Hyundai Motor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Motor Bundle

Hyundai Motor faces a dynamic automotive landscape, with intense rivalry among established players and the looming threat of new entrants challenging market share. Understanding the bargaining power of both suppliers and buyers is crucial for navigating cost structures and customer loyalty.

The complete report reveals the real forces shaping Hyundai Motor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive industry, including Hyundai, depends on a vast network of suppliers. When a few suppliers dominate the market for critical components or possess unique expertise, their bargaining power escalates. This concentration allows them to dictate terms, potentially impacting production costs and schedules for manufacturers like Hyundai.

The global semiconductor shortage, which significantly affected automotive production throughout 2021 and 2022, serves as a prime example. Many automakers, including Hyundai, faced production delays and increased costs due to the limited capacity and concentrated nature of chip manufacturers. In 2023, while some improvements were seen, the strategic importance of these specialized suppliers remained a key factor in supply chain resilience.

Hyundai's bargaining power with its suppliers is significantly influenced by switching costs. If Hyundai faces high costs to change suppliers, perhaps due to specialized tooling, complex integration, or rigorous certification processes, then current suppliers gain leverage. This is especially true for components that are deeply integrated or uniquely designed for Hyundai's vehicles, making a switch to a new supplier both difficult and expensive.

For instance, the development and integration of advanced powertrain components or sophisticated infotainment systems often involve substantial upfront investment and bespoke engineering. In 2023, global automotive suppliers invested billions in research and development for next-generation technologies like solid-state batteries and advanced driver-assistance systems (ADAS), creating deep dependencies for automakers like Hyundai.

The cost of retooling production lines, re-certifying new parts, and retraining personnel can be prohibitive. This makes Hyundai more reliant on its existing supplier relationships, especially for critical, high-value components, thereby strengthening the suppliers' bargaining position.

Suppliers who offer unique or patented technologies, like specialized electric vehicle battery components or advanced driver-assistance system sensors, hold significant sway. Hyundai's strategic push into electric and hydrogen vehicles amplifies its dependence on suppliers possessing these critical, high-tech innovations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into vehicle manufacturing, while typically low in the mature automotive sector, can still subtly shift their bargaining leverage. Should a significant component provider contemplate producing vehicles, it would fundamentally alter the existing power balance with automakers like Hyundai.

While direct forward integration by automotive suppliers into full vehicle production is rare due to the immense capital and brand recognition required, the *potential* for such a move can still exert pressure. For instance, a supplier controlling a highly specialized and critical component, like advanced battery technology for EVs, might gain leverage if they could credibly threaten to enter the EV manufacturing space themselves, especially if they possess unique intellectual property.

- Low Likelihood, High Impact: While direct forward integration by suppliers into vehicle manufacturing is uncommon due to high entry barriers, the credible threat can enhance supplier bargaining power.

- Component Specialization: Suppliers of highly specialized or proprietary components, particularly in emerging areas like EV battery technology, may possess greater potential leverage if they can hint at manufacturing capabilities.

- Strategic Partnerships: Hyundai's reliance on key suppliers for critical technologies, such as advanced semiconductors or battery packs, means any perceived shift in a supplier's strategic direction could influence negotiations.

Importance of Hyundai to the Supplier

Hyundai's substantial global presence and high production output make it a crucial client for numerous component manufacturers. For instance, in 2023, Hyundai Motor Group sold approximately 7.3 million vehicles worldwide, underscoring the significant volume of parts required. This sheer scale inherently diminishes a supplier's leverage, as losing Hyundai as a customer would represent a substantial revenue loss for many. Consequently, suppliers are often motivated to offer competitive pricing and favorable terms to retain Hyundai's business.

The bargaining power of suppliers is directly influenced by how much revenue they derive from a particular buyer. When Hyundai accounts for a large percentage of a supplier's total sales, that supplier's ability to dictate terms or increase prices is considerably weakened. This is a common dynamic in the automotive industry where major manufacturers like Hyundai often secure exclusive or primary supply agreements, further solidifying their purchasing power.

- Significant Customer Base: Hyundai's global sales of 7.3 million vehicles in 2023 highlight its importance as a major buyer in the automotive supply chain.

- Reduced Supplier Leverage: When a supplier relies heavily on Hyundai for a substantial portion of its revenue, its bargaining power is significantly curtailed.

- Favorable Negotiation Terms: Hyundai's large-scale operations enable it to negotiate more advantageous pricing and contract conditions with its suppliers.

Suppliers of critical components, especially those with unique or patented technologies like advanced EV batteries, wield significant bargaining power over Hyundai. High switching costs for Hyundai, stemming from specialized integration and retooling needs, further bolster supplier leverage. While Hyundai's massive scale (7.3 million vehicles sold globally in 2023) generally reduces supplier power, the dependence on a few key tech providers can create imbalances.

| Factor | Impact on Hyundai's Bargaining Power with Suppliers | Example/Data Point |

|---|---|---|

| Supplier Concentration & Uniqueness | Increases supplier power | Semiconductor shortage (2021-2023) highlighted dependence on few chip manufacturers. Suppliers of advanced EV battery tech also hold leverage. |

| Switching Costs | Increases supplier power | High costs for retooling, re-certification, and integration of specialized components (e.g., ADAS sensors, powertrain). Billions invested by suppliers in next-gen tech in 2023. |

| Threat of Forward Integration | Low likelihood, but potential to increase supplier power | Credible threat from a supplier controlling highly specialized IP (e.g., unique EV battery tech) could shift power balance. |

| Hyundai's Buyer Volume | Decreases supplier power | 7.3 million vehicles sold globally in 2023 means suppliers rely heavily on Hyundai, encouraging competitive terms. |

| Supplier Revenue Dependence | Decreases supplier power | If Hyundai represents a large portion of a supplier's sales, that supplier has less ability to dictate terms. |

What is included in the product

This analysis of Hyundai Motor's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

Gain immediate clarity on competitive pressures with a dynamic Porter's Five Forces analysis, allowing for swift strategic adjustments in the Hyundai Motor market.

Customers Bargaining Power

Customers in the automotive sector are highly sensitive to price, a key factor that amplifies their bargaining power against manufacturers like Hyundai. This sensitivity is particularly pronounced given that vehicles represent a significant expenditure for most consumers.

Economic headwinds and rising interest rates in 2024 have further intensified customer price sensitivity. For instance, the average interest rate on a new car loan in the US hovered around 7.5% in early 2024, making financing a substantial part of the total cost and pushing buyers to seek better deals.

The abundance of choices available in the highly competitive automotive market means customers can easily switch to a rival brand if they perceive a better value proposition. This competitive landscape directly pressures Hyundai to manage its pricing strategies carefully to retain market share and customer loyalty.

The availability of substitute products significantly bolsters customer bargaining power in the automotive sector. Hyundai's customers can easily switch to competitors offering comparable vehicles, forcing Hyundai to remain competitive on price and features. For instance, in 2024, the global automotive market is saturated with options, from established giants like Toyota and Volkswagen to rapidly growing Chinese manufacturers, providing consumers with abundant alternatives.

The internet has dramatically shifted the balance of power towards customers in the automotive industry. With readily available information on vehicle specifications, pricing across dealerships, and independent customer reviews, buyers are more informed than ever before. This accessibility allows them to easily compare options, understand true market value, and identify potential discounts.

This increased buyer information availability directly translates into heightened bargaining power for customers. For instance, in 2024, online automotive marketplaces and review sites saw significant traffic, with platforms like Edmunds and Kelley Blue Book providing detailed pricing guides and comparison tools. This transparency empowers consumers to negotiate effectively, often leveraging the lowest advertised prices or incentives found online to secure better deals from dealerships, impacting Hyundai's pricing strategies and profit margins.

Low Switching Costs for Customers

For consumers looking to purchase a new vehicle, the financial and practical hurdles to switching brands are generally quite low. With a wide array of manufacturers offering vehicles with similar features, performance, and price ranges, buyers can easily move from one brand to another without significant penalty. This accessibility to comparable alternatives directly amplifies the bargaining power of customers.

This low switching cost is a significant factor in the automotive industry, allowing consumers to readily compare options and demand better pricing or features. For instance, in 2024, the automotive market remained highly competitive, with numerous brands vying for market share. Many consumers can transition between brands with minimal effort, impacting pricing strategies for manufacturers like Hyundai.

- Low Switching Costs: Customers face minimal financial or practical barriers when moving from one car brand to another.

- Abundant Alternatives: The market offers a broad selection of vehicles with comparable features and price points, increasing customer choice.

- Enhanced Bargaining Power: The ease of switching allows customers to negotiate more effectively for better deals and specifications.

- Competitive Landscape: In 2024, the automotive sector's intense competition further empowered consumers due to the availability of diverse and similar product offerings.

Homogeneity of Products

Even with efforts to differentiate, many cars in the same class offer comparable features and performance. This similarity means buyers often focus on price or small distinguishing factors, giving them more leverage.

For instance, in 2024, the compact sedan segment, a core area for Hyundai, saw intense competition where features like fuel efficiency and basic infotainment systems were largely standardized across brands. This homogeneity directly impacts customer bargaining power.

- Standardized Features: Many vehicles in a given segment provide similar core functionalities, reducing perceived uniqueness.

- Price Sensitivity: When products are seen as alike, customers are more likely to switch based on price differences.

- Increased Switching: Product homogeneity encourages customers to compare offers across manufacturers, amplifying their negotiating position.

Customers in the automotive market possess significant bargaining power, largely due to low switching costs and the abundance of readily available information. The ease with which consumers can compare prices, features, and reviews online empowers them to negotiate effectively, often leveraging competitive offers to secure better deals. This dynamic forces manufacturers like Hyundai to remain highly competitive on pricing and product differentiation to maintain customer loyalty.

The intense competition in 2024, with numerous brands offering similar vehicles, further amplifies customer leverage. For example, the average transaction price for a new vehicle in the US reached approximately $47,000 in early 2024, a figure that buyers are highly motivated to reduce through negotiation, especially with rising interest rates impacting affordability.

This situation directly pressures Hyundai to manage its pricing strategies and incentives carefully. The availability of comparable alternatives across different manufacturers means that customers can easily shift their purchasing decisions, making price and perceived value key determinants in their choices.

The automotive market in 2024 remained characterized by a high degree of product similarity within segments, such as compact SUVs or mid-size sedans. This homogeneity means that features like fuel efficiency or basic safety systems are often standardized, pushing customers to focus on price as a primary differentiating factor, thereby increasing their bargaining power.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | Average new car loan interest rates around 7.5% in early 2024 increased buyer focus on total cost. |

| Availability of Alternatives | High | Saturated global market with established and emerging manufacturers offering comparable vehicles. |

| Switching Costs | Low | Minimal financial or practical barriers for consumers to change brands. |

| Information Accessibility | High | Online platforms (Edmunds, Kelley Blue Book) provide extensive pricing and review data, empowering buyers. |

| Product Homogeneity | Moderate to High | Standardized features in popular segments (e.g., compact sedans) lead to price-based decision making. |

Preview Before You Purchase

Hyundai Motor Porter's Five Forces Analysis

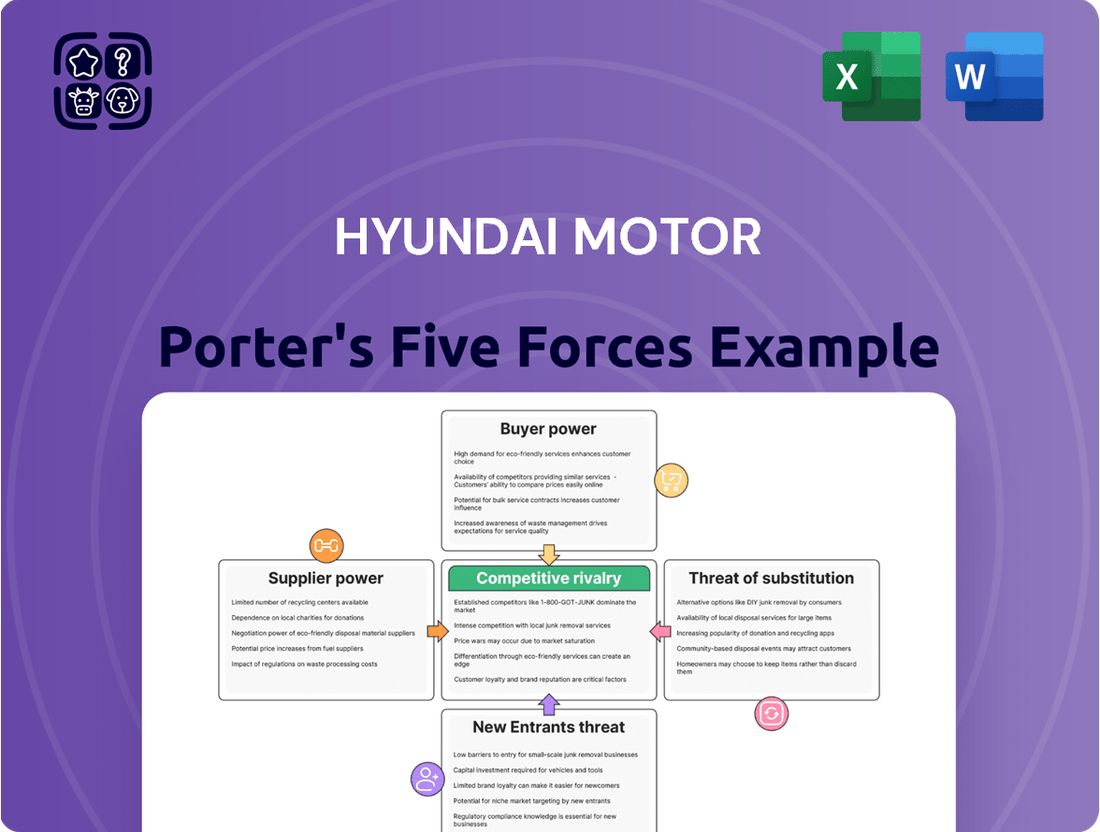

This preview showcases the comprehensive Porter's Five Forces analysis of Hyundai Motor, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently assess the strategic implications of each force on Hyundai's market position knowing that the insights provided are directly applicable to your business decisions.

Rivalry Among Competitors

The global automotive sector is a crowded arena, featuring a vast array of companies. Hyundai competes with established giants such as Toyota, which sold over 11.2 million vehicles globally in 2023, and Volkswagen, with over 9.2 million vehicles sold in the same year.

Beyond these traditional powerhouses, Hyundai also contends with emerging players, particularly from China. BYD, for instance, has seen remarkable growth, becoming the world's largest seller of new energy vehicles in 2023, surpassing Tesla. Geely is another significant Chinese competitor, expanding its global footprint.

This diverse competitive landscape includes not only traditional internal combustion engine manufacturers but also a growing number of companies heavily invested in electric vehicles (EVs) and autonomous driving technologies. This dynamic means Hyundai must constantly innovate and adapt to a multifaceted competitive environment.

The global light vehicle market is projected for modest growth in 2025. However, this growth is overshadowed by fierce competition for market share, especially within the rapidly expanding electric vehicle (EV) sector.

While EV adoption continues, the pace of growth in certain key markets is slowing due to factors like affordability issues and a reduction in government subsidies. This slowdown further intensifies the rivalry among automakers as they battle for existing and future customers.

Automakers are locked in a fierce race to differentiate through innovation, particularly in burgeoning sectors like electric vehicles (EVs), hydrogen fuel cell technology, and autonomous driving. This intense pressure forces continuous investment in research and development to capture market share.

Hyundai's strategic commitment to advanced mobility solutions, including significant investments in new EV platforms and hydrogen fuel cell systems, directly addresses this competitive imperative. For instance, Hyundai announced plans to invest over $5 billion in the U.S. by 2025 for future mobility, underscoring its dedication to staying ahead.

High Fixed Costs and Exit Barriers

The automotive sector is inherently capital-intensive, demanding substantial investments in manufacturing facilities, advanced technology, and ongoing research and development. These high fixed costs act as significant barriers to exiting the industry, compelling existing players to continue production and sales even when market conditions are unfavorable to avoid substantial losses on underutilized assets.

This situation intensifies competitive rivalry as companies strive to maintain sales volumes and cover their overheads. For instance, in 2024, global automotive manufacturers continue to grapple with the immense capital expenditure required for transitioning to electric vehicles, further cementing the high fixed cost structure and discouraging new entrants while pressuring incumbents to compete fiercely.

- Capital Intensity: The automotive industry requires billions of dollars for plant construction, machinery, and technology development.

- Exit Barriers: High sunk costs in specialized equipment and facilities make it difficult and costly for companies to leave the market.

- Aggressive Competition: Companies often engage in price wars or heavy discounting to ensure their factories operate at optimal capacity and fixed costs are absorbed.

- R&D Investment: Continuous investment in new technologies, such as autonomous driving and electrification, adds to the already substantial fixed cost base.

Strategic Stakes

The automotive sector is characterized by exceptionally high strategic stakes. Companies are pouring billions into developing and producing next-generation vehicles, particularly electric and autonomous models. For instance, Hyundai Motor Group announced plans to invest approximately $15 billion in the U.S. through 2030, focusing on future mobility, including EV production and charging infrastructure.

This intense focus on future technologies escalates competition as firms vie for dominance in emerging markets. Hyundai's commitment to expanding its EV lineup, aiming for a significant market share by 2030, highlights the aggressive strategies employed to capture future demand.

- Global Industry Scale: The automotive industry's vast global footprint means success or failure has widespread economic implications.

- Massive R&D Investment: Companies like Hyundai are investing heavily in future technologies, such as advanced battery systems and AI for autonomous driving, to secure long-term competitive advantages.

- Capacity Expansion: Significant capital is being allocated to build new production facilities and retool existing ones for electric vehicle manufacturing, as evidenced by Hyundai's new EV plant in Georgia, USA.

- Market Leadership Ambitions: The race to lead in the EV transition is fierce, with companies aiming to establish strong brand recognition and customer loyalty in this rapidly evolving segment.

Competitive rivalry in the automotive sector is intense, driven by a large number of global players and significant investments in new technologies like EVs. Hyundai faces formidable competition from established automakers such as Toyota and Volkswagen, alongside rapidly growing Chinese manufacturers like BYD. This dynamic forces continuous innovation and aggressive strategies to capture market share, especially in the burgeoning EV segment.

The industry's capital-intensive nature and high exit barriers compel existing companies to compete fiercely, even in challenging market conditions, to cover substantial fixed costs. This perpetuates aggressive pricing and heavy R&D spending, as seen with Hyundai's multi-billion dollar investments in future mobility solutions through 2030.

Companies are locked in a battle for leadership in emerging areas like electric and autonomous vehicles, necessitating massive investments in new production capacity and advanced technology. This race for market dominance, as exemplified by Hyundai's strategic focus on EV expansion, underscores the high stakes and aggressive competition within the global automotive landscape.

| Competitor | 2023 Global Sales (Millions) | Key Focus Areas |

|---|---|---|

| Toyota | 11.2 | Hybrid, EVs, Fuel Cell |

| Volkswagen | 9.2 | EVs, Software Development |

| BYD | ~3.0 (EVs & PHEVs) | New Energy Vehicles, Battery Technology |

| Geely | ~1.7 (Group Sales) | EVs, Autonomous Driving |

SSubstitutes Threaten

The rising convenience and accessibility of public transportation, alongside the boom in ride-sharing platforms such as Uber and Lyft, present a substantial threat to private car sales. By 2025, urban mobility is increasingly favoring shared and micro-mobility options, directly impacting the demand for traditional vehicle ownership.

The proliferation of micromobility solutions like shared bikes, e-scooters, and e-bikes presents a significant threat of substitutes for traditional automotive sales, especially for short urban commutes. By 2024, many cities have expanded dedicated lanes and parking zones for these options, making them increasingly convenient and appealing alternatives to car ownership for many consumers.

New ownership models like vehicle subscriptions and car-sharing platforms are increasingly offering alternatives to traditional car purchases. These flexible mobility solutions cater to evolving consumer preferences, potentially lessening the demand for individual car ownership.

Walking and Cycling

The increasing emphasis on sustainable urban development, with enhanced cycling and pedestrian pathways, presents a significant threat of substitution for short car trips. This trend is supported by government initiatives aimed at promoting eco-friendly transportation and reducing dependence on personal vehicles.

Governments worldwide are actively investing in infrastructure to encourage active mobility. For instance, by the end of 2024, many European cities are expected to have completed major cycling network expansions. In 2023, the global cycling market was valued at approximately $60 billion, with projections indicating continued growth driven by these urban planning shifts.

- Growing Infrastructure Investment: Cities are dedicating more resources to bike lanes and pedestrian zones, making these options more viable and attractive.

- Environmental Consciousness: A rising public awareness of environmental issues fuels a preference for low-emission transportation methods.

- Health Benefits: The recognized health advantages of walking and cycling encourage individuals to adopt these activities for daily commutes.

- Cost Savings: For consumers, choosing to walk or cycle instead of driving can lead to substantial savings on fuel, maintenance, and parking.

Technological Advancements in Mobility-as-a-Service (MaaS)

The increasing sophistication of Mobility-as-a-Service (MaaS) platforms presents a significant threat of substitution for traditional car ownership, including for Hyundai. These platforms, which integrate planning, booking, and payment for various transport modes like ride-sharing, public transit, and micro-mobility, offer unparalleled convenience. For instance, by mid-2024, many urban centers are seeing MaaS adoption rates climb, with users reporting increased reliance on integrated multimodal journeys over private vehicle use.

This seamless integration makes alternatives to car ownership more attractive and user-friendly. As MaaS providers continue to enhance their offerings, the perceived cost and hassle of owning and maintaining a personal vehicle diminish further. By 2024, studies indicate that the total cost of mobility for users of integrated MaaS platforms can be up to 30% lower than private car ownership in densely populated urban areas, directly impacting demand for new vehicles.

The threat is amplified by partnerships between MaaS operators and public transit agencies, creating a more robust and appealing ecosystem.

- Enhanced Convenience: MaaS platforms consolidate multiple transportation options into a single app, simplifying travel planning and execution.

- Cost-Effectiveness: For many users, especially in urban environments, integrated MaaS solutions offer a more economical alternative to private car ownership.

- Growing Adoption: The increasing integration and user-friendliness of MaaS are leading to higher adoption rates, particularly among younger demographics.

- Partnerships: Collaborations between MaaS providers and public transport entities strengthen the substitute offering by providing comprehensive network coverage.

The growing appeal of shared mobility services and enhanced public transportation networks presents a significant threat of substitutes for traditional car sales. By 2024, many cities are prioritizing sustainable urban development, leading to increased investment in cycling infrastructure and pedestrian zones, which further diminishes the necessity of private vehicle ownership for short commutes.

Mobility-as-a-Service (MaaS) platforms are consolidating various transport options, making combined multimodal journeys more convenient and cost-effective than owning a car. By mid-2024, urban MaaS adoption is rising, with users reporting greater reliance on these integrated systems, potentially reducing the demand for new vehicle purchases.

| Substitute Option | Key Drivers | Impact on Auto Sales |

|---|---|---|

| Shared Mobility (Ride-sharing, Car-sharing) | Convenience, Cost Savings, Reduced Hassle of Ownership | Moderate to High |

| Micromobility (E-scooters, Bikes) | Short Commute Viability, Environmental Friendliness, Urban Infrastructure Support | Low to Moderate |

| Public Transportation | Accessibility, Cost-Effectiveness, Urban Planning Focus | Moderate |

| Mobility-as-a-Service (MaaS) | Integrated Convenience, Cost Optimization, Seamless Travel Planning | High |

Entrants Threaten

The automotive manufacturing sector, where Hyundai Motor operates, demands substantial upfront capital. Establishing a new car company requires billions of dollars for research and development, building state-of-the-art factories, creating robust supply chains, and setting up extensive distribution and service networks. For instance, in 2024, the cost to develop a new vehicle platform alone can easily exceed $1 billion, making it a formidable hurdle for aspiring competitors.

Established automakers, including Hyundai, leverage substantial economies of scale in production, purchasing, and advertising. This scale makes it challenging for newcomers to match their cost efficiencies, as new entrants must invest heavily to achieve comparable output levels. For instance, in 2024, the global automotive industry's massive production volumes allow for significant per-unit cost reductions.

The experience curve further solidifies this advantage. As companies like Hyundai produce more vehicles over time, they refine their manufacturing processes, leading to increased efficiency and lower costs per unit. This cumulative learning curve means newer entrants start with a cost disadvantage compared to incumbents who have benefited from years of operational refinement.

Hyundai Motor benefits from decades of building strong brand recognition and customer loyalty, making it difficult for new entrants to gain traction. This loyalty is reinforced by an extensive and well-established dealership and service network, which new players must replicate to compete effectively.

Regulatory Hurdles and Safety Standards

The automotive sector faces intense scrutiny regarding safety and environmental performance. For instance, in 2024, the European Union's Euro 7 emissions standards continued to shape vehicle development, requiring significant technological advancements and compliance investments from all manufacturers, including potential new entrants.

Meeting these evolving global regulations, such as the stringent U.S. CAFE standards for fuel economy, demands substantial capital expenditure and specialized engineering knowledge. This complexity acts as a significant deterrent for any company looking to enter the market without established infrastructure and research capabilities.

- Stringent Safety Regulations: Global automotive safety standards, like NCAP ratings, necessitate extensive testing and design modifications, adding considerable cost and time to market entry.

- Environmental Compliance: Adhering to emission targets, such as those set by the EPA in the US or the aforementioned Euro 7 in Europe, requires advanced powertrain technology and pollution control systems.

- Certification Processes: Obtaining necessary certifications for new vehicle models in major markets can be a lengthy and expensive undertaking, often requiring years of development and validation.

- Investment in R&D: The continuous need to innovate in areas like electric vehicle technology and autonomous driving systems demands ongoing, high-level research and development investment, which is a major barrier for newcomers.

Access to Supply Chains and Technology

Securing dependable supply chains for crucial automotive components, particularly for burgeoning areas like electric vehicle batteries and advanced semiconductors, presents a significant barrier to entry. Newcomers often find it challenging to negotiate favorable terms or gain access to the latest technological innovations from established suppliers, a situation that persisted through 2024 as global supply chain pressures continued.

For instance, the automotive industry in 2024 continued to grapple with the availability and cost of battery raw materials, such as lithium and cobalt, with major players like Hyundai having secured long-term supply agreements that new entrants would find difficult to replicate.

- Supply Chain Dependence: New entrants face difficulties in establishing reliable and cost-effective supply chains for critical components like semiconductors and EV batteries.

- Technological Access: Gaining access to cutting-edge technologies and securing favorable terms from established suppliers remains a significant hurdle for potential competitors.

- Supplier Relationships: Existing automakers, including Hyundai, have cultivated deep relationships with key suppliers, creating an advantage that new entrants struggle to overcome.

The threat of new entrants in the automotive sector, including for Hyundai Motor, remains moderate due to significant capital requirements and established economies of scale. For example, in 2024, the cost of developing new vehicle technologies, such as advanced driver-assistance systems, continues to climb, demanding substantial R&D budgets that deter many potential newcomers.

Brand loyalty and extensive distribution networks built over decades by companies like Hyundai also present a considerable barrier. New companies must invest heavily to replicate these customer relationships and service infrastructures to compete effectively in 2024's market landscape.

Furthermore, stringent safety and environmental regulations, such as evolving emissions standards in 2024, necessitate advanced engineering and compliance investments, adding another layer of difficulty for any new player attempting to enter the automotive manufacturing arena.

Porter's Five Forces Analysis Data Sources

Our Hyundai Motor Porter's Five Forces analysis is built upon a foundation of verified data from Hyundai's annual reports, industry-specific research from firms like IHS Markit and Statista, and regulatory filings from automotive industry bodies.