Hyundai Motor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Motor Bundle

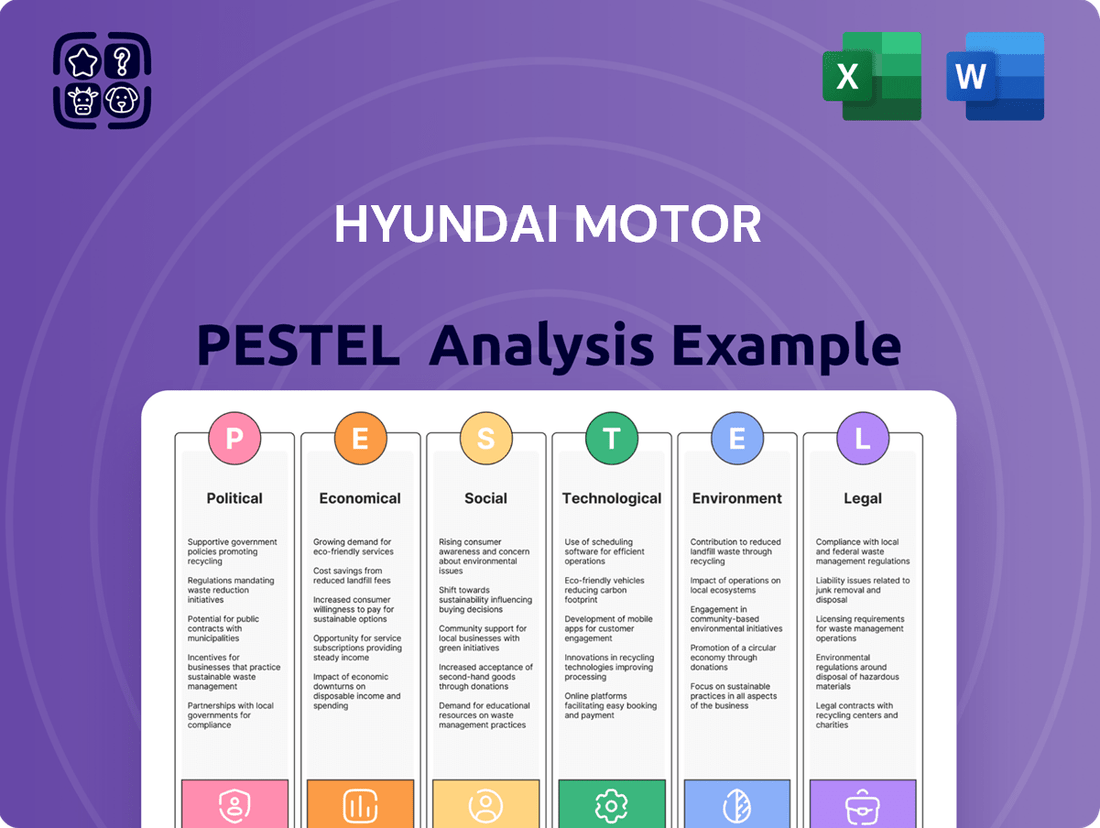

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Hyundai Motor's trajectory. Our expert-crafted PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage.

Political factors

Governments globally are actively promoting electric vehicle (EV) adoption through a mix of incentives. These often include direct purchase subsidies and favorable tax treatments designed to lower the upfront cost for consumers and encourage manufacturers to ramp up production. This policy landscape directly impacts companies like Hyundai by influencing demand and competitive positioning.

South Korea, Hyundai's home market, adjusted its EV subsidy policy in February 2024. The revision specifically benefits domestic manufacturers by prioritizing EVs with higher-performing batteries, potentially giving Hyundai an advantage. Conversely, subsidies for EVs equipped with less efficient batteries were reduced, signaling a push towards higher quality and performance in the domestic EV market.

Trade wars and protectionist policies present a significant challenge for global automakers like Hyundai. Potential tariffs on imported vehicles, for instance, could directly increase the cost of Hyundai's cars in key markets, impacting sales volume. In 2023, the US imposed tariffs on steel and aluminum, which, while not directly targeting vehicles, increased production costs for manufacturers operating within the US, including those with facilities there.

Geopolitical risks and rising protectionism worldwide can disrupt Hyundai's international sales networks and the intricate global supply chains that are vital for vehicle production. For example, ongoing trade disputes between major economic blocs could lead to retaliatory measures that affect component sourcing or finished vehicle exports, as seen with the trade tensions impacting the semiconductor supply chain, a critical component for modern vehicles.

Political instability in regions crucial for automotive component sourcing, such as parts of Southeast Asia and Eastern Europe, poses a significant risk to Hyundai's production. For instance, ongoing geopolitical tensions in 2024 have led to increased shipping costs and lead times for critical electronic components, impacting vehicle assembly schedules globally.

Hyundai's strategic focus on supply chain resilience is paramount in this environment. By diversifying its supplier base and exploring near-shoring options, the company aims to buffer against disruptions. This strategy became particularly evident in 2024 as Hyundai increased investment in manufacturing facilities within North America to reduce reliance on overseas suppliers for key parts.

International Relations and Market Access

Hyundai's international relations significantly shape its market access and sales. For instance, positive diplomatic ties between South Korea and the United States in 2024 facilitate smoother trade for Hyundai vehicles, contributing to its robust performance in the North American market. Conversely, geopolitical tensions can erect trade barriers, impacting import duties and potentially reducing sales volumes.

Hyundai's strategy to mitigate these risks involves expanding local production. By establishing manufacturing facilities in key regions like North America, India, and Saudi Arabia, Hyundai diversifies its operational footprint. This localization approach, seen in Hyundai Motor America's substantial production capacity, helps buffer against the direct impact of fluctuating international trade policies and tariffs, ensuring more stable market access.

The company's global manufacturing network, including significant investments in new plants and expansions, underscores this political risk management. For example, Hyundai's continued investment in its Indian operations, a market projected to see strong automotive growth through 2025, demonstrates a commitment to regions with favorable diplomatic and economic outlooks. This global diversification is crucial for maintaining consistent sales and market presence amidst evolving international political landscapes.

Regulations on Autonomous Driving and Future Mobility

Governments globally are actively shaping the future of mobility by developing comprehensive regulatory frameworks for autonomous driving and advanced air mobility (AAM). For instance, the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) continues to issue guidance and update standards for automated driving systems, with significant updates expected in 2024 and 2025. Hyundai's substantial investments in areas like its Motional joint venture, focused on robotaxi services, necessitate a keen understanding and adaptation to these evolving legal landscapes to ensure its product development and future commercialization efforts remain compliant.

Navigating these regulatory waters is crucial for Hyundai's long-term strategy. The pace of regulatory development directly impacts the timeline for deploying new technologies and services. For example, the European Union's ongoing work on harmonizing AI and autonomous vehicle regulations across member states presents both opportunities and challenges. Hyundai must ensure its technological advancements align with varying national and international safety, data privacy, and operational standards to facilitate widespread adoption and market entry.

- Regulatory Clarity: Hyundai's success in autonomous driving hinges on clear, predictable regulations, which are still under development in key markets like North America and Europe.

- Compliance Costs: Adhering to diverse and evolving safety and testing protocols for autonomous vehicles can lead to significant R&D and compliance expenditures for Hyundai.

- Market Access: Hyundai's ability to launch and scale its autonomous mobility solutions, such as those developed with Motional, is directly tied to regulatory approvals in target regions, with significant market potential in the US and Asia projected to grow substantially by 2025.

Government incentives for electric vehicles (EVs) continue to shape the automotive market, with many nations, including South Korea, adjusting subsidy policies in 2024 to favor higher-performing batteries. This directly influences consumer demand and Hyundai's competitive edge in the burgeoning EV sector.

Trade policies and geopolitical tensions remain significant factors, potentially increasing import costs and disrupting global supply chains for components like semiconductors, a critical element for modern vehicles. Hyundai's strategy to mitigate these risks involves expanding local production in key markets like North America and India.

The evolving regulatory landscape for autonomous driving, with ongoing updates from bodies like the NHTSA expected through 2024 and 2025, directly impacts Hyundai's investments in ventures like Motional. Ensuring compliance with diverse international safety and data privacy standards is crucial for the successful deployment of these advanced mobility solutions.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing Hyundai Motor, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover strategic opportunities and potential threats.

A concise Hyundai Motor PESTLE analysis that highlights key external factors, offering clarity and direction to mitigate risks and capitalize on opportunities during strategic planning.

Economic factors

Global economic growth is a critical driver for Hyundai Motor. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a figure expected to hold steady into 2025. This overall economic health directly impacts consumer confidence and their ability to afford discretionary purchases like new automobiles. A robust economy generally translates to higher demand for vehicles.

However, regional economic performance can vary significantly, affecting Hyundai's sales in different markets. For instance, while some emerging economies might show stronger growth, a slowdown in major markets like Europe or North America could dampen demand for new cars. This softening demand often intensifies competition as manufacturers vie for a smaller pool of buyers, potentially impacting Hyundai's market share and pricing power.

Rising interest rates directly influence the cost of vehicle financing for consumers, potentially dampening demand for new Hyundai vehicles. For instance, if benchmark rates like the Federal Reserve's federal funds rate increase, loan rates for car purchases will likely follow suit. This makes monthly payments higher, impacting affordability and, consequently, sales volumes.

Hyundai's own financial services arm, Hyundai Capital America, is also directly exposed to these interest rate shifts. Higher borrowing costs for Hyundai Capital mean they may need to charge more for financing, further affecting consumer purchasing power and potentially squeezing profit margins on financed sales.

Fluctuations in the cost of essential raw materials, like steel, aluminum, and critical minerals for electric vehicle batteries, directly influence Hyundai's manufacturing expenses and ultimately its profit margins. For instance, the price of lithium carbonate, a key component in EV batteries, saw significant volatility throughout 2023 and into early 2024, impacting the cost structure for electric models.

Persistent global supply chain disruptions, exacerbated by geopolitical tensions and logistical bottlenecks, continue to drive up the cost of these raw materials. These disruptions not only increase the price but also create uncertainty in material availability, forcing manufacturers like Hyundai to potentially pay premiums or seek alternative, sometimes more expensive, sourcing options.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Hyundai Motor. A strong South Korean Won (KRW) can make Hyundai's exports more expensive for international buyers, potentially dampening sales volumes and impacting revenue when converted back to KRW. Conversely, a weaker Won can boost profitability by making Korean-made vehicles more competitive abroad and increasing the KRW value of profits earned in foreign currencies.

Hyundai's global operations mean it's exposed to a variety of currency movements. For instance, in 2023, the average exchange rate saw the KRW strengthen against major currencies like the US Dollar (USD) and Euro (EUR) for parts of the year, which would have presented a headwind. The company's financial reports often detail the impact of foreign exchange on its operating profit, highlighting the need for robust hedging strategies.

- Impact on Revenue: A stronger KRW relative to key markets like the US and Europe can reduce the KRW equivalent of sales generated in those regions.

- Profitability Concerns: Unfavorable currency movements can erode operating profit margins, particularly for vehicles manufactured in Korea and sold overseas.

- Hedging Strategies: Hyundai actively employs financial instruments to mitigate currency risks, aiming to stabilize earnings despite market volatility.

Competition and Pricing Pressure in EV Market

The electric vehicle (EV) market is experiencing fierce competition, with established automakers and new entrants aggressively vying for market share. This heightened rivalry has led to price wars, directly impacting profitability for companies like Hyundai. For instance, in early 2024, several manufacturers announced price cuts on popular EV models, forcing others to re-evaluate their pricing strategies to remain competitive.

Hyundai is actively navigating this challenging landscape by focusing on a dual strategy. They are introducing more budget-friendly EV options to attract a wider customer base and simultaneously expanding their range of hybrid vehicles. This approach aims to cater to diverse consumer preferences and price sensitivities while still participating in the EV transition. As of late 2023, Hyundai's IONIQ 5 and Kona Electric models have seen adjustments in their pricing in key markets to counter competitor moves.

- Intensified Competition: The global EV market saw a significant increase in new model introductions throughout 2023 and early 2024, with over 150 distinct EV models available in major markets by mid-2024.

- Price Wars: Average EV prices have seen a downward trend, with some segments experiencing price reductions of 10-15% year-over-year in certain regions due to aggressive manufacturer pricing.

- Hyundai's Response: Hyundai has launched or announced plans for more accessible EV variants, such as potential lower-trim versions of existing models, and has seen a notable uptick in demand for its hybrid offerings, which constituted approximately 25% of its total vehicle sales in Q1 2024.

- Profit Margin Pressure: The combination of increased competition and price reductions is squeezing profit margins, making operational efficiency and cost management critical for sustained profitability in the EV sector.

Global economic growth remains a key indicator for Hyundai, with projections for 2024 and 2025 hovering around 3.2%. This stability suggests a consistent demand environment, though regional variations are critical. For instance, while some emerging markets are showing robust expansion, potential slowdowns in established markets like Europe could temper overall vehicle sales and intensify competition for Hyundai.

Interest rate hikes directly impact vehicle affordability, as higher financing costs for consumers can dampen demand for new Hyundai vehicles. For example, if central banks maintain or increase benchmark rates, car loan rates will likely rise, making monthly payments more expensive and potentially reducing sales volumes. This also affects Hyundai's own financing arm, potentially increasing its borrowing costs.

Fluctuations in raw material costs, particularly for EV battery components like lithium, continue to affect Hyundai's manufacturing expenses. Geopolitical factors and supply chain disruptions in 2023 and early 2024 have driven up prices and created sourcing uncertainties, forcing Hyundai to potentially absorb higher costs or find more expensive alternatives.

Currency exchange rates significantly influence Hyundai's profitability. A stronger South Korean Won (KRW) against currencies like the US Dollar or Euro can make exports more expensive, impacting revenue. For example, the KRW's strength at various points in 2023 presented a headwind for Korean exports, underscoring the importance of Hyundai's hedging strategies.

| Economic Factor | 2024 Projection/Status | Impact on Hyundai | Key Data Point |

|---|---|---|---|

| Global Economic Growth | Stable at ~3.2% | Supports demand, but regional variations matter | IMF projection for 2024/2025 |

| Interest Rates | Elevated in major economies | Increases vehicle financing costs, dampens demand | Federal Reserve federal funds rate |

| Raw Material Costs | Volatile, influenced by supply chains | Increases manufacturing expenses, particularly for EVs | Lithium carbonate price fluctuations |

| Currency Exchange Rates | Fluctuating KRW vs. USD/EUR | Affects export competitiveness and repatriated profits | KRW strength in 2023 |

Preview the Actual Deliverable

Hyundai Motor PESTLE Analysis

The Hyundai Motor PESTLE Analysis preview you're viewing is the exact document you'll receive after purchase, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting the company. This detailed report is fully formatted and ready to be utilized for strategic planning and market understanding. What you see here is the final, professionally structured analysis, ensuring no surprises and immediate value upon acquisition.

Sociological factors

Consumer demand for electric and hybrid vehicles (EVs/hybrids) is on a significant upward trend, fueled by increasing environmental consciousness and the volatility of gasoline prices. This shift is a major sociological factor influencing the automotive industry.

Hyundai is actively responding to this evolving market by strategically expanding its portfolio of electrified vehicles. For instance, in 2023, Hyundai Motor Group sold over 1.2 million electrified vehicles globally, marking a substantial increase from previous years and demonstrating their commitment to this burgeoning segment.

Demographic shifts, such as an aging global population and a growing middle class in emerging markets, directly impact vehicle demand and preferences. For instance, by 2025, the global population is projected to reach over 8 billion, with a significant portion residing in urban centers. This trend fuels the need for efficient, sustainable, and often smaller vehicles suited for city driving.

Hyundai's strategic response includes significant investment in purpose-built vehicles (PBVs) designed for diverse urban logistics and personal mobility needs. Furthermore, the company is exploring urban air mobility (UAM) solutions, anticipating a future where aerial transport complements ground-based travel in densely populated areas. These initiatives position Hyundai to capitalize on the evolving transportation landscape driven by urbanization and changing demographic needs.

Consumer trust and brand perception are paramount for Hyundai, directly impacting sales and market share. Recent surveys in 2024 indicate that vehicle safety remains a top concern for car buyers, with 78% of respondents prioritizing advanced safety features. Hyundai's investment in technologies like Hyundai SmartSense, which includes features like forward collision-avoidance assist and blind-spot collision-avoidance assist, directly addresses this concern.

Hyundai's dedication to environmental responsibility is also shaping its brand image. By 2025, Hyundai aims for 30% of its global sales to be zero-emission vehicles, a commitment that resonates with an increasing segment of environmentally conscious consumers. This focus on sustainability, coupled with a strong emphasis on quality, builds a positive brand perception that supports market growth.

Labor Relations and Workforce Skills

Hyundai Motor faces ongoing challenges in maintaining positive labor relations and addressing potential labor shortages, particularly for skilled technical workers crucial in advanced automotive manufacturing. Worker wages and retention remain key discussion points within the sector, impacting production stability.

The automotive industry, including Hyundai, is navigating evolving workforce needs. For instance, in 2024, reports highlighted a growing demand for technicians proficient in electric vehicle (EV) and autonomous driving technologies, a skill gap that could hinder production scaling.

- Skilled Labor Demand: The shift towards EVs necessitates a workforce trained in battery technology, software integration, and advanced diagnostics.

- Wage Pressures: Competition for skilled labor in 2024 and 2025 is likely to drive wage increases, impacting Hyundai's labor costs.

- Retention Strategies: Companies like Hyundai are investing in training and development programs to retain their existing workforce and attract new talent.

- Union Negotiations: Ongoing labor contract negotiations in major automotive markets can influence wage structures and working conditions for Hyundai's employees globally.

Accessibility and Mobility for All

Societal expectations are shifting towards greater inclusivity, pushing automakers like Hyundai to prioritize accessibility. This means designing vehicles and services that accommodate a wider range of users, including those with disabilities. Hyundai’s commitment to this area is evident in its ongoing development of advanced driver-assistance systems and user-friendly interfaces.

Hyundai is actively investing in technologies that enhance mobility for all individuals. For instance, the company has been exploring autonomous driving features and adaptable interior designs to improve the user experience for people with varying physical needs. This proactive approach aligns with a growing global emphasis on universal design principles in product development.

- Hyundai's focus on accessibility includes developing vehicles with features like wider door openings and customizable seating arrangements.

- The company is researching and implementing advanced driver-assistance systems (ADAS) that can reduce the physical demands of driving.

- Societal pressure for inclusive design is a significant driver for innovation in the automotive sector, impacting future product roadmaps.

- By 2025, it's projected that a significant portion of new vehicle sales will incorporate some level of enhanced accessibility features, driven by consumer demand and regulatory trends.

Societal attitudes towards sustainability are a powerful driver for Hyundai's product development and marketing strategies. Consumers are increasingly prioritizing eco-friendly transportation options, influencing purchasing decisions and brand loyalty. Hyundai's investment in electric and hydrogen fuel cell technologies directly addresses this growing societal concern.

The global shift towards electrification is projected to accelerate, with projections indicating that by 2025, electric vehicles will constitute a significant portion of new car sales in key markets. This trend is supported by government incentives and a growing awareness of climate change, making sustainability a core consideration for consumers and a strategic imperative for Hyundai.

Hyundai's commitment to sustainability is reflected in its ambitious goals, such as aiming for 30% of its global sales to be zero-emission vehicles by 2025. This proactive approach not only aligns with societal expectations but also positions Hyundai as a leader in the transition to cleaner mobility solutions, enhancing its brand reputation and market appeal.

| Sociological Factor | Impact on Hyundai | Hyundai's Response/Data (2023-2025 Projections) |

|---|---|---|

| Environmental Consciousness | Increased demand for EVs and hybrids, preference for sustainable brands. | Hyundai Motor Group sold over 1.2 million electrified vehicles globally in 2023. Aims for 30% of global sales to be zero-emission vehicles by 2025. |

| Demographic Shifts (Urbanization, Aging Population) | Demand for efficient, smaller, and accessible urban mobility solutions. | Investment in Purpose-Built Vehicles (PBVs) and exploration of Urban Air Mobility (UAM). Global population projected to exceed 8 billion by 2025. |

| Consumer Trust & Safety Concerns | Prioritization of advanced safety features and reliable technology. | 78% of car buyers in 2024 surveys prioritize safety features. Hyundai SmartSense technology integration. |

| Workforce Needs & Skills Gap | Demand for EV/autonomous driving expertise, wage pressures for skilled labor. | Reports in 2024 highlight demand for EV technicians. Wage increases expected in 2024-2025 due to competition for talent. |

| Inclusivity & Accessibility | Growing expectation for vehicles accommodating diverse user needs. | Development of advanced driver-assistance systems (ADAS) and adaptable interior designs. Projections suggest enhanced accessibility features in a significant portion of new vehicle sales by 2025. |

Technological factors

Hyundai's strategic focus on battery technology is evident in its investments. For instance, the company is actively developing advanced battery chemistries, including more cost-effective Nickel Cobalt Manganese (NCM) batteries, aiming to improve electric vehicle (EV) range and reduce manufacturing costs.

The pursuit of next-generation power sources like solid-state batteries is also a key initiative, promising faster charging times and enhanced safety, crucial for competitive EV market positioning. Hyundai's commitment to this area is underscored by its investment in new battery research facilities, bolstering its capacity for innovation and development in this critical technological domain.

Furthermore, Hyundai is enhancing its Battery Management System (BMS), a vital component for optimizing battery performance, longevity, and safety. This technological advancement is essential for ensuring the reliability and efficiency of its growing EV lineup, aligning with the company's broader sustainability goals and market expansion strategies.

Hyundai is heavily investing in autonomous driving, moving from driver assistance to full self-driving capabilities. This focus is evident in their plan to introduce their first Software-Defined Vehicle (SDV) Pace Car by 2026, signaling a significant leap in vehicle intelligence and connectivity.

The company is also actively building its autonomous vehicle foundry business, aiming to commercialize this technology. This strategic move positions Hyundai to capitalize on the growing demand for self-driving solutions across various mobility sectors.

The automotive industry's shift towards Software-Defined Vehicles (SDVs) is revolutionizing how cars function, enabling features like over-the-air (OTA) updates, deeply personalized user experiences, and seamless connectivity. Hyundai is actively embracing this transformation, aiming to equip all its global models with wireless software updates by 2025, underscoring its commitment to software-centric development.

This strategic pivot allows Hyundai to continuously improve vehicle performance, introduce new functionalities post-purchase, and offer enhanced customer engagement through connected services. For instance, the ability to remotely update vehicle software means improvements in areas like battery management for electric vehicles or infotainment system enhancements can be delivered efficiently, keeping vehicles modern and competitive.

Hydrogen Fuel Cell Technology

Hyundai is a significant player in hydrogen fuel cell vehicle (FCEV) technology, actively developing advanced fuel cell systems for diverse mobility sectors. This includes passenger cars, heavy-duty trucks, and even emerging urban air mobility solutions.

The company’s commitment is evident in its continuous investment in R&D for next-generation fuel cell stacks, aiming to improve efficiency and reduce costs. For instance, Hyundai’s Nexo FCEV, launched in 2018, represents a key milestone in their hydrogen strategy, showcasing the viability of this technology for everyday use.

By 2024, the global hydrogen fuel cell market is projected to reach substantial growth, with FCEVs expected to capture a growing share. Hyundai’s strategic focus positions them to capitalize on this expansion.

- Technological Advancement: Hyundai is pushing the boundaries of fuel cell efficiency and durability for both passenger and commercial applications.

- Market Leadership: The company aims to solidify its position as a leader in the burgeoning FCEV market, anticipating increased demand.

- Diversification: Hyundai is exploring hydrogen fuel cell applications beyond traditional vehicles, targeting new mobility segments.

- Investment: Significant R&D funding is allocated to enhance fuel cell performance and cost-competitiveness, crucial for wider adoption.

Smart Mobility Solutions and Robotics

Hyundai Motor is heavily investing in advanced mobility solutions, including Urban Air Mobility (UAM), Purpose-Built Vehicles (PBVs), and robotics, aiming to redefine transportation. This strategic focus is evident in their commitment to creating integrated mobility ecosystems.

The company's vision extends to providing comprehensive mobility experiences, moving beyond traditional car manufacturing. For instance, Hyundai's investment in Supernal, its UAM division, underscores its dedication to this future-forward approach.

- Hyundai's Supernal aims to launch commercial UAM operations by 2028.

- The global UAM market is projected to reach over $1 trillion by 2040, according to some industry analyses.

- Hyundai is also developing PBVs, like the Concept MPV, designed for flexible urban logistics and passenger transport.

Hyundai is aggressively pursuing advancements in battery technology, focusing on next-generation chemistries like solid-state batteries to boost EV range and charging speeds. The company is also refining its Battery Management Systems (BMS) to optimize performance and longevity, critical for its expanding electric vehicle portfolio.

The company's commitment to autonomous driving is highlighted by its plan for the first Software-Defined Vehicle (SDV) Pace Car by 2026, aiming for full self-driving capabilities and commercializing its autonomous vehicle foundry business.

Hyundai is investing heavily in hydrogen fuel cell technology, developing advanced systems for various mobility sectors and aiming for market leadership in FCEVs, with projections indicating significant market growth by 2024.

Hyundai is also pioneering advanced mobility solutions like Urban Air Mobility (UAM) through its Supernal division, targeting commercial operations by 2028, and developing Purpose-Built Vehicles (PBVs) for flexible urban logistics.

Legal factors

Global and regional vehicle safety regulations are becoming increasingly stringent, compelling automakers like Hyundai to constantly innovate in vehicle design and incorporate advanced safety features. These regulations cover everything from crashworthiness to the performance of driver-assistance systems, demanding significant investment in research and development.

Hyundai actively addresses these requirements by integrating its Hyundai SmartSense suite of advanced driver-assistance systems (ADAS). Features such as Forward Collision-Avoidance Assist, Lane Keeping Assist, and Blind-Spot Collision-Avoidance Assist are designed not only to meet but often surpass regulatory mandates, enhancing overall vehicle safety and consumer confidence. For instance, in 2023, Hyundai’s commitment to safety was recognized with multiple IIHS Top Safety Pick+ awards, underscoring their proactive approach to compliance and exceeding standards.

Evolving emissions standards, like the anticipated EURO 7 regulations in Europe, demand substantial investment from automakers such as Hyundai in developing cleaner technologies and refining production methods. These stricter rules, expected to be fully implemented by 2025, will require significant capital expenditure to meet new limits on pollutants like nitrogen oxides and particulate matter.

Hyundai has publicly committed to substantial investments in reducing its greenhouse gas emissions, aiming for carbon neutrality. This commitment is reflected in their strategy to increase the proportion of electrified vehicles in their sales mix, with a target of over 30% of global sales to be eco-friendly vehicles by 2025.

Hyundai's operations are significantly shaped by evolving data privacy and cybersecurity regulations. With connected car technology generating vast amounts of customer data, laws like the GDPR in Europe and similar frameworks globally dictate how Hyundai must handle personal information, impacting everything from data collection to storage and usage. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Maintaining robust cybersecurity measures is paramount to protect against data breaches and ensure consumer trust. The increasing sophistication of cyber threats means Hyundai must continuously invest in advanced security protocols for its connected vehicle platforms and digital services. A 2024 report by Cybersecurity Ventures predicted that cybercrime costs would reach $10.5 trillion annually by 2025, highlighting the critical need for proactive defense in the automotive sector.

Intellectual Property Rights and Patents

Hyundai's commitment to innovation, particularly in areas like electric vehicle battery technology and autonomous driving, underscores the critical importance of safeguarding its intellectual property. Protecting these advancements through patents and robust IP strategies is essential for maintaining a competitive advantage in the rapidly evolving automotive landscape. For instance, in 2023, Hyundai Motor Group announced significant investments in battery development, aiming to secure proprietary technologies that will differentiate its future offerings.

The company's substantial research and development expenditure, which reached approximately 3.2 trillion Korean Won (around $2.4 billion USD) in 2023, directly fuels the need for strong patent portfolios. These patents not only shield Hyundai's proprietary technologies from competitors but also provide a basis for licensing and collaboration opportunities. By securing patents for novel battery chemistries, advanced driver-assistance systems (ADAS) algorithms, and unique manufacturing processes, Hyundai reinforces its market position and its ability to command premium pricing for its technological innovations.

- Patent Protection: Hyundai actively pursues patents for its innovations in areas such as solid-state batteries and AI-driven driving systems.

- R&D Investment: The company's 2023 R&D spending highlights its dedication to developing and protecting cutting-edge automotive technologies.

- Competitive Edge: Robust IP rights are crucial for maintaining Hyundai's technological leadership and market differentiation.

- Strategic Licensing: Patents can enable strategic partnerships and revenue streams through technology licensing agreements.

Consumer Protection and Warranty Laws

Consumer protection laws and warranty regulations are critical for Hyundai, as they dictate how the company must handle customer complaints, product defects, and recall processes. These laws, which differ significantly across markets like the US (e.g., Magnuson-Moss Warranty Act) and the EU (e.g., Consumer Rights Directive), directly influence Hyundai's liabilities and the scope of its customer service obligations. For instance, stringent consumer protection measures can increase the cost of doing business due to stricter disclosure requirements and longer warranty periods.

Warranty provisions, in particular, can have a notable impact on Hyundai's operating profit. The company must set aside reserves for potential warranty claims, and unexpected spikes in these claims due to product issues can directly reduce profitability. In 2023, for example, the automotive industry globally saw increased warranty costs, partly driven by the complexity of new technologies and supply chain issues affecting parts quality. Hyundai's specific warranty expenses are detailed in its financial reports, often impacting its cost of goods sold and operating margins.

- Regional Variance: Consumer protection and warranty laws differ significantly by country, affecting Hyundai's compliance costs and customer service standards.

- Liability Impact: Stricter regulations can increase Hyundai's potential liabilities related to product defects and recalls.

- Profitability Factor: Higher warranty provisions and claims can directly reduce Hyundai's operating profit.

- Industry Trend: The automotive sector in 2023 experienced rising warranty costs, a trend Hyundai also navigated.

Hyundai's legal landscape is complex, shaped by global and regional regulations. Vehicle safety standards, like those from the IIHS, are increasingly stringent, pushing Hyundai to invest heavily in advanced driver-assistance systems. For example, Hyundai received multiple IIHS Top Safety Pick+ awards in 2023, demonstrating their proactive approach to safety compliance.

Emissions standards are also a major legal factor. Anticipated EURO 7 regulations, expected to be fully implemented by 2025, will require substantial capital for cleaner technologies. Hyundai's commitment to carbon neutrality includes a target of over 30% of global sales being eco-friendly vehicles by 2025.

Data privacy and cybersecurity laws, such as GDPR, significantly impact how Hyundai handles customer data from connected cars. Non-compliance can lead to severe penalties, with GDPR fines potentially reaching up to 4% of global annual turnover. The company must invest in robust cybersecurity to protect against breaches, a critical concern given that cybercrime costs were projected to reach $10.5 trillion annually by 2025.

Intellectual property law is crucial for protecting Hyundai's innovations in areas like EV batteries and autonomous driving. The company's R&D spending, around 3.2 trillion Korean Won ($2.4 billion USD) in 2023, fuels the need for strong patent portfolios to maintain a competitive edge.

| Legal Factor | Impact on Hyundai | Key Regulations/Examples | Hyundai's Response/Data |

| Vehicle Safety | Increased R&D investment in ADAS | IIHS Standards | Multiple IIHS Top Safety Pick+ awards in 2023 |

| Emissions Standards | Capital expenditure on cleaner tech | EURO 7 (by 2025) | Target: >30% eco-friendly sales by 2025 |

| Data Privacy & Cybersecurity | Investment in data security protocols | GDPR | Projected global cybercrime costs: $10.5 trillion by 2025 |

| Intellectual Property | Protection of proprietary technologies | Patent Law | 2023 R&D spending: ~3.2 trillion KRW (~$2.4 billion USD) |

Environmental factors

Hyundai Motor Company is actively pursuing carbon neutrality by 2045, a significant undertaking that encompasses its entire value chain, from manufacturing to end-of-life vehicle management. This commitment translates into substantial investments in reducing greenhouse gas emissions throughout the product lifecycle. For instance, in 2023, Hyundai announced plans to invest approximately $1.5 billion in building a new battery manufacturing plant in Georgia, USA, a key step in electrifying its vehicle lineup and thus lowering operational emissions.

Hyundai Motor is actively embracing circular economy principles. In 2023, the company reported a 15% increase in the use of recycled materials across its vehicle production lines, significantly reducing reliance on virgin resources.

The company's commitment extends to water conservation, with its manufacturing facilities achieving a 20% reduction in water consumption per vehicle produced compared to 2022 levels through enhanced recycling processes.

Furthermore, Hyundai's efforts in biodiversity protection are evident in its reforestation initiatives surrounding key production sites, contributing to ecological balance and resource regeneration.

Hyundai is significantly increasing its use of renewable energy across its manufacturing operations. For instance, its plant in Nošovice, Czech Republic, has achieved the RE100 initiative, committing to 100% renewable electricity. This move is driven by both environmental commitments and the increasing availability and cost-competitiveness of renewable sources.

The company is also making direct investments in renewable energy generation, such as solar power facilities, to supplement its energy needs. In 2023, global renewable energy capacity additions reached a record high of 510 gigawatts, a 50% increase from 2022, indicating a favorable external environment for Hyundai's strategy.

Waste Management and Recycling Initiatives

Hyundai Motor is increasingly focused on sustainable waste management, particularly the recycling and reuse of electric vehicle batteries and other vehicle components. This aligns with global environmental priorities and regulatory pressures to reduce landfill waste and promote a circular economy. For instance, in 2023, South Korea, Hyundai's home market, continued its significant investments in building a robust ecosystem for waste battery management and recycling, aiming to capture the valuable materials within them.

South Korea's commitment to battery recycling is crucial for automakers like Hyundai. The nation's strategy involves developing advanced sorting and processing technologies. By 2025, the government aims to have established multiple large-scale battery recycling facilities, capable of processing thousands of tons of batteries annually, thereby supporting Hyundai's efforts to incorporate recycled materials into new vehicle production.

- Battery Recycling Targets: South Korea has set ambitious targets for battery recycling, with projections indicating that by 2026, over 80% of end-of-life EV batteries will be collected for reuse or recycling.

- Economic Incentives: The South Korean government is providing financial incentives and tax breaks for companies investing in battery recycling infrastructure and technologies, encouraging players like Hyundai to expand their sustainable practices.

- Component Reuse: Beyond batteries, Hyundai is exploring initiatives for the reuse and recycling of other vehicle parts, such as plastics and metals, contributing to a more comprehensive approach to automotive sustainability.

Water Management and Biodiversity Protection

Hyundai Motor is actively engaged in improving its water management practices, with a focus on increasing water recycling rates across its operations. This initiative is crucial for reducing reliance on fresh water sources and minimizing the environmental footprint of its manufacturing processes. For instance, the company reported significant progress in its water recycling efforts, aiming to achieve ambitious targets by 2025.

Beyond water, Hyundai places a strong emphasis on biodiversity protection. This involves implementing strategies to conserve natural habitats and promote ecological balance around its production facilities. These efforts are integrated into its broader environmental management system, reflecting a commitment to sustainable growth.

- Water Recycling: Hyundai aims to boost water recycling efficiency, targeting a significant increase in reuse by 2025 across its global plants.

- Biodiversity Initiatives: The company is investing in projects designed to protect and enhance local ecosystems near its manufacturing sites.

- Environmental Management: These actions are part of a comprehensive strategy to minimize environmental impact and promote sustainability in automotive production.

Hyundai Motor is prioritizing carbon neutrality by 2045, investing heavily in emission reduction across its value chain. In 2023, the company announced a $1.5 billion investment in a Georgia, USA battery plant, a crucial step for its electric vehicle strategy and reduced operational emissions.

The company is also focusing on circular economy principles, reporting a 15% increase in recycled material usage in 2023. Furthermore, Hyundai aims to enhance water recycling efficiency across its global plants by 2025 and is implementing biodiversity initiatives near its manufacturing sites.

Hyundai's commitment to renewable energy is strong, with its Czech plant achieving 100% renewable electricity use. Global renewable energy capacity saw a record 510 GW addition in 2023, a 50% increase from 2022, indicating a supportive external environment for Hyundai's energy strategy.

Sustainable waste management, particularly EV battery recycling, is a key focus. South Korea, Hyundai's home market, is significantly investing in battery recycling infrastructure, aiming for multiple large-scale facilities by 2025 to support Hyundai's use of recycled materials. By 2026, South Korea targets over 80% of end-of-life EV batteries for collection and recycling.

| Environmental Factor | Hyundai's Action/Commitment | Key Data/Target |

| Carbon Neutrality | Pursuing carbon neutrality across the value chain | Target: 2045 |

| Electrification Investment | Building battery manufacturing plants | 2023 Investment: $1.5 billion in Georgia, USA |

| Circular Economy | Increasing use of recycled materials | 2023: 15% increase in recycled material usage |

| Renewable Energy | Utilizing renewable electricity in manufacturing | Czech plant: 100% renewable electricity (RE100) |

| Battery Recycling | Focus on EV battery recycling and reuse | South Korea target: >80% EV battery collection by 2026 |

PESTLE Analysis Data Sources

Our Hyundai Motor PESTLE Analysis is grounded in a comprehensive review of data from leading automotive industry research firms, global economic indicators, and government regulatory bodies. We incorporate insights from international trade agreements, technological innovation reports, and environmental policy updates to ensure a thorough understanding of the macro-environment.