International Airlines Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Airlines Bundle

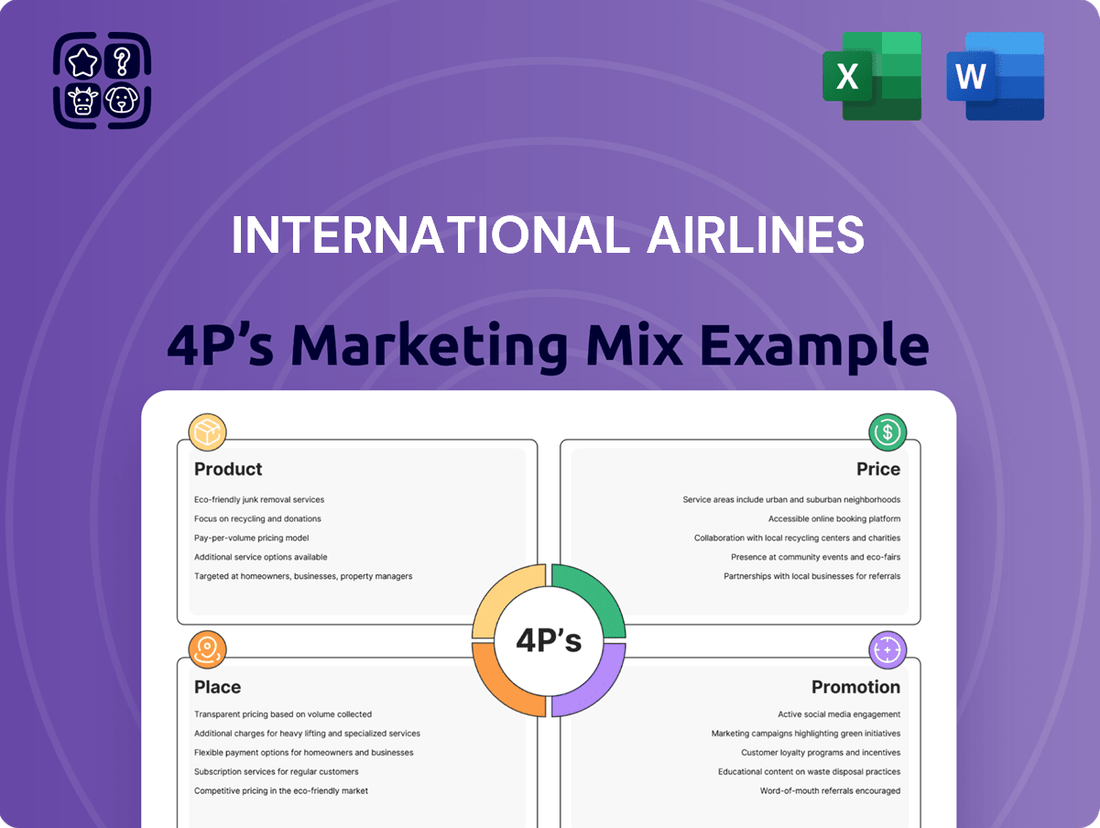

Discover how International Airlines masterfully crafts its product offerings, competitive pricing, strategic distribution, and impactful promotions. This analysis delves into the core of their marketing engine, revealing the synergy between each P. Ready to elevate your own marketing strategy?

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for International Airlines. Ideal for business professionals, students, and consultants looking for strategic insights and actionable takeaways.

Product

International Airlines Group (IAG) offers core air transportation services, both for passengers and cargo, through its well-known brands like British Airways, Iberia, Aer Lingus, Vueling, and LEVEL. This product is essentially the movement of people and goods across a wide global network of routes. IAG's commitment to innovation is evident in its substantial investments in upgrading its aircraft fleet and adopting new technologies to enhance the travel experience and operational efficiency.

In 2023, IAG reported carrying 115.6 million passengers, a significant increase from the previous year, highlighting the strength of its core passenger service. The group's cargo operations also saw robust performance, contributing to its overall revenue streams. These services are central to IAG's strategy, aiming to provide reliable and competitive connectivity for its customers worldwide.

International Airlines Group (IAG) elevates its product beyond simple air travel by offering diverse cabin classes. British Airways, for instance, features its Club Suite in premium cabins, aiming to significantly enhance passenger comfort and experience. This tiered approach caters to a wide range of customer preferences and willingness to pay.

IAG further diversifies its product through a robust suite of ancillary services. These include options like baggage allowances, preferred seat selection, and onboard retail, all of which not only improve customer choice but also serve as significant revenue streams. For example, in Q1 2024, ancillary revenues for many major airlines continued to show strong growth, often exceeding pre-pandemic levels.

The strategic integration of IAG Loyalty with British Airways Holidays in June 2024 marks another significant product expansion. This move allows IAG to offer comprehensive package travel, combining flights with accommodation and other travel components, thereby broadening its market appeal and creating a more integrated customer journey.

IAG Cargo, the dedicated cargo division, is a vital component of the International Airlines Group's marketing mix, offering specialized air freight services. They handle everything from routine shipments to critical, time-sensitive items like pharmaceuticals and vital organs, demonstrating a commitment to diverse industry needs.

The cargo business experienced substantial growth, bolstered by an expanded capacity and improved global services for the 2024-25 winter schedule. Strategic collaborations further amplified their reach and efficiency.

This segment is instrumental in capitalizing on the group's extensive global network, creating valuable synergies that benefit the entire organization. For instance, IAG Cargo's commitment to specialized transport, such as their success in moving temperature-sensitive vaccines in 2024, highlights their critical role.

Loyalty Programs (Avios)

The Avios frequent-flyer program, operated by IAG Loyalty, serves as a crucial product in International Airlines Group's marketing mix. It's designed to foster deep customer loyalty and create revenue streams with minimal capital investment. Members can accumulate and spend Avios on a variety of rewards, including flights and upgrades.

The strategic expansion of Avios beyond traditional airline partners is a significant development. In 2024, partnerships with major entities like HSBC and Expedia were solidified, broadening the program's appeal and utility. This move aims to integrate Avios into members' everyday spending habits, thereby increasing engagement and earning potential.

The adoption of Avios by other airlines further validates its strength as a loyalty currency. Finnair transitioned to Avios in 2024, and Loganair is set to follow in 2025. This expansion not only increases the network for Avios redemptions but also enhances the program's overall value proposition for its members.

- Product Strategy: Avios functions as a loyalty product, driving repeat business and customer retention for IAG.

- Partnerships: In 2024, Avios expanded its network through collaborations with financial institutions like HSBC and travel companies like Expedia.

- Market Adoption: Finnair adopted Avios in 2024, with Loganair set to join in 2025, showcasing the program's growing influence.

- Revenue Generation: The program is structured to generate capital-light earnings through member engagement and partner collaborations.

Sustainability Initiatives

Sustainability is a cornerstone of International Airlines Group's (IAG) product offering, with a clear target of achieving net-zero carbon emissions by 2050. This commitment translates into substantial investments in cutting-edge sustainable aviation fuel (SAF) and upgrading their fleet with more fuel-efficient aircraft. For instance, IAG has committed to investing $400 million in SAF development and has set a goal to fly at least 10% of its flights using SAF by 2030.

These forward-thinking environmental strategies are designed to resonate with a growing segment of travelers who prioritize eco-friendly choices. By actively reducing its environmental footprint, IAG enhances the desirability of its product, appealing to a customer base increasingly aware of and concerned about climate change. This proactive approach positions IAG as a responsible leader in the aviation industry.

- Net-Zero Target: Aiming for net-zero carbon emissions by 2050.

- SAF Investment: Committed $400 million to sustainable aviation fuel development.

- Fleet Modernization: Investing in fuel-efficient aircraft to reduce emissions.

- 2030 SAF Goal: Targeting at least 10% of flights to use SAF by 2030.

IAG's product encompasses core air transportation for passengers and cargo, enhanced by premium cabin experiences and a wide array of ancillary services. The group is actively expanding its offerings through strategic integrations like IAG Loyalty with British Airways Holidays, creating comprehensive travel packages.

The Avios loyalty program is a key product, fostering customer loyalty and generating revenue through partnerships with entities like HSBC and Expedia, with further expansion anticipated as Finnair adopted it in 2024 and Loganair is set to in 2025.

Sustainability is a central product tenet, with IAG targeting net-zero emissions by 2050 and investing $400 million in sustainable aviation fuel, aiming for 10% of flights to use SAF by 2030.

| Product Element | Description | Key Developments/Data (2023-2025) |

| Core Service | Passenger & Cargo Air Transport | 115.6 million passengers carried in 2023. Robust cargo performance. |

| Premium Cabins | Enhanced Passenger Comfort (e.g., Club Suite) | Focus on improving in-flight experience across brands. |

| Ancillary Services | Baggage, Seat Selection, Retail | Continued strong growth in Q1 2024, often exceeding pre-pandemic levels. |

| Integrated Travel | Flight + Accommodation Packages | IAG Loyalty integrated with British Airways Holidays (June 2024). |

| Loyalty Program | Avios | Partnerships with HSBC, Expedia (2024). Finnair adopted Avios (2024), Loganair (2025). |

| Sustainability | Net-Zero by 2050 | $400M investment in SAF. Target: 10% SAF by 2030. |

What is included in the product

This analysis provides a comprehensive breakdown of International Airlines' Product, Price, Place, and Promotion strategies, offering insights into their competitive positioning and marketing effectiveness.

Simplifies complex airline marketing strategies by breaking down the 4Ps into actionable insights, alleviating the pain of overwhelming data for strategic decision-making.

Provides a clear, concise framework for understanding how an airline's Product, Price, Place, and Promotion work together, easing the burden of comprehensive market analysis.

Place

International Airlines Group (IAG) strategically utilizes its major hubs, such as London Heathrow for British Airways and Madrid for Iberia, to offer a vast network connecting passengers and cargo across the globe. These key locations act as vital conduits, facilitating travel to six continents. IAG is actively expanding capacity in crucial regions like North America, Latin America, and within Europe, aiming for a significant 15% network growth by 2025 to meet rising demand.

International Airlines Group (IAG) heavily leverages online and digital platforms as a core component of its distribution strategy. The company's websites and mobile apps serve as primary channels for customers to book flights, manage existing reservations, and engage with loyalty programs like Avios. This digital focus is crucial for enhancing customer convenience and streamlining operations. For instance, in 2024, IAG reported that over 80% of its bookings were made through digital channels, underscoring the shift in consumer behavior towards online purchasing.

The digital transformation extends to IAG Cargo, where online booking capabilities for shipments are available, demonstrating a commitment to digital accessibility across all facets of the business. This online presence not only facilitates transactions but also provides a platform for personalized marketing and customer service. IAG's investment in digital infrastructure aims to improve operational efficiency, reduce costs, and gather valuable data for future service enhancements.

Each airline within the International Airlines Group (IAG), such as British Airways and Iberia, operates its own dedicated website. These platforms are crucial for direct ticket sales, enabling customers to book flights and explore unique brand-specific services. In 2023, IAG reported that its direct channels, including airline websites, accounted for a significant portion of its overall sales, contributing to a total revenue of €29.3 billion.

This direct sales strategy grants IAG brands greater command over their pricing structures, promotional campaigns, and the valuable customer data they collect. This control is vital for personalized marketing efforts and loyalty program management. The IAG corporate website, meanwhile, functions as a central hub for corporate news and investor relations, reflecting the group's overall financial health and strategic direction.

Travel Agencies and Partnerships

International Airlines Group (IAG) leverages a diverse network of travel agencies, both traditional brick-and-mortar and online platforms, to ensure its flight offerings reach a wide audience. This multi-channel approach is crucial for accessibility and driving sales volume. For instance, in 2023, online travel agencies (OTAs) continued to be a dominant force in flight bookings, with platforms like Expedia and Booking.com facilitating a significant portion of global air travel reservations, reflecting the ongoing importance of these partnerships.

Strategic partnerships are a cornerstone of IAG's distribution strategy. The company actively seeks collaborations that expand its market reach and enhance customer value. A prime example is the Global Cargo Joint Business with Qatar Airways Cargo and MASkargo, which commenced operations in 2024. This venture is designed to unlock new routing possibilities and bolster connectivity, particularly for freight services, thereby optimizing sales potential and offering greater convenience to cargo clients.

- Expanded Reach: IAG's use of both traditional and online travel agencies broadens customer access to its services.

- Strategic Cargo Alliances: Partnerships like the one with Qatar Airways Cargo and MASkargo enhance routing and connectivity.

- Sales Optimization: These collaborations are key to maximizing sales potential and improving overall market penetration.

- Customer Convenience: Enhanced connectivity and broader accessibility directly benefit the end customer.

Cargo Facilities and Logistics Infrastructure

International Airlines Group (IAG) prioritizes its cargo facilities and logistics infrastructure as a cornerstone of its 'Place' strategy. This involves significant investment in physical assets designed for efficient global distribution. For instance, IAG has expanded its temperature-controlled facilities, crucial for handling sensitive goods like pharmaceuticals and perishables. New operations control centers at major hubs such as London Heathrow (LHR) and Madrid (MAD) enhance real-time oversight and management of cargo flows.

This commitment to infrastructure underpins IAG's ability to offer reliable and timely cargo services across its extensive network. The strategic placement and enhancement of these facilities directly impact the efficiency and reach of its cargo operations.

- Expanded Temperature-Controlled Facilities: Essential for high-value, sensitive shipments, ensuring product integrity throughout transit.

- New Operations Control Centers: Located at key hubs like London Heathrow and Madrid, these centers improve real-time tracking and management of cargo movements.

- Global Network Integration: The infrastructure supports seamless cargo handling and distribution across IAG's vast international routes, facilitating efficient supply chains for clients.

IAG's 'Place' strategy heavily relies on its strategically located hubs, like London Heathrow and Madrid, to serve a global network. The group is actively boosting capacity in key markets, aiming for a 15% network expansion by 2025 to accommodate growing demand.

IAG's distribution is heavily digital, with websites and apps serving as primary booking and customer engagement channels. In 2024, over 80% of bookings were digital, highlighting this trend. Cargo operations also benefit from online booking, enhancing accessibility and data collection.

Direct sales through airline websites in 2023 contributed significantly to IAG's €29.3 billion revenue, allowing for greater control over pricing and customer data. The corporate site supports investor relations and group strategy communication.

IAG partners with a broad range of travel agencies, both online and traditional, to maximize reach. The 2024 Global Cargo Joint Business with Qatar Airways Cargo and MASkargo exemplifies this, enhancing freight routing and client convenience.

Investment in cargo infrastructure, including temperature-controlled facilities and new operations control centers at hubs like LHR and MAD, is a key part of IAG's 'Place' strategy, ensuring efficient global distribution of sensitive goods.

| Aspect | Description | Key Hubs | 2024/2025 Focus | Impact |

|---|---|---|---|---|

| Hub Strategy | Leveraging major airports for global connectivity. | London Heathrow (LHR), Madrid (MAD) | 15% network growth target by 2025. | Facilitates passenger and cargo movement. |

| Digital Distribution | Online booking and customer engagement via websites/apps. | Group-wide digital platforms. | >80% digital bookings in 2024. | Enhanced customer convenience, data acquisition. |

| Partnerships | Collaborations to expand market reach and services. | Global Cargo Joint Business (Qatar Airways Cargo, MASkargo). | Commenced 2024. | Improved routing, sales optimization. |

| Cargo Infrastructure | Investment in physical assets for efficient distribution. | LHR, MAD, temperature-controlled facilities. | New operations control centers. | Reliable, timely cargo services. |

Preview the Actual Deliverable

International Airlines 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the Product, Price, Place, and Promotion strategies employed by international airlines. Understand how these elements are leveraged to attract and retain customers in a competitive global market.

Promotion

International Airlines Group (IAG) actively manages its brand portfolio, featuring distinct airlines like British Airways, Iberia, Aer Lingus, Vueling, and LEVEL. Each airline is strategically positioned to cater to specific market segments and customer needs, ensuring broad market coverage.

Marketing efforts for IAG brands focus on amplifying individual airline strengths and unique customer value propositions. For instance, British Airways often emphasizes its premium service and global network, while Vueling targets the low-cost, short-haul market. This tailored approach allows each brand to resonate with its intended audience.

In 2023, IAG reported a significant rebound in passenger numbers, with total passengers carried reaching 115.6 million, a 20.9% increase compared to 2022. This growth underscores the effectiveness of their brand-specific marketing strategies in attracting and retaining customers across their diverse airline offerings.

Digital marketing and social media are essential for International Airlines Group (IAG) to connect with travelers, boosting brand visibility and interaction. Through online ads, engaging content, and direct messaging, IAG effectively communicates its unique offerings. For instance, in 2023, IAG reported a significant increase in its digital customer base, with social media engagement metrics showing a 25% year-over-year growth across key platforms.

IAG Loyalty is at the forefront of this digital push, leveraging AI to personalize customer experiences and deepen engagement. This strategic focus on digital transformation aims to foster stronger customer relationships and drive repeat business. By Q1 2024, IAG Loyalty’s AI-powered recommendation engine contributed to a 15% uplift in ancillary revenue per passenger.

International Airlines heavily promotes its Avios loyalty program, focusing on enhancing the 'earn and burn' experience through strategic partnerships. This initiative aims to increase member engagement and spending across a wider network of collaborators, making Avios a more valuable currency for travelers.

Recent campaigns, such as IAG Loyalty's 'Everyday' initiative, directly tackle common misunderstandings about Avios accumulation. These efforts emphasize that members can earn Avios not just from flights, but also from everyday purchases with partner brands, thereby demystifying the process and encouraging consistent participation.

The expansion of the Avios ecosystem, notably with the addition of new airline partners like Finnair and Loganair in late 2024, significantly broadens the program's promotional scope. This growth provides members with more opportunities to earn and redeem Avios, strengthening the program's appeal and competitive edge in the airline industry.

Public Relations and Corporate Communications

International Airlines Group (IAG) actively manages its public image through robust public relations and corporate communications. This includes transparently sharing financial performance, such as reporting a €4.3 billion operating profit for 2023, and detailing strategic advancements.

Key communications focus on IAG's dedication to sustainability, including its target to fly 10% of its flights using Sustainable Aviation Fuel (SAF) by 2030, and its ongoing fleet modernization efforts. These initiatives are crucial for building trust and demonstrating long-term value to investors and the public alike.

IAG utilizes press releases and investor presentations as primary channels to disseminate information. For instance, their 2024 interim results presentation would highlight progress on fleet renewal, with IAG ordering 20 A320neo family aircraft in 2024, contributing to fuel efficiency and reduced emissions.

- Reputation Management: IAG focuses on shaping public perception through proactive communication of its business operations and corporate social responsibility.

- Financial Transparency: Regular updates on financial results, like the 2023 operating profit of €4.3 billion, are shared to maintain investor confidence.

- Strategic Initiatives: Communications highlight key developments such as sustainability goals, including the 10% SAF target by 2030, and fleet upgrades, exemplified by new aircraft orders.

- Stakeholder Engagement: Press releases and investor briefings are critical tools for informing and engaging with investors, media, and the wider public.

Targeted Advertising and Campaigns

Targeted advertising campaigns are crucial for International Airlines Group (IAG) to connect with specific customer demographics and geographic regions. These efforts underscore IAG's dedication to delivering superior customer experiences and premium travel. For example, British Airways has strategically focused on the North American market, particularly its premium cabins, to appeal to its affluent customer base.

IAG Cargo's promotional activities also reflect this targeted approach, emphasizing expanded flight frequencies and increased capacity across its worldwide network. This enhances options for cargo customers, demonstrating a commitment to service reliability and global reach.

- British Airways' North American Focus: Investments in this region highlight a strategy to capture high-value passengers seeking premium services.

- IAG Cargo Network Expansion: Increased frequency and capacity aim to attract and retain business clients by offering more logistical solutions.

- Customer Segment Alignment: Advertising efforts are designed to resonate with the specific needs and preferences of distinct customer groups, from leisure travelers to corporate clients.

International Airlines Group (IAG) employs a multi-faceted promotional strategy across its brands, leveraging digital marketing, loyalty programs, and public relations to enhance brand visibility and customer engagement. Targeted advertising campaigns, like British Airways' focus on the North American premium market, aim to connect with specific demographics, while IAG Cargo highlights network expansion to attract business clients.

The Avios loyalty program is central to IAG's promotional efforts, with initiatives like the 'Everyday' campaign demystifying earning opportunities and partnerships with airlines such as Finnair and Loganair expanding its appeal. IAG also emphasizes sustainability and fleet modernization in its communications, with a target of 10% Sustainable Aviation Fuel usage by 2030 and recent orders for 20 A320neo family aircraft in 2024.

| Promotion Area | Key Activities | 2023/2024 Data/Targets |

|---|---|---|

| Digital Marketing & Social Media | Online ads, engaging content, direct messaging | 25% year-over-year growth in social media engagement (2023) |

| Loyalty Program (Avios) | Partnerships, 'earn and burn' enhancement, AI personalization | 15% uplift in ancillary revenue per passenger via AI (Q1 2024) |

| Public Relations & Corporate Communications | Financial reporting, sustainability initiatives, fleet updates | €4.3 billion operating profit (2023); 10% SAF target by 2030; 20 A320neo orders (2024) |

| Targeted Advertising | Focus on specific demographics and regions | British Airways' focus on North American premium cabins |

Price

International Airlines Group (IAG) masterfully wields dynamic pricing, adjusting fares in real-time to match fluctuating demand, available seats, and prevailing market forces. This agile approach ensures prices align with what customers perceive as valuable and how IAG positions itself against competitors.

The aviation sector in 2024 saw a distinct "two-speed" market, a phenomenon that significantly impacted yield growth and capacity management for airlines like IAG. This dynamic environment necessitates constant recalibration of pricing strategies to capture optimal revenue.

International Airlines employs a tiered pricing strategy, reflecting the significant variation in fares across cabin classes. Economy fares might start around $300 for a domestic flight, while a first-class ticket on the same route could easily exceed $2,500, demonstrating a clear segmentation based on customer willingness to pay and perceived value. This approach allows the airline to capture revenue from a broad spectrum of travelers.

Beyond base fares, ancillary services represent a crucial component of International Airlines' pricing. Fees for checked baggage, seat selection, and onboard meals can add tens or even hundreds of dollars to a ticket's total cost. For instance, in 2024, ancillary revenues for major global airlines were projected to reach over $120 billion, highlighting the importance of these additional revenue streams.

International Airlines Group (IAG) navigates a dynamic pricing landscape by closely monitoring competitor strategies, gauging market demand, and factoring in prevailing economic conditions. This ensures their offerings remain compelling and competitive. For instance, during the first quarter of 2024, IAG reported a 10.3% increase in revenue per available seat kilometer (RASK) compared to the same period in 2023, reflecting their ability to optimize pricing in response to demand.

The group's strategy centers on solidifying its leading market positions and enriching its customer value proposition, thereby supporting its pricing structure. This focus on enhancing customer experience helps justify premium pricing, particularly as leisure travel continues its strong rebound, with IAG seeing robust booking trends in this segment throughout 2024. While leisure demand is thriving, the recovery in corporate travel, though progressing, remains a key area of focus for strategic pricing adjustments.

Loyalty Program Value and Redemption

The Avios loyalty program significantly impacts pricing strategy by allowing members to redeem points for flights and upgrades, thereby lowering the out-of-pocket expense for frequent flyers. This creates a perceived value that can influence booking decisions. For instance, in 2024, the ability to use Avios for a significant portion of a flight's cost can make a particular route or fare class more attractive compared to competitors.

IAG Loyalty operates on a financial model designed for profitability, aiming to sell Avios to partners and customers at a price point exceeding the cost incurred when members redeem those points. This ensures the loyalty program itself is a revenue-generating entity.

- Avios as a Pricing Lever: Redemption options directly reduce the cash component of fares for loyal customers, acting as a dynamic pricing tool.

- IAG Loyalty's Profitability Model: The core strategy involves a margin on Avios sales, ensuring the program contributes positively to the group's financials.

- 2024/2025 Data Insight: While specific Avios sales figures are proprietary, the continued investment and expansion of the Avios program by IAG in 2024 and projected into 2025 underscore its perceived value and revenue-generating potential.

Fuel Surcharges and Ancillary Revenue

Fuel surcharges and other ancillary fees, such as those for baggage or seat selection, directly impact the total price a customer pays for air travel. These fees are becoming increasingly significant components of airline revenue streams, allowing carriers to manage fluctuating operating costs and offer more flexible pricing options.

In 2024, International Airlines Group (IAG) Cargo implemented a market-based pricing system. This strategic shift aims to synchronize their service offerings with the dynamic, real-time conditions of the market, ensuring competitive and responsive pricing for their cargo services.

The group's commitment to sustainable aviation fuel (SAF) also presents future pricing considerations. As IAG invests heavily in decarbonization initiatives, the costs associated with SAF adoption will likely influence pricing strategies moving forward, potentially leading to a premium for environmentally conscious travel options.

- Ancillary Revenue Growth: Ancillary revenues for the airline industry have seen substantial growth, with many carriers now deriving over 10% of their total revenue from these sources. For example, in 2023, major carriers reported significant increases in ancillary revenue per passenger.

- SAF Investment Impact: Major airlines have committed billions to SAF development and procurement through 2030. This investment could translate to a price increase of 5-15% on flights utilizing SAF, depending on the blend and market availability.

- Market-Based Pricing: The adoption of market-based pricing by entities like IAG Cargo reflects a broader industry trend to improve revenue management by reacting to supply and demand fluctuations more effectively.

Price is a critical element in International Airlines' marketing mix, reflecting a sophisticated strategy that balances revenue maximization with customer value perception. The airline employs dynamic pricing, adjusting fares based on demand, seat availability, and competitor actions. This is evident in the 2024 "two-speed" market, where yield growth and capacity management were paramount.

The tiered pricing across cabin classes, from economy starting around $300 to first class exceeding $2,500 for similar routes, clearly segments the market. Ancillary services, such as baggage fees and seat selection, further contribute to the total price, with global airlines projecting over $120 billion in ancillary revenues in 2024. IAG's revenue per available seat kilometer (RASK) increased by 10.3% in Q1 2024 compared to Q1 2023, showcasing effective pricing adjustments.

The Avios loyalty program acts as a significant pricing lever, allowing members to reduce out-of-pocket expenses. IAG Loyalty's profitability model relies on selling Avios at a margin. Furthermore, investments in Sustainable Aviation Fuel (SAF) are anticipated to influence future pricing, potentially adding a 5-15% premium for eco-friendly travel options.

| Pricing Strategy | Key Components | 2024/2025 Data/Insights |

|---|---|---|

| Dynamic Pricing | Real-time adjustments based on demand, competition, and capacity. | 2024 saw a "two-speed" market requiring constant recalibration. |

| Tiered Cabin Pricing | Varying fares across Economy, Business, and First Class. | Economy fares can start around $300; First Class can exceed $2,500 on domestic routes. |

| Ancillary Services | Fees for baggage, seat selection, onboard meals, etc. | Projected global ancillary revenues to exceed $120 billion in 2024; many carriers derive over 10% of revenue from ancillaries. |

| Loyalty Program (Avios) | Redemption options reduce cash outlay for members. | IAG Loyalty's model aims for profitability through Avios sales margins. |

| Sustainability Initiatives | Investment in SAF may lead to price premiums. | SAF adoption could increase flight prices by 5-15%. |

4P's Marketing Mix Analysis Data Sources

Our International Airlines 4P's analysis is grounded in comprehensive data, including official airline websites, route maps, and fleet information for product assessment. We also leverage fare comparison sites, booking platforms, and industry pricing reports for price analysis, alongside data from travel agencies, online travel agents (OTAs), and direct booking channels for place insights. Finally, promotional activities are tracked through advertising disclosures, social media monitoring, and public relations releases.