Hyundai Motor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Motor Bundle

Hyundai Motor's strong brand recognition and expanding EV lineup are key strengths, but they face challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the automotive landscape.

Want the full story behind Hyundai's market position, including detailed insights into their opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Hyundai Motor's strength lies in its remarkably diversified product portfolio. The company offers a wide spectrum of vehicles, from popular passenger cars and versatile SUVs to robust commercial vehicles, effectively meeting the varied demands of consumers worldwide. This broad appeal across different segments is a key competitive advantage.

Furthermore, Hyundai is aggressively pursuing sustainable mobility, with a growing lineup of electric vehicles (EVs) and hydrogen fuel cell vehicles (FCEVs). For instance, by the end of 2023, Hyundai Motor Group had sold over 1 million EVs globally, showcasing their commitment to future-forward technology and environmental responsibility.

Hyundai Motor boasts an impressive global reach, operating in over 190 countries. This extensive network includes numerous production facilities, design studios, and R&D centers strategically located across the globe. By 2023, Hyundai Motor Group had solidified its position as the third-largest automaker globally by sales volume, demonstrating its significant market penetration.

Hyundai's aggressive electrification strategy is a significant strength, with a clear target of selling 2 million electric vehicles annually by 2030, supported by a planned introduction of 21 new EV models. This commitment extends to a robust hybrid vehicle lineup and the introduction of Extended Range Electric Vehicles (EREVs), designed to ease consumer adoption of electric mobility.

Pioneering Hydrogen Fuel Cell Technology

Hyundai Motor is a significant player in the burgeoning hydrogen fuel cell electric vehicle (FCEV) market. Their commitment is evident in upcoming models like INITIUM, expected to reach production in the first half of 2025, building on the success of the NEXO. This focus positions Hyundai as a pioneer in a critical clean energy sector.

The company's strategic investment in its HTWO hydrogen ecosystem further solidifies its leadership. This comprehensive approach, covering everything from hydrogen production to vehicle deployment, is a key differentiator. It demonstrates a long-term vision for hydrogen as a sustainable energy source.

Hyundai's dedication to hydrogen technology sets it apart in the rapidly changing automotive industry. This early and consistent investment provides a competitive edge as global demand for zero-emission transportation solutions grows.

Key aspects of Hyundai's hydrogen fuel cell strength include:

- Leading FCEV Development: With models like the NEXO and the upcoming INITIUM slated for 2025 production, Hyundai is at the forefront of hydrogen vehicle innovation.

- HTWO Ecosystem Investment: The company's comprehensive strategy for hydrogen production, storage, and distribution through its HTWO brand showcases a deep commitment to the entire hydrogen value chain.

- Long-Term Vision: Hyundai's sustained focus on hydrogen technology distinguishes it from competitors, positioning it as a key enabler of the future hydrogen economy.

Strategic Investments in Advanced Mobility Solutions

Hyundai is making substantial strategic investments in advanced mobility, pouring capital into areas like autonomous driving, AI, robotics, and urban air mobility (UAM). This forward-thinking approach aims to reposition Hyundai as a comprehensive smart mobility solutions provider, not just a car manufacturer. By 2024, Hyundai Motor Group had committed over $7.4 billion to future mobility technologies, signaling a strong commitment to innovation.

These investments are crucial for future growth and market leadership. For instance, Hyundai's partnership with Motional, a joint venture with Aptiv, is a significant step in developing and commercializing self-driving technology. Motional aims to deploy robotaxi services in cities like Las Vegas by 2024, showcasing tangible progress in their advanced mobility strategy.

- Significant R&D Allocation: Hyundai has earmarked substantial funds for future mobility, including autonomous driving, AI, and robotics.

- Strategic Partnerships: Collaborations with companies like Waymo and Avride are accelerating the development and deployment of new mobility services.

- Transformation Goal: The company's objective is to evolve from a traditional automaker into a leading smart mobility solutions provider.

- Commercialization Focus: Partnerships are geared towards bringing self-driving technologies and innovative mobility services to market.

Hyundai's diversified product range, encompassing everything from compact cars to heavy-duty trucks, ensures broad market appeal and resilience. This comprehensive offering allows them to cater to a wide array of consumer needs and preferences across different global markets, a significant advantage in the competitive automotive landscape.

The company's aggressive push into electric vehicles (EVs) and hydrogen fuel cell electric vehicles (FCEVs) positions it strongly for the future of mobility. By the end of 2023, Hyundai Motor Group had achieved over 1 million global EV sales, underscoring their commitment to sustainable transportation solutions and technological advancement.

Hyundai's global manufacturing and sales network is a key strength, operating in over 190 countries. This extensive reach, supported by strategically located production facilities and R&D centers, solidifies its position as a major global automotive player, evidenced by its ranking as the third-largest automaker worldwide by sales volume in 2023.

Hyundai's commitment to electrification is further demonstrated by its ambitious goal to sell 2 million EVs annually by 2030 and the planned introduction of 21 new EV models. This forward-thinking strategy includes a robust hybrid lineup and the development of Extended Range Electric Vehicles (EREVs) to facilitate consumer adoption of electric mobility.

Hyundai's pioneering role in hydrogen fuel cell technology, with models like the NEXO and the upcoming INITIUM (production slated for early 2025), provides a distinct competitive edge. Their investment in the HTWO hydrogen ecosystem, covering production to deployment, highlights a comprehensive, long-term vision for clean energy mobility.

Hyundai is making substantial investments in advanced mobility technologies, including autonomous driving, AI, and robotics, aiming to transform into a comprehensive smart mobility solutions provider. By 2024, Hyundai Motor Group had committed over $7.4 billion to these future mobility initiatives, with ventures like Motional aiming for robotaxi services in cities like Las Vegas by 2024.

| Key Strength | Description | Supporting Data/Fact |

| Product Diversification | Wide range of vehicles including passenger cars, SUVs, and commercial vehicles. | Caters to diverse global consumer demands. |

| Electrification Leadership | Aggressive pursuit of EVs and FCEVs. | Over 1 million global EV sales by end of 2023; target of 2 million EVs annually by 2030. |

| Global Reach | Operations in over 190 countries with extensive production and R&D facilities. | Ranked third-largest automaker globally by sales volume in 2023. |

| Hydrogen Technology | Pioneering FCEV development and investment in the HTWO ecosystem. | Upcoming INITIUM model for 2025 production; comprehensive strategy for hydrogen value chain. |

| Advanced Mobility Investment | Significant capital allocation to autonomous driving, AI, robotics, and UAM. | Over $7.4 billion committed by 2024; Motional robotaxi services planned for 2024. |

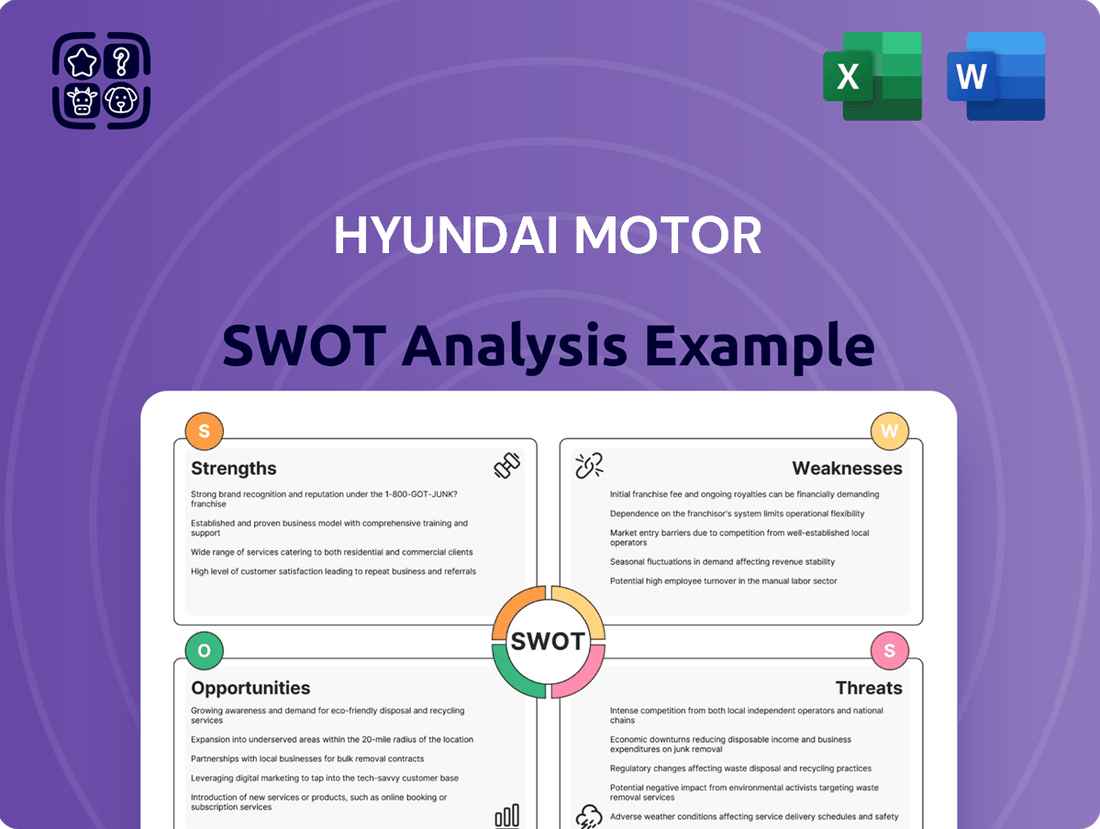

What is included in the product

Delivers a strategic overview of Hyundai Motor’s internal and external business factors, highlighting its brand reputation and technological advancements alongside competitive pressures and evolving market demands.

Offers a clear, actionable framework to identify and address Hyundai's competitive challenges and leverage its strengths for market growth.

Weaknesses

Hyundai's financial health is significantly tied to its automotive division, which accounts for roughly 70% of its total revenue. This substantial reliance makes the company particularly vulnerable to the ups and downs inherent in the global car market. Fluctuations in consumer preferences or economic slowdowns directly affect its bottom line.

Hyundai's Genesis luxury brand, while growing, still struggles to shake off the company's long-held reputation for producing more budget-friendly vehicles. This perception gap makes it difficult to command premium pricing and directly compete with established luxury players like BMW or Mercedes-Benz, impacting its ability to capture higher-margin sales.

Hyundai has faced significant challenges due to numerous product recalls and reported quality concerns in recent years. These issues have directly harmed its brand reputation and eroded consumer confidence. For example, a major recall in 2023 involving over 1.7 million vehicles in the US, primarily for fire risks, cost the company millions in repair expenses and further dented its image.

Lower Market Share in Key Segments

Hyundai's market share in crucial segments, particularly in the United States against established Japanese competitors, presents a notable weakness. For instance, while Hyundai has seen growth, its share in the U.S. light-duty truck market, dominated by domestic players, remains comparatively small. This competitive landscape necessitates significant strategic investment to gain traction.

Further illustrating this point, consider the U.S. auto market overall. As of early 2024, while Hyundai and its affiliate Kia have collectively garnered a respectable market share, they still trail behind giants like Toyota and General Motors in total sales volume. This disparity is even more pronounced in specific vehicle categories where competition is particularly fierce.

- U.S. Market Share Challenges: Hyundai's presence in the U.S. pickup truck segment, a highly lucrative but competitive area, is minimal compared to market leaders.

- Regional Saturation: In certain mature markets, Hyundai faces intense competition which limits its ability to capture a larger market share without substantial strategic shifts.

- Brand Perception in Specific Segments: In some segments, Hyundai may still be working to overcome established perceptions of quality or performance associated with long-standing competitors.

Vulnerability to Supply Chain Disruptions

Hyundai, like many global automakers, faces significant risks from supply chain interruptions. Shortages of essential parts and raw materials can directly affect production output. For instance, the ongoing semiconductor shortage, which began in 2020 and continued through 2023, impacted numerous manufacturers, including Hyundai, leading to temporary production halts and reduced vehicle availability.

Geopolitical instability, natural disasters, and trade disputes pose further threats. These events can disrupt the flow of necessary components, leading to increased operational expenses and delays. The automotive industry's reliance on a global network of suppliers means that even localized issues can have widespread consequences.

Recent trade policies, such as U.S. tariffs on imported vehicles and auto parts, underscore this vulnerability. These tariffs can escalate costs and necessitate adjustments in sourcing strategies. Hyundai has responded by exploring increased localization of production to mitigate such risks and improve supply chain resilience.

- Component Shortages: The global semiconductor shortage led to an estimated production loss of over 400,000 vehicles for Hyundai and Kia combined in 2021.

- Raw Material Volatility: Fluctuations in the prices of critical materials like lithium and nickel, essential for EV batteries, can impact manufacturing costs.

- Geopolitical Impact: The war in Ukraine disrupted the supply of wiring harnesses for some European operations, highlighting the impact of regional conflicts.

- Trade Policy Sensitivity: Tariffs can increase the cost of imported components, potentially affecting vehicle pricing and competitiveness.

Hyundai's brand perception, particularly for its Genesis luxury line, still lags behind established premium automakers. This makes it harder to command higher prices and compete effectively in the lucrative luxury segment, impacting overall profitability and market positioning against brands like BMW and Mercedes-Benz.

The company has faced significant challenges with product recalls and quality concerns, which have eroded consumer trust and damaged its reputation. A major recall in 2023 involving over 1.7 million vehicles in the U.S. due to fire risks cost millions and highlighted ongoing quality control issues.

Hyundai's market share in key segments, especially in the highly competitive U.S. market against Japanese rivals and domestic brands, remains a weakness. For instance, its penetration in the U.S. light-duty truck market is considerably smaller than market leaders, requiring substantial investment to gain ground.

Supply chain vulnerabilities, exacerbated by events like the global semiconductor shortage that impacted production by hundreds of thousands of vehicles for Hyundai and Kia in 2021, continue to pose a risk. Volatility in raw material prices, such as for EV batteries, and geopolitical disruptions also add to operational costs and production uncertainties.

What You See Is What You Get

Hyundai Motor SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global shift towards electric vehicles (EVs) and hybrids is accelerating, creating a substantial opportunity for Hyundai. As of early 2024, EV sales continue to surge, with projections indicating sustained double-digit growth throughout the year and into 2025. Hyundai's strategic commitment, including plans to introduce 21 new EV models by 2030 and bolster its hybrid offerings, directly aligns with this burgeoning market demand.

Hyundai's proactive investments in advanced EV platforms and next-generation battery technology are crucial for capitalizing on this trend. These developments are designed to enhance vehicle performance, range, and charging efficiency, key factors influencing consumer adoption. By strengthening its electrification capabilities, Hyundai is positioning itself to gain a more significant market share in the rapidly expanding green automotive sector.

Hyundai is making significant strides in commercializing autonomous driving, evidenced by its collaborations with Waymo and Avride. These partnerships are key to integrating advanced self-driving systems, like those powering robotaxi services and Level 4 autonomy, into vehicles such as the IONIQ 5.

This strategic push into driverless technology is not just about innovation; it's about unlocking new revenue streams. By positioning itself at the forefront of future mobility, Hyundai aims to capture a substantial share of a market projected to reach hundreds of billions of dollars in the coming years, with some estimates placing the global autonomous vehicle market value at over $2 trillion by 2030.

Hyundai's significant investments in hydrogen fuel cell technology, spearheaded by its HTWO brand, position it to be a frontrunner in building a comprehensive hydrogen ecosystem. This strategic focus allows Hyundai to capitalize on the growing global demand for clean energy solutions.

By introducing new fuel cell electric vehicle (FCEV) models through 2025 and embedding hydrogen solutions across its operations, Hyundai is poised to capture the expanding market for hydrogen beyond passenger cars, particularly in commercial transportation sectors.

Growth in Emerging Markets

Emerging economies, especially in Asia, are seeing substantial growth in their automotive sectors. This is largely due to increasing disposable incomes and more people moving to cities. Hyundai is already a major player in India, holding the position of the second-largest car manufacturer there, which gives it a significant advantage in this expanding market.

Hyundai can leverage this opportunity by focusing on its electric vehicle (EV) range and developing more affordable models specifically for these cost-sensitive emerging markets. This strategy is expected to drive higher sales volumes and increase its market share.

- India's automotive market is projected to reach over 6 million units annually by 2030, with EVs expected to capture a significant portion.

- Hyundai's market share in India stood at approximately 15.5% as of early 2024.

- The company has invested heavily in its Indian manufacturing facilities, enhancing its capacity to meet growing demand.

Development of Smart Mobility Services

Hyundai's 'Strategy 2025' clearly signals a pivot from just making cars to offering comprehensive smart mobility solutions. This means expanding into areas like integrated mobility platforms, urban air mobility (UAM), and even robotics, moving beyond traditional manufacturing.

By integrating hardware with personalized services, Hyundai aims to unlock new revenue streams and attract a wider customer base. This strategic shift allows them to cater to changing consumer demands for flexible and diverse transportation options.

- Integrated Mobility Platforms: Hyundai is investing heavily in platforms that connect various transport modes, aiming to simplify urban travel.

- Urban Air Mobility (UAM): The company is actively developing electric vertical takeoff and landing (eVTOL) aircraft, with plans for initial commercial operations in the mid-2020s.

- Robotics Integration: Hyundai is exploring how robotics can enhance mobility services, such as last-mile delivery and assistance for individuals with mobility challenges.

- New Revenue Streams: This diversification into services, rather than just vehicle sales, offers significant potential for recurring revenue and increased customer lifetime value.

Hyundai's strategic focus on electrification, including a robust pipeline of new EV models and advancements in battery technology, positions it to capitalize on the rapidly expanding green vehicle market. The company's commitment to autonomous driving, through partnerships and development of advanced self-driving systems, opens doors to new mobility services and revenue streams. Furthermore, Hyundai's investments in hydrogen fuel cell technology and its expansion into emerging markets, particularly India, provide significant growth avenues.

Threats

Hyundai faces significant challenges from established global automakers like Toyota and Volkswagen, as well as a growing number of agile electric vehicle startups. This crowded market means constant pressure on pricing and market share. For instance, in 2023, Toyota sold over 11 million vehicles globally, while Volkswagen Group delivered approximately 9.2 million units, highlighting the scale of the competition Hyundai must contend with.

The need for continuous innovation is paramount. Hyundai must invest heavily in research and development, particularly in areas like electrification, autonomous driving, and connected car technologies, to stay ahead. Failure to do so risks losing ground to competitors who are rapidly advancing in these critical future mobility segments.

Hyundai faces ongoing threats from global supply chain disruptions, which have already impacted automotive production worldwide. For instance, the semiconductor shortage experienced in 2021-2022 led to significant production cuts across the industry, and similar vulnerabilities persist.

Furthermore, rising geopolitical tensions and trade protectionism present a considerable risk. Potential U.S. tariffs on vehicles or parts not meeting specific compliance standards could directly increase Hyundai's production costs and complicate market access, affecting its competitive pricing strategy and overall profitability in key markets.

The automotive sector, including Hyundai, navigates a dynamic regulatory environment. Stricter emission standards, like those being implemented in the EU with targets for 2030, and evolving safety mandates necessitate significant R&D investment. For instance, the transition to electric vehicles (EVs) requires substantial capital for battery technology and charging infrastructure development, impacting production costs and vehicle offerings.

Economic Fluctuations and Inflation

Global economic uncertainties, including elevated interest rates and persistent inflationary pressures, are dampening consumer purchasing power and confidence. These conditions are expected to lead to slower market growth throughout 2024 and into 2025, potentially reducing demand for new vehicles.

Economic downturns directly impact Hyundai's sales volumes and overall financial performance by decreasing consumer willingness to make large purchases like new cars. For instance, while Hyundai reported strong sales in certain regions in late 2023, the broader economic headwinds pose a significant risk to sustained growth.

- Economic Uncertainty: High interest rates and inflation continue to be a concern for global economies in 2024.

- Consumer Confidence: Weakening consumer confidence directly affects discretionary spending on big-ticket items like automobiles.

- Market Demand: Slower market expectations suggest a potential contraction in new vehicle sales for manufacturers like Hyundai.

- Financial Impact: Reduced sales volumes can negatively impact Hyundai's revenue and profitability.

Rapid Technological Advancements and Disruption

The automotive industry is rapidly evolving with electrification, autonomous driving, and advanced connectivity. Hyundai is making significant investments, but the relentless pace of innovation presents a threat. New technologies or business models could emerge that quickly disrupt the market, potentially making current offerings obsolete.

For instance, the global market for advanced driver-assistance systems (ADAS), a precursor to fully autonomous driving, was projected to reach approximately $100 billion by 2025. Companies that fail to adapt to these shifts, such as integrating advanced AI for autonomous features or developing robust cybersecurity for connected vehicles, risk losing market share.

- Electrification Pace: Hyundai's commitment to its E-GMP platform is substantial, but competitors are also accelerating their EV development, potentially leading to a crowded market and intense price competition.

- Autonomous Driving Standards: Evolving regulatory frameworks and the high cost of developing and validating Level 4/5 autonomous systems pose a significant challenge.

- Software-Defined Vehicles: The shift towards vehicles primarily defined by software requires a different skillset and development cycle, which could be a hurdle if not managed effectively.

Intensifying competition from both traditional automakers and emerging EV players poses a significant threat to Hyundai's market position and pricing power. The rapid pace of technological advancement, particularly in electrification and autonomous driving, necessitates substantial and ongoing R&D investment to avoid falling behind. Supply chain vulnerabilities, geopolitical instability, and evolving regulatory landscapes, such as stricter emissions standards, add further layers of complexity and potential cost increases for Hyundai.

| Threat Category | Specific Challenge | Impact on Hyundai | Illustrative Data/Context |

| Competition | Established automakers & EV startups | Pressure on market share and pricing | Global EV sales projected to reach 14 million units in 2024, increasing competition. |

| Technological Disruption | Rapid advancements in EVs, AVs, connectivity | Risk of obsolescence, need for high R&D spend | Global ADAS market to exceed $100 billion by 2025. |

| Supply Chain & Geopolitics | Disruptions, trade protectionism, tariffs | Increased production costs, market access issues | Semiconductor shortages caused significant production cuts in 2021-2022. |

| Regulatory Environment | Stricter emissions, safety mandates | Increased R&D investment, higher production costs | EU targets for CO2 emissions reduction impacting vehicle development. |

| Economic Factors | Inflation, interest rates, consumer confidence | Reduced consumer purchasing power, slower market growth | Global economic growth forecasts for 2024 indicate moderate expansion, but risks remain. |

SWOT Analysis Data Sources

This Hyundai Motor SWOT analysis is built upon a foundation of robust data, including official financial statements, comprehensive market research reports, and expert industry analysis to provide a thorough and actionable strategic overview.