International Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Airlines Bundle

Curious about which international airlines are soaring as Stars, which are steady Cash Cows, and which might be struggling Dogs in the current market? This preview offers a glimpse into the strategic positioning of key players.

Unlock the full potential of this analysis by purchasing the complete International Airlines BCG Matrix. Gain a comprehensive understanding of each airline's market share and growth rate, empowering you to make informed investment and partnership decisions.

Don't miss out on critical insights that can shape your strategy in the dynamic aviation industry. Get the full report today for a detailed breakdown and actionable recommendations.

Stars

Iberia shines as a Star in the International Airlines Group (IAG) portfolio, driven by its exceptional performance in high-growth markets. Its strategic focus on Latin America and the Caribbean has yielded significant results, positioning it as a dominant player in these lucrative corridors.

The airline's commitment to expansion is evident in its 2024 capacity increase of 16% to Latin America. Looking ahead to summer 2025, Iberia is set to offer a record 3.2 million seats in the region, underscoring its aggressive growth strategy and market leadership.

Iberia's long-haul network, particularly its routes to Latin America, represents its most profitable segment, consistently delivering double-digit profit margins. This strong financial performance solidifies Iberia's status as the premier airline connecting Europe and Latin America.

IAG Loyalty is a clear Star within the International Airlines Group's portfolio, demonstrating robust expansion in its loyalty program sector. In 2024, this division saw profits climb by a significant 14.4%, hitting €420 million, underscoring its high profit margins and strong cash generation capabilities.

The growth trajectory of IAG Loyalty is further evidenced by its expanding customer base. The first half of 2024 recorded a 23% surge in Avios issued and a 13% increase in active customers. This upward trend is fueled by strategic non-airline partnerships and the successful integration of offerings like BA Holidays, solidifying its position as a high-growth, high-share business.

International Airlines Group's (IAG) strategic investment of up to €200 million over five years into IAGi Ventures, targeting sustainable aviation and customer experience, firmly places this initiative as a Star within the International Airlines BCG Matrix. This significant capital allocation demonstrates a clear focus on high-growth potential companies that are shaping the future of air travel.

IAGi Ventures' mandate to foster innovation in areas like sustainable fuels and advanced operational technologies positions it as a key driver for IAG's long-term value creation. For instance, by 2024, the aviation industry is projected to see a substantial increase in demand for sustainable aviation fuels (SAFs), with global production expected to reach 10 billion liters, a significant jump from previous years, highlighting the market's rapid expansion and IAG's strategic foresight.

North Atlantic Routes Performance

The North Atlantic market represents a significant growth opportunity for International Airlines Group (IAG). Airlines like British Airways and Iberia are strategically allocating substantial resources and increasing capacity on these routes. This focus is driven by robust demand for air travel, particularly in the lucrative premium cabin segments.

These routes are considered Stars within the BCG matrix because of their high growth and high market share potential. The strong performance in the North Atlantic directly contributes to IAG's overall revenue and profitability, underscoring their strategic importance and capacity for further expansion.

- High Demand: The North Atlantic consistently shows strong passenger demand, especially for business and first-class travel.

- Revenue Generation: Premium cabin demand on these routes significantly boosts revenue and profitability for IAG carriers.

- Strategic Focus: IAG is investing heavily in fleet and network expansion to capitalize on this high-growth market.

- Market Share: British Airways and Iberia hold strong positions, indicating a high market share in this key region.

Premium Cabin Demand

Premium cabin demand remains robust for International Airlines Group (IAG) across its key markets. This sustained interest, even amidst global economic fluctuations, highlights a segment characterized by both high growth potential and strong profitability. For instance, IAG reported that its premium cabins, including First and Business Class, continued to outperform expectations in 2023, contributing significantly to overall revenue. This resilience positions premium travel as a core 'Star' product within IAG's portfolio.

The consistent demand for premium services allows IAG to achieve higher returns on investment. This strategic focus not only drives increased profitability but also reinforces the value proposition of its premium offerings across airlines like British Airways and Iberia. In 2024, IAG is further investing in enhancing these premium experiences, anticipating continued strong performance.

- Resilient Demand: Premium cabin bookings saw a notable increase in 2023 compared to pre-pandemic levels.

- Profitability Driver: Premium segments typically offer higher profit margins than economy class.

- Strategic Focus: IAG's investment in premium product enhancement aims to capture and retain high-value customers.

- Market Strength: Continued strength in premium travel indicates a healthy market segment for airlines like IAG.

Iberia's strategic expansion into Latin America, marked by a 16% capacity increase in 2024 and a projected 3.2 million seats for summer 2025, solidifies its Star status. This focus on high-growth markets and profitable long-haul routes, particularly to Latin America, consistently delivers strong financial results for IAG.

IAG Loyalty is a clear Star, demonstrating impressive growth with a 14.4% profit increase to €420 million in 2024. The program's expanding customer base, evidenced by a 23% surge in Avios issued in H1 2024, highlights its high market share and growth potential within the loyalty sector.

IAGi Ventures, with its significant €200 million investment over five years into sustainable aviation and customer experience, is positioned as a Star. This initiative targets high-growth potential in a rapidly expanding market, exemplified by the projected 10 billion liters of global SAF production by 2024.

The North Atlantic market, with its consistently strong passenger demand and high revenue potential from premium cabins, represents a Star for IAG. British Airways and Iberia's increased capacity and investment in this region underscore their high market share and strategic focus on this lucrative corridor.

Premium cabins across IAG's network are Stars due to resilient demand and higher profit margins. IAG's continued investment in enhancing these premium experiences, which outperformed expectations in 2023, reinforces their status as a key driver of profitability and customer value.

| Business Unit | BCG Category | Key Growth Drivers | Financial Performance Highlight | Strategic Importance |

|---|---|---|---|---|

| Iberia (Latin America Routes) | Star | High demand, capacity expansion | Double-digit profit margins | Dominant player in lucrative corridors |

| IAG Loyalty | Star | Expanding customer base, strategic partnerships | 14.4% profit growth (2024) to €420 million | High profit margins, strong cash generation |

| IAGi Ventures | Star | Investment in sustainable aviation, customer experience | Targeting high-growth potential companies | Shaping the future of air travel |

| North Atlantic Routes | Star | Robust demand, premium cabin strength | Significant revenue and profitability contribution | Key growth opportunity, strong market positions |

| Premium Cabins | Star | Resilient demand, high-value customers | Outperformed expectations in 2023 | Core driver of profitability and brand value |

What is included in the product

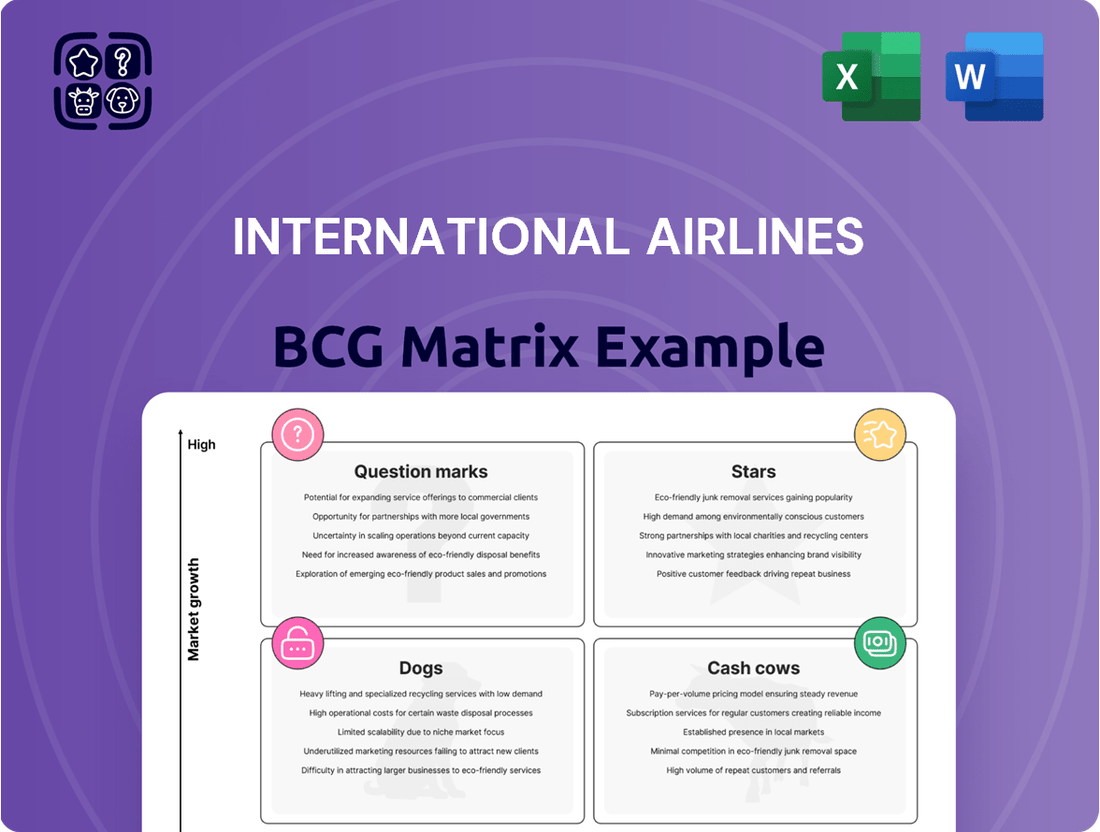

The International Airlines BCG Matrix offers a strategic overview of airline business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis helps airlines make informed decisions about resource allocation, identifying which routes or services to invest in, maintain, or divest.

Visualize airline business units in a BCG matrix, simplifying complex portfolio decisions.

Cash Cows

British Airways stands as a significant Cash Cow for its parent company, IAG. Its profitability stems from a dominant position in mature markets, especially its extensive long-haul flight network.

In 2024, British Airways achieved an operating profit exceeding €2 billion. This strong performance is further bolstered by a substantial €7 billion transformation initiative focused on improving operational efficiency and elevating the customer journey.

Vueling operates as a Cash Cow within the International Airlines BCG Matrix, leveraging its established position in the mature intra-European market. As a low-cost carrier, it commands a significant market share.

The airline's operational excellence is a key driver of its Cash Cow status. Vueling achieved the top spot globally for punctuality in February 2025, a testament to its efficient operations. This reliability fosters customer loyalty and reduces the need for extensive marketing spend.

IAG Cargo stands as a prime example of a Cash Cow within the International Airlines Group's portfolio. It effectively utilizes the group's vast global reach to produce significant revenue without demanding substantial new investments. This strong performance is underpinned by consistent operational efficiency and established market presence.

The financial performance of IAG Cargo in the first quarter of 2025 further solidifies its Cash Cow status. Cargo revenue saw a notable increase of 12.4%, driven by robust yields. This growth highlights its consistent capacity to generate substantial cash flow, leveraging its existing infrastructure and operational strengths.

Mature European Network

IAG's mature European network, encompassing airlines like Vueling and significant operations within British Airways and Iberia, functions as a Cash Cow. Despite lower growth prospects compared to long-haul routes, this segment offers a reliable foundation for the group, generating consistent revenue streams.

- Stable Revenue Generation: The established intra-European routes provide predictable income, underpinning IAG's financial stability.

- High Passenger Volumes: These mature markets typically handle substantial passenger numbers, ensuring high utilization rates.

- Operational Efficiency: Airlines within this segment often benefit from optimized operations and economies of scale in a well-developed market.

- Contribution to Group Profitability: The consistent cash flow from this segment allows IAG to invest in other areas of its business.

Cost Management and Operational Efficiency

International Airlines Group (IAG) leverages its group-wide commitment to operational excellence and disciplined capital allocation, solidifying its efficient operations as a Cash Cow within the BCG Matrix. This focus allows IAG to maximize cash generation from its established high market share assets.

Strategic investments in modernizing its fleet, such as the 2024 order of 20 A320neo family aircraft for Vueling, and embracing new technologies are key to this strategy. These initiatives streamline processes, enhancing overall efficiency and supporting sustainable shareholder returns.

- Fleet Modernization: IAG's ongoing investment in fuel-efficient aircraft, like the A320neo family, directly contributes to lower operating costs per available seat kilometer (CASK).

- Streamlined Operations: Initiatives to optimize aircraft utilization and turnaround times at airports reduce operational friction and boost productivity.

- Cost Discipline: A consistent focus on managing costs across the group, from maintenance to labor, ensures that the high market share assets generate strong, reliable cash flows.

- Shareholder Returns: The cash generated from these efficient operations supports IAG's ability to provide consistent dividends and engage in share buybacks, rewarding investors.

Cash Cows within IAG's portfolio represent established, high-market-share businesses in mature industries that generate more cash than they consume. These operations, like British Airways' long-haul routes and Vueling's intra-European network, benefit from strong brand recognition and efficient operations, providing a stable financial base for the group.

| Business Unit | BCG Matrix Category | Key Strengths | 2024/2025 Performance Indicators |

| British Airways (Long-Haul) | Cash Cow | Dominant market position, extensive network | Operating profit > €2 billion (2024) |

| Vueling (Intra-European) | Cash Cow | Low-cost carrier, high market share, operational efficiency | Global punctuality leader (Feb 2025) |

| IAG Cargo | Cash Cow | Leverages group reach, operational efficiency | Cargo revenue +12.4% (Q1 2025) |

Delivered as Shown

International Airlines BCG Matrix

The International Airlines BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no altered content or watermarks, just the comprehensive strategic analysis ready for your immediate use. You can confidently assess the market share and growth rate of various airlines, knowing that the purchased file will be identical to this preview. This ensures you get precisely what you need for informed decision-making and strategic planning within the aviation industry.

Dogs

Certain short-duration, short-haul corporate travel segments are showing signs of being Dogs in the International Airlines BCG Matrix. These routes, heavily reliant on pre-pandemic business travel, are estimated not to fully recover to their previous levels. For instance, a significant portion of business travel, particularly for shorter trips, has permanently shifted to virtual alternatives, impacting airlines that catered to these routes.

Some less strategic regional routes within IAG's portfolio might be categorized as Dogs. These routes often grapple with a low market share and face limited growth prospects. For instance, while specific route profitability data for IAG isn't publicly detailed in a way that isolates individual regional routes for BCG analysis, airlines generally experience this phenomenon on less-trafficked, shorter-haul connections that compete with ground transportation or have declining local demand.

Aging aircraft with high maintenance needs, like certain older Boeing 777 variants experiencing recurring engine issues, can be categorized as Dogs in the International Airlines BCG Matrix. These aircraft demand significant capital for upkeep, diverting resources from more promising growth areas. For instance, a major airline reported a 15% increase in unscheduled engine maintenance costs for its older wide-body fleet in 2024, directly impacting operational efficiency.

Outdated Legacy IT Systems

Outdated legacy IT systems represent significant challenges for airlines, often acting as cash traps. These older operational platforms, like the 15-year-old system IAG Loyalty is replacing, are inherently inefficient and costly to maintain. Their inability to support modern demands for customer experience and operational agility makes them a drag on profitability.

The financial burden of maintaining these systems is substantial. For instance, a significant portion of IT budgets in many industries is allocated to simply keeping legacy systems running, diverting funds from innovation and growth. In 2024, the airline industry continues to grapple with this, as the cost of maintaining aging infrastructure can easily outstrip the value they provide.

- High Maintenance Costs: Legacy systems often require specialized, costly support and are prone to frequent breakdowns, leading to unexpected expenses.

- Operational Inefficiency: Older platforms lack the speed and integration capabilities needed for streamlined operations, impacting everything from booking to baggage handling.

- Limited Scalability: They struggle to adapt to fluctuating passenger volumes or new service offerings, hindering business growth and flexibility.

- Poor Customer Experience: Outdated interfaces and slow processing times directly translate to a subpar experience for travelers, impacting loyalty and revenue.

Non-Core or Divested Ventures

International Airlines Group (IAG) has strategically divested or withdrawn from ventures that no longer fit its core business or growth objectives, mirroring a 'Dog' category management approach. A prime example is the withdrawal from the Air Europa transaction in late 2021, a move that freed up capital and management focus. This decision was driven by a reassessment of the deal's strategic fit and potential synergies in the evolving aviation landscape.

This approach to managing non-core or divested ventures is crucial for optimizing resource allocation. By exiting ventures with low growth prospects or high risk, IAG can concentrate its efforts on its stronger business units. For instance, IAG's continued investment in its core airlines like British Airways and Iberia, which represent its Stars and Cash Cows, demonstrates this strategic focus.

- Strategic Divestment: IAG's decision to pull out of the Air Europa acquisition in December 2021, following initial agreement in November 2019, highlights a proactive management of non-core assets.

- Focus on Core Strengths: This action allows IAG to better invest in and develop its existing airline portfolio, such as its profitable low-cost carrier Vueling or its premium long-haul operations.

- Capital Reallocation: By avoiding capital lock-up in potentially underperforming or non-strategic ventures, IAG can redirect funds towards areas with higher potential returns and strategic alignment.

- Risk Mitigation: Exiting complex transactions that face regulatory hurdles or changing market conditions, as seen with Air Europa, is a key risk management strategy.

Certain underperforming routes, particularly those with declining passenger numbers or intense competition from low-cost carriers, can be classified as Dogs. These routes often have a low market share and struggle to generate significant revenue. For example, some niche international routes that were once profitable may now face reduced demand due to shifting travel patterns or the rise of alternative transportation options, impacting their viability.

Airlines may also identify specific aircraft types with high operating costs and low passenger appeal as Dogs. These might be older models that are less fuel-efficient or lack modern amenities, leading to higher maintenance expenses and lower load factors. In 2024, the industry continues to retire older, less efficient aircraft to manage these costs.

Legacy IT systems that are costly to maintain and hinder operational efficiency can also be considered Dogs. These systems often require substantial investment for upkeep without offering commensurate returns or supporting advanced customer services. The cost of maintaining such systems can divert crucial capital from more strategic investments.

Airlines might also categorize certain non-core or divested business units as Dogs. These are segments that have consistently underperformed or no longer align with the company's strategic direction, representing a drain on resources. Proactive management involves divesting these units to focus on more profitable areas.

| Category | Characteristics | Example in Airlines | 2024 Impact |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Underperforming regional routes, older aircraft types | Increased maintenance costs, reduced operational efficiency, capital diversion |

| High operating costs, limited passenger appeal | Legacy IT systems | Hindered innovation, higher operational expenses | |

| Non-core or divested ventures | Past divestitures of unprofitable subsidiaries | Resource drain, strategic misalignment |

Question Marks

Aer Lingus currently occupies a 'Question Mark' position within the International Airlines BCG Matrix. This is driven by its ambitious strategy to significantly expand its transatlantic routes, particularly its North American network. For instance, in 2024, the airline announced plans to launch new services to Minneapolis-Saint Paul and Denver, alongside increasing frequencies on existing popular routes.

While the airline is investing heavily in new aircraft like the A321 XLR, crucial for enabling these long-haul expansions and positioning Dublin as a primary gateway to the USA, it still contends with past operational challenges. Despite a reported Q1 operating loss in 2024, this figure represented a substantial improvement compared to the previous year, signaling a potential turnaround and high growth trajectory that necessitates continued, substantial investment to capture market share.

LEVEL, currently positioned as a Question Mark in the International Airlines BCG Matrix, is undergoing a significant transformation towards full operational independence. This includes obtaining its own Air Operator's Certificate, a crucial step for self-sufficiency.

The airline is actively pursuing an aggressive expansion strategy, notably focusing on the transatlantic market with the introduction of new routes to the United States. This strategic push aims to capture a larger share of a competitive long-haul segment.

Despite reporting robust growth in passenger numbers and load factors, LEVEL is still in the process of establishing its independent market share and brand identity. Significant ongoing investment is necessary to support this growth and ensure its long-term viability, preventing a potential decline into the 'Dog' category.

New route development in emerging markets for International Airlines Group (IAG) falls into the question mark category of the BCG matrix. These ventures, like IAG's recent expansion into several African and Southeast Asian destinations, often represent high-potential growth areas but currently hold a small market share.

For example, while IAG's passenger numbers to India grew by approximately 15% in 2024 compared to 2023, the overall market share remains modest against established carriers. These routes demand substantial investment in marketing, fleet allocation, and operational support to build brand awareness and achieve profitability.

Early-Stage Sustainable Aviation Technologies

IAG's investments through IAGi Ventures into early-stage sustainable aviation technologies are positioned as Stars in the BCG matrix. These ventures are in a rapidly expanding market, aiming to revolutionize aviation with innovations like SAF production and electric propulsion.

The sustainable aviation fuel market, for instance, is projected to grow significantly. By 2030, it's estimated to reach $10.7 billion, up from $1.9 billion in 2022, showcasing the high-growth potential. These investments, while requiring substantial capital and facing long development cycles, represent IAG's commitment to future industry leadership.

- High Growth Potential: The sustainable aviation sector is experiencing rapid expansion, driven by environmental regulations and consumer demand.

- Low Current Market Share: Despite growth, these technologies currently hold a very small fraction of the overall aviation market.

- Significant Investment Required: Developing and scaling these innovations demands considerable capital and a long-term perspective.

- Transformative Impact: Success in these areas could fundamentally alter the aviation industry's environmental footprint.

Digital Transformation and Customer Experience Innovations

Investments in advanced digital tools, enhanced web and app functionality, and improved customer experience initiatives are crucial for airlines navigating the evolving digital landscape. These projects are designed to capture future market share by boosting service quality and operational efficiency.

While the long-term benefits are clear, the immediate market impact and return on investment for these digital transformation efforts are still unfolding. For instance, in 2024, many major carriers continued to pour significant capital into these areas, with some reporting substantial increases in digital engagement metrics.

- Digital Investment: Airlines globally are projected to invest billions in digital transformation in 2024, focusing on AI-driven personalization and seamless booking processes.

- App Usage: Mobile app bookings continued to rise in 2024, with some airlines seeing over 60% of their bookings processed through their native applications.

- Customer Satisfaction: Initiatives like contactless check-in and personalized in-flight entertainment saw positive impacts on customer satisfaction scores, with reported improvements of up to 15% in specific surveys.

- ROI Uncertainty: The full financial returns on these digital projects are often realized over several years, making short-term ROI assessments challenging but essential for strategic planning.

New route development in emerging markets for International Airlines Group (IAG) falls into the question mark category of the BCG matrix. These ventures, like IAG's recent expansion into several African and Southeast Asian destinations, often represent high-potential growth areas but currently hold a small market share.

For example, while IAG's passenger numbers to India grew by approximately 15% in 2024 compared to 2023, the overall market share remains modest against established carriers. These routes demand substantial investment in marketing, fleet allocation, and operational support to build brand awareness and achieve profitability.

The airline is actively pursuing an aggressive expansion strategy, notably focusing on the transatlantic market with the introduction of new routes to the United States. This strategic push aims to capture a larger share of a competitive long-haul segment.

Despite reporting robust growth in passenger numbers and load factors, LEVEL is still in the process of establishing its independent market share and brand identity. Significant ongoing investment is necessary to support this growth and ensure its long-term viability, preventing a potential decline into the 'Dog' category.

BCG Matrix Data Sources

Our International Airlines BCG Matrix leverages comprehensive data from airline financial reports, global air traffic statistics, and industry growth forecasts to accurately position each business unit.