Limited availability of prime slots at major international airports. | London Heathrow (LHR) operates at over 98% capacity, making new slot acquisition extremely difficult and costly. |

| Economies of Scale | Established carriers benefit from lower per-unit costs due to large fleet size and passenger volume. | Major airlines in 2024 reported operating costs per available seat mile (CASM) significantly lower than what a startup could achieve. For instance, Southwest Airlines' CASM was around $0.07 in Q1 2024. |

Porter's Five Forces Analysis Data Sources

Our International Airlines Porter's Five Forces analysis is built upon a robust foundation of data, including annual reports, industry-specific market research from firms like OAG and IATA, and publicly available financial filings from major carriers.