Hydrofarm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydrofarm Bundle

Unlock the unseen forces shaping Hydrofarm's market with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges. This expertly crafted report provides the actionable intelligence you need to anticipate trends and make informed strategic decisions. Download the full version now and gain a significant competitive advantage.

Political factors

Government initiatives and subsidies are a major tailwind for controlled environment agriculture (CEA), directly benefiting companies like Hydrofarm. For instance, the USDA's Urban Agriculture and Innovative Production (UAIP) competitive grant program, which saw a significant funding increase in 2024, directly supports projects that utilize hydroponic and other CEA technologies. This governmental backing translates into increased demand for Hydrofarm's products as more operations become viable.

Policies promoting local food production and sustainable farming practices further bolster the market for hydroponic equipment. Many states and municipalities are enacting legislation to incentivize urban farming, which often relies on hydroponic systems. In 2024, several major cities announced new zoning regulations and tax breaks specifically for urban agriculture, creating a more favorable environment for Hydrofarm's customer base and driving sales of their cultivation supplies.

The expanding landscape of cannabis legalization across North America, encompassing both medical and recreational use, is a significant driver for Hydrofarm. As of early 2024, over 24 US states and Washington D.C. have legalized recreational cannabis, with many more allowing medical use, creating a burgeoning market for cultivation supplies. This trend directly translates to increased demand for Hydrofarm's hydroponic systems and grow lights as commercial operations scale up and home growers enter the market.

However, the patchwork of federal versus state laws, particularly in the United States where cannabis remains illegal federally, presents a persistent challenge. This regulatory uncertainty can create logistical hurdles and limit the ability of larger, publicly traded companies to fully capitalize on the market, though it also provides opportunities for specialized suppliers like Hydrofarm. The pace of legalization in key Canadian provinces and emerging US markets will continue to shape Hydrofarm's growth trajectory.

Changes in international trade policies, like new tariffs on agricultural equipment components, directly impact Hydrofarm's cost of goods sold. For instance, a hypothetical 10% tariff on imported LED lighting systems, a key component for indoor farming, could increase Hydrofarm's production costs by an estimated 2-3% in 2024, forcing price adjustments or margin compression.

Hydrofarm's reliance on global sourcing for specialized sensors and nutrient delivery systems makes it vulnerable to trade disputes. A breakdown in trade relations with a major supplier country could lead to significant disruptions in product availability and necessitate costly shifts to alternative, potentially less efficient, suppliers.

The stability of trade agreements, such as the USMCA, is critical for Hydrofarm's predictable business operations and market access. Favorable trade terms ensure smoother cross-border movement of finished goods and raw materials, contributing to consistent supply chains and competitive pricing for their hydroponic systems.

Agricultural Regulations and Standards

Evolving agricultural regulations significantly shape Hydrofarm's operational landscape. For instance, the U.S. Environmental Protection Agency (EPA) continually reviews and updates pesticide regulations, impacting the types of crop protection products available to growers. In 2024, ongoing discussions around stricter limits on certain agricultural chemicals could necessitate Hydrofarm adjusting its product portfolio or investing in compliance measures.

Compliance with food safety standards, such as those enforced by the Food and Drug Administration (FDA), is paramount for Hydrofarm's distribution and manufacturing processes. The Global Food Safety Initiative (GFSI) benchmarks, increasingly adopted by retailers, also drive higher standards. Failure to meet these can restrict market access, as seen in past instances where non-compliance led to product recalls, costing companies millions.

New organic certification requirements, driven by consumer demand for sustainable produce, present both challenges and opportunities. Hydrofarm must ensure its supply chain and manufacturing practices align with these evolving standards. For example, the USDA Organic regulations are subject to interpretation and updates, requiring continuous monitoring to maintain certification for relevant product lines.

- Regulatory Shifts: Anticipate changes in pesticide use and food safety standards, as exemplified by the EPA's ongoing reviews of agricultural chemicals.

- Compliance Costs: Factor in potential investments needed for product reformulation or process adjustments to meet new regulations, such as stricter organic certification criteria.

- Market Access: Recognize that adherence to standards like GFSI benchmarks is crucial for maintaining relationships with major retailers and ensuring broad market penetration.

- Competitive Edge: Leverage high compliance and robust safety protocols as a differentiator, potentially attracting environmentally conscious consumers and partners.

Political Stability and Geopolitical Risks

Political stability in major markets like the United States and Canada directly impacts consumer and business confidence, influencing spending and investment in sectors like indoor farming. For example, the U.S. experienced a GDP growth of 2.5% in 2023, indicating a generally stable economic environment that supports market expansion, though localized policy shifts can still create uncertainty.

Geopolitical tensions, such as ongoing trade disputes or regional conflicts, pose a significant risk to Hydrofarm's operations by potentially disrupting global supply chains. This could lead to increased costs for essential inputs like specialized lighting or nutrient solutions, and affect the timely delivery of finished hydroponic produce to consumers.

A predictable political landscape is crucial for long-term investment in capital-intensive industries like controlled environment agriculture. Fluctuations in government regulations, subsidies for sustainable practices, or import/export policies can create volatility, making strategic planning more challenging.

- United States: Political stability supports consumer spending, a key driver for produce demand.

- Canada: Consistent policies on agriculture and technology adoption are beneficial for hydroponic growth.

- Supply Chain Disruptions: Geopolitical risks can escalate logistics costs, impacting Hydrofarm's profitability.

- Regulatory Environment: Changes in environmental or food safety regulations require constant adaptation.

Government support for controlled environment agriculture (CEA) continues to be a significant positive factor for Hydrofarm. Initiatives like the USDA's Urban Agriculture and Innovative Production (UAIP) grant program, which saw increased funding in 2024, directly benefit companies supplying hydroponic technologies. This governmental backing translates into increased demand for Hydrofarm's products as more operations become financially viable.

Policies promoting local food production and sustainable farming practices further bolster the market for hydroponic equipment. Many municipalities are enacting legislation to incentivize urban farming, which often relies on hydroponic systems. In 2024, several major cities announced new zoning regulations and tax breaks specifically for urban agriculture, creating a more favorable environment for Hydrofarm's customer base and driving sales of their cultivation supplies.

The expanding landscape of cannabis legalization across North America is a significant driver for Hydrofarm. As of early 2024, over 24 US states and Washington D.C. have legalized recreational cannabis, with many more allowing medical use, creating a burgeoning market for cultivation supplies. This trend directly translates to increased demand for Hydrofarm's hydroponic systems and grow lights as commercial operations scale up.

Political stability in key markets directly impacts consumer and business confidence, influencing spending in sectors like indoor farming. For example, the U.S. experienced a GDP growth of 2.5% in 2023, indicating a generally stable economic environment that supports market expansion. Geopolitical tensions, however, pose a risk by potentially disrupting global supply chains and increasing costs for essential inputs.

What is included in the product

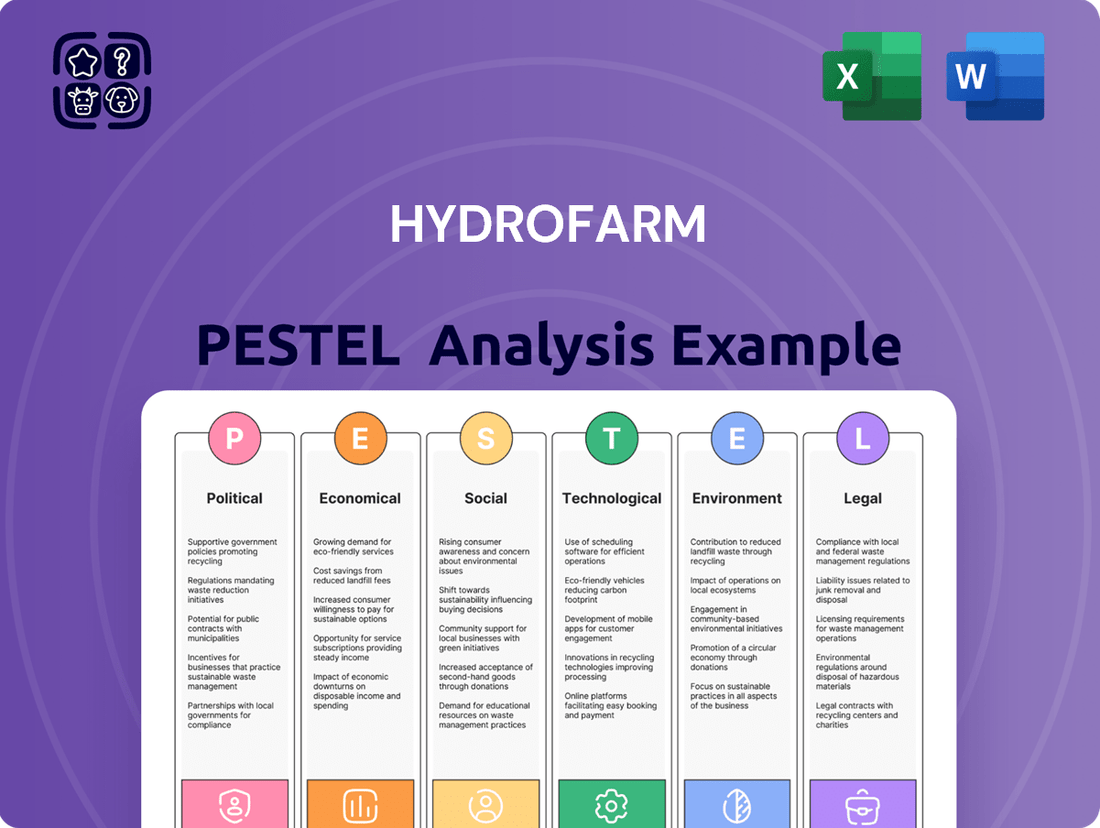

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hydrofarm, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify emerging opportunities and threats within the hydroponics industry.

Hydrofarm's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors into actionable insights.

Economic factors

Rising inflation presents a significant challenge for Hydrofarm. For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% year-over-year in April 2024, impacting the cost of essential inputs like fertilizers, energy for lighting and climate control, and packaging materials. This upward pressure on operational expenses could squeeze Hydrofarm's profit margins if it cannot effectively transfer these increased costs to its customers.

Furthermore, the prevailing interest rate environment, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range as of May 2024, adds another layer of complexity. Higher borrowing costs could make it more expensive for Hydrofarm to finance expansion projects or manage its working capital. Simultaneously, elevated interest rates can reduce discretionary spending by consumers and potentially slow down commercial investment in new controlled environment agriculture (CEA) facilities, impacting demand.

Consumer disposable income is a significant driver for Hydrofarm, as it directly impacts the demand for home gardening and personal cultivation equipment. When households have more discretionary funds, they are more likely to invest in hobbies like hydroponics. For instance, in 2024, the U.S. personal saving rate saw fluctuations, but overall, a robust job market and wage growth in certain sectors supported consumer spending on non-essential items, benefiting companies like Hydrofarm.

Economic downturns or periods of reduced disposable income can lead consumers to cut back on discretionary spending, which includes hobbyist hydroponics supplies. This was evident in some consumer spending patterns observed during periods of higher inflation in late 2023 and early 2024, where consumers prioritized essentials. A healthy economy, characterized by stable employment and rising real wages, generally translates to stronger consumer sales for Hydrofarm's product lines.

Hydroponic farming, a cornerstone of controlled environment agriculture, demands substantial energy for essential functions like lighting and climate regulation. This inherent energy intensity makes the sector highly susceptible to shifts in energy prices.

For Hydrofarm's commercial clientele, volatile electricity or natural gas costs directly influence their operational expenses, potentially dampening demand for the very systems Hydrofarm provides if those costs become prohibitive. For instance, in early 2024, wholesale electricity prices in many regions saw increases compared to the previous year, driven by factors like increased demand and natural gas price volatility.

Conversely, periods of stable or declining energy costs offer a more favorable economic climate for hydroponic operations, supporting growth and investment in energy-efficient technologies that Hydrofarm champions.

Supply Chain Costs and Disruptions

The cost and reliability of Hydrofarm's supply chain, encompassing everything from manufacturing components to getting products to customers, are crucial economic considerations. For instance, the global shipping container spot rate from Asia to the US West Coast, which saw significant spikes in 2021 and 2022, remained elevated in early 2024, impacting the landed cost of goods.

Disruptions stemming from geopolitical events, widespread labor shortages, or persistent transportation bottlenecks can directly inflate operational expenses and create stockouts, thereby hindering sales and diminishing customer satisfaction. The semiconductor shortage, which began impacting various industries in 2020, continued to affect the availability and cost of electronic components used in some horticultural equipment through 2023 and into 2024.

Effective management of these supply chain complexities is paramount for Hydrofarm to navigate these economic headwinds and maintain consistent product availability and competitive pricing.

- Component Costs: The average price of key raw materials like aluminum, a primary component in many hydroponic systems, experienced volatility in 2023 and early 2024, influenced by global industrial demand and energy prices.

- Logistics Expenses: Freight rates for trucking within North America saw a moderate increase of approximately 3-5% in late 2023 compared to the previous year, reflecting ongoing driver shortages and fuel cost fluctuations.

- Inventory Management: Companies holding excess inventory to buffer against disruptions faced higher carrying costs, estimated to be around 20-30% of inventory value annually, a factor Hydrofarm must balance against the risk of stockouts.

Market Competition and Pricing Pressure

The hydroponics and controlled environment agriculture (CEA) sector is becoming increasingly crowded, leading to significant pricing pressure for companies like Hydrofarm. As more players enter the market, competition intensifies, potentially forcing price reductions or limiting Hydrofarm's ability to pass on rising operational costs. This dynamic directly impacts revenue streams and profit margins.

For instance, the global CEA market, valued at approximately $43.4 billion in 2023, is projected to grow substantially, indicating a fertile ground for new entrants and increased competition. This expansion means Hydrofarm faces not only established competitors but also a growing number of innovative startups vying for market share.

To navigate this, Hydrofarm must focus on differentiating its product offerings and services. This could involve exclusive product lines, superior customer support, or innovative technological solutions.

- Intensifying Competition: The CEA market's rapid growth attracts new entrants, increasing competitive pressure.

- Pricing Pressure: Competition limits Hydrofarm's ability to raise prices, impacting profitability.

- Cost Management: Rising input costs, coupled with pricing pressure, necessitate efficient operations.

- Differentiation Strategy: Unique products and services are key to maintaining market position and pricing power.

The economic landscape presents both opportunities and challenges for Hydrofarm. Persistent inflation, with the U.S. CPI at 3.4% year-over-year in April 2024, directly increases operational costs for inputs like energy and materials. Coupled with interest rates holding steady in the 5.25%-5.50% range as of May 2024, borrowing and consumer spending are impacted.

Consumer disposable income remains a key economic driver, with a robust job market in 2024 generally supporting spending on non-essential items like hydroponic hobbyist supplies. However, economic downturns can shift consumer priorities back to essentials, affecting sales. Energy price volatility, evident in early 2024 wholesale electricity price increases, directly influences the operational costs for Hydrofarm's commercial clients, potentially impacting their demand for CEA systems.

Supply chain costs, such as elevated shipping rates from Asia to the U.S. West Coast in early 2024 and the continued impact of component shortages on electronic parts, inflate landed costs and risk stockouts. The competitive landscape is also intensifying, with the global CEA market projected for substantial growth, leading to pricing pressures that necessitate differentiation and efficient cost management for Hydrofarm.

| Economic Factor | 2024 Data Point | Impact on Hydrofarm |

|---|---|---|

| Inflation (U.S. CPI YoY) | 3.4% (April 2024) | Increased input costs (energy, materials), potential margin squeeze. |

| Federal Funds Rate | 5.25%-5.50% (May 2024) | Higher borrowing costs, potential dampening of consumer and commercial investment. |

| Consumer Spending | Supported by robust job market, but sensitive to economic shifts. | Directly influences demand for hobbyist hydroponics products. |

| Energy Prices (Wholesale Electricity) | Increased in early 2024 vs. prior year. | Impacts operational costs for commercial CEA clients, affecting demand. |

| Supply Chain Costs (Shipping Rates) | Elevated early 2024 (Asia-US West Coast). | Increases landed costs of goods, potential for stockouts. |

| Competitive Landscape (CEA Market) | Projected substantial growth, increasing competition. | Leads to pricing pressure, requires differentiation and cost efficiency. |

Full Version Awaits

Hydrofarm PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hydrofarm PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the hydroponics industry.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides actionable insights and strategic recommendations for businesses operating within or looking to enter the hydroponic market.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain a deep understanding of the external forces shaping Hydrofarm's competitive landscape and future growth opportunities.

Sociological factors

A growing societal interest in self-sufficiency and hobby gardening is a significant driver for Hydrofarm. This trend is amplified by the increasing legal acceptance of home cultivation, especially for cannabis in various jurisdictions. For instance, in the US, states that have legalized cannabis for recreational use have seen a surge in home growing, directly impacting the demand for indoor gardening equipment.

The growing societal emphasis on health, wellness, and the consumption of organic foods directly benefits hydroponic systems like those offered by Hydrofarm. Consumers are more conscious than ever about where their food comes from and its quality, driving demand for home-grown, pesticide-free produce.

This heightened awareness fuels interest in controlled growing environments, making hydroponics an attractive solution for individuals seeking fresh fruits, vegetables, and herbs. For instance, the global indoor farming market, which includes hydroponics, was projected to reach approximately $40 billion by 2026, demonstrating significant consumer adoption of these methods.

As urban populations continue to swell, the shrinking availability of outdoor space for traditional gardening is a significant trend. This sociological shift directly fuels a growing interest in alternative growing methods, such as indoor and vertical farming, which are perfectly suited for urban environments.

Hydroponic systems, like those offered by Hydrofarm, directly address this need by providing compact and efficient solutions for cultivating plants in limited spaces. This allows city dwellers to grow their own produce even in small apartments or areas with minimal outdoor access, highlighting the critical need for efficient space utilization in modern living.

Globally, over 57% of the world's population lived in urban areas in 2023, a figure projected to reach 60% by 2030. This increasing urbanization directly translates to a larger potential customer base for space-saving agricultural technologies like hydroponics.

Environmental Consciousness and Sustainability

Growing public concern over climate change and resource depletion is significantly shaping consumer preferences, pushing demand towards more sustainable food production methods. This heightened environmental consciousness directly benefits hydroponics, which uses up to 90% less water than conventional soil-based farming, a critical advantage in water-scarce regions. For instance, a 2024 report indicated that 78% of consumers are actively seeking out products with verifiable sustainability claims.

Hydrofarm can leverage this trend by emphasizing its water-saving technologies and reduced carbon footprint in its marketing. By clearly communicating these eco-friendly attributes, Hydrofarm can attract and retain environmentally aware customers, a segment that is increasingly willing to pay a premium for sustainable options. This aligns with a broader market shift where sustainability is moving from a niche concern to a mainstream purchasing driver.

Key aspects for Hydrofarm to highlight include:

- Water Efficiency: Quantifiable data on water savings compared to traditional agriculture.

- Reduced Land Use: The ability to grow more food in less space, minimizing habitat disruption.

- Local Sourcing: Potential for reduced transportation emissions by locating farms closer to urban centers.

- Pesticide Reduction: Controlled environments often require fewer or no pesticides, appealing to health and eco-conscious buyers.

Shifting Perceptions of Cannabis

Societal views on cannabis have dramatically shifted, moving it from a forbidden substance to a recognized plant with both medicinal and recreational applications. This evolution is a key sociological factor impacting Hydrofarm. As the stigma surrounding cannabis use and cultivation diminishes, a wider array of individuals and businesses are becoming more open to purchasing equipment for growing operations.

This growing acceptance directly translates into an expanded potential customer base for Hydrofarm. For instance, a significant portion of the U.S. population now supports cannabis legalization, with polls indicating over 60% approval for recreational use. This cultural transformation is a powerful underlying driver for a segment of Hydrofarm's market, as more people feel comfortable exploring cultivation.

The increasing acceptance of cannabis for medical purposes also plays a crucial role. As more states legalize medical cannabis, the demand for high-quality cultivation equipment rises. This trend is evidenced by the growth in the medical cannabis market, which was projected to reach over $50 billion globally by 2025, creating a substantial opportunity for companies like Hydrofarm that supply the necessary tools.

- Broadened Customer Base: Decreased stigma opens doors for more individuals and businesses to invest in cannabis cultivation.

- Increased Acceptance: Public opinion polls consistently show growing support for both medical and recreational cannabis use.

- Medical Market Growth: Legalization of medical cannabis in numerous regions fuels demand for specialized growing equipment.

- Cultural Shift Impact: The overall societal embrace of cannabis is a fundamental driver for Hydrofarm's market expansion.

Societal trends toward healthier lifestyles and organic food consumption directly benefit hydroponics, as consumers seek pesticide-free, locally grown produce. This is evidenced by the increasing demand for home gardening solutions, with the global indoor farming market expected to reach approximately $40 billion by 2026.

Urbanization is another key factor; as more people live in cities, the demand for space-saving growing methods like hydroponics rises. With over 57% of the global population residing in urban areas in 2023, this trend directly expands Hydrofarm's potential customer base.

Growing environmental awareness, particularly concerning climate change and water scarcity, also favors hydroponics due to its significantly reduced water usage compared to traditional farming. A 2024 report found that 78% of consumers actively seek sustainable products, making Hydrofarm's eco-friendly technology a strong selling point.

The evolving societal view on cannabis, from stigma to acceptance for medical and recreational use, is a significant driver for Hydrofarm. This shift is supported by over 60% U.S. public approval for recreational cannabis, expanding the market for cultivation equipment.

| Sociological Factor | Impact on Hydrofarm | Supporting Data/Trend |

| Health & Organic Food Demand | Increased demand for home-grown, pesticide-free produce. | Global indoor farming market projected at $40 billion by 2026. |

| Urbanization | Growing need for space-efficient growing solutions. | 57% of global population lived in urban areas in 2023. |

| Environmental Consciousness | Preference for sustainable, water-saving agriculture. | 78% of consumers seek sustainable products (2024 report). |

| Cannabis Acceptance | Expanded market for cultivation equipment. | Over 60% U.S. public approval for recreational cannabis. |

Technological factors

Ongoing innovations in LED grow light technology are significantly impacting Hydrofarm's product offerings. These advancements are delivering higher energy efficiency, tailored light spectrums for specific plant needs, and extended operational lifespans, directly benefiting Hydrofarm's customer base seeking optimized cultivation. For instance, by 2024, the global horticultural lighting market, heavily influenced by LED adoption, was projected to reach over $3.5 billion, with LEDs dominating due to their superior performance and cost-effectiveness over time. This trend underscores the critical need for Hydrofarm to integrate these cutting-edge solutions to reduce energy consumption for growers and enhance plant yields, thereby securing a competitive edge.

Technological advancements in climate control and automation are revolutionizing controlled environment agriculture. Systems like advanced HVAC, CO2 enrichment, and automated irrigation are becoming more precise and efficient, leading to better crop management. For instance, smart farming technologies are projected to grow significantly, with the global smart agriculture market expected to reach an estimated USD 32.01 billion by 2026, according to MarketsandMarkets, showcasing the increasing adoption of such solutions.

Hydrofarm's offering of integrated, smart climate control solutions directly addresses this trend. These systems empower growers to fine-tune environmental conditions, which in turn reduces manual labor needs and boosts crop yields. The demand for sophisticated, integrated solutions is clearly on the rise, as growers seek to maximize productivity and minimize resource waste in their operations.

Data analytics and AI are revolutionizing hydroponics, enabling real-time monitoring of crucial variables like nutrient levels and pH. This allows for predictive analysis, anticipating potential issues before they impact crop yield. Hydrofarm can capitalize on this by offering AI-powered insights and automated adjustments to their systems, directly enhancing grower efficiency and profitability.

The adoption of these technologies is accelerating. For instance, the global AI in agriculture market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, demonstrating a significant growth trajectory. Hydrofarm's ability to integrate these advanced capabilities into its offerings will be a key differentiator in this expanding market.

Nutrient Delivery and Media Innovations

Advancements in nutrient delivery and growing media are transforming hydroponics. Research into sophisticated nutrient formulations and alternatives to traditional media like rockwool, such as biochar or recycled materials, is ongoing. Hydrofarm needs to monitor these developments to ensure its product offerings remain competitive and meet evolving customer demands for both performance and sustainability.

The hydroponics market is projected to reach $33.1 billion by 2028, growing at a compound annual growth rate of 11.3% from 2023 to 2028. This growth is fueled by innovations in nutrient solutions and growing substrates that enhance crop yields and resource efficiency.

- Nutrient Formulation: Development of tailored nutrient mixes for specific crops, optimizing micronutrient delivery for improved plant health and faster growth cycles.

- Growing Media Evolution: Increased adoption of sustainable and biodegradable media like coco coir, peat moss alternatives, and even aeroponics systems that minimize media use altogether.

- Delivery Systems: Innovations in precision fertigation, including sensor-based systems that adjust nutrient delivery in real-time, leading to better water and nutrient utilization.

Vertical Farming Technologies

The evolution of advanced vertical farming technologies, such as multi-tier growing systems and innovative shelving, represents a significant technological shift. These advancements are crucial for optimizing crop production in confined urban settings.

Hydrofarm's product portfolio directly supports these vertical farms, allowing cultivators to enhance space efficiency and boost crop yields. This is particularly vital for operations in densely populated areas or locations with restricted physical footprints.

The market for vertical farming solutions is experiencing robust growth. For instance, the global vertical farming market was valued at approximately $5.5 billion in 2023 and is projected to reach over $20 billion by 2030, exhibiting a compound annual growth rate of around 20%.

- Technological Advancement: Sophisticated multi-tier growing systems and specialized shelving are central to modern vertical farming.

- Hydrofarm's Role: The company's product range facilitates maximum space utilization and yield for vertical farms.

- Market Growth: The vertical farming sector is expanding rapidly, with significant investment opportunities.

- Investment Strategy: Hydrofarm's focus on these cutting-edge solutions positions it for substantial future growth in this burgeoning market segment.

Technological advancements in LED lighting, climate control, and automation are reshaping the hydroponics industry, presenting both opportunities and challenges for Hydrofarm. The increasing efficiency and tailored spectrums of LED grow lights, with the horticultural lighting market projected to exceed $3.5 billion by 2024, directly impact cultivation optimization. Furthermore, smart farming technologies, expected to reach $32.01 billion by 2026, highlight the growing demand for automated climate control and data analytics, which Hydrofarm can leverage to enhance grower efficiency.

The integration of AI and data analytics is crucial for real-time monitoring and predictive maintenance in hydroponic systems. The global AI in agriculture market, valued at $1.5 billion in 2023 and projected to reach over $5 billion by 2028, underscores the significant trend towards data-driven cultivation. Hydrofarm's ability to incorporate these AI-powered insights will be a key differentiator.

Innovations in nutrient delivery and growing media are also vital, with the hydroponics market anticipated to reach $33.1 billion by 2028. Advancements in nutrient formulations and sustainable media like coco coir are enhancing crop yields and resource efficiency, areas where Hydrofarm must remain competitive. Similarly, the vertical farming market, projected to grow from approximately $5.5 billion in 2023 to over $20 billion by 2030, emphasizes the need for Hydrofarm to support space-efficient growing systems.

| Technology Area | 2023/2024 Data Point | Projected Growth/Impact | Hydrofarm Relevance |

| LED Grow Lights | Horticultural lighting market > $3.5B (2024) | Increased energy efficiency, tailored spectrums | Optimize cultivation, reduce grower energy costs |

| Smart Farming/Automation | Smart agriculture market ~ $32.01B (by 2026) | Precise climate control, automated irrigation | Enhance crop management, reduce labor |

| AI & Data Analytics | AI in agriculture market ~ $1.5B (2023) | Real-time monitoring, predictive analysis, AI insights | Improve grower efficiency and profitability |

| Vertical Farming | Vertical farming market ~ $5.5B (2023) | Multi-tier systems, space optimization | Support space-efficient urban cultivation |

Legal factors

The legal landscape for cannabis cultivation is a significant factor for Hydrofarm, as its sales are directly tied to the success and expansion of commercial growers. These growers must navigate a patchwork of state-specific regulations concerning licensing, cultivation volume caps, and rigorous product testing protocols. For instance, in states like California, which saw over $5 billion in legal cannabis sales in 2023, the compliance burden is substantial.

The ongoing federal prohibition of cannabis in the United States presents a persistent legal challenge, impacting everything from banking access for cannabis businesses to interstate commerce. This creates uncertainty for Hydrofarm's clients and can influence their investment in cultivation technology. As of early 2024, while some states continue to legalize, the federal stance remains a critical constraint on industry growth.

Hydrofarm is bound by stringent product safety and quality standards for its horticultural equipment and supplies. This includes adherence to electrical safety codes, material safety guidelines, and performance specifications to ensure user and environmental safety. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over 100,000 product-related injuries annually, underscoring the critical nature of compliance.

Failure to meet these standards can result in severe consequences, such as costly product recalls, significant legal liabilities, and irreparable damage to Hydrofarm's reputation. In 2023, the U.S. Food and Drug Administration (FDA) issued numerous recalls for products failing to meet safety regulations, impacting manufacturers' market standing and financial performance.

Therefore, maintaining rigorous quality control processes is not just a matter of best practice but a legal imperative for Hydrofarm. This commitment is vital for ensuring ongoing legal compliance and fostering enduring customer trust, as demonstrated by companies that prioritize quality often experiencing fewer regulatory interventions and higher customer retention rates.

Intellectual property laws are crucial for Hydrofarm. Protecting its patents on innovative growing systems and trademarks for its well-known brands is key to staying ahead in the competitive indoor gardening market. For instance, as of early 2024, the U.S. Patent and Trademark Office continues to see a steady stream of applications in the horticultural technology sector, highlighting the importance of robust IP protection.

Hydrofarm must also be vigilant about not infringing on the intellectual property rights of other companies. Successfully navigating patent law and securing trademark registrations directly impacts Hydrofarm's ability to innovate and maintain its market standing, ensuring its unique technologies and brand identity are legally safeguarded.

Environmental Regulations and Permitting

Hydrofarm's operations, from manufacturing to product distribution, are significantly influenced by environmental regulations. These laws govern crucial aspects like waste disposal, the handling of chemicals used in cultivation products, and energy efficiency standards for its facilities. Failure to comply can result in substantial fines and operational interruptions, impacting profitability and market standing. For instance, in 2024, the EPA continued to enforce stricter emissions standards, with penalties for non-compliance potentially reaching tens of thousands of dollars per day per violation.

The legal framework surrounding sustainable manufacturing practices is demonstrably tightening. Obtaining and maintaining the necessary environmental permits is not merely a bureaucratic step but a critical operational requirement. Hydrofarm must navigate these evolving legal requirements to ensure uninterrupted business flow and to avoid costly legal challenges. The increasing global focus on carbon footprints and sustainable supply chains means that regulatory scrutiny is likely to intensify in the coming years, affecting all players in the horticultural supply sector.

Key areas of regulatory focus for Hydrofarm include:

- Waste Management: Adherence to regulations concerning the disposal of packaging materials, used growing media, and any chemical byproducts from manufacturing.

- Chemical Handling and Safety: Compliance with laws governing the storage, transportation, and use of fertilizers, pesticides, and other chemicals.

- Energy Efficiency: Meeting standards for energy consumption in manufacturing plants and distribution centers, with potential incentives or penalties tied to performance.

- Water Usage: Regulations may also pertain to water sourcing and discharge quality, particularly in regions experiencing water scarcity.

Import/Export Laws and Customs

Hydrofarm, as a global distributor, must meticulously adhere to a complex web of import and export laws, customs regulations, and international trade agreements. These legal frameworks directly influence the cost-effectiveness and logistical feasibility of sourcing raw materials and distributing finished goods across international borders. For instance, changes in tariffs or trade policies, such as those potentially arising from ongoing trade discussions between major economic blocs in 2024 and 2025, could significantly alter Hydrofarm's operational expenses and market access.

Navigating these intricate customs procedures and understanding applicable tariffs are critical legal considerations that directly impact Hydrofarm's supply chain efficiency and its ability to reach diverse markets. The World Trade Organization (WTO) reported that global trade in goods saw a moderate increase in early 2024, but noted that protectionist measures and evolving trade agreements continue to present challenges. This underscores the need for constant legal vigilance.

- Compliance with Import/Export Regulations: Hydrofarm must ensure all shipments meet the specific legal requirements of both origin and destination countries.

- Tariff and Duty Management: Understanding and accurately calculating import duties and export taxes is crucial for cost control and pricing strategies.

- International Trade Agreements: Staying informed about free trade agreements or trade barriers that affect its key markets is vital for strategic planning.

- Customs Brokerage and Documentation: Reliable customs brokerage services and accurate documentation are essential to avoid delays and penalties.

The legal landscape for cannabis cultivation significantly impacts Hydrofarm, as its sales are tied to grower success. Navigating state-specific licensing, volume caps, and testing protocols is crucial, with states like California generating over $5 billion in legal sales in 2023, highlighting the compliance burden.

Federal prohibition remains a major hurdle, affecting banking and interstate commerce, creating uncertainty for clients and influencing their investment in cultivation technology. As of early 2024, this federal stance continues to be a critical constraint on industry growth.

Hydrofarm must also adhere to stringent product safety and quality standards for its horticultural equipment, including electrical safety codes and material safety guidelines. The U.S. Consumer Product Safety Commission reported over 100,000 product-related injuries annually in 2024, emphasizing the critical nature of compliance.

Failure to meet these standards can lead to recalls, legal liabilities, and reputational damage. In 2023, the FDA issued numerous recalls for non-compliant products, impacting manufacturers' market standing and financial performance.

Environmental factors

Global water scarcity is a growing concern, with projections indicating that by 2050, over 5 billion people could experience water shortages. Hydroponic systems, like those offered by Hydrofarm, are inherently water-efficient, using up to 90% less water than conventional agriculture. This efficiency is a significant advantage as environmental regulations and consumer demand for sustainable practices intensify.

Controlled environment agriculture, like that facilitated by Hydrofarm's products, can be quite energy-hungry, especially with powerful grow lights. This energy use directly impacts a farm's carbon footprint. For instance, in 2024, the average commercial greenhouse in the US can spend upwards of $10,000 annually on electricity, a significant portion of which is for lighting and climate control.

Consequently, Hydrofarm is under pressure to develop and market energy-efficient solutions. This includes advanced LED grow lights that offer better light spectrums and lower wattage, alongside sophisticated climate control systems. By helping their customers reduce energy consumption, Hydrofarm not only aids in lowering operational costs but also addresses the growing demand for environmentally responsible agriculture.

The company's commitment to promoting sustainable energy is therefore crucial. As of early 2025, the global market for horticultural lighting is projected to reach over $4 billion, with LEDs capturing a significant and growing share due to their efficiency advantages. Hydrofarm's focus on these technologies positions them to capitalize on this trend while supporting a greener agricultural sector.

The environmental footprint of hydroponic equipment, from manufacturing plastics and metals to disposing of electronic components, is increasingly scrutinized. Hydrofarm must actively manage product lifecycles, prioritizing sustainable material sourcing and ensuring end-of-life recyclability. For instance, the global plastic waste problem saw over 400 million tonnes produced in 2023, highlighting the urgency for manufacturers like Hydrofarm to adopt responsible disposal and material innovation.

Implementing circular economy principles, such as designing for disassembly and repair, can significantly bolster Hydrofarm's environmental credentials. This approach not only minimizes waste but also creates opportunities for resource efficiency. By 2025, the European Union aims to increase recycling rates for plastics to 55%, a benchmark that forward-thinking companies like Hydrofarm should strive to exceed through product design and operational practices.

Climate Change and Extreme Weather

Climate change is increasingly impacting global food security, with extreme weather events like droughts and floods disrupting traditional outdoor agriculture. This trend is projected to continue, with the World Meteorological Organization reporting 2023 as the warmest year on record, exacerbating these challenges. Consequently, the demand for controlled environment agriculture (CEA) solutions, such as those offered by Hydrofarm, is on the rise as they provide a buffer against unpredictable weather patterns.

Hydrofarm's indoor growing systems offer a significant advantage by mitigating the risks associated with climate-driven agricultural disruptions. The ability to maintain stable growing conditions, regardless of external environmental volatility, makes these systems highly attractive. This resilience directly translates into increased market appeal and necessity for Hydrofarm's offerings, as growers seek to ensure consistent production and reduce crop loss.

- Increased Demand for CEA: As extreme weather events become more frequent and severe, the market for controlled environment agriculture is expected to grow significantly. Analysts project the global CEA market to reach over $80 billion by 2027, up from an estimated $30 billion in 2022.

- Resilience as a Key Selling Point: Hydrofarm's systems are inherently more resilient to climate impacts than traditional farming, offering a stable and predictable growing environment. This is a critical differentiator in a market increasingly concerned with supply chain stability.

- Reduced Crop Loss: By controlling variables like temperature, humidity, and light, indoor farms can significantly reduce crop loss due to adverse weather, a major concern for outdoor growers facing climate change impacts.

Sustainable Sourcing and Manufacturing

Consumers and regulators are increasingly demanding that companies source materials responsibly and manufacture products using environmentally sound methods. Hydrofarm can bolster its environmental credentials by incorporating recycled content into its products, minimizing waste during its manufacturing processes, and verifying that its suppliers also follow robust environmental standards. For instance, in 2024, the global market for sustainable agriculture technology, which includes elements of Hydrofarm's business, was projected to reach over $20 billion, indicating a strong consumer and industry push towards greener practices.

By prioritizing sustainable sourcing and manufacturing, Hydrofarm can differentiate itself in the market. This commitment can resonate with a growing segment of environmentally aware consumers, potentially leading to increased brand loyalty and sales. Transparency regarding these initiatives, such as publishing sustainability reports detailing recycled material usage or waste reduction targets, can further enhance customer trust and appeal. For example, many companies in the gardening sector are now highlighting their use of recycled plastics, with some reporting that up to 70% of their product packaging is now made from post-consumer recycled materials.

- Recycled Materials: Incorporating recycled plastics and metals into product design and packaging.

- Waste Reduction: Implementing lean manufacturing principles to minimize production waste and energy consumption.

- Supply Chain Audits: Ensuring suppliers meet environmental compliance and sustainability benchmarks.

- Eco-friendly Packaging: Shifting towards biodegradable or recyclable packaging solutions.

Hydroponic systems offer significant water conservation, using up to 90% less water than traditional farming, a crucial advantage given global water scarcity projections. However, controlled environment agriculture can be energy-intensive, impacting carbon footprints, with average US commercial greenhouses spending over $10,000 annually on electricity for lighting and climate control in 2024. Hydrofarm faces pressure to provide energy-efficient solutions like advanced LED grow lights, a market segment projected to exceed $4 billion globally by early 2025.

The environmental impact of manufacturing and disposing of hydroponic equipment is under scrutiny, pushing Hydrofarm to focus on sustainable material sourcing and product lifecycle management. With global plastic waste exceeding 400 million tonnes in 2023, adopting circular economy principles, like designing for disassembly, is vital. The EU's aim to increase plastic recycling rates to 55% by 2025 provides a benchmark for companies like Hydrofarm to improve their environmental credentials.

Climate change is driving demand for controlled environment agriculture (CEA) as a buffer against extreme weather, with the CEA market projected to reach over $80 billion by 2027. Hydrofarm's indoor growing systems offer resilience by maintaining stable conditions, reducing crop loss and ensuring consistent production. This resilience is a key selling point for growers seeking to mitigate climate-related agricultural disruptions.

PESTLE Analysis Data Sources

Our Hydrofarm PESTLE Analysis is built upon a comprehensive blend of data from agricultural technology journals, environmental protection agency reports, and global market research firms. We meticulously gather insights on political stability, economic growth, technological advancements, and social trends impacting the hydroponics sector.