Hyundai Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Motor Bundle

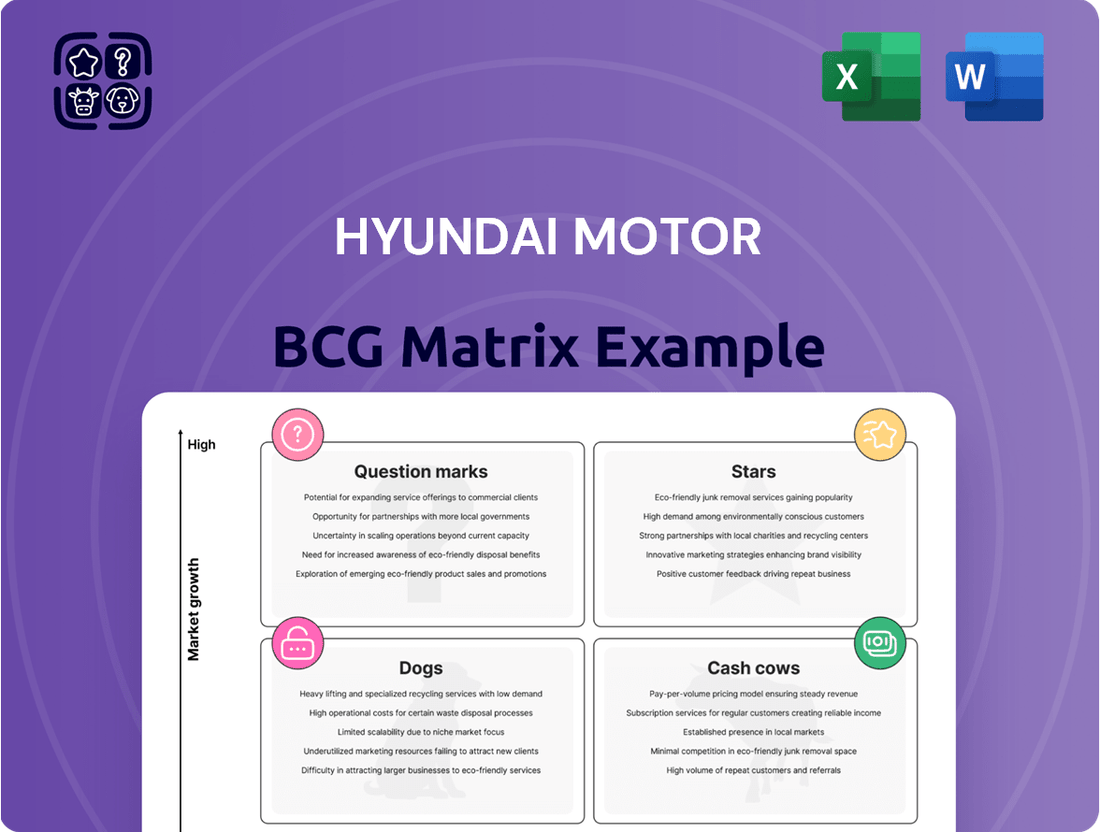

Curious about Hyundai's product portfolio performance? This glimpse into their BCG Matrix reveals where their vehicles stand as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete strategic picture; purchase the full BCG Matrix for detailed quadrant analysis and actionable insights to drive your own automotive investment decisions.

Stars

Hyundai's electrified vehicle lineup is a significant growth area, with global sales of EVs and HEVs showing robust expansion. In 2024, these electrified models saw an 8.9% increase in sales worldwide, accelerating to a 21% surge in the fourth quarter.

The U.S. market reflects this trend, with electrified vehicle sales climbing 38% in the first quarter of 2025. This growth was particularly fueled by a substantial 68% jump in hybrid electric vehicle sales, indicating strong consumer preference for these options.

Looking ahead, Hyundai has ambitious goals, targeting 2 million EV sales globally by 2030. The company is also broadening its hybrid portfolio to include 14 models, extending this strategy to its Genesis luxury brand, underscoring a clear commitment to the electrified segment.

The Hyundai IONIQ 5 is a clear star in Hyundai's lineup, demonstrating exceptional growth and market penetration in the electric vehicle sector.

In July 2025, the IONIQ 5 saw its US sales jump by an impressive 71%, a key driver behind Hyundai's record-breaking July sales performance. Year-to-date through July 2025, nearly 25,000 IONIQ 5 units were sold in the US, positioning it as a leading EV model.

Continuous improvements, such as enhanced range and the integration of the NACS charging port, coupled with its production in Georgia, solidify the IONIQ 5's strong market standing and its status as a high-growth product.

Genesis, Hyundai's luxury division, is making significant strides in the premium SUV arena with its GV70 and GV80 models. These vehicles are key drivers of the brand's expansion, demonstrating robust performance in a competitive market segment.

From January through May of 2025, Genesis experienced a notable 16.5% surge in U.S. sales. SUVs were particularly dominant, representing a substantial 80% of the brand's total U.S. sales during this period.

The GV70 specifically saw a remarkable 31.9% year-over-year sales increase, while the larger GV80 also posted strong growth with a 25.3% rise. This upward trend highlights their strong market positioning and increasing appeal among luxury consumers.

This impressive sales growth for the GV70 and GV80 suggests a strong competitive edge for Genesis in the high-growth luxury SUV market, even as they challenge established luxury brands on both pricing and perceived prestige.

Hyundai Tucson

The Hyundai Tucson is a clear Star in Hyundai's product portfolio, consistently leading sales. In 2024, it was Hyundai's best-selling vehicle in the US, a trend that continued into the first half of 2025. May 2025 alone saw 19,905 Tucson units sold, a testament to its broad appeal and the strong performance of its fuel-efficient hybrid option, which helped set new yearly sales records in 2024.

- Top-Selling Model: Hyundai's best-selling vehicle in the US for 2024 and H1 2025.

- Strong May 2025 Sales: 19,905 units sold in May 2025.

- Hybrid Variant Success: Fuel-efficient hybrid model contributed to new yearly sales records in 2024.

- Market Dominance: Consistent high sales volume and versatility in the SUV market confirm its Star status.

Hyundai Elantra

The Hyundai Elantra has experienced a remarkable resurgence, particularly within the crucial US market. Its sales figures reflect this positive trend, with an 18% year-over-year increase noted in May 2024 and a substantial 25% jump in March 2025.

As a cornerstone of Hyundai's sedan lineup, the Elantra's appeal is driven by its attractive styling, integrated advanced technology, and the availability of all-wheel drive. These factors have allowed it to capture a significant market share in a highly competitive automotive segment.

- Strong Sales Growth: Elantra sales saw an 18% rise in May 2024 and a 25% increase in March 2025.

- Competitive Positioning: Its design, technology, and AWD option contribute to a high market share.

- Key Star Performer: The Elantra's robust growth trajectory firmly establishes it as a Star in Hyundai's portfolio.

The Hyundai IONIQ 5 and the Genesis GV70/GV80 are clear Stars within Hyundai's portfolio, demonstrating exceptional growth and market leadership. The IONIQ 5's 71% US sales jump in July 2025, with nearly 25,000 units sold year-to-date, highlights its strong EV performance. Similarly, Genesis's luxury SUVs, the GV70 and GV80, saw a combined 16.5% US sales surge in H1 2025, with the GV70 alone increasing sales by 31.9% year-over-year, solidifying their premium market appeal.

| Product | Key Performance Indicator | Value | Period | Growth/Trend |

| Hyundai IONIQ 5 | US Sales Growth | 71% | July 2025 | Significant increase |

| Hyundai IONIQ 5 | US Year-to-Date Sales | ~25,000 units | Through July 2025 | Leading EV model |

| Genesis GV70 | Year-over-Year Sales Increase | 31.9% | H1 2025 | Strong growth |

| Genesis GV80 | Year-over-Year Sales Increase | 25.3% | H1 2025 | Robust growth |

| Genesis (Overall SUV Sales) | Share of Total US Sales | 80% | Jan-May 2025 | Dominant segment |

What is included in the product

This analysis categorizes Hyundai's product lines, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

A clear Hyundai Motor BCG Matrix visually simplifies complex portfolio challenges, offering a pain-point reliever for strategic decision-making.

Cash Cows

The Hyundai Santa Fe, especially its gasoline-powered versions, acts as a reliable income stream for Hyundai. In 2024, it set new annual sales records in the United States, demonstrating its enduring appeal.

The Santa Fe family, which now includes hybrid (HEV) options, continued this trend, with July 2025 seeing a remarkable 54% surge in retail sales. This consistent performance highlights its established market position and strong brand recognition, allowing for efficient capital deployment.

These vehicles contribute substantially to Hyundai's top line due to steady demand in the competitive mid-size SUV segment, requiring less intensive investment for expansion compared to emerging product categories.

Hyundai's established internal combustion engine (ICE) models, outside of its burgeoning electric vehicle lines, are the bedrock of its financial stability. These vehicles, while not in a rapid growth phase, consistently contribute substantial cash flow to the company.

Despite the strategic pivot towards electrification, these ICE vehicles benefit from a substantial existing customer base and continue to drive sales and aftermarket revenue. Importantly, the research and development investment for these traditional models is significantly lower than for new electric technologies, enhancing their profitability.

In 2024, Hyundai reported global sales of 4,141,959 vehicles. This impressive volume underscores the significant contribution of its ICE portfolio, providing a robust and dependable cash stream that supports the company's broader strategic initiatives, including its investments in future mobility solutions.

Hyundai's global manufacturing operations, exemplified by facilities such as the Hyundai Motor Manufacturing Alabama and the upcoming Metaplant America in Georgia, represent mature, high-volume production assets. These established plants are crucial for consistent vehicle output and operational efficiency, serving as reliable sources of cash generation for the company. In 2023, Hyundai Motor Group's global sales reached 4.31 million vehicles, underscoring the significant output from these operations.

Vehicle Financing Services

Hyundai's vehicle financing services are a key cash cow, generating consistent, high-margin revenue. These offerings make purchasing Hyundai vehicles more accessible, driving sales and creating predictable income from interest and fees.

This segment requires minimal additional investment for expansion, ensuring a stable and reliable cash flow for Hyundai. In 2023, Hyundai Capital America, a significant part of Hyundai's financing operations, reported strong performance, contributing substantially to the overall profitability.

- Steady Revenue: Hyundai's financing arm provides a reliable income stream independent of direct vehicle sales volume.

- High Margins: Interest and fees collected on loans offer higher profit margins compared to vehicle manufacturing alone.

- Sales Enablement: Financing options directly support and boost new and used vehicle sales.

- Low Investment Needs: The segment generally requires less capital for growth compared to R&D or manufacturing expansion.

Automotive Parts and Aftermarket Business

The automotive parts and aftermarket business for Hyundai operates as a classic cash cow. This segment benefits from the sheer volume of Hyundai vehicles already on the road worldwide, creating a consistent demand for replacement parts and servicing. For instance, in 2023, Hyundai Motor Group reported a significant increase in its global vehicle sales, contributing directly to the aftermarket segment's revenue stream.

This mature business typically enjoys high profit margins due to established supply chains and economies of scale. Unlike new vehicle sales which require substantial R&D and marketing, the aftermarket segment demands less investment for growth, making it a highly reliable generator of cash.

- Stable Revenue: Driven by a large installed base of Hyundai vehicles requiring maintenance and repairs.

- High Profitability: Mature operations and established supply chains contribute to strong profit margins.

- Low Investment Needs: Requires minimal new market development or R&D compared to other business units.

- Consistent Cash Generation: Provides a steady and predictable source of funds for the company.

Hyundai's established internal combustion engine (ICE) models, particularly those with a strong sales history like the Santa Fe, represent significant cash cows. These vehicles generate consistent profits with relatively low investment needs for further development, allowing Hyundai to allocate capital to newer technologies.

The automotive parts and aftermarket business, fueled by Hyundai's vast global vehicle fleet, also acts as a dependable cash cow. This segment benefits from high profit margins and minimal capital expenditure, providing a stable revenue stream that supports overall company financial health.

Hyundai's vehicle financing services, such as those offered through Hyundai Capital America, are another prime example of a cash cow. This segment delivers consistent, high-margin income through interest and fees, while also acting as a sales enabler for new vehicles, requiring limited additional investment for growth.

| Business Unit | Role in BCG Matrix | Key Financial Contribution | Investment Needs | 2024/2023 Data Point |

|---|---|---|---|---|

| ICE Models (e.g., Santa Fe) | Cash Cow | Consistent Profit Generation | Low | Santa Fe set new annual sales records in the US in 2024. |

| Aftermarket Parts & Service | Cash Cow | High Profit Margins, Stable Revenue | Minimal | Hyundai Motor Group's global sales increase in 2023 boosted aftermarket revenue. |

| Vehicle Financing | Cash Cow | High-Margin Income, Sales Enablement | Low | Hyundai Capital America reported strong performance in 2023. |

Preview = Final Product

Hyundai Motor BCG Matrix

The Hyundai Motor BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document is designed for immediate strategic insight, offering a clear visual representation of Hyundai's product portfolio without any watermarks or sample content.

What you see here is the final, unwatermarked Hyundai Motor BCG Matrix report that will be delivered to you after completing your purchase. This professionally crafted analysis is ready for immediate download and use in your business planning, providing actionable insights into Hyundai's market position.

This preview accurately represents the Hyundai Motor BCG Matrix document you will acquire upon purchase, ensuring no surprises and no demo content. The purchased file will be identical, allowing you to directly integrate this expert analysis into your strategic decision-making processes.

Dogs

While Hyundai's sedan lineup sees some strong performers, models like the IONIQ 6 have faced challenges in the US market. Sales for the IONIQ 6 declined by 6% in 2024, and through July 2025 year-to-date, they were down another 5%. This suggests a relatively small market share in a segment that may be facing headwinds or intense competition, potentially placing these less popular sedans in the 'Dog' category of the BCG Matrix.

The Hyundai Santa Cruz, a niche crossover pickup, faced a challenging sales environment in 2024, with US sales dropping by 13%. This downward trend continued into 2025, as indicated by a 19% year-to-date decline in May.

Despite its unique market position, the Santa Cruz's persistent sales slump suggests it's a product with low market share in a slow-growing segment. This performance profile aligns with a 'Dog' in the BCG matrix, potentially consuming resources without generating substantial returns.

While Hyundai Motor boasts strong global performance in many segments, a 1.8% decrease in overall global vehicle sales during 2024 indicates pockets of underperformance. These could be specific regional markets or niche vehicle segments where Hyundai's market share is low and growth prospects are limited.

These underperforming areas might act as cash traps, demanding significant investment for meager returns. For instance, if a particular regional market experiences declining demand for internal combustion engine vehicles and Hyundai hasn't adequately shifted its product mix towards EVs in that area, it could become a drag on overall profitability.

Boston Dynamics (Short-term Financial Performance)

Boston Dynamics, a key player in Hyundai's future mobility strategy, is currently categorized as a 'Dog' in the BCG Matrix due to its significant financial challenges. In 2024, the company reported a substantial net loss of 440.5 billion won, which converts to approximately $319 million. This indicates a high cash burn rate with minimal immediate returns, a hallmark of a 'Dog' portfolio component.

The financial performance of Boston Dynamics has shown a concerning trend of widening losses since its acquisition by Hyundai Motor Group. This situation has prompted Hyundai to reassess and scale back investments in certain future mobility projects, including its robotics ventures. This strategic adjustment underscores the difficult short-term financial outlook for Boston Dynamics.

- Net Loss in 2024: Boston Dynamics reported a net loss of 440.5 billion won ($319 million).

- Widening Losses: Annual losses have increased since Hyundai's acquisition.

- Investment Scaling: Hyundai Motor Group has reduced investment in robotics and other future mobility areas.

- 'Dog' Classification: High cash consumption and low immediate returns place it in the 'Dog' category.

Motional (Autonomous Driving Joint Venture)

Motional, Hyundai's ambitious autonomous driving joint venture with Aptiv, is currently positioned as a 'Dog' within the BCG Matrix framework. This classification stems from its current financial performance and market penetration, despite its high-potential future technology. The venture has recently undertaken a reduction in its headcount, signaling a strategic re-evaluation of its immediate investment and operational scale.

Autonomous driving, while a significant long-term prospect, faces considerable hurdles in terms of commercialization timelines and escalating research and development expenditures. Without substantial near-term revenue generation, Motional's current financial standing and market presence are characteristic of a 'Dog' category. For instance, while specific financial performance data for the joint venture is not publicly detailed, the broader autonomous vehicle industry faced significant capital demands in 2024, with companies investing billions in R&D.

- High R&D Costs: The continuous need for substantial investment in developing and refining autonomous driving technology.

- Delayed Commercialization: The slow pace of regulatory approvals and public acceptance impacting widespread deployment.

- Limited Near-Term Revenue: The absence of significant revenue streams to offset the high operational and development costs.

- Headcount Reduction: A recent indicator of a scaled-back operational scope or a shift in strategic priorities.

Hyundai's IONIQ 6, despite initial promise, has experienced a sales downturn. In 2024, its US sales fell by 6%, and through July 2025, they were down an additional 5%. This performance, coupled with a potentially shrinking market segment, suggests the IONIQ 6 might be a 'Dog' in the BCG matrix, indicating low market share and slow growth.

The Hyundai Santa Cruz also faces challenges, with a 13% drop in US sales in 2024 and a further 19% year-to-date decline by May 2025. This persistent sales slump places the Santa Cruz, a niche product, into the 'Dog' category due to its low market share in a slow-growing market, likely consuming resources without significant returns.

Boston Dynamics, a crucial part of Hyundai's future mobility, is currently a 'Dog' due to its significant financial drain. In 2024, it reported a net loss of 440.5 billion won (approximately $319 million), reflecting a high cash burn rate and minimal immediate returns, a classic trait of a 'Dog' asset.

Motional, Hyundai's autonomous driving venture, is also classified as a 'Dog' due to high R&D costs and delayed commercialization. Despite its long-term potential, the venture's current financial standing, characterized by limited near-term revenue and a recent headcount reduction, aligns with the 'Dog' profile.

Question Marks

Hyundai's HTWO brand represents a significant commitment to hydrogen fuel cell technology, extending beyond passenger cars to encompass ships, trains, and urban air mobility. This broad approach aims to build a robust hydrogen ecosystem, positioning Hyundai as a leader in future transportation solutions.

The NEXO, Hyundai's current flagship fuel cell electric vehicle (FCEV), with a new INITIUM model slated for a 2025 launch, faces a market still in its early stages. Despite the long-term potential, global sales of the NEXO reached only 2,774 units by 2024, highlighting a very low market share and the substantial investment required for widespread adoption.

Hyundai's subsidiary, Supernal, is a key player in the burgeoning Urban Air Mobility (UAM) sector, aiming for a commercial air taxi launch in 2028. This venture into advanced air travel signifies a substantial investment in a highly innovative field with significant future growth potential.

Despite the promising outlook, Supernal currently holds no market share in the UAM space. The company requires considerable research and development funding, as indicated by recent strategic workforce adjustments designed to support its long-term vision.

These factors—high innovation, substantial investment needs, and zero current market share—firmly position Supernal within the Question Mark quadrant of the BCG Matrix, highlighting its potential for high growth but also its inherent risks.

Hyundai is heavily investing in autonomous driving and the development of Software-Defined Vehicles (SDVs), with a goal to introduce its first SDV Pace Car by 2026. This strategic push includes plans to establish an autonomous driving vehicle foundry business, aiming to serve global software companies. The company sees significant future growth potential in this sector, evidenced by its commitment to innovation.

While the long-term outlook for SDVs and autonomous driving is promising, the current market penetration and revenue generation remain low. This segment requires substantial upfront investment in research and development, as well as the necessary infrastructure, positioning it as a high-risk, high-reward venture within Hyundai's portfolio. The company's investment in this area reflects a belief in its transformative potential for the automotive industry.

Hyundai IONIQ 9

The Hyundai IONIQ 9, a new entrant in the burgeoning three-row electric SUV market, commenced its US deliveries in late May 2025. By the end of July 2025, it had achieved initial sales of 2,086 units. This positions the IONIQ 9 as a potential star in Hyundai's lineup, given its entry into a segment experiencing robust growth.

The IONIQ 9's high growth potential is directly linked to the escalating consumer preference for larger electric vehicles. As a brand-new model, it is poised to capitalize on this trend.

Despite its promising growth prospects, the IONIQ 9 currently commands a very low market share. This necessitates substantial investment in marketing and sales initiatives to build brand awareness and secure a more significant foothold in the competitive EV SUV landscape.

- Market Position: Question Mark (low market share, high growth potential)

- Sales Data (as of July 2025): 2,086 units

- Segment Growth Driver: Increasing demand for three-row electric SUVs

- Strategic Need: Significant marketing and sales investment

Advanced Battery Technologies (Solid-State Batteries)

Hyundai is actively investing in advanced battery technologies, including solid-state batteries, as part of its long-term EV strategy. This focus on internalization aims to secure a competitive edge in the rapidly evolving electric vehicle market.

While Hyundai's current NCM batteries are crucial for its existing EV lineup, solid-state batteries are seen as a potential game-changer, promising enhanced safety, energy density, and faster charging times. This positions them as a future high-growth opportunity.

However, solid-state battery technology is still in its nascent stages of development. Significant research and development investments are required, with commercialization timelines and market acceptance remaining uncertain, characteristic of a Question Mark in the BCG matrix.

- Research & Development Investment: Hyundai has committed billions to battery R&D, with a portion allocated to solid-state technology.

- Potential Performance Gains: Solid-state batteries could offer double the energy density compared to current lithium-ion batteries.

- Commercialization Challenges: Scaling production and achieving cost parity with existing technologies are major hurdles.

- Market Uncertainty: Widespread adoption depends on overcoming technical challenges and consumer acceptance.

Hyundai's ventures into emerging technologies like hydrogen mobility (HTWO) and Urban Air Mobility (Supernal) represent significant investments in high-growth potential markets. These initiatives, while promising for the future, currently have limited market penetration and require substantial capital for development and market entry, characteristic of Question Marks.

The IONIQ 9, a new entrant in the expanding three-row electric SUV segment, shows early promise with 2,086 units sold by July 2025, indicating high growth potential but a currently low market share. Similarly, advanced battery technologies like solid-state batteries are crucial for future competitiveness but face significant R&D and commercialization hurdles, placing them in the Question Mark category due to their high growth prospects and current market uncertainty.

| Initiative | Market Position | Growth Potential | Current Market Share | Investment Needs |

| HTWO (Hydrogen Mobility) | Question Mark | High | Low | High |

| Supernal (UAM) | Question Mark | Very High | Zero | Very High |

| IONIQ 9 | Question Mark | High | Low (2,086 units by July 2025) | High (Marketing/Sales) |

| Solid-State Batteries | Question Mark | High | Zero (Commercial) | Very High (R&D) |

BCG Matrix Data Sources

Our Hyundai Motor BCG Matrix leverages a robust foundation of data, including Hyundai's annual reports, market share data, and industry growth forecasts to accurately position each business unit.